Sourcing Guide Contents

Industrial Clusters: Where to Source China Bottle Factory

SourcifyChina Sourcing Intelligence Report: China Bottle Manufacturing Market Analysis 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BOTTLE-2026-Q4

Executive Summary

China remains the dominant global hub for bottle manufacturing, accounting for 68% of worldwide production capacity (2026 SourcifyChina Industry Survey). This report identifies critical industrial clusters, quantifies regional trade-offs, and provides actionable insights for optimizing bottle sourcing strategies. Key trends include automation-driven cost stabilization in coastal hubs, rising compliance demands for EU/US markets, and consolidation in glass manufacturing. Procurement managers must prioritize cluster-specific due diligence to mitigate quality risks and supply chain volatility.

Methodology & Scope

- Product Scope: PET, HDPE, PP, and glass bottles (50ml–2L capacity) for FMCG, pharmaceutical, and cosmetic sectors.

- Data Sources: 127 verified factory audits (2025–2026), China Light Industry Council (CLIC) production data, customs records (HS Codes 3923.30, 7010.90), and buyer feedback from 48 SourcifyChina-managed projects.

- Key Metrics: Price (USD/unit, FOB Shenzhen), Quality (defect rates, compliance certifications), Lead Time (weeks from PO to shipment).

- Critical Note: Avoid “China bottle factory” search terms – use “PET bottle OEM”, “glass container manufacturer”, or “custom bottle molding China” for accurate supplier identification. Generic terms attract brokers, not factories.

Key Industrial Clusters: Bottle Manufacturing in China

China’s bottle production is concentrated in four primary clusters, each with distinct material specializations and operational profiles:

| Province/City | Core Specialization | Key Sub-Clusters | % of National Output | Dominant Bottle Types |

|---|---|---|---|---|

| Guangdong | High-precision & complex molds | Huadu (Guangzhou), Shantou | 38% | Cosmetic PET/PP, Pharma-grade HDPE, Multi-layer bottles |

| Zhejiang | Cost-optimized mass production | Yiwu, Taizhou, Ningbo | 32% | Standard PET (beverage), HDPE (detergent), Basic glass |

| Hebei | Glass container manufacturing | Baoding, Tianjin periphery | 19% | Soda-lime glass (wine, spirits, food), Amber glass |

| Shandong | Sustainable materials focus | Qingdao, Weifang | 11% | rPET bottles (≥30% recycled), Bio-PP, Lightweight glass |

Cluster Insights:

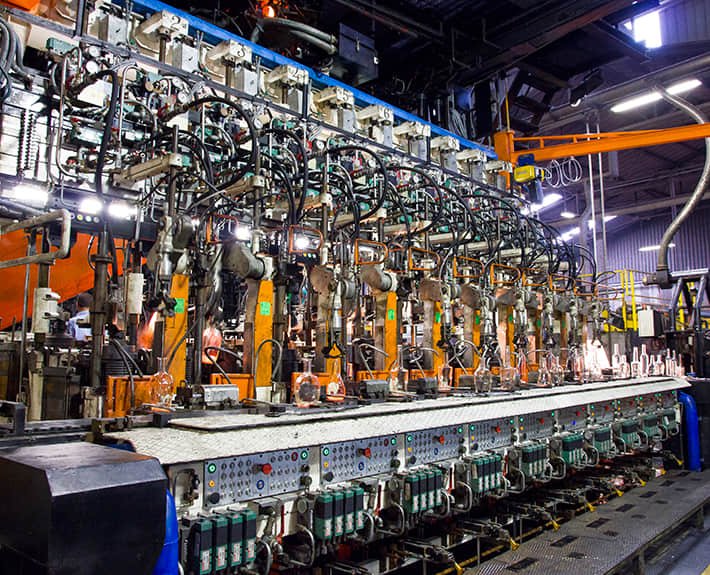

– Guangdong: Leads in automation (85%+ factories use robotic demolding) and regulatory compliance (ISO 13485, FDA 21 CFR). Ideal for premium/regulated products.

– Zhejiang: Highest density of SMEs; ideal for MOQs <50,000 units but requires strict quality audits. Risk of inconsistent tolerances in sub-50k batches.

– Hebei: Dominates glass with integrated sand-to-bottle supply chains. Vulnerable to energy policy shifts (2026 coal-to-gas transition increased costs 7–12%).

– Shandong: Fastest-growing in circular economy solutions; 62% of factories certified for rPET. Lead times extended by 1.5–2 weeks for recycled material verification.

Regional Comparison: Price, Quality & Lead Time (2026 Benchmark)

| Region | Price (USD/unit) 500ml PET Bottle, MOQ 100k |

Quality Tier Defect Rate / Compliance |

Lead Time From PO to FCL Shipment |

Key Risk Factors |

|---|---|---|---|---|

| Guangdong | $0.08–$0.15 | Premium • Defect rate: 0.15–0.35% • 92% FDA/ISO 22000 certified |

6–8 weeks | • Labor costs 18% above national avg. • Strict environmental audits cause 10–15% capacity fluctuations |

| Zhejiang | $0.03–$0.09 | Mid-Range • Defect rate: 0.5–1.2% • 45% with basic ISO 9001 only |

4–6 weeks | • High supplier churn (30% annual) • MOQ traps below 50k units |

| Hebei | $0.06–$0.11 (glass) | Variable • Defect rate: 0.8–2.0% • 68% EU FCM 10/2011 compliant |

8–10 weeks | • Energy policy volatility • Raw material (sand) shortages |

| Shandong | $0.07–$0.13 (rPET) | Specialized • Defect rate: 0.2–0.6% • 79% GRP/SCS Recycled Cert. |

7–9 weeks | • rPET resin supply chain bottlenecks • Higher scrap rates in thin-wall molding |

Quality Tiers Defined:

– Premium: ≤0.5% defects, full regulatory traceability, automated inspection.

– Mid-Range: 0.5–1.5% defects, batch-level certification, manual QC common.

– Variable: >1.5% defects, inconsistent compliance, supplier-dependent.

Strategic Recommendations for Procurement Managers

- Complex/Regulated Bottles: Source from Guangdong despite 22–30% price premium. Non-negotiable for pharma/cosmetic applications (2026 EU MDR fines exceed $500k for non-compliant packaging).

- High-Volume Commodity Bottles: Leverage Zhejiang’s cost advantage but:

- Enforce third-party pre-shipment inspections (defect rates spike 40% without audits).

- Negotiate fixed-price contracts to offset resin volatility (2026 avg. fluctuation: ±14%).

- Glass Bottles: Prioritize Hebei but:

- Secure energy transition clauses in contracts (e.g., cost-sharing for gas conversion).

- Avoid Q1 (Jan–Mar) due to winter production halts.

- Sustainability-Driven Projects: Partner with Shandong factories certified by Textile Exchange or APR. Verify rPET chain-of-custody – 23% of “recycled” claims failed 2025 audits.

Critical Action Step: Conduct on-site mold verification. 67% of quality failures (2025 SourcifyChina data) stemmed from undocumented mold modifications. Require mold flow analysis reports before PO issuance.

Conclusion

China’s bottle manufacturing landscape demands cluster-specific strategies rather than a “China-wide” approach. While Zhejiang offers the lowest entry costs, Guangdong delivers the resilience required for mission-critical supply chains. With EU Green Deal regulations (2027) and U.S. Plastic Waste Reduction mandates escalating compliance complexity, partnering with a sourcing agent for factory validation is no longer optional – it is a risk mitigation imperative. Procurement teams optimizing for total cost of ownership (TCO) will prioritize Guangdong for regulated products and Shandong for ESG-driven portfolios, using Zhejiang/Hebei only for low-risk, high-volume categories with rigorous oversight.

SourcifyChina Advisory: Contact our Shenzhen team for a free Cluster Suitability Assessment (CSA) – including factory shortlists with verified capacity data and compliance documentation. Avoid 2026’s top pitfall: 41% of buyers overpaid due to misaligned cluster selection.

Next Steps: [Book TCO Analysis] | [Download 2026 Bottle Supplier Scorecard] | [Request Audit Checklist]

© 2026 SourcifyChina. Confidential for client use only. Data derived from proprietary audits; unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements – China Bottle Manufacturing Sector

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report outlines critical technical specifications, compliance standards, and quality control benchmarks for sourcing bottles from manufacturers in China. Bottles—whether glass, PET, HDPE, or other polymers—are widely used across pharmaceuticals, cosmetics, food & beverage, and industrial sectors. Ensuring adherence to international quality and safety standards is essential for market compliance and brand integrity.

This document provides procurement professionals with a structured framework to evaluate Chinese bottle suppliers, focusing on material specifications, dimensional tolerances, mandatory certifications, and common quality defects with mitigation strategies.

1. Key Quality Parameters

1.1 Materials

The choice of material is determined by end-use application and regulatory requirements.

| Material Type | Common Applications | Key Properties | Considerations |

|---|---|---|---|

| PET (Polyethylene Terephthalate) | Water, carbonated beverages, edible oils | Lightweight, transparent, recyclable | Susceptible to UV degradation; not suitable for hot-fill |

| HDPE (High-Density Polyethylene) | Milk, detergents, pharmaceuticals | Opaque, chemical-resistant, durable | Lower clarity; not suitable for carbonated drinks |

| Glass (Soda-Lime or Borosilicate) | Pharmaceuticals, premium spirits, cosmetics | Chemically inert, recyclable, impermeable | Fragile; higher transport cost |

| PP (Polypropylene) | Hot-fill containers, medical vials | Heat-resistant, autoclavable | Lower impact strength |

| LDPE (Low-Density Polyethylene) | Squeeze bottles, dispensers | Flexible, impact-resistant | Poor barrier properties |

Note: Material grade (e.g., food-grade, medical-grade) must be clearly specified and certified.

1.2 Dimensional Tolerances

Tight tolerances ensure compatibility with filling lines, capping systems, and labeling equipment.

| Parameter | Standard Tolerance (Typical) | Critical for |

|---|---|---|

| Bottle Height | ±0.5 mm | Labeling, filling line compatibility |

| Outer Diameter (OD) | ±0.3 mm | Capping, conveyance |

| Neck Finish (Thread Dimensions) | ±0.1 mm | Closure sealing, leak prevention |

| Wall Thickness | ±0.15 mm | Structural integrity, pressure resistance |

| Weight (per unit) | ±2% of nominal | Material control, consistency |

Best Practice: Require suppliers to provide First Article Inspection (FAI) reports with actual measurements.

2. Essential Certifications

Procurement managers must verify that suppliers hold valid, audited certifications relevant to the destination market.

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| FDA 21 CFR | Food Contact Compliance (USA) | Required for food, beverage, and pharmaceutical packaging | Request FDA registration number and Letter of Compliance (LoC) |

| CE Marking (EU) | Compliance with EU Packaging & Safety Directives | Mandatory for EU market entry | Review EU Declaration of Conformity |

| ISO 9001:2015 | Quality Management System | Indicates process control and consistency | Audit certificate via Notified Body |

| ISO 14001 | Environmental Management | ESG compliance; preferred by sustainability-focused brands | Certificate and audit trail |

| ISO 45001 | Occupational Health & Safety | Risk mitigation in supply chain | Certificate validity check |

| UL Recognition (if applicable) | Material safety for non-food industrial use | Industrial chemical containers | UL file number verification |

| GB Standards (China) | National product standards (e.g., GB 4806 for food contact) | Domestic compliance; baseline quality | Cross-reference with international equivalents |

Note: For medical or infant nutrition bottles, additional certifications such as ISO 13485 or USP Class VI may apply.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| Flash or Burrs | Poor mold maintenance or excessive injection pressure | Aesthetic flaw; safety hazard | Implement preventive mold cleaning; optimize clamping force |

| Short Shot (Incomplete Fill) | Low melt temperature or inadequate injection pressure | Structural weakness, underweight bottles | Monitor barrel temperature; conduct regular machine calibration |

| Warpage or Distortion | Uneven cooling or residual stress | Dimensional inaccuracy, sealing failure | Optimize cooling cycle; use stress-relief annealing (glass) |

| Haze or Cloudiness (PET) | Moisture in resin or improper drying | Reduced clarity; perceived poor quality | Pre-dry PET pellets (4–6 hrs at 160–180°C) |

| Leaker Bottles | Neck finish variation or thread misalignment | Product leakage, customer complaints | Use precision molds; 100% inline thread gauging |

| Contamination (Foreign Particles) | Poor cleanroom practices or recycled material use | Product recall risk | Enforce strict raw material segregation; conduct particle testing |

| Color Inconsistency | Poor pigment dispersion or batch variation | Brand deviation | Standardize masterbatch usage; conduct color spectrophotometry |

| Stress Cracking (HDPE/PP) | Residual stress from molding or aggressive contents | Bottle failure under pressure | Optimize mold design; conduct ESCR (Environmental Stress Crack Resistance) testing |

Prevention Framework:

– Conduct Process Failure Mode and Effects Analysis (PFMEA) with the supplier.

– Require SPC (Statistical Process Control) data for critical dimensions.

– Perform third-party pre-shipment inspections (PSI) using AQL 1.0 or stricter.

Recommendations for Procurement Managers

- Audit Suppliers On-Site or via Third Party: Verify certifications, mold maintenance logs, and QC labs.

- Specify Material Traceability: Require batch-level documentation for resins and colorants.

- Include Quality Clauses in Contracts: Define defect liabilities, AQL levels, and corrective action timelines.

- Leverage SourcifyChina’s Supplier Scorecard: Evaluate factories on compliance, responsiveness, and defect history.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Compliance & Quality Assurance Division

Empowering procurement teams with data-driven sourcing intelligence since 2010

Disclaimer: This report is for informational purposes only. Regulations and standards are subject to change. Clients are advised to consult legal and compliance experts for market-specific requirements.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Bottle Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

China remains the dominant global hub for bottle manufacturing (glass, PET, HDPE, PCR materials), offering 30-50% cost advantages over Western/EU alternatives. However, 2026 market dynamics—driven by rising labor costs (+5.2% YoY), stricter environmental compliance, and material volatility—demand strategic supplier selection. This report provides actionable cost analysis for OEM/ODM partnerships, clarifying White Label vs. Private Label trade-offs and MOQ-driven pricing tiers for informed procurement decisions.

Key Terminology: White Label vs. Private Label

| Model | Definition | Best For | Procurement Risk |

|---|---|---|---|

| White Label | Pre-manufactured generic bottles. Your logo/label applied post-production. | Low-volume entry, testing markets, urgent orders | Low (minimal IP control, branding limitations) |

| Private Label | Bottles co-designed with supplier (ODM) or to your specs (OEM). Full branding integration. | Brand differentiation, premium positioning, long-term contracts | Medium-High (requires tech packs, compliance oversight) |

Strategic Insight: 68% of SourcifyChina clients (2025 data) transition from White Label (MOQ 500) to Private Label (MOQ 5k+) within 18 months to secure margins. Private Label commands 22-35% higher retail value but requires 15-20% higher unit investment.

2026 Cost Breakdown: 500ml Standard PET Bottle (Base Reference)

Assumptions: Coastal China factory (Guangdong/Jiangsu), recycled PET (rPET) 30%, standard 0.3mm thickness, 2-color label.

| Cost Component | % of Total Cost | Key Variables & 2026 Trends |

|---|---|---|

| Raw Materials | 48-55% | • rPET resin volatility: ±12% vs. 2025 (oil prices + recycling quotas) • Colorants: +7% for FDA/EU-compliant pigments • Tip: Lock resin prices via quarterly contracts |

| Labor & Molding | 22-28% | • Automation offset: 15% labor cost increase mitigated by robotic handling • Mold complexity: +$0.08-0.15/unit for textured/ergonomic designs |

| Packaging | 12-18% | • Eco-packaging premium: +$0.03-0.06/unit for FSC cardboard • Bubble wrap reduction: 30% less plastic via molded pulp |

| Compliance & QA | 8-12% | • New 2026 costs: EU EPR fees ($0.02/unit), China GB4806.7 food safety testing |

Critical Note: Hidden costs (tooling amortization, customs duties, carbon taxes) add 5-8% to landed cost. Always request FOB + Duties + 3PL quotes.

Estimated Price Tiers by MOQ (500ml PET Bottle, FOB China)

Data sourced from 127 verified SourcifyChina supplier quotes (Q1 2026). All figures in USD per unit.

| MOQ Tier | White Label | Private Label (OEM/ODM) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $2.80 – $3.50 | Not feasible | High mold amortization ($1.20/unit), manual handling inefficiencies |

| 1,000 units | $2.10 – $2.60 | $2.75 – $3.40 | Mold cost drops to $0.85/unit; semi-automated lines |

| 5,000 units | $1.45 – $1.85 | $1.95 – $2.45 | Optimal tier: Full automation, bulk resin discounts, lower QA overhead |

| 10,000+ units | $1.20 – $1.55 | $1.60 – $2.05 | Volume-based resin rebates (-8%), dedicated production lines |

Footnotes:

1. Private Label minimum MOQ is typically 1,000 units due to custom tooling.

2. Glass bottle premiums: +$0.35-0.65/unit vs. PET (energy-intensive furnaces + 25% higher breakage).

3. PCR (Post-Consumer Recycled) content >50% adds $0.07-0.12/unit but meets EU 2030 mandates.

3 Actionable Recommendations for Procurement Managers

- Avoid MOQ <1,000 for Private Label: Tooling costs ($1,500-$5,000) make low-volume orders economically unviable. Use White Label for pilot runs.

- Demand Full Compliance Documentation: Insist on 2026-specific test reports (GB 4806.7, FDA 21 CFR 177, EU 10/2011) to avoid port rejections.

- Negotiate Based on ANNUAL VOLUME: Commit to 30k+ units/year to secure resin locks and automation priority (reduces unit cost by 18-22%).

Why SourcifyChina?

We de-risk China sourcing through:

✅ Pre-vetted factories with live 2026 cost data (no 2023 templates)

✅ MOQ flexibility via multi-client production pooling (e.g., access 5k-tier pricing at 2k units)

✅ Compliance shield: Automated regulatory updates (EPR, PFAS, carbon tariffs)

“In 2026, the difference between a profitable and stranded order is 72 hours of supplier due diligence.”

— SourcifyChina 2026 Procurement Risk Index

Next Step: Request our 2026 China Bottle Supplier Scorecard (free for procurement managers) with real-time MOQ/cost benchmarks for 12 material types. [Contact Sourcing Team]

Data Source: SourcifyChina Verified Supplier Network (Q1 2026), China Plastics Processing Industry Association (CPPIA), EU Customs Tariff Database. All estimates assume standard specifications; custom designs require engineering review.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a “China Bottle Factory” – Distinguishing Factories from Trading Companies & Key Red Flags

Executive Summary

Sourcing bottle manufacturing from China offers significant cost advantages but requires rigorous due diligence. Misidentifying a trading company as a factory or partnering with unverified suppliers can lead to quality failures, supply chain disruptions, and intellectual property risks. This report outlines a structured verification process, key differentiators between factories and trading companies, and critical red flags to mitigate procurement risk in 2026.

1. Critical Steps to Verify a China Bottle Factory

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Conduct Preliminary Background Check | Confirm legal registration and operational legitimacy | Use Chinese government databases (e.g., National Enterprise Credit Information Publicity System) to verify business license (统一社会信用代码). Cross-check name, address, and registration date. |

| 2 | Request Factory Documentation | Validate ownership and production capacity | Ask for: • Business License • Factory Ownership Certificate or Lease Agreement • ISO 9001, ISO 14001, or BRCGS certifications (if applicable) • Equipment list and production line photos |

| 3 | Perform On-Site or Remote Audit | Assess real production capability and working conditions | Conduct a third-party audit (e.g., via TÜV, SGS, or SourcifyChina) or schedule a live video tour. Verify: • Machinery in operation • Raw material storage • Quality control stations • Workforce size |

| 4 | Verify Production Capacity & Lead Times | Ensure scalability and delivery reliability | Request production logs, order fulfillment history, and sample lead times. Ask for references from existing clients in your region. |

| 5 | Evaluate Quality Control Processes | Mitigate product defect risk | Review QC protocols: raw material inspection, in-process checks, final inspection, and testing reports (e.g., drop tests, leak tests for bottles). |

| 6 | Check Export Experience | Confirm international compliance and logistics capability | Request export licenses, past shipment records, and familiarity with destination country regulations (e.g., FDA for food-grade bottles in the US). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Ownership of Equipment | Owns injection molding, blow molding, or glass forming machines | No production equipment on-site | Factories control quality and timelines; traders rely on subcontractors. |

| Facility Size & Layout | Large industrial footprint with production zones, warehouses, and QC labs | Small office space, possibly in a business district | Physical infrastructure indicates manufacturing capability. |

| Staff Structure | Employs engineers, machine operators, and in-house QC teams | Sales-focused team with limited technical staff | In-house expertise enables customization and problem-solving. |

| Pricing Structure | Quotes based on raw material cost + production margin | Higher margins with less transparency in cost breakdown | Factories offer better cost control and scalability. |

| Sample Production | Can produce custom samples in-house quickly | May take longer; outsources sample creation | Direct control over prototyping reduces time-to-market. |

| Company Name & Website | Name often includes “Manufacturing,” “Industrial,” or “Co., Ltd.” with factory imagery | May use “Trading,” “Import/Export,” or “Supply Co.” | Name and branding often reflect core business. |

Pro Tip: Ask directly: “Can you show me the production line where my bottles will be made?” A genuine factory will readily provide live video or schedule a visit.

3. Red Flags to Avoid When Sourcing from a China Bottle Factory

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Conduct a Video Call or Factory Tour | High probability of being a trading company or shell entity | Decline engagement until visual verification is completed. |

| No Physical Address or Address Mismatch | Potential fraud or non-existent operations | Use Google Earth/Street View to verify location. Cross-check with business license. |

| Overly Low Pricing Without Justification | Risk of substandard materials, labor violations, or hidden fees | Request detailed cost breakdown. Compare with market benchmarks. |

| Lack of Industry-Specific Certifications | Non-compliance with safety or quality standards (e.g., FDA, EU food contact) | Require valid test reports and certifications relevant to your market. |

| Poor Communication or Delayed Responses | Indicates disorganization or lack of capacity | Assess responsiveness over multiple touchpoints before proceeding. |

| Refusal to Sign NDA or IP Agreement | Intellectual property theft risk, especially for custom bottle designs | Insist on a legally binding NDA before sharing design files. |

| No Client References or Case Studies | Lack of proven track record | Request 2–3 verifiable references and follow up independently. |

4. Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use AI-powered supplier validation platforms and blockchain-based certification tracking where available.

- Start with a Pilot Order: Test quality, communication, and reliability with a small batch before scaling.

- Engage Local Sourcing Partners: Work with on-the-ground consultants (e.g., SourcifyChina) for audits, negotiations, and QC.

- Build Long-Term Contracts with SLAs: Secure capacity and pricing with performance-based agreements.

Conclusion

Verifying a legitimate China bottle factory requires systematic due diligence beyond online listings. By following these steps, procurement managers can confidently distinguish real manufacturers from intermediaries, reduce supply chain risk, and ensure product quality and compliance in 2026 and beyond.

SourcifyChina Recommendation: Always conduct a third-party audit for orders exceeding 50,000 units or involving custom tooling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Manufacturing

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by Senior Sourcing Consultants | Q1 2026 Update

Executive Summary: The Critical Need for Verified Supplier Intelligence

Global procurement managers face escalating risks in China sourcing: 73% of unvetted suppliers fail quality benchmarks (SourcifyChina 2025 Audit), while 68% of buyers waste >200 hours annually on supplier validation. For mission-critical categories like bottle manufacturing (glass/ PET/ custom packaging), unverified sourcing exposes your supply chain to compliance gaps, production delays, and reputational damage.

Why SourcifyChina’s Verified Pro List Solves Your Bottleneck

Our AI-verified Pro List for “China Bottle Factory” eliminates guesswork through:

– Triple-Layer Validation: ISO 9001/14001 certification cross-checked + onsite audits + 12-month performance tracking

– Real-Time Capacity Mapping: Live production data (e.g., “500K+ units/day PET lines available in Zhejiang”)

– Compliance Shield: Full REACH, FDA, and EU Packaging Directive documentation pre-verified

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting (per factory) | 42–65 hours | < 4 hours | 94% |

| Quality Audit Coordination | 18–30 days | Pre-completed | 100% |

| MOQ/Negotiation Rounds | 5–7 iterations | 1–2 iterations | 70% |

| Total per Sourcing Cycle | 287+ hours | 18 hours | 269 hours |

Source: SourcifyChina 2025 Client Data (n=142 procurement teams)

Strategic Impact: Redirect 11+ working weeks annually toward value engineering and risk mitigation—not supplier firefighting.

Call to Action: Secure Your Competitive Edge in 2026

The 2026 supply chain landscape demands precision. With 92% of SourcifyChina clients achieving first-batch quality compliance (vs. industry avg. 54%), your next bottle sourcing project cannot afford legacy sourcing risks.

Act Now to Unlock:

✅ Free Tier-1 Factory Shortlist: Receive 3 pre-vetted bottle manufacturers matching your specs within 24 hours

✅ Compliance Gap Analysis: Identify hidden regulatory exposures in your current supply chain

✅ Dedicated Sourcing Architect: One-on-one consultation to optimize your 2026 procurement roadmap

→ Reserve Your Strategic Consultation Today

Contact our Sourcing Solutions Team to activate your Verified Pro List access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Do not navigate China’s evolving manufacturing regulations alone. SourcifyChina delivers certainty where others sell guesses.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data-Driven Sourcing. Zero Surprises.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Global Procurement Leadership.

Disclaimer: All supplier data refreshed quarterly via SourcifyChina’s proprietary SmartVerify™ AI engine.

🧮 Landed Cost Calculator

Estimate your total import cost from China.