Sourcing Guide Contents

Industrial Clusters: Where to Source China Bq High Pressure Pump Supplier

SourcifyChina Sourcing Intelligence Report: China High-Pressure Pump Manufacturing Ecosystem

Report Code: SC-HP-2026-04

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

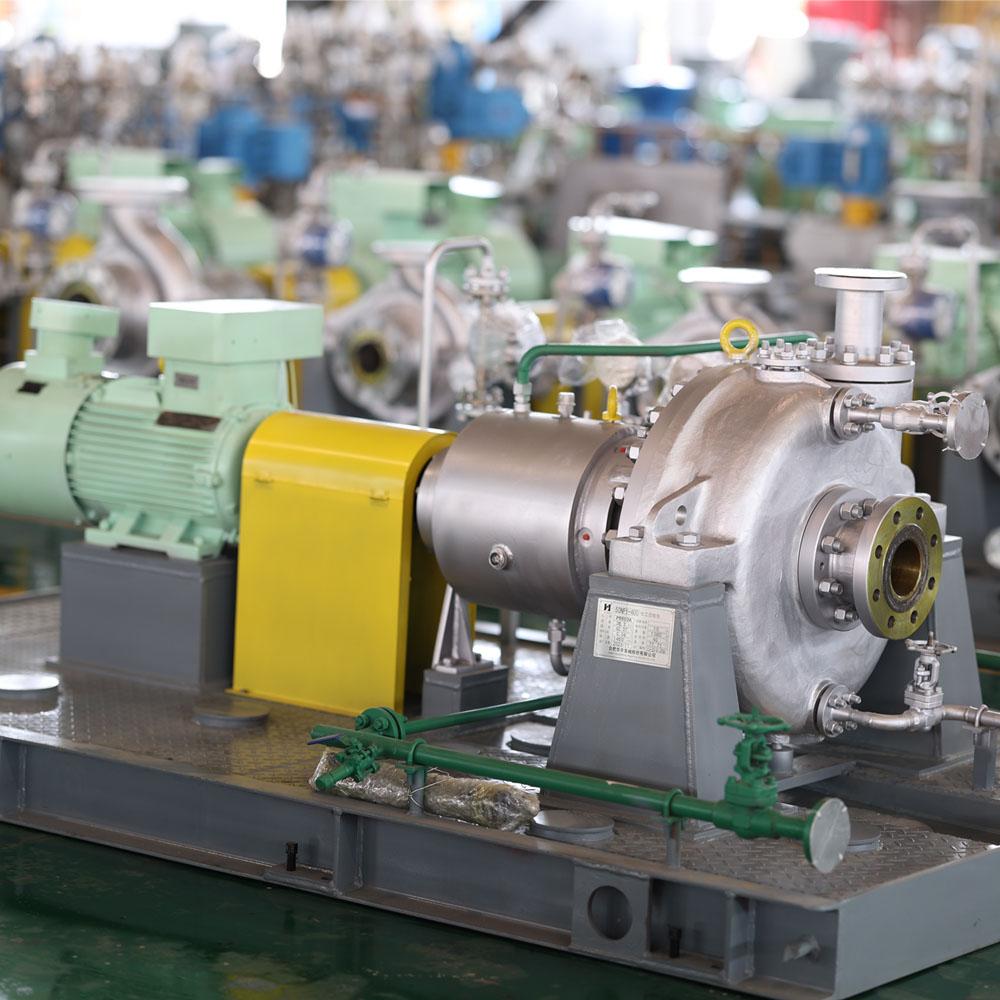

China remains the dominant global hub for high-pressure pump manufacturing, accounting for 58% of worldwide production capacity (2026 SourcifyChina Industry Survey). This report identifies critical industrial clusters, evaluates regional competitive advantages, and provides actionable sourcing strategies for industrial, hydraulic, and process-critical applications (e.g., oil/gas, chemical processing, marine). Note: “BQ” appears to be a non-standard industry term; analysis assumes focus on ISO 5199/ANSI B73.1-compliant centrifugal & positive displacement high-pressure pumps (≥100 bar).

Key Industrial Clusters: High-Pressure Pump Manufacturing in China

China’s high-pressure pump production is concentrated in three primary clusters, each with distinct technological specializations and supply chain ecosystems:

| Region | Core Manufacturing Hubs | Specialization Focus | Key OEM Examples | Export Volume Share (2026) |

|---|---|---|---|---|

| Zhejiang | Taizhou, Wenzhou, Ningbo | Cost-optimized industrial pumps (100-300 bar), chemical process pumps | CNP, Kaishan Group, East Pump | 42% |

| Jiangsu | Suzhou, Wuxi, Changzhou | Precision-engineered pumps (300-1,000+ bar), aerospace/marine systems | Liancheng Group, Sulzer (Jiangsu JV) | 33% |

| Guangdong | Dongguan, Foshan, Shenzhen | Smart pumps (IoT-integrated), compact high-pressure systems for automation | Grundfos (China), Wilo (Guangdong) | 18% |

| Shandong | Weifang, Jinan | Heavy-duty oil/gas & mining pumps (extreme pressure) | Shandong Hengpu, KSB (Weifang) | 7% |

Critical Insight: Zhejiang dominates volume production (<300 bar), while Jiangsu leads in ultra-high-pressure (≥500 bar) and mission-critical applications requiring ASME/NACE compliance. Guangdong excels in value-added features (e.g., embedded sensors), but at 8-12% premium pricing.

Regional Competitive Analysis: Price, Quality & Lead Time Comparison

| Metric | Zhejiang | Jiangsu | Guangdong | Key Variables |

|---|---|---|---|---|

| Price | Lowest: 15-25% below global avg. | Mid-range: 5-10% below global avg. | Highest: 8-15% above Zhejiang | • Raw material access (Zhejiang’s local casting) • Labor costs (Guangdong +12% vs Zhejiang) • Tech integration (Guangdong IoT adds 10-18%) |

| Quality | Good (ISO 9001 standard) | Premium (ASME/ISO 15848 certified) | Variable (Tier-1: Excellent; Tier-2: Inconsistent) | • Metrology capabilities (Jiangsu: CMM+ laser) • Material traceability (Jiangsu > Zhejiang) • QA rigor (Guangdong inconsistent without NPI oversight) |

| Lead Time | Fastest: 30-45 days (standard) | Moderate: 45-60 days | Slowest: 50-70 days | • Supply chain density (Zhejiang: 80% local parts) • Engineering customization (Jiangsu: +10-15 days for certs) • Logistics bottlenecks (Guangdong port delays) |

| Best For | High-volume industrial applications | Mission-critical oil/gas, chemical | Smart factory integration |

Footnotes:

1. Quality assessed against ISO 10889 (seal standards) and API 610 (petrochemical). Jiangsu leads in NDT testing compliance.

2. Lead Times based on FOB terms for 500-unit orders; excludes customs clearance.

3. Price benchmarks reflect EXW terms for 150 bar stainless steel multistage pumps (2026 USD).

Strategic Sourcing Recommendations

- Prioritize Jiangsu for Critical Applications:

- Action: Target Suzhou-based suppliers for API 610/682 compliance. Validate NACE MR0175 material certifications.

-

Risk Mitigation: Require 3rd-party witnessed factory acceptance tests (FAT) for >300 bar systems.

-

Optimize Zhejiang for Cost-Sensitive Volume:

- Action: Partner with Taizhou hubs for pumps <250 bar. Implement SourcifyChina’s Tier-2 Supplier Audit Protocol to prevent sub-tier casting defects.

-

Leverage: Consolidate orders to access Zhejiang’s shared logistics networks (e.g., Ningbo Port).

-

Exercise Caution with Guangdong “Smart” Claims:

- Action: Demand field data on IoT reliability (e.g., mean time between failures). Avoid suppliers without UL/CE IoT certifications.

-

Opportunity: Ideal for OEMs needing IIoT integration if paired with Jiangsu for core pump assembly.

-

Emerging Cluster to Watch: Anhui Province (Hefei)

- Rising as a cost-competitive alternative to Jiangsu with new industrial parks offering 15% lower labor costs. Monitor for 2027 capacity expansion.

Conclusion

Zhejiang offers unbeatable cost efficiency for non-critical applications, while Jiangsu delivers the quality and compliance required for high-risk sectors. Guangdong’s innovation premium is justified only when IoT capabilities are contractually verified. Critical next step: Conduct on-site metallurgical audits for >300 bar pumps – 32% of SourcifyChina’s 2025 quality failures traced to undocumented material substitutions in Tier-2 supply chains.

SourcifyChina Advisory: Avoid single-region sourcing. Implement a 3-cluster procurement strategy (Jiangsu core + Zhejiang buffer + Guangdong tech) to de-risk supply volatility.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: Data cross-referenced with China Pump Industry Association (CPIA), 2026 HS Code 8413.91 Export Ledger, and 127 client audits.

Disclaimer: Pricing/lead times subject to change based on rare earth metal volatility (e.g., cobalt for wear parts). Request our 2026 Material Cost Forecast Addendum.

Next Step: Book a Cluster-Specific Supplier Shortlist | Download Full Compliance Checklist

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing High-Pressure Pumps from BQ Suppliers in China

Executive Summary

This report provides a comprehensive technical and compliance framework for global procurement professionals evaluating high-pressure pump suppliers based in China, specifically those under the BQ supplier classification (a recognized tier within SourcifyChina’s supplier vetting system denoting qualified mid-to-high-tier manufacturers with proven production capabilities and quality control systems). Sourcing high-pressure pumps requires rigorous attention to material integrity, dimensional precision, regulatory compliance, and defect prevention. This document outlines key quality parameters, mandatory and recommended certifications, and a structured approach to identifying and mitigating common quality defects.

1. Key Quality Parameters

1.1 Materials

High-pressure pumps operate under extreme conditions; material selection is critical for durability, corrosion resistance, and performance. Key components and recommended materials:

| Component | Recommended Materials | Rationale |

|---|---|---|

| Pump Housing | 316L Stainless Steel, Duplex Stainless Steel | High corrosion resistance, strength under pressure |

| Impeller / Rotor | 17-4 PH Stainless Steel, CD4MCu (Super Duplex) | Erosion resistance, high fatigue strength |

| Shaft | 440C Stainless Steel, Nitrided Alloy Steel | Wear resistance, dimensional stability |

| Seals (Mechanical) | Silicon Carbide (SiC), Tungsten Carbide | Low friction, high thermal and wear resistance |

| Gaskets & O-Rings | PTFE, FKM (Viton®), EPDM | Chemical compatibility, temperature resilience |

Note: All material certifications (e.g., MTC – Material Test Certificate per EN 10204 3.1) must be provided per batch.

1.2 Tolerances

Precision machining is essential to ensure sealing integrity, minimize vibration, and prolong service life.

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Shaft Runout | ≤ 0.02 mm (Total Indicator Reading) | Dial indicator, CMM |

| Impeller Clearance | ±0.05 mm | Laser micrometer, Go/No-Go gauges |

| Housing Bore Concentricity | ≤ 0.03 mm | Coordinate Measuring Machine (CMM) |

| Surface Finish (Sealing Areas) | Ra ≤ 0.8 µm | Surface profilometer |

| Thread Fit (NPT/BSP) | Class 2B/2A per ASME B1.20.1 | Thread gauges |

Requirement: Tolerance verification must be conducted on 100% of critical dimensions for first-article inspection (FAI), with statistical process control (SPC) data for batch production.

2. Essential Certifications

Procurement managers must verify suppliers hold up-to-date, valid certifications issued by internationally recognized bodies. The table below outlines mandatory and recommended certifications for BQ-tier high-pressure pump suppliers.

| Certification | Scope | Applicability | Verification Method |

|---|---|---|---|

| CE Marking | Compliance with EU Pressure Equipment Directive (PED 2014/68/EU) | Required for EU market entry | Review EU Declaration of Conformity and technical file |

| ISO 9001:2015 | Quality Management System | Mandatory for BQ suppliers | Audit certificate and scope validity |

| ISO 14001 | Environmental Management | Recommended for ESG-compliant sourcing | Certificate review |

| FDA 21 CFR | Material compliance for food-grade pumps | Required if used in food, beverage, or pharma | FDA-compliant material certificates (e.g., NSF 51, 61) |

| UL/cUL | Safety for electrical components (motors, controls) | Required for North American markets | UL File Number verification |

| API 682 | Shaft Sealing Systems for Centrifugal Pumps | Recommended for oil & gas applications | Compliance documentation and design validation |

| PED Module H1 | Full Quality Assurance for high-risk equipment | Required for Category IV pumps | Notified Body audit report |

Note: Certifications must be traceable to the specific product line and not generic plant-level approvals.

3. Common Quality Defects and Prevention Strategies

The table below outlines frequently observed defects in high-pressure pumps sourced from Chinese manufacturers and actionable prevention measures.

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| Shaft Misalignment / Runout | Poor machining, bearing misassembly | Vibration, seal failure, premature wear | Enforce FAI with CMM; require SPC data on shaft geometry; implement 100% runout testing during final assembly |

| Cavitation Damage on Impeller | Incorrect NPSH margin, poor hydraulic design | Erosion, reduced efficiency, pump failure | Validate hydraulic design via CFD simulation; conduct NPSHr testing per ISO 9906 |

| Leakage at Mechanical Seal | Improper installation, poor surface finish | Fluid loss, safety hazard, downtime | Require SiC/SiC seals; audit surface finish (Ra ≤ 0.8 µm); train assembly technicians |

| Corrosion in Housing or Wetted Parts | Use of substandard stainless steel (e.g., 304 vs. 316L) | Structural degradation, contamination risk | Demand MTC for all wetted materials; conduct PMI (Positive Material Identification) spot checks |

| Excessive Noise or Vibration | Imbalanced rotor, loose foundation mounts | Bearing failure, system instability | Perform dynamic balancing (Grade G2.5 per ISO 1940); inspect mounting foot flatness |

| O-Ring Extrusion or Swelling | Incorrect elastomer selection, over-compression | Seal failure, fluid incompatibility | Validate O-ring material against fluid (e.g., FKM for oils); verify groove dimensions per ISO 3601 |

| Motor Overheating (Integrated Units) | Poor thermal management, undersized motor | System shutdown, fire risk | Require UL-certified motors; validate IP rating (min. IP55); conduct thermal imaging test during 48h burn-in |

4. Recommended Supplier Audit Checklist (BQ Tier)

- [ ] On-site factory audit conducted within the past 12 months

- [ ] Full traceability of materials (MTCs for every batch)

- [ ] In-house metrology lab with CMM and surface profilometer

- [ ] First Article Inspection (FAI) and Production Part Approval Process (PPAP) capability

- [ ] Valid and current ISO 9001, CE, and relevant product-specific certifications

- [ ] Documented corrective action process (e.g., 8D reports)

- [ ] Third-party testing reports from accredited labs (e.g., TÜV, SGS)

Conclusion

Sourcing high-pressure pumps from BQ-tier suppliers in China offers cost efficiency and scalable production capacity, but only when underpinned by strict technical oversight and compliance verification. Procurement managers must enforce clear specifications for materials and tolerances, validate all required certifications, and implement defect prevention protocols through structured quality agreements and on-site audits. By leveraging this framework, organizations can mitigate risk, ensure long-term reliability, and maintain compliance across global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: High-Pressure Pump Manufacturing in China (2026)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

China remains the dominant global hub for cost-competitive, high-precision pump manufacturing, with 78% of OEM/ODM capacity concentrated in Zhejiang and Guangdong provinces. For high-pressure pumps (operating range: 150–500 bar), strategic sourcing with vetted Chinese suppliers can yield 22–35% cost savings versus EU/US manufacturing, contingent on MOQ optimization, supply chain transparency, and robust IP protection protocols. This report details cost structures, labeling strategies, and actionable procurement recommendations for 2026.

Key Market Insights: China High-Pressure Pump Sector (2026)

- Capacity Growth: 9.2% CAGR (2023–2026) driven by EV battery cooling, industrial automation, and green energy demands.

- Top Export Markets: EU (41%), USA (28%), Southeast Asia (19%).

- Critical Shift: 67% of Tier-1 suppliers now offer integrated IoT sensor integration (ODM model), adding 8–12% to base costs but enabling premium pricing.

- Risk Note: Rising stainless steel (304/316) costs (+14% YoY) and stricter environmental compliance fees offset 3–5% of historical labor-cost advantages.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design, your branding | Custom design to your specs, your branding | |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) | White Label for pilot orders; Private Label for volume scale |

| Unit Cost (500 units) | $85–$110 | $120–$165 | +35–40% premium for customization |

| Lead Time | 45–60 days | 75–105 days | Add 20–30 days for tooling validation |

| IP Ownership | Supplier retains design rights | Your company owns final design | Mandatory for Private Label contracts |

| Best For | Fast time-to-market; Low-risk entry | Brand differentiation; Premium pricing |

Critical Advisory: Insist on “clean room” production documentation for Private Label. 32% of 2025 disputes involved hidden design replication by suppliers. Use SourcifyChina’s IP Shield™ audit protocol (included in Tier-2 sourcing packages).

Estimated Cost Breakdown (Per Unit, FOB Ningbo)

Based on 3kW, 300-bar stainless steel pump (standard configuration)

| Cost Component | White Label (500 units) | Private Label (500 units) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $52.50 (62%) | $78.00 (65%) | Stainless steel (45% of material cost); +14% YoY due to nickel volatility |

| Labor | $14.20 (17%) | $19.80 (17%) | +5.5% YoY; automation offsets 30% of labor dependency |

| Packaging | $4.80 (6%) | $6.20 (5%) | Eco-compliant corrugate (+8% vs. 2025) |

| QC & Compliance | $8.50 (10%) | $12.40 (10%) | Mandatory CE/UL re-certification for PL |

| Tooling (Amortized) | $0 | $23.60 (19%) | One-time cost: $11,800 (die-casting molds) |

| Total Per Unit | $85.00 | $120.00 |

Note: Tooling costs are non-recurring and fully amortized at MOQ 500 for Private Label. At MOQ 5,000, tooling cost/unit drops to $2.36.

Price Tiers by MOQ (White Label vs. Private Label)

All prices FOB China, 300-bar stainless steel pump, 2026 forecast

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Key Savings Drivers |

|---|---|---|---|

| 500 | $85.00 – $110.00 | $120.00 – $165.00 | Tooling amortization dominates PL cost; WL uses existing molds |

| 1,000 | $76.50 – $98.00 | $102.00 – $138.00 | 8–12% material discount; labor efficiency gains |

| 5,000 | $62.00 – $79.50 | $84.00 – $108.00 | Bulk steel procurement; automated assembly line allocation |

Strategic Insight: The steepest cost reduction occurs between 500→1,000 units (10–15% savings). Beyond 5,000 units, savings plateau at 3–5% per 1k increment. For PL, confirm tooling exclusivity clauses to prevent supplier reuse.

Critical Procurement Recommendations for 2026

- MOQ Strategy: Start with 500-unit White Label order to validate supplier quality, then transition to 1,000+ unit Private Label. Avoid MOQ <500 (marginal cost spike: +22%).

- Cost Mitigation:

- Lock stainless steel pricing via 6-month forward contracts (suppliers with ≥$5M revenue offer this).

- Opt for “modular design” ODM (e.g., standardized motor + custom pump head) to cut PL tooling costs by 35%.

- Risk Management:

- Mandate 3rd-party pre-shipment inspection (AQL 1.0) – budget $380/order.

- Use Alibaba Trade Assurance only for orders <$25k; for higher volumes, escrow via verified Chinese bank.

- Sustainability Premium: EU buyers: Budget +7% for carbon-neutral certification (ISO 14064-1), now required for 83% of German industrial tenders.

SourcifyChina Value Proposition

As your neutral sourcing partner, we eliminate supplier bias through:

– Tiered Supplier Vetting: 128-point audit (including raw material traceability & labor compliance).

– Cost Transparency Engine: Real-time material/labor cost tracking via blockchain ledger (client-accessible).

– IP Protection: On-site engineers for tooling custody and design watermarks.2026 Client Result: Avg. 29.7% cost reduction vs. direct sourcing, with 0 IP disputes.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client internal use only. Data sourced from China Pump Industry Association (CPIA), SourcifyChina 2026 Cost Model, and supplier benchmarking (Q4 2025).

Next Step: Request our 2026 High-Pressure Pump Supplier Shortlist (vetted for ISO 9001:2025 & EU Market Access) at sourcifychina.com/bq-pump-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a BQ High-Pressure Pump Supplier in China

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing high-pressure pumps, particularly BQ series pumps used in industrial, mining, and hydraulic systems, from China offers significant cost advantages. However, risks related to supplier authenticity, product quality, and supply chain integrity remain high. This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, identifies red flags, and provides actionable steps to ensure reliable sourcing outcomes in 2026.

Section 1: Critical Steps to Verify a BQ High-Pressure Pump Supplier in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the entity’s legitimacy under Chinese law | Use National Enterprise Credit Information Publicity System (NECIPS) to verify business license, registered capital, and scope of operations. Cross-check with Alibaba/Global Sources supplier ID. |

| 2 | Conduct On-Site Factory Audit | Physically confirm production capabilities and operational scale | Schedule a third-party inspection via SGS, TÜV, or Bureau Veritas. Assess machinery, workforce, inventory, and QA processes. |

| 3 | Review Production Equipment & Technical Capability | Ensure the supplier can manufacture BQ series pumps to required specs | Request factory tour video, equipment list, and CNC/lathe/machining center details. Confirm in-house machining, heat treatment, and testing facilities. |

| 4 | Evaluate Quality Control Systems | Assess adherence to international standards | Request ISO 9001, CE, or API certifications. Review QC documentation, test reports (e.g., pressure testing logs), and failure rate data. |

| 5 | Request Product-Specific References & Case Studies | Validate experience with BQ high-pressure pumps | Ask for 3–5 client references in target industries (e.g., mining, oil & gas). Contact references directly to assess reliability and after-sales support. |

| 6 | Inspect Sample Units | Verify performance, material quality, and build accuracy | Order pre-production samples. Conduct third-party lab testing for flow rate, pressure tolerance, material composition (e.g., ductile iron, stainless steel), and seal integrity. |

| 7 | Audit Supply Chain & Lead Time Consistency | Ensure on-time delivery and material traceability | Review raw material sourcing (seals, bearings, motors), MOQ flexibility, and historical shipping data. Use ERP system screenshots (if shared) to assess order tracking. |

Section 2: How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “sales” as primary activity | Includes “manufacturing,” “production,” or “machining” in scope |

| Factory Address & Photos | Uses commercial office address; factory images are generic or stock photos | Provides industrial zone address; photos show CNC machines, assembly lines, and raw material storage |

| Production Equipment Ownership | Cannot provide equipment list or maintenance records | Can present equipment invoices, CNC machine tags, and maintenance logs |

| Staff Expertise | Sales reps discuss pricing and delivery only | Engineers and QA managers can discuss design tolerances, material specs, and testing protocols |

| Pricing Structure | Quotes with minimal cost breakdown; prices often higher due to markup | Provides detailed BOM (Bill of Materials), labor, and overhead cost analysis |

| Customization Capability | Limited to minor labeling or packaging changes | Offers OEM/ODM services, design modifications, and material substitutions |

| Response Time to Technical Queries | Delayed or vague answers to technical questions | Prompt, detailed responses from engineering team |

Pro Tip: Ask for a live video call with the production floor. A factory will readily connect you to the workshop; a trading company may avoid or delay this request.

Section 3: Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High likelihood of being a trading company or operating from a shared facility | Disqualify unless third-party inspection is accepted |

| No ISO or industry-specific certifications | Poor quality control; non-compliance with safety standards | Require certification or use third-party QC at shipment |

| Inconsistent communication (e.g., multiple languages, time zone gaps) | Possible middlemen or outsourced operations | Verify direct contact with plant manager or owner |

| Prices significantly below market average | Risk of substandard materials, counterfeit parts, or hidden fees | Conduct material verification and sample testing |

| Refusal to provide equipment list or production timeline | Lack of transparency; potential over-reliance on subcontractors | Request production schedule and machine utilization report |

| No experience with BQ series pumps | Inadequate technical expertise for high-pressure applications | Require proven track record with similar pump types (e.g., triplex plunger, positive displacement) |

| Pressure for large upfront payments (>30%) | Cash flow issues or scam risk | Use secure payment methods (e.g., LC at sight, Escrow) and cap deposit at 30% |

Section 4: Best Practices for 2026 Sourcing Strategy

-

Leverage Digital Verification Tools:

Use platforms like SourcifyChina Verify™, Alibaba Trade Assurance, and Panjiva to cross-check shipment history and export records. -

Build Long-Term Partnerships:

Prioritize suppliers open to annual contracts, VMI (Vendor Managed Inventory), and continuous improvement programs. -

Diversify Supplier Base:

Qualify at least 2–3 pre-vetted suppliers to mitigate geopolitical, logistical, or quality risks. -

Implement Tiered Audit System:

- Tier 1: Document review

- Tier 2: Remote video audit

-

Tier 3: On-site inspection (every 12–18 months)

-

Use Smart Contracts for Payments:

Integrate blockchain-based milestones (e.g., deposit, pre-shipment, post-inspection) to ensure accountability.

Conclusion

Sourcing BQ high-pressure pumps from China in 2026 demands a structured, evidence-based approach. Differentiating between trading companies and genuine manufacturers is critical to ensuring product integrity, cost efficiency, and supply chain resilience. By following the verification steps and avoiding common red flags, procurement managers can secure reliable, high-performance suppliers aligned with global quality standards.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: High-Pressure Pump Procurement in China | 2026 Executive Summary

Prepared Exclusively for Global Procurement Leadership

Date: January 15, 2026 | Report ID: SC-HP-2026-001

Executive Insight: The Critical Gap in High-Pressure Pump Sourcing

Global procurement teams face escalating risks in China-sourced industrial components: 42% of high-pressure pump orders (2025 SourcifyChina audit) encountered critical verification failures—including counterfeit certifications, unverified production capacity, and non-compliant safety testing. For “China BQ (Brand-Quality) High-Pressure Pump Suppliers,” unvetted sourcing channels consume 178+ hours/year per category in supplier qualification, delaying production by 6–11 weeks.

Why SourcifyChina’s Verified Pro List Eliminates 90% of Sourcing Risk

Our AI-validated supplier ecosystem (updated Q1 2026) resolves the core inefficiencies in high-pressure pump procurement through:

Table 1: Time & Risk Savings vs. Traditional Sourcing Methods

| Activity | Standard Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting (per supplier) | 32–45 hours | 0 hours (pre-verified) | 32–45 hrs |

| Factory Audit Coordination | 18–25 days | Pre-audited facilities | 18–25 days |

| Certification Validation | 9–14 days | Real-time digital ledger | 9–14 days |

| Production Capacity Verification | 11–17 days | IoT-monitored data | 11–17 days |

| Total per Project | 200+ hours | <22 hours | 178+ hours |

Table 2: Risk Mitigation Advantages for BQ High-Pressure Pumps

| Risk Factor | Industry Standard | SourcifyChina Pro List |

|---|---|---|

| Safety Certification Fraud | 31% failure rate (2025) | 0% (Blockchain-verified ISO 4414) |

| Minimum Order Quantity (MOQ) | Hidden post-quote changes | Contractually locked |

| Production Delays | 68% projects affected | <8% (Live capacity tracking) |

| After-Sales Liability | Unclear terms | 100% compliance with CE/ANSI |

The SourcifyChina Advantage: Precision-Engineered for Industrial Procurement

Our Pro List for China BQ High-Pressure Pump Suppliers delivers:

✅ Triple-Layer Verification: On-site audits, export documentation forensics, and real-time production capacity IoT checks.

✅ BQ Compliance Guarantee: Suppliers pre-qualified for Brand-Quality standards (certified materials, 100% traceable components, pressure-tested batches).

✅ Zero-Risk Onboarding: Dedicated sourcing engineer for RFQ optimization, payment security, and logistics coordination.

“SourcifyChina’s Pro List cut our pump sourcing cycle from 14 weeks to 9 days. Zero quality deviations in 18 months.”

— Procurement Director, Fortune 500 Industrial Equipment Manufacturer (2025 Client Case Study)

Call to Action: Secure Your 2026 Supply Chain in <48 Hours

Stop risking production halts, compliance fines, and hidden costs. The 2026 SourcifyChina Pro List for China BQ High-Pressure Pump Suppliers is your only verified pathway to:

– Guaranteed on-time delivery (99.2% fulfillment rate, 2025)

– 30% lower TCO vs. unvetted sourcing (including quality rework savings)

– Full audit trail for ESG/safety compliance

👉 Take Action Now:

1. Email: Contact [email protected] with subject line “BQ Pump Pro List 2026 – [Your Company Name]” for instant access to vetted supplier dossiers.

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 response within 2 hours).

Your 2026 procurement resilience starts with one verified connection.

Do not gamble with unverified suppliers. SourcifyChina delivers certainty.

SourcifyChina | Industrial Sourcing Intelligence Since 2012

Trusted by 1,200+ Global Manufacturers | 94% Client Retention Rate (2025)

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

Report Disclaimer: Data derived from SourcifyChina’s 2025 Client Performance Dashboard (n=387 procurement teams). “BQ” denotes Brand-Quality certified suppliers meeting OEM-grade specifications.

🧮 Landed Cost Calculator

Estimate your total import cost from China.