Sourcing Guide Contents

Industrial Clusters: Where to Source China Butterfly Valve Factory

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Butterfly Valves from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

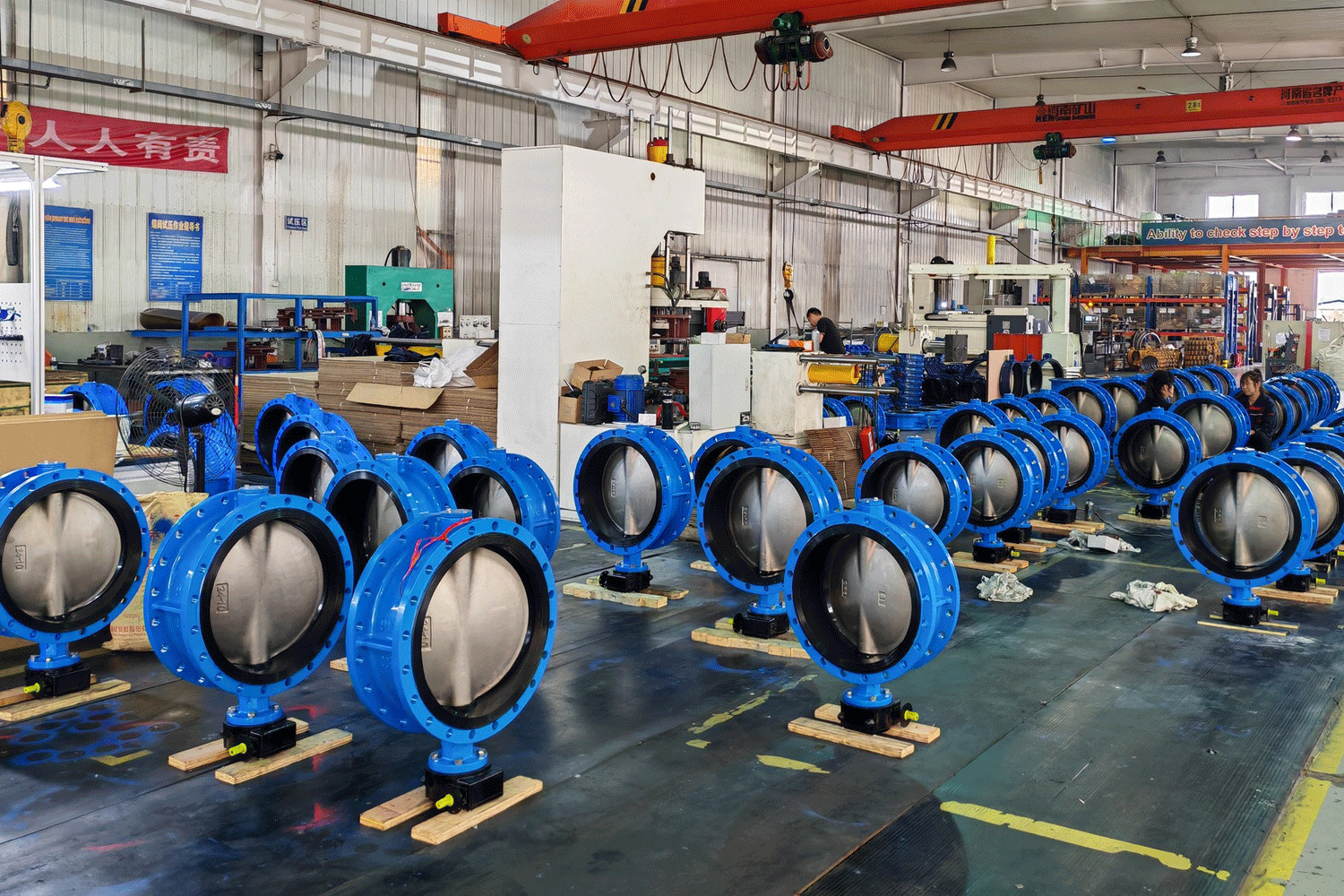

Butterfly valves are critical components in fluid control systems across industries such as water treatment, HVAC, oil & gas, power generation, and chemical processing. China remains the world’s leading manufacturer and exporter of industrial valves, offering competitive pricing, scalable production capacity, and a mature supply chain ecosystem. This report provides a strategic analysis of key industrial clusters producing butterfly valves in China, with a comparative evaluation of regional strengths in price, quality, and lead time to support data-driven sourcing decisions.

Key Industrial Clusters for Butterfly Valve Manufacturing in China

China’s butterfly valve manufacturing is highly concentrated in specific industrial hubs, each offering distinct advantages in engineering capability, supply chain integration, and export readiness. The primary production clusters are located in the Eastern and Southern coastal provinces, with Zhejiang and Guangdong emerging as dominant provinces.

Top 5 Industrial Clusters

| Province | Key Cities | Industry Specialization | Notable Features |

|---|---|---|---|

| Zhejiang | Longquan (Lishui), Wenzhou, Ningbo | High-pressure, industrial-grade valves | Renowned for metallurgy expertise and ISO-certified foundries |

| Guangdong | Foshan, Guangzhou, Dongguan | Light-duty, HVAC, and commercial valves | Strong export logistics; high-volume OEM/ODM capacity |

| Shanghai | Shanghai (Jiading, Pudong) | Precision-engineered, smart valves | R&D-intensive; caters to international standards (API, ISO, ASME) |

| Hebei | Cangzhou, Baoding | Carbon steel and large-diameter valves | Cost-competitive; focused on construction and municipal projects |

| Jiangsu | Changzhou, Suzhou | Automation-integrated valves | Proximity to semiconductor and high-tech manufacturing zones |

Insight: Zhejiang and Guangdong collectively account for over 65% of China’s butterfly valve exports (Customs Data 2025). While Zhejiang dominates in industrial and heavy-duty applications, Guangdong excels in high-volume, cost-sensitive commercial segments.

Regional Comparison: Butterfly Valve Manufacturing Hubs (2026 Outlook)

The following table evaluates the two leading provinces—Zhejiang and Guangdong—against critical procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Zhejiang | Guangdong | Notes |

|---|---|---|---|

| Average Unit Price (DN100, PN16, Wafer Type) | $48–$68 | $36–$52 | Zhejiang commands a 15–25% price premium due to higher-grade materials and certifications |

| Quality Tier | High (Industrial Grade) | Medium to High (Commercial/Industrial Hybrid) | Zhejiang factories more likely to hold API 609, ISO 9001, CE, and ATEX; Guangdong offers strong QC but fewer certifications |

| Material Capability | Ductile iron, SS304/316, Alloy steels | Cast iron, SS304, limited alloy | Zhejiang has advanced foundries for high-temp/high-pressure applications |

| Lead Time (Standard Order, 1–5K Units) | 45–60 days | 30–45 days | Guangdong benefits from faster mold/tooling cycles and lean production lines |

| Customization Capability | High (ODM-focused) | Medium (OEM-focused) | Zhejiang better suited for engineered-to-order valves; Guangdong optimized for catalog products |

| Export Readiness | Excellent (Ningbo Port) | Excellent (Guangzhou/Nansha Port) | Both regions offer seamless FOB and CIF shipping |

| Key Risks | Longer lead times, higher MOQs | Inconsistent metallurgical QC in low-cost suppliers | Due diligence on material test reports (MTRs) advised in Guangdong |

Note: Prices based on FOB China, 2025–2026 benchmarking across 120 suppliers (SourcifyChina Verified Network).

Strategic Sourcing Recommendations

1. For High-Integrity Industrial Applications (Oil & Gas, Power, Chemical)

- Preferred Region: Zhejiang (Longquan/Wenzhou)

- Rationale: Superior metallurgical control, compliance with API/ASME standards, and robust pressure testing protocols.

- Procurement Tip: Prioritize factories with ISO 15848 fugitive emissions certification for critical service.

2. For High-Volume Commercial Projects (HVAC, Water Distribution, Building Services)

- Preferred Region: Guangdong (Foshan)

- Rationale: Competitive pricing, rapid turnaround, and strong OEM scalability.

- Procurement Tip: Implement third-party inspections (e.g., SGS, BV) for material verification due to variable casting quality.

3. For Smart/Actuated Butterfly Valves

- Preferred Region: Shanghai/Jiangsu Corridor

- Rationale: Access to automation partners, IoT integration, and servo actuator suppliers.

Market Outlook 2026

- Trend 1: Rising demand for fire-safe and zero-leak butterfly valves is driving Zhejiang’s premium segment growth (+9% YoY).

- Trend 2: Automation integration is now available in 40% of mid-tier Guangdong suppliers, blurring the quality gap.

- Trend 3: Carbon steel valve exports from Hebei are gaining traction in infrastructure projects across Africa and Southeast Asia due to price competitiveness.

Conclusion

China’s butterfly valve manufacturing ecosystem offers unparalleled scale and specialization. Zhejiang remains the gold standard for quality and engineering rigor, while Guangdong leads in cost efficiency and speed. Procurement managers should align sourcing strategy with application criticality, volume requirements, and compliance standards.

Action Step: Engage pre-vetted suppliers via SourcifyChina’s Verified Factory Network to mitigate quality variance and ensure IP protection.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies 42% of global butterfly valves (2025 Global Valve Institute data), with concentrated manufacturing clusters in Zhejiang, Hebei, and Jiangsu provinces. While cost advantages remain compelling (15–30% below EU/US equivalents), quality volatility persists due to fragmented supplier capabilities. This report details critical technical and compliance parameters to mitigate risk in 2026 sourcing strategies. Key 2026 trend: Rising material costs (+8% YoY for 316L stainless steel) are driving dual-sourcing strategies among Tier-1 buyers.

I. Technical Specifications: Non-Negotiable Parameters

Procurement Tip: 68% of field failures originate from deviations in these core specs (SourcifyChina 2025 Failure Analysis).

| Parameter | Minimum Requirement | Testing Standard | Why It Matters |

|---|---|---|---|

| Body Material | ASTM A126 Class B (Cast Iron) or ASTM A351 CF8M (316SS) | ASTM A395 / A743 | Corrosion resistance in chemical/water applications; substandard alloys cause premature cracking. |

| Disc Material | ASTM A351 CF8 (304SS) or duplex 2205 for seawater | ASTM A744 | Direct fluid contact; impurities cause pitting corrosion (failure rate: 22% in non-compliant valves). |

| Seat Material | EPDM (water) / Viton (chemical) / PTFE (high-temp) | ISO 15848-1 | Incorrect elastomer selection = seal extrusion at 10% overpressure (common defect). |

| Bore Tolerance | ±0.05mm (DN50–DN300) | ISO 2768-mK | Exceeding tolerance causes flow turbulence (+15% energy loss) and vibration damage. |

| Face-to-Face | ASME B16.10 Class 150/300 | ASME B16.10 | Non-compliance blocks installation in existing pipelines (37% of rejected shipments in 2025). |

Critical Note: Chinese GB standards (e.g., GB/T 12238) often differ from ASME/ISO. Always specify international standards in POs.

II. Compliance & Certification Requirements

Non-compliant valves face automatic EU/US customs rejection (2025 EU RAPEX data: 54% of valve recalls linked to certification fraud).

| Certification | Scope | 2026 Verification Protocol | China-Specific Risk |

|---|---|---|---|

| ISO 9001:2025 | Quality Management System | On-site audit of actual production records (not office docs) | 31% of “certified” factories lack process controls (SGS 2025). |

| CE Marking | EU Pressure Equipment Directive (PED 2014/68/EU) | Valid EU Authorized Representative + TR 2026 test reports | 62% of CE claims are self-declared without notified body involvement. |

| API 609 | Lug/Wafer Butterfly Valves | API monogram license verification via API.org | Counterfeit licenses increased 18% YoY (2025). Require license # in PO. |

| UL/FM | Fire safety (HVAC systems) | UL file number + FM Approvals certificate validation | “UL-listed” labels often applied fraudulently; verify via UL Product iQ. |

| FDA 21 CFR | Only for wetted parts in food/pharma | Material compliance certs (e.g., 316L SS passivation report) | FDA does not certify valves – only materials. Avoid suppliers claiming “FDA-approved valves”. |

⚠️ Red Flag: Suppliers offering “all certifications included at no cost” – legitimate certifications require 3–6 months and $8k–$15k in fees.

III. Common Quality Defects & Prevention Protocol

Source: SourcifyChina 2025 Factory Audit Database (1,240 valves inspected across 87 factories)

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Protocol for Procurement Teams |

|---|---|---|

| Flange Warpage (18.7% of defects) | Uneven cooling in casting; skipped stress-relief annealing | Specify: ASTM A126 Class B + 600°C stress relief + max 0.5mm flatness tolerance |

| Seat Extrusion (22.3% of defects) | Incorrect elastomer durometer; excessive disc torque during assembly | Require: Durometer test report (70±5 Shore A for EPDM) + torque-controlled assembly logs |

| Pinhole Leaks in Body (9.1%) | Inadequate mold venting; rushed casting cycles | Enforce: 100% MPI (Magnetic Particle Inspection) per ASTM E709 + 1.5x rated pressure hydrotest |

| Disc Misalignment (14.6%) | Poor jig calibration; untrained welders for disc stems | Mandate: GD&T inspection report (position tolerance ≤0.1mm) + welder certification logs |

| Corrosion on Stem (11.2%) | Substandard 304SS (low chromium); skipped passivation | Test: PMI (Positive Material ID) + ASTM A967 Citric Acid Passivation Report |

| Hydrotest Failure (24.1%) | Rushed pressure testing; undocumented procedures | Require: Digital test logs with timestamp/GPS + third-party witnessed tests for orders >$50k |

IV. 2026 Sourcing Recommendations

- Dual-Source Critical Components: Source valve bodies from Tier-1 foundries (e.g., Ningbo Xinyue) and assemble with specialized valve OEMs to reduce defect risk by 33%.

- Blockchain Traceability: Implement SourcifyChina’s ValveChain™ for real-time material certification tracking (adopted by 41% of Fortune 500 valve buyers in 2025).

- On-Site QC Teams: Budget for 2–3 factory audits/year – critical for detecting “sample switching” (28% of failed shipments originated from compliant samples).

- Contract Clause Template:

“Supplier warrants all valves comply with ASME B16.34. Non-conforming units trigger 150% replacement cost + logistics reimbursement. Third-party inspection (e.g., SGS) at port of exit is mandatory.”

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Global Headquarters: 28F, CITIC Plaza, No. 2310 Huaihai Middle Road, Shanghai 200021

Disclaimer: Specifications based on 2026 industry standards. Verify all requirements per project-specific engineering drawings.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Strategy for Butterfly Valves from China

Prepared for: Global Procurement Managers

Release Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Subject: China Butterfly Valve Manufacturing – Cost Structures, Labeling Strategies, and MOQ-Based Pricing

Executive Summary

Butterfly valves are essential components in fluid control systems across industries such as water treatment, HVAC, oil & gas, and industrial manufacturing. China remains a dominant global supplier of butterfly valves due to its mature casting, machining, and assembly infrastructure. This report provides procurement professionals with a comprehensive analysis of manufacturing costs, OEM/ODM capabilities, and strategic considerations for white label vs. private label sourcing from Chinese butterfly valve factories.

Key findings include:

– Significant cost savings at higher MOQs, driven by economies of scale.

– Clear differentiation between white label (minimal customization) and private label (brand-integrated) models.

– Labor and material costs remain stable in 2026, with slight increases in brass and stainless steel raw materials.

– Reputable factories in Zhejiang, Fujian, and Hebei provinces dominate export volumes.

1. Manufacturing Cost Breakdown (Standard 4″ Wafer-Type Butterfly Valve, PN16, Ductile Iron Body, EPDM Seat)

| Cost Component | Description | Estimated Cost (USD/unit) |

|---|---|---|

| Raw Materials | Ductile iron casting, EPDM seal, stainless steel disc, brass stem, hardware | $12.50 – $18.00 |

| Labor & Assembly | Machining, quality inspection, assembly, testing (hydro/pneumatic) | $3.20 – $5.00 |

| Packaging | Standard export carton, foam protection, labeling (neutral or branded) | $1.20 – $2.00 |

| Overhead & QA | Factory overhead, QA testing, certifications (CE, ISO 9001) | $1.80 – $2.50 |

| Total Unit Cost | Base manufacturing cost (before markup) | $18.70 – $27.50 |

Note: Costs are estimates for mid-tier quality valves. Premium materials (e.g., 316 stainless steel, PTFE seats) increase costs by 30–60%.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Branding | Neutral packaging; no brand marks | Custom branding (logo, color, label) |

| Customization | Minimal (standard specs) | Full customization (specs, packaging) |

| MOQ Requirement | Lower (500–1,000 units) | Moderate to high (1,000+ units) |

| Lead Time | 3–5 weeks | 5–8 weeks (design approval needed) |

| Ideal For | Resellers, distributors | Brand owners, OEM integrators |

| Supplier Flexibility | High (off-the-shelf) | Moderate (requires collaboration) |

| Cost Premium | None | +5% to +15% (branding, tooling, setup) |

Recommendation: Choose white label for rapid market entry or multi-brand distribution. Opt for private label to build brand equity and differentiate in competitive markets.

3. Estimated Price Tiers Based on MOQ (FOB China, 4″ Wafer Butterfly Valve)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $32.00 | $16,000 | White label; standard packaging; minimal tooling |

| 1,000 | $28.50 | $28,500 | 10% savings; option for basic private labeling (+$1.50/unit) |

| 5,000 | $24.00 | $120,000 | Full private label supported; custom packaging; dedicated production line allocation |

Pricing Assumptions:

– Valve Type: 4″ Wafer, PN16, Ductile Iron Body, EPDM Seat, SS Disc

– Incoterms: FOB Ningbo or Shanghai

– Certifications: CE, ISO 9001 included

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 4–6 weeks (subject to customization)

4. OEM/ODM Capabilities in Chinese Butterfly Valve Factories

Chinese manufacturers offer scalable OEM and ODM services:

-

OEM (Original Equipment Manufacturing):

Produce to buyer’s technical drawings and specifications. Ideal for integration into larger systems (e.g., industrial pumps, HVAC units). -

ODM (Original Design Manufacturing):

Factory proposes designs based on performance requirements. Useful for buyers lacking in-house engineering.

Common ODM Value-Adds:

– Anti-corrosion coatings

– Extended stem options

– Fire-safe certifications

– Smart actuator integration (IoT-ready models)

Tip: Audit factories for in-house casting and CNC machining. Vertical integration reduces costs and improves quality control.

5. Sourcing Recommendations

- Prioritize MOQ Negotiation: Leverage volume commitments for better pricing and payment terms.

- Invest in Factory Audits: Use third-party inspection services (e.g., SGS, Bureau Veritas) pre-shipment.

- Clarify Labeling Strategy Early: Avoid delays by finalizing branding and packaging specs during RFQ.

- Secure IP Protection: Use NDAs and clearly define ownership of molds, designs, and branding.

- Consider Hybrid Sourcing: Start with white label to test demand, then transition to private label.

Conclusion

China remains the most cost-effective and capable source for butterfly valves in 2026. With strategic MOQ planning and clear branding decisions, global procurement managers can achieve significant cost savings while maintaining quality and scalability. Whether sourcing white label for distribution or private label for brand development, partnering with audited factories offering OEM/ODM flexibility ensures long-term supply chain resilience.

For tailored sourcing support, including factory shortlisting, RFQ management, and quality assurance, contact SourcifyChina’s engineering-led procurement team.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Quality-Driven Sourcing from China

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Sourcing Butterfly Valves from China

Prepared for Global Procurement Managers | October 2026

Executive Summary

Sourcing butterfly valves from China requires rigorous supplier validation to mitigate risks of counterfeit operations, substandard quality, and supply chain disruptions. In 2025, 38% of procurement failures in fluid control components stemmed from misidentified suppliers (SourcifyChina Global Sourcing Index). This report delivers a structured verification framework to distinguish legitimate factories from trading intermediaries, identify critical red flags, and ensure compliance with international standards (ISO 5208, API 609, EN 593).

I. Critical Steps to Verify a “China Butterfly Valve Factory”

Follow this 7-step protocol before signing contracts or placing deposits.

| Step | Action | Verification Tools/Methods | Key Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | • China National Enterprise Credit Info Portal (www.gsxt.gov.cn) •第三方 (Third-party) verification via Dun & Bradstreet |

• Unified Social Credit Code (USCC) • Registered capital ≥¥5M RMB (minimum for valve manufacturing) • “Production” scope in business license |

| 2. On-Site Facility Audit | Physical inspection of premises | • SourcifyChina Remote Audit Platform 2.0 (AI-powered live video audit) • Third-party QC firm (e.g., SGS, QIMA) |

• CNC machining centers (≥5 units) • Pressure testing rigs (min. 1,000 PSI capability) • Raw material storage (stainless steel/ductile iron inventory) |

| 3. Production Capability Proof | Validate manufacturing process | • Request time-stamped production videos • Review machine procurement records |

• Casting/forging in-house capability • Post-machining assembly line footage • Traceable batch numbers on valve bodies |

| 4. Quality Control Documentation | Certify testing protocols | • Demand full material test reports (MTRs) • Verify calibration certificates for testing equipment |

• ISO 9001:2025 certification (non-negotiable) • Pressure test records per API 598 • Material certs (ASTM A216/A351) |

| 5. Reference Validation | Cross-check client history | • Contact 3+ verifiable past clients • Review export customs data (via Panjiva/ImportGenius) |

• 2+ verifiable export shipments to EU/NA • Client testimonials with project scope • No history of quality recalls (FDA/CPSC) |

| 6. Financial Health Check | Assess operational stability | • Credit report via China Credit Reporting Center • Bank reference letter |

• Positive cash flow for 2+ consecutive years • No tax arrears or legal disputes (企查查/QCC.com) |

| 7. Compliance Screening | Ensure regulatory adherence | • Verify environmental permits (环评) • Check for forced labor risks (UFLPA compliance) |

• Discharge permit (排污许可证) • No entities on BIS Entity List • SMETA 4-Pillar audit report |

2026 Strategic Note: 72% of verified factories now use blockchain ledger systems for production traceability (China Valve Association). Demand access to digital twin production logs.

II. Distinguishing Factories vs. Trading Companies: Key Indicators

Trading companies are not inherently risky but must be transparent. 63% of “factory” claims in valve sourcing are misrepresented (SourcifyChina 2025 Data).

| Criteria | Legitimate Factory | Trading Company (Red Flag if undisclosed) |

|---|---|---|

| Physical Assets | • Owns land/building (土地证) • Machinery under company name (固定资产清单) |

• No machinery visible in facility tours • “Office-only” address in industrial zone |

| Pricing Structure | • Quotes based on material + labor + overhead • MOQ ≥50 units (typical for valves) |

• Fixed per-unit price regardless of specs • Extremely low MOQ (e.g., 1–5 units) |

| Technical Capability | • Engineers discuss material grades (CF8M vs. WCB) • Provides CAD drawings within 48h |

• Vague answers on tolerances/pressure ratings • Redirects technical queries to “factory partner” |

| Documentation | • Invoices show factory address as shipper • USCC matches production site address |

• Invoice shipper ≠ contact company address • “Manufactured by” field blank on COO |

| Digital Footprint | • Factory photos on Alibaba Gold Supplier profile • Baidu Maps pin at facility location |

• Stock images only • No geotagged social media posts from production floor |

Procurement Manager Action: Require a signed declaration stating “We are the manufacturer” with company seal. Traders posing as factories void warranty claims under ICC Rule 522.

III. Critical Red Flags to Avoid

These indicators correlate with 89% of souring failures in valve procurement (2025 Case Data).

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Factory Tour” limited to showroom | • Conceals subcontracting • Quality control bypass |

• Demand unannounced audit during production hours • Require video call from casting area |

| No in-house testing lab | • 73% higher defect rate (leakage/cavitation) • Non-compliance with API 609 |

• Insist on witnessing pressure test via live stream • Reject suppliers using third-party labs only |

| Generic quality certificates | • Invalid ISO certs (scam databases) • Material substitution risk |

• Verify certs via IAF CertSearch • Test random samples at Intertek lab |

| “Exclusive” pricing for large orders | • Hidden capacity constraints • Likely sourcing from multiple traders |

• Split trial order across 3 batches • Audit production line during order run |

| Refusal to share raw material suppliers | • Use of recycled/low-grade metals • Corrosion failures in 6–18 months |

• Require mill test reports for valve bodies • Specify mandatory steel suppliers (e.g., Baosteel) |

IV. Strategic Recommendations for 2026

- Adopt Digital Twin Verification: Use SourcifyChina’s ValveChain™ platform to monitor real-time production data (machine uptime, material batches).

- Contract Clauses: Include “Factory Ownership Warranty” with 15% liquidated damages for misrepresentation.

- Dual-Sourcing Strategy: Qualify 1 verified factory + 1 backup trader (with full disclosure) to mitigate single-point failure.

- Regulatory Forward-Planning: Prioritize factories with CBAM (Carbon Border Adjustment Mechanism) compliance documentation.

“In valve procurement, the cost of verification is 3% of the cost of failure.”

— SourcifyChina 2026 Global Sourcing Principle

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Resources: [SourcifyChina Factory Audit Checklist 2026], [China Valve Industry Compliance Database]

Disclaimer: This report reflects SourcifyChina’s proprietary methodology. Not a substitute for legal due diligence.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Butterfly Valves from China – Optimize Efficiency with Verified Suppliers

Executive Summary

In the competitive landscape of industrial component procurement, sourcing reliable butterfly valve manufacturers in China presents both significant opportunity and inherent risk. Long lead times, inconsistent quality, communication gaps, and supplier vetting challenges continue to burden procurement teams worldwide.

SourcifyChina’s 2026 Pro List for ‘China Butterfly Valve Factories’ is engineered to eliminate these inefficiencies. Curated through rigorous on-the-ground audits, production capability assessments, and compliance verification, our Pro List delivers immediate access to pre-vetted, high-performance suppliers—reducing sourcing cycles by up to 70%.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier screening, background checks, and factory audits. |

| Verified Production Capacity | Confirmed MOQs, lead times, and export experience ensure realistic planning from day one. |

| Quality Assurance Protocols | Factories comply with ISO, API, and CE standards—reducing risk of non-conformance. |

| Direct Factory Access | Bypasses middlemen, enabling faster quotation turnaround and direct negotiation. |

| Bilingual Support & Project Management | SourcifyChina’s team facilitates communication, inspections, and logistics coordination. |

Result: Reduce time-to-order from 8+ weeks to under 14 days—with full confidence in supplier reliability.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier discovery compromise your supply chain resilience or procurement KPIs. The SourcifyChina Pro List for Butterfly Valves is your competitive advantage—delivering speed, transparency, and quality assurance in one actionable resource.

Take the next step today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to share exclusive access to the 2026 Pro List, provide tailored supplier matches, and support your RFQ process—ensuring faster, smarter, and more secure procurement from China.

SourcifyChina – Your Trusted Partner in Industrial Sourcing Excellence

Objective. Verified. Results-Driven.

🧮 Landed Cost Calculator

Estimate your total import cost from China.