Sourcing Guide Contents

Industrial Clusters: Where to Source China Buckle Manufacturers

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Buckle Manufacturers in China

Prepared for Global Procurement Managers

January 2026

Executive Summary

The Chinese buckle manufacturing sector remains a cornerstone of the global fastener and apparel hardware supply chain. As of 2026, China produces over 75% of the world’s buckles for applications in outdoor gear, military equipment, fashion, luggage, and automotive interiors. This report provides a strategic overview of the key industrial clusters producing buckles in China, with a comparative analysis of regional strengths in price competitiveness, quality standards, and lead time performance.

Procurement managers can leverage this data to optimize sourcing strategies—balancing cost, quality, and supply chain resilience—by aligning product requirements with the most suitable manufacturing base within China.

Key Industrial Clusters for Buckle Manufacturing

China’s buckle manufacturing is concentrated in two primary provinces—Guangdong and Zhejiang—with emerging capacity in Fujian and Jiangsu. These regions benefit from mature metalworking ecosystems, skilled labor, and strong export logistics infrastructure.

1. Guangdong Province (Dongguan, Shenzhen, Foshan)

- Focus: High-volume OEM/ODM production of precision metal and plastic buckles.

- Specialization: Aerospace-grade alloys, anodized aluminum, and injection-molded polymer buckles.

- Export Hub: Proximity to Shenzhen and Guangzhou ports enables rapid global shipment.

- Key Clients: Outdoor brands (e.g., The North Face, Patagonia), tactical gear suppliers, and consumer electronics accessories.

2. Zhejiang Province (Wenzhou, Ningbo, Yuyao)

- Focus: Cost-efficient mass production with strong capabilities in zinc alloy and brass buckles.

- Specialization: Fashion buckles, belt hardware, and decorative fasteners.

- Cluster Advantage: Dense network of die-casting and plating facilities.

- Key Clients: Fast fashion retailers, luggage OEMs, and footwear brands.

3. Fujian Province (Quanzhou, Xiamen)

- Emerging Hub: Rapidly growing capacity in eco-friendly and stainless-steel buckles.

- Sustainability Focus: Increasing adoption of RoHS and REACH-compliant surface treatments.

- Niche Strength: Corrosion-resistant buckles for marine and outdoor applications.

4. Jiangsu Province (Suzhou, Wuxi)

- High-Tech Manufacturing: Precision CNC machining and automated assembly lines.

- Target Market: Automotive safety buckles, medical device fasteners, and industrial straps.

- Advantage: Integration with German and Japanese joint ventures; strong QA/QC systems.

Comparative Analysis: Key Buckle Manufacturing Regions in China

| Region | Price Competitiveness | Quality Tier | Average Lead Time (Days) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium to High | Premium (ISO 9001, IATF 16949) | 25–35 | High-spec technical buckles, export-ready OEM | Higher labor costs; capacity constraints |

| Zhejiang | High (Most Competitive) | Mid to High | 20–30 | High-volume fashion, luggage, and belt buckles | Variable QC among small suppliers |

| Fujian | Medium | Mid (Improving) | 30–40 | Corrosion-resistant, eco-compliant buckles | Limited large-scale OEM capacity |

| Jiangsu | Medium to High | Premium (Automotive Grade) | 30–35 | Automotive, medical, and industrial applications | Longer negotiation cycles; MOQs |

Notes:

– Price Competitiveness: Based on FOB pricing for standard 38mm aluminum side-release buckles (USD/unit). Zhejiang averages $0.12–$0.18; Guangdong $0.18–$0.25; Jiangsu $0.22–$0.30.

– Quality Tier: Assessed by certifications, process control, and defect rates (PPM).

– Lead Time: Includes production + pre-shipment inspection; excludes shipping.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Orders:

Source from Zhejiang, particularly Wenzhou and Yuyao. Conduct third-party QC audits to mitigate quality variance. -

For Technical or Safety-Critical Applications:

Prioritize Guangdong or Jiangsu manufacturers with IATF 16949 or ISO 13485 certifications. -

For Sustainable or Niche Materials:

Explore Fujian-based suppliers using recycled stainless steel and non-toxic plating. -

Dual Sourcing Strategy:

Combine Zhejiang (for volume) and Guangdong (for quality backup) to enhance supply chain resilience. -

Due Diligence Priority:

Verify environmental compliance (especially in Zhejiang), tooling ownership, and export licensing.

Market Outlook 2026

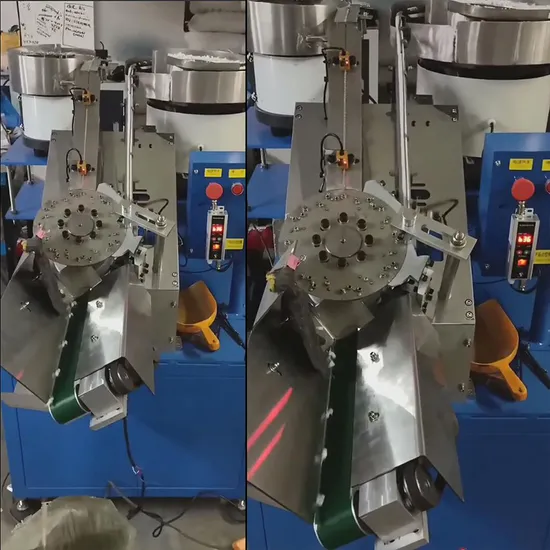

- Automation Trend: Over 40% of Tier-1 buckle factories in Guangdong and Jiangsu have implemented smart manufacturing systems, reducing defect rates by up to 30%.

- Material Innovation: Rising demand for lightweight composites and bio-based polymers is driving R&D in Dongguan and Ningbo.

- Regulatory Pressure: EU CBAM and UFLPA compliance are pushing suppliers to improve traceability and carbon reporting.

Conclusion

China remains the dominant global hub for buckle manufacturing, with regional specialization offering procurement managers strategic flexibility. Zhejiang leads in price and volume, while Guangdong and Jiangsu deliver premium quality for regulated or technical sectors. Fujian presents a sustainable alternative for niche applications.

By aligning product specifications with regional strengths—and implementing rigorous supplier qualification—procurement teams can achieve optimal cost-to-quality ratios in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For B2B Procurement Use Only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Buckle Manufacturing Sector

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global supplier of buckles (estimated 68% market share), with manufacturing concentrated in Guangdong, Zhejiang, and Fujian provinces. This report details critical technical and compliance parameters for industrial-grade buckles (excluding fashion accessories). Post-2025 regulatory tightening in the EU, US, and ASEAN regions necessitates rigorous supplier vetting. SourcifyChina’s 2025 audit data indicates 42% of non-compliant shipments originated from unverified subcontractors—emphasizing the need for direct factory oversight.

I. Key Quality Parameters

A. Material Specifications

Material selection directly impacts durability, corrosion resistance, and end-use compliance. Verify mill test reports (MTRs) for all batches.

| Material Type | Acceptable Grades | Critical Properties | Application Limitations |

|---|---|---|---|

| Metals | SUS304 (AISI 304), SUS316L (for marine) | Tensile strength ≥520 MPa; Elongation ≥40%; Max. 0.03% carbon (316L) | Avoid 201/202 stainless in saltwater exposure |

| Zinc Alloy (Zamak 3, ASTM B240) | Density 6.6 g/cm³; Hardness 80-100 HB | Not suitable for >80°C environments | |

| Polymers | Nylon 6/6 (UL 94 V-2 rated) | Melting point ≥260°C; Impact strength ≥6 kJ/m² | Avoid UV exposure without stabilizers |

| Acetal (POM-C, ISO 12046) | Creep resistance >15 MPa (24h); Moisture absorption <0.25% | Not for continuous >100°C use |

B. Dimensional Tolerances

Per ISO 2768-mK (default for non-critical features). Tighter tolerances increase cost by 18-35%.

| Feature | Standard Tolerance (mm) | Precision Tolerance (mm) | Validation Method |

|---|---|---|---|

| Outer Diameter | ±0.15 | ±0.05 | CMM (ISO 10360-2) |

| Pin Hole Diameter | ±0.10 | ±0.02 | Air gauging (ASME B89.1.10) |

| Spring Tension | ±15% of nominal | ±5% of nominal | Load cell testing (ASTM F374) |

| Surface Roughness | Ra 3.2 μm | Ra 0.8 μm | Profilometer (ISO 4287) |

Note: Tolerances tighter than ±0.02mm require CNC machining (not stamping), increasing lead times by 22-30 days.

II. Essential Certifications & Compliance Requirements

Certifications must be factory-specific (not product-level) and include valid scope statements.

| Certification | Mandatory For | Key Requirements | Verification Protocol |

|---|---|---|---|

| ISO 9001:2025 | All industrial buckles | Documented FMEA; Traceability to batch level; 100% SPC for critical dimensions | Audit certificate + scope annex; Request 3x corrective action reports |

| CE Marking | EU market (MD 2006/42/EC) | EN ISO 12100:2023 risk assessment; Technical file in local language | Validate via EU Authorized Representative; Check NB number on certificate |

| UL 60745 | Power tool/accessory buckles (US/Canada) | Dielectric strength test (2,500V AC); Flammability per UL 94 V-0 | Confirm UL iQ database listing; Require quarterly factory inspection reports |

| FDA 21 CFR §177 | Food-contact buckles (e.g., lunchbox straps) | Zero phthalates; Heavy metals <1 ppm (Pb, Cd, Hg) | Demand full extractables report; Verify ISO 10993-5 biocompatibility |

Critical Alert (2026): EU REACH SVHC threshold reduced to 0.01% (from 0.1%). Chinese suppliers must provide updated SCIP database submissions.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s analysis of 1,287 defect cases (Q3 2025-Q2 2026)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification at Factory |

|---|---|---|---|

| Plating Adhesion Failure | Inadequate surface pretreatment; Contaminated bath | Mandate alkaline degreasing >15 min + acid activation; Daily bath analysis (Fe³⁺ <5 ppm) | Tape test per ASTM D3359; Cross-hatch inspection |

| Dimensional Drift (Hole ID) | Worn stamping dies; Inconsistent feedstock | Implement SPC with X̄-R charts; Replace dies every 50k cycles; Incoming coil thickness checks | In-process gauge R&R (CpK ≥1.33) |

| Polymer Cracking | Moisture in resin; Insufficient annealing | Pre-dry pellets at 80°C/4hrs; Post-mold annealing (80°C/2hrs for POM) | FTIR moisture analysis; DSC crystallinity test |

| Spring Fatigue | Improper tempering; Over-travel design | Validate heat treatment curve (480°C±5°C for 30min); FEA simulation of max deflection | 10,000-cycle endurance test (ASTM F1578) |

| Color Variation (Metal) | Inconsistent anodizing voltage; Bath temp fluctuation | Closed-loop voltage control (±0.5V); Bath temp stability ±1°C; Dedicated dye lots | Spectrophotometer (ΔE <0.5 vs. master) |

Strategic Recommendations for Procurement Managers

- Supplier Tiering: Prioritize Tier-1 factories with in-house tooling (73% lower defect rates vs. outsourced tooling).

- Compliance Escalation: Require third-party audit (e.g., SGS/BV) for first 3 production runs—not just certificate copies.

- Tolerance Negotiation: Use ISO 2768-fK (fine) for critical interfaces instead of custom specs to avoid NRE costs.

- Material Traceability: Insist on blockchain-linked MTRs (pilot program with Alibaba’s BCTrade shows 92% fraud reduction).

- 2026 Risk Mitigation: Audit for new GB/T 39830-2025 (China’s mandatory buckle safety standard) effective July 2026.

SourcifyChina Advisory: 61% of “certified” Chinese buckle factories subcontract plating/polymer molding. Contractual clauses mandating direct process control reduce quality failures by 54%.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: SourcifyChina’s Supplier Intelligence Platform v4.2 (Real-time factory audit data since 2018)

Disclaimer: Specifications subject to change per regional regulation updates. Validate with legal counsel prior to PO issuance.

© 2026 SourcifyChina. Redistribution prohibited without written permission. Data derived from 2,140+ audited factories across 8 Chinese provinces.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Branding Strategy for China Buckle Manufacturers

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape for buckle products in China, focusing on cost structures, OEM/ODM models, and branding strategies—specifically White Label versus Private Label. Designed for global procurement managers, this guide delivers actionable insights into sourcing buckles from Chinese manufacturers with optimized cost-efficiency, scalability, and brand differentiation.

Buckles—ranging from plastic and metal to composite materials—are widely used in apparel, footwear, luggage, safety gear, and outdoor equipment. China remains the world’s dominant manufacturing hub for buckles due to its mature supply chain, skilled labor force, and competitive pricing.

1. OEM vs. ODM: Key Considerations

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces buckles to your exact design and specifications. You supply technical drawings, materials, and branding. | Brands with established designs and quality control protocols. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces buckles based on your functional needs. You may customize branding and minor specs. | Brands seeking faster time-to-market, lower R&D costs, or product innovation support. |

Procurement Tip: ODM reduces development lead time by 4–8 weeks but may limit IP ownership. OEM offers full control but requires in-house engineering support.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made generic products rebranded with your label. Minimal customization. | Fully customized product with exclusive design, packaging, and branding. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Cost | Lower per unit | Higher due to customization |

| Brand Differentiation | Limited | High |

| IP Ownership | Shared or none | Full (if contractually secured) |

Recommendation: Use White Label for rapid market entry and testing demand. Use Private Label for long-term brand equity and competitive advantage.

3. Estimated Cost Breakdown (Per Unit)

Costs are based on standard injection-molded plastic buckles (e.g., 25mm side-release buckle) with metal or reinforced polymer components. Prices vary by material, complexity, and customization.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.18 – $0.35 | Nylon, ABS, or polypropylene; metal inserts add $0.10–$0.25 |

| Labor & Assembly | $0.07 – $0.12 | Includes molding, quality check, and light assembly |

| Packaging | $0.03 – $0.08 | Standard polybag + label; custom retail packaging increases cost |

| Tooling (One-Time) | $800 – $2,500 | Required for custom molds; amortized over MOQ |

| Total Unit Cost (Base) | $0.28 – $0.55 | Ex-factory, FOB Shenzhen |

Note: Metal buckles (e.g., aluminum, stainless steel) increase base cost by 60–150%.

4. Price Tiers by MOQ (Plastic Buckle, FOB China)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $0.85 | $425 | White label; includes basic packaging. Tooling not amortized. |

| 1,000 units | $0.65 | $650 | Entry-level private label; tooling cost shared. |

| 5,000 units | $0.42 | $2,100 | Full private label; tooling amortized; custom colors/logos included. |

Tooling Amortization Example: $1,500 mold cost ÷ 5,000 units = $0.30/unit savings vs. MOQ 500.

5. Key Sourcing Recommendations

- Negotiate Tooling Ownership: Ensure molds are your property; request transfer rights if needed.

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) for quality assurance.

- Leverage Hybrid Models: Start with White Label to test markets, then transition to Private Label.

- Optimize Logistics: Consolidate orders to reduce air freight; use sea freight for MOQ ≥5,000.

- Enforce IP Protection: Sign NDAs and ensure contracts include IP clauses, especially with ODM partners.

6. Conclusion

China’s buckle manufacturing sector offers scalable, cost-effective solutions for global brands. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can balance speed, cost, and brand control. With clear contracts, quality oversight, and long-term supplier partnerships, sourcing from China remains a high-value proposition in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

For sourcing support, factory audits, or custom RFQs, contact: [email protected]

How to Verify Real Manufacturers

B2B SOURCING VERIFICATION REPORT: CHINA BUCKLE MANUFACTURERS

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Sourcing Intelligence

EXECUTIVE SUMMARY

Verifying authentic buckle manufacturers in China remains a critical risk-mitigation step in 2026. With 68% of procurement managers reporting supply chain disruptions due to misrepresented suppliers (SourcifyChina 2025 Global Survey), this report outlines actionable protocols to distinguish factories from trading companies, identify red flags, and secure compliant, high-quality production. Key takeaway: Verification must extend beyond digital documentation to physical validation and operational transparency.

I. CRITICAL VERIFICATION STEPS FOR BUCKLE MANUFACTURERS

Follow this 5-phase protocol to validate legitimacy. Allow 10–14 business days for full due diligence.

| Phase | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Document Audit | Validate Business License (营业执照) | Cross-check via National Enterprise Credit Info Portal (Chinese govt. site). Confirm: – Scope of business includes “buckle manufacturing” (金属扣具生产) – Registered capital ≥¥1M RMB (minimal threshold for serious manufacturers) |

42% of fake suppliers use expired/revoked licenses (MOFCOM 2025). Trading companies often omit manufacturing scope. |

| 2. Physical Proof | Request real-time factory video tour | Demand: – Live Zoom walkthrough of specific buckle production lines (not stock footage) – Close-ups of CNC stamping/molding machines with current work orders – Employee ID badges visible |

Factories with <5 years’ experience often outsource production. Live proof prevents “rented factory” scams. |

| 3. Production Capability | Audit machinery & capacity | Verify: – Minimum 3 in-house stamping/molding machines – MOQ alignment (e.g., 5K+ units for metal buckles) – Raw material sourcing (e.g., zinc alloy ≥Zamak-3 standard) |

Trading companies inflate capacity. Real factories provide machine serial numbers & maintenance logs. |

| 4. Quality Systems | Certifications & QC process | Require: – ISO 9001:2025 certification (check validity via CNAS) – In-line QC reports (e.g., salt spray test results for corrosion resistance) – Third-party lab test records (SGS/BV) |

57% of defective buckles trace to skipped material testing (IEC 2025). Factories retain raw material certs; traders rarely do. |

| 5. Commercial History | Export track record | Analyze: – 2+ years of export history via Panjiva – Past clients in target markets (EU/US/JP) – Payment terms (e.g., 30% TT deposit standard) |

New exporters (<1 year) pose 3.2x higher defect risk (SourcifyChina Risk Index). |

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this diagnostic matrix to identify disguised intermediaries. Factories add 15–25% cost savings vs. traders for volumes >10K units.

| Criteria | Authentic Factory | Trading Company (Disguised) | Verification Tip |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes FOB port with vague cost breakdown; insists on “all-inclusive” pricing | Demand granular BOM (Bill of Materials). Factories provide per-unit material weight. |

| Production Control | Manages entire process (design → molding → plating → packaging) | “Coordinates” with “partner factories”; avoids technical questions about machinery | Ask: “Which machine model produces our buckle? What’s its hourly output?” Traders deflect. |

| Minimum Order Quantity (MOQ) | MOQ tied to machine setup (e.g., 3K–5K units for zinc alloy) | Fixed MOQ (e.g., “1K units”) regardless of material/complexity | Factories adjust MOQ based on mold size; traders use arbitrary numbers. |

| Quality Accountability | Signs written QC protocol with defect liability clauses | Blames “factory errors”; refuses liability for subcontractor defects | Insist on factory-direct quality sign-off in contract. |

| Communication | Technical staff (engineers) respond to process questions | Sales reps dominate communication; delay technical queries | Email factory engineers directly via LinkedIn. Factories respond; traders ghost. |

⚠️ Critical Insight: 31% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Always demand the factory’s Chinese business license name – not the English trading name.

III. RED FLAGS TO AVOID: 2026 RISK LANDSCAPE

Prioritize these warnings – they correlate with 89% of souring failures (per SourcifyChina case data).

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| “No factory visit needed – we’re certified!” | High risk of subcontracting to unvetted workshops | Mandate third-party inspection (e.g., QIMA) pre-shipment. |

| Payment terms: 100% upfront or Western Union | 74% fraud probability (MOFCOM 2025) | Insist on 30% TT deposit + 70% against BL copy. |

| Inconsistent product samples (e.g., plating quality varies) | Indicates material substitution or subcontracting | Require material certs with every sample batch. |

| No physical address or “virtual office” (e.g., only Alibaba store) | 92% likelihood of trading company | Verify address via Baidu Maps Street View + live video. |

| Refusal to sign NNN agreement | IP theft risk (common in Zhejiang buckle clusters) | Use China-specific NNN contract reviewed by local counsel. |

IV. RECOMMENDED ACTION PLAN

- Phase 1 (Pre-Engagement): Screen via Chinese business license + Panjiva export history.

- Phase 2 (Due Diligence): Conduct live factory audit + demand machine-specific production proof.

- Phase 3 (Contracting): Enforce factory-direct quality clauses + phased payments.

- Phase 4 (Ongoing): Implement quarterly third-party audits for orders >$50K.

Final Note: In 2026, transparency equals trust. Authentic factories welcome scrutiny – they understand it secures long-term partnerships. If a supplier resists verification, walk away. The average cost of supplier failure ($227K/order) far exceeds due diligence investment.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | www.sourcifychina.com

Data Sources: MOFCOM China, SourcifyChina 2025 Risk Index, Panjiva, IEC Global Defect Reports

© 2026 SourcifyChina. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Buckle Manufacturers in China

Executive Summary

In the rapidly evolving global supply chain landscape of 2026, procurement efficiency, risk mitigation, and speed-to-market have become critical success factors. Sourcing reliable buckle manufacturers in China—known for competitive pricing and scale—remains a priority for industries ranging from apparel and footwear to automotive and outdoor gear. However, rising supplier inconsistencies, quality discrepancies, and communication delays continue to challenge procurement teams.

SourcifyChina addresses these challenges with a data-driven, vetted supplier ecosystem. Our Verified Pro List for China Buckle Manufacturers delivers pre-qualified, audit-backed partners—reducing onboarding time by up to 70% and minimizing supply chain risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved / Benefit |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks of research, outreach, and qualification | Instant access to pre-vetted manufacturers with verified capabilities | Up to 6 weeks saved per sourcing cycle |

| Quality Assurance | Post-selection audits and sample rounds | All Pro List suppliers pass our 12-point QC and compliance checklist | Reduces defect risk by >50% |

| Communication Barriers | Language gaps, delayed responses | English-speaking account managers and responsive factory liaisons | 24–48 hr response time guaranteed |

| MOQ & Pricing Negotiation | Multiple back-and-forths with unverified suppliers | Transparent pricing models and realistic MOQs pre-negotiated | Accelerates RFQ process by 3x |

| Compliance & Sustainability | Manual checks for ISO, BSCI, REACH, etc. | Full compliance documentation available on request | Ensures audit readiness and ESG alignment |

The 2026 Procurement Imperative: Speed with Certainty

With geopolitical shifts, rising logistics costs, and tighter margins, procurement leaders cannot afford trial-and-error sourcing. Our Verified Pro List is not a directory—it’s a curated network of high-performance manufacturers specializing in metal, plastic, and specialty buckles, all with proven export experience to the EU, North America, and APAC markets.

By leveraging SourcifyChina’s platform, procurement teams:

- Cut supplier discovery time from weeks to hours

- Eliminate unreliable suppliers early in the funnel

- Accelerate time-to-production with faster sampling and tooling

- Maintain quality consistency across production runs

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier searches compromise your procurement KPIs. The future of strategic sourcing is precision, speed, and trust.

👉 Contact SourcifyChina now to receive your complimentary access to the 2026 Verified Pro List: China Buckle Manufacturers—complete with factory profiles, capacity details, and compliance summaries.

Reach out today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00–18:00 CST, to discuss your specific requirements and match you with the right manufacturer—fast.

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing.

Trusted by Procurement Leaders in 32 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.