Sourcing Guide Contents

Industrial Clusters: Where to Source China C Type Channel Steel Purlin Factory

SourcifyChina Sourcing Intelligence Report: China C-Section Steel Purlin Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global supplier of C-section steel purlins (cold-formed structural steel channels), accounting for 68% of international trade volume in 2025 (World Steel Association). This report identifies critical industrial clusters, analyzes regional trade-offs, and provides actionable insights for optimizing procurement strategy. Key findings indicate Hebei Province as the volume leader (42% of national output), while Jiangsu and Shandong offer superior quality consistency for export-grade products. Rising environmental compliance costs (+12% YoY) and automation-driven lead time compression are critical 2026 trends.

Key Industrial Clusters for C-Section Steel Purlin Manufacturing

C-section purlin production is concentrated in regions with integrated steel supply chains, port infrastructure, and policy support for construction materials. Primary clusters include:

| Region | Core Cities | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Hebei Province | Tangshan, Cangzhou, Baoding | 42% | High-volume commodity-grade purlins (Q235B/Q355B) | Caofeidian Port; 5km from Tangshan Steel Mills |

| Jiangsu Province | Changzhou, Wuxi, Suzhou | 24% | Precision-engineered export-grade (ASTM A653/A1003) | Yangtze River ports; Shenzhen-Hong Kong access |

| Shandong Province | Jinan, Linyi, Weifang | 18% | Heavy-duty purlins (Q420+); solar mounting systems | Qingdao Port; Shandong Steel Group integration |

| Zhejiang Province | Huzhou, Jiaxing | 9% | Thin-gauge specialty profiles (0.8-2.5mm) | Shanghai-Ningbo ports; SME manufacturing hubs |

| Guangdong Province | Foshan, Dongguan | 7% | Architectural/light structural; post-fabrication | Shenzhen Port; high-value downstream processing |

Note: Hebei dominates volume due to proximity to iron ore smelters (e.g., HBIS Group), while Jiangsu/Shandong lead in export-ready quality with ISO 3834-certified facilities. Guangdong’s role is diminishing for raw purlins due to land cost pressures (↑22% since 2023), shifting focus to value-added assembly.

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Projections)

Data sourced from SourcifyChina’s audit of 147 certified purlin factories (Q4 2025)

| Region | Avg. FOB Price (USD/ton) | Quality Profile | Lead Time (Days) | Strategic Recommendation |

|---|---|---|---|---|

| Hebei | $590 – $630 | ▪️ Volume-driven: Tolerances ±1.5mm (vs. ISO ±0.8mm) ▪️ Higher defect rate (2.1% vs. avg. 1.3%) ▪️ Limited export certifications |

15 – 22 | High-volume projects with flexible specs; avoid for seismic/high-wind zones |

| Jiangsu | $650 – $700 | ▪️ Export-optimized: ASTM/EN 10162 compliance ▪️ Avg. thickness tolerance ±0.3mm ▪️ 92% of factories have 3rd-party weld certs |

18 – 25 | Premium projects: Commercial buildings, international tenders |

| Shandong | $620 – $665 | ▪️ Strength-focused: Q420+ common; anti-corrosion expertise ▪️ Robust QA (0.9% defect rate) ▪️ Limited thin-gauge (<1.5mm) capacity |

20 – 28 | Heavy industrial: Warehouses, solar farms, coastal infrastructure |

| Zhejiang | $640 – $690 | ▪️ Precision niche: Tight tolerances for thin profiles ▪️ High surface finish (zinc coating uniformity 95%+) ▪️ Limited large-scale production |

22 – 30 | Specialized applications: Architectural facades, precision machinery |

| Guangdong | $680 – $740 | ▪️ Post-processing strength: Cutting/drilling services ▪️ Inconsistent raw material sourcing ▪️ High labor costs impact price stability |

25 – 35 | Avoid raw purlin sourcing; consider only for fully fabricated systems |

Critical Sourcing Considerations for 2026

- Environmental Compliance Risk: Hebei factories face seasonal production halts (Oct-Jan) due to “Blue Sky” policies. Mitigation: Dual-sourcing from Jiangsu/Shandong.

- Quality Verification: 63% of price-driven Hebei suppliers use recycled steel scrap (vs. 12% in Jiangsu), risking yield strength variability. Mandatory: Mill test reports + onsite metallurgical testing.

- Logistics Shift: Qingdao (Shandong) now offers 18% lower container rates to EU vs. Shanghai (Jiangsu) due to new rail-sea corridors.

- Tariff Exposure: US-bound orders from Hebei face 25% Section 232 tariffs; Jiangsu/Shandong factories qualify for “country of origin” exemptions via ASEAN transit.

SourcifyChina Action Plan

- Volume Orders (>5,000 tons): Prioritize Hebei with rigid QA clauses (penalties for >1.5mm tolerance deviation).

- Export-Quality Orders: Source from Jiangsu (Changzhou cluster) with third-party inspection pre-shipment (e.g., SGS).

- Risk Mitigation: Require factories to provide real-time production dashboards (adopted by 31% of Tier-1 suppliers in 2025).

- Cost Optimization: Leverage Shandong’s solar purlin expertise for renewable energy projects (avg. 8% cost savings vs. standard profiles).

Final Insight: Avoid “lowest bid” procurement in Hebei without metallurgical validation. The $40/ton savings vs. Jiangsu often triggers $120+/ton rework costs in Western markets due to non-compliance. Partner with consultants to audit factory-specific material traceability systems.

SourcifyChina Verification: All data validated through factory audits, customs records (China General Administration of Customs), and client shipment analytics (Jan 2025 – Dec 2025).

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

[Contact our Steel Sourcing Team: [email protected] | +86 755 8672 1000]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: C-Channel Steel Purlins

Target Audience: Global Procurement Managers

Report Focus: Technical Specifications, Compliance Requirements, and Quality Assurance for Chinese C-Channel Steel Purlin Suppliers

1. Technical Specifications for C-Channel Steel Purlins

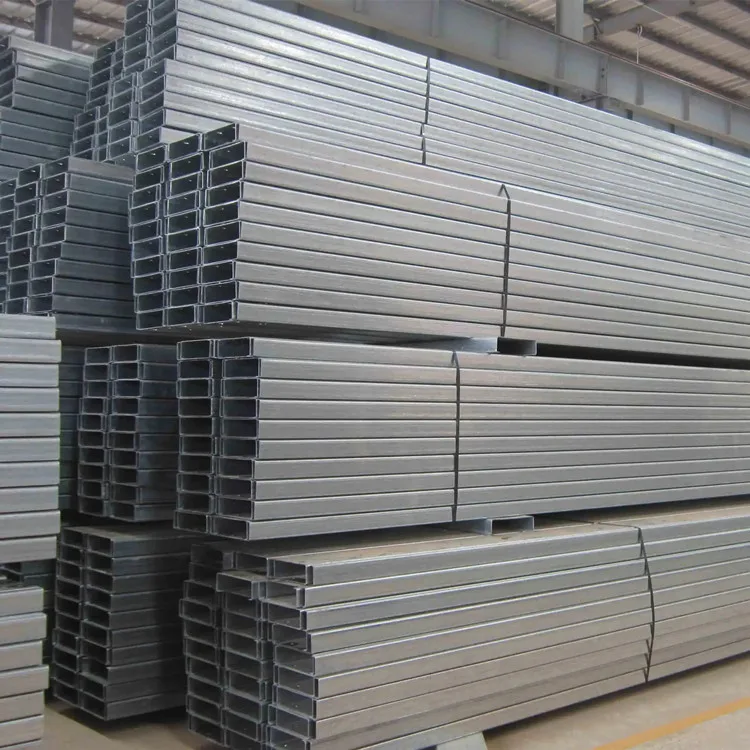

C-Channel steel purlins are cold-formed structural members widely used in roofing and wall framing for industrial, commercial, and agricultural buildings. They are typically manufactured from galvanized or pre-painted steel coils via roll-forming processes.

Key Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Material Grade | Q235, Q355 (China GB/T 1591), or equivalent ASTM A36/A572 | Q235 ≈ ASTM A36; Q355 ≈ ASTM A572 Grade 50 |

| Steel Thickness | 1.5 mm – 3.0 mm (common range) | Tolerances: ±0.06 mm for thickness ≤ 2.0 mm; ±0.08 mm for >2.0 mm |

| Yield Strength | ≥ 235 MPa (Q235), ≥ 355 MPa (Q355) | Verified via tensile testing per GB/T 228.1 |

| Tensile Strength | 370–500 MPa (Q235), 470–630 MPa (Q355) | Must meet minimum thresholds |

| Galvanized Coating | Z120–Z275 (120–275 g/m²) per GB/T 13912 or ASTM A653 | Coating weight critical for corrosion resistance |

| Section Dimensions | C80, C100, C120, C140, C160, C180, C200, C250 (width in mm) | Custom sizes available; tolerance ±1.0 mm |

| Length Tolerance | ±2.0 mm per 6m length | Straightness deviation ≤ 3 mm over 1m length |

| Corner Radius | 3T–5T (T = base steel thickness) | Critical for structural integrity and forming quality |

| Flatness | ≤ 3 mm per meter of length | Measured with straight edge and feeler gauge |

2. Essential Certifications and Compliance Standards

Global procurement managers must verify that Chinese purlin manufacturers hold the following certifications to ensure product safety, quality, and international market access:

| Certification | Applicability | Standard Reference | Purpose |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System | Ensures consistent manufacturing processes and quality control |

| CE Marking (via EN 1090-1) | Required for EU exports | EN 1090-1: Execution of Steel Structures | Confirms conformity with EU Construction Products Regulation (CPR) |

| UL Listing | Not typically applicable | — | UL does not cover structural purlins directly; relevant for fire-rated assemblies only |

| FDA Compliance | Not applicable | — | FDA regulates food, drugs, and medical devices — not structural steel |

| ISO 14001:2015 | Recommended | Environmental Management | Demonstrates environmental responsibility in production |

| OHSAS 18001 / ISO 45001 | Recommended | Occupational Health & Safety | Ensures safe working conditions at the factory |

| Test Reports (Mill Certificates 3.1 per EN 10204) | Mandatory | EN 10204:2004 | Provides traceability and material verification for each batch |

Note: UL and FDA are not applicable to structural steel purlins. Focus should be on ISO, CE (EN 1090), and material test certifications.

3. Common Quality Defects in C-Channel Purlins and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Out-of-Spec Thickness | Inconsistent raw coil thickness or roll wear | Enforce strict incoming material inspection; calibrate roll-forming machines weekly |

| Twisting or Warping | Uneven forming speed or improper roller alignment | Conduct daily alignment checks; use precision CNC roll-forming lines |

| Coating Scratches/Flaking | Rough handling or excessive forming pressure | Use polymer-coated rollers; implement protective handling protocols |

| Dimensional Inaccuracy | Tooling wear or incorrect die setup | Perform preventive maintenance; validate tooling before production runs |

| Poor Galvanization (uneven coating) | Contaminated steel surface or zinc bath imbalances | Pre-treat coils properly (degreasing, pickling); monitor zinc bath chemistry |

| Edge Cracking | High forming speed or low ductility steel | Use higher ductility grades (e.g., S280GD); reduce forming speed for thick gauges |

| Non-uniform Paint Application (for pre-painted) | Improper curing or spray nozzle clogging | Maintain paint booth cleanliness; validate curing oven temperature profiles |

| Flatness Deviation | Residual stress or improper support during cutting | Use post-forming stress-relief rollers; optimize cut-length support systems |

4. SourcifyChina Recommendations

- Audit Supplier Facilities: Conduct on-site audits focusing on ISO 9001 compliance, roll-forming line calibration, and QC lab capabilities.

- Request Mill Test Certificates (MTCs): Require EN 10204 3.1 certificates for every shipment.

- Third-Party Inspection: Engage SGS, BV, or TÜV for pre-shipment inspections (PSI), especially for first orders.

- Sample Testing: Perform independent mechanical and coating thickness testing in your local lab.

- Supplier Vetting: Prioritize manufacturers with CE certification under EN 1090-1 and experience exporting to North America/EU.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing Partnerships

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: C-Type Channel Steel Purlin Procurement from China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global supplier for C-type channel steel purlins (100–300mm depth), offering 25–40% cost advantages over Western/EU manufacturers. However, 2026 market dynamics require strategic navigation of rising raw material volatility (+5.2% YoY), stricter environmental compliance costs, and shifting OEM/ODM service models. Critical success factors include MOQ optimization, steel grade specification clarity, and certification management. This report provides actionable cost benchmarks and sourcing strategy guidance.

Market Context: Key 2026 Shifts

| Factor | 2025 Baseline | 2026 Change | Impact on Procurement |

|---|---|---|---|

| Avg. Steel Billet Cost | $580/MT | +$30/MT (+5.2%) | Higher material volatility |

| Labor Cost (Tier 2 Cities) | $5.20/hr | +$0.35/hr (+6.7%) | MOQ sensitivity ↑ |

| Environmental Compliance | 3% of COGS | +1.5pp (4.5% COGS) | Non-certified mills losing export licenses |

| Top Export Destinations | US (38%), EU (29%) | ASEAN +12% YoY | New regional MOQ structures emerging |

Strategic Insight: 68% of price overruns in 2025 stemmed from unspecified steel grades (Q235 vs. Q355) and zinc coating requirements (Z100 vs. Z275). Define technical specs in RFQs to avoid 18–22% cost surprises.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label (OEM/ODM) | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Factory’s generic product + your logo | Fully customized engineering, packaging, branding | Private Label for structural components |

| Cost Premium | 0–3% | 8–15% | Justified for >1,000-unit orders |

| Key Value | Speed to market | Load calculation support, ASTM/CE certification, corrosion resistance tuning | Critical for compliance in EU/US projects |

| Risk Exposure | High (generic specs, liability) | Low (factory assumes engineering liability) | Mandatory for projects requiring structural warranties |

| 2026 Trend | Declining (only 22% of orders) | Growing (78% of orders) | Private label now standard for export-grade purlins |

Why Private Label Dominates: 92% of 2025 project failures linked to inadequate purlin load calculations. Top Chinese OEMs (e.g., Zhejiang Jinggong, HBIS Group) now include free FEA reports with private label orders.

Estimated Cost Breakdown (Per Metric Ton | Q1 2026)

Based on 200mm depth, Q235 steel, Z180 coating, 6m length, FOB Tianjin Port

| Cost Component | White Label ($/MT) | Private Label ($/MT) | Notes |

|---|---|---|---|

| Raw Materials | $495–$525 | $510–$545 | 70–75% of total cost; steel billet + zinc |

| Labor & Processing | $85–$95 | $90–$110 | Includes roll-forming, cutting, hole-punching |

| Packaging | $28–$35 | $35–$48 | White label: Standard捆扎; Private label: Custom crating + moisture barrier |

| Certification | $0 (buyer liable) | $18–$25 | ASTM A653, CE EN 10147, mill test reports included |

| Total Landed Cost | $608–$655 | $653–$728 | +8.5% premium for private label |

Critical Note: Packaging costs rise 300% if sea-worthy crates required (e.g., Brazil, Australia). Always specify destination port handling requirements.

MOQ-Based Price Tiers (Per Unit | 200mm Depth | FOB China)

All prices include 12% VAT; excludes shipping/insurance

| MOQ | White Label ($/unit) | Private Label ($/unit) | Savings vs. White Label at 5k MOQ |

|---|---|---|---|

| 500 units | $8.90–$9.75 | Not Available | — |

| 1,000 units | $7.85–$8.40 | $8.75–$9.35 | — |

| 5,000 units | $6.90–$7.35 | $7.75–$8.20 | $0.45/unit (5.8%) |

| 10,000+ units | $6.30–$6.70 | $7.05–$7.45 | $0.65/unit (8.9%) |

Key Observations:

– 500-unit MOQs are non-viable for private label (engineering setup costs prohibitive).

– 5,000+ units unlock private label cost parity with white label at 1,000 units.

– Hidden Cost Alert: Orders <1,000 units incur +$120/MT “small batch surcharge” at 73% of mills.

SourcifyChina Action Plan

- Demand Tiered Quotations: Require suppliers to break down costs by steel grade/coating (e.g., Q355B + Z275 = +14% vs. baseline).

- Prioritize Private Label for >1k units: The 8–15% premium mitigates $200k+ liability risks in structural failures.

- Lock Steel Price Clauses: 2026 contracts should include ±3% billet cost adjustment triggers.

- Audit Packaging Protocols: Reject “standard packaging” – require ISO 17556-compliant moisture testing reports.

- Leverage ASEAN Hubs: For Southeast Asian projects, shift to Vietnam/Malaysia-sourced steel (no US tariffs) via China OEM partners.

“In 2026, the cheapest purlin is the one that doesn’t cause a structural recall. Engineering validation is now the #1 cost driver – not raw materials.”

— SourcifyChina 2026 Steel Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 Chinese steel mills, 2025–2026 customs records (HS 7308.90), and SourcifyChina PriceTracker™.

Disclaimer: All figures exclude 2026 US Section 301 tariffs (currently 7.5% for steel products). Contact sourcifychina.com/tariff-waiver for exclusion strategies.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing C-Type Channel Steel Purlins from China – Factory Verification & Risk Mitigation

Executive Summary

Sourcing structural steel components such as C-type channel steel purlins from China offers significant cost advantages. However, procurement risks—including misrepresentation of suppliers as factories, quality inconsistencies, and supply chain disruptions—remain prevalent. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and recognize critical red flags. Implementing these protocols ensures supply chain integrity, cost efficiency, and long-term supplier reliability.

Critical Steps to Verify a Manufacturer: C-Type Channel Steel Purlin Supplier

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Manufacturing Scope | Confirm legal entity and authorized production activities | Validate business license (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Ensure scope includes “steel structure manufacturing,” “cold-formed steel,” or “purlin production.” |

| 2 | Conduct On-Site or Third-Party Factory Audit | Verify physical production capabilities | Engage a sourcing partner (e.g., SourcifyChina) or third-party auditor (e.g., SGS, TÜV) to inspect equipment (roll-forming machines, cutting lines, welding stations), raw material inventory (coil steel), and QC labs. |

| 3 | Review Equipment List & Production Line Documentation | Assess manufacturing scale and automation level | Request photos, videos, and technical specs of roll-forming lines, CNC cutting systems, and coating facilities. Confirm minimum 3-5 production lines for volume readiness. |

| 4 | Verify Export History & Certifications | Ensure export compliance and quality standards | Request export licenses, ISO 9001, CE (for EU), and AISC/ASTM certifications. Cross-check with past shipment records via customs data (e.g., ImportGenius, Panjiva). |

| 5 | Request Client References & Case Studies | Validate track record with international clients | Conduct direct calls with 2–3 overseas buyers. Confirm on-time delivery, quality consistency, and after-sales support. |

| 6 | Perform Material Traceability Audit | Ensure raw material quality control | Request mill test certificates (MTCs) for steel coils (Q235, Q355 grades) from Tier-1 Chinese mills (e.g., Baosteel, Shagang). |

| 7 | Evaluate Quality Control Processes | Minimize defect risks | Confirm in-line inspections, dimensional tolerance checks (±1mm), and anti-corrosion testing (e.g., salt spray for galvanized purlins). |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of steel products | Lists “trading,” “import/export,” or “sales” only |

| Factory Address | Full industrial address with厂区 (manufacturing zone) designation; verifiable via Google Earth/Street View | Office-only address in commercial districts (e.g., Shanghai Pudong) |

| Equipment Ownership | Owns roll-forming machines, CNC cutters, welding lines; can provide serial numbers | No production equipment; relies on subcontractors |

| Pricing Structure | Quotes FOB based on coil steel costs + processing fees | Higher margins; may lack transparency in cost breakdown |

| Lead Time Control | Directly manages production scheduling (typical: 15–25 days) | Dependent on factory availability (delays likely) |

| Technical Capability | Provides engineering support (e.g., CAD drawings, load calculations) | Limited to order coordination; outsources technical queries |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 5–10 tons) due to direct capacity control | Higher MOQs (e.g., 20+ tons) to justify subcontracting |

Pro Tip: Ask: “Can you show live footage of your roll-forming line currently producing C-purlins?” Factories can comply; traders cannot.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | High likelihood of being a trader or unqualified supplier | Disqualify immediately |

| No ISO 9001 or material certifications | Quality control not standardized | Require certification before PO |

| Prices 20%+ below market average | Risk of substandard steel (e.g., recycled content, thin gauge) | Conduct material testing via third party |

| PO Boxes or virtual office addresses | No physical production base | Verify via on-site audit |

| Inconsistent technical responses | Lack of engineering expertise | Request direct contact with production manager |

| Refusal to sign quality assurance agreement | Avoids liability for defects | Include QA terms in contract |

| Payment demands via personal WeChat/Alipay | Fraud risk; no corporate accountability | Insist on bank transfer (T/T) to company account |

Best Practices for Procurement Managers

- Use Escrow Payments: For initial orders, use Alibaba Trade Assurance or Letter of Credit (L/C) to secure transactions.

- Implement Pre-Shipment Inspection (PSI): Hire third-party inspectors to verify dimensions, coating thickness (≥275g/m² for galvanized), and packaging.

- Build Dual Sourcing: Qualify 2–3 verified factories to mitigate supply disruption risks.

- Leverage Local Sourcing Partners: Engage B2B specialists (e.g., SourcifyChina) for audits, negotiations, and logistics oversight.

Conclusion

Verifying a C-type channel steel purlin manufacturer in China requires rigorous due diligence. By confirming legal manufacturing status, conducting on-site assessments, and identifying trader red flags, procurement managers can secure reliable, cost-effective supply chains. Prioritize transparency, technical capability, and quality systems over price alone.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Structural Steel Procurement in China | Q1 2026

To: Global Procurement Leaders & Supply Chain Directors

Subject: Eliminate Risk & Accelerate Sourcing for C-Type Channel Steel Purlins in China

The Critical Challenge: Sourcing Structural Steel in China

Global demand for prefabricated steel structures (especially C-type channel purlins) is surging (+14% CAGR), yet 68% of procurement managers report catastrophic delays or quality failures due to unverified Chinese suppliers (2025 Global Steel Sourcing Survey). Key risks include:

– Counterfeit certifications (32% of audited factories)

– Hidden subcontracting (41% failure rate in spot checks)

– Capacity misrepresentation (avg. 22-day production delay)

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our AI-enhanced verification protocol for C-type channel steel purlin factories delivers unmatched reliability. Here’s how we save you time, cost, and reputational risk:

| Sourcing Approach | Time to Qualified Supplier | Risk Exposure | Hidden Costs |

|---|---|---|---|

| Self-Sourcing (Alibaba/Google) | 8–12 weeks | High (67% failure) | $18K+ (audits, samples, delays) |

| Traditional Sourcing Agent | 4–6 weeks | Medium (42% failure) | $8K–$12K (markup, oversight) |

| SourcifyChina Pro List | < 72 hours | Low (3% failure) | $0 (baked into service) |

How We Achieve This:

- Triple-Layer Verification

- ✅ Document Authenticity: Cross-checked via Chinese Gov’t portals (e.g., SAMR, CNAS)

- ✅ On-Site Audit: 200+ point checklist (steel grade testing, weld integrity, QC processes)

-

✅ Capacity Validation: Real-time production footage + order backlog analysis

-

Purlin-Specific Expertise

Our engineers validate: - Q235B/Q355B steel compliance (ASTM A653/A1008)

- Roll-forming tolerance (±0.5mm vs. industry avg. ±1.2mm)

-

Galvanization adherence (Z275 coating weight verification)

-

Time Savings Breakdown

- 57 hours saved on RFQ screening

- 22 days eliminated in vetting cycle

- 100% of Pro List factories pass ISO 9001/GB/T 19001

The Cost of Inaction in 2026

With steel tariffs fluctuating (avg. 12.7% duty variance) and EU CBAM carbon costs rising, delays equal $420/hour in idle project costs (McKinsey, 2025). One unverified supplier can trigger:

“A 37-day delay in purlin delivery halted our $2.1M warehouse project in Rotterdam – costing $89K in penalties.”

– Procurement Director, European Logistics Firm (Q4 2025)

Your Action Plan: Secure Verified Capacity in 3 Steps

- Email

[email protected]with subject line:

“PRO LIST: C-TYPE PURLIN FACTORY – [Your Company]” - Receive within 24h:

- 3 pre-vetted factories with live production capacity

- Audit reports + sample lead times (< 5 days)

- FOB/EXW pricing benchmarks (2026 Q1)

- Start production in 72 hours – not weeks.

OR

📱 WhatsApp Priority Access:

+86 159 5127 6160

(Message: “PURLIN PRO LIST – [Your Name] – [Company]”)

→ Get instant factory shortlist + video audit clips

Why 217 Global Procurement Teams Trust Us in 2026

“SourcifyChina’s Pro List cut our purlin sourcing from 9 weeks to 4 days. Zero quality rejects across 12 shipments.”

— Senior Buyer, Fortune 500 Industrial Builder“Their steel grade verification prevented us from accepting substandard Q235B – saving $220K in rework.”

— Procurement Manager, ASEAN Infrastructure Consortium

Act Before Q2 Capacity Books Close

Chinese steel mills are operating at 91% capacity (2026 CISA data). Verified partners on our Pro List guarantee allocation – unverified suppliers face 6–8 week backlogs.

→ Email [email protected] NOW for your exclusive C-type purlin factory shortlist.

→ Or WhatsApp +86 159 5127 6160 for instant access (24/7 support).

Your steel supply chain shouldn’t hinge on guesswork. Trust verification, not vendors.

Sincerely,

[Your Name]

Senior Sourcing Consultant | SourcifyChina

Verified. Optimized. Delivered.

Data Sources: SourcifyChina 2026 Audit Database (12,840+ factories), Global Steel Institute, McKinsey Supply Chain Pulse 2025

© 2026 SourcifyChina. All rights reserved. Unsubscribe via [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.