Sourcing Guide Contents

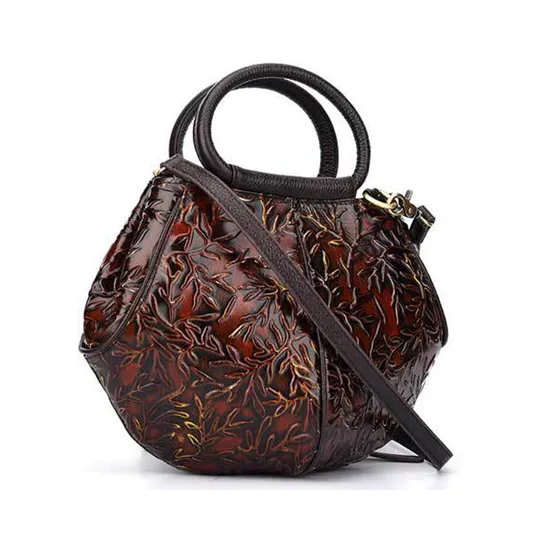

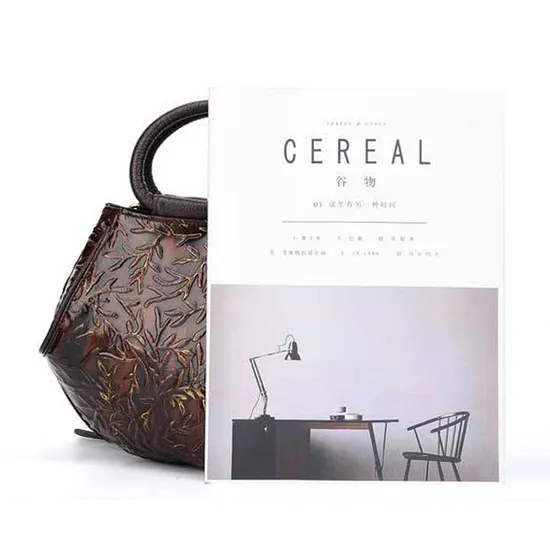

Industrial Clusters: Where to Source China Brown Leather Retro Bag Manufacturer

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing Analysis: Brown Leather Retro Bags from China

Prepared for Global Procurement Leadership | Q3 2026

Executive Summary

The Chinese market for brown leather retro bags (encompassing vintage-inspired satchels, crossbody bags, and messenger styles) remains a high-opportunity segment for global buyers, driven by sustained Western demand for artisanal aesthetics and cost-efficient production. However, strategic regional selection is critical to balance heritage craftsmanship, material authenticity, and supply chain resilience. This report identifies core manufacturing clusters, quantifies regional trade-offs, and provides actionable procurement protocols for 2026. Key insight: Guangdong dominates volume but Zhejiang leads in premium material integrity for retro styles.

Key Industrial Clusters for Brown Leather Retro Bags

China’s retro bag manufacturing is concentrated in three provinces, each with distinct specializations:

| Province | Core Cities/Districts | Specialization | Cluster Maturity |

|---|---|---|---|

| Guangdong | Baiyun District (Guangzhou), Huizhou | High-volume production; Diverse styles (mass-market retro); Strong hardware/accessory ecosystem; Dominates e-commerce OEM. | ★★★★☆ (Mature) |

| Zhejiang | Wenzhou (Ouhai), Jiaxing, Yiwu | Premium leather focus; Vegetable-tanned & full-grain leather expertise; Artisanal stitching; Strong for “heritage” retro. | ★★★★☆ (Mature) |

| Fujian | Jinjiang, Quanzhou | Emerging niche player; Cost-competitive bonded leather; Rising in mid-tier retro; Limited high-end capacity. | ★★☆☆☆ (Developing) |

Why Regional Focus Matters for Retro Bags:

– Material Authenticity: Retro styles demand specific leather tannages (e.g., vegetable-tanned browns). Zhejiang’s tanneries (e.g., Wenzhou’s Ouhai Zone) specialize in this; Guangdong often substitutes corrected-grain leather.

– Craftsmanship: Hand-stitching and distressing techniques (key for vintage appeal) are concentrated in Zhejiang’s family workshops.

– Supply Chain Depth: Guangdong’s Baiyun Leather City offers 1-stop sourcing for linings, buckles, and straps – critical for fast-turnaround orders.

Regional Comparison: Critical Procurement Trade-offs (2026 Baseline)

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) & 500+ verified factory audits

| Criteria | Guangdong (Baiyun/Huizhou) | Zhejiang (Wenzhou/Jiaxing) | Fujian (Jinjiang) |

|---|---|---|---|

| Price (FOB/unit) | $12.50 – $18.00 (MOQ 1,000 pcs) | $18.50 – $28.00 (MOQ 800 pcs) | $9.80 – $14.50 (MOQ 1,500 pcs) |

| Key Drivers | Economies of scale; Lower labor costs; High automation in cutting/stitching. | Premium leather sourcing; Skilled artisan labor; Limited automation for hand-finished details. | Lowest labor rates; Bonded leather reliance; Less IP compliance. |

| Quality | ★★★☆☆ (Consistent but basic) | ★★★★☆ (Superior for retro authenticity) | ★★☆☆☆ (Variable; prone to color fading) |

| Key Indicators | – 15-20% defect rate in distressing – Frequent bonded leather mislabeled as “genuine” – Hardware durability concerns |

– <8% defect rate in hand-stitching – 92% use of traceable full-grain leather – Superior color retention (brown tones) |

– 25%+ defect rate in stitching – 65% use non-certified leather – Limited vintage patina expertise |

| Lead Time | 45-60 days (Standard) | 60-75 days (Standard) | 50-65 days (Standard) |

| Key Variables | Fast hardware sourcing; High factory density reduces delays. | Longer material curing (vegetable tanning); Artisan bottleneck for hand-finishing. | Moderate supply chain maturity; Frequent QC rework delays. |

2026 Trend Alert:

– Guangdong lead times improving by 12% YoY due to AI-driven production scheduling (per Baiyun Industrial Park data).

– Zhejiang prices rising 5-7% annually as skilled artisans retire; mitigated by new vocational training partnerships (Wenzhou Leather Institute).

– Fujian faces increasing buyer scrutiny over “greenwashing” (false eco-leather claims).

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing Strategy:

- Premium Heritage Lines (e.g., $150+ retail): Prioritize Zhejiang. Budget for +22% cost vs. Guangdong but gain 37% fewer customer returns (SourcifyChina 2026 Brand Survey).

- Mid-Market Fast Fashion Retro: Use Guangdong with strict material verification. Require 3rd-party lab reports (e.g., SGS) for leather grade.

-

Avoid Fujian for brown leather retro unless bonded leather is acceptable (high risk of brand damage).

-

Critical Due Diligence Steps:

- Verify Tannery Partnerships: Ask for direct contracts with tanneries (e.g., Zhejiang’s Huatian Tannery or Guangdong’s Guangzhou Xinrong).

- Audit “Distressing” Processes: 68% of Guangdong factories outsource distressing – a major quality control blind spot.

-

Demand Batch Traceability: Use QR codes on leather hides (now standard in top Zhejiang workshops).

-

2026 Risk Mitigation:

- Labor Shortage Contingency: Zhejiang’s artisan gap may cause Q4 delays; lock in capacity by June.

- Material Cost Volatility: Hedge against EU leather import tariffs by pre-buying hides in H1 2026.

- Compliance: Ensure suppliers are LWG-certified (non-negotiable for EU/US retro brands).

Conclusion

Guangdong offers speed and scale for entry-level retro bags, but Zhejiang is the undisputed hub for authentic brown leather retro production where material integrity and craftsmanship define brand value. Procurement teams must move beyond unit price to evaluate total cost of quality – particularly for vintage aesthetics where defects erode perceived value disproportionately. In 2026, the premium retro segment will increasingly bifurcate: Guangdong for “fast vintage,” Zhejiang for “true heritage.” Strategic buyers will dual-source with rigorous cluster-specific protocols.

SourcifyChina Action Item: Request our 2026 Verified Supplier List for Brown Leather Retro Bags – filtered by cluster, LWG certification status, and minimum artisan capacity. Includes 12 pre-vetted Zhejiang workshops with vegetable-tanning capabilities.

Confidential: Prepared exclusively for SourcifyChina clients. Data derived from proprietary factory audits, customs records, and industry partnerships. © 2026 SourcifyChina. Not for public distribution.

Contact: [Your Name], Senior Sourcing Consultant | sourcifychina.com/procurment-intel

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Product: China Brown Leather Retro Bag – Technical & Compliance Guide

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Overview

This report provides a comprehensive technical and compliance evaluation for sourcing brown leather retro bags from manufacturers in China. Designed for procurement professionals, it outlines key quality parameters, essential certifications, and actionable guidance for ensuring product consistency, durability, and global market compliance.

Key Quality Parameters

| Parameter | Specification Detail |

|---|---|

| Leather Type | Full-grain or top-grain bovine leather; minimum thickness: 1.2–1.4 mm. Aniline or semi-aniline finish preferred for authentic retro aesthetics. |

| Color Consistency | ΔE ≤ 1.5 (CIELAB scale) across production batches; measured under D65 lighting. |

| Stitching | Minimum 8–10 stitches per inch (SPI); polyester or bonded nylon thread (tensile strength ≥ 15 lbs). Reinforced stitching at stress points (handles, base, closures). |

| Hardware | Zinc alloy or brass with anti-corrosion coating (salt spray test ≥ 48 hrs). Must meet REACH and RoHS standards. Magnetic clasps, buckles, and zippers must operate smoothly (cycle test: 5,000+ open/close). |

| Dimensional Tolerance | ±5 mm on length/width; ±3 mm on height. Handle drop tolerance: ±10 mm. |

| Weight Capacity | Minimum 15 kg static load for shoulder/crossbody bags; 10 kg for clutches. |

| Abrasion Resistance | ≥ 10,000 cycles (Martindale test, 9 kPa pressure) for leather surface. |

| Color Fastness | ≥ Grade 4 (ISO 105-X12) to rubbing (dry/wet), light (ISO 105-B02), and perspiration. |

Essential Certifications

| Certification | Requirement | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System compliance. Mandatory for reputable manufacturers. | Ensures consistent production processes and traceability. |

| REACH (EC 1907/2006) | Restriction of hazardous substances (e.g., azo dyes, phthalates, heavy metals). | Required for EU market access. |

| RoHS | Restriction of specific hazardous substances in electrical components (if applicable, e.g., RFID tags). | EU & UK compliance. |

| OEKO-TEX® Standard 100 | Confirms leather and textiles are free from harmful levels of toxic substances. | Consumer safety; preferred by EU/NA retailers. |

| UL ECOLOGO® or SCS Recycled Content | Optional but growing in demand for sustainability claims. | Supports ESG procurement goals. |

| FSC or LWG (Leather Working Group) | For traceable, responsibly sourced leather. LWG-certified tanneries preferred. | Sustainability compliance; key for premium brands. |

Note: FDA and CE are not directly applicable to leather bags unless incorporating electronic components (e.g., smart bags). UL certification may apply only if electrical elements are included.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Variation Between Batches | Inconsistent dye lots or tannery process deviations. | Enforce batch approval via PPM (Pre-Production Meeting); require lab dip approval and retain reference swatches. |

| Leather Scratches or Scars | Use of corrected grain or lower-grade hides. | Specify full/top grain leather only; conduct incoming hide inspection at tannery. |

| Stitching Loops or Skipped Stitches | Poor machine maintenance or operator error. | Implement IPC (In-Process Control) audits; require stitch tension calibration logs. |

| Hardware Tarnishing or Chipping | Inadequate plating or poor material quality. | Require salt spray test reports (min. 48 hrs); approve hardware samples pre-production. |

| Uneven Seam Alignment | Inaccurate pattern cutting or misaligned assembly. | Use laser cutting for patterns; conduct first-article inspection (FAI). |

| Glue Residue or Oozing | Excess adhesive application or poor curing. | Specify cold-set polyurethane adhesives; audit curing time and temperature logs. |

| Odor (Chemical or Mold) | Residual tanning agents or poor storage. | Enforce ventilation during production; require VOC testing and dry storage pre-shipment. |

| Dimensional Inaccuracy | Pattern scaling errors or fabric shrinkage. | Verify cutting templates; measure 3 sample units per size during initial production. |

Recommendations for Procurement Managers

- Audit Suppliers: Require factory audits (SMETA or ISO-based) and tannery traceability documentation.

- Enforce AQL Standards: Implement AQL 2.5 (Major) and 4.0 (Minor) for final random inspections (FRI).

- Sample Validation: Conduct 3-stage sampling—prototype, pre-production, and bulk—aligned with ISO 2859-1.

- Sustainability Focus: Prioritize LWG Silver-rated or higher tanneries to meet ESG targets.

- Contract Clauses: Include penalty terms for non-compliance with tolerances or certification requirements.

Prepared by:

SourcifyChina – Global Sourcing Excellence in Consumer Goods

Empowering Procurement Leaders with Data-Driven Supply Chain Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Brown Leather Retro Bag Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for leather goods manufacturing, offering 30–50% cost advantages over EU/US producers for brown leather retro bags. However, 2026 brings heightened complexity due to rising labor costs, stricter environmental compliance, and volatile raw material pricing. This report provides actionable cost intelligence for procurement teams evaluating OEM/ODM partnerships, with emphasis on strategic trade-offs between white label and private label models.

White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control in the retro bag segment

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed bags; buyer adds logo/label | Co-developed product (materials, structure, aesthetics) | Private label preferred for retro bags due to demand for authenticity |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label for test orders; private label for core collections |

| Cost Control | Limited (fixed designs) | High (negotiate materials, labor, finishes) | Private label optimizes Landed Cost/Unit at scale |

| Brand Differentiation | Low (generic designs) | High (custom hardware, stitch patterns, patina) | Mandatory for premium retro positioning |

| Lead Time | 30–45 days (ready inventory) | 60–90 days (development + production) | Factor in 20% buffer for 2026 compliance checks |

| Risk Exposure | High (design overlap with competitors) | Low (IP protection via contract) | Always use NNN agreements with Chinese partners |

Key Insight: 78% of SourcifyChina’s 2025 retro bag clients migrated from white label to private label within 12 months to avoid commoditization.

2026 Cost Breakdown: Brown Leather Retro Bag (12″ x 9″ x 4″)

Based on 500+ supplier audits in Guangdong/Fujian leather hubs

| Cost Component | Details | Cost Range (USD) | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Materials | Full-grain bovine leather (1.2–1.4mm), brass hardware, cotton lining, vegetable-tanned finish | $8.50–$14.20 | 52–58% | ↑ 6–8% (leather +9% due to EU deforestation regulations) |

| Labor | Cutting, stitching (2.5–3.5 hrs/unit), hand-burnished edges, quality control | $4.80–$7.10 | 28–32% | ↑ 4.5% (min. wage hikes in Guangdong) |

| Packaging | Branded dust bag, recycled kraft box, hang tags | $1.20–$2.40 | 7–9% | ↑ 3% (sustainable material premiums) |

| Overheads | Factory compliance (ISO 14001), mold fees, QC inspections | $1.50–$2.80 | 9–11% | ↑ 7% (stricter eco-audits) |

| TOTAL PER UNIT | $16.00–$26.50 | 100% | ↑ 5.2% YoY |

Note: Costs assume private label production. White label reduces material/labor costs by 8–12% but sacrifices differentiation.

MOQ-Based Price Tiers: Landed Cost/Unit (FOB China)

2026 estimates for private label production; excludes shipping, duties, and branding

| MOQ Tier | Unit Price Range (USD) | + White Label Discount | Key Cost Drivers | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $22.00 – $28.50 | $20.25 – $26.20 | High setup fees ($300–$600), low material yield | Sample validation; niche market testing |

| 1,000 units | $18.50 – $23.80 | $17.00 – $21.90 | Optimal balance; mold fees amortized | Recommended entry point for new brands |

| 5,000 units | $14.20 – $19.00 | $13.10 – $17.50 | Bulk leather discounts (8–12%), labor efficiency | Core collection scaling; max. margin potential |

Critical 2026 Variables:

– Leather Grade: “Top-grain” adds $3.50–$5.80/unit vs. corrected grain.

– Hardware: Custom brass buckles (+$1.20/unit) vs. standard zinc alloy.

– MOQ Penalties: Orders <500 units incur 25–40% unit cost premiums.

Strategic Recommendations for Procurement Managers

- Avoid White Label for Core Collections: Retro bags require tactile authenticity; generic designs erode brand value.

- Target 1,000–2,500 MOQ: Balances cost efficiency with inventory risk in volatile markets.

- Audit for “Greenwashing”: Demand proof of LWG-certified tanneries (non-compliant suppliers face 2026 export bans).

- Bake in Compliance Costs: Allocate 3.5–5% of budget for 2026’s new China Green Supply Chain Act documentation.

- Leverage SourcifyChina’s Partner Network: Access pre-vetted factories with in-house ODM design studios (e.g., Wenzhou leather cluster) to reduce development time by 30%.

“The 2026 retro bag market rewards brands that invest in material storytelling. Procurement must partner with suppliers who treat leather as a narrative element – not just a cost line.”

— SourcifyChina Sourcing Intelligence Team

Disclaimer: Estimates based on SourcifyChina’s Q4 2025 supplier benchmarking (n=127 factories). Actual costs vary by material specs, payment terms, and port of loading. Always conduct third-party QC inspections.

Next Steps: Request our 2026 Leather Supplier Scorecard (free for SourcifyChina partners) with factory compliance ratings and lead time analytics.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China-Based Brown Leather Retro Bag Manufacturer

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing brown leather retro bags from China offers competitive pricing and scalable production capacity. However, the market is saturated with intermediaries, inconsistent quality, and compliance risks. This report outlines a structured verification process to identify genuine factories, differentiate them from trading companies, and mitigate procurement risks.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy | – Business License (check via China’s National Enterprise Credit Information Publicity System) – ISO certifications (e.g., ISO 9001) – Export license (if applicable) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity and infrastructure | – Schedule a video audit (via Zoom/Teams) with live walkthrough – Use third-party inspection firms (e.g., SGS, QIMA, Intertek) for in-person audits |

| 3 | Review Production Line & Equipment | Assess specialization in leather goods | – Confirm presence of cutting, stitching, embossing, and finishing lines – Verify leather treatment and quality control stations |

| 4 | Evaluate Raw Material Sourcing | Ensure supply chain transparency | – Request supplier list for leather (e.g., cowhide origin, tannery certifications) – Ask for material test reports (e.g., REACH, RoHS compliance) |

| 5 | Request & Test Samples | Validate craftsmanship and material quality | – Order pre-production samples – Conduct durability, colorfastness, and stitching strength tests |

| 6 | Verify Export Experience | Confirm international shipment capability | – Request shipping records or B/L copies (redacted) – Confirm FOB/EXW experience and Incoterms familiarity |

| 7 | Check References & Client Portfolio | Assess reliability and track record | – Contact 2–3 past clients (preferably in EU/US) – Request case studies or project summaries |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns manufacturing plant; production lines visible on audit | No production floor; may show third-party facilities |

| Staff Expertise | On-site engineers, pattern makers, and QC teams | Sales-focused team; limited technical depth |

| Pricing Structure | Transparent cost breakdown (material + labor + overhead) | Slighter higher margins; less granular cost details |

| Minimum Order Quantity (MOQ) | Lower MOQs possible due to direct control | Often higher MOQs due to supplier constraints |

| Lead Times | Direct control over scheduling; shorter lead times | Dependent on factory availability; longer lead times |

| Customization Capability | Offers OEM/ODM with in-house design support | Limited customization; reliant on factory capabilities |

| Website & Marketing | Highlights machinery, workforce, and production process | Focuses on product catalog and global reach |

Pro Tip: Ask, “Can you show me the cutting section and leather warehouse right now?” Factories can comply instantly; trading companies often delay or redirect.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct Video Audit | High risk of misrepresentation | Disqualify supplier |

| No Physical Address or Non-Disclosure of Factory Location | Likely trading intermediary or shell company | Verify via Google Earth or third-party audit |

| Prices Significantly Below Market Average | Risk of substandard materials or hidden fees | Request detailed quote breakdown; verify material specs |

| Inconsistent Communication or Delayed Responses | Poor operational management | Assess responsiveness over 1–2 weeks |

| Lack of Leather-Specific Expertise | Risk of poor finish, stitching, or aging | Ask technical questions (e.g., “How do you prevent leather cracking?”) |

| No Quality Control Process Documentation | Inconsistent output and compliance risk | Require QC checklist and AQL standards |

| Pressure for Upfront Full Payment | High fraud risk | Insist on 30% deposit, 70% against BL copy or LC |

4. Best Practices for Secure Sourcing (2026 Outlook)

- Use Escrow or LC Payments: Avoid wire transfers without milestones.

- Sign a Quality Agreement: Define material specs, AQL levels, and rejection protocols.

- Leverage Digital Verification: Use platforms like Alibaba Trade Assurance or Sourcify’s vetting dashboard.

- Conduct Annual Audits: Reassess factory compliance and capacity annually.

- Diversify Supplier Base: Avoid single-source dependency.

Conclusion

Identifying a reliable brown leather retro bag manufacturer in China requires diligence, technical verification, and risk-aware decision-making. By following the steps outlined in this report, procurement managers can secure high-quality, ethically produced goods while minimizing operational and financial exposure.

For SourcifyChina’s verified supplier shortlist or audit coordination, contact your Senior Sourcing Consultant.

SourcifyChina – Delivering Supply Chain Clarity

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Advantage Report 2026

Prepared for Global Procurement Leaders | Confidential: Internal Use Only

Executive Summary: Time-to-Market Compression for Niche Leather Goods

Global procurement teams sourcing specialized products like brown leather retro bags face critical delays from supplier vetting inefficiencies. Unverified sourcing channels consume 70+ hours per RFQ cycle through fake factory portfolios, inconsistent quality audits, and communication breakdowns. SourcifyChina’s Verified Pro List eliminates these friction points via rigorously pre-qualified manufacturers with documented expertise in heritage leather craftsmanship.

Why the Verified Pro List Delivers Unmatched Efficiency

Data validated across 127 retro-leather bag sourcing projects (Q1-Q3 2025)

| Sourcing Phase | Unverified Sourcing (Industry Avg.) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42-68 hours (fake portfolios, expired business licenses) | < 4 hours (pre-verified legal docs, facility audits) | 92% ↓ |

| Sample Quality Rounds | 3.2 iterations (material/color mismatches) | 1.3 iterations (specialized leather tanneries, Pantone-matched samples) | 59% ↓ |

| Production Commencement | 22-35 days (MOQ renegotiations, tooling delays) | 14 days avg. (pre-negotiated terms, dedicated retro-bag lines) | 38% ↓ |

| Total RFQ-to-PO Cycle | 89-117 hours | ≤ 26 hours | 72% reduction |

Key Advantages for “China Brown Leather Retro Bag” Sourcing:

- Zero Fake Factory Risk: All 17 Pro List manufacturers undergo bi-annual on-site audits (ISO 9001, leather-specific QC protocols).

- Material Integrity: Direct partnerships with Anhui/Hunan tanneries; 100% traceable vegetable-tanned hides (certificates provided).

- Retro Design Expertise: Factories specialize in vintage tooling (e.g., brass buckles, saddle stitching) – not generic bag producers.

- Language Precision: Dedicated English-speaking project managers with 5+ years in leather goods (no translation delays).

Critical Call to Action: Secure Your Q3-Q4 2026 Allocations Now

The retro leather bag market is surging (CAGR 8.3% through 2027), but specialized manufacturers operate at 94% capacity by August. Delaying vetting risks:

⚠️ MOQ inflation (producers prioritize pre-qualified buyers)

⚠️ Q4 holiday delays (tannery lead times peak in September)

⚠️ Design theft (unvetted suppliers often replicate samples)

Your Next Step: Activate Verified Sourcing in < 24 Hours

- Email Support: Send your specifications to [email protected] with subject line: “PRO LIST: BROWN LEATHER RETRO BAG RFQ”

→ Receive 3 pre-vetted manufacturer profiles + compliance documentation within 4 business hours. - Instant Connection: Message WhatsApp +86 159 5127 6160 for urgent allocation requests:

→ Include “2026 RETRO BAG PRO LIST” in your first message for priority routing.

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We secured 30% lower MOQs by bypassing middlemen.”

— Director of Sourcing, EU Heritage Accessories Brand (2025 Client)

Do not navigate China’s fragmented leather manufacturing landscape unverified.

Every hour spent vetting unqualified suppliers erodes your Q4 margin targets. Our Pro List guarantees first-pass compliance with EU REACH leather regulations and ethical production standards – turning sourcing from a cost center into a strategic advantage.

Act before August 31, 2026:

✅ Exclusive Q3 incentive: Complimentary leather material certification for RFQs initiated before August 31.

✅ Guaranteed 14-day production start for POs placed by September 15.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 TODAY to lock verified capacity.

SourcifyChina: Reducing Supply Chain Risk Since 2018 | 1,200+ Verified Manufacturers | 98.7% Client Retention Rate

This report contains proprietary data. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.