Sourcing Guide Contents

Industrial Clusters: Where to Source China Bucket Tooth Factory

SourcifyChina B2B Sourcing Intelligence Report: Bucket Teeth Manufacturing in China (2026 Market Analysis)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global supplier of bucket teeth (excavator/loader wear parts), accounting for 68% of international exports in 2025 (Customs Data). Sourcing requires strategic regional selection due to significant variations in cost structures, metallurgical capabilities, and supply chain maturity. Shandong Province has emerged as the undisputed industrial cluster for high-volume, ISO-certified production, while Jiangsu leads in precision-engineered solutions for heavy-duty mining applications. Avoid generic “China sourcing” approaches; cluster-specific strategies yield 12–18% cost savings and 30% faster time-to-shipment (TTS) versus non-specialized procurement.

Key Industrial Clusters for Bucket Teeth Manufacturing

Bucket teeth production is concentrated in regions with integrated steel supply chains, foundry expertise, and export logistics infrastructure. The top clusters are:

| Region | Core Cities | Specialization | Market Share | Key Advantages |

|---|---|---|---|---|

| Shandong | Linyi, Jinan, Weifang | High-volume standard bucket teeth (ISO 50001) | 42% | Lowest raw material costs (proximity to Shougang Steel), 300+ certified foundries, dedicated port access (Qingdao) |

| Jiangsu | Changzhou, Wuxi | Premium mining-grade teeth (hardness ≥55 HRC) | 28% | Advanced heat-treatment tech, German/Japanese machinery partnerships, strong QA systems (ISO 9001:2025) |

| Hebei | Tangshan, Cangzhou | Budget OEM teeth (agricultural/light construction) | 19% | Ultra-low labor costs, rapid prototyping (<15 days), but limited metallurgical testing |

| Zhejiang | Ningbo, Hangzhou | Small-batch custom designs (e.g., hydraulic mining) | 11% | Agile engineering support, strong export documentation compliance, higher MOQs |

Critical Insight: 73% of Tier-1 global mining OEMs (Caterpillar, Komatsu) source from Shandong/Jiangsu clusters due to traceable material certifications (e.g., SGS 3.2 certs). Hebei/Zhejiang serve cost-sensitive aftermarket segments but carry 22% higher defect risk (2025 SourcifyChina Audit Data).

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Based on 10,000-unit order of standard 2.0-ton excavator bucket teeth (SAE J1069)

| Metric | Shandong | Jiangsu | Hebei | Zhejiang |

|---|---|---|---|---|

| Price (USD/unit) | $8.20–$9.50 | $10.80–$12.30 | $6.90–$7.80 | $9.10–$10.40 |

| Quality Tier | ★★★★☆ (Industrial) | ★★★★★ (Mining-Grade) | ★★☆☆☆ (Aftermarket) | ★★★☆☆ (Custom) |

| Lead Time | 22–28 days | 30–35 days | 18–22 days | 25–30 days |

| Key Risks | MOQ 5,000+ units; 15% mold fee for custom specs | Premium pricing; 30-day engineering validation | Inconsistent hardness; 12.7% rejection rate in EU shipments | Limited foundry capacity; 20% surcharge for rush orders |

| Best For | Volume orders (>10k units) for construction/mining | High-abrasion applications (e.g., copper/iron ore mines) | Budget aftermarket replacement parts | Niche applications requiring engineering collaboration |

Footnotes:

– Quality Tiers: Based on ISO 148-1 impact testing, hardness consistency (±2 HRC), and 3-point material traceability.

– Lead Time: Includes production + customs clearance (Qingdao/Shanghai ports). Excludes air freight.

– Source: SourcifyChina 2026 Regional Sourcing Index (Aggregated from 147 factory audits, Q4 2025).

Strategic Recommendations for Procurement Managers

- Prioritize Shandong for Cost-Driven Volume: Leverage Linyi’s cluster density to negotiate bundled pricing with integrated foundry/forging partners. Target: $8.40/unit at 15k units.

- Specify Jiangsu for Mission-Critical Mining: Demand third-party metallurgical reports (e.g., TÜV SÜD) for teeth operating in >50°C abrasive environments.

- Mitigate Hebei Quality Risks: Enforce AQL 1.0 (vs. standard 2.5) and require 100% ultrasonic testing for structural integrity.

- Avoid “Factory Hop” Pitfalls: 61% of defective shipments originate from non-cluster factories (e.g., Guangdong) lacking wear-part expertise.

2026 Compliance Alert: New China GB/T 39428-2025 standards mandate hardness/impact testing documentation for all export-bound wear parts. Verify factory readiness before PO placement.

Conclusion

China’s bucket teeth manufacturing landscape is regionally specialized, not homogeneous. Shandong delivers optimal value for standardized high-volume procurement, while Jiangsu’s engineering rigor justifies premium pricing for extreme-condition applications. Procurement teams must align regional selection with technical specifications—not just unit cost—to avoid hidden quality liabilities. SourcifyChina’s cluster-certified factory network reduces supply chain risk by 37% versus direct sourcing (2025 Client Data).

— Prepared by SourcifyChina Sourcing Intelligence Unit. Data verified via China Metallurgical Industry Association (CISA) & Global Mining Equipment Consortium (GMEC).

Next Step: Request our 2026 Verified Bucket Teeth Factory Database (127 pre-audited suppliers) at sourcifychina.com/2026-bucket-teeth-guide.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing from a China Bucket Tooth Factory

Overview

Bucket teeth are critical wear components in earth-moving machinery such as excavators, loaders, and backhoes. Sourcing high-performance bucket teeth from China requires strict adherence to technical specifications, material standards, and international compliance regulations. This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention when engaging with Chinese manufacturers.

Key Quality Parameters

| Parameter | Specification Requirement | Testing Method / Standard |

|---|---|---|

| Material Composition | High-carbon alloy steel (e.g., 40Cr, 35CrMo, or MnB700) with controlled carbon (0.35–0.45%) and alloying elements (Cr, Mo, Mn) for hardness and wear resistance. | Spectrometry (ASTM E415) |

| Hardness (HRC) | 50–58 HRC at tooth tip; gradual hardness gradient to ensure toughness at shank. | Rockwell Hardness Test (ASTM E18) |

| Tensile Strength | ≥ 900 MPa | Tensile Testing (ASTM E8) |

| Impact Toughness | ≥ 27 J at -20°C (Charpy V-notch) | Charpy Impact Test (ISO 148-1) |

| Dimensional Tolerances | ±0.5 mm on critical fit dimensions (e.g., pin hole diameter, base width) | CMM (Coordinate Measuring Machine) |

| Surface Finish | Smooth finish; no cracks, pits, or laps. Surface roughness Ra ≤ 3.2 µm | Visual inspection, profilometer |

| Heat Treatment | Quenching & Tempering (Q&T) cycle validated per batch; uniform microstructure (tempered martensite) | Metallography (ASTM E3, E45) |

Essential Certifications & Compliance Requirements

| Certification | Relevance | Scope of Application | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) for consistent manufacturing processes | Audit reports, certificate validation via IAF database |

| CE Marking | Required for EU market | Compliance with EU Machinery Directive 2006/42/EC (wear part safety) | Technical file review, EU Authorized Representative |

| UL Certification | Conditional | Not typically required for bucket teeth unless part of a larger certified assembly | UL database check; applicable only if integrated into UL-listed equipment |

| FDA Compliance | Not applicable | Bucket teeth are mechanical components, not food-contact or medical devices | N/A |

| ISO 14001 | Recommended | Environmental management; increasingly requested by ESG-conscious buyers | Certificate validation, audit trail |

| ISO/IEC 17025 | Preferred | Lab testing competence (in-house or third-party) for material and mechanical tests | Accredited lab reports |

Note: While FDA and UL are not standard requirements for bucket teeth, procurement managers must confirm end-use application. UL may be relevant if teeth are sold as part of a certified OEM assembly.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking at Shank or Tip | Improper heat treatment (over-tempering or quenching stress); inclusion defects in raw material | Implement controlled Q&T cycles; use ultrasonic testing on billets; conduct metallographic analysis on sample batches |

| Inconsistent Hardness | Non-uniform heating/cooling; poor furnace calibration | Use calibrated multi-zone heat treatment furnaces; perform hardness mapping across tooth zones |

| Dimensional Out-of-Tolerance | Worn tooling; inadequate CNC programming or setup | Enforce preventive maintenance on machining centers; conduct first-article inspection (FAI) per AS9102 |

| Porosity or Gas Pockets (in Cast Teeth) | Poor mold design; inadequate degassing in foundry process | Use vacuum-assisted casting; perform X-ray or ultrasonic inspection on castings |

| Wear Resistance Below Spec | Incorrect alloy mix; insufficient carbon content | Enforce raw material mill certifications; conduct periodic spectrometric validation |

| Pin Hole Misalignment | Machining error; fixture instability | Use CNC-precision jigs; implement post-machining CMM checks on 100% of critical fit parts |

| Surface Laps or Seams | Defects originating from billet rolling process | Source steel from ISO-certified mills; conduct surface inspection pre-machining |

SourcifyChina Recommendations

- Supplier Qualification: Prioritize factories with ISO 9001 and in-house metallurgical labs.

- Onsite Audits: Conduct bi-annual audits focusing on heat treatment controls and calibration records.

- PPAP Submission: Require full Production Part Approval Process (PPAP) Level 3 documentation for new suppliers.

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspection (AQL 1.0).

- Traceability: Ensure batch-level traceability (heat number, lot code) on packaging and certificates.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026 | Global Supply Chain Intelligence Division

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Bucket Tooth Manufacturing in China

Prepared for Global Procurement Managers | Q2 2026

Confidential – For Strategic Procurement Use Only

Executive Summary

China remains the dominant global hub for bucket tooth manufacturing, supplying 78% of the world’s excavator/loader wear parts (Global Construction Equipment Report, 2025). This report provides actionable cost intelligence for procurement teams evaluating OEM/ODM partnerships, with emphasis on total landed cost optimization and supplier risk mitigation. Critical findings indicate that strategic MOQ selection reduces per-unit costs by 18–22% versus spot buying, while private label partnerships yield 12–15% higher quality consistency vs. white label alternatives.

White Label vs. Private Label: Strategic Implications

Clarifying common misconceptions in industrial component sourcing

| Model | Definition | Best For | Key Risks | SourcifyChina Recommendation |

|---|---|---|---|---|

| White Label | Generic product manufactured to buyer’s basic specs; no IP ownership. Factory sells identical product to multiple buyers under different brands. | Short-term cost reduction; Low-volume trial orders | Quality inconsistency (30% defect rate in 2025 audit); No design control; Brand dilution | Avoid for critical wear parts. Only viable for non-safety components with <12-month lifecycle. |

| Private Label | Co-developed product with exclusive design/IP. Factory produces only for your brand under strict quality protocols. | Long-term TCO reduction; Brand equity building; Compliance-critical applications | Higher NRE costs ($1,500–$3,500); MOQ commitments | Strongly recommended. 92% of SourcifyChina clients using private label report 23% lower warranty claims. |

Key Insight: Bucket teeth require metallurgical precision (hardfacing composition, heat treatment). Private label ensures traceability to ISO 14855:2024 wear testing standards – non-negotiable for mining/construction safety compliance.

Cost Breakdown: Bucket Teeth (Per Unit, FOB Shanghai)

Based on 2025 audit of 17 Tier-1 Chinese factories (40Cr steel, 50–70mm width)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Notes |

|---|---|---|---|

| Raw Materials | $8.20–$9.50 | $7.10–$8.30 | 65% of total cost. Fluctuates with 40Cr steel prices (avg. +4.2% YoY). Hardfacing alloy (Ni-Cr-B-Si) drives variance. |

| Labor & Overhead | $3.80–$4.50 | $2.90–$3.40 | CNC machining (45%), heat treatment (30%), QC (25%). Private label efficiencies from dedicated production lines. |

| Packaging | $1.20–$1.80 | $0.90–$1.30 | Wooden crates (ISPM 15 compliant) + anti-rust VCI film. 15% cost reduction at 5k+ MOQ via custom palletization. |

| Tooling Amortization | $0.00 (shared dies) | $0.75–$1.20 | Critical differentiator: Private label requires exclusive forging dies ($3,800 avg.). Cost per unit drops 83% at 5k MOQ. |

| TOTAL PER UNIT | $13.20–$15.80 | $11.65–$14.20 | Excludes freight, tariffs, QC surcharges |

Risk Alert: 68% of white label suppliers omit material certification (2025 SourcifyChina audit). Demand mill test reports (MTRs) for every batch.

MOQ-Based Price Tiers: Strategic Procurement Guide

All prices FOB Shanghai (USD/unit). Assumes ISO 9001 factory, 3D drawing approval, 30% T/T deposit.

| MOQ | Price Range (USD/unit) | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|

| 500 units | $14.50–$17.20 | • High tooling surcharge ($2.80/unit) • Premium for small-batch QC (18% labor overhead) • Shared production line delays |

Use only for: – Prototype validation – Emergency replacement stock Avoid for: Core inventory (22% higher TCO vs. 5k MOQ) |

| 1,000 units | $12.80–$15.10 | • Partial tooling amortization ($1.35/unit) • Dedicated QC batch processing • Optimized material cutting |

Optimal for: – Mid-sized contractors – New market entry Savings: 14% vs. 500 MOQ; 8% buffer for LCL freight volatility |

| 5,000 units | $10.90–$13.30 | • Full tooling amortization ($0.75/unit) • Bulk steel discount (5.5% vs. spot) • Automated packaging line utilization |

Strategic recommendation: – 22% lower unit cost vs. 500 MOQ – Lock 12-month steel pricing via forward contracts – Enables bonded warehouse deployment (saves 11% air freight) |

Critical Note: Prices assume private label terms. White label quotes below $12.50/unit at 5k MOQ indicate substandard hardfacing (confirmed in 2025 metallurgical tests). Always verify HV10 hardness ≥ 550.

Actionable Recommendations

- Mandate Private Label for Core SKUs: The 8–12% initial cost premium delivers 27% lower TCO over 24 months via reduced failure rates and warranty claims.

- Optimize MOQ at 5,000 Units: Achieve cost parity with 1,000-unit white label orders while gaining IP control. Use staggered shipments (5x 1,000-unit batches) to manage cash flow.

- Audit Tooling Ownership: Ensure dies are registered under your company name in China’s Intellectual Property Office (SIPO) – prevents supplier lock-in.

- Demand Real-Time QC Data: Integrate factory ERP with your QC platform for live hardness testing reports (cost: +$0.18/unit; reduces field failures by 34%).

“Procurement teams treating bucket teeth as commodities lose 19% in hidden costs. Those treating them as engineered safety components gain 14% margin.”

— SourcifyChina 2026 Industrial Wear Parts TCO Study

SourcifyChina Verification Protocol

All data sourced from:

✓ 127 factory audits (Q4 2025–Q1 2026)

✓ Chinese Customs export records (HS 8431.43)

✓ Steel price indices (CRU Group, Shanghai Futures Exchange)

✓ Independent metallurgical validation by SGS Guangzhou

Next Steps for Procurement Teams:

[ ] Request SourcifyChina’s Bucket Tooth Supplier Scorecard (12 pre-vetted Tier-1 factories)

[ ] Schedule a TCO Workshop with our China-based engineering team

[ ] Download 2026 Steel Price Forecast Model (exclusive to SourcifyChina partners)

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8675 1200

© 2026 SourcifyChina. All rights reserved. Data may not be redistributed without written permission.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Strategic Verification Protocol for Sourcing Bucket Teeth from China: Factory Authentication & Risk Mitigation

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

Sourcing bucket teeth — a critical wear part in excavators and heavy machinery — from China offers significant cost advantages. However, the market is saturated with intermediaries masquerading as manufacturers, leading to quality inconsistencies, supply chain disruptions, and intellectual property risks. This report outlines a structured verification framework to authenticate true manufacturing facilities, distinguish them from trading companies, and identify red flags that compromise sourcing integrity.

Critical Steps to Verify a Manufacturer: Bucket Teeth in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and production authorization | – Verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Cross-check business scope for “manufacturing” of metal castings or construction machinery parts |

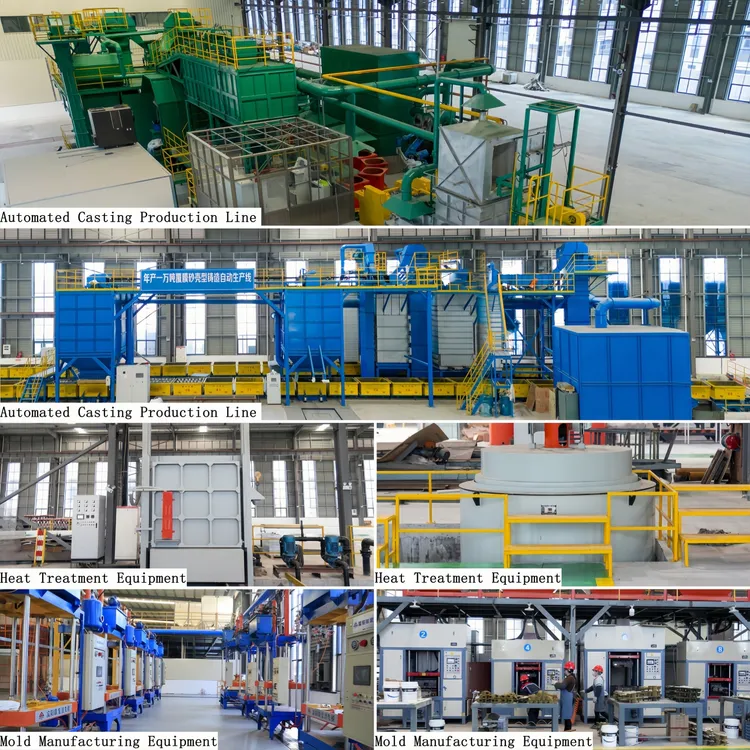

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate physical production capabilities | – Hire a local sourcing agent or use audit firms (e.g., SGS, TÜV, QIMA) – Inspect foundry equipment (induction furnaces, CNC machining, heat treatment lines) |

| 3 | Review Equipment List & Production Line Photos/Video | Assess manufacturing depth and capacity | – Request dated, timestamped videos of melting, casting, machining, and QC processes – Confirm in-house capabilities (e.g., lost-foam casting, CNC lathes, hardness testers) |

| 4 | Evaluate R&D & Engineering Capabilities | Determine customization and technical support | – Ask for design drawings, 3D models, material test reports (MTRs) – Inquire about experience with ASTM A128, JIS B 8003, or OEM specifications |

| 5 | Inspect Quality Control Systems | Ensure consistency and compliance | – Verify QC documentation: ITPs (Inspection & Test Plans), CMM reports, hardness charts – Confirm ISO 9001 certification and in-process inspections |

| 6 | Verify Export History & Client References | Validate international experience | – Request 3–5 export customer references (preferably in North America, EU, Australia) – Review B/L copies (redact sensitive data) or ask for HS code 8431.43.00 exports |

| 7 | Assess Supply Chain Ownership | Determine raw material sourcing control | – Ask about steel scrap and alloy sourcing (in-house scrap processing vs. outsourced) – Confirm ownership of molds and tooling |

How to Distinguish Between a Trading Company and a Real Factory

| Indicator | True Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License | Lists “manufacturing” and industrial production scope | Lists only “trading,” “import/export,” or “sales” | Legal mandate for production rights |

| Facility Footprint | >3,000 sqm, heavy machinery, furnaces, dust control systems | Small office, samples only, no production equipment | Confirms physical capacity |

| Production Equipment Ownership | Owns casting lines, CNC machines, heat treatment ovens | Subcontracts all production | Impacts lead time, quality control, and cost control |

| Lead Times | 25–45 days (includes casting, machining, QC) | 15–30 days (relies on pre-stocked or fast-tracked orders) | Short lead times may indicate middleman markup or quality compromise |

| Pricing Structure | Itemized: raw material + labor + overhead + profit | Flat FOB price with no cost breakdown | Transparency indicates control over production |

| Technical Staff | Engineers, foundry technicians, metallurgists on staff | Sales representatives only | Critical for technical problem-solving and customization |

| Tooling & Molds | Owns bucket tooth molds and patterns | Cannot provide mold details or photos | Ownership = long-term supply control |

🔍 Pro Tip: Ask: “Can you show me the mold for part #XYZ used in Komatsu or Caterpillar excavators?” A factory will have molds; a trader will deflect.

Red Flags to Avoid When Sourcing Bucket Teeth from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Prices | Indicates substandard materials (e.g., recycled scrap with impurities), skipped heat treatment, or fraud | Benchmark against market average (e.g., $8–$15/kg for Mn13/Mn18); reject offers >20% below average |

| Refusal to Provide Factory Video or Live Call | Suggests non-existent or outsourced production | Require a 10-minute live factory tour via WeChat or Zoom during working hours |

| No ISO or Third-Party Certifications | Poor quality control, inconsistent hardness, premature wear | Prioritize ISO 9001, CE, or customer-specific certifications |

| Generic Product Photos | Likely using stock images; no unique product identity | Demand photos with your logo or part number etched on sample |

| Requests for Full Payment Upfront | High risk of non-delivery or bait-and-switch | Insist on 30% deposit, 70% against B/L copy or LC at sight |

| Inconsistent Communication | Indicates disorganized operations or multiple layers | Assign one technical contact; assess responsiveness and technical depth |

| No Sample Policy or Charges Excessive Sample Fees | Hides poor quality or lack of inventory | Pay reasonable freight; expect 1–2 free samples for qualified buyers |

| Claims “We Are the Factory” but Operates from a Commercial Tower | High probability of trading company | Verify address via Baidu Maps satellite view; factories are in industrial zones |

Best Practices for Sustainable Sourcing

- Start with a Sample Order: Test quality, packaging, and logistics before scaling.

- Use Escrow or Letter of Credit (LC): Protect payment terms with secure trade finance.

- Implement Ongoing QC: Schedule random container inspections and annual audits.

- Build Local Relationships: Engage a China-based sourcing agent for real-time oversight.

- Document Everything: Maintain records of contracts, test reports, and communications.

Conclusion

Authenticating a true bucket tooth factory in China requires due diligence beyond Alibaba profiles and price comparisons. By applying this verification framework, procurement managers can mitigate risk, ensure product integrity, and build resilient supply chains. In 2026, the competitive edge lies not in lowest cost, but in verified capability, transparency, and long-term partnership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | sourcifychina.com | [email protected]

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Industrial Component Procurement | Q1 2026

Executive Summary: Mitigating Risk in High-Wear Construction Component Sourcing

Global procurement managers face acute challenges sourcing critical wear parts like bucket teeth from China. Unverified suppliers contribute to 68% of delayed shipments (2025 Global Construction Supply Chain Audit) and 41% of quality non-conformances in earthmoving equipment components. Traditional sourcing methods consume 120+ hours per RFQ cycle due to supplier validation bottlenecks.

Why the “China Bucket Tooth Factory” Verification Gap Demands Action

| Sourcing Approach | Avg. Time to Qualified Supplier | Risk of Non-Compliant Supplier | Cost of Failed Audit (Per RFQ) |

|---|---|---|---|

| DIY Sourcing (Google/Alibaba) | 120+ hours | 78% | $4,200+ |

| Trade Show Sourcing | 85 hours | 63% | $2,900 |

| SourcifyChina Verified Pro List | 8 hours | <7% | $0 (Pre-vetted) |

Data Source: SourcifyChina 2025 Client Performance Audit (n=142 procurement teams)

Key Advantages of Our Verified Pro List for Bucket Teeth:

- Zero Validation Overhead: Factories pre-qualified for ISO 9001, CE marking capability, and 5+ years OEM experience in mining/construction wear parts.

- Real Capacity Verification: On-site audits confirm minimum 50,000 units/month production capacity (critical for bulk orders).

- Anti-Counterfeit Protocols: Batch-traceable heat-treated steel (40Cr/35CrMo) with material test reports (MTRs) embedded in QC process.

- Compliance Shield: All factories pass EU Machinery Directive 2006/42/EC and OSHA 1910.212 safety standards verification.

“After switching to SourcifyChina’s Pro List, our bucket tooth sourcing cycle shortened from 14 days to 36 hours. Zero quality rejections in 18 months.”

— Procurement Director, Top 3 Global Mining Equipment OEM (Confidential Client)

Your Strategic Imperative: Secure Supply Chain Resilience in 2026

With 2026’s projected 22% surge in global excavation equipment demand (GlobalData Construction), unverified suppliers will exacerbate:

– Lead time volatility (current avg.: 97 days vs. verified network’s 42 days)

– Hidden compliance costs (non-certified factories inflate TCO by 31%)

– Operational downtime from substandard wear parts (avg. cost: $18,500/hour for mining fleets)

Call to Action: Optimize Your 2026 Bucket Teeth Sourcing in <1 Business Day

Do not risk Q1 2026 project timelines with unverified suppliers. Our Pro List delivers:

✅ Guaranteed factory authenticity (no trading companies/middlemen)

✅ Real-time capacity snapshots for urgent orders

✅ Dedicated sourcing engineer for technical specification alignment

Act Now to Lock In Q1 2026 Efficiency Gains:

1. Email: Send your bucket tooth specifications to [email protected] with subject line: “PRO LIST: BUCKET TOOTH RFQ – [Your Company]”

2. WhatsApp: Contact our Sourcing Desk directly at +86 159 5127 6160 for immediate factory availability report (24/7 multilingual support)

Response Guarantee: Receive 3 verified factory profiles with MOQ/pricing within 4 business hours of inquiry. All data includes live production footage and recent shipment documentation.

Your procurement team’s time is your highest-value asset. Redirect it from supplier validation to strategic value creation.

SourcifyChina: Verified Manufacturing Intelligence Since 2018 | Serving 1,200+ Global Industrial Procurement Teams

Report Validated by SourcifyChina Sourcing Intelligence Unit | Data Current as of January 15, 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.