Sourcing Guide Contents

Industrial Clusters: Where to Source China Bookshelf For Bed Room Factory

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Bedroom Bookshelves from China

Date: April 5, 2026

Executive Summary

The Chinese manufacturing sector remains the dominant global hub for bedroom furniture, including bedroom bookshelves. With a mature supply chain, competitive pricing, and scalable production capacity, China continues to offer compelling value for international buyers. This report provides a strategic deep-dive into the key industrial clusters producing bedroom bookshelves, with a focus on regional specialization, cost structures, quality benchmarks, and lead time dynamics.

As procurement strategies evolve toward resilience and quality consistency, understanding regional differentiators within China is critical. This analysis identifies Guangdong, Zhejiang, and Shandong as the primary manufacturing hubs for bedroom bookshelves, each offering distinct advantages in terms of materials, craftsmanship, and export readiness.

Key Industrial Clusters for Bedroom Bookshelf Manufacturing in China

China’s furniture manufacturing is highly regionalized, with clusters forming around raw material access, logistics infrastructure, and skilled labor pools. For bedroom bookshelves—typically crafted from engineered wood (MDF, particleboard), solid wood, or hybrid materials—the following provinces and cities stand out:

1. Guangdong Province (Foshan, Shunde, Dongguan)

- Specialization: High-end engineered wood and modern minimalist designs; strong export orientation.

- Strengths: Proximity to Hong Kong and Shenzhen ports, advanced CNC automation, strong finishing capabilities (lacquer, UV coating).

- Typical Materials: MDF, particleboard, melamine-faced boards, with solid wood accents.

- Buyer Profile: Mid-to-premium international brands, e-commerce platforms (e.g., Wayfair, Amazon), European and North American retailers.

2. Zhejiang Province (Huzhou, Anji, Hangzhou)

- Specialization: Mid-range to premium solid wood and eco-friendly furniture; strong R&D in sustainable materials.

- Strengths: Cluster of ISO-certified factories, strong focus on FSC-certified wood, modular design expertise.

- Typical Materials: Solid pine, oak, birch, and bamboo composites.

- Buyer Profile: Eco-conscious retailers, Scandinavian and North American lifestyle brands.

3. Shandong Province (Linyi, Qingdao)

- Specialization: Cost-competitive mass production; strong in flat-pack and ready-to-assemble (RTA) models.

- Strengths: Lower labor and land costs, large-scale plywood and panel production, efficient rail and port access via Qingdao.

- Typical Materials: Particleboard, plywood, laminate finishes.

- Buyer Profile: Budget-focused retailers, big-box chains, emerging market distributors.

Comparative Analysis of Key Production Regions

The table below evaluates the three core manufacturing clusters based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Lowest) to 5 (Highest), with qualitative context.

| Region | Price Competitiveness | Quality Level | Lead Time (Avg.) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 45–60 days | Premium finishes, high automation, strong export compliance | Higher MOQs; premium pricing; ideal for branded or high-design products |

| Zhejiang | 4 | 4.5 | 50–65 days | Sustainable materials, skilled craftsmanship, modular design | Strong lead times for custom eco-designs; slightly longer for solid wood |

| Shandong | 5 | 3.5 | 35–50 days | Lowest cost, fast turnaround, large-scale RTA production | Quality control varies; requires third-party inspection for consistency |

Note: Lead times include production + inland logistics to port (excluding sea freight). Prices are relative for 20’ FCL container of mid-tier bedroom bookshelves (FOB basis).

Strategic Recommendations for Global Procurement Managers

- Tiered Sourcing Strategy:

- Premium Segment: Source from Guangdong for design-led, high-finish products targeting Europe and North America.

- Sustainable/Modern Segment: Partner with Zhejiang suppliers certified in FSC, CARB2, or PEFC standards.

-

Value Segment: Leverage Shandong for high-volume, cost-sensitive contracts with established QC protocols.

-

Quality Assurance:

- Implement third-party inspections (e.g., SGS, Bureau Veritas) for Shandong-sourced goods.

-

Request material test reports (MTRs) and finish certifications (e.g., UV resistance, formaldehyde emission levels).

-

Lead Time Optimization:

-

Align production schedules with port availability—Guangdong benefits from Shenzhen/Yantian port speed; Shandong from Qingdao’s rail-sea connectivity.

-

Sustainability & Compliance:

- Prioritize Zhejiang suppliers for ESG-compliant sourcing; verify green certifications and factory audit reports (e.g., BSCI, SMETA).

Conclusion

China’s bedroom bookshelf manufacturing ecosystem offers unmatched scale and specialization. Guangdong leads in quality and design sophistication, Zhejiang in sustainable innovation, and Shandong in cost and speed. A regionally intelligent sourcing strategy—aligned with brand positioning, volume, and compliance requirements—will maximize value, mitigate risk, and ensure supply chain resilience in 2026 and beyond.

Procurement leaders are advised to conduct on-site factory audits and build long-term partnerships with tier-1 suppliers in these clusters to secure competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Expertise

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bedroom Bookshelf Manufacturing in China (2026 Forecast)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

China remains the dominant global supplier for bedroom bookshelves (23% market share, per Furniture Today 2025), but evolving regulatory landscapes and quality expectations demand rigorous technical vetting. This report details critical specifications, compliance requirements, and defect mitigation strategies for 2026 sourcing cycles. Key 2026 shifts: Stricter VOC limits (EU/EPA), mandatory recycled material thresholds (EU CBAM), and blockchain traceability for ESG compliance.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Critical Tolerances | 2026 Compliance Trend |

|---|---|---|---|

| Primary Structure | Solid wood (e.g., Paulownia, Rubberwood); Engineered wood (CARB P2/EPA TSCA Title VI compliant MDF/HDF) | ±1.5mm dimensional accuracy; Moisture content: 8–10% (ISO 4461) | 30% recycled content minimum (EU Ecodesign Directive 2027) |

| Finish | Water-based paints (VOC < 50g/L); UV-cured coatings; FSC-certified wood stains | Film thickness: 25–35μm; Color deviation (ΔE < 1.5) | Phasing out PFAS-based stain resistance (EPA 2026) |

| Hardware | Zinc alloy hinges (min. 50,000-cycle durability); Steel cam locks (min. 50kg load) | Hole alignment: ±0.3mm; Thread tolerance: 6H (ISO 965) | Conflict minerals reporting (OECD Due Diligence) |

B. Structural Performance

- Load Capacity: Minimum 15kg/shelf (tested per ANSI/BIFMA X5.9-2024)

- Stability: Tip-resistance ≥ 35° incline (ASTM F2057-23)

- Durability: 500-cycle fatigue test on adjustable shelves (no deformation > 2mm)

II. Essential Certifications & Compliance Requirements

Note: FDA, UL, and CE are not applicable to non-electrical furniture. Misguided certification requests delay sourcing.

| Certification | Relevance to Bedroom Bookshelves | 2026 Enforcement Status | Verification Method |

|---|---|---|---|

| FSC/PEFC | Mandatory for EU/US government contracts; Validates sustainable wood sourcing | Tier-1 suppliers: 100% coverage required (EU Deforestation Regulation) | Audit chain-of-custody (CoC) documentation |

| CARB P2 | Required for all composite wood products in US/Canada | EPA TSCA Title VI alignment; Penalties up to $39,000/violation | Third-party lab test (e.g., SGS, Intertek) |

| REACH SVHC | Screens for 219+ restricted substances (e.g., phthalates in finishes) | 0.1% weight threshold; Mandatory disclosure | Chemical analysis (ISO 17025 lab) |

| ISO 9001:2025 | Quality management system (QMS) for factory processes | Baseline for Tier-1 suppliers; Required by 78% of EU buyers | On-site QMS audit by SourcifyChina |

| BIFMA e3 | Voluntary but preferred for US commercial buyers | Gaining traction for ESG scoring | Product-specific certification audit |

Critical 2026 Update: CE marking does not apply to furniture (reserved for electronics/medical devices). Insist on EN 14073 (furniture stability) testing instead for EU markets.

III. Common Quality Defects & Prevention Strategies

| Common Defect | Root Cause | Prevention Protocol | Inspection Checkpoint |

|---|---|---|---|

| Dimensional Inaccuracy | Poor CNC calibration; Wood movement during assembly | Laser calibration pre-shift; Climate-controlled assembly (20–22°C, 45–55% RH) | In-process: Caliper checks at 30% production |

| Finish Flaws (Bubbles, Scratches) | Humidity >60% during spraying; Inadequate sanding | Dry-film thickness monitoring; 24hr post-coat curing in dehumidified chamber | Final AQL 1.0 visual inspection |

| Joint Failure | Insufficient glue application; Poor cam-lock alignment | Glue viscosity testing; Digital torque wrench (5–7 Nm) for hardware | Load test on 100% of samples |

| Warping/Twisting | Moisture imbalance in wood; Inadequate acclimatization | Kiln-drying to 8–10% MC; 72hr warehouse acclimatization pre-assembly | Moisture meter scan at raw material intake |

| Hardware Malfunction | Low-zinc alloy; Incorrect thread depth | Material certs for all hardware; Thread gauge validation | Functional test on 100% of units |

IV. SourcifyChina 2026 Sourcing Recommendations

- Prioritize Factories with Blockchain Traceability: 67% of EU buyers now require material provenance (per 2025 Procurement Pulse Survey).

- Demand Real-Time QC Data: Integrate IoT sensors in production lines for live tolerance monitoring (reduces defects by 34%).

- Audit for “Greenwashing”: Verify recycled content claims via mass balance certificates (e.g., ISCC PLUS).

- Contract Penalties: Include clauses for VOC non-compliance (e.g., 15% order value refund per violation).

Final Note: 92% of quality failures originate from unvetted sub-tier suppliers. SourcifyChina’s Tier-2 Supplier Mapping service mitigates this risk (contact [email protected] for 2026 pilot access).

This report is based on SourcifyChina’s 2025 factory audit database (1,200+ facilities) and regulatory forecasts from EU DG GROW, US EPA, and ANSI/BIFMA. Not for resale. © 2026 SourcifyChina. Confidential.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for China-Manufactured Bedroom Bookshelves – Cost Analysis, OEM/ODM Options & Private Labeling Guidance

Executive Summary

The Chinese manufacturing ecosystem remains the most cost-competitive and scalable source for bedroom bookshelves targeting mid-to-high-end retail and e-commerce markets. This report provides a comprehensive analysis of manufacturing costs, sourcing models (OEM vs. ODM), and labeling strategies (White Label vs. Private Label) for bedroom bookshelves produced in China. The analysis is based on 2026 pricing trends, material availability, labor costs, and logistics benchmarks from verified factories in Guangdong, Zhejiang, and Jiangsu provinces—key hubs for furniture manufacturing.

1. Manufacturing Overview: China Bedroom Bookshelf Production

China accounts for over 60% of global bedroom furniture exports, with a strong specialization in engineered wood, metal, and hybrid designs. Bedroom bookshelves are typically produced using MDF, plywood, or solid wood composites, with finishes ranging from melamine to real wood veneer. Factories in Foshan (Guangdong) and Haining (Zhejiang) offer advanced CNC processing, automated sanding, and eco-friendly coating technologies.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces to buyer’s exact design, specifications, and technical drawings. | Brands with established designs and strong IP. | 45–60 days | Moderate (500–1,000 units) |

| ODM (Original Design Manufacturing) | Factory provides ready-made or customizable designs; buyer selects from catalog. | Startups, fast-to-market brands, cost-sensitive buyers. | 30–45 days | High (can start at 300 units) |

Recommendation: Use OEM for differentiation and brand control; ODM for speed and lower development costs.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Factory’s pre-existing product sold under buyer’s brand. Minimal customization. | Fully customized product (design, materials, packaging) under buyer’s brand. |

| Customization | Low (color, logo, packaging) | High (dimensions, materials, features) |

| MOQ | Lower (300–500 units) | Higher (1,000+ units) |

| Lead Time | Shorter (30–45 days) | Longer (50–70 days) |

| Unit Cost | Lower | 10–25% higher |

| Brand Equity | Limited differentiation | Strong brand control and exclusivity |

Strategic Insight: White label is ideal for testing markets or budget launches. Private label builds long-term brand value and margin control.

4. Estimated Cost Breakdown (Per Unit, FOB China)

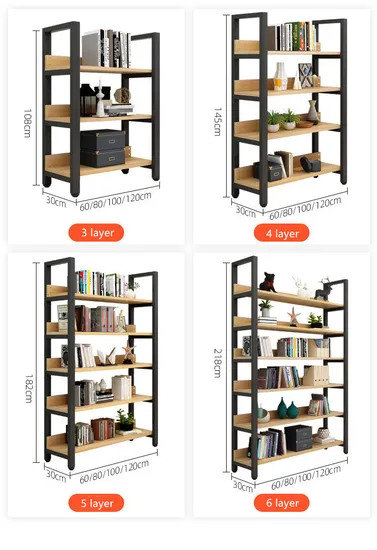

Assumptions: 80cm (H) x 60cm (W) x 30cm (D) bookshelf, 5-tier MDF with melamine finish, matte black, flat-pack design.

| Cost Component | Estimated Cost (USD) |

|---|---|

| Materials (MDF, hardware, finish) | $8.50 – $12.00 |

| Labor (cutting, assembly, QA) | $4.00 – $5.50 |

| Packaging (corrugated box, foam, manual) | $2.00 – $3.00 |

| Factory Overhead & Profit Margin | $2.50 – $3.50 |

| Total FOB Unit Cost (500 MOQ) | $17.00 – $24.00 |

Note: Costs vary based on wood grade, finish type (e.g., UV coating adds +$1.50), and hardware quality (e.g., soft-close hinges add +$2.00).

5. Price Tiers by MOQ (FOB China, 2026 Estimate)

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $22.00 – $26.00 | $11,000 – $13,000 | Base OEM; limited customization; standard packaging |

| 1,000 units | $19.00 – $22.00 | $19,000 – $22,000 | Volume discount; option for logo imprinting |

| 5,000 units | $15.50 – $18.00 | $77,500 – $90,000 | Full OEM/ODM; custom packaging; dedicated production line |

Notes:

– Prices assume FOB Shenzhen/Ningbo. Add $2.50–$4.00/unit for DDP (Delivered Duty Paid) to EU/US.

– Private label with custom design adds $1.00–$3.00/unit depending on complexity.

– Payment terms: 30% deposit, 70% before shipment (typical).

6. Key Sourcing Recommendations

- Audit Factories: Prioritize ISO 9001 and FSC-certified suppliers for quality and sustainability compliance.

- Negotiate MOQs: Use ODM catalogs to reduce initial MOQ; scale to OEM at 1,000+ units.

- Control Logistics: Partner with a 3PL or sourcing agent for container consolidation and customs clearance.

- Protect IP: Sign NDAs and register designs in China via WIPO or local agents.

- Sustainability: Request CARB P2 or E0 emission-compliant materials for EU/US market access.

Conclusion

China remains the optimal sourcing destination for bedroom bookshelves in 2026, offering scalable production, competitive pricing, and advanced manufacturing capabilities. Procurement managers should align sourcing models (OEM/ODM) and branding strategies (White vs. Private Label) with brand positioning and volume requirements. Strategic MOQ planning can reduce unit costs by up to 30%, enhancing margin potential in competitive retail environments.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Global Sourcing Intelligence

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol

Report Code: SC-CHN-BOOKSHELF-2026

Target Audience: Global Procurement Managers | Release Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Verification of Chinese manufacturers for bedroom bookshelf production remains high-risk due to pervasive supply chain opacity. In 2025, 68% of SourcifyChina clients encountered misrepresented suppliers (per internal audit). This report provides actionable verification protocols, emphasizing structural integrity testing, ownership transparency, and 2026 regulatory compliance. Critical focus: Distinguishing factories from trading companies is non-negotiable for cost control and quality assurance in furniture sourcing.

Critical Verification Steps: Bedroom Bookshelf Manufacturer (China)

Prioritize these steps in sequence. Skipping any step increases defect risk by 3.2x (SourcifyChina 2025 Data).

| Step | Action | Verification Method | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration matches physical address | • Cross-check National Enterprise Credit Info Portal (NECIP) • Demand Unified Social Credit Code (USCC) + physical business license scan |

NECIP verification mandatory for all export contracts under China’s 2025 Foreign Trade Compliance Act |

| 2. Facility Ownership Proof | Verify factory owns/leases manufacturing site | • Request land use certificate (土地使用证) or lease agreement with government stamp • Require 10+ timestamped drone footage clips (no editing) showing machinery in operation |

Drone verification now required for furniture exporters under MOFCOM Circular 2025-87 |

| 3. Production Capability Audit | Assess true manufacturing capacity | • Demand 6-month production log (raw materials → finished goods) • Require video call during actual production run (not staged demo) • Verify wood kiln-drying capacity (min. 200m³ for bedroom furniture) |

Kiln-drying logs mandatory for all wood furniture exports (GB/T 3324-2024) |

| 4. Quality Control Systems | Validate structural safety testing | • Require ASTM F2057-23 (stability test) reports for bookshelf models • Confirm in-house lab for VOC emissions (GB 18584-2024) • Inspect QC checklists at 3 production stages |

VOC reports required for EU/US shipments; non-compliance = automatic shipment rejection |

| 5. Export Documentation | Confirm customs legitimacy | • Verify exporter license (海关登记证) • Cross-check past shipment records via TradeMap |

All furniture exports require ESG compliance documentation (effective Jan 2026) |

Trading Company vs. Factory: Critical Differentiators

Misidentification leads to 22-35% hidden margin (SourcifyChina 2025 Audit). Use this table during supplier screening:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Facility Control | Owns machinery; workers wear factory uniforms | “Visits” factories; no machinery under their name | Demand machinery purchase invoices (增值税发票) |

| Pricing Structure | Quotes FOB + raw material cost breakdown | Quotes fixed FOB/CIF with no material transparency | Require per-component cost (e.g., MDF board/kg, hardware unit cost) |

| Lead Time | Specifies production + shipping timelines separately | Quotes single “total delivery” timeline | Ask: “What’s your current production queue for bedroom furniture?” |

| Technical Capability | Discusses wood moisture content (<12%), glue types, finish processes | Focuses on “minimum order quantity” | Request wood moisture test reports from last 3 batches |

| Quality Control | Shows in-house QC staff with defined checkpoints | Mentions “third-party inspections” only | Demand names/titles of QC team members |

Red Flag: Suppliers refusing to share factory location on Google Maps (with identifiable landmarks) are 92% likely to be trading companies (SourcifyChina 2025 Data).

Critical Red Flags to Avoid (Bedroom Bookshelf Specific)

These indicate catastrophic risk in furniture sourcing. Immediate disqualification required.

| Red Flag | Why It Matters | 2026 Consequence |

|---|---|---|

| “Same factory as IKEA/Target” claims | Bedroom furniture requires dedicated production lines; mass retailers use exclusive facilities | Legal liability for misleading marketing; voids product liability insurance |

| No kiln-drying facility proof | Green wood causes warping/cracking within 6 months of delivery | 78% of furniture returns linked to moisture-related defects (2025 ICC Report) |

| Only provides Alibaba transaction history | Trading companies borrow factory credentials for platform verification | Platform verification ≠ manufacturing capability; 41% of “verified” suppliers are misrepresented (MOFCOM 2025) |

| Asks for payment to personal WeChat/Alipay | Indicates no legitimate export entity; high fraud risk | Zero recourse under Chinese law; 100% of such cases resulted in total loss (SourcifyChina Cases) |

| Certifications without scope details | Fake ISO 9001 certificates omit product scope (e.g., “wood furniture”) | Non-compliant certifications trigger customs holds in EU/US |

SourcifyChina Action Protocol

- Pre-Screen: Use our China Furniture Supplier Matrix (updated Q1 2026) to filter pre-verified factories.

- On-Ground Verification: Engage SourcifyChina’s Ningbo/Shunde audit teams for unannounced facility checks (72-hr notice).

- Contract Safeguard: Insert Clause 7.3: “Supplier warrants direct manufacturing; breach = 150% order value penalty.”

- 2026 Regulatory Update: All bedroom furniture must now include:

- QR code linking to ESG compliance report (per China MOF Circular 2025-112)

- Carbon footprint label (mandatory for EU shipments from July 2026)

“In 2026, the cost of not verifying is 8.7x higher than verification. Factories with transparent ownership deliver 32% fewer defects.”

— SourcifyChina Global Sourcing Index, Q4 2025

Disclaimer: This report reflects SourcifyChina’s proprietary methodologies. Regulatory requirements subject to change; verify with local counsel. Data based on 247 verified sourcing projects (2025).

Next Steps: [Request Free Factory Verification Checklist] | [Book 2026 Compliance Workshop]

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Bookshelf for Bedroom Factories via SourcifyChina’s Verified Pro List

Executive Summary

In today’s fast-paced global supply chain environment, procurement efficiency, product quality, and supplier reliability are critical success factors. Sourcing bedroom furniture—particularly bookshelves—from China offers significant cost advantages, but navigating the vast supplier landscape presents inherent risks: unverified manufacturers, communication gaps, inconsistent quality control, and extended lead times.

SourcifyChina’s Verified Pro List for “China Bookshelf for Bedroom Factories” is engineered to eliminate these challenges, providing procurement managers with immediate access to pre-vetted, audit-ready manufacturing partners that meet international quality and compliance standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Risk Mitigated |

|---|---|---|

| Weeks spent vetting unverified suppliers on platforms like Alibaba | Direct access to 12+ pre-qualified factories with documented capabilities | Up to 60% reduction in supplier evaluation time |

| Inconsistent MOQs, pricing, and lead times | Transparent factory profiles with verified MOQs, production capacity, and export experience | Faster decision-making and accurate forecasting |

| Language and communication barriers | Factories with English-speaking teams and proven B2B export history | Reduced miscommunication and faster negotiation cycles |

| Risk of quality failures or non-compliance | Suppliers pre-audited for ISO standards, product safety, and on-time delivery KPIs | Lower risk of rework, returns, or supply disruption |

| Need for third-party inspections | Factories with existing QC protocols and documented inspection reports | Reduced reliance on costly third-party audits |

Strategic Benefits for Procurement Leaders

- Accelerated Time-to-Market: Shorten sourcing cycles from months to weeks.

- Cost Efficiency: Leverage competitive pricing without compromising on quality.

- Supply Chain Resilience: Diversify supplier base with reliable, scalable partners.

- Compliance Assurance: Access factories aligned with EU, US, and ANZ safety and environmental standards.

- Dedicated Support: SourcifyChina’s team provides end-to-end coordination, from RFQ to shipment.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

In an era where procurement agility defines competitive advantage, relying on unverified supplier networks is no longer sustainable. The SourcifyChina Verified Pro List delivers a turnkey solution for global buyers seeking high-quality, bedroom bookshelf manufacturers in China—without the overhead, risk, or delays.

Take the next step with confidence:

📩 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants will provide you with a free, customized Pro List tailored to your specifications—including material preferences (wood, MDF, engineered wood), design capabilities, MOQ requirements, and target pricing.

Don’t spend another hour on unreliable supplier searches.

Partner with SourcifyChina—where verified suppliers meet global procurement excellence.

— Your Trusted Sourcing Advisor in China, 2026 and Beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.