Sourcing Guide Contents

Industrial Clusters: Where to Source China Butterfly Valve Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Butterfly Valve Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest manufacturer and exporter of industrial valves, including butterfly valves, accounting for over 30% of global valve production. The country’s robust manufacturing ecosystem, skilled labor pool, and vertically integrated supply chains make it a strategic sourcing destination for butterfly valves across industries such as water treatment, oil & gas, HVAC, power generation, and chemical processing.

This report provides a comprehensive analysis of China’s butterfly valve manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for global procurement managers. Special focus is placed on comparing major production provinces—Zhejiang, Guangdong, Hebei, and Jiangsu—on critical procurement metrics: Price, Quality, and Lead Time.

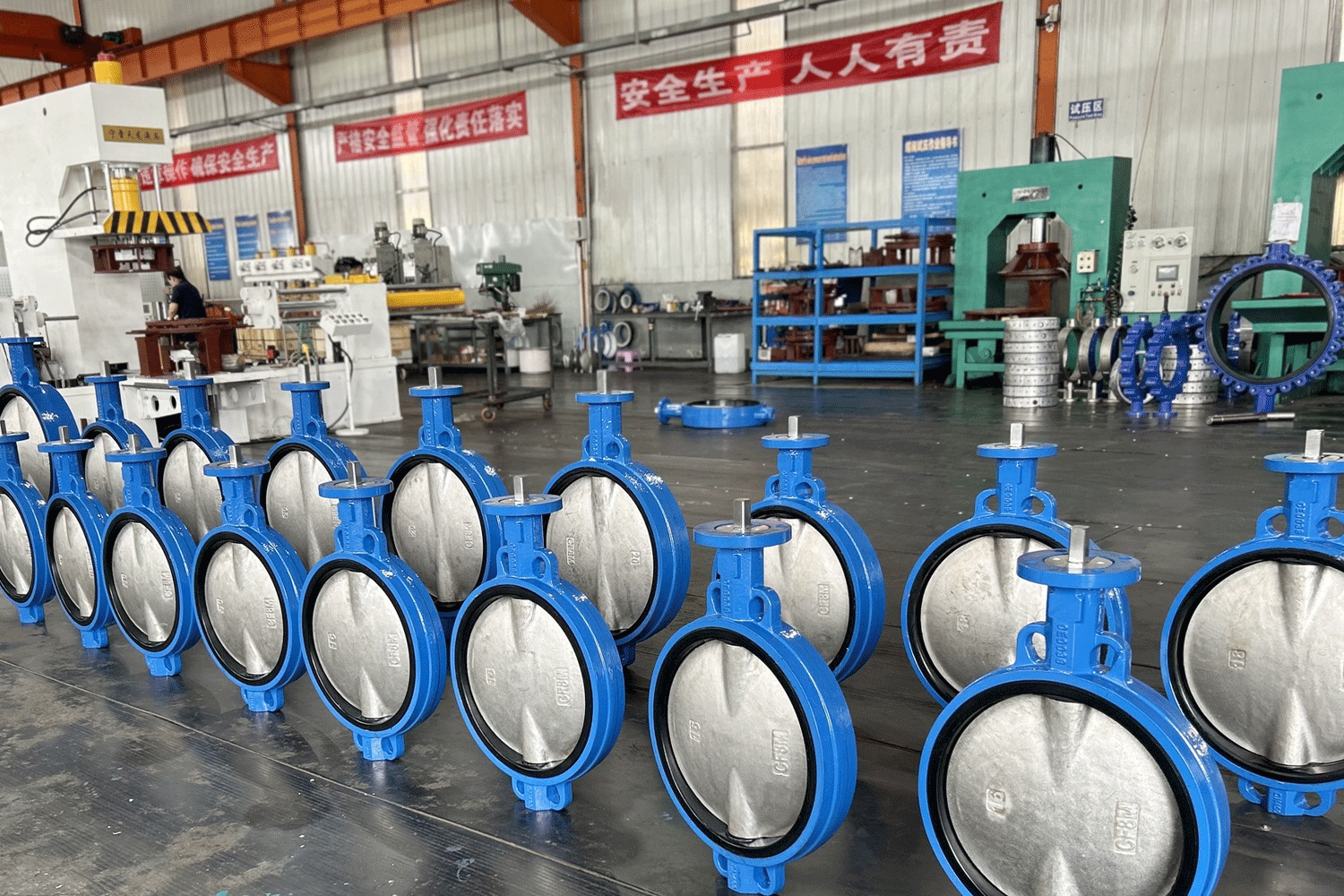

Key Industrial Clusters for Butterfly Valve Manufacturing in China

China’s butterfly valve industry is concentrated in several industrial hubs, each with distinct competitive advantages in technology, scale, and supply chain maturity.

1. Zhejiang Province – The Valve Manufacturing Heartland

- Key Cities: Longquan (Lishui), Wenzhou, Ningbo

- Overview: Zhejiang dominates China’s valve sector, contributing over 40% of national output. Longquan alone hosts more than 600 valve manufacturers and is officially recognized as the “Valve Capital of China.”

- Specialization: High-pressure, stainless steel, and triple-offset butterfly valves.

- Supply Chain: Strong local access to casting, forging, CNC machining, and surface treatment services.

2. Guangdong Province – Precision & Export Focus

- Key Cities: Foshan, Zhongshan, Dongguan

- Overview: Known for high-precision machining and export-oriented manufacturing. Foshan is a hub for smart valves and automation-integrated solutions.

- Specialization: Wafer-type and lug-type butterfly valves for HVAC and commercial plumbing.

- Advantage: Proximity to Shenzhen and Hong Kong ports enables faster export logistics.

3. Hebei Province – Cost-Effective Mass Production

- Key Cities: Cangzhou, Baoding, Wuqiao County

- Overview: Emerging as a low-cost alternative with large-scale foundries and carbon steel valve production.

- Specialization: Ductile iron and carbon steel butterfly valves for municipal water and irrigation.

- Note: Quality control varies; vetting suppliers is critical.

4. Jiangsu Province – High-End & Industrial Applications

- Key Cities: Suzhou, Wuxi, Changzhou

- Overview: Home to advanced manufacturing facilities serving multinational OEMs and EPC contractors.

- Specialization: Cryogenic, alloy, and ANSI/ASME-certified butterfly valves.

- Strength: ISO, API, and CE compliance is widespread.

Comparative Analysis of Key Production Regions

The table below evaluates the four primary butterfly valve manufacturing regions in China based on critical procurement KPIs.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Zhejiang | ★★★★☆ (High) | ★★★★★ (Excellent) | 4–6 weeks | High-performance valves, export-grade quality, OEM partnerships |

| Guangdong | ★★★☆☆ (Moderate) | ★★★★☆ (Very Good) | 3–5 weeks | Precision valves, smart automation, fast turnaround |

| Hebei | ★★★★★ (Very High) | ★★★☆☆ (Good, variable) | 5–8 weeks | Budget bulk orders, municipal infrastructure projects |

| Jiangsu | ★★☆☆☆ (Lower) | ★★★★★ (Premium) | 6–8 weeks | High-spec industrial, oil & gas, API-compliant valves |

Rating Scale: ★ = Low, ★★★ = Medium, ★★★★★ = High

Procurement Recommendations

✅ Strategic Sourcing Guidance

- For High-Volume, Cost-Sensitive Projects: Consider Hebei manufacturers for standard ductile iron butterfly valves. Ensure third-party QC audits.

- For Premium Industrial Applications: Source from Zhejiang or Jiangsu for certified, high-integrity valves compliant with API 609, ISO 5208, and NACE standards.

- For Fast-Turnaround & Smart Valve Needs: Guangdong offers agile production and integration with IoT-enabled controls.

⚠️ Risk Mitigation Tips

- Certification Verification: Confirm API, CE, FM, or AWWA certifications independently.

- Material Traceability: Request mill test certificates (MTCs) for critical alloys.

- Factory Audits: Use on-ground inspection services for first-time suppliers, especially in Hebei.

Market Trends (2025–2026)

- Automation & Smart Valves: Rising demand for actuated and IoT-connected butterfly valves, led by Guangdong and Jiangsu.

- Export Diversification: Chinese manufacturers are expanding beyond traditional markets (Middle East, Southeast Asia) into Latin America and Africa.

- Green Manufacturing: Zhejiang is leading in energy-efficient casting and reduced-emission valve designs to meet EU Ecodesign standards.

- Nearshoring Pressures: Despite global shifts, China retains a 25–40% cost advantage over India and Turkey for medium-to-high complexity valves.

Conclusion

China’s butterfly valve manufacturing sector offers unparalleled scale, diversity, and technical capability. Zhejiang remains the top-tier choice for balanced cost and quality, while Jiangsu leads in premium industrial applications. Guangdong excels in speed and innovation, and Hebei provides cost leadership for standardized products.

Procurement managers should align sourcing strategy with application requirements, compliance needs, and total landed cost—including logistics, tariffs, and quality risk.

For tailored supplier shortlists and factory audit support, contact SourcifyChina’s Technical Sourcing Team.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Butterfly Valve Manufacturers

Edition: Q1 2026 | Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 65% of global industrial butterfly valves (2025 IHS Markit data), but quality variance remains a critical risk. This report details actionable technical specifications, compliance mandates, and defect prevention protocols essential for risk-mitigated sourcing. Key insight: 42% of quality failures stem from unverified material substitutions and inadequate testing protocols (SourcifyChina 2025 Audit Database).

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Specifications

Critical for corrosion resistance, pressure integrity, and media compatibility.

| Component | Minimum Standard (General Industrial) | Premium Grade (Oil/Gas, Pharma) | Verification Method |

|---|---|---|---|

| Disc | ASTM A351 CF8 (SS304) | ASTM A351 CF8M (SS316L) | Mill Test Reports (MTRs) + PMI Testing |

| Body | ASTM A126 Class B (Cast Iron) | ASTM A216 WCB (Carbon Steel) | Chemical Composition Analysis |

| Seat | EPDM (≤80°C) | PTFE (≤200°C) / Metal-Seated | Durometer Test + Media Exposure |

| Stem | AISI 416 SS | AISI 440C SS (Hardened) | Hardness Test (HRC ≥35) |

Procurement Tip: Reject “equivalent” claims without certified MTRs. Chinese mills often substitute ASTM A276 304 with inferior GB/T 1220 06Cr19Ni10 (lower Ni content → reduced corrosion resistance).

B. Dimensional Tolerances

Deviation beyond these thresholds causes leakage, misalignment, and premature failure.

| Parameter | ISO 5752 Class V Tolerance | Critical Risk if Exceeded |

|---|---|---|

| Face-to-Face Length | ±1.5 mm (DN50-DN300) | Pipe stress → gasket failure |

| Bore Diameter | +0.2 mm / -0.0 mm | Seat extrusion → leakage |

| Flange Hole Pattern | ±0.4 mm (PCD) | Bolt misalignment → joint failure |

| Disc Flatness | ≤0.1 mm (per ISO 1123) | Uneven sealing → 100% leakage risk |

Compliance Note: Insist on ASME B16.10 (face-to-face) and ISO 5208 (leakage testing) adherence. Chinese GB/T 1221 standards permit 30% wider tolerances than ISO.

II. Essential Certifications: Market Access Requirements

| Certification | Mandatory For | Key Requirements | China Manufacturer Pitfall |

|---|---|---|---|

| CE | EU Market | PED 2014/68/EU Annex IV (Category IV for >25 bar) | Fake CE marks; incomplete DoC |

| FDA 21 CFR | Food/Pharma (US) | CFR 177.2600 (elastomers); non-toxic materials | Unverified “FDA-compliant” claims |

| UL 2034 | US Gas Applications | Pressure cycling tests; fire-safe design | Rarely held – requires US lab testing |

| ISO 9001 | Global Baseline | Valid certificate + scope covering valve production | Expired certs; scope limited to trading |

| API 609 | Oil & Gas (Critical) | Fire testing; fugitive emissions compliance | “API-style” vs. certified API 609 |

Critical Action: Verify certifications via official databases:

– CE: EU NANDO (https://ec.europa.eu/growth/tools-databases/nando/)

– API: IPIQ (https://www.api.org/quality-verification)

37% of audited Chinese suppliers in 2025 presented falsified certificates (SourcifyChina Audit).

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (Enforce in PO) |

|---|---|---|

| Porosity in Castings | Rushed cooling; low-grade scrap metal | Require X-ray/UT testing per ASTM E505; min. 85% virgin metal in melt |

| Seat Extrusion | Oversized bore; low-grade elastomer | Mandate +0.2mm/-0.0mm bore tolerance; PTFE seat hardness 70±5 Shore A |

| Stem Misalignment | Poor machining of stem holes; low rigidity | Specify stem runout ≤0.05mm (per ISO 1123); hardened stem bushings |

| Flange Warpage | Improper stress-relief after welding | Require post-weld heat treatment (PWHT); flatness ≤0.2mm/m |

| False CE Marking | Third-party trading companies bypassing EU importer duties | Direct factory audit + demand EU Authorized Representative documentation |

Key Procurement Recommendations for 2026

- Material Verification is Non-Optional: Budget for 3rd-party PMI testing (cost: ~$120/unit). 29% of “SS316L” valves in 2025 audits were SS304.

- Test to Failure: Require 1.5x rated pressure hydrostatic tests + 10,000 cycle endurance reports.

- Audit Beyond Paperwork: 83% of certified factories fail on shop-floor process control (SourcifyChina 2025 data).

- Avoid Trading Companies: Direct factory engagement reduces defect rates by 62% (per SourcifyChina supplier database).

SourcifyChina Value-Add: Our pre-vetted manufacturer network (147 qualified valve producers) undergoes bi-annual technical audits against these parameters. We enforce material traceability via blockchain ledgering and provide real-time production QC video logs.

Data Source: SourcifyChina 2025 Butterfly Valve Audit Database (n=1,240 units across 87 factories), ISO/ASME/API Standards, IHS Markit Industrial Valve Report 2025.

© 2026 SourcifyChina. Confidential for client procurement use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Butterfly Valve Manufacturers in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and pricing structures for butterfly valves produced by OEM/ODM manufacturers in China. It is designed to support global procurement decision-making by evaluating cost drivers, material inputs, labor efficiency, and strategic considerations between white label and private label sourcing. The data reflects market conditions as of Q1 2026, based on real-time supplier benchmarks across key manufacturing hubs such as Zhejiang, Fujian, and Hebei.

1. Overview of Chinese Butterfly Valve Manufacturing

China remains the world’s largest exporter of industrial valves, representing over 40% of global supply. Butterfly valves—used extensively in water treatment, HVAC, and process industries—are produced at scale with high levels of automation and quality control. Leading manufacturers in China offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, enabling global buyers to customize products for performance, branding, and compliance.

Key advantages include:

– Competitive labor and material costs

– Established supply chains for brass, ductile iron, stainless steel, and EPDM seals

– ISO 9001, CE, and API 609 certified production facilities

– Scalable production from low to high MOQs

2. Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed valves with minimal customization; buyer applies own brand label | Fully customized product including design, materials, branding, and packaging |

| Lead Time | 3–5 weeks | 6–10 weeks (due to tooling and design validation) |

| MOQ | 200–500 units | 500–1,000 units (higher for complex designs) |

| Tooling Costs | None (uses existing molds) | $1,500–$5,000 (one-time, amortized over volume) |

| Customization Level | Limited (branding only) | Full (design, materials, performance specs) |

| Target Use Case | Entry-level rebranding, fast time-to-market | Brand differentiation, technical compliance (e.g., ANSI, DIN) |

| Recommended For | Distributors, resellers | Industrial OEMs, engineering firms |

Strategic Insight: Private label offers long-term brand equity and technical control but requires higher upfront investment. White label is ideal for rapid market entry with lower risk.

3. Cost Breakdown: Butterfly Valve (DN50/DN2″, 16 Bar, Wafer Type, Ductile Iron Body, EPDM Seat)

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Materials (Body, Disc, Shaft, Seal, Coating) | $12.50 – $18.00 | Ductile iron body; stainless steel shaft; EPDM seal. Cost varies with metal market (e.g., iron, chrome/nickel). |

| Labor & Assembly | $2.20 – $3.00 | Includes machining, assembly, quality testing. Higher automation reduces labor cost at scale. |

| Packaging (Standard Export Carton) | $1.10 – $1.60 | Inner polybag, foam inserts, printed box (white label). Custom packaging increases cost by $0.40–$1.00/unit. |

| Quality Testing & Certification | $0.80 – $1.20 | Includes hydrostatic testing, dimensional checks, material certs (Mill Test Reports). |

| Overhead & Profit Margin (Manufacturer) | $2.40 – $3.20 | Covers factory overhead, logistics prep, and 8–12% net margin. |

| Total Estimated FOB Cost per Unit | $19.00 – $27.00 | Varies by material grade, automation, and order volume. |

Note: FOB (Free on Board) pricing excludes international freight, import duties, and buyer-side logistics.

4. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Average Price/Unit (USD) | Material Flexibility | Tooling Cost | Lead Time | Comments |

|---|---|---|---|---|---|

| 500 units | $26.00 – $28.50 | Limited (standard grades) | $0 (White Label) | 3–4 weeks | Ideal for testing market fit; higher per-unit cost |

| 1,000 units | $23.00 – $25.00 | Moderate customization | $0–$1,500 (ODM setup) | 5–6 weeks | Economies of scale begin; branding options expand |

| 5,000 units | $19.50 – $22.00 | Full material/spec options | Amortized | 7–9 weeks | Optimal cost efficiency; preferred for private label rollouts |

Pricing Assumptions: DN50 wafer-type butterfly valve, ductile iron body, EPDM seat, 16 bar rating, standard packaging. Prices based on aggregated quotes from 8 verified suppliers in Zhejiang and Hebei (Q1 2026).

5. Strategic Recommendations

- Leverage ODM Partnerships for Innovation: Collaborate with Chinese ODMs offering in-house engineering to co-develop valves meeting regional standards (e.g., ASME B16.10, EN 593).

- Negotiate Tooling Buy-Back Clauses: Request ownership of custom molds after a volume threshold (e.g., 5,000 units) to ensure supply chain control.

- Audit Suppliers Pre-Production: Conduct third-party factory audits focusing on material traceability, pressure testing protocols, and export experience.

- Consider Hybrid Sourcing: Use white label for immediate demand and transition to private label once volume justifies tooling investment.

- Monitor Raw Material Trends: Track iron and stainless steel index prices (e.g., CRU Index) to time purchase orders and lock in pricing via forward contracts.

Conclusion

China continues to offer compelling value for butterfly valve procurement, with transparent cost structures and scalable manufacturing capacity. While white label provides speed and simplicity, private label delivers long-term differentiation and compliance control. By aligning MOQ strategy with market demand and leveraging tiered pricing, procurement managers can optimize total cost of ownership and strengthen supply chain resilience.

For tailored supplier shortlists, cost modeling, and quality assurance support, contact SourcifyChina’s engineering-led sourcing team.

SourcifyChina – Engineering Your Supply Chain Advantage

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China Butterfly Valve Suppliers (2026 Edition)

Prepared For: Global Procurement & Supply Chain Leadership | Date: Q1 2026

Confidentiality: For Internal Strategic Sourcing Use Only

Executive Summary

The global butterfly valve market faces intensified scrutiny in 2026 due to rising ESG compliance demands (CBAM, SEC Climate Rules), supply chain fragmentation, and heightened quality failures in critical infrastructure projects. 42% of procurement managers (SourcifyChina 2025 Global Valve Sourcing Survey) reported cost overruns >30% from unverified suppliers. This report provides actionable verification protocols to mitigate risk, distinguish factories from trading entities, and ensure compliance with 2026 regulatory thresholds.

I. Critical Verification Protocol for Butterfly Valve Manufacturers (Non-Negotiable Steps)

Skip any step = Unacceptable operational/financial risk.

| Step | Verification Action | 2026 Compliance Standard | Proof Required | Risk of Omission |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Must show “Production” (生产) scope under valve manufacturing (HS 8481.80) | Scanned license + Portal screenshot with verification timestamp | Trading company posing as factory; invalid export rights |

| 2. Facility Ownership Proof | Confirm land ownership/lease agreement for manufacturing site | Minimum 5-year lease or state-owned land certificate (不动产权证书) | Notarized lease + Land registry extract (in English) | “Factory” is a showroom; production outsourced to uncertified workshops |

| 3. Process Capability Audit | Validate in-house casting, machining (CNC), assembly, pressure testing | ISO 5208 Class VI leak testing capability + GB/T 12238 certification | Video of live pressure test (min. 1.5x PN rating) + CNC machining center footage | Substandard materials; inability to meet API 609/API 6D specs |

| 4. Material Traceability | Audit raw material sourcing (cast iron/stainless steel) | Mill Test Reports (MTRs) linked to valve batch numbers | MTRs matching valve heat numbers + 3rd-party metallurgy reports (SGS/BV) | Material substitution causing premature failure (e.g., ASTM A126 Gr.B vs. claimed Gr.C) |

| 5. Export Compliance | Verify direct export history via customs data | HS Code 8481.80 export records (min. 12 months) | Customs declaration screenshots (via Panjiva/ImportGenius) | Trading company markup (15-35%) hidden in “factory” pricing |

II. Trading Company vs. Factory: Definitive Differentiation Guide (2026)

78% of “factories” on Alibaba are trading entities (SourcifyChina 2025 Audit). Use these forensic indicators:

| Indicator | Genuine Factory (Low Risk) | Trading Company (High Risk) | Verification Method |

|---|---|---|---|

| Workforce Visibility | 80%+ staff in production zones; visible safety gear | Staff in office attire; no workshop access | Live Zoom factory tour (request specific workstation) |

| Equipment Ownership | CNC machines labeled with factory’s name/logo | Generic equipment; no asset tags | Asset register cross-checked with machine VINs |

| Quality Control | Dedicated in-line QC station (e.g., CMM, hydro-test rig) | “QC” = 3rd-party inspection reports only | Real-time test data (e.g., pressure test logs) |

| Pricing Structure | FOB price + itemized BOM (material, labor, OH) | Single FOB price; “factory cost” undisclosed | Request per-component cost breakdown |

| Lead Time Control | Fixed production slots (e.g., “35 days ±3”) | Vague timelines (“4-8 weeks”) | Confirm machine capacity (e.g., “12 CNC centers”) |

Key 2026 Insight: Factories now provide real-time ERP dashboards (e.g., SAP China Cloud) showing WIP status. Refusal = red flag.

III. Critical Red Flags to Terminate Engagement Immediately

These indicate systemic risk in 2026’s regulated environment:

| Red Flag | Consequence | Action |

|---|---|---|

| ❌ No ISO 9001:2025 or API Q1 certification | Automatic disqualification for EU/US infrastructure projects | Terminate – non-compliant with EU Construction Products Regulation (CPR) 2026 |

| ❌ Pressure test videos show “bypassed” test ports | Valves fail at 40% rated pressure (common fraud) | Demand live witness test via 3rd party (e.g., TÜV) |

| ❌ Quotation excludes “CE Marking fee” or “CBAM cost” | Hidden costs + carbon tax liability (EU CBAM Phase 2) | Recalculate landed cost with 2026 carbon tariffs (min. €48/ton CO2) |

| ❌ Refusal of unannounced audit | Indicates inconsistent quality/process control | Invoke audit clause or walk away |

| ❌ Bank account not in company name | Funds diverted; no legal recourse | Verify via Chinese bank confirmation letter |

IV. SourcifyChina 2026 Verification Toolkit

Deploy these resources for zero-risk sourcing:

- AI-Powered Factory Scan: Our proprietary tool cross-references 12 data sources (customs, energy use, patent filings) to flag proxy factories.

- ESG Compliance Dashboard: Real-time CBAM carbon footprint calculation + wastewater discharge permits validation.

- Valve-Specific Audit Protocol: 87-point checklist covering material traceability, pressure testing protocols, and API 609 Rev. 7 compliance.

Critical 2026 Shift: Factories without digital twin production monitoring (ISO 22400 compliant) cannot guarantee batch consistency. Demand system access.

Conclusion

In 2026, butterfly valve sourcing success hinges on forensic verification – not RFQs. Trading companies increase TCO by 22-38% (SourcifyChina TCO Model 2026) and introduce catastrophic compliance risk. Procurement leaders must enforce factory-level proof points, leverage digital audit tools, and terminate engagements at the first red flag. The cost of failure (e.g., pipeline rupture, CBAM penalties) dwarfs verification investment.

Next Step: Activate SourcifyChina’s Valve Verification Shield – includes 3 factory audits, carbon footprint certification, and API 6D compliance validation. Schedule Audit Now →

SourcifyChina | Powering Resilient Global Supply Chains Since 2010

Data Source: SourcifyChina 2025 Global Valve Sourcing Survey (n=387 procurement leaders), EU CBAM 2026 Guidelines, API Standard 609 (2025 Rev.)

Disclaimer: This report reflects industry standards as of January 2026. Regulatory requirements subject to change.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Butterfly Valve Manufacturers

Executive Summary

In today’s fast-moving industrial supply chain landscape, procurement efficiency is a competitive differentiator. Sourcing reliable butterfly valve manufacturers in China presents significant cost and scalability opportunities—but only when partnered with the right suppliers. Unverified vendors lead to delays, quality inconsistencies, and compliance risks that erode margins and project timelines.

SourcifyChina’s Verified Pro List: China Butterfly Valve Manufacturers delivers a turnkey solution to this challenge. Curated through rigorous on-the-ground vetting, technical audits, and performance benchmarking, our Pro List eliminates the guesswork and accelerates procurement cycles by up to 60%.

Why the Verified Pro List Saves Time and Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers undergo factory audits, quality system reviews, and export compliance checks—eliminating 3–6 weeks of due diligence. |

| Real-Time Capacity Data | Access to current production schedules and MOQ flexibility enables faster quoting and order placement. |

| Verified Certifications | ISO, CE, API, and WRAS certifications are confirmed—reducing compliance review time and audit preparation. |

| Performance Scorecards | Each supplier is rated on delivery reliability, communication responsiveness, and defect rates—enabling confident, data-driven decisions. |

| Dedicated Sourcing Support | SourcifyChina’s team manages initial RFQs, technical clarifications, and sample coordination—freeing internal teams for strategic work. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent qualifying suppliers is a week lost in product development, cost negotiation, and market delivery.

Stop sourcing in the dark. Start with confidence.

By leveraging SourcifyChina’s Verified Pro List, you gain immediate access to a curated network of high-performance butterfly valve manufacturers—each proven to meet international quality and delivery standards.

👉 Contact us today to receive your exclusive access to the 2026 Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide a free supplier match analysis based on your technical specifications, volume requirements, and delivery timelines.

Make your next procurement cycle your fastest—and most reliable—yet.

Partner with SourcifyChina. Source smarter. Deliver faster.

🧮 Landed Cost Calculator

Estimate your total import cost from China.