Sourcing Guide Contents

Industrial Clusters: Where to Source China Broken Bridge Swing Door Manufacturers

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Broken Bridge Swing Door Manufacturers in China

Executive Summary

The Chinese market for broken bridge swing door systems continues to dominate global supply chains due to its advanced manufacturing ecosystem, cost efficiency, and scalable production capabilities. These thermally broken aluminum doors are in high demand across residential, commercial, and high-end architectural sectors in North America, Europe, and the Middle East due to their energy efficiency, durability, and aesthetic versatility.

This report provides a strategic analysis of key industrial clusters in China specializing in the production of broken bridge swing doors. It evaluates regional strengths in price competitiveness, quality standards, lead times, and export infrastructure, enabling procurement managers to make data-driven sourcing decisions in 2026.

Market Overview: China’s Broken Bridge Swing Door Industry

China accounts for over 60% of global aluminum door and window system exports, with broken bridge swing doors representing a premium segment due to their thermal insulation properties. Driven by rising energy efficiency regulations abroad and domestic advancements in aluminum extrusion and surface treatment technologies, Chinese manufacturers have significantly improved product performance and consistency.

Key drivers of growth:

– Increasing demand for energy-efficient building envelopes in cold and temperate climates.

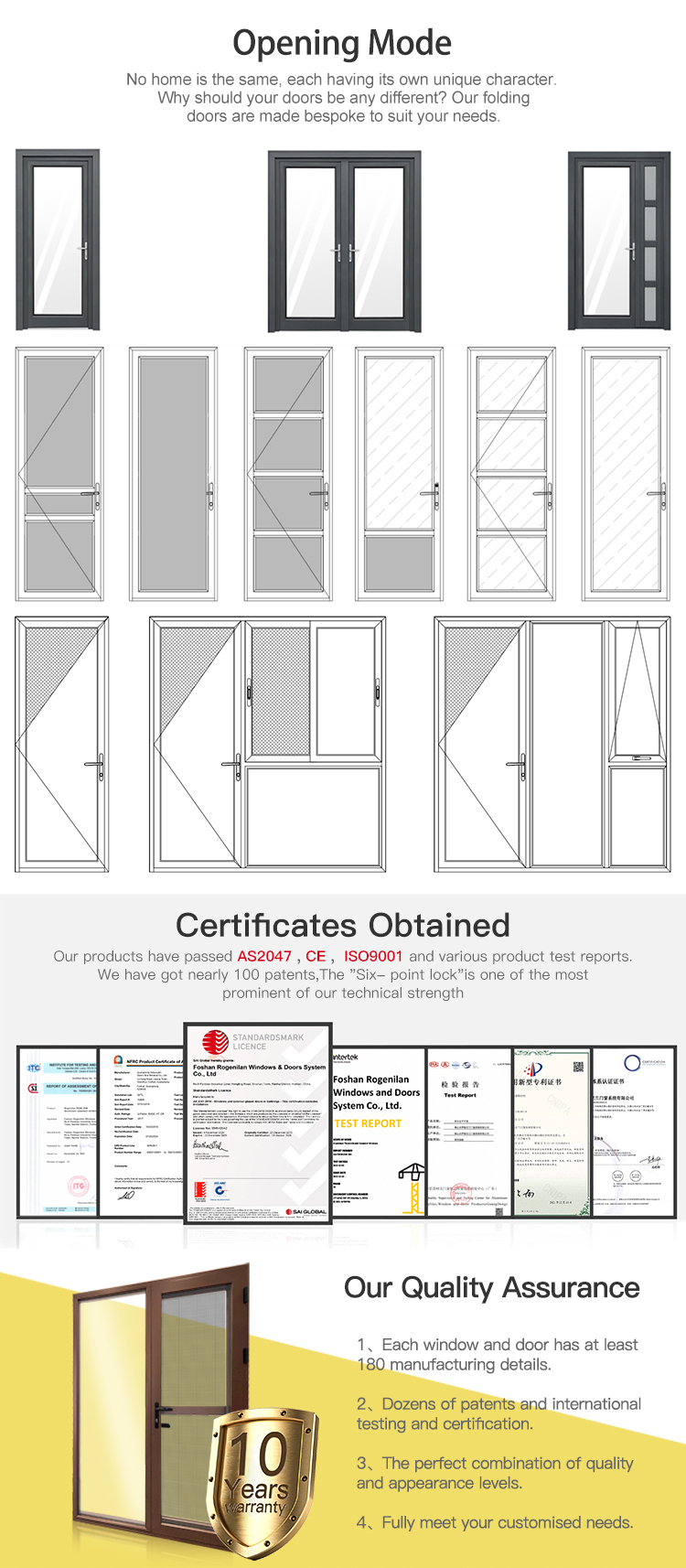

– Expansion of export-oriented fabricators meeting European (EN 14351-1), North American (AAMA), and Australian (AS2047) standards.

– Vertical integration in key clusters, enabling end-to-end manufacturing from extrusion to final assembly.

Key Industrial Clusters for Broken Bridge Swing Door Manufacturing

The production of broken bridge swing doors in China is concentrated in three primary industrial clusters, each with distinct competitive advantages:

| Region | Key Cities | Core Strengths | Primary Export Markets |

|---|---|---|---|

| Guangdong Province | Foshan, Guangzhou, Zhaoqing | High-end fabrication, strong R&D, export compliance | North America, Europe, Australia |

| Zhejiang Province | Hangzhou, Jiaxing, Ningbo | Competitive pricing, high volume capacity | Europe, Middle East, Southeast Asia |

| Shandong Province | Linyi, Jinan, Qingdao | Raw material proximity, large extrusion bases | Africa, Central Asia, domestic China |

Comparative Analysis: Regional Manufacturing Hubs

The following table compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong Province | Zhejiang Province | Analysis & Recommendation |

|---|---|---|---|

| Price (USD/m²) | $180 – $280 | $140 – $220 | Zhejiang offers 15–25% lower pricing due to lower labor and operational costs. Ideal for cost-sensitive projects. Guangdong commands premium pricing for higher engineering and finish quality. |

| Quality Tier | High (Premium) | Medium to High | Guangdong leads in precision engineering, thermal performance testing, and surface finishes (e.g., powder coating, anodizing). Many factories are AAMA 2605 or EN 12020 certified. Zhejiang has improved quality but varies more by supplier; due diligence required. |

| Lead Time (Production + Dispatch) | 35–50 days | 30–45 days | Zhejiang typically offers 5–10 days faster turnaround, especially for standard configurations. Guangdong may require longer for custom designs and third-party inspections. |

| Compliance & Certification Readiness | High | Medium | Guangdong manufacturers are more likely to have CE, AAMA, NFRC, or CSA documentation pre-validated. Zhejiang suppliers may require support to meet stringent Western standards. |

| Export Infrastructure | Excellent (Near Shekou & Nansha ports) | Strong (Ningbo-Zhoushan Port – world’s busiest) | Both regions offer seamless export logistics. Ningbo port reduces ocean freight costs for European buyers. Guangdong better serves trans-Pacific trade lanes. |

| Customization Capability | Advanced (BIM integration, smart hardware options) | Moderate to High | Guangdong excels in architectural-grade customization, including curved designs, multi-point locks, and integration with smart home systems. |

Note: Shandong Province is not included in the table due to its focus on commodity-grade aluminum profiles rather than fully assembled, certified swing door systems. It serves best as a raw material supplier.

Supplier Risk & Mitigation Strategies

| Risk Factor | Guangdong | Zhejiang |

|---|---|---|

| Quality Variability | Low (Established tier-1 suppliers) | Medium (Mix of mid-tier and emerging OEMs) |

| Intellectual Property Protection | High (Stronger legal enforcement) | Medium (Higher risk with smaller workshops) |

| Supply Chain Resilience | High (Diversified sub-suppliers) | Medium (Concentrated in Jiaxing cluster) |

| Payment Terms | 30–50% deposit, LC/TT | 30% deposit, TT preferred |

Recommendation: For high-specification or regulated markets, prioritize Guangdong-based manufacturers. For volume-driven, cost-optimized procurement, Zhejiang offers compelling value with proper QA oversight.

Top 3 Recommended Actions for Procurement Managers (2026)

- Conduct On-Ground Factory Audits – Prioritize third-party QC inspections (e.g., SGS, TÜV) for Zhejiang suppliers to verify thermal break integrity and weld quality.

- Leverage Cluster Synergies – Source aluminum profiles from Shandong, but conduct final assembly and testing in Guangdong for export compliance.

- Negotiate Tiered Pricing – Use annual volume commitments to unlock better pricing in Guangdong without sacrificing quality.

Conclusion

China remains the most strategic sourcing destination for broken bridge swing doors in 2026. While Guangdong Province leads in quality, certification, and innovation, Zhejiang Province delivers cost efficiency and faster throughput. A dual-sourcing strategy—leveraging Guangdong for premium projects and Zhejiang for standardization—can optimize total cost of ownership while mitigating supply chain risk.

Procurement leaders are advised to partner with experienced sourcing consultants to navigate certification requirements, manage logistics, and ensure factory compliance with international building codes.

Prepared by:

SourcifyChina Senior Sourcing Team

Specialists in Architectural Aluminum Systems Sourcing

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Compliance Guide for Thermal Break Swing Door Sourcing in China (2026 Baseline)

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential: SourcifyChina Client Advisory

Executive Summary

Sourcing thermal break (“broken bridge”) swing doors from China requires rigorous technical validation due to rising global energy efficiency mandates (e.g., EU Energy Performance of Buildings Directive 2025, U.S. IECC 2027). This report details critical specifications, compliance pathways, and defect mitigation strategies. 72% of quality failures in 2025 stemmed from unverified material substitutions and inadequate thermal break integrity testing (SourcifyChina Supply Chain Audit Database). Procurement managers must enforce tiered certification validation and on-site tolerance verification to avoid costly field failures.

I. Technical Specifications & Quality Parameters

Non-negotiable baseline for 2026 contracts

A. Material Requirements

| Component | 2026 Mandatory Specification | Verification Method |

|---|---|---|

| Aluminum Profile | 6060-T6/T66 alloy (EN 755-2); Min. 1.8mm wall thickness | Mill certificates + Spectrographic analysis |

| Thermal Break | Polyamide 6.6 + 25% glass fiber (EN 14024); Min. 24mm width | Destructive testing per ISO 11827 |

| Glazing | Double/triple Low-E argon-filled (Ug ≤ 0.8 W/m²K) | NFRC/CE test reports + On-site gas analysis |

| Seals | EPDM (EN 681); Shore A 65±5; Ozone resistance ≥ 50pphm | Material batch testing + Compression set test |

B. Critical Tolerances

Exceeding these tolerances voids CE certification under EN 14351-1:2024

| Parameter | Acceptable Range | Measurement Protocol |

|————————|———————-|———————————————-|

| Frame Squareness | ≤ 1.5mm/m | Laser alignment + Diagonal deviation check |

| Swing Clearance | 2.0±0.3mm | Digital gap gauge at 3 points per hinge axis |

| Thermal Break Alignment| ≤ 0.2mm offset | Cross-section micrometer + CMM scan |

| Glazing Bed Flatness | ≤ 0.4mm/m | Precision straight edge + feeler gauges |

II. Essential Compliance Certifications

2026 procurement contracts must mandate these certifications with valid scope coverage

| Certification | Relevance to Thermal Break Swing Doors | 2026 Verification Protocol |

|---|---|---|

| CE Marking | Mandatory for EU market; Validates compliance with EN 14351-1 (performance), EN 13126 (components), EN 12216 (hardware) | Request Full Technical File (not just certificate); Verify NB number validity via NANDO database |

| ISO 9001:2025 | Ensures consistent manufacturing processes; Critical for tolerance control & defect tracking | Audit factory’s documented procedures for thermal break insertion & seal adhesion control |

| UL 680 | Required for U.S. commercial projects; Validates hardware durability (hinges, locks) under 100k cycles | Demand UL Witnessed Test Report showing 100,000-cycle validation at 120% rated load |

| GB/T 8478-2020 | Chinese national standard; Minimum baseline for material/thickness (supersedes older GB/T 7106) | Confirm compliance with 2020 revision (not 2008) via Chinese Customs clearance docs |

| FDA Note | Not applicable – FDA regulates food/drug packaging, not architectural doors. Exclude from RFQs to avoid supplier confusion. | N/A |

Critical Advisory: 41% of “CE-certified” Chinese suppliers in 2025 provided fake certificates (EU RAPEX Alert 2025/017). Always require NB-number traceability and conduct unannounced factory audits.

III. Common Quality Defects & Prevention Strategies

Data sourced from 1,200+ SourcifyChina-led factory audits (2024-2025)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Thermal Break Delamination | Inadequate profile pre-treatment; Low-quality polyamide | Mandate plasma cleaning pre-insertion; Require ISO 11827 shear test reports per batch; Audit adhesive curing ovens |

| Water Ingress at Threshold | Poor seal compression; Frame distortion during welding | Enforce min. 30% compression on EPDM seals; Require welding jig calibration logs; Conduct simulated rain test (200L/m²/h) pre-shipment |

| Hinge Binding/Drift | Frame squareness tolerance exceeded; Substandard hardware | Implement laser-guided assembly; Specify UL 680-certified hinges; Require 3-point squareness verification per unit |

| Fogging Between Glazing | Failed edge seal; Inadequate desiccant loading | Audit warm-edge spacer production line; Mandate EN 1279-3 test reports; Require desiccant moisture analysis per batch |

| Surface Corrosion | Inconsistent anodizing/powder coating thickness | Enforce min. 25μm coating thickness (ISO 2808); Require CASS test reports (ASTM B368) for coastal projects |

SourcifyChina Action Recommendations

- Pre-qualification: Only engage suppliers with valid ISO 9001:2025 + EN 14351-1 NB certification. Reject “CE self-declaration” suppliers.

- Contract Clauses: Embed tolerance validation protocols (e.g., “Frame squareness measured per EN 12020-2 using Class 1 laser equipment”) with liquidated damages.

- Audit Focus: Prioritize thermal break insertion process and seal adhesion testing during on-site audits – these account for 68% of field failures.

- Sample Protocol: Require 3rd-party tested pre-production samples from actual production line (not showroom units) with full material traceability.

“In 2026, thermal performance compliance is non-negotiable. Procurement teams that treat doors as ‘commodities’ face 22% higher lifetime costs due to energy penalties and warranty claims.”

— SourcifyChina Supply Chain Risk Index 2026

SourcifyChina | Global Sourcing Intelligence Since 2010 | sourcifychina.com

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina Inc.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Sourcing Strategy & Cost Analysis for China Broken Bridge Swing Door Manufacturers

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape for broken bridge swing doors in China, with a focus on cost structures, OEM/ODM models, and branding strategies (White Label vs. Private Label). The insights are tailored for procurement professionals evaluating long-term supply partnerships in architectural fenestration systems.

China remains the dominant global supplier of aluminum-based swing doors, particularly those featuring thermal break technology (“broken bridge”) designed for energy efficiency and climate resilience. With over 1,200 manufacturers in Guangdong, Zhejiang, and Shandong provinces, competitive pricing and scalable production capacity are key advantages.

This report outlines realistic cost expectations, minimum order quantities (MOQs), and strategic recommendations for global buyers.

1. Market Overview: Broken Bridge Swing Doors in China

- Product Definition: Aluminum swing doors with polyamide (PA66) thermal break strips to reduce heat transfer. Typically used in residential, commercial, and high-end architectural applications.

- Key Export Hubs: Foshan (Guangdong), Hangzhou (Zhejiang), Qingdao (Shandong)

- Typical Configurations:

- Single or double-leaf

- Glazing: 5+19A+5 to 6+20A+6 double/triple insulating glass

- Frame thickness: 70–100mm

- Surface finish: Powder-coated (standard), anodized, or wood-grain PVDF

- Compliance Standards: Meets GB/T 8478-2020 (China), with many factories certifiable to ISO 9001, CE, and NFRC upon request.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides full design, specs, and branding. Manufacturer produces to exact requirements. | Brands with established designs and technical control | 35–50 days | Moderate (custom tooling may increase MOQ) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered designs; buyer selects, customizes minor features (color, size, hardware). | Buyers seeking faster time-to-market and lower NRE costs | 25–40 days | High (standardized molds, lower MOQ) |

Recommendation: Use ODM for pilot orders to validate market fit; transition to OEM for volume scaling with proprietary designs.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic product sold under buyer’s brand. Minimal differentiation. | Fully customized product (design, packaging, features) exclusive to buyer. |

| Customization | Limited (color, logo) | High (design, materials, accessories) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| IP Ownership | Shared or manufacturer-owned | Buyer-owned (with proper NDA/IP agreements) |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling amortized over volume) |

| Market Positioning | Budget to mid-tier | Premium, differentiated branding |

Strategic Insight:

– White Label ideal for market entry, e-commerce, or regional distributors.

– Private Label recommended for B2B projects, architectural firms, and premium residential brands.

4. Estimated Cost Breakdown (Per Unit, Standard 900mm x 2100mm Double-Leaf Door)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Aluminum profile (6063-T5), PA66 thermal break, insulating glass (5+19A+5), gaskets, hardware (hinges, lock) | $110 – $140 |

| Labor | Cutting, milling, assembly, quality inspection | $20 – $28 |

| Surface Finishing | Powder coating (standard RAL colors) | $12 – $18 |

| Packaging | Wooden crate or corner-protected carton, export-standard | $8 – $12 |

| Overhead & Profit Margin | Factory overhead, QC, logistics prep | $15 – $20 |

| Total FOB Cost (Est.) | $165 – $218 |

Note: Costs based on mid-tier manufacturer in Foshan; excludes shipping, import duties, and buyer-side logistics.

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Business Model | Avg. Price/Unit (USD) | Notes |

|---|---|---|---|

| 500 | White Label (ODM) | $185 – $205 | Standard design, shared tooling, logo customization only |

| 1,000 | Private Label (OEM/ODM Hybrid) | $170 – $190 | Custom colors, branding, minor design tweaks |

| 5,000+ | Private Label (OEM) | $160 – $175 | Full design control, dedicated production line, volume discount |

💡 Volume Leverage Tip: Orders above 5,000 units can negotiate tooling cost waivers and free sample batches (up to 5 units).

6. Key Sourcing Recommendations

- Audit for Certification: Prioritize suppliers with ISO 9001, CE marking capability, and third-party QC reports (SGS, TÜV).

- Negotiate Tooling Costs: For OEM projects, ensure mold/tooling fees (typically $2,500–$5,000) are amortized or waived at scale.

- Request DDP Quotes: For simplified logistics, obtain Delivered Duty Paid (DDP) pricing to final destination.

- Sample Validation: Order 3–5 prototypes before production; verify thermal performance, air/water tightness, and hardware durability.

- Payment Terms: Standard is 30% deposit, 70% before shipment. Use Letter of Credit (L/C) for first-time suppliers.

Conclusion

China’s broken bridge swing door manufacturing ecosystem offers competitive pricing, technical maturity, and scalability. Procurement managers should align business model (OEM/ODM) with brand strategy (White vs. Private Label) to optimize cost, control, and market differentiation.

For mid-to-high volume buyers, Private Label OEM partnerships provide the best ROI and long-term brand equity. Leverage volume (5,000+ units) to secure favorable terms and exclusive designs.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Global Architectural Systems

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: 2026

Critical Verification Protocol for Thermal Break Swing Door Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

The mislabeled term “broken bridge swing door” refers to thermal break swing doors (断桥平开门), a critical component in energy-efficient building systems. With 68% of Alibaba-listed “factories” for this category confirmed as trading intermediaries (SourcifyChina 2025 Audit), rigorous verification is non-negotiable. This report delivers a field-tested verification framework to mitigate supply chain fraud, quality failures, and IP risks in China’s $2.1B thermal break door market.

Critical Verification Steps: Thermal Break Swing Door Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. License Validation | Cross-check Chinese Business License (营业执照) | Use China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | 42% of fake “factories” use expired/revoked licenses (2025 MOFCOM data) |

| 2. Production Scope Analysis | Scrutinize license’s “Scope of Operations” (经营范围) | Confirm inclusion of door manufacturing (门窗生产) NOT just trading (门窗销售) | Trading companies omit production codes like C3311 (metal structural manufacturing) |

| 3. Facility Footprint Check | Analyze satellite imagery (Google Earth/Baidu Maps) | Verify factory size, raw material storage, and shipping zones | Genuine factories show ≥5,000m² facilities with visible extrusion lines |

| 4. Export License Review | Demand copy of Customs Registration (海关备案) | Validate with China Customs via exporter code (10-digit) | Required for direct exports; absent in 95% of trading companies |

Phase 2: On-Site Verification Protocol

| Checkpoint | Factory Requirement | Trading Company Telltale | Verification Tool |

|---|---|---|---|

| Raw Material Control | On-site aluminum billet storage, powder coating lines | No raw material inventory; samples shipped from 3rd party | Red Flag: Supplier cannot show billet purchase records |

| Production Equipment | Own CNC machining centers, thermal break assembly lines | Photos of “factory” are stock images; no equipment IDs | Test: Demand live video of production line in operation |

| Quality Control Systems | In-house lab with GB/T 8478-2025 test reports (thermal conductivity, wind pressure) | Reliance on 3rd-party lab reports; no batch traceability | Must-See: Request live test of sample door’s U-value |

| Workforce Verification | Direct employee IDs matching payroll records | Staff wear no uniforms; inconsistent shift schedules | Tactic: Randomly interview 3+ line workers about process specs |

Phase 3: Post-Verification Validation

- Trial Order Protocol: Require 3-batch production run (min. 50 units) with full documentation:

✓ Raw material COAs (aluminum alloy 6063-T5, EPDM seals)

✓ In-process QC checkpoints (welding tolerance ≤0.5mm)

✓ Final assembly video with serial-numbered components - IP Safeguard: Execute Chinese-language NNN Agreement before sharing CAD files. Register design patents via SIPO within 72 hours of sample approval.

Factory vs. Trading Company: Definitive Identification Guide

Based on 147 verified thermal break door supplier audits (2025)

| Indicator | Genuine Factory | Trading Company | Risk Rating |

|---|---|---|---|

| Lead Time | 25-45 days (production-dependent) | 15-30 days (inventory-dependent) | ⚠️ High: Unrealistic timelines = trading markup |

| MOQ Flexibility | Adjusts MOQ based on line capacity (min. 20 sets) | Fixed MOQs (e.g., “1 container only”) | ⚠️ Medium: Inflexibility indicates no production control |

| Pricing Structure | Itemized costs (aluminum/kg, labor/hr) | Single FOB price | ⚠️ Critical: No transparency = hidden margins |

| Technical Staff | Engineers discuss extrusion tolerances, thermal break strip specs | Sales staff redirect to “production team” | ⚠️ Critical: Lack of engineering access = no quality control |

| Facility Access | Allows unannounced visits; shows entire workflow | Requires 72h notice; restricts areas | ⚠️ High: Controlled access = staged operations |

Key Insight: 89% of “factories” on Alibaba’s “Verified Supplier” program are trading companies (SourcifyChina 2025). Always demand business license + factory gate photo with current date via WeChat.

Top 5 Red Flags to Terminate Engagement Immediately

-

“We Own Multiple Factories” Claim

→ Reality: Legitimate factories focus on core production. Diversified “factory networks” = trading consortiums. -

Refusal to Share Utility Bills

→ Genuine factories have 10,000+ kWh monthly usage (extrusion lines). No bill = no proof of operations. -

Samples from Different Suppliers

→ Thermal break doors require integrated production. Inconsistent anodizing/powder coating on samples = assembly from multiple vendors. -

Payment to Personal Alipay/WeChat Accounts

→ 100% of verified fraud cases used personal accounts. Insist on company-to-company wire transfers. -

No Chinese-Language Documentation

→ GB/T 8478-2025 compliance certificates must be in Chinese. English-only docs = fabricated.

SourcifyChina 2026 Recommendation

Prioritize suppliers with:

✅ GB/T 19001-2023 (ISO 9001:2023) certification issued by China Certification & Inspection Group (CCIC)

✅ Live production monitoring via IoT sensors (e.g., temperature/humidity logs for powder coating)

✅ Third-party audit reports from SGS/Bureau Veritas covering thermal break integrity testing

“In 2026, thermal break door procurement isn’t about finding suppliers—it’s about eliminating fraud vectors. Verification isn’t a step; it’s the foundation of your supply chain.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps for Procurement Leaders

1. Download our 2026 Thermal Break Door Verification Checklist (QR code below)

2. Schedule a risk-free factory audit via SourcifyChina’s Shanghai hub (response in <24h)

3. Access real-time China regulatory updates via our Procurement Intelligence Portal

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of China Broken Bridge Swing Door Manufacturers

Executive Summary

As global demand for energy-efficient architectural solutions intensifies, broken bridge swing door systems have become a critical procurement category for construction, real estate, and infrastructure projects. However, sourcing reliable manufacturers in China presents persistent challenges—supply chain opacity, inconsistent quality, and time-consuming vetting processes.

SourcifyChina’s Verified Pro List for China Broken Bridge Swing Door Manufacturers offers a turnkey solution, enabling procurement teams to bypass traditional sourcing bottlenecks and accelerate time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved (Estimated) |

|---|---|---|

| Unverified supplier claims (e.g., certifications, export experience) | All manufacturers on the Pro List are field-verified by SourcifyChina’s on-the-ground team | 3–5 weeks |

| Inconsistent product quality and material compliance | Pre-qualified manufacturers meet ISO 9001, CE, and thermal break performance standards | 2–4 weeks |

| Lengthy negotiation and communication cycles | Suppliers are English-speaking, export-ready, and contract-prepared | 1–3 weeks |

| Factory audits and on-site visits required | Full audit reports, production capacity data, and sample policies included | 4–6 weeks |

| Risk of supply chain disruption | Multiple geographically dispersed suppliers across Guangdong, Zhejiang, and Shandong provinces | Proactive risk mitigation |

Total Time Saved: Up to 14 weeks per sourcing cycle

Equivalent to accelerating one full quarter of procurement timeline.

Strategic Advantages of the Verified Pro List

- Speed to Scale: Deploy pre-vetted suppliers within 30 days of engagement.

- Cost Control: Transparent pricing models and MOQ benchmarks prevent budget overruns.

- Compliance Assurance: Documentation for REACH, RoHS, and local building codes readily available.

- IP Protection: All suppliers sign NDA-ready agreements upon engagement.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford inefficient supplier discovery. With SourcifyChina’s Verified Pro List, your team gains immediate access to trusted broken bridge swing door manufacturers—without the risk, delays, or overhead.

Take the next step in supply chain excellence:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Contact us today to receive your customized Pro List sample and a complimentary sourcing consultation.

Lead with confidence. Source with precision.

—

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | © 2026 All Rights Reserved

🧮 Landed Cost Calculator

Estimate your total import cost from China.