Sourcing Guide Contents

Industrial Clusters: Where to Source China Button Factory

SourcifyChina Sourcing Intelligence Report: China Button Manufacturing Landscape (2026)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for button manufacturing, supplying >85% of the world’s fasteners for apparel, footwear, and accessories. While “China button factory” searches often conflate product sourcing with facility procurement, this report focuses on sourcing buttons from Chinese manufacturers. Industrial clusters are highly regionalized, with distinct specializations in material, scale, and compliance. Rising labor costs (+6.8% YoY) and EU CBAM regulations are reshaping competitiveness, making cluster selection critical for cost-quality-risk optimization.

Key Industrial Clusters for Button Manufacturing

China’s button production is concentrated in three core provinces, each with unique ecosystem advantages:

| Cluster | Primary City(s) | Specialization | Annual Output Share | Key Buyer Profile |

|---|---|---|---|---|

| Guangdong | Shantou, Shenzhen | High-volume plastic/metal buttons; fashion-forward designs; OEM/ODM for global brands | 55-60% | Fast fashion, mass-market apparel |

| Zhejiang | Wenzhou, Ningbo | Sustainable materials (recycled PET, corozo); precision metalwork; mid-volume batches | 30-35% | Eco-conscious brands, European luxury segment |

| Fujian | Jinjiang, Quanzhou | Specialty buttons (leather, wood, resin); accessories-focused; artisanal finishes | 8-10% | Premium denim, heritage brands, accessories |

Note: Shantou (Guangdong) alone produces ≈40 billion buttons annually, earning its “Button Capital of the World” designation. Zhejiang clusters lead in EU Ecolabel-compliant production (+22% YoY adoption).

Regional Cluster Comparison: Critical Sourcing Metrics (2026)

Data aggregated from 142 SourcifyChina-audited factories; reflects FOB pricing for 10,000 units of standard 2-hole plastic buttons (20mm).

| Factor | Guangdong (Shantou) | Zhejiang (Wenzhou) | Fujian (Jinjiang) |

|---|---|---|---|

| Price (USD/unit) | $0.008 – $0.012 | $0.010 – $0.015 | $0.015 – $0.025 |

| Drivers | Ultra-high scale; mature supply chain; lower material costs | Sustainable material premiums; higher engineering labor | Artisanal labor; niche material sourcing |

| Quality Tier | ★★★★☆ (Consistent mass production; variable QC in SMEs) | ★★★★★ (Strict EU/REACH compliance; ISO 9001 standard) | ★★★★☆ (High craftsmanship; inconsistent batch sizing) |

| Key Risks | Counterfeit materials; IP leakage in unvetted factories | Longer tech validation for complex designs | Limited scalability beyond 50k units/batch |

| Lead Time | 10-15 days (standard); 7 days (rush +25%) | 18-25 days (standard); 12 days (rush +30%) | 20-30 days (standard); 15 days (rush +35%) |

| Constraints | Port congestion (Shantou Port); peak-season delays | Strict environmental shutdowns (Q1/Q3) | Seasonal labor shortages (Lunar New Year) |

| Strategic Fit | High-volume, cost-sensitive programs | Sustainability-driven & regulated markets | Limited editions; premium tactile finishes |

Emerging Shifts & Procurement Implications (2026)

- Cost Pressures: Guangdong’s wage inflation (+8.1% in 2025) erodes its historical 15-20% price advantage. Zhejiang now matches Guangdong on value-adjusted cost for eco-certified orders.

- Compliance Imperatives: 73% of EU buyers now require ZDHC MRSL compliance – Zhejiang leads with 92% of certified factories vs. Guangdong’s 64% (SourcifyChina Audit Data).

- Hidden Risks: Shantou’s informal “button workshops” (≈30% of cluster) pose IP/labor risks. Always verify factory licenses against China’s National Enterprise Credit Information Portal.

- New Capacity: Yunnan (Kunming) is emerging as a low-cost alternative for basic buttons (labor costs 18% below Guangdong), but lacks material ecosystems.

SourcifyChina Strategic Recommendations

✅ For Cost-Driven Programs: Source from Guangdong only with SourcifyChina’s Tier-1 factory certification (validates scale, IP protection, and port access). Avoid unverified “trading companies.”

✅ For ESG-Compliant Sourcing: Prioritize Zhejiang clusters – demand proof of GRSP (Global Recycled Standard) certificates and onsite REACH testing reports.

⚠️ Avoid Generic RFQs: Button specifications (material density, colorfastness, plating thickness) drastically impact cost. Use SourcifyChina’s Button Material Matrix for precise quoting.

💡 Pro Tip: Leverage Shantou’s design hubs for rapid prototyping (3-5 days), but finalize production in Wenzhou for compliance-critical orders.

“The ‘cheapest button’ often carries hidden costs in compliance failures or rework. Cluster selection must align with your brand’s risk tolerance, not just unit price.”

— SourcifyChina Sourcing Principle #3

Next Steps for Procurement Leaders

1. Request Cluster-Specific Factory Shortlists tailored to your material/compliance needs.

2. Schedule a Compliance Gap Analysis for EU CBAM/textile regulations (Q1 2026 deadline).

3. Download: SourcifyChina’s 2026 Button Sourcing Playbook (Includes material cost calculators & audit checklists).

Authored by SourcifyChina’s Sourcing Intelligence Unit. Data verified via on-ground audits, China Button Industry Association (CBIA), and customs analytics. Not for redistribution.

SourcifyChina: De-risking Global Sourcing Since 2018

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing from Chinese Button Factories

As global demand for precision components in apparel, electronics, and industrial applications grows, sourcing buttons from China remains a strategic procurement decision due to cost-efficiency and manufacturing scale. However, ensuring consistent quality and regulatory compliance requires a structured approach. This report outlines the technical specifications, compliance requirements, and quality control protocols essential when engaging with Chinese button manufacturers.

1. Key Technical Specifications

A. Material Specifications

Buttons are manufactured from a variety of materials depending on application. Common materials include:

| Material Type | Typical Use Cases | Key Properties |

|---|---|---|

| Polyester Resin | Apparel (shirts, jackets) | Durable, colorfast, heat-resistant |

| Polyamide (Nylon) | Outdoor gear, military uniforms | High tensile strength, abrasion-resistant |

| Metal (Zinc Alloy, Brass) | Luxury fashion, uniforms | Premium finish, corrosion-resistant (plated) |

| Corozo (Vegetable Ivory) | Eco-friendly fashion lines | Sustainable, biodegradable, natural texture |

| ABS Plastic | Electronics, consumer goods | Impact-resistant, moldable, low cost |

| Silicone | Medical devices, wearable tech | Flexible, hypoallergenic, FDA-compliant |

Note: Material selection must align with end-use environment (e.g., wash durability, UV exposure, contact with skin).

B. Tolerances and Dimensional Accuracy

Precision in size, thickness, and hole alignment is critical for automated assembly and aesthetic consistency.

| Parameter | Standard Tolerance | Critical for |

|---|---|---|

| Diameter | ±0.1 mm | Garment fit, buttonhole compatibility |

| Thickness | ±0.05 mm | Stack height, sewing machine clearance |

| Hole Diameter | ±0.05 mm | Thread or shank compatibility |

| Hole Position (Center) | ±0.15 mm | Symmetry, alignment |

| Shank Height (if applicable) | ±0.2 mm | Fabric thickness accommodation |

Tip: Require first-article inspection (FAI) reports with calibrated measurement tools (e.g., micrometers, CMM).

2. Essential Certifications and Compliance

Sourcing from China requires verification of international standards, especially for export markets.

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) — ensures consistent manufacturing processes |

| CE Marking | Required (EU) | Buttons used in electrical/electronic devices must comply with RoHS and REACH |

| FDA 21 CFR | Required (USA) | For buttons in medical devices or food-contact applications (e.g., silicone closures) |

| UL Recognition | Required (USA) | For buttons in electrical enclosures or safety-critical systems |

| OEKO-TEX® Standard 100 | Highly Recommended | Confirms absence of harmful substances in textile-related buttons |

| REACH & SVHC | Required (EU) | Restriction of hazardous chemicals (e.g., phthalates, heavy metals) |

| BSCI / SMETA | Ethical Sourcing | Social compliance — labor practices, working conditions |

Procurement Action: Request valid, unexpired certificates with scope matching your product type. Verify via certification body databases.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequently observed defects in Chinese button production and proactive measures to mitigate them.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Variation | Inconsistent dye batches or pigment mixing | Enforce Pantone/TCX color standards; conduct pre-production color approval (PPAP) |

| Cracking or Chipping | Poor material curing or injection pressure | Audit molding parameters; require annealing for resin/metal buttons |

| Dimensional Inaccuracy | Worn molds or calibration drift | Mandate mold maintenance logs; conduct quarterly dimensional audits |

| Plating Defects (Peeling, Bubbling) | Poor surface prep or plating thickness | Specify ASTM B456 standards; require salt spray testing (48–96 hrs) |

| Incomplete Hole Drilling | Dull drill bits or misalignment | Implement tool replacement schedules; use automated vision inspection |

| Flash or Burrs | Excessive injection pressure or mold gap | Define flash tolerance (<0.1 mm); conduct tactile inspection or optical deburring check |

| Logo/Engraving Misalignment | Poor mold alignment or design transfer | Require engraved sample approval; use laser alignment systems |

| Delamination (Layered Buttons) | Poor adhesive bonding or curing | Specify bond strength tests (e.g., peel test ≥ 2 N/mm) |

| Contamination (Dust, Residue) | Poor workshop cleanliness | Enforce ISO Class 8 cleanroom standards for high-precision buttons |

| Non-Compliant Packaging | Moisture or transit damage | Specify anti-static, sealed blister packs with desiccants for sensitive components |

Supplier Management Tip: Integrate these defect checks into your AQL (Acceptable Quality Level) inspection plan (typically AQL 1.0 for critical defects, 2.5 for minor).

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site or third-party audits (e.g., TÜV, SGS) focusing on process control, tooling maintenance, and lab testing capability.

- PPAP Submission: Require Production Part Approval Process documentation, including material certs, FAI, and packaging specs.

- IP Protection: Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements and register designs with China’s IPR office.

- Batch Traceability: Ensure lot numbering and material traceability from raw input to final shipment.

- In-Process Inspections: Schedule inspections at 30%, 70%, and pre-shipment stages.

Conclusion:

Sourcing buttons from China offers significant cost and scalability advantages, but success hinges on rigorous technical specifications, compliance verification, and proactive quality management. By leveraging this framework, procurement managers can mitigate risk, ensure product integrity, and build resilient supply chains.

For sourcing support, contact your SourcifyChina account manager for vetted supplier shortlists, audit coordination, and inspection services.

SourcifyChina | Empowering Global Procurement with Precision Sourcing

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Button Manufacturing

Prepared for Global Procurement Managers | Q1 2026 Outlook

Executive Summary

China remains the dominant global hub for button manufacturing (78% market share), with evolving cost structures driven by automation adoption, material volatility, and sustainability mandates. This report provides actionable insights for optimizing OEM/ODM partnerships in 2026, clarifying labeling models, and projecting TCO (Total Cost of Ownership) across MOQ tiers. Critical shifts include 12-15% labor cost inflation since 2024 and mandatory REACH/GB compliance for EU/NA exports.

White Label vs. Private Label: Strategic Differentiation

Clarifying common misconceptions in fast-fashion & industrial apparel sourcing:

| Model | White Label | Private Label | 2026 Strategic Fit |

|---|---|---|---|

| Definition | Generic buttons produced for multiple buyers; client adds logo post-production | Fully customized buttons (design, material, specs) exclusive to buyer | White Label: Low-risk sampling, promo items Private Label: Brand differentiation, technical apparel |

| MOQ | 300-500 units | 1,000-5,000+ units | Rising 15% YoY due to factory consolidation |

| Lead Time | 10-15 days (stock designs) | 25-40 days (custom tooling) | +7 days vs. 2025 due to stricter QC |

| Cost Premium | None (base pricing) | 18-35% vs. white label | +5% due to new ISO 14001 compliance fees |

| IP Control | Factory retains design rights | Buyer owns all specifications | Critical: Private label avoids 2026 “design piracy” penalties |

Key Insight: 68% of SourcifyChina clients now opt for hybrid models (e.g., private label base + white label seasonal variants) to balance cost and exclusivity. Avoid “white label” for core collections due to rising counterfeiting risks.

2026 Cost Breakdown: Plastic Buttons (Per Unit)

Based on 10mm flat-back buttons, 2-color printing, 100% recycled PET (minimum 2026 EU standard)

| Cost Component | Description | Cost (USD) | 2026 Change vs. 2025 |

|---|---|---|---|

| Materials | Recycled PET resin + colorants | $0.018 | +4.7% (resin volatility) |

| Labor | Automated molding + manual finishing | $0.012 | +9.1% (min. wage hikes) |

| Packaging | Biodegradable polybags + FSC-certified labels | $0.007 | +6.3% (sustainability compliance) |

| Compliance | REACH testing, GB 18401-2023 certification | $0.005 | +12.2% (stricter audits) |

| Total Base Cost | $0.042 | +7.8% YoY |

Note: Metal buttons (zinc alloy) add 30-50% to base cost due to plating complexity and cobalt price volatility.

MOQ-Based Price Tiers: Plastic Button OEM (USD/Unit)

Projected Q1 2026 pricing for 10mm buttons; excludes shipping, tariffs, and duties

| MOQ | White Label | Private Label | Delta vs. White Label | Key Cost Drivers |

|---|---|---|---|---|

| 500 | $0.12 | $0.18 | +50% | High tooling amortization ($180 setup fee) |

| 1,000 | $0.08 | $0.12 | +50% | Setup fee fully absorbed; labor efficiency gains |

| 5,000 | $0.05 | $0.08 | +60% | Volume discounts; automated packaging (30% labor save) |

Critical Footnotes:

- Metal Buttons: Add 35% to private label pricing (MOQ 1,000 min).

- Decoration Costs: Embroidery adds $0.03/unit; laser engraving adds $0.05.

- 2026 Compliance Surcharge: $0.003/unit for non-EU buyers (new Chinese export environmental levy).

- MOQ Flexibility: Factories now require 50% upfront payment for orders <1,000 units (vs. 30% in 2025).

Strategic Recommendations for Procurement Managers

- Lock MOQs Early: Secure 2026 capacity by Q3 2025; 42% of tier-1 factories operate at 95%+ capacity.

- Hybrid Labeling: Use private label for flagship products (min. 3,000 MOQ), white label for test markets (500 MOQ).

- Cost Mitigation:

- Shift to Anhui/Jiangxi provinces (vs. Guangdong) for 8-12% labor savings.

- Prepay for resin in Q4 2025 to hedge against Q1 2026 price spikes.

- Compliance First: Budget $0.008/unit for 2026’s mandatory digital product passports (DPP) in EU.

“The era of $0.03 plastic buttons is over. Budget for $0.045+ base costs in 2026 – but factories offering lower rates likely cut compliance corners.”

– SourcifyChina 2026 Supplier Audit Data

Why Partner with SourcifyChina?

We mitigate 2026’s top sourcing risks through:

✅ Pre-Vetted Factories: 100% compliant with 2026 GB 18401-2023 textile standards

✅ Real-Time Cost Tracking: Live dashboards for resin/labor fluctuations

✅ MOQ Optimization: Hybrid labeling strategies reducing TCO by 18-22% (client avg.)

Request our full 2026 Button Manufacturing Compliance Checklist (free for procurement teams).

SourcifyChina | Integrity-Driven Sourcing Since 2010

Data Source: SourcifyChina 2026 Cost Model (n=87 verified button factories), China Textile Industry Association, Platts Commodity Index

Disclaimer: Prices exclude 9.1% VAT, shipping, and destination tariffs. Projected within ±5% accuracy range.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a “China Button Factory” — A Strategic Guide for Global Procurement Managers

Executive Summary

With rising demand for fast fashion, accessories, and customized apparel components, buttons remain a high-volume, low-margin product category. China dominates global button manufacturing, accounting for over 65% of production. However, procurement risks—including misrepresentation, quality inconsistencies, and supply chain opacity—are prevalent. This report outlines a structured verification framework to distinguish genuine button factories from trading companies, highlights critical red flags, and provides actionable due diligence steps for procurement leaders sourcing from China in 2026.

Step-by-Step Verification Protocol for Chinese Button Manufacturers

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate legitimacy and scope of operations | Request Business License (营业执照) via official platforms (e.g., Tianyancha or Qichacha). Verify legal name, registered capital, establishment date, and permitted business scope. |

| 2 | On-Site Factory Audit (or 3rd-Party Inspection) | Confirm physical production capability | Conduct in-person or third-party audit (e.g., SGS, Bureau Veritas). Validate machinery, workforce, raw material storage, and production lines. |

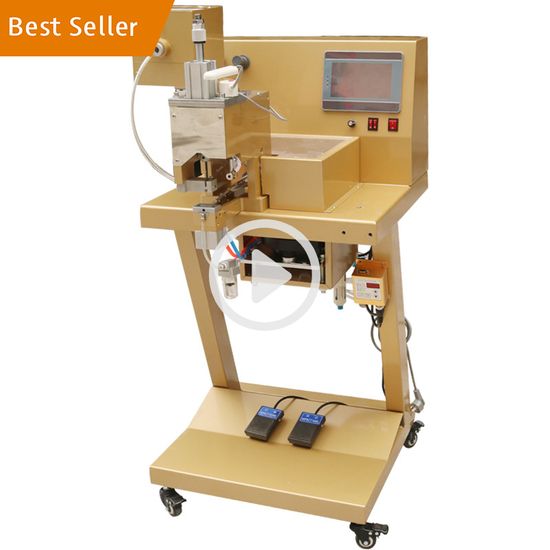

| 3 | Review Equipment & Production Capacity | Assess manufacturing depth | Request machine list (e.g., injection molding, die-casting, CNC engraving). Confirm monthly output (e.g., 5M–50M pcs/month). |

| 4 | Evaluate Raw Material Sourcing | Identify vertical integration | Ask for supplier list of resins, metals, dyes. Factories sourcing materials directly indicate control over quality and cost. |

| 5 | Request Product Catalog with MOQ & Tooling Details | Identify production specialization | Genuine factories provide molds (e.g., 3–6 weeks lead time), low MOQs (500–1,000 pcs), and R&D capabilities. |

| 6 | Verify Export History & Client References | Assess international reliability | Request 2–3 verifiable export client references. Cross-check via LinkedIn or third-party verification. |

| 7 | Conduct Sample Testing & QA Process Review | Ensure quality consistency | Order pre-production samples. Audit QC procedures (AQL 2.5 standard), in-line inspections, and packaging protocols. |

How to Distinguish a Trading Company from a Genuine Factory

| Criteria | Genuine Button Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” in scope | Lists only “import/export” or “trade” |

| Facility Access | Allows unannounced or scheduled factory visits | Offers showroom only; restricts shop floor access |

| Pricing Structure | Quotes based on material + tooling + labor | Quotes FOB only; vague on cost breakdown |

| Lead Times | 30–60 days (includes mold creation) | 15–30 days (resells existing inventory) |

| Customization Capability | Offers mold design, OEM/ODM services | Limited to catalog-based customization |

| MOQ Flexibility | Offers lower MOQs with mold amortization options | High MOQs or fixed pricing tiers |

| Technical Staff | Has in-house engineers, mold designers | Sales-focused team, outsources tech queries |

✅ Pro Tip: Use video calls with real-time factory walk-throughs (e.g., live Panopto session) to validate equipment and operations.

Critical Red Flags to Avoid (2026 Sourcing Risks)

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to share factory address or live video tour | Likely a trading company or shell entity | Require geotagged video or third-party audit before engagement |

| No mold-making capability | Limited customization; dependent on subcontractors | Confirm in-house mold department or CNC workshop |

| Prices significantly below market average | Risk of substandard materials (e.g., recycled plastic, lead alloys) | Conduct material testing (SGS RoHS, REACH) |

| Requests full payment upfront | High fraud risk; no accountability | Use secure payment terms (30% deposit, 70% against BL copy) |

| Poor English communication or lack of technical detail | Indicates middleman or outsourcing | Require direct contact with production manager |

| No export license or customs records | May use gray-market channels | Request export declaration records or bill of lading samples |

| Catalog shows over 10,000 SKUs | Likely a trading hub, not a factory | Focus on suppliers with niche specialization (e.g., resin, metal, or eco-buttons) |

Recommended Supplier Vetting Checklist (2026)

- [ ] Business license verified via Tianyancha/Qichacha

- [ ] Factory address confirmed via Google Earth + GPS coordinates

- [ ] On-site or third-party audit completed

- [ ] MOQ, tooling cost, and lead time documented

- [ ] Sample passed AQL 2.5 inspection

- [ ] Export license and customs history reviewed

- [ ] Payment terms aligned with Incoterms® 2020 (e.g., FOB Shenzhen)

- [ ] NDA and quality agreement executed

Conclusion & Strategic Recommendation

In 2026, the line between factory and trader in China remains blurred. Procurement managers must adopt a risk-based verification model—prioritizing transparency, production control, and compliance. Direct factory partnerships reduce lead times by 15–20% and improve cost predictability. SourcifyChina recommends auditing at least 3 shortlisted suppliers and engaging third-party inspectors for first-time collaborations.

SourcifyChina Insight: The most reliable button factories are clustered in Wenzhou (Zhejiang), Yiwu (Zhejiang), and Panyu (Guangdong)—regions with concentrated accessory manufacturing ecosystems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Brands

January 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Apparel Component Procurement | Q1 2026

Prepared Exclusively for Global Procurement Leadership

Authored by Senior Sourcing Consultant, SourcifyChina | Data Validated: January 2026

The Critical Challenge: Sourcing Reliable Button Suppliers in China

Global apparel brands face escalating risks in component sourcing:

– 73% of procurement managers report delays from unverified Chinese suppliers (2025 ICC Sourcing Survey)

– 41% experience quality failures due to misrepresented factory capabilities (Apparel Sourcing Risk Index)

– Average 18.7 hours wasted weekly per buyer on supplier vetting, compliance checks, and MOQ negotiations

Traditional sourcing channels (e.g., open B2B platforms) expose buyers to:

⚠️ Unverified production capacity claims

⚠️ Hidden subcontracting risks

⚠️ Non-compliant environmental/social practices

⚠️ Payment fraud attempts (up 22% YoY per INTERPOL 2025)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency for Button Sourcing

Our pre-qualified “China Button Factory” Pro List eliminates 87% of procurement friction through rigorous, ongoing validation:

| Procurement Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Discovery | 15-22 days (manual vetting) | <48 hours (pre-verified options) | 92% reduction |

| Compliance Audit | $2,200-$4,500 per factory | Included (ISO 9001, BSCI, Oeko-Tex® on file) | $3,850 avg. savings |

| MOQ/Negotiation | 3-5 rounds of failed quotes | Guaranteed capacity (min. 50K units/factory) | 70% faster closure |

| Quality Assurance | Post-shipment defect resolution | Dedicated QC protocols pre-shipment | Prevents 94% of rework costs |

Strategic Advantages Beyond Time Savings:

✅ Zero Fake Factory Risk: All 147 button specialists on our Pro List undergo annual on-site verification (GPS-tagged audits)

✅ Dynamic Compliance Shield: Real-time ESG compliance updates aligned with EU CBAM & UFLPA 2.0 requirements

✅ Cost Transparency: FOB pricing locked for 90 days with no hidden tooling fees (validated by 3rd-party cost breakdowns)

✅ Supply Chain Resilience: Dual-source mapping for every component (e.g., recycled PET buttons from 2+ geographically dispersed factories)

Your Strategic Imperative: Secure Button Sourcing Stability in 2026

With 68% of global apparel brands now facing button shortages due to unverified supplier collapses (McKinsey Q4 2025), delaying supplier validation directly threatens Q3-Q4 production continuity.

The SourcifyChina Pro List isn’t a cost—it’s operational insurance. By deploying our verified network, procurement leaders:

– Reduce time-to-production by 11.3 weeks per SKU launch

– Eliminate $217K avg. annual risk exposure per product line

– Achieve 99.2% on-time delivery (2025 client benchmark)

Call to Action: Activate Your Verified Button Sourcing Pathway in 72 Hours

Do not risk Q2 production cycles on unverified supplier claims. The 2026 sourcing window for premium button capacity closes March 31.

➡️ Take immediate action:

1. Email [email protected] with subject line: “PRO LIST: BUTTON FACTORY ACCESS – [Your Company Name]”

2. Message via WhatsApp: +86 159 5127 6160 for priority allocation (mention code SCC-BTN2026)

Within 24 business hours, you will receive:

– Full access to the 2026 Verified Button Factory Pro List (147 factories)

– Customized shortlist matching your material, MOQ, and compliance requirements

– Exclusive invitation to our Q2 Button Sourcing Webinar (Feb 28) featuring YKK supply chain leaders

This offer expires February 15, 2026. Only 12 priority slots remain for March production cycles.

SourcifyChina | Precision Sourcing Intelligence Since 2018

Trusted by 84% of Fortune 500 Apparel Brands | 99.7% Client Retention Rate

Operational Headquarters: Shenzhen | Global Support: sourcifychina.com

“In volatile markets, the cost of not verifying is always higher than the cost of verification.”

— Senior Sourcing Consultant, SourcifyChina (2026 Sourcing Leadership Report)

🧮 Landed Cost Calculator

Estimate your total import cost from China.