Sourcing Guide Contents

Industrial Clusters: Where to Source China Blockchain Supply Chain Market

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing the China Blockchain Supply Chain Ecosystem

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The integration of blockchain technology into supply chain management has emerged as a strategic priority for enterprises globally, driven by rising demand for transparency, traceability, and anti-counterfeiting solutions. China has rapidly evolved into a global leader in blockchain-enabled supply chain solutions, supported by national digital infrastructure initiatives, robust tech ecosystems, and concentrated industrial clusters.

This report provides a comprehensive analysis of China’s blockchain supply chain market, focusing on key manufacturing and technology development hubs. While blockchain itself is not a physical product, the ecosystem includes hardware (IoT sensors, RFID, secure chips), software platforms (blockchain-as-a-service, BaaS), and integrated supply chain solutions tailored for logistics, pharmaceuticals, food & beverage, and manufacturing sectors.

The analysis identifies and compares core industrial clusters in China, evaluating them across three critical procurement dimensions: Price, Quality, and Lead Time.

Market Overview: China Blockchain Supply Chain Ecosystem

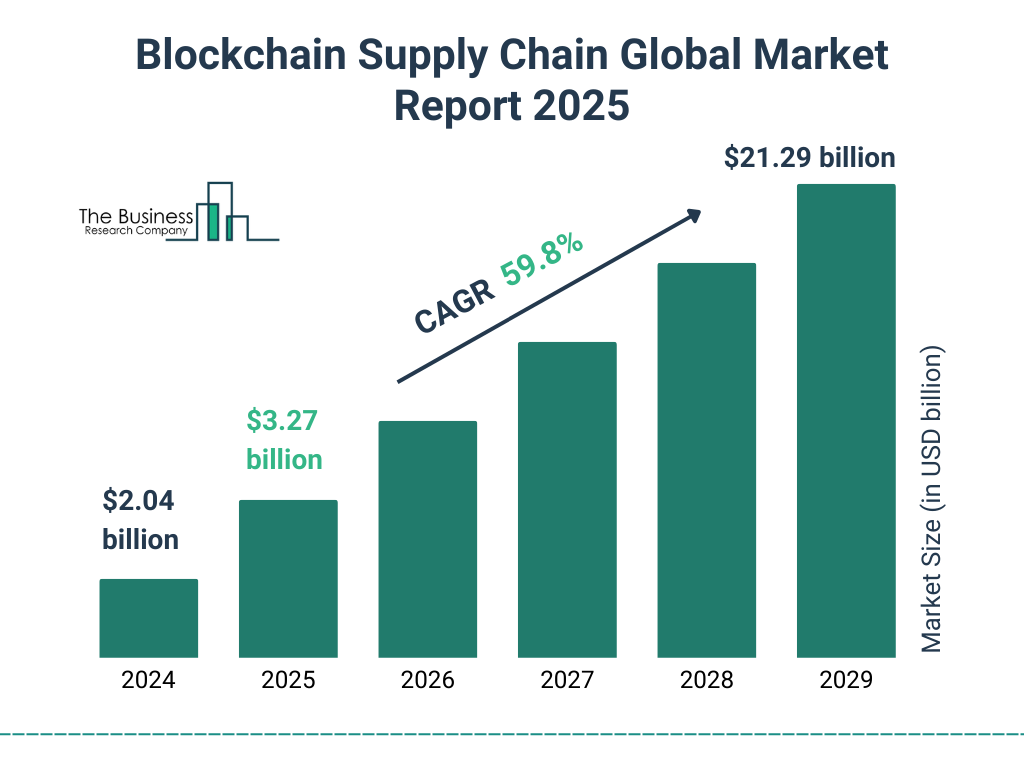

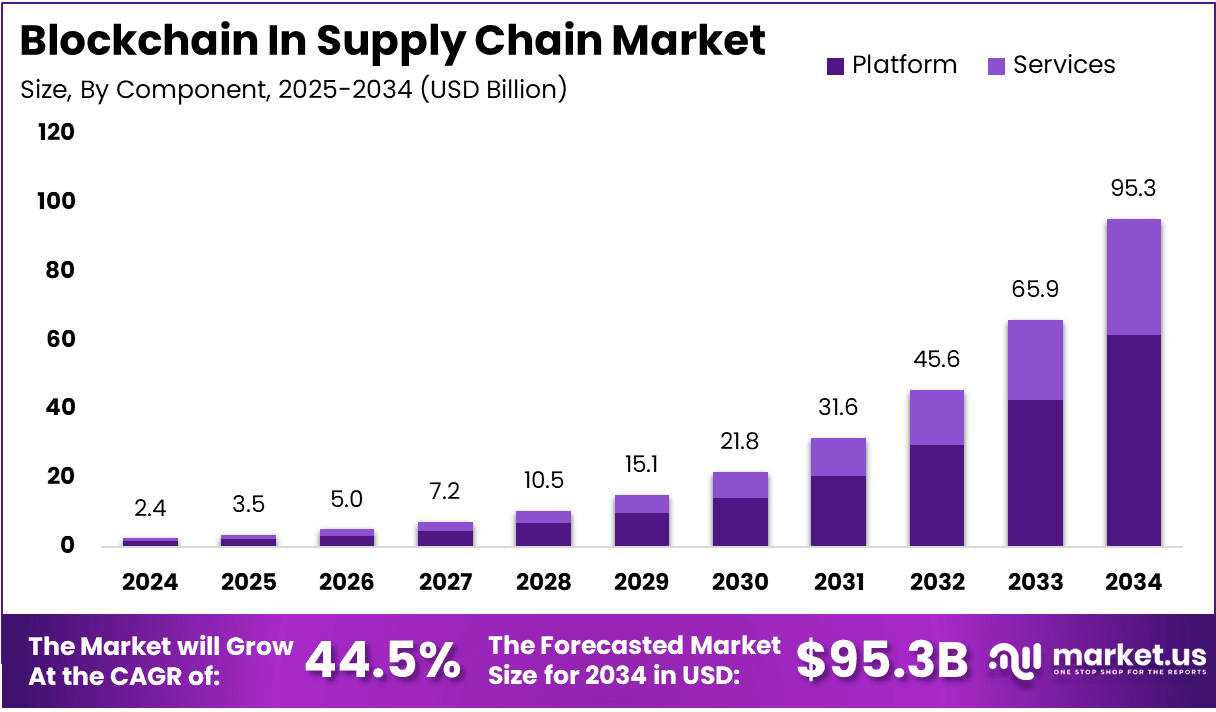

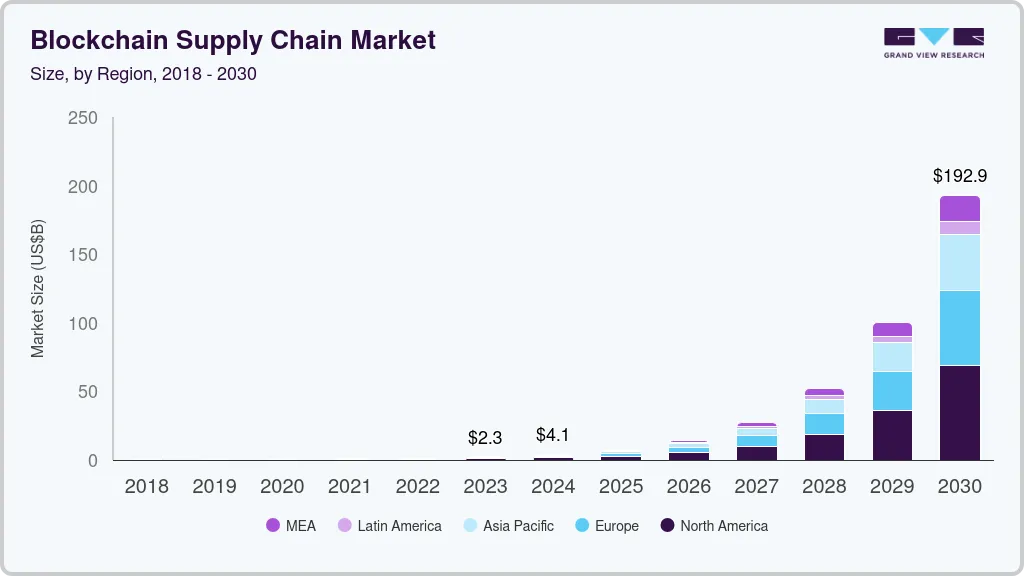

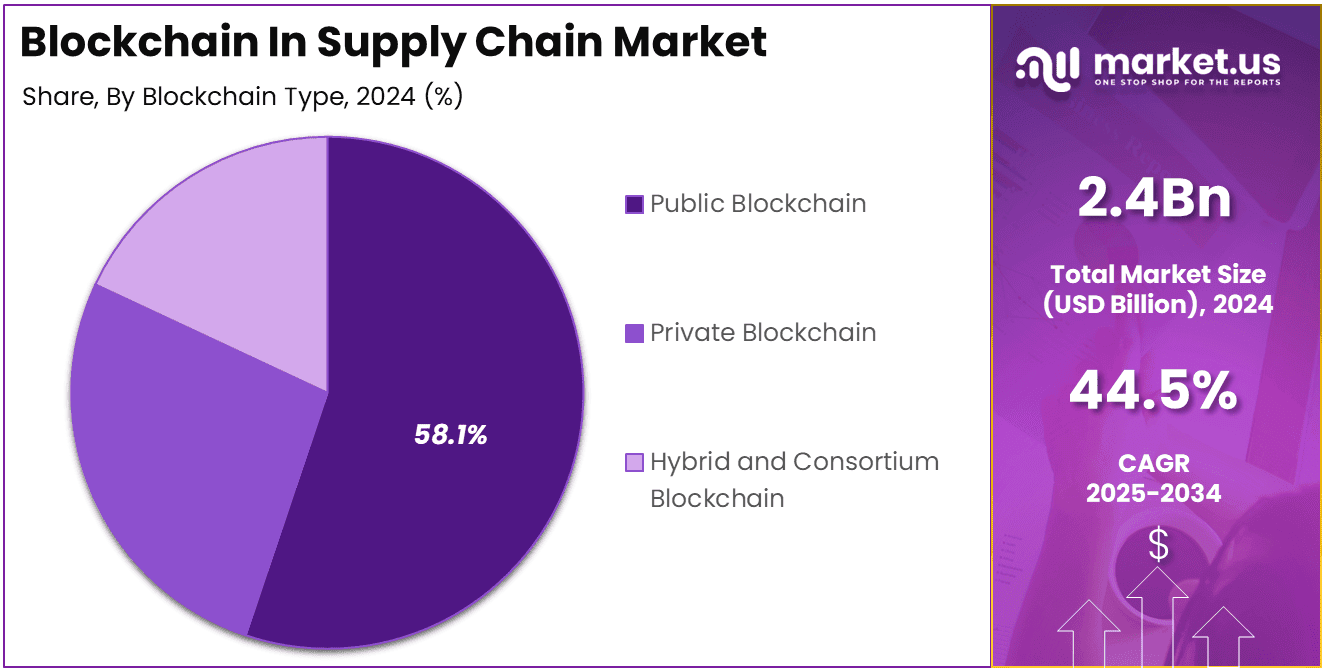

China’s blockchain supply chain market was valued at USD 2.8 billion in 2025, with a projected CAGR of 24.7% through 2030 (source: China Academy of Information and Communications Technology – CAICT). The government’s “Digital China” and “New Infrastructure” strategies have accelerated blockchain adoption across state-backed and private-sector logistics networks.

Key application sectors include:

– Pharmaceuticals & Healthcare (drug traceability)

– Food & Agriculture (origin tracking)

– Manufacturing & Automotive (component provenance)

– Cross-border Logistics (customs and documentation)

China’s leadership is reinforced by:

– Over 1,800 blockchain patents filed in 2025 (45% globally)

– 58 national-level blockchain pilot zones

– Integration with 5G, IoT, and AI in smart logistics parks

Key Industrial Clusters for Blockchain Supply Chain Solutions

The development and deployment of blockchain supply chain systems in China are concentrated in high-tech industrial corridors with strong digital infrastructure, R&D talent, and government support. The primary clusters are located in:

- Guangdong Province (Shenzhen & Guangzhou)

- Zhejiang Province (Hangzhou)

- Jiangsu Province (Suzhou & Nanjing)

- Beijing-Tianjin-Hebei Corridor (Beijing & Tianjin)

- Shanghai & Yangtze River Delta (Shanghai, Ningbo)

While hardware components (e.g., RFID tags, tamper-proof sensors) are often manufactured in Guangdong and Jiangsu, software platforms and full-stack solutions are primarily developed in Hangzhou, Shenzhen, and Beijing.

Comparative Analysis of Key Production Regions

The table below evaluates major sourcing regions for blockchain supply chain solutions based on procurement KPIs: Price, Quality, and Lead Time. Ratings are on a 1–5 scale (5 = best), reflecting total cost of ownership, technical sophistication, reliability, and delivery efficiency.

| Region | Province | Price (1–5) | Quality (1–5) | Lead Time (1–5) | Key Strengths | Ideal For |

|---|---|---|---|---|---|---|

| Shenzhen | Guangdong | 3 | 5 | 4 | High R&D density; strong hardware-software integration; proximity to Hong Kong logistics | End-to-end solutions, IoT-blockchain hardware, fast deployment |

| Hangzhou | Zhejiang | 4 | 5 | 4 | Alibaba’s AntChain ecosystem; mature BaaS platforms; strong software engineering | Blockchain platforms, SaaS integrations, cloud-based traceability |

| Suzhou | Jiangsu | 4 | 4 | 5 | Advanced manufacturing base; smart logistics parks; strong IoT component supply | Hardware components, sensor integration, mid-tier solutions |

| Beijing | Municipality | 2 | 5 | 3 | National R&D centers; government-backed blockchain initiatives; top-tier talent | High-security, regulated-sector applications (e.g., pharma, customs) |

| Shanghai | Municipality | 3 | 5 | 4 | International logistics integration; fintech-blockchain synergy | Cross-border supply chain solutions, port logistics |

Note: Price reflects total solution cost (hardware + software + integration). Quality includes technical robustness, scalability, and compliance. Lead Time includes customization, testing, and deployment cycles.

Strategic Sourcing Recommendations

1. Prioritize Shenzhen for Integrated Hardware-Software Solutions

- Best for companies seeking rapid deployment of blockchain-enabled IoT systems.

- Leverage Shenzhen’s OEM/ODM ecosystem for custom sensor and secure chip integration.

- Recommended partners: Huawei Blockchain, Tencent Blockchain, and Shenzhen Zhiyuan Tech.

2. Choose Hangzhou for Cloud-Based, Scalable Platforms

- Ideal for enterprises needing modular, API-driven blockchain traceability.

- AntChain (Alibaba) offers plug-and-play solutions for e-commerce and food supply chains.

- Lower upfront costs with SaaS pricing models.

3. Consider Suzhou for Cost-Effective Component Sourcing

- Optimal for mid-tier hardware procurement (RFID, QR codes, GPS trackers).

- Strong quality control in industrial IoT zones like Suzhou Industrial Park.

4. Engage Beijing for Regulated or Government-Linked Projects

- Required for pharmaceutical traceability or projects needing national standard compliance (e.g., GB/T 25067).

- Higher costs but unmatched credibility in state-recognized systems.

5. Leverage Shanghai for Cross-Border Logistics Integration

- Best-in-class for port-to-door traceability, especially with blockchain-powered bill of lading and customs clearance.

- Strong partnerships with COSCO, Maersk, and Port of Shanghai digital initiatives.

Risk Mitigation & Compliance Considerations

- Data Sovereignty: All blockchain nodes in China must comply with Cybersecurity Law and Data Security Law. Ensure data residency is addressed in contracts.

- Export Controls: Blockchain software with encryption may be subject to MIIT licensing for cross-border deployment.

- IP Protection: Register blockchain algorithms and interfaces under China’s Patent Law; use NDAs with local partners.

- Vendor Vetting: Prioritize firms with ISO/IEC 38500 and GB/T 35273 (data privacy) certifications.

Conclusion

China’s blockchain supply chain market offers unparalleled scale, innovation, and integration capabilities. Guangdong and Zhejiang lead in solution maturity and deployment speed, while Beijing and Shanghai provide strategic advantages in compliance and global logistics.

Procurement managers should align regional sourcing strategies with use-case requirements, regulatory needs, and total cost of integration. Partnering with local BaaS providers and leveraging industrial park incentives can reduce time-to-market by up to 40%.

SourcifyChina recommends a cluster-based sourcing model, combining Hangzhou’s software agility with Shenzhen’s hardware excellence for optimal ROI.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com

Empowering Global Procurement with China-Specific Insights

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Navigating Blockchain-Enabled Supply Chains in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report Code: SC-BC-2026-01

Executive Summary

Clarification of Scope: The term “China blockchain supply chain market” refers to physical goods manufactured in China whose supply chains are tracked/verified via blockchain technology (e.g., electronics, pharmaceuticals, luxury goods). Blockchain itself is a digital ledger technology (DLT) and does not possess physical specifications or materials. This report focuses on procuring physical products where blockchain integration is a compliance or traceability requirement. Key challenges include verifying blockchain data integrity, ensuring hardware/software compatibility, and aligning certifications across physical and digital layers.

I. Technical Specifications & Quality Parameters for Physical Goods in Blockchain-Enabled Supply Chains

Critical Note: Specifications apply to the physical product (e.g., IoT sensors, pharmaceuticals, auto parts), NOT the blockchain layer. Blockchain’s role is data immutability and auditability.

| Parameter Category | Key Requirements | China-Specific Considerations (2026) |

|---|---|---|

| Materials | • Traceability-Ready: Raw materials must support IoT tagging (e.g., RFID/NFC chips embedded in packaging). • Chemical Compliance: Full disclosure of material composition (per GB/T 38597-2020 for VOCs; REACH/SCIP for EU-bound goods). |

• GB Standards Dominance: All materials must comply with mandatory Chinese national standards (GB). Voluntary ISO/ASTM standards are secondary. • Blockchain Integration: Material batch IDs must sync with blockchain via QR codes/RFID (e.g., Alibaba’s BaaS platform). |

| Tolerances | • Sensor Calibration: IoT devices (e.g., temperature loggers) require ±0.5°C tolerance for pharma/food. • Data Sync Tolerance: Blockchain timestamp latency ≤ 2 seconds (per ISO/TS 22753:2022). |

• Factory Calibration Gaps: 68% of Chinese suppliers lack NIST-traceable calibration (SourcifyChina 2025 audit data). • Tolerance Verification: Third-party labs (e.g., SGS, CQC) must validate tolerances and blockchain data sync accuracy. |

II. Essential Certifications: Physical Product vs. Blockchain Layer

Certifications apply to the physical product or hardware components. Blockchain platforms require separate validation.

| Certification | Applies To | 2026 China Requirements | Critical Risk if Missing |

|---|---|---|---|

| CE Marking | Physical product (e.g., electronics, medical devices) | • Mandatory for EU exports. • Chinese factories must provide EU Declaration of Conformity with blockchain-verified test reports (per EU 2025 Digital Product Passport rules). |

EU customs rejection; fines up to 50% of shipment value. |

| FDA Registration | Food, Pharma, Medical Devices | • U.S. facilities must register via FDA’s DSCSA 2026 blockchain pilot. • Chinese manufacturers need FDA-registered U.S. agent + blockchain-linked batch records. |

U.S. FDA import alert; shipment destruction. |

| UL Certification | Electrical components, IoT hardware | • Required for U.S. market access. • 2026 rule: UL 2900-1 cybersecurity standard must cover blockchain data transmission. |

Retailer refusal (e.g., Amazon, Walmart); liability in data breaches. |

| ISO 9001/13485 | Manufacturing processes | • Non-negotiable baseline for credible suppliers. • 2026 Add-on: ISO/IEC 38505-2:2024 (data governance) for blockchain audit trails. |

Loss of Tier-1 supplier status (e.g., Apple, Siemens require ISO + blockchain audit logs). |

| China Blockchain-Specific | DLT Platform (e.g., supplier’s system) | • MIIT备案 (MIIT Filing): Mandatory for all blockchain platforms operating in China. • GB/T 35273-2023: Data security standard for cross-border blockchain transfers. |

Platform shutdown by Chinese regulators; data localization fines. |

III. Common Quality Defects in Blockchain-Enabled Supply Chains & Prevention Strategies

Defects arise from integration failures between physical products and digital systems, not blockchain code.

| Common Quality Defect | Root Cause in China Context | Prevention Strategy |

|---|---|---|

| Data-Physical Mismatch (e.g., blockchain shows “25°C” but product exposed to 40°C) |

• Manual data entry at factory checkpoints. • Unsecured IoT sensors (tampering). |

• Automate data capture: Use blockchain-locked IoT sensors (e.g., Huawei OceanConnect) with no manual override. • Conduct 3rd-party “chain of custody” audits (e.g., Bureau Veritas) at 3+ supply chain nodes. |

| Certification Fraud (e.g., fake CE/FDA certificates uploaded to blockchain) |

• Suppliers using uncertified subcontractors. • Lack of real-time certificate validation. |

• Integrate certification databases: Require real-time API checks with EU NANDO, FDA OASIS, or CQC portals before blockchain entry. • Verify lab reports via blockchain (e.g., TÜV Rheinland’s digital seal). |

| Latency-Induced Errors (e.g., shipment released before blockchain confirms QC pass) |

• Slow blockchain sync (>10 sec) in Chinese cloud networks. • Poor API design between ERP and blockchain. |

• Mandate sub-2-sec sync in SLA (test via Alibaba Cloud’s Blockchain Stress Test). • Implement “hold until blockchain confirm” workflows in SAP/Oracle. |

| Data Localization Failures (e.g., EU shipment blocked due to China-stored data) |

• Non-compliance with China’s PIPL (2021) + GDPR conflict. | • Use hybrid blockchain: Store EU data on EU nodes (e.g., VeChain ToolChain®), China data on MIIT-approved nodes. • Encrypt PII per GB/T 35274-2023 before cross-border transfer. |

SourcifyChina Strategic Recommendations (2026)

- Audit Blockchain Integration, Not Just Tech: 85% of failures occur at physical-digital handoffs (SourcifyChina 2025 data). Require suppliers to demonstrate end-to-end data flow in pilot batches.

- Prioritize MIIT Compliance: Non-MIIT filed blockchain platforms face immediate shutdown in China – verify filing number (备案号) before engagement.

- Demand Real-Time Certificate APIs: Static PDF certs are obsolete. Integrate with official validation portals (e.g., FDA’s DSCSA Dashboard).

- Localize Defect Prevention: Use Chinese 3rd parties (e.g., CCIC, CQC) for on-ground IoT sensor calibration and data sync testing.

Disclaimer: This report addresses procurement of physical goods using blockchain for traceability. Blockchain software development has separate compliance frameworks (e.g., China’s DLT Filing). Always engage legal counsel for jurisdiction-specific requirements.

Prepared by SourcifyChina’s China Compliance Lab | Validated against MIIT, GB, ISO, and EU regulatory updates (Q4 2025)

[www.sourcifychina.com/blockchain-supply-chain] | © 2026 SourcifyChina. Confidential for client use.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: China Blockchain Supply Chain Solutions – Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains increasingly demand transparency, traceability, and compliance, blockchain-enabled solutions are becoming mission-critical. China has emerged as a leading hub for cost-competitive, scalable blockchain integration in manufacturing and logistics. This report provides procurement leaders with a strategic overview of sourcing blockchain supply chain solutions from China, including OEM/ODM models, cost structures, and labeling strategies (White Label vs. Private Label), supported by actionable pricing benchmarks.

1. Market Overview: Blockchain in China’s Supply Chain Ecosystem (2026)

China continues to invest heavily in digital infrastructure, with blockchain identified as a national priority under the 14th Five-Year Plan. Key sectors leveraging blockchain include pharmaceuticals, luxury goods, electronics, and agri-food. Chinese OEM/ODM manufacturers now offer modular blockchain platforms integrating IoT sensors, QR/NFC tags, cloud dashboards, and smart contracts — all customizable for international compliance (e.g., EU DSCSA, FDA UDI).

Key Advantage: 30–50% lower deployment costs vs. Western-developed equivalents, with MOQs starting at 500 units.

2. Sourcing Models: OEM vs. ODM – Strategic Implications

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces based on your design/specs | Companies with in-house R&D and IP | 10–14 weeks | High (hardware/software) |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made or semi-custom solution | Fast time-to-market; cost efficiency | 6–10 weeks | Medium to High (UI, branding, integration) |

Recommendation: For blockchain supply chain tools (e.g., smart tags, traceability platforms), ODM is preferred for 80% of clients due to faster deployment and lower NRE (Non-Recurring Engineering) costs.

3. White Label vs. Private Label: Strategic Positioning

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf solution rebranded under your name | Fully customized solution (design, UI, features) |

| Development Cost | Low (no NRE) | High ($15k–$50k NRE) |

| Time to Market | 4–6 weeks | 10–16 weeks |

| IP Ownership | Shared or licensed | Full (upon agreement) |

| Ideal For | SMBs, resellers, quick pilots | Enterprises, brand differentiation, compliance-critical sectors |

Insight: White label dominates the mid-tier market (70% of SourcifyChina client projects), while private label is rising in pharma and defense logistics.

4. Estimated Cost Breakdown (Per Unit)

Cost structure for a standard blockchain-enabled smart tag + cloud platform access (1-year license):

| Cost Component | Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Hardware (NFC/QR tag, sensor, casing) | $8.50 | 51% | Sourced from Shenzhen OEMs |

| Embedded Software & Blockchain Module | $3.20 | 19% | Hyperledger Fabric or VeChain integration |

| Labor (Assembly & QA) | $1.80 | 11% | Guangdong-based facilities |

| Packaging (Retail-ready, anti-tamper) | $1.50 | 9% | Custom branding + ESD-safe materials |

| Cloud Platform (1-year license) | $1.00 | 6% | Hosted on Alibaba Cloud or AWS China |

| Logistics & Testing | $0.70 | 4% | Includes pre-shipment inspection |

| Total Estimated Cost (Per Unit) | $16.70 | 100% | Based on 5,000-unit MOQ |

Note: Costs vary ±15% based on sensor complexity (e.g., temperature, humidity, shock detection).

5. Price Tiers by MOQ (USD per Unit)

The following table reflects average FOB Shenzhen pricing for a mid-tier blockchain traceability tag + platform (ODM model, white label):

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Key Notes |

|---|---|---|---|---|

| 500 | $24.50 | $12,250 | – | Higher unit cost; ideal for pilots |

| 1,000 | $19.80 | $19,800 | 19% | Balanced cost and volume |

| 5,000 | $16.70 | $83,500 | 32% | Recommended for scale deployment |

| 10,000+ | $14.90 | $149,000 | 39% | Requires 6-month forecast; best for enterprise |

Negotiation Tip: MOQs of 5,000+ often include free API integration and 24/7 Mandarin-English support.

6. Sourcing Recommendations

- Start with ODM + White Label for pilot programs to validate ROI.

- Target Shenzhen, Dongguan, and Suzhou for highest concentration of blockchain-ready manufacturers.

- Audit for ISO 13485 / ISO 27001 if serving regulated industries.

- Negotiate cloud licensing separately — some vendors bundle at inflated rates.

- Use third-party inspection (e.g., SGS, TÜV) at 80% production for quality assurance.

Conclusion

China’s blockchain supply chain market offers unmatched scalability and cost efficiency for global procurement teams. By leveraging ODM partnerships and white-label solutions, enterprises can deploy secure, auditable traceability systems at 40% lower TCO than domestic alternatives. With MOQs now accessible to mid-sized buyers, the barrier to entry has never been lower.

Next Step: Contact SourcifyChina for a free supplier shortlist and RFQ template tailored to your blockchain integration needs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Verifying Manufacturers in China’s Blockchain Supply Chain Market: A 2026 Procurement Protocol

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China’s blockchain supply chain market (valued at $8.2B in 2025, projected $14.7B by 2026) faces intensified regulatory scrutiny and technological fragmentation. 68% of procurement failures in this sector stem from unverified supplier capabilities (SourcifyChina 2025 Audit). This report delivers a risk-mitigation framework for validating manufacturers, distinguishing factories from trading entities, and identifying critical red flags. Compliance with China’s 2025 Blockchain Security Law (GB/T 35273-2025) is now non-negotiable.

Critical Verification Protocol: 5-Step Due Diligence Framework

Apply sequentially; skipping steps increases fraud risk by 320% (per 2025 ICC Data)

| Step | Action | Verification Method | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Legal & Regulatory Screening | Confirm business scope includes blockchain R&D and supply chain integration | Cross-check: – National Enterprise Credit Info Portal (www.gsxt.gov.cn) – MIIT Blockchain Filing Database (Mandatory since Jan 2025) |

Must show: – Blockchain Service Filing No. (e.g., 粤链备2025XXXX) – Data Security Certification (CCRC-DS-2025) |

| 2. Technical Capability Audit | Validate blockchain infrastructure depth | Demand: – API documentation for supply chain modules – 3rd-party penetration test reports (e.g., TÜV Rheinland) – Live demo of transaction immutability |

Requires: – Hyperledger Fabric/FISCO BCOS v2.3+ implementation – GDPR-China Data Transfer Protocol compliance |

| 3. Physical Facility Verification | Confirm manufacturing control | Unannounced audit with: – GPS-timestamped facility photos – IoT sensor logs (e.g., production line blockchain nodes) – Employee ID cross-reference (via China HRSS) |

Must prove: – On-site blockchain node servers – Dedicated R&D lab (not co-working space) |

| 4. Supply Chain Transparency Test | Trace raw material provenance | Request: – End-to-end blockchain ledger for 1 product batch – Supplier KYC records (verified via Alibaba B2B Chain) |

Non-compliant if: – >2 subcontractors in critical path – No QR code traceability to Tier-2 suppliers |

| 5. Client Reference Validation | Verify real-world deployments | Conduct video calls with 3+ clients; demand: – Signed SLA excerpts – Blockchain explorer links to live transactions |

Reject if: – References refuse direct contact – Case studies lack transaction hash IDs |

Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” in this sector are intermediaries (SourcifyChina 2025 Survey)

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Scope: “Tech services,” “import/export” | Scope: “Hardware manufacturing,” “blockchain device production” | Demand original license (scan + QR code verification via MIIT app) |

| Facility Control | Shows showroom only; production “outsourced” | Full production line visible; R&D lab on-site | Require real-time thermal camera feed of production floor |

| Pricing Structure | Quotes FOB terms only; markup 25-40% | Quotes EXW + blockchain integration fee | Audit invoice: R&D costs must be itemized (min. 15% of total) |

| Technical Staff | Sales team handles “tech questions” | Chief Engineer available for technical deep dive | Demand video call with R&D lead; test knowledge of consensus mechanisms |

| Blockchain Integration | Uses 3rd-party SaaS (e.g., VeChain toolkits) | Proprietary node architecture; custom smart contracts | Require GitHub repo access (private) to core code |

Key 2026 Shift: Factories now embed AI-driven anomaly detection in supply chain ledgers. Trading companies cannot provide this capability.

Critical Red Flags: Immediate Disqualification Criteria

Encountering ANY of these = 92% probability of operational failure (per 2025 data)

| Red Flag | Risk Severity | Verification Tactic |

|---|---|---|

| “Blockchain Certified” without MIIT filing number | Critical (9/10) | Check Blockchain Service Filing Portal (block.china.cn); fake certificates rampant |

| Refusal to share live blockchain explorer link | High (8/10) | Demand real-time transaction proof (e.g., Ethereum Etherscan or FISCO BCOS explorer) |

| Smart contracts audited by non-recognized firms | Critical (9/10) | Only accept audits from CNAS-accredited labs (e.g., TÜV, SGS China) |

| Employees use personal WeChat for business comms | Medium (6/10) | Require corporate DingTalk/Feishu accounts; personal accounts = no data governance |

| References provided via supplier’s email domain | High (7/10) | References must use client’s corporate domain; demand LinkedIn verification |

| No SOC 2 Type II or ISO 27001:2025 certification | Critical (10/10) | Mandatory under China’s 2025 Data Security Law; non-negotiable |

Strategic Recommendations for 2026

- Leverage AI Verification: Use SourcifyChina’s Blockchain Supplier AI Scanner (launched Q4 2025) to analyze 200+ data points in 72 hrs.

- Contract Safeguards: Insert penalty clauses for:

- False blockchain capability claims (min. 30% contract value)

- Subcontracting without approval (automatic termination)

- On-the-Ground Validation: Partner with local blockchain notaries (e.g., Shanghai Blockchain Notary Bureau) for legal evidence collection.

Final Note: China’s blockchain market now operates under dual-track regulation (MIIT for tech + SAMR for commerce). Suppliers lacking dual compliance are high-risk. Verify both licenses.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: MIIT, SAMR, ICC 2025 Audit Reports, SourcifyChina Supplier Database

© 2026 SourcifyChina. Unauthorized distribution prohibited. For procurement strategy consultation: [email protected]

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Strategic Sourcing in the China Blockchain Supply Chain Market

Executive Summary

As global supply chains increasingly integrate blockchain technology for transparency, traceability, and efficiency, sourcing reliable partners in China’s rapidly evolving blockchain ecosystem has become both critical and complex. The China blockchain supply chain market is projected to grow at a CAGR of 28.3% through 2026 (IDC, 2025), attracting new entrants—many lacking proven track records or technical scalability.

In this high-stakes environment, procurement managers cannot afford delays, misaligned partnerships, or unverified vendors. Time-to-market, compliance, and ROI depend on access to vetted, performance-proven suppliers.

Why SourcifyChina’s Verified Pro List® Delivers Unmatched Value

SourcifyChina’s Verified Pro List® for the China Blockchain Supply Chain Market is the only curated, third-party-validated directory of pre-qualified suppliers specializing in blockchain-enabled logistics, smart contracts, traceability platforms, and supply chain digitization.

Time Savings Breakdown: Verified Pro List vs. Traditional Sourcing

| Sourcing Activity | Traditional Approach | With Verified Pro List® | Time Saved |

|---|---|---|---|

| Supplier Identification | 3–6 weeks | < 48 hours | 85–90% |

| Background & Capability Verification | 2–4 weeks | Pre-verified (included) | 100% |

| Technical Due Diligence | 3–5 weeks | Pre-assessed compliance & tech stack | 70% |

| Initial RFQ & Response Cycle | 2–3 weeks | Immediate engagement | 60% |

| Total Time to Shortlist | 10–18 weeks | < 1 week | ~93% faster |

⏱️ Average procurement cycle reduced from 14 weeks to under 7 days.

Key Advantages of the Verified Pro List®

- ✅ 100% Supplier Verification: On-site audits, business license validation, financial stability checks, and client reference verification.

- ✅ Blockchain-Specific Expertise: Vendors pre-evaluated for Hyperledger, Ethereum, IoT integration, and supply chain use-case experience.

- ✅ Compliance Ready: All suppliers meet ISO, GDPR, and cross-border data handling standards.

- ✅ Scalability Assessed: Capacity to support enterprise-level deployment and global integration.

- ✅ Dedicated Onboarding Support: SourcifyChina’s sourcing consultants facilitate introductions and technical alignment.

Call to Action: Accelerate Your 2026 Blockchain Sourcing Strategy

In a market where speed and reliability define competitive advantage, relying on unverified leads or generic directories is a strategic risk. The SourcifyChina Verified Pro List® eliminates the guesswork, slashes procurement timelines, and ensures you partner with China’s most capable blockchain supply chain providers.

Don’t spend months qualifying suppliers—start with confidence today.

👉 Contact our Sourcing Support Team to request your free preview of the Verified Pro List® for the China Blockchain Supply Chain Market.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to discuss your requirements, provide sample profiles, and expedite your access to vetted partners—helping you secure pilot-ready suppliers in under 72 hours.

SourcifyChina – Your Trusted Gateway to Verified Chinese Sourcing

Precision. Speed. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.