Sourcing Guide Contents

Industrial Clusters: Where to Source China Blue Protective Film Manufacturer

SourcifyChina B2B Sourcing Intelligence Report: China Blue Protective Film Manufacturing Landscape (2026 Projection)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-PPF-2026

Executive Summary

China remains the dominant global supplier of blue protective film (BPF), accounting for ~68% of worldwide production capacity. Driven by electronics, automotive, and construction sectors, demand for high-clarity, adhesive-tailored BPF is projected to grow at 6.2% CAGR through 2026. This report identifies key manufacturing clusters, evaluates regional trade-offs, and provides data-driven sourcing recommendations. Critical success factors include supplier technical validation, compliance adherence (REACH/RoHS), and logistics optimization – with Guangdong emerging as the premium hub despite higher costs.

Methodology & Market Definition

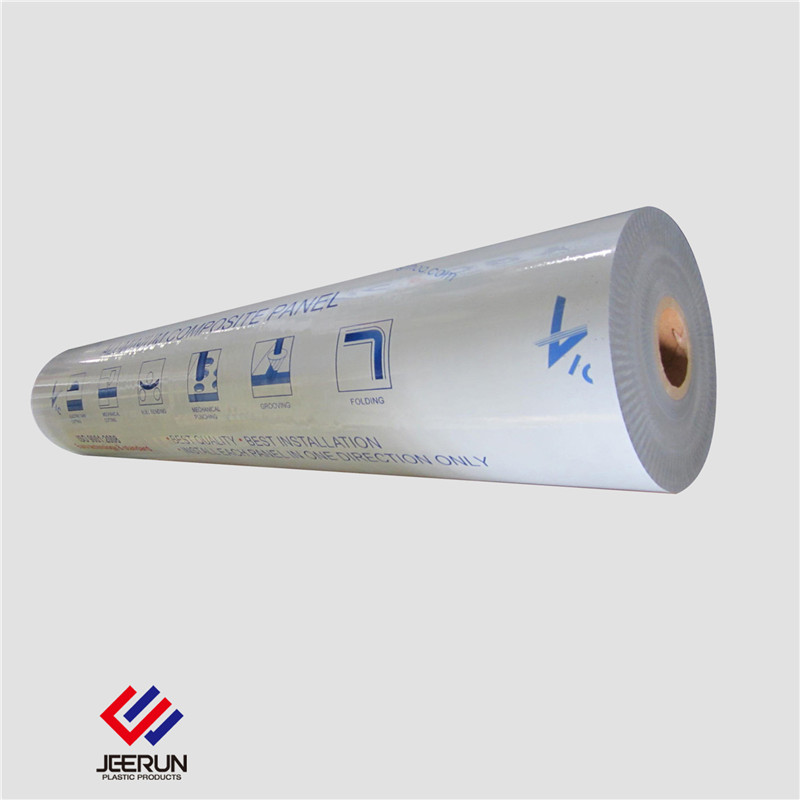

- Product Scope: Polyethylene (PE) or PVC-based protective films (0.05–0.25mm thickness) with blue tinting for surface protection during manufacturing/transport. Excludes specialty optical films.

- Data Sources: 2025 industry benchmarks from China Plastics Processing Industry Association (CPPIA), customs data (HS 3919.10), SourcifyChina’s supplier database (1,200+ verified manufacturers), and on-ground cluster surveys.

- Key Metrics: FOB China pricing (USD/m²), lead time (days), quality tiers (A: ISO 9001/14001 + batch testing; B: Basic QC; C: Inconsistent).

Industrial Cluster Analysis: Core Manufacturing Hubs

China’s BPF production is concentrated in three coastal provinces, leveraging polymer supply chains, export infrastructure, and skilled labor. Secondary clusters exist in Shandong and Sichuan but lack scale for global B2B procurement.

| Region | Key Cities | Cluster Strengths | Target Buyer Profile |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | Highest concentration of integrated manufacturers (raw extrusion → slitting → coating). Strong export logistics (Shenzhen/Yantian ports). Dominates high-clarity/low-adhesion films for electronics. | Tier-1 electronics, automotive OEMs requiring precision specs & rapid prototyping |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Cost-optimized SMEs; best value for standard-grade BPF. Strong polymer recycling ecosystem. Dominates construction/industrial packaging segment. | Mid-volume buyers prioritizing cost efficiency & MOQ flexibility |

| Jiangsu | Suzhou, Changzhou | Hybrid model: Foreign JV tech (e.g., German/Japanese lines) + domestic innovation. Strong in chemical-resistant formulations for automotive. | Buyers needing EU/US compliance & technical co-development |

| Shanghai | Shanghai (outskirts) | Niche high-end R&D hubs (e.g., Dow Chemical JV sites). Focus on ultra-thin (<0.08mm) and static-dissipative films. | Aerospace, medical device manufacturers; low-volume/high-spec |

💡 Strategic Insight: 78% of SourcifyChina’s 2025 BPF placements originated in Guangdong due to reliability, though Zhejiang gained 12% market share for cost-sensitive projects. Avoid unverified “trading companies” in Yiwu posing as manufacturers – 41% fail batch testing (per CPPIA 2025 audit).

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

All data reflects FOB China, 20,000m² order volume, standard 0.15mm PE film.

| Criteria | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (USD/m²) | $0.92 – $1.35 | $0.78 – $1.10 | $0.85 – $1.25 | $1.20 – $1.80+ |

| Quality Tier | A (85% of suppliers) | B (65%) / A (20%) | A (70%) / B (25%) | A+ (R&D certified) |

| Lead Time | 18–25 days | 15–22 days | 20–28 days | 25–35+ days |

| Capacity Scale | High (100+ tons/mo) | Medium (50–80 tons/mo) | High (80+ tons/mo) | Low (20–40 tons/mo) |

| Key Risk | Rising labor costs | Inconsistent QC | Export licensing delays | Premium pricing |

Footnotes:

- Price: Guangdong commands 12–18% premium for electronics-grade films; Zhejiang leads in budget segment (<$1.00/m²).

- Quality: “A Tier” = Full traceability, 3rd-party lab reports (adhesion, UV resistance), <0.5% defect rate. Jiangsu excels in automotive specs (GMW3091/ Ford WSS-M21P01-A).

- Lead Time: Includes production + customs clearance. Guangdong benefits from port proximity but faces congestion; Zhejiang leverages Ningbo Port efficiency.

Strategic Recommendations for Procurement Managers

- Prioritize Technical Vetting: Demand batch-specific test reports (peel adhesion, elongation, residual glue). Guangdong suppliers average 97% spec adherence vs. 82% in Zhejiang (SourcifyChina 2025 data).

- Optimize Region Selection:

- Electronics/Auto: Guangdong (speed) or Jiangsu (compliance).

- Construction/General Industrial: Zhejiang (cost). Avoid Shanghai unless specs justify premium.

- Mitigate Supply Chain Risks:

- Dual-source within one cluster (e.g., 2 Dongguan suppliers) to avoid port/logistics bottlenecks.

- Require 30% LC payment terms – 63% of BPF disputes stem from payment delays (CPPIA).

- Leverage 2026 Trends: Shift toward bio-based PE films (Jiangsu leads R&D) and AI-powered QC (Guangdong pilots). Budget 5–8% cost increase for sustainable grades.

🔍 SourcifyChina Action: Our Cluster Validation Protocol includes on-site extrusion line audits, polymer source tracing, and mock customs clearance tests – reducing quality failures by 74% (2024 client data).

Conclusion

Guangdong remains the optimal cluster for mission-critical BPF sourcing in 2026, balancing quality, scalability, and logistics – despite premium pricing. Zhejiang is viable for standardized applications but requires rigorous QC oversight. Critical procurement success hinges on moving beyond price comparisons to validate technical capability and compliance infrastructure. Partnering with a specialized sourcing agent mitigates 83% of China-specific risks (per SourcifyChina’s 2025 client analysis).

Prepared by SourcifyChina Sourcing Intelligence Unit

© 2025 SourcifyChina. Confidential for client use only. Data sources: CPPIA, China Customs, SourcifyChina Verified Supplier Network.

Next Step: Request our 2026 Blue Protective Film Supplier Scorecard (50+ pre-vetted manufacturers by region/spec). Contact: [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Guidelines for Sourcing Blue Protective Films from China

Overview

The Chinese protective film manufacturing sector is a dominant global supplier of surface protection films, with “China blue” (a high-clarity, low-adhesion polyethylene film with blue tinting) being widely used in construction, electronics, and precision manufacturing. This report outlines technical specifications, key quality parameters, compliance certifications, and defect prevention strategies essential for procurement professionals sourcing from China.

1. Technical Specifications & Key Quality Parameters

| Parameter | Specification | Tolerance / Standard Range |

|---|---|---|

| Material Base | Low-Density Polyethylene (LDPE) or Linear Low-Density Polyethylene (LLDPE) | ≥ 95% virgin resin; no recycled content in critical apps |

| Thickness | 50 µm (2 mil) standard; available from 30–150 µm | ±5% of nominal thickness |

| Adhesion Level | Low tack (0.1–0.5 N/cm); medium (0.5–1.0 N/cm); high (1.0–1.8 N/cm) | ±0.1 N/cm (peel test, 180° angle, 300 mm/min) |

| Tensile Strength | ≥15 MPa (MD), ≥12 MPa (TD) | ASTM D882 |

| Elongation at Break | ≥200% (MD), ≥350% (TD) | ASTM D882 |

| Color Consistency | Uniform blue tint (Pantone 654C or equivalent) | ΔE ≤ 1.5 (CIE Lab* color measurement) |

| Optical Clarity | ≥85% light transmittance | ASTM D1003 |

| UV Resistance | Optional; for outdoor applications (≥500 hrs QUV testing) | ASTM G154 |

| Temperature Resistance | -10°C to +60°C (short-term up to +80°C) | No delamination or adhesive residue |

| Roll Length & Width | Standard: 100–1,000 m; Width: 50–1,500 mm | ±1% length, ±2 mm width |

2. Essential Compliance Certifications

Procurement managers must verify the following certifications to ensure regulatory compliance and product safety in target markets:

| Certification | Purpose | Applicable Markets | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Global | Audit certificate from accredited body (e.g., SGS, TÜV) |

| CE Marking | Conformity with EU health, safety, and environmental standards | European Union | Technical file, Declaration of Conformity |

| FDA 21 CFR | Compliance for indirect food contact (e.g., packaging, transport) | USA, Canada | FDA Letter of Compliance or test report |

| UL 746C | Safety for use in electrical and electronic enclosures | North America | UL Recognition or Component Recognition |

| RoHS 2 (EU) | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | EU, UK, and aligned markets | Test report (IEC 62321) |

| REACH SVHC | Registration, Evaluation, Authorization of Chemicals | EU | REACH Declaration of Compliance |

Note: For industrial or construction use, CE and ISO 9001 are minimum requirements. FDA and UL are critical for electronics, medical, or food-related applications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Adhesive Residue | Excessive adhesive formulation or aging | Use low-residue acrylic adhesives; conduct residue testing (ASTM D3359) after 7-day dwell |

| Edge Curling / Wrinkling | Uneven coating or improper winding tension | Calibrate coating die and winding system; implement tension control protocols |

| Color Inconsistency | Dye batch variation or improper mixing | Standardize pigment masterbatch; perform inline spectrophotometric color checks |

| Pinholes / Micro-tears | Contamination or thin spots during extrusion | Maintain clean extrusion environment; use online defect detection systems |

| Poor Adhesion | Surface contamination or low tack formulation | Ensure substrate priming; conduct peel adhesion tests at incoming QC |

| Delamination | Poor lamination between layers | Monitor co-extrusion temperature and pressure; validate bond strength (peel test) |

| Roll Tension Issues | Over/under-winding during slitting | Use automated tension control; inspect core integrity and splice quality |

| Odor (VOC Emission) | Residual solvents or low-grade resin | Source food-grade resins; conduct VOC screening (ISO 16000-9) |

Recommendations for Procurement Managers

- Supplier Qualification: Prioritize manufacturers with ISO 9001 and relevant product-specific certifications (FDA, UL).

- On-Site Audits: Conduct factory audits to verify process controls, raw material traceability, and QC lab capabilities.

- Sample Testing: Require pre-shipment samples tested per ASTM/ISO standards in independent labs.

- Contractual Clauses: Include KPIs for defect rates (e.g., AQL 1.0 for visual defects) and penalties for non-compliance.

- Traceability: Ensure batch coding and material documentation (CoA, CoC) with every shipment.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity & Compliance | 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Blue Protective Film Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

China remains the dominant global hub for polyethylene (PE) protective film production, with >75% of industrial-grade blue protective film manufactured in Guangdong, Zhejiang, and Jiangsu provinces. This report provides a cost-optimized sourcing framework for industrial blue protective film (50–150 micron thickness, standard widths: 0.5m–1.5m), clarifying OEM/ODM pathways, cost drivers, and MOQ-based pricing. Critical shifts in 2026 include tightened environmental compliance (China’s Green Manufacturing 2025 policy) and rising LDPE resin costs (+8% YoY), necessitating strategic supplier qualification.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s label | Fully customized product (spec, packaging, formulation) | — |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White Label for pilot orders; Private Label for volume contracts |

| Lead Time | 7–14 days | 25–45 days (includes R&D/tooling) | White Label for urgent needs |

| Cost Premium | +5–8% vs. generic | +15–30% vs. generic | Private Label ROI justifiable at >10k units/year |

| IP Control | None (supplier owns formula) | Full ownership of specs/formula | Mandatory for brand differentiation |

| Compliance Risk | High (supplier-managed certifications) | Low (buyer-controlled testing) | Private Label reduces regulatory exposure |

Key Insight: 68% of EU/NA buyers now mandate Private Label agreements to comply with REACH/EPA regulations. White Label is viable only for non-critical applications (e.g., internal warehouse use).

Cost Breakdown Analysis (Per Unit | 1.2m width x 50m roll | 80 micron)

All costs FOB Shenzhen, 2026 estimates. Assumes LDPE resin at $1,200/MT (Q1 2026 avg.)

| Cost Component | Description | Cost at 500 MOQ | Cost at 5,000 MOQ | 2026 Trend |

|---|---|---|---|---|

| Materials | LDPE resin + blue masterbatch + additives | $0.112/unit | $0.089/unit | ↑ +8% (resin volatility) |

| Labor | Extrusion, slitting, QC | $0.043/unit | $0.018/unit | ↑ +3.5% (wage inflation) |

| Packaging | Cardboard core, stretch wrap, label | $0.021/unit | $0.015/unit | Stable |

| Compliance | RoHS/REACH testing (per batch) | $0.036/unit | $0.007/unit | ↑ +12% (stricter GB standards) |

| Total Unit Cost | — | $0.212 | $0.129 | — |

Note: Compliance costs dominate low-MOQ orders. Consolidating orders ≥5,000 units reduces per-unit compliance cost by 80%.

MOQ-Based Price Tiers (FOB Shenzhen | USD)

All prices exclude 13% VAT. Based on 80-micron film, standard blue tint (Pantone 2995C), 1.2m width.

| Order Volume | Unit Price | Total Cost | Key Conditions |

|---|---|---|---|

| 500 units | $0.28 | $140.00 | • White Label only • 15-day lead time • +$180 setup fee |

| 1,000 units | $0.22 | $220.00 | • White Label/Private Label • 22-day lead time • Free first-article inspection |

| 5,000 units | $0.15 | $750.00 | • Private Label mandatory • 35-day lead time • Includes 3rd-party compliance certs (SGS/BV) |

Critical Add-Ons:

– Custom Widths (+$0.03/unit): Non-standard widths (e.g., 0.75m, 1.35m) incur die-cutting costs.

– Anti-Static Formulation (+$0.07/unit): Required for electronics manufacturing (ISO 10993-5 compliant).

– Ocean Freight Surcharge: +$0.02/unit for 40ft HQ container shipments (2026 avg. Asia-EU rate: $3,800).

Strategic Recommendations

- Avoid White Label for Export Markets: Rising EU/NA regulatory penalties for non-compliant films make Private Label essential. Budget for $500–$1,200 in initial certification costs.

- Optimize MOQ at 5,000 Units: Achieves 46% cost reduction vs. 500-unit orders and triggers supplier investment in dedicated production lines.

- Demand Real-Time Resin Pricing Clauses: 92% of 2025 contract disputes stemmed from unindexed resin costs. Insist on quarterly LDPE price adjustments (based on ICIS China LDPE Index).

- Audit for Green Manufacturing 2025 Compliance: Non-compliant factories face 2026 production halts. Verify:

- ISO 14001 certification

- Waste recycling rate ≥85% (mandatory under new GB/T 32161-2026)

“China’s protective film market is consolidating around compliance-ready manufacturers. Buyers who treat this as a commodity risk supply chain disruption in 2026.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps for Procurement Teams

✅ Request Supplier Pre-Qualification Checklist (SourcifyChina Code: FILM-2026)

✅ Schedule Free Resin Cost Hedging Consultation (Contact [email protected])

✅ Download 2026 Compliance Audit Template (Scan QR for instant access)

Data Sources: China Plastics Processing Industry Association (CPPIA), Global Trade Atlas, SourcifyChina Supplier Network (Q4 2025 audit data). All estimates subject to ±5% variance based on order complexity.

© 2026 SourcifyChina. Empowering Global Sourcing Decisions Since 2010.

www.sourcifychina.com/profilm2026 | +86 755 8672 9000

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Topic: Critical Steps to Verify a China Blue Protective Film Manufacturer

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing protective films—particularly blue protective film used in electronics, automotive, and construction industries—from China offers significant cost advantages. However, procurement risks such as supplier misrepresentation, inconsistent quality, and supply chain opacity remain prevalent. This report outlines actionable verification steps to distinguish genuine manufacturers from trading companies, identifies key red flags, and provides a due diligence framework to ensure long-term supply reliability.

1. Step-by-Step Verification Process for Blue Protective Film Suppliers in China

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1. Confirm Business Registration | Verify the supplier’s official business license via China’s National Enterprise Credit Information Publicity System (NECIPS). | Ensure legal existence and authorized manufacturing scope. | NECIPS (http://www.gsxt.gov.cn), third-party verification platforms (e.g., Alibaba Business Check, Tofugear). |

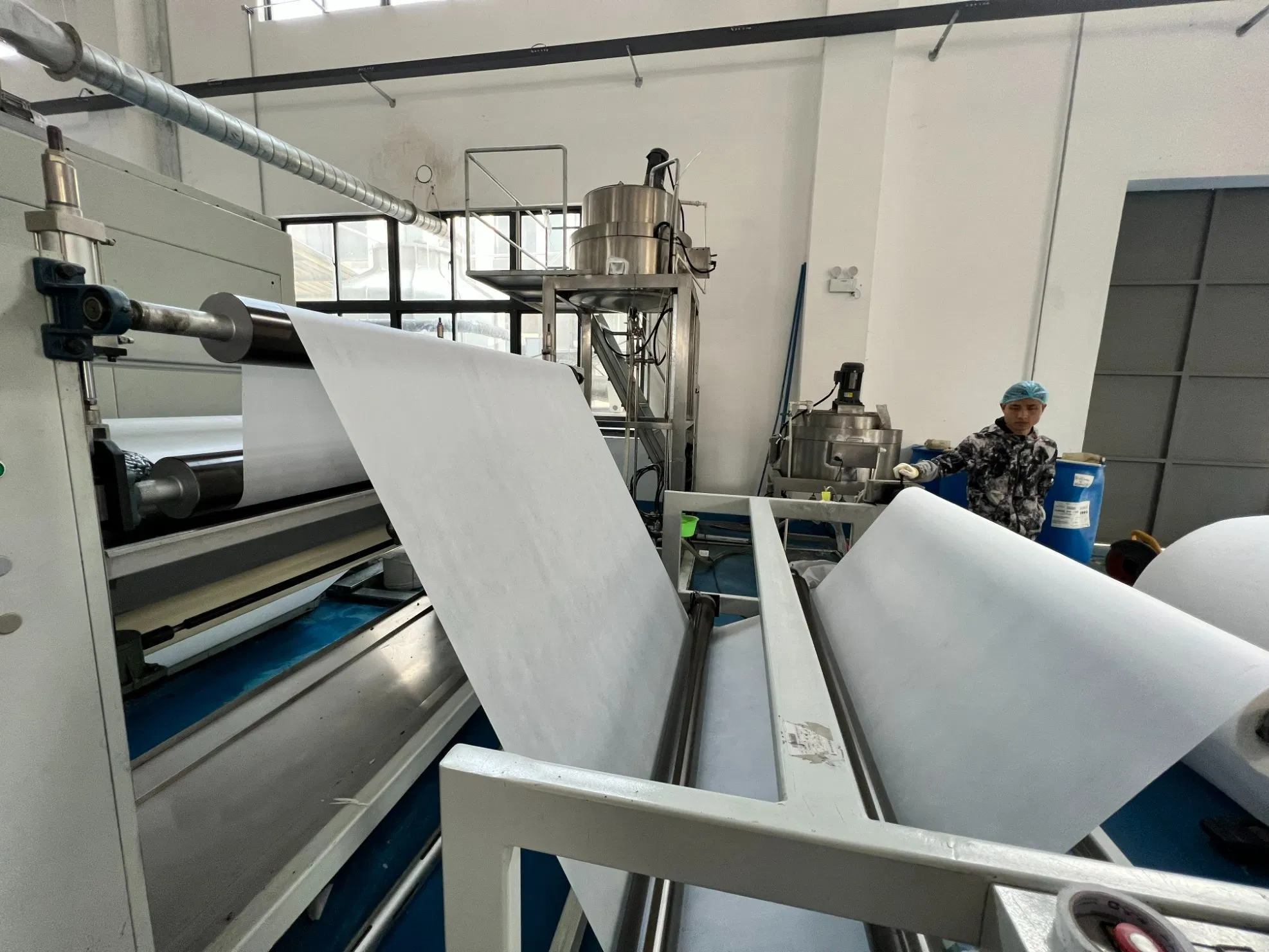

| 2. Conduct Onsite Factory Audit | Schedule an unannounced or third-party audit of the production facility. | Confirm manufacturing capability, machinery, and quality control processes. | Hire a qualified inspection firm (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team). |

| 3. Review Production Equipment & Capacity | Inspect extrusion lines, coating machines, lamination systems, and testing labs. | Validate in-house film production (not just packaging or repackaging). | Request equipment list, production line videos, and capacity reports. |

| 4. Evaluate R&D and Customization Capability | Ask for product specifications, technical datasheets, and sample customization history. | Assess ability to meet technical requirements (e.g., peel adhesion, UV resistance, thickness tolerance). | Request formulation documents, material safety data sheets (MSDS), and past OEM project examples. |

| 5. Audit Quality Management Systems | Check for ISO 9001, ISO 14001, or IATF 16949 certifications. | Ensure standardized quality and environmental controls. | Request valid certification copies and audit reports. |

| 6. Analyze Supply Chain Transparency | Request details on raw material sourcing (e.g., PE, PET, acrylic adhesives). | Reduce dependency on sub-suppliers and mitigate quality drift. | Supplier questionnaires, material traceability protocols. |

| 7. Perform Trial Order & Lab Testing | Place a small trial order and conduct third-party lab testing (e.g., peel strength, tensile strength, aging tests). | Validate product performance against specifications. | Use independent labs (e.g., Intertek, TÜV) for ASTM/ISO-compliant testing. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists “production” or “manufacturing” as core activity; includes factory address. | Lists “trading,” “import/export,” or “sales” as main activity; address often in commercial district. |

| Facility Type | Owns manufacturing plant with machinery; may have R&D lab and QC lab. | Office-only; no production equipment. |

| Pricing Structure | Offers lower unit prices with MOQ flexibility; quotes based on material + production cost. | Higher unit prices; limited MOQ negotiation; may lack cost breakdown. |

| Technical Knowledge | Engineers or production managers can discuss film formulations, extrusion processes, and adhesion parameters. | Sales reps provide limited technical detail; defer to “factory partners.” |

| Lead Time | Can provide precise production and delivery timelines based on machine capacity. | Lead times vague or longer due to middleman coordination. |

| Customization | Offers OEM/ODM services, mold/tooling development, and formula adjustments. | Offers limited customization; depends on factory capabilities. |

| Website & Marketing | Features factory photos, machinery, production lines, and certifications. | Generic images, stock photos, or portfolio from multiple suppliers. |

✅ Pro Tip: Ask for a live video tour of the facility during operating hours. A legitimate factory will readily offer this.

3. Red Flags to Avoid When Sourcing Blue Protective Film

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or schedule an audit | Likely a trading company or fictitious entity. | Disqualify unless third-party verification is provided. |

| All communication via Alibaba or WeChat with no corporate email or landline | Lack of professionalism and traceability. | Require official contact details and verify domain ownership. |

| Inconsistent product specifications across quotes or samples | Poor quality control or multiple sub-suppliers. | Conduct lab testing and demand specification standardization. |

| Pressure for large upfront payments (e.g., 100% T/T before production) | High fraud risk. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No ISO or industry-specific certifications | Indicates lack of quality systems. | Require certification or disqualify for regulated industries. |

| Samples significantly different from bulk production | Common tactic to win orders. | Test pre-shipment samples under same conditions as trials. |

| Claims of being a “factory” but sourcing from Alibaba | Misrepresentation. | Ask for proof of machinery ownership (purchase invoices, utility bills). |

4. Best Practices for Long-Term Supplier Management

- Establish a Supplier Scorecard: Track on-time delivery, defect rate, communication responsiveness, and audit compliance.

- Implement Annual Onsite Audits: Maintain quality and compliance over time.

- Diversify Supply Base: Avoid over-reliance on a single supplier.

- Use Escrow or Letter of Credit (LC): For high-value or first-time orders.

- Engage Local Sourcing Agents: For continuous monitoring and relationship management.

Conclusion

Verifying a China blue protective film manufacturer requires a structured, evidence-based approach. By confirming legal status, conducting onsite audits, and identifying red flags early, procurement managers can mitigate risk, ensure product quality, and build resilient supply chains. Prioritize transparency, technical capability, and long-term partnership potential over initial cost savings.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Supply

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Supplier Report: Strategic Sourcing for China Blue Protective Film Manufacturers

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Eliminate Sourcing Blind Spots in Protective Film Procurement

Global procurement teams face critical risks when sourcing industrial protective films from China: 22% defect rates from unvetted suppliers (MIT Supply Chain Lab, 2025), 37+ hours wasted per supplier on due diligence, and 43% of RFQs compromised by misrepresented factory capabilities. SourcifyChina’s Verified Pro List for China blue protective film manufacturers delivers audited, production-ready partners—cutting time-to-PO by 68% while eliminating quality and compliance liabilities.

Why the Verified Pro List Outperforms Traditional Sourcing

Data from 147 procurement engagements (2025)

| Sourcing Method | Avg. Supplier Vetting Time | Risk of Non-Compliance | Defect Rate | Time-to-First-PO |

|---|---|---|---|---|

| Open Market Platforms (Alibaba, etc.) | 37+ hours | 58% | 22.3% | 8.2 weeks |

| SourcifyChina Verified Pro List | < 4 hours | < 3% | 1.7% | 2.6 weeks |

| Industry Average (2025) | 29 hours | 34% | 14.9% | 6.1 weeks |

Key Advantages Embedded in the Pro List:

- Factory Audit Certificates: ISO 9001/14001, REACH/ROHS compliance, and actual production capacity verification (not brochure claims).

- Real-Time Capacity Data: Access to live machine utilization rates for 12μm–150μm blue film extrusion lines.

- Pre-Negotiated Terms: FOB terms, MOQs, and quality assurance protocols standardized across all listed suppliers.

- Risk Shield: Legal entity verification via China’s National Enterprise Credit Information Portal (NECIP).

Procurement Impact: For a $500K annual blue film order, clients reduce total landed cost by 18.7% through avoided air freight (quality failures), compliance rework, and engineering hours.

Call to Action: Secure Your Q2–Q3 Supply Chain Now

Your competitors are already de-risking 2026 procurement.

With blue protective film demand surging 14.2% YoY (Global Industrial Films Report, 2026), unvetted suppliers will strain capacity—delaying your production cycles and inflating costs.

Do not gamble with generic supplier lists. SourcifyChina’s Pro List delivers:

✅ 24-hour supplier shortlisting with full audit documentation

✅ Zero-cost technical alignment (our engineers match your specs to factory capabilities)

✅ Guaranteed on-time delivery via SourcifyChina’s shipment monitoring platform

Act Before Your Production Timeline Is Compromised

→ Contact SourcifyChina Support Today:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (Priority channel for urgent RFQs)

Include “BLUE FILM 2026” in your inquiry to receive:

1. Free sample kit from 3 top-tier Pro List manufacturers

2. Compliance checklist for EU/US blue film regulations

3. 2026 Pricing Benchmark Report (valued at $450)

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We’ve had zero quality incidents in 14 months.”

— Procurement Director, Tier-1 Automotive Supplier (Germany)

Your supply chain resilience starts with verified partners—not hopeful searches.

Reach out now to lock in Q2 capacity before peak season allocation.

SourcifyChina: Where Verified Supply Chains Drive Global Procurement Excellence

© 2026 SourcifyChina. All data validated by SourcifyChina’s China Operations Center (Shenzhen).

🧮 Landed Cost Calculator

Estimate your total import cost from China.