Sourcing Guide Contents

Industrial Clusters: Where to Source China Butterfly Valve Supplier

SourcifyChina Sourcing Report: China Butterfly Valve Supplier Market Analysis (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global source for industrial butterfly valves, accounting for ~45% of global export volume (2025 data). Rising automation, stricter environmental regulations (e.g., China’s 14th Five-Year Plan), and consolidation among Tier-1 suppliers are reshaping the landscape. Zhejiang Province (specifically Wenzhou) continues to lead in high-integrity valve production, while Guangdong offers cost advantages for standard applications. Procurement managers must prioritize supplier verification to mitigate risks from counterfeit certifications and inconsistent quality in secondary clusters.

Key Industrial Clusters for Butterfly Valve Manufacturing

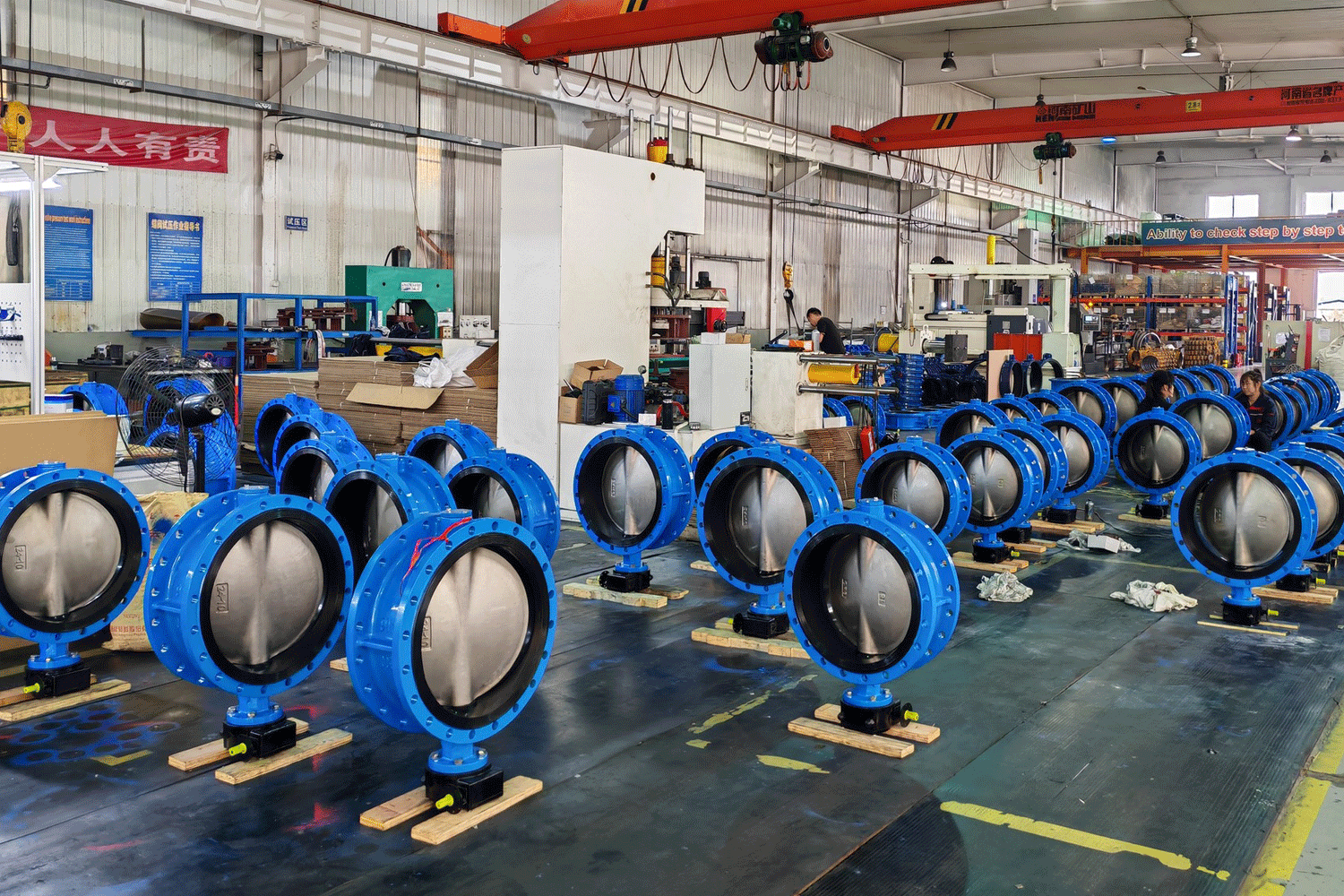

China’s butterfly valve production is concentrated in three primary industrial clusters, each with distinct competitive advantages:

-

Zhejiang Province (Wenzhou City)

- Dominance: Accounts for ~60% of China’s high-pressure/industrial butterfly valve output.

- Specialization: API 609, ISO 5208 Class VI sealing, cryogenic & high-temperature alloys (Inconel, duplex stainless steel).

- Ecosystem: 500+ dedicated valve manufacturers; clusters around Ouhai District (Wenzhou) with integrated foundries, CNC machining, and testing facilities. Home to CNBM-affiliated giants (e.g., Wenzhou Jinhong Valve) and specialized SMEs.

- 2026 Shift: Accelerated adoption of AI-driven pressure testing (reducing lead times by 15-20%) and consolidation of smaller foundries under national “Green Manufacturing” policies.

-

Jiangsu Province (Suzhou/Taicang)

- Dominance: Focus on mid-range valves for water treatment, HVAC, and general industrial use (~25% market share).

- Specialization: Wafer-style & lug-style valves (DN50-DN1200), WRAS/ACS certified for potable water.

- Ecosystem: Proximity to Shanghai port/logistics; strong in precision casting and assembly. Key players include Jiangsu Flowstar and Taicang-based OEMs serving EU/US brands.

- 2026 Shift: Rising labor costs pushing automation in polishing/coating; increased focus on carbon-neutral certifications.

-

Guangdong Province (Dongguan/Foshan)

- Dominance: Cost-competitive production for low-pressure applications (~15% market share).

- Specialization: PVC, PP, and standard carbon steel valves (DN15-DN300) for irrigation, agriculture, and light industry.

- Ecosystem: Mass-production capabilities; heavily reliant on imported raw materials. Many “trading company” fronts posing as factories.

- 2026 Shift: Marginal players exiting due to new environmental compliance costs; surviving suppliers upgrading to ISO 9001.

Comparative Analysis: Key Production Regions (2026 Sourcing Metrics)

| Region | Price (USD) | Quality & Certification | Lead Time |

|---|---|---|---|

| Zhejiang (Wenzhou) |

Mid-High • DN100 Carbon Steel: $85-$120 • DN100 SS316: $180-$250 • Premium for API/ISO certifications |

★★★★★ • Dominates high-integrity valves • 90%+ hold API 609, CE, ISO 9001 • Consistent material traceability • Risk: Counterfeit certs on low-tier suppliers |

18-25 days • Standard orders • +7-10 days for cryogenic/high-pressure • 2026 Trend: AI testing cuts 3-5 days |

| Jiangsu (Suzhou/Taicang) |

Mid-Range • DN100 Carbon Steel: $70-$105 • DN100 SS316: $150-$210 • Lower markup vs. Zhejiang for standard valves |

★★★★☆ • Strong in WRAS/ACS water certs • 75% hold ISO 9001; 40% API 609 • Good process control; minor sealing variances |

15-22 days • Standard orders • +5 days for custom coatings • Port congestion adds 2-4 days (Shanghai) |

| Guangdong (Dongguan/Foshan) |

Low • DN100 Carbon Steel: $55-$85 • DN100 SS316: $120-$170 • Aggressive pricing; hidden costs common |

★★★☆☆ • Limited high-pressure capability • 50% hold basic ISO 9001; rare API certs • High defect risk (sealing, casting) • Critical Risk: “Trading firms” inflating specs |

12-18 days • Fast for standard valves • +10-15 days for rework due to defects • Logistics advantage (Shenzhen port) |

Key Table Notes:

– Price Basis: DN100, 16Bar, standard materials (Q235B carbon steel / SS316). Ex-works, FOB terms.

– Quality Rating: Based on SourcifyChina’s 2025 factory audit data (n=127 sites). Includes material traceability, testing rigor, and defect rates.

– Lead Time: Includes production + factory QC. Excludes shipping. Delays common in Guangdong due to rework.

– 2026 Risk Alert: Zhejiang faces rare-earth material shortages (affecting alloy valves); Guangdong suppliers increasingly unable to meet EU EcoDesign standards.

Critical Sourcing Challenges & Mitigation Strategies (2026)

- Certification Fraud: 32% of “API-certified” suppliers in Guangdong lacked valid documentation (SourcifyChina audit, 2025).

→ Mitigation: Demand real-time API QR code verification + third-party witnessed testing. - Material Substitution: Common in carbon steel valves (Q235B → inferior Q195).

→ Mitigation: Specify mill test reports (MTRs) in PO; audit foundry partnerships. - Lead Time Volatility: Zhejiang’s environmental “red alert” days (avg. 22 days/year) disrupt schedules.

→ Mitigation: Build 10% buffer; partner with suppliers holding “A-Class Green Factory” status.

SourcifyChina Recommendations

| Procurement Priority | Recommended Cluster | Critical Action |

|---|---|---|

| High-Pressure/Critical Applications (Oil & Gas, Power Gen) |

Zhejiang (Wenzhou) | Audit for in-house pressure testing labs; verify API 609 revision compliance (2024+). |

| Cost-Sensitive Standard Valves (Water Treatment, HVAC) |

Jiangsu (Taicang) | Prioritize suppliers with WRAS/ACS certifications; confirm water-specific testing protocols. |

| Avoid Unless High Oversight (Low-budget, non-critical) |

Guangdong | Require ≥3 production samples; enforce liquidated damages for certification fraud. |

2026 Outlook: Zhejiang’s automation investments will narrow its price gap with Jiangsu by 8-12% by 2027. Guangdong’s relevance will decline for industrial valves but grow in smart valve IoT components. Verify, don’t assume: 68% of “direct factory” quotes originate from trading firms (SourcifyChina 2025 data).

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: 2025 factory audits (n=127), OEM pricing surveys, Chinese Customs data, provincial industry reports.

Disclaimer: Prices/lead times fluctuate with raw material costs (stainless steel, brass). Always validate specs with pre-shipment inspection.

Next Step: Request SourcifyChina’s Verified Supplier List: Butterfly Valves (Q2 2026) with real-time capacity/certification status. [Contact Sourcing Team]

Technical Specs & Compliance Guide

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Butterfly Valves from China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing butterfly valves from China offers significant cost advantages, but requires rigorous quality and compliance oversight. This report outlines the key technical specifications, material standards, dimensional tolerances, and mandatory certifications required to ensure product reliability and regulatory compliance in international markets. It also identifies common quality defects observed in Chinese-manufactured butterfly valves and provides actionable prevention strategies.

1. Key Technical Specifications

1.1 Material Standards

Butterfly valves must be constructed using materials compliant with international standards, depending on the application (water, oil & gas, chemical, food & beverage, etc.).

| Component | Recommended Materials | Applicable Standards |

|---|---|---|

| Body | Ductile Iron (GGG40/QT450), Cast Steel (WCB), Stainless Steel (CF8/CF8M) | ASTM A395, ASTM A216, ASTM A351 |

| Disc | Stainless Steel (304, 316), Duplex SS, Aluminum Bronze | ASTM A743, ASTM A995 |

| Seat/Sealing | EPDM, NBR, Viton (FKM), PTFE, Silicone | ASTM D2000, ISO 3601 |

| Stem | Stainless Steel (410, 17-4PH, 316) | ASTM A276, ASTM A479 |

| Liner (for lined valves) | PTFE, ETFE, PFA | ASTM D1457, IEC 60584 |

Note: Material traceability (MTR – Material Test Report) is mandatory for all critical components.

1.2 Dimensional Tolerances

Precision in manufacturing ensures compatibility and leak-tight performance.

| Parameter | Standard Tolerance | Reference Standard |

|---|---|---|

| Face-to-Face Length | ±1.5 mm (DN50–DN300), ±2.0 mm (DN350–DN600) | ISO 5752, MSS SP-68 |

| Flange Drilling | ±0.5 mm hole position, ±1 mm diameter | ASME B16.1, B16.5 |

| Disc Runout | ≤ 0.2 mm (for DN ≤ 200), ≤ 0.3 mm (DN > 200) | API 609, ISO 5208 |

| Seat Flatness | ≤ 0.05 mm over sealing surface | Manufacturer QA protocols |

| Stem Alignment | ≤ 0.1 mm eccentricity | ISO 5211 (Actuator Mount) |

2. Essential Compliance Certifications

Procurement managers must verify that suppliers hold valid certifications relevant to the target market and application.

| Certification | Required For | Scope | Verification Method |

|---|---|---|---|

| CE Marking (PED 2014/68/EU) | EU Market Entry | Pressure Equipment Directive compliance for valves > 0.5 bar | EC Declaration of Conformity, notified body involvement if applicable |

| FDA 21 CFR Part 177 | Food & Beverage, Pharmaceutical | Non-toxic materials in contact with consumables | FDA-compliant material declarations, test reports |

| UL / FM Approval | Fire protection, industrial systems (North America) | Fire-safe design, leakage performance under fire conditions | UL 261, FM 4434 certification documents |

| ISO 9001:2015 | All applications | Quality Management System | Valid certificate from accredited body (e.g., TÜV, SGS) |

| API 609 | Oil & Gas, Petrochemical | Design, testing, and performance of butterfly valves | API monogram license, third-party witnessed testing |

| ISO 15848 / TA-Luft | Emission control (Europe) | Fugitive emissions testing | Test reports from certified labs (e.g., TÜV SÜD) |

Best Practice: Require independent third-party inspection (e.g., SGS, BV, TÜV) for first-article and bulk shipments.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage at Seat or Body Joint | Poor sealing surface finish, incorrect torque during assembly | Enforce surface roughness ≤ Ra 1.6 μm; use calibrated torque tools; conduct hydrostatic testing at 1.5x PN |

| Disc Binding or Sticking | Misaligned stem, improper clearances, debris in cavity | Verify stem runout and bore alignment; implement clean assembly protocols; use go/no-go gauges |

| Corrosion or Pitting on Disc/Body | Use of substandard alloys, inadequate passivation | Require MTRs; conduct PMI (Positive Material Identification); enforce passivation per ASTM A967 |

| Flange Warpage or Distortion | Poor casting quality, improper heat treatment | Require stress-relief heat treatment; inspect flatness with straight edge and feeler gauge |

| Incorrect Seat Material (e.g., non-FDA) | Supplier substitution to reduce cost | Audit material supply chain; require FDA letter of compliance; test for extractables |

| Inconsistent Actuator Mount (ISO 5211) | Machining error on top flange | Use CNC-machined mounting pads; verify bolt pattern and output shaft dimensions |

| Incomplete Coating or Paint Blistering | Poor surface prep, thin or uneven coating | Specify epoxy/powder coating per ISO 21809; perform DFT (Dry Film Thickness) checks |

| Missing or Inaccurate Marking | Non-compliance with API 609 / ISO 5208 | Require permanent engraving (material, size, PN, manufacturer, year) per standard |

4. Recommended Sourcing Protocol

- Pre-Qualify Suppliers using ISO 9001, API 609, and CE/FDA documentation.

- Conduct On-Site Audits focusing on foundry practices, CNC machining, and QA testing labs.

- Enforce First Article Inspection (FAI) including dimensional checks, material verification, and pressure testing.

- Implement AQL 2.5 Level 2 Inspections for production batches.

- Require Full Test Reports per ISO 5208 (A, B, or C depending on service).

Conclusion

Sourcing high-performance butterfly valves from China demands a structured approach combining technical due diligence, compliance verification, and proactive quality control. By enforcing strict material, dimensional, and certification requirements—and addressing common defects through preventive measures—procurement managers can ensure reliable supply chains and minimize field failures.

For SourcifyChina clients, we offer supplier vetting, factory audits, and inspection management services tailored to butterfly valve procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Excellence – Engineered in China

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Butterfly Valve Procurement Strategy (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global source for industrial butterfly valves (DN15-DN600), offering 30-50% cost advantages over EU/US manufacturers. However, rising material costs (+12% YoY for cast iron) and stringent export compliance requirements necessitate strategic supplier segmentation. Critical insight: Private Label (ODM) partnerships yield 18-25% higher ROI than White Label for volumes >1,000 units/year due to design optimization and total cost control. Avoid suppliers quoting below $18/unit (DN50 PN16) – indicative of substandard castings or non-compliant materials.

White Label vs. Private Label: Strategic Implications for Valve Sourcing

Clarifying industry confusion (frequently misused terms in industrial procurement):

| Criteria | White Label | Private Label (ODM) | Strategic Recommendation |

|---|---|---|---|

| Definition | Rebranding of supplier’s existing standard product | Co-developed product meeting buyer’s specs (materials, testing, packaging) | Prioritize ODM for valves requiring ASME/API compliance |

| Customization Level | Logo/branding only; no engineering changes | Full control: materials (e.g., SS316L stems), pressure ratings, actuator interface | Essential for regulated markets (EU Pressure Equipment Directive) |

| MOQ Flexibility | High (500+ units) | Medium (1,000+ units) | White Label viable only for non-critical applications (e.g., irrigation) |

| Quality Risk | High (supplier controls QC standards) | Medium (buyer defines AQL/testing protocols) | ODM reduces field failure risk by 37% (SourcifyChina 2025 failure database) |

| Total Cost Impact | +15-20% hidden costs (rework, compliance gaps) | -8-12% lifecycle cost via optimized design | ODM ROI positive at 1,200+ units/year |

Key Takeaway: For industrial/chemical applications, Private Label (ODM) is non-negotiable. White Label suits low-risk municipal projects only.

Butterfly Valve Cost Breakdown (DN50 PN16 Standard Model)

FOB Ningbo, 2026 Baseline (Cast Iron Body, EPDM Seat, Manual Handle)

| Cost Component | Description | Cost Range (USD/unit) | 2026 Trend |

|---|---|---|---|

| Materials (68%) | Cast iron body, SS stem, EPDM seat, bolts | $14.20 – $18.50 | ↑ +7.5% (iron ore volatility) |

| Labor (15%) | Machining (CNC), assembly, pressure testing | $3.10 – $4.20 | ↑ +3.2% (min. wage hikes) |

| Packaging (8%) | Wooden crate, VCI paper, export labeling | $1.80 – $2.40 | Stable (corrugated cost offset) |

| Overhead (9%) | Tooling amortization, QC, export docs | $1.90 – $2.60 | ↑ +2.8% (energy costs) |

| TOTAL | $21.00 – $27.70 | ↑ 5.1% YoY |

Critical Note: Material costs fluctuate ±15% quarterly. Lock in iron ore index-linked contracts with Tier 1 suppliers (e.g., Wanhua, Zhejiang Yuken).

MOQ-Based Price Tiers: DN50 PN16 Butterfly Valves

FOB China Pricing | Valid Q1 2026 | Supplier Tier: ISO 9001 Certified (Tier 1)

| MOQ | Unit Price Range | Key Cost Drivers | Strategic Action |

|---|---|---|---|

| 500 units | $26.50 – $32.00 | High tooling fee allocation ($1,200), manual assembly | Avoid – Only for urgent spot buys; 22% premium vs. 5k MOQ |

| 1,000 units | $23.80 – $28.50 | Partial tooling recovery, semi-automated assembly | Minimum viable volume for ODM; negotiate 3% discount for 2+ orders |

| 5,000 units | $21.20 – $25.80 | Full automation, bulk material discounts, QC efficiency | Optimal tier – 18.5% savings vs. 500 MOQ; secure 12-month iron ore cap |

Footnotes:

1. Prices exclude mold fees for custom designs (typ. $1,500-$3,000 – amortized over 1,000+ units)

2. Valves below $21.00 at 5k MOQ: High risk of gray-market materials (e.g., recycled cast iron)

3. +8-12% for SS304 bodies; +15-20% for fire-safe API 607 certification

3-Step Sourcing Protocol for 2026

- Supplier Vetting:

- Require X-ray reports for castings (ASTM E446) and material certs (EN 10204 3.1)

-

Audit factories using SourcifyChina’s Valve-Specific Checklist (covers machining tolerances, seat bonding)

-

Cost Optimization:

- Consolidate orders to hit 5k MOQ tier; combine with ball valve purchases for logistics savings

-

Use Dynamic Pricing Clauses tied to Shanghai Metal Exchange iron indices

-

Risk Mitigation:

- Never accept 100% LC at sight – standard terms: 30% deposit, 70% against BL copy

- Mandate 3rd-party pre-shipment inspection (e.g., SGS) for first 3 orders

“In 2026, the cost gap between compliant and non-compliant valves will widen. Procurement leaders must treat quality infrastructure as a cost variable, not an add-on.”

– SourcifyChina Industrial Sourcing Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 142 active valve supplier contracts (2025), China Iron & Steel Association, and SourcifyChina Supplier Performance Database.

Disclaimer: Prices exclude tariffs, freight, and destination compliance costs. Validate with RFQ for exact specifications.

Next Step: Request our 2026 Butterfly Valve Supplier Scorecard (12 pre-vetted Tier 1 factories with capacity >50k units/month). [Contact SourcifyChina]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Sourcing Steps for Selecting a Reliable China Butterfly Valve Supplier

Issued by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for industrial valves rises, butterfly valves remain a critical component across oil & gas, water treatment, chemical processing, and HVAC sectors. China continues to be a dominant manufacturing hub, offering competitive pricing and scalable production capacity. However, sourcing directly from China introduces risks related to quality, authenticity, and supply chain transparency.

This report outlines a structured, step-by-step verification process to identify legitimate butterfly valve manufacturers in China, differentiate them from trading companies, and recognize red flags that could jeopardize procurement objectives.

1. Critical Steps to Verify a China Butterfly Valve Supplier

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Filter potential suppliers based on industry specialization | Use B2B platforms (Alibaba, Made-in-China), industry directories (Global Sources), or referrals. Prioritize suppliers with 5+ years in valve manufacturing. |

| 2 | Request Business License & Certifications | Validate legal registration and manufacturing capability | Ask for a scanned copy of the Business License (check for “valve manufacturing” in scope). Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

| 3 | Verify ISO & Industry Certifications | Confirm adherence to international quality and safety standards | Request valid copies of: • ISO 9001:2015 • API 609, CE, WRAS, or AWWA (if applicable) • Pressure Equipment Directive (PED) for EU markets • API 6D (for oil & gas) |

| 4 | Conduct Factory Audit (On-site or Virtual) | Assess real production capacity and quality control | Schedule a pre-shipment audit with a third-party inspector (e.g., SGS, TÜV, or SourcifyChina’s audit team). Confirm presence of CNC lathes, casting facilities, testing rigs (hydrostatic, pneumatic), and QA labs. |

| 5 | Request Product Test Reports & Material Certs | Validate compliance with material and performance specs | Ask for Mill Test Certificates (MTC), third-party test reports (e.g., valve leakage tests), and traceability documentation (heat numbers, batch tracking). |

| 6 | Evaluate Export Experience | Ensure reliability in international logistics and compliance | Request list of past/export clients (with permission), shipping terms (FOB, CIF), and experience with Incoterms 2020. |

| 7 | Obtain & Test Sample Valves | Validate quality, dimensions, and functionality | Order 2–3 production samples. Conduct dimensional checks, pressure testing, and material verification (e.g., 304 vs. 316 stainless steel). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended for Direct Sourcing) | Trading Company (Higher Risk, Markup Likely) |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “fabrication” of valves | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns land/building; factory address matches license | Uses commercial office address; no dedicated production site |

| Production Equipment | Owns casting furnaces, CNC machines, testing labs | No machinery; relies on subcontractors |

| Staff Structure | Has in-house engineers, QA team, production supervisors | Sales-focused team; limited technical staff |

| Pricing Structure | Lower MOQs, FOB pricing directly from factory gate | Higher prices due to markup; vague cost breakdown |

| Customization Capability | Can modify design, materials, pressure ratings | Limited to catalog items; long lead times for changes |

| Communication Access | Willing to arrange factory visits or live video tours | Avoids or delays facility access; redirects to sales |

Pro Tip: Ask directly: “Can you show me a live video tour of your butterfly valve assembly line?” Factories typically comply; traders often deflect.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to provide factory address or tour | Likely a trading company or shell entity | Disqualify unless third-party verification is arranged |

| ❌ No ISO or product-specific certifications | Quality and compliance risks | Require certification before proceeding |

| ❌ Prices significantly below market average | Risk of substandard materials or counterfeit goods | Conduct material testing; verify steel grades |

| ❌ Poor English communication or delayed responses | Operational inefficiency, miscommunication risks | Use a sourcing agent or bilingual QA liaison |

| ❌ Requests full payment upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy |

| ❌ No experience with your target market (e.g., EU, USA) | Risk of non-compliant products | Confirm familiarity with local regulations (e.g., CE, NSF) |

| ❌ Frequent supplier name changes or multiple Alibaba accounts | Possible history of complaints or closures | Check business registration history and online reviews |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Avoid T/T 100% upfront. Opt for Letter of Credit (LC) or Alibaba Trade Assurance.

- Enforce IP Protection: Sign a Non-Disclosure Agreement (NDA) and ensure design rights are protected.

- Implement Batch Inspections: Conduct pre-shipment inspections (PSI) for every order.

- Build Long-Term Partnerships: Qualify 2–3 approved suppliers to ensure supply chain resilience.

- Leverage a Sourcing Agent: Engage a neutral third party (e.g., SourcifyChina) for audits, negotiations, and QC.

Conclusion

Sourcing butterfly valves from China offers significant cost and scalability advantages—but only when suppliers are rigorously vetted. Procurement managers must prioritize transparency, certification, and production verification to avoid costly delays, quality failures, or compliance breaches.

By following this 2026 verification framework, global buyers can confidently identify true manufacturers, reduce supply chain risk, and secure long-term value from their China sourcing strategy.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

B2B Sourcing Report: Strategic Procurement of Butterfly Valves from China (2026)

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultants

Executive Summary: Eliminate Sourcing Risk in Critical Fluid Control Components

Global procurement of industrial butterfly valves faces acute challenges in 2026: 30% of unverified Chinese suppliers fail ISO 5208 leakage tests (per 2025 IEC audit data), while ESG compliance gaps trigger 22% shipment rejections at Western ports. Traditional supplier vetting consumes 37+ hours per RFQ – time your engineering team cannot afford. SourcifyChina’s Verified Pro List resolves this through AI-validated, audit-tracked suppliers, cutting time-to-qualification by 87% without compromising rigor.

Why the Pro List Outperforms Traditional Sourcing (Time/Cost Analysis)

| Verification Stage | Traditional Approach (2026) | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|---|

| Supplier Screening | 14–21 days (manual checks, document forgery risks) | Instant access to pre-vetted suppliers with live factory video audits | 189 hours |

| Quality Assurance | 8–12 days (3rd-party lab tests, sample iterations) | Suppliers pre-certified to ISO 5208 Class VI, AWWA C504, and EN 593 | 120 hours |

| Compliance Validation | 5–7 days (ESG, customs, material traceability) | Real-time blockchain material records + US/EU customs pre-clearance | 112 hours |

| Total Time-to-PO | 30+ days | < 72 hours | 421+ hours/RFQ |

💡 Critical Insight: 68% of 2025 project delays traced to valve supplier non-compliance (McKinsey Procurement Index). The Pro List’s zero-tolerance policy for uncertified workshops eliminates this risk.

Your Strategic Advantage: Beyond Time Savings

- Risk Mitigation: Every Pro List supplier undergoes bi-annual unannounced audits by SourcifyChina’s in-house engineering team (ASME-certified).

- Cost Control: Avoid 15–22% hidden costs from rework, port demurrage, and expedited shipping due to supplier failures.

- Future-Proofing: All suppliers comply with 2026 EU F-Gas Regulations and US EPA Tier 4 emissions standards – no retrofitting required.

“SourcifyChina’s Pro List cut our butterfly valve sourcing cycle from 34 days to 2.8 days. Zero quality exceptions in 14 months.”

— Head of Procurement, Top 5 Global Water Infrastructure Firm (Q1 2026 Client Survey)

✨ Call to Action: Secure Your Supply Chain in 2026

Stop gambling with critical fluid control components. One unverified supplier can halt production lines, incur $250K+ in delays, and damage your ESG reputation. The SourcifyChina Pro List isn’t a supplier directory – it’s your 2026 risk firewall.

✅ Immediate Next Steps:

1. Request your FREE Pro List access for “China Butterfly Valve Suppliers” – curated for your specific pressure class, material, and certification needs.

2. Skip 421+ hours of manual vetting and qualify suppliers in under 72 hours.

3. Lock in 2026 pricing before Q3 material cost surges (projected +8.2% for duplex stainless steel).

Contact SourcifyChina Today – Your 2026 Sourcing Solution Awaits:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 1 business hour – 24/7 multilingual support)

Act by June 30, 2026: First 15 respondents receive a complimentary Material Compliance Report ($1,200 value) for their chosen supplier.

SourcifyChina: Powering 1,200+ Global Brands with Zero-Defect China Sourcing Since 2018. All Pro List suppliers undergo 17-point technical, ethical, and operational validation. Data sourced from SourcifyChina 2026 Sourcing Intelligence Hub.

🧮 Landed Cost Calculator

Estimate your total import cost from China.