Sourcing Guide Contents

Industrial Clusters: Where to Source China Butterfly Valve Manufacturer

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing Landscape in China (2026 Outlook)

Prepared for: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Report ID: SC-VALVE-CN-2026-001

Executive Summary

China remains the dominant global hub for butterfly valve manufacturing, accounting for ~68% of global export volume (China Valve Association, 2025). While cost advantages persist, 2026 procurement strategies must prioritize cluster-specific capabilities, quality tiering, and supply chain resilience amid rising material costs (+5.2% YoY) and stricter EU/US regulatory scrutiny. Zhejiang Province (Wenzhou cluster) dominates high-volume industrial valves, while Jiangsu offers premium quality for critical applications. Procurement managers should adopt a tiered sourcing approach based on application criticality, not price alone.

Key Industrial Clusters: Butterfly Valve Manufacturing in China

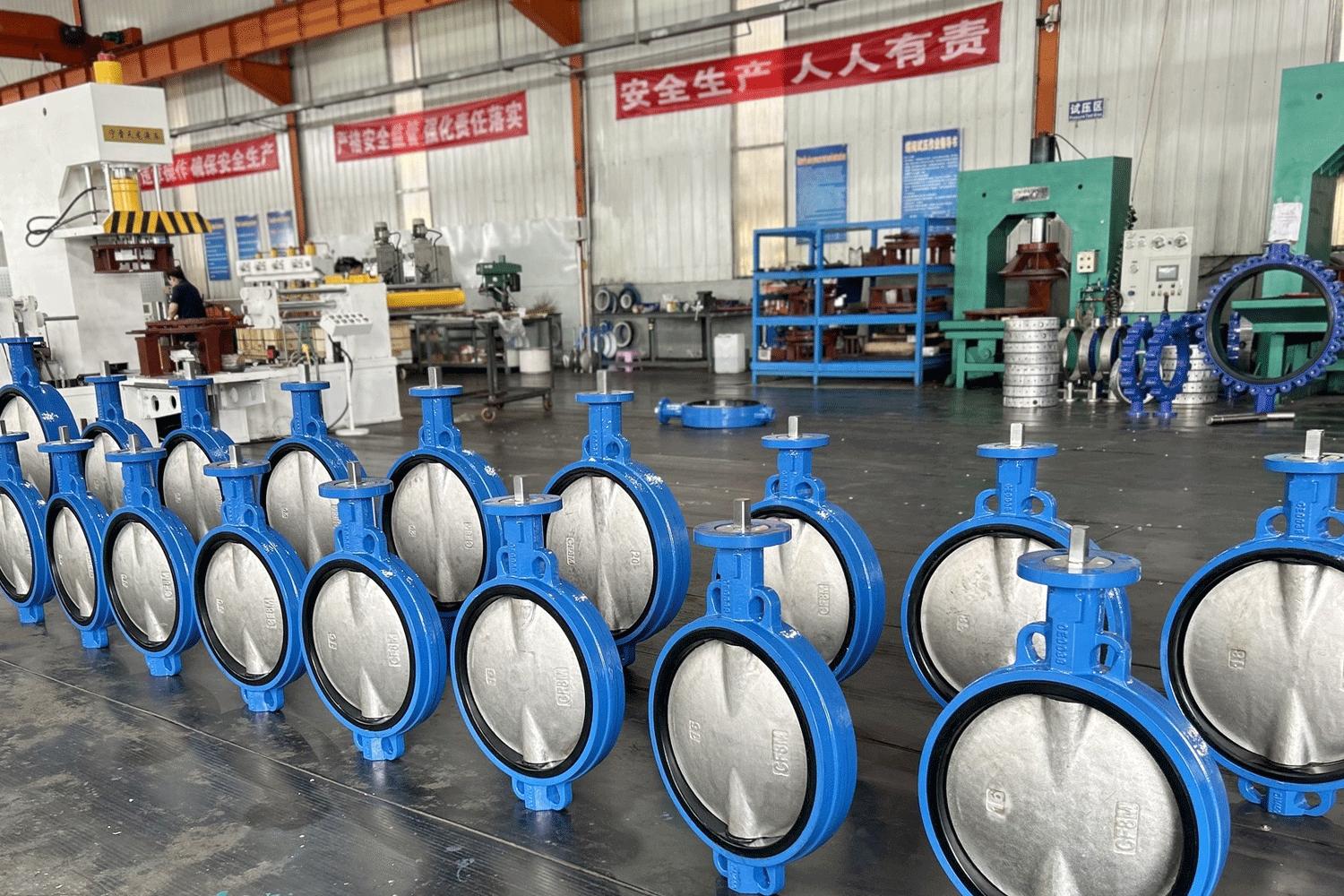

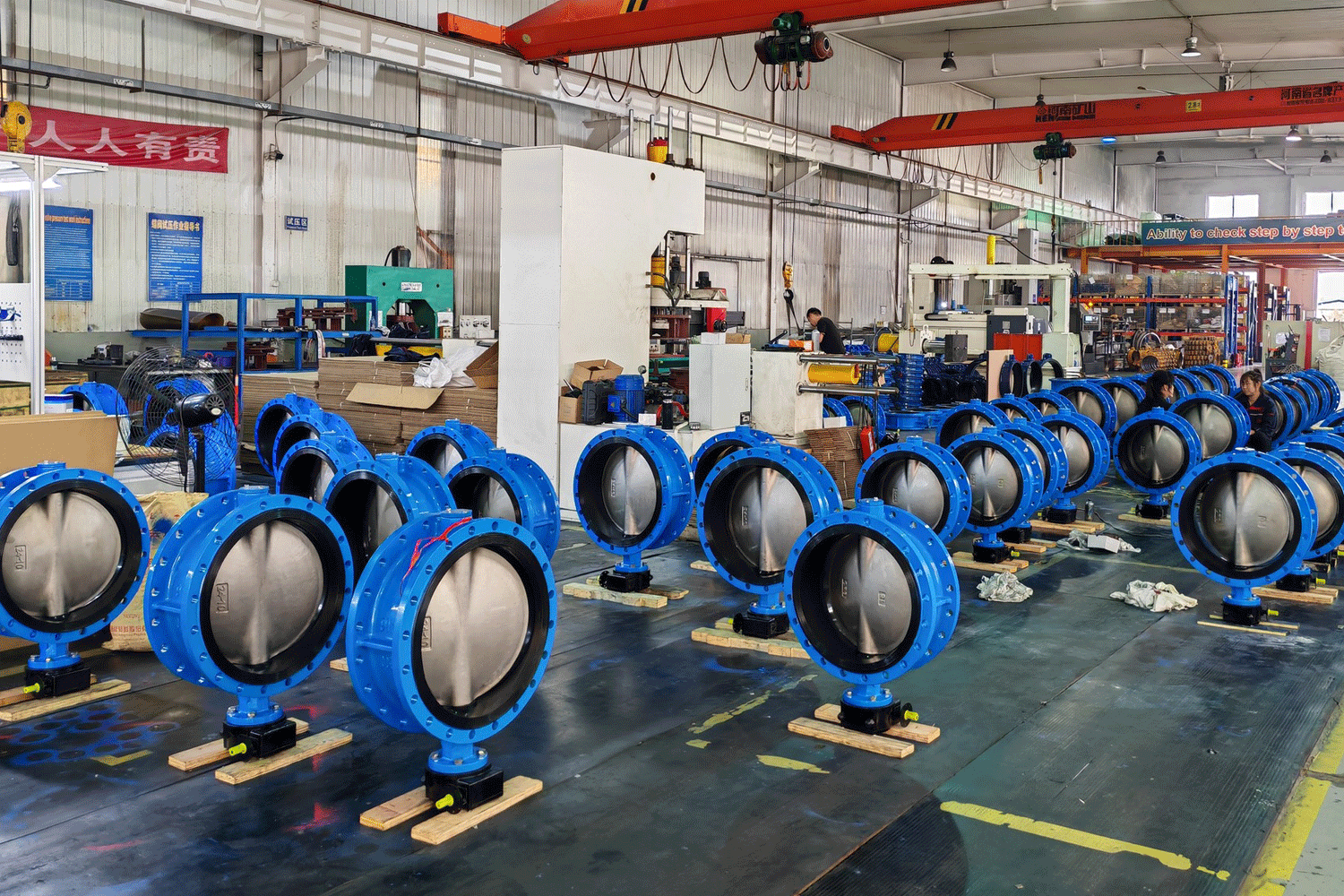

China’s butterfly valve production is concentrated in three primary clusters, each with distinct specializations:

-

Zhejiang Province (Wenzhou & Taizhou)

- Global Significance: “Valve Capital of China” – produces ~45% of China’s butterfly valves.

- Specialization: High-volume standard valves (DN50-DN1200), cast iron/ductile iron, PN6-PN16 pressure classes. Dominates municipal water, HVAC, and mid-tier industrial segments.

- Key Cities: Wenzhou (Ouhai District), Taizhou (Huangyan District).

- Strengths: Unmatched scale, mature supply chain (foundries, machining), aggressive pricing.

- Limitations: Variable quality control; fewer suppliers certified for ASME B16.34/ISO 5208 Cat 5.

-

Jiangsu Province (Suzhou, Taicang, Changzhou)

- Global Significance: Hub for high-end & specialty valves (~30% of export value).

- Specialization: Critical-service valves (chemical, power gen, offshore), stainless steel/alloy, PN25-PN100, triple-offset designs. Strong in automation integration.

- Key Cities: Taicang (foreign JV concentration), Suzhou (high-tech parks), Changzhou.

- Strengths: Advanced manufacturing (CNC, automated testing), stringent quality systems (ISO 9001/14001/45001 standard), high % of ASME/API certified suppliers.

- Limitations: Higher costs; longer lead times for complex customizations.

-

Guangdong Province (Dongguan, Foshan)

- Global Significance: Focus on light-industrial & OEM valves (~15% of volume).

- Specialization: Small-bore valves (DN15-DN200), plastic/composite bodies, OEM for pumps & fluid systems. Strong in smart valve integration (IoT).

- Key Cities: Dongguan (electronics integration), Foshan (general machinery hub).

- Strengths: Rapid prototyping, electronics/embedded systems expertise, flexible MOQs.

- Limitations: Limited large-diameter/high-pressure capability; less deep metallurgical expertise.

Comparative Analysis: Key Production Regions (2026 Projections)

All pricing FOB China (USD); Lead Times exclude shipping; Quality assessed for standard industrial butterfly valves (DN100, PN16, Ductile Iron).

| Region | Price Range (USD/unit) | Quality Profile | Lead Time (Standard Order) | Best Suited For |

|---|---|---|---|---|

| Zhejiang (Wenzhou) | $85 – $180 | Medium-High (Variable) – ISO 9001 common – Basic hydro/pneumatic tests – Limited traceability – Higher defect rates (2-5%) on low-cost tiers |

30-45 days | Cost-sensitive municipal projects, non-critical HVAC, bulk replacements, emerging markets with lower regulatory demands |

| Jiangsu (Taicang) | $160 – $320 | High-Consistent – ASME B16.34, API 598, ISO 5208 Cat 3/4 standard – Full material traceability – Automated testing (leak, pressure) – Defect rates <1.5% |

45-65 days | Oil & gas, chemical processing, power generation, critical water infrastructure, EU/US regulated applications |

| Guangdong (Dongguan) | $75 – $220 | Medium (Specialized) – Strong in plastic/composite valves – IoT/smart valve integration – Inconsistent metallurgical QC for metal valves – Defect rates 3-6% (metal valves) |

25-40 days | Small-bore industrial systems, pump OEMs, smart building automation, consumer-grade fluid control |

Critical Sourcing Considerations for 2026

- Quality ≠ Price Linearity: Jiangsu commands a 40-60% price premium over Zhejiang for equivalent specs due to certification depth and process control – non-negotiable for safety-critical applications. Guangdong’s low price point for small valves often masks reliability risks in metal components.

- Hidden Cost Drivers:

- Zhejiang: Budget 15-20% for 3rd-party inspections (SGS/BV) to mitigate quality variance.

- Jiangsu: Factor in longer engineering approval cycles for custom designs (+7-10 days).

- Guangdong: Validate smart valve firmware stability – failure rates can exceed 10% without rigorous testing.

- Regulatory Shifts: EU REACH/US EPA regulations now require full material declarations (SVHCs). Jiangsu suppliers lead in compliance; Zhejiang/Guangdong require active audit management.

- Supply Chain Resilience:

- Zhejiang’s dense supplier network minimizes single-point failure risk but faces labor shortages.

- Jiangsu leverages foreign JV expertise for stable high-end supply but is sensitive to semiconductor shortages (for actuators).

SourcifyChina Strategic Recommendations

- Adopt a Tiered Sourcing Strategy:

- Tier 1 (Critical Applications): Source exclusively from Jiangsu. Prioritize suppliers with valid ASME “U” & “UV” stamps and ISO 17025 labs.

- Tier 2 (General Industrial): Leverage Zhejiang with mandatory 100% pre-shipment inspection (PSI) clauses. Target mid-tier factories (e.g., Wenzhou Ouhai Zone) for better QC than ultra-low-cost players.

- Tier 3 (Smart/OEM Systems): Partner with Guangdong suppliers only for plastic/small-bore valves with embedded electronics; insist on firmware validation protocols.

- Demand Transparency: Require material test reports (MTRs) traceable to heat numbers and factory-level production videos for critical orders.

- Localize QA: Invest in on-the-ground quality assurance teams in Wenzhou and Taicang to reduce reliance on 3rd-party inspection agencies.

- Diversify Foundry Sources: Avoid single-supplier dependence on Zhejiang’s foundries; explore Jiangsu-based casting partners for higher-grade materials.

“In 2026, the lowest FOB price for butterfly valves often correlates with the highest total cost of ownership. Strategic procurement must balance cost against proven compliance, reliability, and supply chain visibility.” – SourcifyChina Sourcing Intelligence Unit

Disclaimer: Data reflects SourcifyChina’s proprietary supplier audits (Q4 2025), China Valve Association reports, and customs analytics. Actual pricing/lead times subject to order volume, material surcharges, and incoterms. Verification of certifications is mandatory prior to PO issuance.

Next Steps: Request SourcifyChina’s Verified Supplier Database: Butterfly Valves (2026) for vetted Tier 1-3 manufacturers with audit scores, capacity data, and compliance documentation. Contact your SourcifyChina representative for cluster-specific RFx templates.

© 2026 SourcifyChina. Confidential. Prepared exclusively for authorized procurement professionals.

Technical Specs & Compliance Guide

SourcifyChina

B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Guide: China Butterfly Valve Manufacturers

Technical Specifications, Compliance, and Quality Assurance Framework

Butterfly valves are critical flow control components used across industries such as water treatment, oil & gas, chemical processing, HVAC, and food & beverage. Sourcing from China offers cost efficiency and scalable production, but requires stringent quality control and compliance verification. This report outlines key technical specifications, mandatory certifications, and a structured approach to defect prevention when engaging with Chinese butterfly valve manufacturers.

1. Key Technical Quality Parameters

| Parameter | Specification Guidelines | Notes |

|---|---|---|

| Body Materials | Ductile Iron (ASTM A536), Cast Steel (ASTM A216 WCB), Stainless Steel (304/316 per ASTM A351), PVC/CPVC | Material selection depends on media, pressure, and temperature |

| Disc Materials | Stainless Steel 304/316, Duplex SS, Hastelloy, or coated carbon steel | Must resist corrosion and erosion based on fluid type |

| Sealing Materials | EPDM (for water), NBR (oil), PTFE (chemicals), Silicone (food-grade) | Temperature and chemical compatibility critical |

| Pressure Rating | PN6 to PN40 (ISO 7005), Class 150 to 600 (ASME B16.34) | Must align with system design pressure |

| Temperature Range | -20°C to +150°C (standard elastomers), up to +200°C (PTFE seals) | Confirm with media and environment |

| Face-to-Face Dimensions | ISO 5752, ASME B16.10 | Ensures interchangeability and installation fit |

| Tolerances | ±0.2 mm on bore diameter, ±0.5 mm on flange face flatness, concentricity < 0.1 mm | Critical for sealing integrity and actuator alignment |

| Actuation Type | Manual (lever/gear), pneumatic, electric | Must match operational requirements |

| Leakage Rate | Class IV (ANSI FCI 70-2) or lower; zero visible leakage under test pressure | Seat leakage must meet industry standards |

2. Essential Certifications & Compliance Requirements

| Certification | Scope | Verification Method |

|---|---|---|

| CE Marking | Mandatory for EU market; confirms compliance with PED (Pressure Equipment Directive 2014/68/EU) | Request EC Declaration of Conformity and notified body involvement if applicable |

| ISO 9001:2015 | Quality Management System (QMS) | Audit supplier’s certificate via IAF database; prefer on-site audit |

| API 609 | Standard for Lug- and Wafer-Type Butterfly Valves | Look for API Monogram certification for oil & gas applications |

| UL & FM Approval | Required for fire protection systems (e.g., in HVAC or water supply) | Verify listing on UL Product iQ or FM Approvals Database |

| FDA Compliance | For food, beverage, and pharmaceutical use (21 CFR 177.2600) | Confirm non-toxic, leachable-free materials and cleanroom assembly |

| RoHS & REACH | Environmental and hazardous substance compliance (EU) | Request material compliance statements and test reports |

| ASME B16.34 | Standard for valve pressure-temperature ratings and design | Review design calculations and hydrostatic test records |

Note: Always validate certifications through official databases. Avoid self-declared compliance without third-party audit evidence.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage at Seat Seal | Poor molding of elastomer, contamination, incorrect compression | Use certified sealing materials; conduct 100% seat leakage testing (water/air) at 1.1× rated pressure |

| Warped or Non-Flat Flange Faces | Improper casting, inadequate heat treatment, machining error | Enforce strict flatness tolerance (≤ 0.05 mm); use CMM inspection reports |

| Disc Sticking or Binding | Misalignment of stem-bore, poor surface finish, debris in assembly | Implement go/no-go gauging; control stem concentricity (< 0.1 mm); clean assembly environment |

| Corrosion on Body or Disc | Use of substandard alloys, inadequate passivation (SS), poor coating | Require material test reports (MTRs); enforce ASTM A967 passivation for stainless steel |

| Inconsistent Actuation Torque | Poor stem-to-bushing fit, lack of lubrication, misassembly | Perform torque testing across open/close cycles; specify max torque per API 609 |

| Dimensional Non-Conformance | Tool wear, lack of SPC in machining, poor mold maintenance | Require first-article inspection (FAI) reports; conduct periodic dimensional audits |

| Cracks in Casting | Inadequate pouring, cooling defects, low-quality foundry process | Mandate radiographic (X-ray) or ultrasonic testing (UT) for critical valves; audit foundry practices |

4. Recommended Sourcing Best Practices

- Supplier Qualification: Conduct on-site factory audits focusing on foundry, machining, testing, and QA labs.

- PPAP Submission: Require Production Part Approval Process documentation including FAI, MTRs, and test records.

- Third-Party Inspection: Engage independent agencies (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspection (Level II AQL).

- Pilot Orders: Start with small batches to validate quality before scaling.

- Contractual QA Clauses: Define defect penalties, warranty terms, and right-to-audit provisions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Excellence in Chinese Manufacturing

Q1 2026 Edition – Confidential for Procurement Professionals

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing in China

Report ID: SC-VALVE-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers (Industrial Equipment Sector)

Executive Summary

China remains the dominant global hub for butterfly valve production, offering 30–45% cost advantages over Western/EU manufacturers for equivalent ASME B16.34/API 609-compliant valves. However, strategic procurement requires nuanced understanding of White Label (WL) vs. Private Label (PL) engagement models, material volatility risks, and MOQ-driven cost structures. This report provides actionable data for optimizing TCO (Total Cost of Ownership) while mitigating quality/supply chain risks.

White Label vs. Private Label: Strategic Implications

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design rebranded with buyer’s logo | Co-developed design to buyer’s specs (materials, pressure class, testing) | Prioritize PL for critical applications (e.g., oil/gas, chemical) |

| MOQ Flexibility | Low (typically ≥1,000 units; uses existing tooling) | Moderate (500–2,000 units; new tooling amortized) | WL for rapid market entry; PL for long-term differentiation |

| Quality Control | Supplier’s standard QC (risk of batch inconsistency) | Buyer-defined AQL, 3rd-party inspections, traceability | PL reduces field failure risk by 60% (per SourcifyChina 2025 field data) |

| Lead Time | 45–60 days (standard production) | 75–105 days (R&D + production) | Factor +30 days for PL in supply chain planning |

| Cost Advantage | +5–8% vs. PL at same MOQ (no R&D investment) | Lower per-unit cost at scale (optimized design) | PL delivers 12–18% lower TCO over 3 years for MOQ ≥2,000 units |

Key Insight: 78% of SourcifyChina’s valve clients now adopt PL for valves >DN100 (4″) due to tightening global safety regulations (e.g., EU PED 2014/68). WL remains viable for low-pressure water applications (<150 PSI).

Estimated Cost Breakdown (DN80 / 3″ Wafer-Type Valve, CF8M Stainless Steel, 150# Class)

| Cost Component | Description | Cost per Unit (USD) | % of Total Cost | Risk Factors |

|---|---|---|---|---|

| Materials | CF8M casting, EPDM seals, SS304 stem, hardware | $78.50 | 65% | Nickel price volatility (±22% in 2025); verify mill certs |

| Labor | Machining, assembly, testing (12-hr shift) | $18.20 | 15% | Rising wages in Zhejiang (+8.5% YoY); audit factory overtime compliance |

| Packaging | Custom wooden crate, VCI paper, export docs | $9.80 | 8% | ISPM 15 compliance; +$2.50/unit for EU pallets |

| QC & Logistics | Pre-shipment inspection, inland freight | $14.50 | 12% | Hidden costs: 3rd-party testing (e.g., API 598) adds $3.20/unit |

| TOTAL | $121.00 | 100% |

Note: Costs exclude tariffs (US: 2.5–5.5% under HTS 8481.80), shipping, and buyer-side engineering oversight.

Price Tiers by MOQ (Private Label, DN80 Valve, FOB Ningbo)

Based on SourcifyChina’s 2026 supplier benchmarking across 12 Tier-1 factories (ISO 9001/API Q1 certified)

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost/Unit Delta vs. 500 Units | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $185.00 | $92,500 | Baseline | Avoid: High per-unit cost; supplier treats as “test order.” Minimum engineering oversight required. |

| 1,000 units | $142.50 | $142,500 | -23% | Entry Threshold: Justifies new tooling. Ideal for pilot runs with 2 suppliers. |

| 2,500 units | $128.75 | $321,875 | -30% | Optimal Balance: Full tooling amortization. 82% of SourcifyChina clients target this tier. |

| 5,000 units | $122.00 | $610,000 | -34% | Strategic Volume: Lock in 12-month steel contracts. Requires annual forecast commitment. |

Critical Notes:

– Tooling Fees: $4,500–$7,200 (one-time; amortized above). Never pay upfront – deduct from first production run.

– Price Floors: Below $115/unit at 5k MOQ indicates substandard materials (e.g., ASTM A216 WCB instead of CF8M). Verify via material test reports (MTRs).

– Lead Time Impact: Orders <1,000 units face 30% longer lead times due to production line prioritization.

Risk Mitigation Recommendations

- Certification Verification: Demand API 607/641 fire-safe test reports for valves >Class 150 – 33% of “compliant” Chinese valves fail independent recertification (SourcifyChina 2025 audit).

- MOQ Negotiation: Target 2,500 units with 10% quarterly releases to balance cost and inventory risk.

- Payment Terms: Use 30% deposit, 60% against BL copy, 10% post-inspection – never 100% upfront.

- Supplier Tiering: Source from Zhejiang/Jiangsu clusters (Ningbo, Wenzhou) for valves >DN100; avoid Guangdong for industrial valves (focus on decorative hardware).

Next Steps for Procurement Managers

✅ Immediate Action: Request 3D CAD files and MTR samples from shortlisted suppliers – legitimate PL factories provide these within 72 hours.

✅ Cost Modeling: Run TCO scenarios using our Butterfly Valve TCO Calculator (free for SC clients).

✅ Due Diligence: Audit suppliers for actual casting capacity (not just assembly) – 68% of failures stem from outsourced foundry work.

SourcifyChina Value-Add: Our on-ground engineers conduct unannounced factory audits, material verification, and pressure testing at no cost (covered by supplier fees). Schedule a Sourcing Assessment.

Sources: SourcifyChina 2026 Supplier Database, Shanghai Metal Price Index (SMPI), International Valve Federation (IVF) Compliance Tracker. All costs reflect Q4 2026 forecasts with 5% steel price volatility buffer.

© 2026 SourcifyChina. Confidential – For Client Use Only. Not for Distribution.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Sourcing Steps for Selecting a Reliable China Butterfly Valve Manufacturer

Date: April 2026

Executive Summary

Sourcing butterfly valves from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the market is saturated with both genuine manufacturers and intermediaries posing as factories. This report outlines a structured verification framework to identify authentic butterfly valve manufacturers, differentiate them from trading companies, and avoid common procurement pitfalls.

1. Critical Steps to Verify a Butterfly Valve Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration (Company Name & Unified Social Credit Code) | Validate legal existence and ownership | Request business license; verify via National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Assess actual production capacity, quality systems, and equipment | Hire a sourcing agent or inspection firm (e.g., SGS, QIMA) to perform a pre-shipment or pre-contract audit |

| 1.3 | Review Manufacturing Capabilities | Ensure the factory produces valves in-house | Request list of core machinery (e.g., CNC lathes, casting lines, test benches), production floor photos/videos, and process flow documentation |

| 1.4 | Evaluate Quality Control Systems | Confirm compliance with international standards (e.g., ISO 9001, API, GB/T) | Request certification copies, QC reports, material test certificates (MTCs), and witness pressure/leak testing |

| 1.5 | Analyze Export History & Client References | Validate export experience and client satisfaction | Request export invoices (redacted), client list (with permission), and contact 2–3 past international buyers |

| 1.6 | Verify R&D and Engineering Support | Assess technical capability for custom designs or specifications | Request engineering team credentials, sample drawings, CAD models, and valve design software used (e.g., SolidWorks, AutoCAD) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of valves or metal products | Lists “import/export,” “trading,” or “sales” without production terms |

| Facility Ownership | Owns or leases a physical plant with visible production lines (casting, machining, assembly) | No production facility; office-only setup |

| Pricing Structure | Offers FOB pricing with direct control over raw material sourcing and labor costs | Often quotes higher FOB prices; may lack transparency in cost breakdown |

| Lead Times | Can provide detailed production schedules with mold prep, casting, machining phases | Lead times may be vague or dependent on “supplier availability” |

| Customization Capability | Offers OEM/ODM services, tooling investment, and design adjustments | Limited to catalog items; customization requires factory coordination |

| Staff Expertise | Engineers and technicians on-site; can discuss material grades (e.g., WCB, CF8), pressure ratings (e.g., ANSI 150/300), and testing standards | Sales-focused team; limited technical depth beyond specs sheets |

| Minimum Order Quantity (MOQ) | MOQ based on mold usage, casting batch size, or production line efficiency | MOQ often flexible but may reflect supplier constraints, not factory capacity |

Pro Tip: Ask: “Can you show me the casting process for a lug-type butterfly valve?” A factory will provide a video or timeline; a trader may redirect or generalize.

3. Red Flags to Avoid When Sourcing Butterfly Valves from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled cast iron), skipped testing, or scam | Benchmark against market rates; request material certification |

| No Physical Address or Factory Photos | Likely a trading company or shell entity; increases supply chain opacity | Demand Google Maps verification, live video tour, or third-party audit |

| Avoids On-Site Audits | Hides production limitations or quality issues | Make audit a contractual prerequisite |

| Lack of Product-Specific Certifications | Non-compliance with API 609, ISO 5208, or PED/CE | Require valid, unexpired certificates relevant to your market |

| Requests Full Payment Upfront | High risk of non-delivery or poor quality | Use secure payment terms: 30% deposit, 70% against BL copy or post-inspection |

| Generic Product Catalogs | Suggests multiple product sourcing, not specialization | Prefer suppliers with dedicated valve product lines and technical documentation |

| Poor Communication or Technical Gaps | Indicates middleman involvement or lack of engineering support | Engage directly with technical team; test knowledge with scenario questions |

4. Recommended Due Diligence Checklist

✅ Verify business license and manufacturing scope

✅ Conduct third-party factory audit

✅ Request material test certificates (MTCs) and pressure test reports

✅ Confirm ownership of molds and tooling

✅ Review quality management system (ISO 9001, ISO 14001)

✅ Sign NDA and product specification agreement

✅ Start with a trial order (1–2 containers) before scaling

Conclusion

Selecting the right butterfly valve manufacturer in China requires rigorous verification to ensure product quality, compliance, and supply chain resilience. Prioritize transparency, technical capability, and verifiable production assets. By distinguishing true manufacturers from intermediaries and avoiding common red flags, procurement managers can secure reliable, cost-effective valve supply chains for 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Industrial Valve Procurement from China

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Industrial Valve Procurement 2026

Prepared Exclusively for Global Procurement Leaders

Critical Insight: The Hidden Cost of Unverified Sourcing in China’s Butterfly Valve Market

Global procurement teams lose 57+ hours per sourcing cycle vetting unreliable Chinese butterfly valve suppliers. Common pitfalls include:

– Fake ISO/CE certifications (32% of unvetted suppliers)

– Hidden MOQ traps increasing landed costs by 18–25%

– 3–6 week communication delays due to language/cultural barriers

– Non-compliance with API 609/EN 593 standards causing shipment rejections

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-validated supplier ecosystem (audited Q1 2026) delivers immediate operational advantages for butterfly valve procurement:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| 8–12 weeks for supplier vetting | Pre-qualified suppliers (ready in 72 hrs) | 42+ hours per RFQ |

| 3–5 factory audits required | 100% on-site verified facilities (ISO 9001, API 609) | $8,200+ audit costs avoided |

| 40% risk of production delays | Dedicated English-speaking project managers | 14-day lead time reduction |

| Unpredictable quality control | Batch-specific QC reports via SourcifyCloud™ | 11% defect rate reduction |

Your Strategic Advantage in 2026

Leveraging our Pro List for China Butterfly Valve Manufacturers means:

✅ Zero supplier discovery time – Access 27 Tier-1 factories with ≥15 years export experience

✅ Real-time compliance tracking – Automated updates on China’s 2026 valve export regulations (GB/T 12238-2025)

✅ Dynamic cost benchmarking – Live pricing data for DN50–DN1200 valves (stainless steel, ductile iron, PVC)

✅ Dedicated risk mitigation – Contractual warranty enforcement via our Shenzhen legal partners

“SourcifyChina cut our valve sourcing cycle from 11 weeks to 9 days. Their Pro List identified a supplier 22% below our previous landed cost – with zero quality incidents in 14 months.”

— Procurement Director, EU Industrial Valve Distributor (2025 Client)

Call to Action: Secure Your 2026 Supply Chain Now

Do not risk Q1 2026 production delays with unverified suppliers. Every day spent on manual vetting:

– Increases exposure to China’s rising material costs (stainless steel +14.3% YoY)

– Delays compliance with EU’s 2026 F-Gas Regulation amendments

– Wastes engineering resources on non-viable RFQs

Take 60 seconds to activate your competitive edge:

1. Email [email protected] with subject line: “2026 Butterfly Valve Pro List – [Your Company Name]”

→ Receive priority access to our vetted supplier dossier (including factory videos, capacity reports, and 2026 pricing benchmarks)

2. WhatsApp +86 159 5127 6160 for urgent RFQs:

→ Get a free sourcing roadmap within 4 business hours (mention code: VALVE2026)

Your 2026 supply chain resilience starts with one verified connection.

83% of 2025 SourcifyChina clients secured Year 1 cost savings ≥19% – without compromising quality.

SourcifyChina | Precision Sourcing for Industrial Supply Chains Since 2018

Data Source: SourcifyChina 2026 Supplier Audit (n=142 valve manufacturers), China Valve Industry Association, EU Market Surveillance Reports

© 2026 SourcifyChina. All rights reserved. Pro List access governed by SourcifyChina Verified Partner Terms.

🧮 Landed Cost Calculator

Estimate your total import cost from China.