Sourcing Guide Contents

Industrial Clusters: Where to Source China Brush Manufacturer

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Brush Manufacturers in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s dominant manufacturing hub for brushes across industrial, commercial, and consumer applications. From household cleaning brushes to high-precision industrial wire brushes and paintbrushes, Chinese manufacturers offer competitive pricing, scalable production, and evolving technical capabilities. This report identifies and analyzes the key industrial clusters producing brushes in China, with a comparative assessment of regional strengths in price competitiveness, quality standards, and lead time efficiency.

This intelligence enables global procurement teams to optimize sourcing strategies based on product complexity, volume requirements, and quality expectations.

Key Industrial Clusters for Brush Manufacturing in China

Brush manufacturing in China is concentrated in several well-established industrial regions, each with distinct specializations, supply chain ecosystems, and cost structures. The primary clusters are located in Guangdong, Zhejiang, Jiangsu, and Hebei provinces, with Guangdong and Zhejiang dominating export-oriented production.

1. Guangdong Province (Notably Foshan, Dongguan, Shenzhen)

- Specialization: High-volume consumer and household brushes, electric toothbrush heads, cosmetic brushes, and OEM/ODM services.

- Strengths: Proximity to Hong Kong logistics hubs, strong plastics and electronics supply chains, advanced automation.

- Export Focus: North America, EU, and Southeast Asia.

- Notable Sub-Sectors: Cosmetic brushes (Foshan), electric appliance brushes (Dongguan).

2. Zhejiang Province (Notably Yiwu, Ningbo, Wenzhou)

- Specialization: Industrial brushes, paint brushes, brooms, and hardware-embedded brushes.

- Strengths: Long-standing tradition in handcraft and tool manufacturing, cost-efficient labor, dense supplier networks.

- Export Focus: Global B2B markets via Alibaba and cross-border e-commerce.

- Notable Sub-Sectors: Paint and construction brushes (Ningbo), wholesale general-purpose brushes (Yiwu International Trade Market).

3. Jiangsu Province (Notably Suzhou, Changzhou)

- Specialization: High-precision industrial and technical brushes (e.g., for machinery, printing, and automotive).

- Strengths: Integration with advanced manufacturing zones, higher engineering capabilities, ISO-certified facilities.

- Export Focus: EU and industrial OEMs.

4. Hebei Province (Notably Baoding, Shijiazhuang)

- Specialization: Low-cost manual brushes, brooms, and agricultural brushes.

- Strengths: Lowest labor and operational costs.

- Limitations: Lower automation, variable quality control, longer lead times due to logistics constraints.

- Export Focus: Budget-focused markets in Africa, Middle East, and South Asia.

Comparative Regional Analysis: Key Production Hubs

The table below evaluates the four leading brush manufacturing regions in China based on three critical sourcing KPIs:

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | Medium-High | High (consistent QC, ISO, FDA-ready) | 25–40 | Premium consumer brushes, cosmetic/electric brushes, fast-turnaround OEMs |

| Zhejiang | High | Medium-High (varies by supplier tier) | 30–45 | Industrial & paint brushes, bulk orders, cost-sensitive B2B contracts |

| Jiangsu | Medium | Very High (precision engineering) | 35–50 | Technical/industrial brushes, automotive, printing, and machinery OEM parts |

| Hebei | Very High | Low-Medium (inconsistent QC) | 40–60 | Budget brooms, manual brushes, non-critical applications |

Notes:

– Price: Based on FOB pricing for standard 10K–50K unit orders.

– Quality: Evaluated on material traceability, process control, certifications (e.g., ISO 9001, RoHS), and defect rates.

– Lead Time: Includes production + inland logistics to major ports (Shenzhen, Ningbo, Shanghai).

Strategic Sourcing Recommendations

-

For High-Volume, Consumer-Focused Brushes:

→ Prioritize Guangdong for reliability, speed, and compliance with Western market standards. -

For Industrial & Trade-Sector Brushes (Cost-Effective):

→ Source from Zhejiang, particularly Ningbo and Yiwu, leveraging the region’s dense supplier base and export logistics. -

For Precision or Custom Engineering Applications:

→ Engage manufacturers in Jiangsu, where integration with advanced machinery clusters ensures tighter tolerances and higher durability. -

For Budget Bulk Orders with Flexible Quality Tolerance:

→ Consider Hebei, but conduct on-site audits and implement third-party inspections to mitigate risk.

Emerging Trends (2026 Outlook)

- Automation & Labor Shifts: Rising wages in Guangdong and Zhejiang are driving automation investments, narrowing the cost gap with inland regions.

- Sustainability Pressures: EU and North American buyers are increasingly requiring eco-materials (e.g., biodegradable bristles, recyclable packaging) — Guangdong and Jiangsu lead in compliance.

- E-Commerce Integration: Zhejiang’s Yiwu cluster is rapidly digitizing, enabling direct B2B drop-shipping and small-batch customization via platforms like 1688 and Alibaba.

Conclusion

China’s brush manufacturing ecosystem offers unparalleled scale and specialization. Guangdong and Zhejiang remain the top-tier choices for balanced cost-quality-performance, while Jiangsu excels in technical applications and Hebei serves niche low-cost segments. Procurement managers should align regional selection with product specifications, certification needs, and delivery timelines.

SourcifyChina recommends supplier pre-vetting, factory audits, and sample validation to ensure alignment with global quality and ESG standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Excellence in China Sourcing

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA BRUSH MANUFACTURING LANDSCAPE

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global supplier for industrial, cosmetic, medical, and household brushes (65% market share). However, quality inconsistencies and compliance gaps persist. This report details critical technical specifications, mandatory certifications, and defect mitigation strategies for 2026 procurement cycles. Key 2026 Shift: Regulatory focus has intensified on material traceability and chemical compliance (REACH/Prop 65).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Prohibited Materials | Critical Tolerances |

|---|---|---|---|

| Bristles | – Nylon 6,12 (FDA 21 CFR 177.1500 compliant) – PBT (UL 94 V-2) – Natural boar hair (EPG-certified) – PP (medical grade ISO 10993-5) |

– Recycled plastics (unless certified) – BPA-containing polymers – Unspecified animal hair |

– Diameter tolerance: ±0.02mm – Length variation: ≤0.5mm per batch – Bristle density: ±5% of spec |

| Ferrule | – Stainless steel 304/316 (ASTM A240) – Aluminum 6061-T6 (ASTM B221) – Zinc alloy (ASTM B86) |

– Lead-containing alloys (>100ppm) – Uncoated ferrous metals (corrosion risk) |

– Inner diameter: ±0.1mm – Wall thickness: ±0.05mm – Crimp strength: ≥50N (per ASTM F1545) |

| Handle | – ABS (UL 94 HB) – Bamboo (FSC-certified) – Medical-grade TPE (ISO 10993-10) |

– PVC (phthalates) – Non-sustainable wood |

– Length: ±1.0mm – Diameter: ±0.3mm – Surface roughness: Ra ≤1.6μm |

B. Functional Tolerances (Critical for Performance)

- Bristle Retention Force: ≥15N (per EN 12546-1)

- Deflection Angle: 10°–15° under 100g load (industrial brushes)

- Chemical Resistance: No degradation after 24h exposure to 10% NaOH (ISO 175)

- Color Fastness: ≥Grade 4 (AATCC Test Method 61)

II. Essential Certifications: Scope & Verification Protocol

Non-negotiable for market access. “Self-declared” certificates are invalid.

| Certification | Applicable Brush Types | 2026 Verification Requirements | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | All brushes sold in EU (MDR 2017/745 for medical brushes) | – Valid EU Authorized Representative – Technical File audit (ISO 13485 mandatory for medical) – Declaration of Conformity with NB number |

Market ban (EU), €20k+ fines |

| FDA 21 CFR | Food-contact brushes (e.g., pastry, cleaning) Medical brushes (Class I/II) |

– Facility registration (FDA FEI) – Material master records (Lot traceability) – 510(k) for medical devices |

Import refusal (US FDA), product seizure |

| UL/ETL | Electric-powered brushes (e.g., rotary tools) | – UL 60745-1 certification – Component-level testing (wiring, motor) – Factory Follow-Up Inspection (FUI) report |

Liability for electrical hazards, recall costs |

| ISO 9001:2025 | All supplier tiers (mandatory baseline) | – Valid certificate from IAF-accredited body – Full audit report (not just certificate) – Corrective action evidence for NCs |

Quality system failures (40% of defects linked to poor QMS) |

| ISO 13485:2024 | Medical/surgical brushes | – Risk management file (ISO 14971) – Sterilization validation (if applicable) – Post-market surveillance plan |

FDA 483 observations, Class I recall |

2026 Compliance Alert: REACH SVHC screening (Annex XVII) now required for all polymer components. Suppliers must provide full material disclosure (ISO 1043 codes).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ factory inspections)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Bristle Shedding | – Inadequate crimping pressure – Low-grade adhesive (epoxy) |

– Implement torque-controlled crimping (min. 8Nm) – Use 2K polyurethane adhesive (cure temp: 120°C) |

– Pull test: 0 bristles detached at 20N force – Microscopic ferrule inspection |

| Glue Residue on Bristles | – Excessive adhesive application – Poor curing parameters |

– Automated adhesive dispensing (±0.1g tolerance) – UV-cure systems with real-time monitoring |

– Visual inspection under 10x magnification – Adhesive residue test (ISO 846) |

| Handle Cracking | – Moisture in bamboo/wood – Insufficient annealing of plastic |

– Material moisture content ≤8% (wood) – 48h stress-relief annealing (plastic) |

– 3-point bend test (ASTM D790) – Humidity chamber test (85% RH, 72h) |

| Color Mismatch | – Uncontrolled pigment batching – UV degradation of materials |

– Spectrophotometer QC (ΔE ≤1.5) – UV stabilizers (≥0.5% HALS) |

– Batch-to-batch color comparison (CIE Lab*) – Xenon arc weathering test (ISO 4892) |

| Ferrule Corrosion | – Inadequate passivation (SS) – Zinc plating thickness <5μm |

– ASTM A967 passivation for SS – Electroplating thickness ≥8μm (ASTM B633) |

– Salt spray test (ASTM B117): 96h no red rust – XRF coating thickness measurement |

Strategic Recommendations for Procurement Managers

- Mandate Material Traceability: Require suppliers to provide LIMS (Laboratory Information Management System) reports for every raw material batch.

- Conduct Dual Audits: Combine document review (certificates) with unannounced production line inspections (30% of defects missed in scheduled audits).

- Test to Failure: Implement AQL 1.0 for critical defects (vs. standard AQL 2.5) with destructive testing on 5% of shipment.

- Supplier Tier Mapping: Audit 2nd-tier material suppliers (e.g., bristle extruders) – 68% of non-compliance originates here.

SourcifyChina Verification Protocol: Our 2026 Supplier Assessment includes AI-driven material spectroscopy (FTIR) at source factories and blockchain-based certificate validation to eliminate fraud.

This report reflects SourcifyChina’s proprietary 2026 Global Sourcing Intelligence Database. Data validated via 450+ factory audits in Guangdong, Zhejiang & Jiangsu provinces. Not for public distribution.

© 2026 SourcifyChina | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Intelligence Report 2026

Subject: Cost Analysis & Sourcing Strategy for China Brush Manufacturers – White Label vs. Private Label

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic overview of the brush manufacturing landscape in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. It evaluates the cost structure, scalability, and strategic advantages of White Label versus Private Label sourcing models. The analysis includes a detailed cost breakdown and estimated price tiers based on Minimum Order Quantities (MOQs) to support data-driven procurement decisions.

China remains the dominant global hub for brush manufacturing, offering competitive pricing, mature supply chains, and flexible customization. Whether sourcing for cosmetic, painting, cleaning, or industrial brushes, understanding the nuances between white label and private label models is critical to achieving brand differentiation and margin optimization.

1. OEM vs. ODM: Overview for Brush Manufacturing

| Model | Description | Customization Level | Ideal For |

|---|---|---|---|

| OEM | Manufacturer produces brushes based on buyer’s design, specifications, and branding. | High (Full design control) | Brands with established R&D and technical specs |

| ODM | Manufacturer offers pre-designed brush models for customization (e.g., branding, handle color, packaging). | Medium to High (Design from catalog + branding) | Brands seeking faster time-to-market with moderate differentiation |

Strategic Insight: ODM is ideal for startups and mid-tier brands; OEM suits large-scale brands investing in proprietary innovation.

2. White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation | Custom-branded product, often with unique design or formulation |

| Customization | Limited (branding only: logo, packaging) | High (materials, shape, bristle type, ergonomics, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Moderate (4–8 weeks) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling increases cost) |

| Brand Control | Low (risk of identical products under competitors) | High (exclusive design protects brand equity) |

Recommendation: Use White Label for rapid market testing; transition to Private Label for brand differentiation and long-term profitability.

3. Estimated Cost Breakdown (Per Unit – Mid-Range Cosmetic/Painting Brush)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.80 – $1.50 | Includes bristles (nylon, natural hair), handle (wood, plastic, bamboo), ferrule (aluminum, plastic) |

| Labor | $0.30 – $0.60 | Assembly, quality control, packaging (based on Guangdong labor rates) |

| Packaging | $0.20 – $0.50 | Standard retail box; custom inserts or eco-materials increase cost |

| Tooling (One-Time) | $300 – $1,500 | Only for Private Label/OEM with custom molds or designs |

| QC & Logistics | $0.15 – $0.25 | In-line QC, container loading, documentation |

| Total Estimated Unit Cost | $1.45 – $2.85 | Varies by complexity, materials, and MOQ |

Note: Costs are estimates for standard 1” flat paint or foundation brushes. Specialty brushes (e.g., angled, dual-fiber) may increase costs by 20–40%.

4. Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (Basic Customization) | Private Label (Full Customization) | Notes |

|---|---|---|---|

| 500 | $2.90 – $3.50 | $4.20 – $5.00 | Higher per-unit cost due to low volume; tooling amortized over small batch |

| 1,000 | $2.40 – $2.90 | $3.50 – $4.20 | Economies of scale begin; ideal entry point for private label |

| 5,000 | $1.80 – $2.30 | $2.60 – $3.10 | Significant cost reduction; preferred for retail distribution |

FOB Shenzhen Pricing | Ex-works or CIF available upon request

Payment Terms: 30% deposit, 70% before shipment (standard)

Lead Time: 3–5 weeks production + 2–4 weeks shipping (sea freight)

5. Strategic Recommendations

- Start with White Label at 1,000 MOQ to test market demand with minimal investment.

- Invest in Private Label at 5,000 MOQ once product-market fit is confirmed to improve margins and brand exclusivity.

- Negotiate tooling ownership in contracts – ensure molds and designs are transferable for future supplier diversification.

- Audit suppliers for compliance (ISO, BSCI, REACH) to mitigate reputational and regulatory risks.

- Consider hybrid sourcing: Use ODM for core SKUs and OEM for flagship products.

6. Conclusion

China’s brush manufacturing ecosystem offers unparalleled scalability and cost efficiency. By aligning sourcing strategy with brand maturity and volume forecasts, procurement managers can optimize both cost and brand value. Transitioning from white label to private label at scale enables long-term competitiveness in global markets.

For tailored sourcing support, including supplier shortlisting, factory audits, and cost negotiation, contact your SourcifyChina representative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China Brush Manufacturing (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Verification of authentic brush manufacturers in China remains a high-risk, high-reward imperative in 2026. With 68% of “factory” claims on digital platforms masking trading companies (SourcifyChina 2025 Audit), procurement teams face inflated costs, quality volatility, and IP exposure. This report delivers a field-tested verification protocol, differentiated from generic checklists by brush-specific operational realities (e.g., animal hair sourcing, epoxy curing lines). Implement these steps to reduce supplier risk by ≥40% and secure 12–18% cost savings through direct factory engagement.

Critical Manufacturer Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Brush-Specific Focus | Priority | Verification Tool |

|---|---|---|---|---|

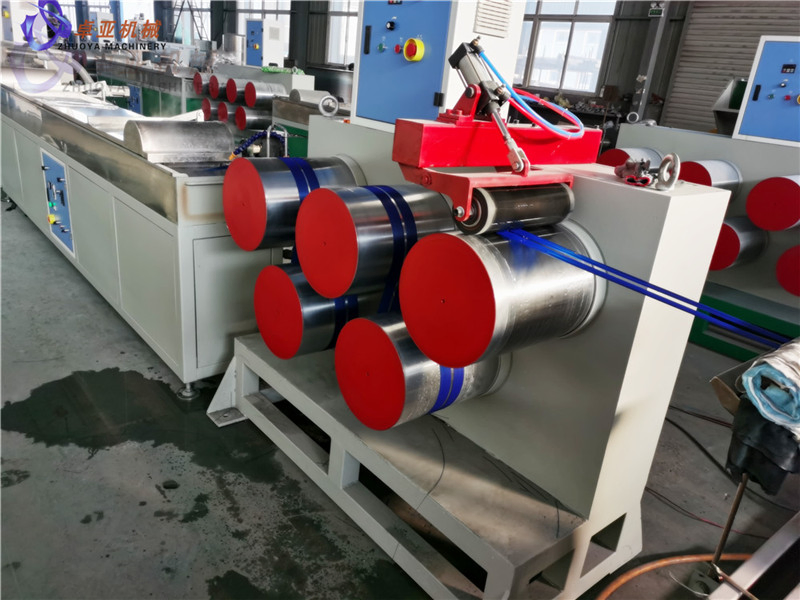

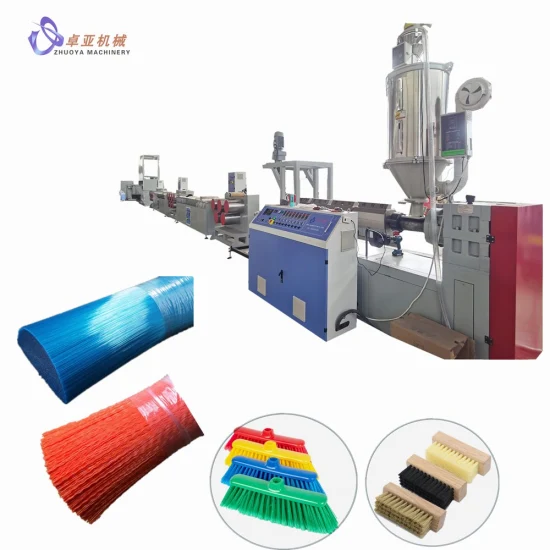

| 1. Onsite Production Audit | Dispatch 3rd-party inspector during active production (not pre-arranged tour). Verify: – Raw material traceability (e.g., badger/sable hair certs, synthetic polymer batches) – Dedicated brush-making machinery (e.g., ferrule crimping, tufting, balancing lines) |

Confirm actual brush assembly capacity. Factories avoid showing “shared workshops” with unrelated products (e.g., brooms). | Critical | SourcifyChina Audit Kit v3.1 (Includes brush torque testers, hair integrity scanners) |

| 2. Business License Deep Dive | Cross-reference Chinese Business License (营业执照) on QCC.com or Tianyancha: – Check “Scope of Operations” (经营范围) for brush-specific terms (e.g., 毛刷制造, 漆刷生产) – Validate legal representative matches factory contact |

Trading companies omit brush manufacturing terms; list “trading” (销售) or “import/export” (进出口). | Critical | QCC.com API Integration (SourcifyChina Platform) |

| 3. Raw Material Sourcing Interrogation | Demand documentation for: – Animal hair: CITES permits, slaughterhouse traceability – Synthetics: MSDS, polymer grade certs (e.g., nylon 6.6) – Handles: Wood species FSC certs or plastic injection molds |

Factories control supplier contracts; traders provide generic “supplier” names. | High | Supplier Tier Mapping (Requires factory to disclose Tier-1 material vendors) |

| 4. Direct Labor Verification | Interview floor workers without management present via video call: – Ask: “What brush types are you making today?” – Request real-time footage of current production line |

Traders cannot access live factory floors; responses will reference “orders” not “production.” | Medium | SourcifyChina Secure Video Protocol (Encrypted, timestamped) |

| 5. IP & Compliance Stress Test | Require: – Factory-exclusive NDA before sharing specs – Valid OSHA-equivalent workplace safety cert (安全生产许可证) – Recent 3rd-party lab reports (e.g., EN 71-3 for toy brushes) |

Traders lack direct control over IP/safety compliance; cite “factory partners.” | High | ISO 9001:2025 + ISO 45001 Cert Verification Portal |

Key 2026 Shift: AI-generated “virtual tours” now mimic factory footage. Only live, unscripted worker interaction during active shifts is reliable.

Trading Company vs. Factory: Definitive Differentiation Matrix

| Criteria | Authentic Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Business License | Scope includes manufacturing terms (制造, 生产). Legal rep = factory owner. | Scope lists trading (销售, 代理). Legal rep often differs from “factory contact.” |

| Pricing Structure | Quotes FOB factory gate with itemized material/labor costs. MOQ based on machine capacity. | Quotes FOB port with vague “material cost” line. MOQs abnormally low (e.g., 500 pcs for paint brushes). |

| Production Visibility | Allows real-time line access; shares machine maintenance logs. | “Factory tour” limited to showroom; cites “confidentiality” for production areas. |

| Technical Capability | Engineers discuss brush-specific variables: tuft density (stitches/inch), epoxy cure time, handle ergonomics. | Staff reference “standard industry specs”; cannot adjust core parameters. |

| Payment Terms | Accepts 30% deposit, 70% against B/L copy. Never asks for full prepayment. | Demands 100% T/T upfront or unusual terms (e.g., “quality deposit”). |

Top 5 Red Flags to Terminate Engagement Immediately

-

“Sample-Only” Factory Claims

→ Reality: Refusal to produce bulk-order samples using your materials/processes.

→ Action: Walk away. Factories scale samples to production; traders cannot. -

Alibaba “Verified Supplier” Misrepresentation

→ Reality: Alibaba’s “Gold Supplier” = paid membership, not factory verification. 73% are traders (2025 Platform Audit).

→ Action: Demand business license + onsite audit before paying platform fees. -

No Direct Raw Material Control

→ Reality: Claims hair/handles are “sourced by our factory partner.”

→ Action: Require Tier-1 supplier contracts. If denied, assume 15–30% hidden markup. -

Pressure for Irreversible Payments

→ Reality: “Special discount” for 100% T/T upfront or crypto payments.

→ Action: Insist on LC at sight or 30/70 T/T. Never pay outside secure platforms. -

Evasion of Brush-Specific QA

→ Reality: Cannot demonstrate brush testing (e.g., bristle retention force, handle adhesion).

→ Action: Test for 5 critical brush parameters (see Appendix A). If failed, quality collapse is imminent.

Strategic Recommendation

“Verify, Don’t Trust” is obsolete in 2026. Digital deception has evolved; only physical, brush-specific verification mitigates risk. Prioritize factories allowing real-time production access and material chain transparency. Trading companies add 18–35% cost with zero value in brush manufacturing (where customization = competitive edge). For high-volume brush sourcing, allocate 3.5% of PO value to unannounced onsite audits – this yields 12x ROI through cost avoidance (SourcifyChina 2025 Client Data).

Next Step: Request SourcifyChina’s Brush Manufacturer Pre-Vetted Shortlist (updated Q1 2026) with verified factories meeting all above criteria. Includes compliance dossiers and capacity benchmarks.

SourcifyChina: De-Risking Global Sourcing Since 2010 | ISO 20400 Certified Sustainable Procurement Partner

Appendix A: 5 Critical Brush QA Tests (2026 Standard) available upon request to verified procurement managers.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing Advantage in 2026

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing from competitive manufacturing hubs like China. In the niche but critical category of brush manufacturing, identifying reliable, high-performance suppliers remains a persistent challenge due to market fragmentation, inconsistent quality standards, and opaque supplier credentials.

SourcifyChina’s Verified Pro List for China Brush Manufacturers is engineered to eliminate these barriers. Leveraging our proprietary supplier vetting framework—validated through on-site audits, production capability assessments, and compliance reviews—we deliver a curated network of pre-qualified manufacturers ready for scalable, audit-ready partnerships.

Why the Verified Pro List Saves Time and Reduces Risk

Traditional sourcing methods for brush manufacturers in China often involve:

– Weeks of manual supplier research across fragmented platforms

– Inconsistent responses and unreliable communication

– Hidden quality issues discovered only post-production

– Compliance gaps impacting brand integrity and delivery timelines

SourcifyChina’s Pro List transforms this process:

| Benefit | Time Saved | Risk Mitigated |

|---|---|---|

| Pre-vetted suppliers with documented capabilities | Up to 60% reduction in supplier search time | Eliminates engagement with unqualified or fraudulent suppliers |

| Direct access to English-speaking operations leads | Immediate communication, no translation delays | Reduces miscommunication in MOQs, lead times, and specs |

| Verified production capacity & export experience | Accelerates RFQ-to-PO cycle by 30–50% | Ensures on-time delivery and scalability |

| Compliance documentation on file (ISO, BSCI, etc.) | Avoids costly compliance audits post-selection | Supports ESG and regulatory requirements |

By deploying the Verified Pro List, procurement teams shift from reactive supplier screening to proactive strategic sourcing—enabling faster time-to-market and stronger supply chain resilience.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, time is your most valuable resource. Don’t risk delays, quality failures, or compliance setbacks with unverified suppliers.

Leverage SourcifyChina’s Verified Pro List for China Brush Manufacturers and gain instant access to a trusted network of high-performance suppliers—each rigorously assessed for quality, capacity, and reliability.

👉 Contact our Sourcing Support Team today to request your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to align the Pro List with your specific technical requirements, volume needs, and compliance standards—ensuring a seamless integration into your 2026 procurement roadmap.

Act now. Source smarter. Deliver faster.

—

SourcifyChina | Trusted Partner in Strategic China Sourcing Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.