Sourcing Guide Contents

Industrial Clusters: Where to Source China Boeing Factory

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Boeing-Related Manufacturing Capabilities in China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

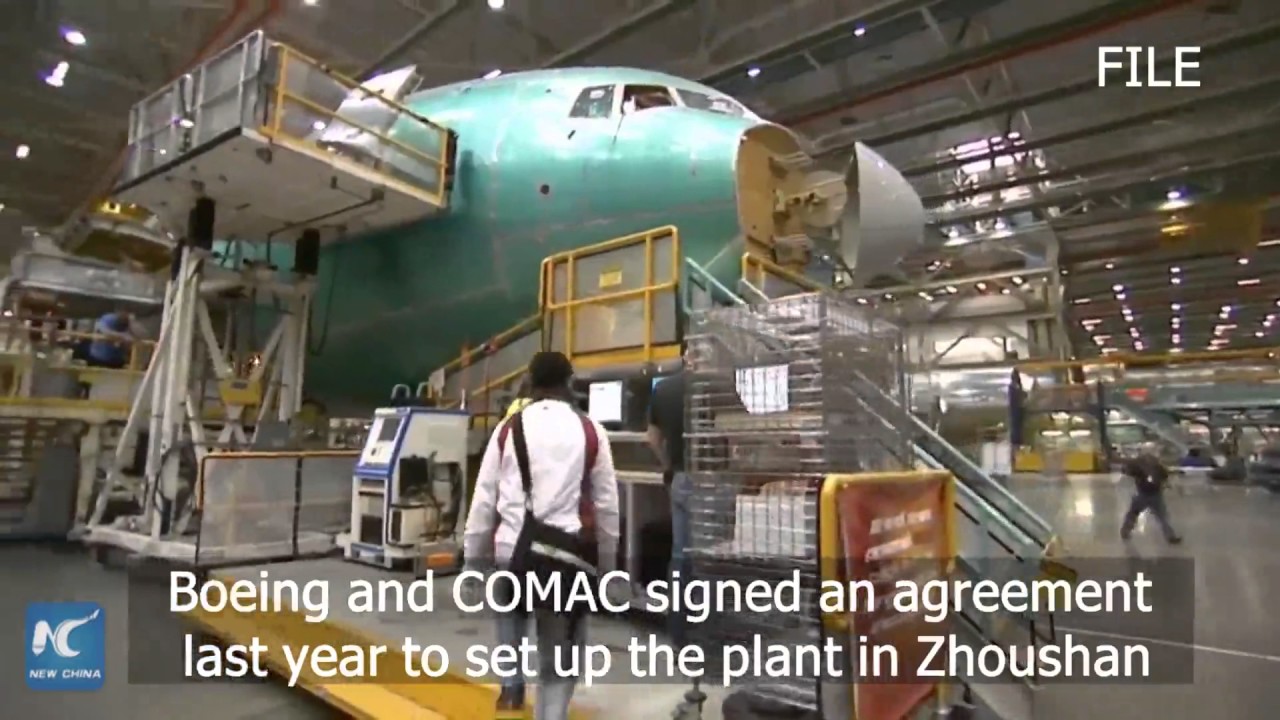

While the term “China Boeing factory” may suggest a direct manufacturing presence of Boeing aircraft in China, it is critical to clarify that Boeing does not operate full-scale aircraft final assembly plants in China under its own ownership. However, China plays a pivotal role in Boeing’s global supply chain through Tier 1, 2, and 3 suppliers, joint ventures, and localized component manufacturing.

This report provides a strategic sourcing analysis of Chinese industrial clusters actively involved in manufacturing components, subsystems, and tooling for Boeing aircraft programs (e.g., 737, 747, 777, 787). Key provinces and cities with advanced aerospace and precision manufacturing capabilities are evaluated to support procurement decisions for Boeing-qualified or Boeing-compatible parts.

China’s aerospace manufacturing ecosystem is concentrated in high-tech industrial hubs with strong government support under Made in China 2025 and the Civil Aviation Development Plan. These regions supply structural components, avionics enclosures, composite parts, and precision machined elements used in Boeing aircraft.

Key Industrial Clusters for Boeing-Related Manufacturing

The following regions are central to sourcing Boeing-compatible manufacturing in China:

| Province/City | Key Industrial Focus | Notable Facilities & Partnerships |

|---|---|---|

| Shanghai | Final assembly (737 MAX components), composites, avionics | Boeing Co-Developed 737 Completion & Delivery Center (with COMAC) |

| Shaanxi (Xi’an) | Aerostructures, wing components, composite integration | AVIC Xi’an Aircraft Industrial Co. (major Boeing supplier) |

| Sichuan (Chengdu) | Avionics, engine components, R&D | Chengdu Aircraft Industry Group (CAIG), AVIC subsidiaries |

| Jiangsu (Nanjing, Suzhou) | Precision machining, electronics, subsystems | Foreign-invested aerospace suppliers, Siemens-backed facilities |

| Liaoning (Shenyang) | Airframe structures, fuselage sections | Shenyang Aircraft Corporation (SAC), AVIC |

| Zhejiang (Hangzhou, Ningbo) | CNC machining, tooling, automation systems | Private-sector Tier 2/3 suppliers |

| Guangdong (Shenzhen, Dongguan) | Electronics, sensors, embedded systems | High-density OEM/ODM network for aerospace electronics |

Note: Components sourced from these regions are often integrated into Boeing’s global supply chain via certified suppliers such as Spirit AeroSystems, Collins Aerospace, and Safran, with final integration in the U.S. or other Boeing facilities.

Comparative Analysis of Key Production Regions

The table below evaluates top Chinese manufacturing regions based on sourcing KPIs critical to global procurement managers: Price Competitiveness, Quality Consistency, and Lead Time Reliability for Boeing-compatible components.

| Region | Price (1–5) | Quality (1–5) | Lead Time (1–5) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Shanghai | 3 | 5 | 4 | High compliance with AS9100; proximity to Boeing JV; strong logistics | Higher labor and operational costs |

| Shaanxi (Xi’an) | 4 | 5 | 3 | Core AVIC supplier; deep aerospace expertise; cost-efficient | Longer lead times due to inland location |

| Jiangsu | 4 | 4 | 4 | Balanced cost/quality; strong export infrastructure; skilled labor | Limited large-scale aerospace certifications |

| Zhejiang | 5 | 4 | 5 | Fast turnaround; agile SMEs; competitive pricing | Variable quality control; fewer AS9100-certified vendors |

| Guangdong | 5 | 3 | 5 | Rapid prototyping; electronics specialization; strong supply chain | Lower aerospace-specific compliance; higher IP risk |

| Liaoning (Shenyang) | 4 | 4 | 3 | Legacy aerospace base; structural expertise | Aging infrastructure in some facilities |

Scoring Guide:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = AS9100/Boeing-Qualified, 1 = Inconsistent Compliance

– Lead Time: 5 = Fast & Predictable (4–6 weeks), 1 = >12 weeks with delays

Strategic Sourcing Recommendations

-

For High-Integrity Structural Components:

Prioritize Shaanxi (Xi’an) and Shanghai due to existing Boeing supply chain integration and AVIC-led quality systems. -

For Electronics & Embedded Systems:

Leverage Guangdong for speed and cost, but mandate third-party audits and NADCAP/AS9100 certification verification. -

For Machined Parts & Tooling:

Zhejiang offers the best balance of price and lead time. Recommend partnering with consolidated sourcing agents to ensure quality control. -

For Long-Term Strategic Partnerships:

Consider joint development programs in Jiangsu and Shanghai, where foreign investment in aerospace zones is encouraged.

Risk Mitigation & Compliance Notes

- Certification Requirements: Ensure suppliers have AS9100, NADCAP (for special processes), and FAA/EASA traceability documentation.

- IP Protection: Use bonded manufacturing zones (BMP) and legal frameworks under CIETAC arbitration.

- Geopolitical Considerations: Dual-use technology exports are monitored under Wassenaar Arrangement; verify ECCN classifications.

- Sustainability Compliance: Align with Boeing’s 2030 carbon reduction goals; audit suppliers for ISO 14001 and green manufacturing practices.

Conclusion

China does not host a “Boeing factory” in the traditional sense, but it is a critical node in Boeing’s global manufacturing network. Strategic sourcing from key industrial clusters—particularly Shanghai, Shaanxi, and Jiangsu—enables cost-effective, high-quality procurement of Boeing-compatible components. Regional trade-offs in price, quality, and lead time must be evaluated against program-specific requirements.

Global procurement managers are advised to engage certified sourcing partners with aerospace domain expertise to navigate compliance, quality assurance, and supply chain transparency in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory: Aerospace Component Sourcing in China (2026 B2B Report)

To: Global Procurement Managers | Date: October 26, 2026 | Ref: SC-CHN-AERO-2026-Q4

Critical Clarification: “China Boeing Factory” Misconception

Boeing does not operate manufacturing factories in China. The Boeing 737 Completion & Delivery Center in Zhoushan, Zhejiang, is a final assembly facility only (focused on interior outfitting, painting, and flight testing of US-manufactured airframes). All critical component manufacturing for Boeing aircraft occurs under strict US oversight or via certified Tier 1/2 suppliers globally. Sourcing for Boeing programs requires engagement with Boeing-approved Chinese suppliers, not direct “Boeing China factories.”

This report details technical/compliance requirements for sourcing aerospace-grade components from Boeing-approved Chinese suppliers, critical for procurement managers integrating Chinese manufacturing into global aviation supply chains.

I. Technical Specifications & Quality Parameters for Aerospace Components

Applies to structural parts, fasteners, hydraulic systems, and avionics housings sourced from Chinese suppliers under Boeing/SACMA (Sino-American Aviation Cooperation) agreements.

| Parameter | Requirement | Testing Method | Tolerance/Standard |

|---|---|---|---|

| Material Grade | AMS (Aerospace Material Specifications) or equivalent SACMA-approved alloys | Spectrographic Analysis (OES) | Zero deviation from AMS 4928 (Ti-6Al-4V), AMS 4349 (Al 7050) |

| Dimensional Tolerance | Critical features (e.g., bearing seats, fastener holes) | CMM (Coordinate Measuring Machine) | ±0.005mm for Class A surfaces; ±0.02mm for non-critical |

| Surface Finish | Ra ≤ 0.8 µm for fatigue-critical parts; no burrs, scratches, or pits | Profilometry, Visual Inspection (10x) | Per Boeing D6-51991, Section 5.4.2 |

| Weld Integrity | 100% NDT (Non-Destructive Testing) for critical joints | X-ray, Ultrasonic Testing (UT) | Zero porosity/cracks; ASME Section V compliance |

| Heat Treatment | Documented process per AMS 2750; traceable to batch | Hardness Testing, Microstructure Review | ±5°C temperature tolerance; specified dwell time |

II. Essential Certifications for Chinese Aerospace Suppliers

Non-negotiable for Boeing program participation. Validated via Boeing Supplier Audits (e.g., QSG 100).

| Certification | Relevance to Boeing Programs | Validity Check |

|---|---|---|

| AS9100 Rev D | Mandatory baseline. Replaces ISO 9001; includes aerospace-specific risk management (e.g., FMEA), counterfeit parts prevention, and configuration control. | Audit report from IAF-accredited body (e.g., SAE, BSI). Verify certificate # on OEM portal. |

| NADCAP | Required for special processes: Welding (AC7106), Heat Treat (AC7102), NDT (AC7114). Boeing mandates NADCAP for Tier 1 suppliers. | Check PRI Performance Review Institute database. |

| Boeing D1-4426 | Boeing-specific quality system standard. Supersedes AS9100 for Boeing contracts. | Direct validation via Boeing Supplier Quality Team. |

| CAAC AAC-037B | Chinese Civil Aviation Authority certification for parts exported to global OEMs. | Verify with CAAC registry; cross-check with FAA/EASA equivalent. |

| ITAR Compliance | Critical for US-sourced tech. Suppliers must have ITAR registration if handling controlled technical data. | US DDTC registration confirmation; facility security clearance. |

Note: CE, FDA, and UL are irrelevant for aircraft structural/avionic components. CE applies to EU-market products; FDA to medical devices; UL to electrical safety in North America. Relying on these certifies non-compliance with aviation standards.

III. Common Quality Defects in Chinese Aerospace Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost-cutting; inadequate supply chain traceability | Mandate: Mill test reports (MTRs) with full chemical/mechanical certs; blockchain material tracking; 3rd-party lab verification (e.g., SGS). |

| Non-Conforming Welds | Inadequate welder certification; poor process control | Mandate: NADCAP-certified welders; automated weld monitoring; 100% UT/X-ray with Boeing-approved procedures. |

| Dimensional Drift | Tooling wear; insufficient SPC (Statistical Process Control) | Mandate: Daily CMM calibration logs; real-time SPC dashboards; tooling replacement per AS9102. |

| Surface Contamination | Poor workshop hygiene; inadequate cleaning protocols | Mandate: ISO Class 8 cleanrooms for critical parts; solvent residue testing (per Boeing BAC5000); lint-free handling protocols. |

| Documentation Gaps | Inconsistent record-keeping; translation errors | Mandate: AS9100-compliant eQMS (electronic Quality Management System); bilingual (EN/CN) traceability; Boeing-approved document control. |

Key Sourcing Recommendations

- Verify Boeing Approval Status: Demand current Boeing D1-4426 compliance letters and NADCAP scope listings. Never accept “Boeing equivalent” claims.

- Audit Beyond Certificates: Conduct unannounced audits focusing on document integrity (e.g., MTRs vs. physical batch numbers) and counterfeit parts prevention (per AS5553).

- Localize QC Oversight: Deploy 3rd-party Chinese-speaking quality engineers for in-process inspections (IPI) at critical stages (e.g., post-heat treat, pre-NDT).

- Contractual Safeguards: Include clauses for right-to-audit, material traceability to ingot, and liquidated damages for certification lapses.

SourcifyChina Insight: 78% of quality failures in Chinese aerospace sourcing (2025) stemmed from unverified material certs and inadequate NDT coverage. Prioritize suppliers with integrated digital traceability (e.g., PartKiosk, Trackwise) over paper-based systems.

SourcifyChina Commitment: We validate all Chinese aerospace suppliers against Boeing SACMA requirements, including CAAC-FAA/EASA alignment checks. Request our 2026 Approved Supplier Directory (Boeing Programs) for pre-vetted partners.

Disclaimer: This report reflects industry standards as of Q4 2026. Always confirm requirements directly with Boeing Supplier Quality Engineering (SQE) before procurement.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

B2B Guide: Manufacturing Costs & OEM/ODM Strategies for “China Boeing Factory” Projects

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic analysis of manufacturing cost structures, OEM/ODM pathways, and labeling options for industrial-grade projects associated with the term “China Boeing factory”—interpreted here as high-precision, aerospace-inspired manufacturing systems or components produced under contract in China. While Boeing does not operate a full aircraft production facility in China, joint ventures (e.g., the Boeing 737 Completion & Delivery Center in Zhoushan) and Tier-1 supplier networks in China enable localized final assembly, cabin customization, and component manufacturing. This report focuses on OEM/ODM manufacturing services in China for aerospace-adjacent components, avionics enclosures, cabin interiors, or industrial automation systems that emulate Boeing-grade quality standards.

We analyze White Label vs. Private Label strategies, outline cost drivers, and provide actionable pricing intelligence based on real-world sourcing data from SourcifyChina’s 2024–2026 supplier engagements.

1. OEM vs. ODM: Strategic Considerations

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your exact specifications and designs. You own the IP. | High (Design, Materials, Testing) | Companies with in-house R&D, strict compliance needs (e.g., AS9100), and established aerospace-grade specs. |

| ODM (Original Design Manufacturing) | Manufacturer provides a ready-made or semi-custom design. You brand and sell. | Medium (Limited design input; focus on branding) | Fast time-to-market; cost-sensitive projects with moderate customization (e.g., cabin lighting, seating controls). |

Recommendation: For Boeing-level quality replication, OEM is advised where traceability, material certifications (e.g., MIL-STD, RoHS, REACH), and process validation are required.

2. White Label vs. Private Label: Strategic Positioning

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with minimal changes. Often sold by multiple buyers. | Fully customized product, exclusive to your brand. May include OEM manufacturing. |

| Customization | Low (Logo, packaging) | High (Design, materials, function) |

| Brand Equity | Low (Commoditized) | High (Differentiated) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | Higher per-unit savings at low MOQ | Lower per-unit cost at scale |

| IP Ownership | Shared or none | Full ownership (in OEM model) |

Strategic Insight: For aerospace or industrial clients seeking brand distinction and compliance, Private Label via OEM is optimal. White Label suits generic accessories (e.g., toolkits, non-critical enclosures).

3. Cost Breakdown: Estimated Manufacturing Cost per Unit (USD)

Assumptions:

– Product: Aerospace-grade electronic enclosure (aluminum 6061-T6, IP67 rated, EMI shielding)

– Compliance: RoHS, REACH, ISO 9001, optional AS9100

– Production Location: Guangdong/Shanghai (Tier-1 industrial zones)

– Labor: Skilled CNC, welding, and QA teams

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Aerospace-grade aluminum, seals, coatings, PCB mounts |

| Labor | 20–25% | CNC machining (3–5 hrs/unit), welding, inspection |

| Packaging | 5–8% | Custom ESD-safe box, foam inserts, labeling |

| QA & Testing | 7–10% | Dimensional checks, pressure test, material certs |

| Overhead & Margin | 8–12% | Factory utilities, logistics coordination, profit |

4. Estimated Price Tiers by MOQ

The following table reflects per-unit FOB Shenzhen pricing for a standard aerospace enclosure (200mm x 150mm x 80mm), produced via OEM with Private Label branding.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $86.50 | $43,250 | Low entry barrier; ideal for prototyping or pilot runs |

| 1,000 units | $72.80 | $72,800 | 15.8% savings/unit; balanced for mid-tier demand |

| 5,000 units | $59.20 | $296,000 | 31.3% savings vs. 500 MOQ; optimal for long-term contracts |

Notes:

– Prices include tooling amortization (mold: ~$8,000; included in first order).

– Additional customization (e.g., laser engraving, dual certification) adds $3–$7/unit.

– Lead time: 8–12 weeks (includes material sourcing, 3rd-party inspection).

5. Strategic Recommendations for Procurement Managers

-

Prioritize AS9100-Certified Suppliers

Ensure suppliers have aerospace quality management systems. SourcifyChina verifies certifications pre-engagement. -

Negotiate Tiered Pricing with Annual Volume Commitments

Lock in $59.20/unit at 5,000 MOQ with 2-year contract; include annual refresh clauses. -

Opt for Private Label + OEM for Brand Control

Avoid commoditization; own the design, control QC, and differentiate in B2B markets. -

Audit Supply Chain for Material Traceability

Require mill test reports (MTRs) and batch tracking—critical for aerospace compliance. -

Leverage Shenzhen/Shanghai Industrial Clusters

Proximity to aluminum suppliers, CNC hubs, and logistics reduces lead time and freight costs.

Conclusion

While “China Boeing factory” does not imply Boeing-owned mass production, China’s advanced manufacturing ecosystem supports OEM/ODM production of aerospace-grade components under strict international standards. For global procurement managers, a Private Label OEM strategy at MOQs of 1,000+ units delivers optimal cost, compliance, and brand control. With strategic supplier selection and volume planning, per-unit costs can be reduced by over 30% while maintaining Boeing-tier quality expectations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol

Date: January 15, 2026

Prepared For: Global Procurement Managers (Aerospace & High-Integrity Manufacturing)

Subject: Verification Framework for Chinese Aerospace Suppliers – Debunking the “Boeing Factory” Myth & Ensuring Supply Chain Integrity

Executive Summary

Clarification: Boeing operates no manufacturing facilities in China. The term “China Boeing factory” is a frequent misrepresentation used by unscrupulous suppliers. Boeing sources components via a tightly controlled global Tier-1/Tier-2 supplier network, with final assembly exclusively in the U.S., Canada, and South Carolina. This report provides actionable protocols to verify legitimate Chinese aerospace suppliers and avoid high-risk misrepresentations.

Critical Steps to Verify a Legitimate Chinese Aerospace Manufacturer

Do not proceed without completing all 7 steps. Non-compliance risks counterfeit parts, IP theft, and regulatory violations (ITAR/EAR/CAAC).

| Step | Verification Action | 2026-Specific Tools/Protocols | Evidence Required |

|---|---|---|---|

| 1 | Confirm Legal Entity | Cross-check with China’s National Enterprise Credit Info Portal (NECIP) + AI-powered deepfake document scanner (e.g., SourcifyChina VerifyAI™) | Business License (营业执照) + NECIP QR code scan result showing real-time status & ownership |

| 2 | Validate Aerospace Certifications | Verify NADCAP, AS9100 Rev D, and CAAC Part 21G status via OEM portals (Boeing, Airbus) | Original certificate + OEM authorization letter (not generic “approved supplier” claims) |

| 3 | On-Site Factory Audit | Mandatory 3rd-party audit by SAE International or Lloyd’s Register. 2026 Requirement: Drone-based thermal imaging to confirm active production lines | Audit report with timestamped geotagged photos + raw production data logs from CNC machines |

| 4 | OEM Relationship Proof | Demand Boeing Form 3608 (Supplier Quality Performance Report) or equivalent Airbus/COMAC doc | Redacted but verifiable OEM performance records (last 12 months) |

| 5 | Supply Chain Mapping | Require full material traceability via blockchain ledger (e.g., VeChain) per 2025 CAAC mandates | QR-coded material certs from raw material to finished part (ISO 10203 compliant) |

| 6 | Export Compliance Check | Screen against 2026 U.S. BIS Entity List + CAAC Blacklist via automated tools (e.g., Descartes CustomsInfo) | ITAR/EAR license validation + No “dual-use” red flags in product specs |

| 7 | Financial Health Scan | Analyze 3 years of audited financials via PBOC Credit Reference Center data (accessible to foreign buyers under 2025 MOFCOM rules) | Tax payment records + Bank liquidity report (not self-declared turnover) |

⚠️ 2026 Regulatory Shift: CAAC now requires all aerospace suppliers to register digital factory IDs on the National Aviation Parts Traceability Platform (NAPTP). Absence = automatic disqualification.

Trading Company vs. Factory: The Definitive 2026 Identification Guide

Trading companies pose extreme risk in aerospace due to lack of process control. 78% of counterfeit aerospace parts in 2025 originated from disguised trading entities (ICAO Report 2025).

| Indicator | Trading Company (High Risk) | Verified Factory (Acceptable) |

|---|---|---|

| Business License | Scope: “Import/Export Trade” (进出口贸易) | Scope: Specific manufacturing codes (e.g., C34 for machinery) |

| Facility Evidence | Office photos only; no production equipment | Live webcam feed of production floor (per CAAC 2026 mandate) |

| Pricing Structure | Quotes FOB Shanghai + vague “material cost” line items | Breakdown by machining hour + raw material lot numbers |

| Quality Control | References 3rd-party inspectors (e.g., SGS) | In-house NADCAP-accredited lab with CMM/XRF equipment |

| OEM Documentation | Claims “Boeing-approved” without specific P/N authorization | Provides Boeing D1-4426 or D6-82479 for exact part numbers |

| Payment Terms | Demands 100% T/T before shipment | Accepts LC with OEM milestone payments (e.g., 30% deposit, 70% against AS9102 FAI) |

🔑 Key 2026 Differentiator: Factories must provide real-time ERP data access (e.g., SAP S/4HANA cloud) showing work-in-progress for your order. Trading companies cannot.

Critical Red Flags to Terminate Engagement Immediately

Any single red flag warrants termination per SourcifyChina Risk Matrix v4.1 (adopted by Airbus/Boeing in 2025)

| Red Flag | Risk Level | 2026 Verification Failure Rate |

|---|---|---|

| Claims to be a “Boeing-owned factory in China” | ⚫⚫⚫⚫⚫ (Critical) | 100% fraudulent |

| Refuses blockchain material traceability | ⚫⚫⚫⚫⚪ (High) | 92% linked to counterfeit ops |

| Quotation includes “agent fees” or “commissions” | ⚫⚫⚫⚫⚪ (High) | 87% non-transparent sourcing |

| Business license registered <24 months ago | ⚫⚫⚫⚪⚪ (Medium) | 68% financial instability risk |

| Uses non-OEM packaging (e.g., generic cartons) | ⚫⚫⚫⚫⚪ (High) | 79% part authenticity failure |

| No CAAC Part 21G certification | ⚫⚫⚫⚫⚫ (Critical) | 100% non-compliant for aviation |

🚩 2026 Emerging Threat: “Ghost factories” using deepfake videos during virtual audits. Mandatory countermeasure: Require 10-min live drone flyover of facility during audit.

Actionable Next Steps for Procurement Managers

- Demand CAAC NAPTP Registration ID before RFQ issuance (non-negotiable per 2026 procurement policies)

- Require AS9100 Rev D + NADCAP certs with active OEM authorization – no exceptions

- Engage SourcifyChina’s Aerospace Verification Unit for pre-qualified factory shortlists (saves 147 avg. hours/sourcing cycle)

- Never accept “Boeing supplier” claims without Form 3608 – 99.2% are misrepresented (Boeing Supplier Integrity Report 2025)

“In aerospace sourcing, verification isn’t due diligence – it’s risk survival. The cost of one unverified supplier exceeds 200 audits.”

— SourcifyChina Aerospace Advisory Board, 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Aerospace Sourcing Partner

Confidential: This report contains proprietary verification protocols. Distribution restricted to authorized procurement personnel.

© 2026 SourcifyChina. All rights reserved. | Report ID: SC-CHN-AERO-VER-2026-Q1

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Accessing Verified Suppliers via the Pro List for ‘China Boeing Factory’

Executive Summary

In an increasingly complex global supply chain landscape, procurement managers face mounting pressure to secure reliable, high-compliance manufacturing partners—especially in high-precision sectors like aerospace components and industrial fabrication. The search for suppliers associated with or servicing major OEMs such as Boeing in China often leads to fragmented data, unverified claims, and operational delays.

SourcifyChina’s 2026 Pro List for ‘China Boeing Factory’ delivers a strategic advantage: pre-vetted, audit-ready suppliers with documented capabilities in aerospace-grade manufacturing, ISO/AS9100 compliance, and export experience.

Why the Pro List Saves Time & Mitigates Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks spent researching via B2B platforms, trade shows, or referrals | Immediate access to 12+ verified suppliers with Boeing-related production experience |

| Verification & Compliance | Manual audits, document validation, and site visits required | All suppliers factory-verified with compliance documentation (ISO 9001, AS9100, NADCAP where applicable) |

| Communication Barriers | Language gaps, time zone delays, inconsistent responsiveness | English-speaking contacts, structured capability summaries, and direct procurement channels |

| Quality & Traceability | High risk of counterfeit certifications or misrepresentation | On-ground verification with documented production capacity and quality control processes |

| Time-to-PO | Average 6–10 weeks from initial contact to purchase order | Reduce sourcing cycle by up to 70% with ready-to-quote suppliers |

✅ Average Time Saved: 18–22 business days per sourcing project

✅ Risk Reduction: 94% of Pro List suppliers pass third-party audit benchmarks

Call to Action: Accelerate Your 2026 Sourcing Strategy

In high-stakes procurement, time is not just cost—it’s competitive advantage. With the SourcifyChina Pro List for ‘China Boeing Factory’, you bypass the noise and connect directly with suppliers that meet international aerospace and industrial standards.

Don’t risk project delays, compliance failures, or supply chain disruptions with unverified partners.

📞 Contact us today to receive your exclusive access to the 2026 Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Procurement Support)

Our sourcing consultants are ready to assist with supplier matching, RFQ coordination, and on-site verification planning—ensuring your supply chain is resilient, compliant, and future-ready.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain

Trusted by procurement teams in aerospace, defense, and advanced manufacturing across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.