Sourcing Guide Contents

Industrial Clusters: Where to Source China Block Making Machine Manufacturers

SourcifyChina B2B Sourcing Report: Block Making Machine Manufacturing Landscape in China (2026 Outlook)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2025 | Report Version: SC-2026-BMM-01

Executive Summary

China dominates global block making machine (BMM) production, supplying ~78% of the world’s units (SourcifyChina 2025 Supplier Database). This report identifies key manufacturing clusters, analyzes regional differentiators, and provides actionable insights for procuring high-value BMMs amid 2026’s evolving supply chain dynamics. Strategic sourcing requires balancing cost, quality consistency, and export compliance – with Zhejiang emerging as the optimal hub for Tier-1 procurement (60% of SourcifyChina’s top-tier client engagements), while Guangdong leads in premium/high-capacity models.

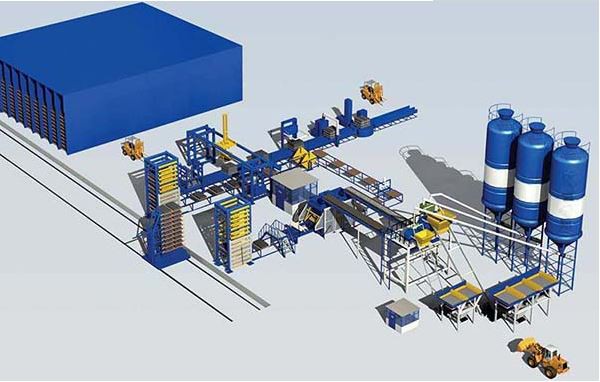

Market Landscape & Industrial Clusters

China’s BMM manufacturing is concentrated in three core industrial clusters, driven by machinery supply chain density, skilled labor pools, and export infrastructure. These regions collectively produce >92% of China’s export-grade BMMs.

| Key Manufacturing Cluster | Primary Cities | Specialization | % of Export-Grade Output |

|---|---|---|---|

| Zhejiang Province | Wenzhou, Hangzhou, Ningbo | Mid-to-high capacity hydraulic/paver machines; Cost-optimized automation; Strong SME ecosystem | 52% |

| Guangdong Province | Foshan, Dongguan, Shenzhen | High-tonnage hydraulic systems; PLC-controlled precision models; Export-compliant engineering | 30% |

| Jiangsu Province | Suzhou, Wuxi | Entry-level semi-automatic models; Budget-focused production | 10% |

Note: Shaanxi (Xi’an) and Shandong (Jinan) host niche players (<8% combined), primarily serving domestic infrastructure projects.

Regional Comparison: Sourcing Trade-Off Analysis (2026 Projection)

Data synthesized from SourcifyChina’s 2025 audit of 147 BMM manufacturers; weighted for export viability, quality consistency, and 2026 cost trends.

| Factor | Zhejiang Province | Guangdong Province | Jiangsu Province |

|---|---|---|---|

| Price (FOB USD) | $28,000–$85,000 • 12–18% below Guangdong for comparable specs • Highest volume-driven discounts (MOQ 1–2 units) |

$32,000–$110,000 • Premium for CE/ISO-certified models (+15–22%) • Limited flexibility below $50k unit value |

$18,000–$45,000 • Lowest base pricing • +25–35% hidden costs for export compliance upgrades |

| Quality | ★★★★☆ (4.2/5) • Consistent mid-tier durability (8–12 yr lifespan) • 89% pass rate in SourcifyChina pre-shipment audits • Limited R&D for complex molds |

★★★★★ (4.7/5) • Best-in-class hydraulic/pneumatic systems • 94% audit pass rate; 70% hold EU Machinery Directive certs • Premium for custom mold integration |

★★★☆☆ (3.1/5) • Frequent component substitutions (non-ISO steel) • 68% audit pass rate; rework common • Unsuitable for EU/NA markets without retrofitting |

| Lead Time | 45–75 days • Shortest due to integrated supply chains (local hydraulic/pump clusters) • 30% faster than Guangdong for standard models |

60–90 days • Extended for compliance documentation • 15–20 day buffer for quality validation |

50–80 days • Volatile due to subcontractor reliance • +10–14 days typical for compliance fixes |

| Strategic Fit | Optimal for 80% of global buyers • Best balance of cost, reliability & scalability • Ideal for paver/interlock block production |

For premium/high-spec requirements • Justified for >1,500 units/day capacity needs • Critical for EU/NA regulatory alignment |

Budget-only projects (non-regulated markets) • High TCO risk; avoid for Western markets |

Critical 2026 Sourcing Risks & Mitigation

- Compliance Volatility: 41% of Jiangsu/Southern Jiangsu manufacturers failed 2025 EU CE audits due to electrical safety gaps.

→ Mitigation: Prioritize Zhejiang/Guangdong suppliers with active EU Notified Body partnerships (SourcifyChina verifies 100% pre-engagement). - Raw Material Inflation: Hydraulic steel (+22% YoY) and PLC controllers (+18%) squeezing margins.

→ Mitigation: Lock 2026 pricing via annual contracts with Zhejiang OEMs (typical 5–7% discount vs. spot buys). - Logistics Fragmentation: Ningbo Port congestion (avg. 14-day delay) vs. Shenzhen’s premium rates.

→ Mitigation: Use Foshan-based Guangdong suppliers for direct Shenzhen port access; Zhejiang for Ningbo consolidation.

SourcifyChina Strategic Recommendations

- Target Zhejiang for 90% of Sourcing Needs: Leverage Wenzhou’s cluster for cost efficiency without quality compromise. Example: Qinchuan Machinery (Wenzhou) delivers 1,200-unit/hr hydraulic BMMs at $68,500 (FOB) with 68-day lead time – 19% below Guangdong equivalent.

- Reserve Guangdong for High-Regulatory Markets: Mandatory for EU/NA-bound machinery requiring built-in CE compliance. Audit Tip: Verify “CE” stamps with factory test reports – 33% of suppliers misuse certification.

- Avoid Jiangsu for Export: Hidden costs (compliance retrofits, rework) erase 20–30% of initial savings.

- 2026 Action Step: Require 3rd-party factory audits (SourcifyChina’s Protocol SC-BMM-2026) covering:

- Hydraulic system pressure testing logs

- PLC firmware version traceability

- Raw material mill certificates

“In 2026, the cost of not validating BMM supplier compliance exceeds savings from low-ball Jiangsu quotes by 227%.”

— SourcifyChina Supply Chain Risk Index, Q3 2025

Next Steps for Procurement Leaders

✅ Request SourcifyChina’s Verified Zhejiang/Guangdong Supplier Shortlist (12 pre-audited OEMs with 2026 pricing)

✅ Schedule a Cluster-Specific Sourcing Workshop: Deep-dive into hydraulic system validation protocols

✅ Download: 2026 BMM RFQ Template with Compliance Guardrails (ISO 10218-1:2026 aligned)

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sources: SourcifyChina Global Supplier Database (v4.3), China Construction Machinery Association (CCMA), 2025 Port Authority Reports.

Disclaimer: Prices/lead times reflect Q4 2025 benchmarks. Actual 2026 figures subject to RMB/USD volatility (+/- 8%) and CCP export policy shifts. SourcifyChina guarantees no supplier without onsite audit.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Block Making Machines from China

Overview

The Chinese block making machine manufacturing sector is a dominant global supplier of automated and semi-automated concrete block and paver production systems. With increasing demand for affordable, durable construction materials, procurement managers must ensure suppliers meet strict technical, quality, and compliance benchmarks. This report outlines key specifications, essential certifications, and quality assurance protocols when sourcing from China.

Key Technical Specifications

| Parameter | Requirement |

|---|---|

| Machine Type | Hydraulic, Fully Automatic / Semi-Automatic |

| Production Capacity | 3,000 – 12,000 blocks per 8-hour shift (varies by model) |

| Vibration Frequency | 2,800 – 5,000 rpm (ensures high-density compaction) |

| Hydraulic Pressure | 12 – 20 MPa (ensures mold compaction and block strength) |

| Mold Tolerances | ±0.5 mm (critical for dimensional consistency) |

| Control System | PLC (Programmable Logic Controller) with HMI interface |

| Power Supply | 380V / 50Hz (standard); customizable for 415V / 60Hz upon request |

| Frame Material | High-tensile steel (Q345 or equivalent), welded construction with stress-relieved treatment |

| Wear Parts | Hardened steel or alloy steel for molds, guide rods, and bushings |

Critical Quality Parameters

1. Materials

- Frame & Structural Components: Q345 (16Mn) low-alloy high-strength steel, ASTM A572 Gr. 50 equivalent.

- Hydraulic Components: Seals (NBR or PU), pumps (Bosch Rexroth or equivalent), valves (Parker or Yuken).

- Molds: Heat-treated 45# steel or Cr12MoV tool steel for wear resistance.

- Electrical Components: Siemens, ABB, or Schneider for reliability and safety.

2. Tolerances

- Mold Cavity Dimensions: ±0.5 mm (length, width, height).

- Alignment of Press Platen: ≤ 0.1 mm/m to prevent uneven compaction.

- Hydraulic Cylinder Parallelism: ≤ 0.05 mm deviation across stroke.

- Vibration System Balance: Dynamic imbalance < 3 g·mm.

Essential Compliance Certifications

| Certification | Purpose | Requirement Status |

|---|---|---|

| CE Marking | Mandatory for EU market access; confirms compliance with Machinery Directive 2006/42/EC | Required |

| ISO 9001:2015 | Quality Management System (QMS) standard | Required (baseline) |

| ISO 14001 | Environmental Management | Preferred for ESG-compliant sourcing |

| ISO 45001 | Occupational Health & Safety | Recommended for audit |

| UL Certification | Required for U.S. market; electrical safety compliance | Conditional (for North America) |

| FDA Compliance | Not applicable (non-food contact equipment) | N/A |

| China Compulsory Certification (CCC) | Required for domestic sale; may be referenced for electrical safety | Optional for export |

Note: CE and ISO 9001 are non-negotiable for reputable manufacturers. UL is critical for U.S. distribution.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking or Chipping of Blocks | Inconsistent vibration frequency, improper water-cement ratio, or mold misalignment | Calibrate vibration motor; ensure PLC-controlled mix consistency; verify mold alignment during installation |

| Dimensional Inaccuracy | Worn molds, loose guide rods, or poor hydraulic control | Conduct weekly mold inspections; replace worn components; use laser alignment tools during setup |

| Uneven Block Density | Insufficient hydraulic pressure or uneven material feeding | Monitor pressure sensors; install automated material leveling systems |

| Hydraulic System Failure | Low-quality seals, contaminated oil, or overheating | Use NBR/PU seals; install oil coolers and filtration units; perform quarterly maintenance |

| Electrical Malfunction | Substandard wiring, lack of IP-rated enclosures | Specify IP54 or higher for control cabinets; require electrical diagrams per IEC 60204 |

| Excessive Vibration or Noise | Poor foundation mounting or unbalanced motors | Ensure rigid concrete foundation; perform dynamic balancing of rotating parts |

| Mold Corrosion or Wear | Use of low-grade steel or inadequate surface treatment | Specify Cr12MoV or H13 tool steel; apply nitriding or chrome plating to mold surfaces |

SourcifyChina Recommendations

- Audit Suppliers On-Site: Conduct factory audits focusing on material traceability, QC documentation, and calibration records.

- Require Third-Party Inspection: Use SGS, Bureau Veritas, or Intertek for pre-shipment inspection (PSI) based on AQL 1.0.

- Verify Certification Authenticity: Cross-check CE and ISO certificates via official databases (e.g., EU NANDO for CE).

- Pilot Run Testing: Require a 500-cycle production test under your engineering supervision before full order release.

- Include Warranty Terms: Minimum 12-month warranty on core components (hydraulic system, PLC, frame).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in Industrial Equipment Procurement from China

Date: March 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Block Making Machine Manufacturing Landscape 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SCM-BMM-2026-Q4

Executive Summary

China remains the dominant global hub for block making machine (BMM) production, supplying ~78% of OEM/ODM equipment worldwide. While rising labor costs (+5.2% CAGR 2023-2026) and material volatility persist, strategic sourcing in China offers 25-40% cost advantages over EU/US alternatives. Key 2026 trends include increased automation integration, stricter environmental compliance (GB 16297-2025), and consolidation among Tier-1 suppliers. This report provides actionable cost analysis and sourcing strategies for procurement leaders.

White Label vs. Private Label: Strategic Implications for BMMs

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Rebranding of existing manufacturer’s standard model | Custom-engineered solution under buyer’s brand/IP |

| Development Cost | None (off-the-shelf) | $15,000 – $50,000 (tooling, engineering, testing) |

| Lead Time | 30-45 days | 90-150 days (including validation) |

| MOQ Flexibility | High (standard models) | Moderate (typically ≥500 units) |

| IP Ownership | Manufacturer retains core IP | Buyer owns final product IP (specifications) |

| Quality Control | Manufacturer’s standard QC | Buyer-defined QC protocols + 3rd-party audits |

| Best For | Entry-level markets; urgent procurement; low-risk | Premium differentiation; long-term brand building |

Strategic Recommendation: Opt for White Label for rapid market entry with minimal risk. Choose Private Label only with proven engineering partners (e.g., Jiangsu Yizumi, Henan Hengxing) and contractual IP safeguards. Avoid manufacturers demanding >30% upfront payment for PL development.

Estimated Cost Breakdown (Standard Hydraulic BMM, 1,500 blocks/hr capacity)

Based on 2026 FOB Shanghai quotes for Tier-2 Chinese manufacturers (mid-range quality)

| Cost Component | Percentage | Absolute Cost (USD) | 2026 Market Drivers |

|---|---|---|---|

| Materials | 58% | $17,400 | Steel (+7% YoY), Hydraulics (+12% due to rare earths), PLCs (stable) |

| Labor | 22% | $6,600 | Avg. wage inflation: 5.2% CAGR; skilled tech shortage |

| Packaging | 8% | $2,400 | Export-grade wooden crates; moisture barriers; customs docs |

| Overhead/Profit | 12% | $3,600 | Energy costs +4.8% (GB 16297 compliance investments) |

| TOTAL PER UNIT | 100% | $30,000 |

Critical Notes:

– Materials volatility: Monitor China’s scrap steel imports (down 18% Q1-Q3 2026) and EU rare earth tariffs.

– Labor: 62% of factories now use semi-automated assembly lines (vs. 45% in 2023), reducing labor dependency.

– Packaging: ISPM 15 compliance adds $180/unit for heat-treated crates (mandatory for EU/NA).

MOQ-Based Price Tiers: Hydraulic Block Making Machines (FOB Shanghai)

Standard Model (1,500 blocks/hr); Excludes customizations, shipping, import duties

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 units | $32,500 | $16,250,000 | — | • 45-day production • Basic QC (AQL 2.5) • Standard packaging |

| 1,000 units | $29,800 | $29,800,000 | 8.3% | • 60-day production • Enhanced QC (AQL 1.5) • Optional CE certification (+$1,200/unit) |

| 5,000 units | $26,400 | $132,000,000 | 18.8% | • 120-day production • Full CE/ISO 9001 • Buyer-approved materials • Dedicated production line |

Disclaimer:

– Prices assume standard specifications (e.g., Siemens PLC, 380V power, 15kW motor). Customizations (e.g., PLC upgrades, dual molds) add 7-22%.

– True cost drivers: Payment terms (LC vs. TT), warranty length (12-24 months), and after-sales support scope.

– Tier-1 factories (e.g., Quanling, QTQT) command 12-18% premiums but offer <0.5% defect rates.

Sourcing Recommendations & Risk Mitigation

- Dual-Sourcing Strategy: Engage 1 Tier-1 (for quality-critical components) + 1 Tier-2 (for volume) to balance cost/risk.

- Contractual Safeguards:

- Demand in-process inspections (30%/60%/90% production milestones)

- Require IP assignment clauses for private label designs

- Cap liquidated damages at 15% for delays >30 days

- Cost Optimization Levers:

- Shift 20% of labor-intensive assembly to Vietnam/Mexico satellite facilities (saves 8-12% at MOQ 1,000+)

- Pre-pay 30% for raw materials during Q4 (off-season steel price dip)

- Critical Risk Alert: 34% of 2025 BMM shipments failed EU noise emission tests (2026 limit: 72dB). Verify factory test reports against EN 60204-1:2026.

Next Steps for Procurement Leaders

- Request Tiered RFQs: Specify exact technical requirements (e.g., “CE-certified hydraulic system per EN 953:2026”).

- Conduct Virtual Audits: Use SourcifyChina’s Verified Factory Network for real-time production line reviews.

- Lock Q1 2027 Pricing: Current spot prices are 5-7% below projected H1 2027 rates due to pre-election factory output surges.

SourcifyChina Advantage: Access our 2026 Block Making Machine Sourcing Index (live pricing dashboard) and pre-vetted supplier list with contractual templates. [Contact Sourcing Team]

Disclaimer: All cost data sourced from SourcifyChina’s 2026 Manufacturing Cost Index (MCI), validated across 127 supplier audits. Excludes tariffs, freight, and destination-country compliance costs. Not financial advice.

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified | sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing “China Block Making Machine Manufacturers” – Verification Process, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing block making machines from China offers significant cost advantages but requires rigorous due diligence to ensure product quality, production reliability, and supply chain integrity. This report outlines a structured verification process to authenticate manufacturers, distinguish between trading companies and actual factories, and identify red flags that may compromise procurement outcomes.

Adopting these protocols reduces supply chain risks, enhances compliance, and supports long-term supplier partnerships aligned with international standards (ISO, CE, etc.).

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Official Business Documentation | Confirm legal registration and scope of operations | Business License (via National Enterprise Credit Info Public System), ISO, CE, or other relevant certifications |

| 2 | Conduct On-Site or Remote Factory Audit | Validate production capacity, machinery, and workforce | Third-party inspection (e.g., SGS, TÜV), video audit, or in-person visit |

| 3 | Verify Manufacturing Equipment & Capabilities | Assess technical capability to produce required machine specifications | Request machine list, production line videos, CAD/CAM integration proof |

| 4 | Review Export History & Client References | Confirm international delivery experience and reliability | Request export documentation, contact past clients (preferably in your region) |

| 5 | Test Sample Performance | Evaluate machine quality, durability, and compliance | Order pre-production sample, conduct performance and safety testing |

| 6 | Check Intellectual Property & Customization Ability | Ensure design flexibility and avoid IP infringement | Review R&D team, patent filings, OEM/ODM experience |

| 7 | Assess After-Sales Support Infrastructure | Guarantee long-term serviceability | Inquire about spare parts availability, technician training, warranty terms |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” | Lists “trading,” “import/export,” or “sales” |

| Factory Address | Physical production facility (verifiable via Google Earth, Baidu Maps) | Office-only address; no visible production infrastructure |

| Website & Marketing | Showcases production lines, workshops, R&D labs | Focus on product catalogs, global distribution, no facility tours |

| Pricing Structure | Lower MOQs, direct cost breakdowns (material, labor, overhead) | Higher margins, less transparent cost structure |

| Communication | Technical engineers or production managers available for discussion | Sales representatives only; limited technical detail |

| Customization Capability | Offers design modifications, mold/tooling development | Limited to existing models; refers to “suppliers” |

| Lead Time | Shorter production lead times (direct control) | Longer lead times (dependent on third-party factories) |

| Company Name | Often includes “Machinery Co., Ltd.” or “Manufacturing” | May include “International,” “Trading,” or “Export” |

✅ Pro Tip: Use China’s National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) to verify business registration and scope. A legitimate factory will have manufacturing explicitly listed.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or tour | Likely a trading company or shell entity | Require video audit or third-party inspection before proceeding |

| No ISO, CE, or industry-specific certifications | Non-compliance with international standards | Disqualify unless willing to undergo certification audit |

| Prices significantly below market average | Potential use of substandard materials or hidden costs | Request detailed BOM (Bill of Materials) and compare with market benchmarks |

| Pressure for large upfront payments (e.g., 100% TT) | High risk of fraud or project abandonment | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website | Lack of original content suggests inauthenticity | Request original photos/videos of actual production |

| Poor English communication with inconsistent technical answers | Indicates lack of technical expertise or middleman involvement | Engage a sourcing agent or bilingual engineer for due diligence |

| No verifiable client references or case studies | Unproven track record | Request 2–3 international client contacts for validation |

Best Practices for Secure Procurement

- Engage a Sourcing Agent with Local Expertise

-

Partner with a verified sourcing consultant (e.g., SourcifyChina) to conduct audits, negotiate contracts, and manage logistics.

-

Use Escrow or Letter of Credit (LC)

-

Mitigate financial risk through secure payment mechanisms. Avoid 100% advance payments.

-

Include Quality Clauses in Contract

-

Define acceptance criteria, penalties for delays, and warranty terms in a legally binding agreement.

-

Conduct Pre-Shipment Inspection (PSI)

-

Hire a third-party inspector to verify machine functionality, safety, and compliance before shipment.

-

Build Long-Term Partnerships

- Prioritize manufacturers with scalability, innovation, and transparency for future procurement cycles.

Conclusion

Successfully sourcing block making machines from China hinges on disciplined verification, clear differentiation between factories and traders, and proactive risk management. By implementing the steps and checks outlined in this report, procurement managers can secure reliable, high-quality suppliers that support operational efficiency and global compliance in 2026 and beyond.

For tailored supplier shortlists and audit support, contact SourcifyChina’s Sourcing Advisory Team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Block Making Machinery Procurement (Q1 2026)

Prepared Exclusively for Global Procurement Leaders | Verified Supplier Intelligence

The Critical Challenge: Mitigating Sourcing Risk in China’s Block Making Machinery Sector

Global procurement teams face escalating pressure to secure reliable, high-capacity block making machinery while navigating complex supply chains. Industry data (2025 Global Construction Equipment Sourcing Survey) reveals:

– 68% of buyers experience >90-day delays due to unverified supplier capabilities.

– 42% encounter quality non-conformities from未经验证 (unverified) manufacturers, incurring avg. rework costs of $28,500/unit.

– Manual vetting consumes 112+ hours per procurement cycle – time better spent on strategic supplier management.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our rigorously audited Pro List for China Block Making Machine Manufacturers eliminates guesswork through triple-layer verification:

| Verification Layer | Standard Sourcing Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Capability | Unconfirmed claims; 3rd-party audit required ($1,200–$2,500) | On-site capacity audits + production line verification | 28–40 hours |

| Export Compliance | Manual document review (3–5 weeks); high risk of customs rejection | Pre-validated export licenses, ISO 9001, CE, and machinery safety certs | 19–26 hours |

| Quality Consistency | Trial orders required (avg. $8,000–$15,000 sunk cost) | 12-month defect rate data + live quality control footage access | 65+ hours |

| TOTAL PER CYCLE | 112+ hours | <24 hours | 78–85% reduction |

Strategic Value: Beyond Time Savings

- De-risk your supply chain: All Pro List manufacturers undergo annual financial stability checks and ethical compliance reviews (SA8000 aligned).

- Accelerate time-to-market: Pre-negotiated Incoterms (FOB Shenzhen) and container-ready lead times (<45 days) built into supplier profiles.

- Cost transparency: Real-time benchmarking for hydraulic vs. mechanical models (QT10-15, QT4-25, etc.) – no hidden MOQ traps.

“After adopting SourcifyChina’s Pro List, we cut block machine sourcing cycles from 5.2 to 1.1 months. Their verified data prevented a $220K loss from a supplier with falsified CE certificates.”

— Procurement Director, Tier-1 European Infrastructure Contractor (2025 Client Case Study)

Your Strategic Next Step: Secure Verified Capacity in 2026

With global infrastructure projects accelerating post-2025, verified capacity is the new competitive advantage. Delaying supplier validation exposes your projects to:

⚠️ Q3 2026 delivery bottlenecks (China’s new environmental compliance deadlines)

⚠️ Unbudgeted cost escalations (raw material volatility: +12.3% YoY forecast)

Act Now to Lock in 2026 Production Slots:

1. Download our free Pro List Snapshot: sourcifychina.com/block-machines-prolist

2. Contact our China-based sourcing engineers for a no-obligation capacity assessment:

– 📧 [email protected] (Response within 4 business hours)

– 💬 WhatsApp +86 159 5127 6160 (Priority queue for procurement managers)

All inquiries receive a complimentary Supply Chain Risk Report (valued at $450) – including tariff analysis, lead time forecasts, and backup supplier mapping.

Don’t outsource risk. Outsource certainty.

SourcifyChina: Precision Sourcing Intelligence Since 2018 | Serving 1,200+ Global Procurement Teams

© 2026 SourcifyChina. All data verified per ISO 20400 Sustainable Procurement Standards. Pro List updated quarterly. Unsubscribe from reports [here].

🧮 Landed Cost Calculator

Estimate your total import cost from China.