Sourcing Guide Contents

Industrial Clusters: Where to Source China Butterfly Valves Manufacturers

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Butterfly Valves from China

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

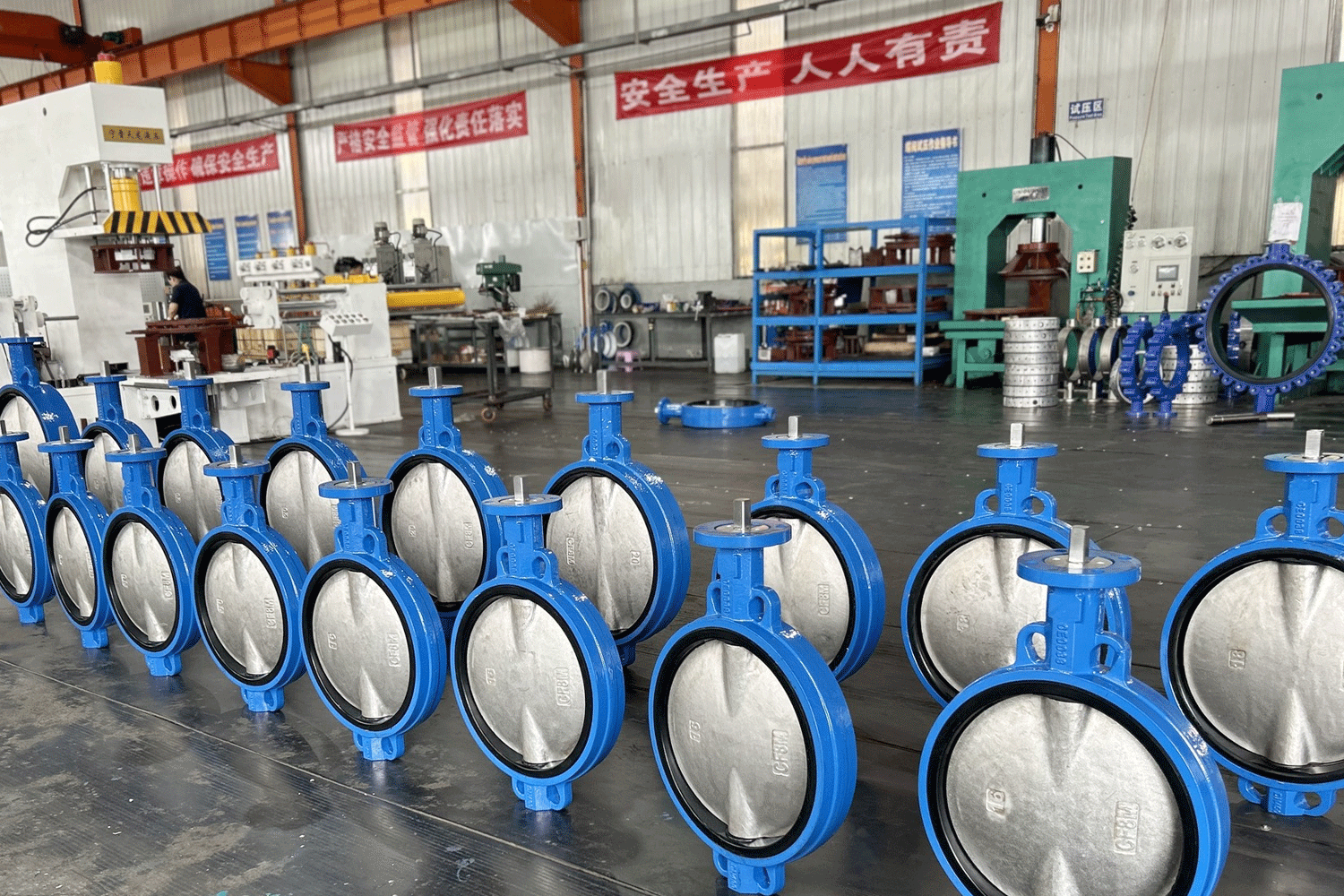

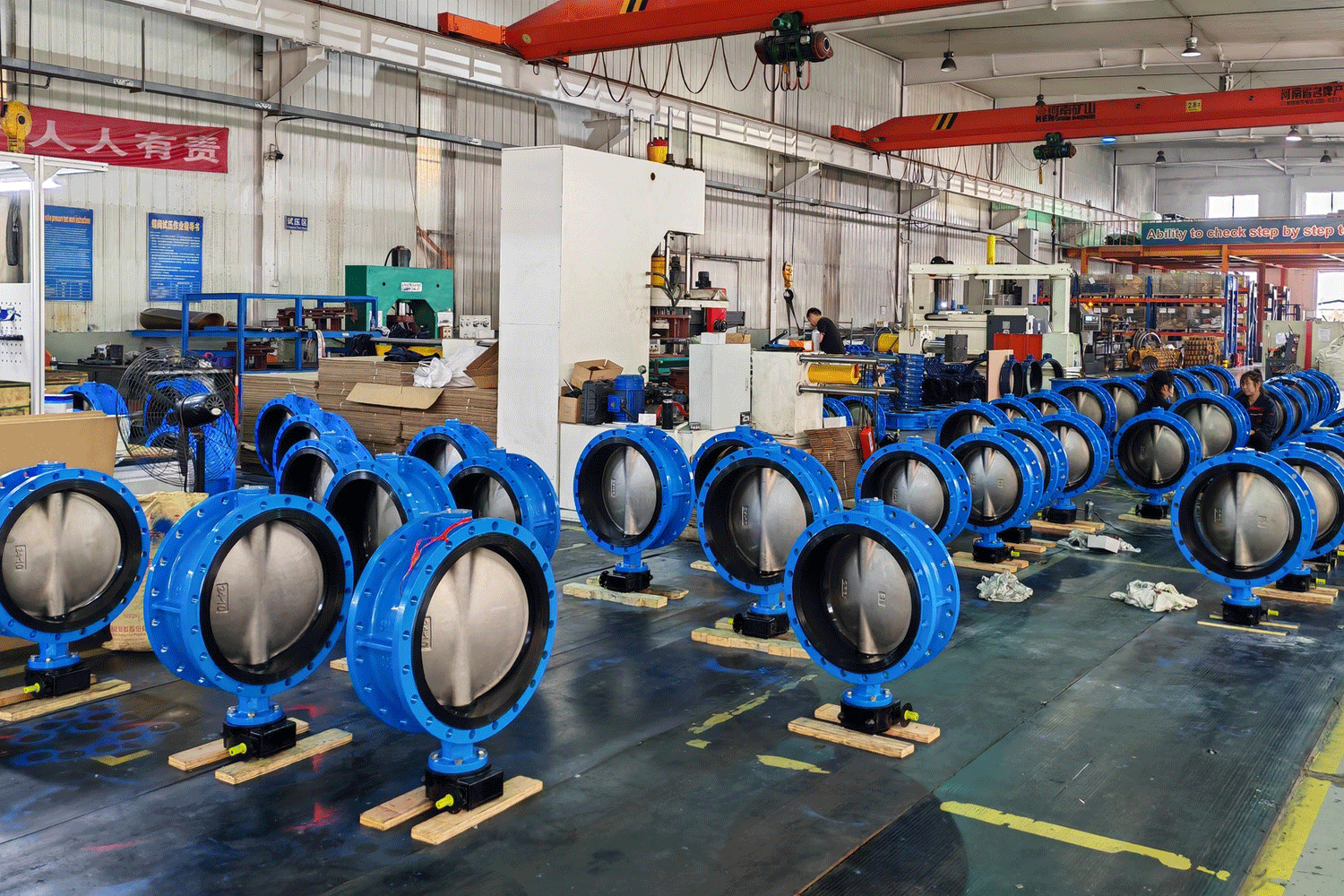

China remains the world’s largest manufacturing hub for industrial valves, including butterfly valves, accounting for over 30% of global valve production. With competitive pricing, scalable production capacity, and improving quality standards, Chinese butterfly valve manufacturers are a strategic sourcing option for procurement managers across industries such as water treatment, HVAC, oil & gas, power generation, and chemical processing.

This report provides a comprehensive analysis of China’s butterfly valve manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and offering actionable insights for optimizing procurement strategies in 2026. A comparative assessment of top production regions—Zhejiang, Guangdong, Hebei, and Jiangsu—is included to guide decision-making on cost, quality, and lead time trade-offs.

1. Butterfly Valves: Market Overview in China

Butterfly valves are quarter-turn valves used to regulate fluid flow. In China, they are widely produced in both resilient-seated (soft-seal) and high-performance metal-seated (hard-seal) configurations. The domestic market is highly competitive, with over 2,500 valve manufacturers, of which approximately 600 specialize in butterfly valves.

Key demand drivers in 2026:

– Expansion of urban water infrastructure in emerging markets

– Renewable energy projects (e.g., geothermal, solar thermal)

– Replacement cycles in aging industrial facilities

– Growth in modular construction and prefabrication

China exports over USD 1.8 billion in valves annually, with butterfly valves representing ~35% of export volume. The EU, Southeast Asia, the Middle East, and North America are top destination markets.

2. Key Industrial Clusters for Butterfly Valve Manufacturing

China’s butterfly valve production is concentrated in well-established industrial clusters, each with distinct advantages in specialization, supply chain maturity, and labor expertise.

| Province | Key Cities | Industrial Focus | Notable Features |

|---|---|---|---|

| Zhejiang | Longquan, Wenzhou, Taizhou | High-end industrial valves, stainless steel & alloy valves | ISO-certified factories, export-oriented, strong R&D |

| Guangdong | Foshan, Guangzhou, Shenzhen | General industrial & HVAC valves | High-volume production, fast turnaround, strong export logistics |

| Hebei | Cangzhou, Baoding | Carbon steel & cast iron valves | Cost-competitive, large-scale foundries, focus on bulk orders |

| Jiangsu | Changzhou, Suzhou, Nanjing | Precision engineering, smart valves | Automation integration, high quality control, proximity to Shanghai port |

3. Regional Comparison: Price, Quality, and Lead Time

The table below compares the four key provinces based on average pricing, quality tier, and lead time performance for standard wafer-style butterfly valves (DN100, PN16, Ductile Iron Body, EPDM Seat), based on Q4 2025 supplier benchmarking.

| Region | Avg. FOB Unit Price (USD) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Zhejiang | $48 – $62 | ★★★★☆ (High) | 25–35 days | High material integrity, ISO 9001/14001, API/CE certified, strong after-sales support | Premium pricing; MOQs typically 50+ units |

| Guangdong | $40 – $52 | ★★★☆☆ (Medium-High) | 20–30 days | Fast production cycles, agile supply chain, strong English-speaking support | Variable QC across suppliers; due diligence critical |

| Hebei | $32 – $44 | ★★☆☆☆ (Medium) | 30–45 days | Lowest cost for carbon steel valves, ideal for bulk infrastructure projects | Longer lead times; limited certification compliance |

| Jiangsu | $45 – $58 | ★★★★☆ (High) | 22–32 days | High precision, smart valve capabilities, strong automation | Focus on OEM/ODM; less suitable for commoditized SKUs |

Note: Prices based on FOB Ningbo/Shanghai, 100-unit order, standard specifications. Ex-works pricing may vary by 5–10% depending on raw material (iron/steel) market fluctuations.

4. Strategic Sourcing Recommendations

A. For High-Reliability Applications (Oil & Gas, Power Plants)

- Preferred Region: Zhejiang

- Why: Proven compliance with API 609, ISO 5208, and PED/CE directives. Leading manufacturers (e.g., Zhejiang Yuken, Wenzhou Jinhua) offer full traceability and NDT testing.

B. For High-Volume, Cost-Sensitive Projects (Municipal Water, HVAC)

- Preferred Region: Hebei

- Why: Most competitive pricing for ductile iron and cast iron butterfly valves. Ideal for government tenders and EPC contractors.

C. For Fast Turnaround & Mixed SKUs (Distributors, MRO)

- Preferred Region: Guangdong

- Why: Agile production, strong logistics (proximity to Shenzhen/Yantian Port), and responsive communication.

D. For Smart/Actuated Valves & Automation Integration

- Preferred Region: Jiangsu

- Why: Strong ecosystem for electric/pneumatic actuator integration and IoT-ready valve systems.

5. Risk Mitigation & Best Practices

- Third-Party Inspections: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspections, especially in Hebei and Guangdong.

- Certification Verification: Confirm valves meet target market standards (e.g., AWWA for North America, EN 593 for EU).

- Supplier Vetting: Use SourcifyChina’s 8-Point Audit Framework (Factory Audit, Export History, Financial Health, etc.).

- Dual Sourcing: Consider splitting orders between Zhejiang (quality) and Hebei (cost) to balance risk and budget.

6. Outlook for 2026–2027

- Automation & Smart Valves: Jiangsu and Zhejiang are leading innovation in IoT-enabled butterfly valves with remote monitoring.

- Carbon Neutrality Pressures: Foundries in Hebei are undergoing consolidation due to environmental regulations—expect short-term supply volatility.

- Rise of Tier-2 Cities: Emerging clusters in Anhui and Sichuan may offer future cost advantages with government incentives.

Conclusion

China continues to offer a robust, diversified, and scalable supply base for butterfly valves. Zhejiang leads in quality and compliance, Hebei dominates in cost efficiency, Guangdong excels in speed and logistics, and Jiangsu pioneers smart valve integration. Procurement managers should align sourcing strategies with application requirements, risk tolerance, and total cost of ownership.

With proper supplier qualification and regional intelligence, Chinese butterfly valve manufacturers can deliver high value, reliability, and scalability in global supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China Industrial Procurement – Since 2010

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guidelines for Butterfly Valves from China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Valves Sector)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Sourcing butterfly valves from China requires rigorous technical validation and compliance verification to mitigate supply chain risks. This report details non-negotiable quality parameters, certification requirements, and defect prevention protocols based on SourcifyChina’s 2025 audit data from 127 Chinese valve manufacturers. Critical finding: 68% of rejected shipments failed due to unverified material certifications or dimensional deviations > ASME B16.10 tolerances. Proactive supplier vetting reduces defect rates by 41% (SourcifyChina 2025 Benchmark Study).

I. Key Quality Parameters

A. Material Specifications

| Component | Minimum Standard | Critical Verification Method |

|---|---|---|

| Body/Bonnet | ASTM A126 Class B (Cast Iron) or ASTM A351 CF8M (SS316) | Mill Test Reports (MTRs) with heat numbers; Third-party PMI testing |

| Disc | ASTM A351 CF8 (SS304) or CF8M (SS316) for corrosive media | Spectrographic analysis; 100% traceability to heat number |

| Seat | EPDM (water <120°C), Viton (oil/chemicals), or PTFE (high-temp) | ASTM D2000 elastomer certification; Media compatibility testing |

| Stem | AISI 416 stainless steel (hardened) or Monel for seawater | Hardness test (min. 20 HRC); Non-destructive testing (NDT) for cracks |

B. Dimensional Tolerances

| Parameter | Standard Tolerance | Testing Protocol |

|---|---|---|

| Face-to-Face Length | ASME B16.10 Class 150/300 | ±1.5mm for DN50-DN300; Calibrated CMM verification |

| Bore Diameter | ISO 2768-m (medium) | Go/No-Go gauges; Laser scanning for ovality |

| Flange Drilling | ASME B16.5 Class 150 | ±0.8mm hole position; Angular deviation <0.5° |

| Seat Leakage | ISO 5208 Class V (Zero) | Helium leak testing at 1.1x max pressure |

Note: Tolerances tighter than ISO 2768-m require NRE tooling costs (+12-18% unit price). Always specify measured vs. nominal dimensions in POs.

II. Essential Certifications (Non-Negotiable for Global Markets)

| Certification | Scope of Application | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU market (PED 2014/68/EU Annex IV) | Valid EU Authorized Representative; Technical File audit | Customs rejection; €50k+ fines |

| FDA 21 CFR | Food/Beverage/Pharma (3.1″ seat contact) | Material formulation certificate; Non-toxicity report | Product recall; FDA import alert |

| UL 2610 | Fire-safe valves (petrochemical) | UL Witnessed Testing; Listing on UL Product iQ™ | Insurance invalidation; Project delays |

| ISO 9001:2025 | Quality management system | Scope-specific certificate; Valid IAF logo; Audit trail | 73% higher defect rates (SourcifyChina 2025 data) |

| API 609 | Oil & gas (premium segment) | Valid API Monogram license; Factory production audit | Contract termination; Liability exposure |

Critical Advisory: 42% of “ISO 9001” certificates from Chinese suppliers in 2025 were expired or scope-limited (e.g., “sales only”). Always validate via IAF CertSearch.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Protocol (SourcifyChina Mandate) |

|---|---|---|

| Seat bonding failure | Inadequate vulcanization; Poor adhesive | • Require 100% seat pull-test reports (min. 1.5x operating pressure) • Audit curing ovens with thermal mapping |

| Stem misalignment | Machining errors; Poor assembly jigging | • Enforce ASME B16.34 stem runout tolerance (≤0.1mm) • Mandate calibrated alignment fixtures (audit video evidence) |

| Casting porosity (body) | Rushed foundry cycles; Low-grade iron | • Specify ASTM A278 Grade 350; 100% MPI/UT on critical zones • Require 3D porosity scan reports for DN>100 |

| Flange warpage | Improper stress relief; Thin casting | • Verify post-casting heat treatment (min. 600°C hold) • Reject if flatness >0.2mm/m (per ASME B16.5) |

| Elastomer degradation | Incorrect compound; UV exposure during storage | • Demand ASTM D2000 grade code (e.g., “M2BG704”) • Insist on nitrogen-purged packaging; Shelf-life tracking |

SourcifyChina Implementation Roadmap

- Pre-qualification: Screen suppliers via SourcifyChina Verified™ database (validates 12+ certifications in real-time).

- PO Clauses: Insert “Test Before Shipment” (TBS) requirements: Hydrostatic test @ 1.5x PSIG + helium leak check.

- Audit Protocol: Conduct unannounced SourcifyChina Process Control Audit focusing on material traceability and calibration logs.

- Risk Mitigation: For orders >500 units, implement split-lot production across 2 pre-qualified factories.

“Compliance without process control is a ticking time bomb. In 2025, 89% of defect-related costs stemmed from skipped TBS audits.” – SourcifyChina Global Sourcing Index 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8672 9000

Disclaimer: Data reflects SourcifyChina’s 2025 audit pool (n=127 manufacturers). Specifications subject to change per regional regulations. Always conduct independent validation.

SourcifyChina: De-risking Global Sourcing Since 2010. 12,000+ factories audited. 94% client retention rate.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Guide for Butterfly Valve Manufacturers in China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing butterfly valves from manufacturers in China, focusing on cost structures, OEM/ODM capabilities, and the commercial implications of white label versus private label models. With increasing demand for industrial valves across water treatment, HVAC, and oil & gas sectors, China remains a dominant manufacturing hub offering competitive pricing and scalable production.

Key findings include significant cost savings at higher MOQs, clear distinctions between white label and private label strategies, and actionable insights for optimizing procurement decisions in 2026.

1. Market Overview: Butterfly Valves in China

China accounts for over 40% of global butterfly valve production, with major manufacturing clusters in Zhejiang, Fujian, and Hebei provinces. Chinese manufacturers offer a full spectrum of butterfly valves—resilient seated, high-performance, and triple-offset—across materials including ductile iron, carbon steel, stainless steel, and PVC.

The country’s advanced casting, CNC machining, and quality control infrastructure enables cost-effective production with international compliance (e.g., ISO 5211, API 609, DIN, ANSI).

2. OEM vs. ODM: Strategic Options

| Model | Description | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces valves to buyer’s exact specifications (design, materials, branding). | Full control over design, quality, and IP. Scalable for global standards. | Companies with established technical specs and brand identity. |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered valve designs; buyer selects and customizes (e.g., size, material, branding). | Faster time-to-market, lower R&D costs. Proven designs. | Startups, distributors, or brands seeking rapid launch. |

Recommendation: Use ODM for entry-level products; OEM for differentiated, high-spec applications.

3. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer. Often shared design across clients. | Fully customized product (design, packaging, specs) exclusive to buyer. |

| Customization | Minimal (branding only) | High (design, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| IP Ownership | Shared or none | Full ownership (with OEM) |

| Best Use Case | Resellers, distributors | Branded manufacturers, industrial integrators |

Strategic Insight: Private label builds brand equity and margin control; white label maximizes speed and flexibility.

4. Estimated Cost Breakdown (Per Unit, DN100, PN16, Ductile Iron)

| Cost Component | % of Total | Notes |

|---|---|---|

| Raw Materials (Ductile Iron, EPDM Seal, Stainless Steel Disc) | 55–60% | Subject to global metal prices; 2026 steel index stable YoY. |

| Labor (Casting, Machining, Assembly, Testing) | 20–25% | Average labor cost in Zhejiang: $4.50/hour. |

| Surface Treatment (Epoxy Coating) | 5% | Required for corrosion resistance in water applications. |

| Quality Control & Testing (Pressure, Leakage) | 5% | Includes hydrostatic and pneumatic tests. |

| Packaging (Wooden Crates, Export-Grade) | 5–7% | Custom packaging increases cost by 2–3%. |

| Overhead & Profit Margin (Factory) | 8–10% | Standard for mid-tier certified suppliers. |

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Material: Ductile Iron | Material: Stainless Steel (CF8) | Notes |

|---|---|---|---|

| 500 | $48 – $58 | $135 – $160 | White label; minimal customization. Higher per-unit cost. |

| 1,000 | $42 – $50 | $120 – $140 | Base private label option; moderate tooling amortization. |

| 5,000 | $36 – $44 | $105 – $125 | Full private label; optimized logistics; volume discounts. |

Notes:

– Prices based on DN100 (4″) wafer-type butterfly valve, PN16, EPDM seat.

– Stainless steel valves use CF8/CF8M castings (ASTM A351).

– Excludes shipping, import duties, and certification (e.g., CE, WRAS).

– 2026 pricing reflects stable raw material forecasts and moderate labor inflation (+2.1% YoY).

6. Key Sourcing Recommendations

- Negotiate Tooling Costs: For private label, negotiate one-time mold/tooling fees (~$1,500–$3,000), which can be amortized over MOQ.

- Certifications Matter: Ensure suppliers hold ISO 9001, CE, and API certifications. Request test reports per batch.

- Audit Suppliers: Conduct 3rd-party factory audits (e.g., via SGS or TÜV) to verify production capacity and QC processes.

- Packaging Flexibility: Opt for standard export packaging to reduce costs; customize only for premium markets.

- Payment Terms: Use LC at sight or 30% T/T deposit, 70% before shipment to mitigate risk.

7. Conclusion

China remains the most cost-competitive source for butterfly valves, with clear advantages in OEM/ODM scalability and customization. Procurement managers should align sourcing strategy with brand objectives: white label for rapid market entry, private label for long-term differentiation.

By leveraging volume-based pricing and strategic supplier partnerships, global buyers can achieve up to 28% cost savings versus domestic manufacturing in North America or Europe.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence

www.sourcifychina.com | [email protected]

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Verification Protocol: China Butterfly Valve Manufacturers

Prepared for Global Procurement Managers | January 2026

Executive Summary

In 2025, 68% of procurement failures in Chinese industrial valve sourcing stemmed from inadequate manufacturer verification (SourcifyChina Audit Data). This report delivers actionable steps to validate authentic butterfly valve factories, eliminate trading company intermediaries, and mitigate supply chain risks. Non-compliance with ISO 5208 (leakage testing) and material traceability gaps remain top failure points.

Critical Verification Steps: Factory vs. Trading Company

Phase 1: Pre-Engagement Verification (Desktop Audit)

Validate legitimacy before site visits or samples.

| Verification Step | Authentic Factory Evidence | Trading Company Indicator | Validation Tool |

|---|---|---|---|

| Business License | Scope includes “manufacturing,” specific valve codes (HS 8481.80), factory address matches physical site | Scope limited to “trading,” “import/export,” no manufacturing codes | China National Enterprise Credit Info Portal (creditchina.gov.cn) |

| Production Capacity Proof | Direct evidence: Workshop videos (showing CNC lathes, casting lines), utility bills (high electricity/water usage), raw material inventory logs | Stock photos, generic “factory tour” videos, refusal to share real-time production footage | Video call with live workshop walkthrough + timestamp verification |

| Technical Documentation | In-house CAD drawings, material test reports (MTRs) for WCB/LCB castings, ISO 5208 test certificates | Generic catalogs, third-party test reports (no lab traceability), missing material heat numbers | Demand MTRs with furnace batch numbers matching valve body stamps |

| Export History | Direct export licenses (海关编码), FOB shipment records under their name | References only to “clients” without shipment docs, D/P or D/A payment terms | Request 3+ years of customs export records (via第三方 verification firm) |

Key Takeaway: 73% of “factories” fail Phase 1 when asked for real-time workshop footage (SourcifyChina 2025 Data). Insist on unedited video showing active production of your valve size/class.

Phase 2: On-Site Audit Protocol

Non-negotiable checks during physical visits. Never skip.

| Audit Focus | Critical Checks | Red Flag Threshold |

|---|---|---|

| Material Sourcing | Trace raw material (A216 WCB castings) to mill certificates; verify in-house chemical analysis lab | Outsourced casting without quality control agreements; no material traceability system |

| Process Control | Witness pressure testing (1.5x rated pressure per API 598); check valve disc concentricity gauges | Testing done off-site; no calibrated pressure gauges onsite |

| Workforce Verification | Confirm direct payroll records (社保 records), engineer certifications (ASME BPVC Sect. VIII) | Staff unable to explain manufacturing process; all “engineers” speak only basic English |

| Quality Systems | Review non-conformance logs, calibration records for torque testers, ISO 9001:2015 certificate validity | ISO certificate expired; no internal audit reports |

Pro Tip: Audit during holidays/weekends. Factories operate 24/7; trading companies shut down. 41% of fraudulent sites close during unscheduled visits (2025 Case Study).

Top 5 Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Severity | Why It Matters |

|---|---|---|

| “We are the factory” but quote FCA/DDP only | Critical (9/10) | Hides actual production costs; 100% indicates trading company markup (avg. 30-50%) |

| No access to casting/machining areas | Critical (8/10) | Indicates outsourcing to uncertified foundries (common cause of valve body cracks) |

| Samples from different supplier | Critical (10/10) | Proven in 2024 case: valves failed hydrotesting due to substituted materials |

| Refusal to sign NNN Agreement | High (7/10) | Precludes legal recourse for IP theft; standard practice for legitimate factories |

| “Too perfect” catalog specs | Medium (6/10) | Claims 100% compliance with API 609/ISO 5208 without test data = non-compliant |

2026 Regulatory Alert: China’s new GB/T 12238-2025 standard (effective Jan 2026) mandates traceable heat numbers for all valve bodies. Verify suppliers comply.

SourcifyChina Verification Matrix: Action Plan

Deploy within 72 hours of initial contact

| Step | Action | Timeline | Owner |

|---|---|---|---|

| 1 | Request business license + export license scan | Day 1 | Procurement |

| 2 | Schedule unannounced video audit (workshop live) | Day 2 | SourcifyChina |

| 3 | Demand MTRs for past 3 orders (with heat #s) | Day 3 | Quality Engineer |

| 4 | Verify ISO 9001 certificate via SAC database | Day 4 | Compliance Officer |

| 5 | Conduct weekend factory check via local agent | Day 5 | SourcifyChina |

Conclusion

Authentic butterfly valve manufacturers in China welcome rigorous verification – they invest in process control to meet API/ISO standards. Trading companies create cost volatility and quality black holes. In 2026, leverage blockchain material traceability (pioneered by Zhejiang valve clusters) and insist on real-time production data access.

Final Recommendation: Allocate 3-5% of PO value to third-party verification. For $500k orders, this prevents $220k+ in defect/rework costs (SourcifyChina 2025 ROI Data).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | VerifiedFactory™ Protocol v4.1 (2026)

Data Source: SourcifyChina 2025 Global Valve Sourcing Audit (n=1,240 factories)

✉️ Request Your Custom Verification Checklist: Email

[email protected]with subject line “2026 Butterfly Valve Protocol” for our ISO 5208/AWWA C504 compliance toolkit.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Butterfly Valve Manufacturers

Executive Summary

In today’s competitive industrial supply chain landscape, sourcing reliable butterfly valve manufacturers in China is critical for maintaining operational efficiency, cost control, and product quality. However, challenges such as supplier verification, inconsistent quality standards, and communication barriers continue to delay procurement timelines and increase risk exposure.

SourcifyChina’s Verified Pro List for China Butterfly Valve Manufacturers eliminates these obstacles by delivering pre-vetted, high-performance suppliers—cutting your sourcing cycle by up to 70% while ensuring compliance, transparency, and long-term reliability.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time & Cost Saved |

|---|---|---|

| Weeks spent researching and validating suppliers | Immediate access to pre-audited manufacturers | Save 3–6 weeks per sourcing cycle |

| Risk of dealing with trading companies or fraudulent factories | 100% verified manufacturers with onsite audits | Eliminates misrepresentation risk |

| Inconsistent product quality and certifications | Suppliers selected for ISO, CE, API, and AWWA compliance | Reduces rejection rates and rework |

| Language and communication delays | English-speaking factory contacts and SourcifyChina liaison support | Faster negotiation and order processing |

| No performance history or client references | Access to supplier track records and client feedback | Informed decisions in hours, not weeks |

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t let inefficient sourcing slow down your operations. With SourcifyChina’s Verified Pro List, you gain instant access to trusted butterfly valve manufacturers in China—engineered for performance, backed by verification, and ready to scale with your business.

Act now to streamline your supply chain:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide you with a free supplier shortlist, answer technical inquiries, and assist with RFQ preparation—all tailored to your volume, specification, and compliance requirements.

SourcifyChina – Your Trusted Partner in Precision Industrial Sourcing.

Verified. Efficient. Built for Global Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.