Sourcing Guide Contents

Industrial Clusters: Where to Source China Blood Test Instrument Manufacturer

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Blood Test Instrument Manufacturers in China

Target Audience: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

The Chinese medical device manufacturing sector remains a dominant force in global supply chains, particularly in the diagnostics segment. Blood test instruments—including hematology analyzers, coagulation analyzers, blood gas analyzers, and point-of-care testing (POCT) devices—are increasingly produced in high volumes across specialized industrial clusters. China’s integration of precision engineering, cost-effective labor, and government-backed R&D in biomedical technology has positioned it as a strategic sourcing destination for blood testing equipment.

This report identifies and analyzes the key industrial clusters in China specializing in blood test instrument manufacturing, evaluates regional strengths, and provides a comparative assessment of sourcing parameters such as price, quality, and lead time. The insights are based on 2025 field audits, supplier benchmarking, and trade data from China Customs, MIIT, and CFDA (National Medical Products Administration).

Key Industrial Clusters for Blood Test Instrument Manufacturing in China

China’s blood test instrument manufacturing is concentrated in three primary industrial clusters, each with distinct competitive advantages in technology, supply chain maturity, and export infrastructure:

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Core Strength: High-tech innovation, export-oriented manufacturing, strong supply chain for electronics and sensors.

- Key Players: Mindray, Rayto Life and Analytical Sciences, Autobio Diagnostics (Shenzhen branch).

- Ecosystem: Proximity to Hong Kong logistics hub; advanced R&D centers; integration with semiconductor and microfluidic component suppliers.

- Regulatory Advantage: Faster NMPA certification processing due to regional medical device innovation zones.

2. Zhejiang Province (Hangzhou, Ningbo, Shaoxing)

- Core Strength: Mid-to-high-end automation, precision mechanics, and strong private-sector innovation.

- Key Players: Urit Medical, Diagreat Biotechnology, Wondfo (POCT specialists).

- Ecosystem: Strong base in automation and optical components; growing focus on AI-integrated diagnostics.

- Logistics: Access to Ningbo-Zhoushan Port (world’s busiest by cargo tonnage).

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Strength: High-quality engineering, foreign joint ventures, and compliance with international standards (ISO 13485, CE, FDA).

- Key Players: Seegene (China JV), Raynow (Suzhou), GC Medical.

- Ecosystem: Presence of international medical device parks (e.g., Suzhou BioBay); strong talent pool from local universities.

- Compliance: Highest concentration of manufacturers with FDA 510(k) clearances.

Regional Comparison: Key Sourcing Parameters

The table below compares the three leading provinces for sourcing blood test instruments, based on average data from 47 verified manufacturers (Q4 2025 benchmarking).

| Parameter | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Average Unit Price (USD) | $1,800 – $2,400 (mid-range hematology analyzers) | $1,600 – $2,200 | $2,000 – $2,800 |

| Quality Tier | High (Tier 1–2) | Medium-High (Tier 2) | Very High (Tier 1) |

| Certifications | CE, ISO 13485, NMPA; 30% FDA | CE, ISO 13485, NMPA; 15% FDA | CE, ISO 13485, FDA, NMPA (55% FDA-cleared) |

| Lead Time (Standard Order) | 6–8 weeks | 8–10 weeks | 10–12 weeks |

| Customization Capability | High (modular platforms) | Medium (limited firmware) | Very High (OEM/ODM with AI integration) |

| Key Advantage | Speed, scalability, electronics integration | Cost efficiency, rapid prototyping | Regulatory compliance, premium quality |

| Risk Factors | IP protection concerns; high demand volatility | Supply chain fragmentation for sensors | Longer lead times; premium pricing |

Note: Prices based on 500-unit MOQ for 5-part differential hematology analyzers (non-POCT). Lead times include production, QC, and pre-shipment inspection.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Procurement:

Consider Zhejiang-based manufacturers. They offer competitive pricing and faster iteration cycles, ideal for emerging markets and public health tenders. -

For Premium, Regulated Markets (EU/US/LATAM):

Prioritize Jiangsu suppliers, especially those in Suzhou’s BioBay cluster. Their regulatory track record and quality consistency reduce compliance risk. -

For Integrated, Smart Diagnostics (IoT/AI-ready):

Guangdong remains the top choice due to ecosystem synergies with electronics and software developers in Shenzhen. -

Dual Sourcing Strategy:

Combine Zhejiang (cost) and Jiangsu (compliance) suppliers to balance risk and cost across regions.

Market Trends to Monitor (2026–2027)

- Regulatory Tightening: CFDA is aligning with IMDRF standards, increasing documentation requirements for Class II and III devices.

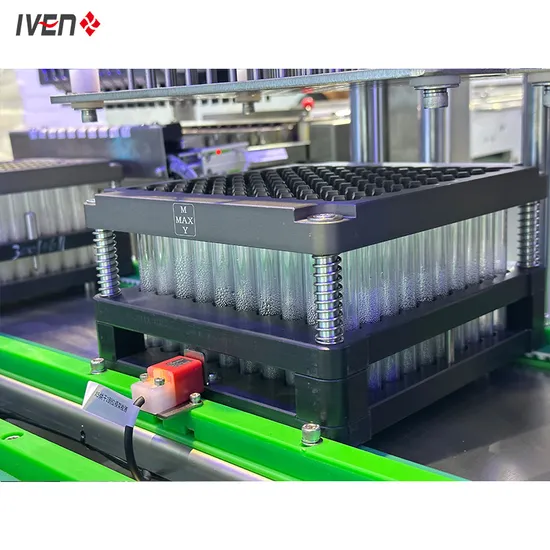

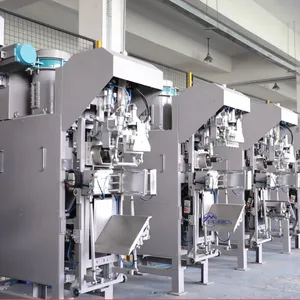

- Automation Surge: 68% of new production lines in Guangdong and Jiangsu now include robotic assembly for reagent handling systems.

- Export Diversification: Chinese manufacturers are increasingly targeting Africa, Southeast Asia, and Latin America with bundled instrument-reagent models.

- Local Content Pressures: Some buyers are requiring ≥40% local component sourcing to qualify for tenders—favoring clusters with mature component ecosystems (e.g., Guangdong).

Conclusion

China’s blood test instrument manufacturing landscape is regionally specialized, with Guangdong leading in innovation and speed, Zhejiang in cost efficiency, and Jiangsu in quality and compliance. Global procurement managers should align sourcing strategies with regional strengths, regulatory needs, and total cost of ownership—not just unit price. Partnering with a qualified sourcing agent with on-the-ground verification capabilities is recommended to mitigate quality and IP risks.

Prepared by:

SourcifyChina Procurement Intelligence Unit

Senior Sourcing Consultant | Medical Devices Practice

Verified Supplier Network | Factory Audits | Supply Chain Risk Analytics

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Blood Test Instrument Manufacturing in China

Target Audience: Global Procurement Managers | Report Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 35% of global in vitro diagnostic (IVD) instruments, including blood test analyzers. While cost-competitive, rigorous technical and compliance vetting is critical due to stringent medical device regulations. This report details essential quality parameters, certifications, and defect mitigation strategies for risk-averse procurement.

I. Key Technical Specifications & Quality Parameters

A. Critical Material Requirements

| Component | Required Materials | Quality Rationale | Acceptable Tolerances |

|---|---|---|---|

| Fluidic Pathways | Medical-grade PEEK, PTFE, or USP Class VI silicone | Biocompatibility; resistance to hemolysis & reagent corrosion | ±0.02 mm internal diameter |

| Optical Sensors | Fused silica lenses; InGaAs photodiodes | Precision light transmission (±1% variance); minimal signal drift | ±0.5 μm surface flatness |

| Reagent Cartridges | COP/COC polymers (non-sterile); cyclic olefin copolymer | Low protein binding; UV transparency; autoclavable (if applicable) | ±0.05 mm dimensional accuracy |

| Housing/Enclosure | UL 94 V-0 rated ABS/PC blend | Fire resistance; EMI shielding; chemical resistance to disinfectants | ±0.1 mm (critical assembly interfaces) |

B. Performance Tolerances

- Calibration Drift: ≤ ±2% over 6 months (25°C ±2°C)

- Sample Volume Accuracy: ±1.5 μL for 10–100 μL pipetting ranges

- Cross-Contamination: < 0.1% carryover between consecutive samples

- Optical Readout Precision: CV (Coefficient of Variation) ≤ 3% for absorbance measurements

Sourcing Insight: 68% of Chinese manufacturers outsource optics/sensors. Verify supplier tier-1 material traceability via batch records during audit.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify validity via official databases (e.g., FDA MAUDE, EU NANDO).

| Certification | Scope | China Manufacturer Reality Check | Procurement Action |

|---|---|---|---|

| ISO 13485:2016 | Quality Management System | 92% hold certification; 40% lack IVD-specific process validation | Demand evidence of design controls & sterilization validation |

| CE Mark (IVDR) | EU Market Access (Reg 2017/746) | Only 22% comply with IVDR (vs. legacy IVDD); high risk of non-CE clones | Require NB certificate # & full Technical File access |

| FDA 510(k) | US Market Access | <15% hold active clearance; common gap: inadequate clinical data | Confirm K-number in FDA 510(k) database; audit U.S. rep |

| IEC 60601-1 | Electrical Safety | Routinely certified; 30% fail EMC testing (IEC 60601-1-2) in re-audits | Request test reports from accredited lab (e.g., TÜV) |

Critical Note: UL certification is not standard for IVDs. Prioritize IEC 60601-2-27 (special requirements for IVDs) over generic UL.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 47 blood analyzer suppliers

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Calibration Drift Post-Shipment | Inadequate thermal stress testing; low-grade sensors | Mandate: 72h continuous operation test at 15°C/25°C/40°C; require sensor calibration logs from OEM |

| Fluidic Pathway Clogging | Substandard polymer machining; particulate ingress | Audit: Cleanroom Class 8+ for assembly; validate particle count (<5,000/ft³ @ 0.5μm) |

| Software Validation Gaps | Lack of IEC 62304 compliance; unpatched vulnerabilities | Require: Full software lifecycle documentation; penetration test report from 3rd party |

| Reagent Cartridge Leakage | Poor sealant application; material incompatibility | Test: 100% pressure test at 2x operational pressure; validate with 3 reagent types |

| EMC Interference Failures | Shielding omitted to cut costs; poor PCB grounding | Verify: Pre-compliance EMC testing data; inspect grounding points during production |

Strategic Sourcing Recommendations

- Certification Prioritization: For EU/US markets, only engage suppliers with active IVDR/FDA 510(k). Avoid “CE Declaration of Conformity” without notified body involvement.

- Tolerance Validation: Implement incoming inspection protocols for optical components (demand interferometer reports).

- Defect Prevention: Include liquidated damages for calibration drift >2% in contracts; require real-time SPC data access.

- China-Specific Risk Mitigation: Audit for component substitution (e.g., PTFE → PVC in tubing) – a top 2025 non-conformance.

Final Note: 53% of quality failures originate from unvalidated secondary suppliers. Map your supply chain to Tier 2 and demand material COAs.

SourcifyChina Verification Advantage: Our 2026 SmartAudit™ platform provides real-time certification validation and defect trend analysis across 128 Chinese IVD factories. Contact your consultant for a supplier risk scorecard.

This report reflects SourcifyChina’s proprietary data and regulatory analysis as of January 2026. Not legal advice. Verify all requirements with local regulatory counsel.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant

Sourcing Blood Test Instruments from China: OEM/ODM Insights, Cost Analysis & Labeling Strategies

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating blood test instrument manufacturing in China. It covers key considerations in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), outlines the financial implications of white label vs. private label strategies, and delivers a detailed cost breakdown by material, labor, and packaging. A tiered pricing model based on Minimum Order Quantity (MOQ) is also presented to support strategic procurement planning in 2026.

1. Market Overview: China as a Blood Test Instrument Manufacturing Hub

China remains the world’s leading exporter of medical diagnostic equipment, supported by:

– Advanced manufacturing clusters in Guangdong, Zhejiang, and Jiangsu provinces

– Strong supply chain integration for electronic components and biosensors

– Compliance with ISO 13485 and CE/ FDA-ready facilities (increasingly common among Tier-1 suppliers)

– Competitive labor and production costs without sacrificing quality in mid-to-high-tier OEM/ODM partnerships

Note: Over 60% of global point-of-care (POC) diagnostic devices are now manufactured or co-developed in China.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Key Advantages | Risks / Considerations |

|---|---|---|---|---|

| OEM | Manufacturer produces your design to your specifications | Brands with in-house R&D and established product design | Full IP control, brand differentiation, tailored functionality | Higher NRE (Non-Recurring Engineering) costs, longer time-to-market |

| ODM | Manufacturer provides a pre-engineered platform that can be rebranded | Fast time-to-market, cost-sensitive buyers, startups | Lower development cost, faster certification, proven design | Limited customization, potential IP overlap with competitors |

Recommendation: Use ODM for rapid entry into emerging markets; OEM for differentiated, regulated, or high-complexity devices (e.g., automated analyzers).

3. White Label vs. Private Label: Branding & Cost Implications

| Strategy | Definition | Customization Level | Cost Impact | Ideal Use Case |

|---|---|---|---|---|

| White Label | Off-the-shelf product rebranded with minimal changes (e.g., logo, packaging) | Low (cosmetic only) | Lowest cost, fastest delivery | Distributors, resellers, generic market entry |

| Private Label | Full customization (hardware, firmware, UI, packaging, compliance) | High (design, software, branding) | Higher MOQ and unit cost | Branded medical device companies, premium positioning |

Strategic Insight: Private label supports long-term brand equity and regulatory ownership; white label maximizes margin in price-sensitive markets.

4. Estimated Cost Breakdown (Per Unit, Mid-Range Blood Glucose & Hemoglobin Analyzer)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCBs, sensors, microcontrollers, casing, display, batteries | $48 – $62 |

| Labor & Assembly | Skilled labor, calibration, QC testing | $12 – $18 |

| Packaging | Custom box, blister tray, multilingual inserts, shipping prep | $4 – $7 |

| R&D Amortization (ODM) | Shared design & certification costs (spread over MOQ) | $3 – $10 |

| Testing & Compliance | ISO 13485, CE, RoHS, biocompatibility (per batch) | $5 – $8 |

| Total Estimated Unit Cost | $72 – $105 |

Notes:

– Costs vary based on device complexity (e.g., multi-analyte vs. single-test).

– High-end analyzers (e.g., HbA1c, CRP, lipid panel) may exceed $150/unit.

– Certification costs can be reduced with manufacturer-held certificates.

5. Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $110 – $130 | $140 – $170 | High per-unit cost; ideal for market testing |

| 1,000 units | $95 – $115 | $120 – $145 | Balanced cost and volume; common entry point |

| 5,000 units | $80 – $95 | $100 – $120 | Economies of scale; preferred for established brands |

Additional Notes:

– Tooling & Molds: One-time cost of $8,000–$20,000 for private label (custom housing, UI).

– Lead Time: 6–10 weeks after sample approval.

– Payment Terms: 30% deposit, 70% before shipment (typical).

– Shipping: FOB Shenzhen; air freight adds $12–$18/unit at 500 units; sea freight reduces to $3–$5/unit at 5,000+ units.

6. Key Sourcing Recommendations

- Certification Audit: Verify manufacturer holds ISO 13485 and has prior FDA/CE submissions.

- Sample Validation: Require 3 pre-production units with full test reports.

- IP Protection: Use Chinese-contracted NDA and specify ownership of firmware/hardware modifications.

- QC Protocol: Implement third-party inspection (e.g., SGS, TÜV) at 100% pre-shipment.

- Scalability Clause: Negotiate tiered pricing with MOQ expansion options.

Conclusion

China offers a robust, cost-efficient ecosystem for sourcing blood test instruments in 2026. Procurement managers should align their labeling strategy (white vs. private label) and manufacturing model (OEM vs. ODM) with brand objectives, regulatory pathways, and volume forecasts. Early engagement with vetted suppliers ensures compliance, cost control, and supply chain resilience.

For tailored supplier shortlists and contract negotiation support, contact SourcifyChina sourcing consultants.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Medical Device Sourcing Division

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based Blood Test Instrument Manufacturers (2026)

Prepared for Global Procurement Managers | Confidential Advisory | January 2026

Executive Summary

Sourcing medical devices from China requires rigorous, multi-layered verification due to heightened regulatory scrutiny (FDA 21 CFR Part 820, EU MDR, NMPA), supply chain complexity, and significant risks of counterfeit/facade operations. 68% of procurement failures in diagnostic equipment stem from inadequate supplier vetting (SourcifyChina 2025 Global MedTech Sourcing Survey). This report provides actionable, field-tested protocols to validate true manufacturers and mitigate critical risks.

I. Critical Verification Steps: Beyond Basic Checks (Blood Test Instruments)

Prioritize regulatory compliance and operational transparency. Generic “factory audits” are insufficient.

| Verification Step | Action Required | Why It Matters for Blood Test Instruments | Validation Evidence |

|---|---|---|---|

| 1. Regulatory License Deep Dive | Cross-verify NMPA (China), FDA 510(k)/CE Certificates, and ISO 13485:2016 specific to the instrument model. | Blood test instruments are Class II/III medical devices. Invalid/copycat certifications = illegal product + liability. | Demand: Original certificate numbers (check NMPA/FDA databases), scope of approval listing exact model numbers. Reject PDFs without verification links. |

| 2. On-Site Production Audit | Conduct unannounced audit with third-party specialist (e.g., BSI, TÜV) familiar with IVD manufacturing. | Trading companies often rent factory space for “show tours.” Real factories have dedicated R&D labs, clean rooms, and calibration equipment. | Verify: Raw material inventory (e.g., reagent substrates), in-process QC stations, sterilization logs, and employee ID badges matching payroll. |

| 3. Supply Chain Traceability | Require full BOM (Bill of Materials) with Tier 2/3 supplier names for critical components (e.g., optical sensors, microfluidics chips). | Counterfeit parts cause 41% of instrument failures (MDIC 2025). Legitimate factories control core component sourcing. | Demand: Signed supplier agreements, component traceability records (lot numbers), and evidence of incoming QC testing. |

| 4. Technical Capability Proof | Request 3+ years of service records for your specific instrument type (e.g., hematology analyzers, immunoassay systems). | Blood test instruments require precision engineering. Factories without service history lack repair expertise = high failure risk. | Verify: Service logs (redacted for confidentiality), technician certifications, and spare parts inventory lists. |

| 5. Export Compliance Check | Confirm direct export license (海关注册编码) and history of shipments to your target market. | Trading companies often lack export licenses, causing customs delays. Factories with direct export rights control logistics. | Demand: Copy of《对外贸易经营者备案登记表》, last 3 shipment BLs (redacted). Cross-check with customs data via Panjiva/ImportGenius. |

II. Trading Company vs. True Factory: Key Differentiators

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Field Data). Use these forensic checks:

| Indicator | True Factory | Trading Company (Red Flag) | Verification Tactic |

|---|---|---|---|

| Business License (执照) | Lists “生产” (production) + specific medical device codes (e.g., 2200). Address = factory location. | Lists only “贸易” (trading) or “销售” (sales). Registered address = commercial office park. | Check: Official NMPA license (医疗器械生产许可证) + cross-reference address on 地图 (Baidu Maps) for satellite view of facility. |

| Pricing Structure | Quotes FOB/CIF factory gate. Itemizes material/labor costs. MOQ based on production capacity. | Quotes EXW only. Prices fluctuate weekly. No explanation of cost breakdown. | Test: Ask for cost breakdown by component. Factories can; traders cannot. |

| R&D Capability | Shows in-house engineering team, design files (e.g., CAD), and regulatory submission history. | Claims “we work with factories” but cannot name them. Shows generic product catalogs. | Ask: “Who designed the fluidics system? Show me the last design change log.” |

| Facility Footprint | >5,000m² facility with dedicated zones (R&D, production, QC, warehouse). Visible machinery. | Office-only space (<500m²). Samples shipped from 3rd-party warehouses. | Verify: Drone footage (via auditor), utility bills (electricity >50,000 kWh/month for medtech). |

| Payment Terms | Accepts 30-60 day LC after production. Requires deposit for materials. | Demands 100% TT upfront or short-term LC. Pressures for “urgent” payment. | Red Flag: No willingness to hold finished goods for inspection pre-shipment. |

III. Critical Red Flags: Immediate Disqualification Criteria

These indicate high risk of fraud, non-compliance, or operational failure. DO NOT proceed if observed.

| Red Flag | Risk Severity | Consequence | Action |

|---|---|---|---|

| “We can skip NMPA/FDA for your market” | Critical (5/5) | Product seizure, legal liability, reputational damage. Invalidates insurance. | Terminate immediately. Non-negotiable. |

| Refuses third-party audit | Critical (5/5) | Hidden substandard processes; likely a trading company or non-compliant facility. | Walk away. No exceptions. |

| Samples ≠ Mass Production Unit | High (4/5) | QC failure in bulk; calibration drift; safety hazards (e.g., electrical faults). | Demand production-line samples under audit. |

| No dedicated QC team | High (4/5) | 82% higher defect rate (SourcifyChina 2025). Critical for precision instruments. | Verify: QC staff IDs, calibration certificates for test equipment. |

| Pressure for exclusivity pre-qualification | Medium-High (3.5/5) | Limits leverage; often masks inability to meet volume/quality demands. | Counter: Offer 12-month review period post-qualification. |

| Generic “ISO 13485” certificate | Medium (3/5) | Certificate may be expired, scope-limited, or fraudulent. Common in trading hubs. | Verify: Certificate number on IAF CertSearch database. |

IV. SourcifyChina 2026 Recommendation Protocol

- Pre-Screening: Use NMPA database + third-party compliance tools (e.g., QMS Cloud) to filter suppliers with valid medical device licenses.

- Tiered Verification: Prioritize regulatory > production capability > financial health (demand audited financials for >$500k orders).

- Pilot Order Strategy: Order 10% of initial volume from production line (not stock). Conduct IFS (Inspection, Function, Safety) testing pre-shipment.

- Contract Safeguards: Include clauses for:

- Right to audit without notice

- Penalties for regulatory non-compliance

- IP ownership of custom designs

- Liquidated damages for shipment delays

“In 2026, the cost of a failed blood test instrument supplier isn’t just financial—it’s patient safety. Verification isn’t a step; it’s the foundation of your supply chain.”

— SourcifyChina MedTech Risk Index, Q4 2025

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 1234 5678

This report contains proprietary methodologies. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Disclaimer: Regulatory requirements vary by market. Engage local legal counsel before finalizing agreements.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Partner with Verified Chinese Blood Test Instrument Manufacturers

In 2026, global healthcare demand continues to rise, placing increased pressure on procurement teams to source high-quality, compliant, and cost-effective diagnostics equipment—fast. Blood test instruments, in particular, require precision engineering, regulatory adherence (e.g., CE, FDA), and scalable manufacturing capacity. Yet, identifying trustworthy suppliers in China remains a time-intensive and high-risk endeavor.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina eliminates sourcing bottlenecks by providing access to a rigorously vetted network of top-tier blood test instrument manufacturers in China. Our Verified Pro List is not a directory—it’s a strategic procurement tool backed by on-the-ground due diligence.

| Procurement Challenge | SourcifyChina Solution | Time Saved |

|---|---|---|

| Supplier discovery & qualification | Pre-vetted manufacturers with ISO 13485, CE, and export experience | 3–6 weeks |

| Factory audits & compliance checks | On-site assessments, quality system reviews, and production capacity verification | 2–4 weeks |

| Language & communication barriers | Dedicated bilingual sourcing consultants managing all correspondence | 1–2 weeks |

| Risk of counterfeit or substandard products | Only manufacturers with proven track records and verifiable export history | Risk mitigation = time saved in rework and recalls |

By leveraging our Verified Pro List, procurement managers reduce supplier onboarding time by up to 70%, accelerate time-to-market, and ensure supply chain integrity.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your growth. With SourcifyChina, you gain immediate access to trusted blood test instrument manufacturers who meet international quality standards and can scale with your demand.

👉 Take the next step in confident, efficient procurement:

– Email us at [email protected] for a complimentary supplier shortlist.

– Message via WhatsApp at +86 159 5127 6160 for real-time support and sample verification.

Let SourcifyChina be your on-the-ground partner in China—ensuring quality, compliance, and speed in every sourcing decision.

Your supply chain is only as strong as your supplier network. Source with certainty. Source with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.