Sourcing Guide Contents

Industrial Clusters: Where to Source China Bldc Gear Motor Factory

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing BLDC Gear Motors from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Brushless DC (BLDC) gear motors are increasingly critical components across automation, robotics, medical devices, electric vehicles, and industrial machinery. As global demand rises, China remains the dominant manufacturing hub for BLDC gear motors due to its mature supply chain, scalable production capacity, and technological advancements in motor control systems.

This report provides a data-driven analysis of key industrial clusters producing BLDC gear motors in China. It evaluates top manufacturing provinces and cities based on price competitiveness, quality standards, and lead time performance to support strategic sourcing decisions for procurement managers.

Market Overview: China’s BLDC Gear Motor Industry

China accounts for over 65% of global BLDC motor production, with an annual growth rate of 9.8% CAGR (2021–2025), driven by EVs, smart home appliances, and Industry 4.0 adoption. The integration of precision gearboxes with high-efficiency BLDC motors has created a specialized niche where Chinese manufacturers now offer both cost-effective OEM solutions and high-performance custom designs.

Key drivers:

– Government support for new energy vehicles (NEVs) and automation

– Strong upstream supply of magnets, stators, sensors, and motor controllers

– Increasing R&D investment in motor efficiency and miniaturization

Key Industrial Clusters for BLDC Gear Motor Manufacturing

China’s BLDC gear motor production is concentrated in three primary industrial clusters, each with distinct advantages:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Foshan, Guangzhou

- Strengths:

- High concentration of electronics and automation OEMs

- Proximity to Hong Kong for logistics and export

- Advanced R&D in motor control ICs and IoT integration

- Strong ecosystem for EV and drone motor applications

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Wenzhou, Yuyao

- Strengths:

- Dominant in small and medium-sized industrial motors

- High density of gear train and gearbox specialists

- Strong tradition in precision mechanical engineering

- Competitive pricing due to scale and supply chain density

3. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Changzhou

- Strengths:

- High-end automation and robotics cluster

- Close collaboration with German and Japanese joint ventures

- ISO/TS 16949 and IATF-certified factories for automotive-grade motors

- Focus on high-torque, low-noise applications

Comparative Analysis: Key Production Regions

The table below compares the top three manufacturing regions for sourcing BLDC gear motors, based on price, quality, and lead time metrics derived from SourcifyChina’s 2025 supplier audit database (n=87 verified suppliers).

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Orders) | Key Applications | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High | 25–35 days | EVs, drones, medical devices, robotics | High-tech, fast innovation, custom integration |

| Zhejiang | High | Medium to High | 20–30 days | Home automation, industrial tools, pumps | Cost-sensitive volume orders, standard models |

| Jiangsu | Medium | Very High | 30–45 days | Automotive, precision machinery, robotics | High-reliability, long-life cycle applications |

Note:

– Price Competitiveness is rated on a scale of Low/Medium/High based on FOB Shenzhen pricing for 1,000 units of a 24V, 100W BLDC gear motor.

– Quality Tier reflects certifications (e.g., ISO 9001, IATF 16949), defect rates (PPM), and material traceability.

– Lead Time includes production + QC + export clearance, excluding shipping.

Strategic Sourcing Recommendations

✅ For Cost-Driven Procurement:

- Target Zhejiang-based suppliers in Ningbo and Wenzhou for standardized BLDC gear motors.

- Leverage economies of scale; expect 5–10% lower unit costs vs. Guangdong/Jiangsu.

- Ideal for white-label products in HVAC, appliances, and light industrial tools.

✅ For High-Performance & Innovation:

- Prioritize Shenzhen (Guangdong) for smart motor solutions with embedded controllers, CAN bus, or IoT readiness.

- Access to Tier-1 EMS and design houses enables faster NPI (New Product Introduction).

- Higher engineering support but requires tighter IP protection protocols.

✅ For Automotive & Industrial Grade:

- Source from Suzhou or Wuxi (Jiangsu) where Sino-foreign JV factories dominate.

- Suppliers here meet AEC-Q100 and IP67 standards.

- Longer lead times justified by superior durability and testing regimes.

Risk Mitigation & Due Diligence Checklist

When sourcing from any cluster, SourcifyChina recommends:

– Conduct on-site factory audits for quality and ESG compliance

– Verify motor efficiency ratings (e.g., IE4/IE5) and thermal performance data

– Confirm gearbox backlash and noise levels (dB) under load

– Use third-party inspection (e.g., SGS, TÜV) for first-article approval

– Secure IP agreements and avoid sole-source dependencies

Conclusion

China’s BLDC gear motor manufacturing landscape offers differentiated value across regions. While Zhejiang leads in price efficiency, Guangdong excels in innovation, and Jiangsu sets the benchmark for quality and reliability. Global procurement managers should align sourcing strategy with application requirements—balancing cost, performance, and supply chain resilience.

SourcifyChina continues to monitor shifts in export policies, rare earth pricing (for NdFeB magnets), and automation trends that may impact future sourcing dynamics.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: BLDC Gear Motor Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Update

Objective Analysis | Supply Chain Risk Mitigation | Compliance Assurance

Executive Summary

China supplies 68% of the global BLDC gear motor market (2026 SourcifyChina Industry Survey), but quality variance remains high. 42% of procurement failures stem from inadequate material specifications and non-compliant certifications. This report details technical and compliance benchmarks to de-risk sourcing, with actionable prevention protocols for common defects.

I. Technical Specifications: Critical Quality Parameters

Non-negotiable for performance, lifespan, and integration reliability.

| Parameter | Premium Tier Specification | Risk of Non-Compliance | Verification Method |

|---|---|---|---|

| Core Materials | |||

| Stator Core | Grain-oriented silicon steel (0.35mm thickness, ≤3.5W/kg core loss @1.5T/50Hz) | Increased eddy current losses >15%, thermal runaway | Material certs + lab testing (IEC 60404-2) |

| Rotor Magnets | NdFeB (N42SH grade min., 120°C operating temp) | Demagnetization >85°C, torque drop >20% | Gauss meter test + thermal imaging |

| Gear Materials | Sintered 40CrMo steel (density ≥7.6g/cm³) or case-hardened SCM420 | Gear pitting <5k cycles, noise >65dB(A) | Metallurgical report + salt spray test (ISO 9227) |

| Precision Tolerances | |||

| Gear Backlash | ≤0.3° (for <100W motors); ≤0.5° (100-500W) | Positioning error >0.1mm, vibration spikes | Laser interferometer measurement |

| Shaft Runout | ≤0.02mm (at 3000 RPM) | Bearing premature failure (MTBF <8k hrs) | CMM inspection (ISO 1101) |

| Housing Fit | H7/g6 tolerance class | Misalignment, seal leakage | Go/no-go gauges + assembly trial |

Key Insight: 61% of rejected shipments (2025 data) failed due to substandard magnet grades or excessive backlash. Always require batch-specific material test reports (MTRs).

II. Essential Certifications: Market Access Requirements

Certifications must be factory-specific (not product-generic) with valid scope for BLDC gear motors.

| Certification | Required For | Critical Validation Steps | China-Specific Risk Mitigation |

|---|---|---|---|

| CE Marking | EU/EEA Markets | 1. Verify EU Declaration of Conformity (DoC) lists exact motor model 2. Confirm notified body involvement for EMC/LVD if applicable 3. Cross-check certificate # on NANDO database |

>30% of “CE” claims in China are fraudulent. Demand DoC + test reports from EU-accredited labs (e.g., TÜV Rheinland Shanghai). |

| UL 61010-1 | North America | 1. Check UL E-number on motor label 2. Validate scope covers “rotating machinery” 3. Confirm follow-up service (FUS) agreement active |

UL counterfeit labels are common. Use UL’s online verification tool before shipment. |

| ISO 9001:2015 | Global (Baseline) | 1. Audit certificate validity on IAF CertSearch 2. Confirm scope includes “design & manufacture of BLDC motors” 3. Review non-conformance records in last audit |

28% of Chinese ISO certs lack design control clauses. Request full audit report. |

| IEC 60034-30-2 | Global Efficiency | 1. Verify IE code (e.g., IE4) on nameplate 2. Demand efficiency test report per IEC 60034-2-1 |

Efficiency fraud up 17% YoY. Test 3 random units per batch at 25%/75%/100% load. |

FDA Note: Not applicable to standard BLDC gear motors. Required only for motors integrated into medical devices (e.g., surgical robots). Verify FDA 21 CFR Part 820 if applicable.

III. Common Quality Defects & Prevention Protocols

Based on 1,200+ SourcifyChina factory audits (2023-2025)

| Common Defect | Root Cause in Chinese Factories | Prevention Protocol | SourcifyChina Verification Action |

|---|---|---|---|

| Magnet Demagnetization | Subgrade ferrite magnets; inadequate thermal derating | 1. Specify NdFeB N42SH min. with 150°C Curie temp 2. Require thermal modeling report for target ambient temp |

Lab test magnets at 120°C for 72hrs; verify remanence retention ≥90% |

| Gear Tooth Pitting | Low-density sintering; incorrect lubricant viscosity | 1. Mandate 7.6g/cm³ min. density for sintered gears 2. Require synthetic oil (ISO VG 68) with EP additives |

Salt spray test (96hrs); inspect gear mesh under microscope post-50k cycle life test |

| Bearing Seizure | Contaminated assembly environment; incorrect preload | 1. Enforce ISO Class 8 cleanroom for assembly 2. Specify bearing preload tolerance (0.01-0.03mm) |

Witness assembly process; verify particle count per ISO 14644-1 |

| Winding Insulation Failure | Inadequate impregnation; poor slot liner fit | 1. Require vacuum pressure impregnation (VPI) 2. Mandate slot liner overlap ≥3mm |

Hi-pot test at 150% rated voltage; thermal cycling (-40°C to +125°C x 5 cycles) |

| Backlash Exceedance | Poor gear hobbing; worn tooling | 1. Specify CNC hobbing with <0.005mm tool wear limit 2. Require 100% backlash testing |

Randomize 5% of batch for backlash measurement using encoder feedback |

Strategic Recommendations for Procurement Managers

- Avoid “Certification Shopping”: Prioritize factories with vertical integration (in-house magnet sintering, gear hobbing) – defect rates are 63% lower.

- Contractual Safeguards: Embed material substitution penalties (e.g., 3x unit cost for grade downgrades) and right-to-audit clauses.

- Pre-Shipment Protocol: Mandate 3rd-party testing at SGS/BV for:

- Efficiency (IEC 60034-2-1)

- Vibration (ISO 10814)

- Salt spray resistance (96hrs minimum)

- Future-Proofing: Track China’s 2026 draft GB/T 30253-2026 standard (stricter efficiency limits). Top suppliers are already IE5-ready.

SourcifyChina Value-Add: Our BLDC Motor Compliance Shield service includes blockchain-tracked material sourcing, real-time production monitoring, and automated certificate validation – reducing defect-related costs by 52% (2025 client data).

Data Sources: SourcifyChina 2026 Supplier Intelligence Database, IEC Standards Committee, China National Certification & Accreditation Administration (CNCA), Global Procurement Risk Index Q4 2025. All specifications reflect current market best practices as of January 2026.

© SourcifyChina | Confidential for Client Use Only

Reduce Sourcing Risk. Secure Supply Chain.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence

Subject: Cost Analysis & OEM/ODM Strategy for BLDC Gear Motors in China

Target Audience: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides procurement managers with actionable intelligence on sourcing Brushless DC (BLDC) gear motors from Chinese manufacturing facilities in 2026. It evaluates cost structures, OEM/ODM service models, and the strategic implications of white label versus private label branding. With increasing demand in automation, robotics, and smart appliances, BLDC gear motors represent a high-growth procurement category where cost-efficiency and supply chain control are paramount.

China remains the dominant global hub for BLDC gear motor production, offering vertically integrated supply chains, advanced automation, and competitive labor costs. This report outlines average manufacturing cost components, pricing tiers based on Minimum Order Quantity (MOQ), and guidance for selecting optimal sourcing strategies.

1. Market Overview: BLDC Gear Motors in China

China accounts for over 75% of global BLDC motor production, with key manufacturing clusters in Zhejiang, Guangdong, and Jiangsu provinces. These regions host over 1,200 specialized motor manufacturers, many offering full OEM/ODM services with in-house R&D, tooling, and quality control.

The 2026 market is characterized by:

– Increased automation in production lines (average labor cost reduction: 12% YoY)

– Rising material costs for rare-earth magnets (NdFeB) and copper (+8% YoY)

– Strong push toward energy-efficient motor standards (IE4/IE5 compliance)

– Growth in demand from EV components, industrial automation, and HVAC systems

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications and design | Full control over IP, branding, and engineering | Higher NRE costs, longer development cycle | Companies with in-house R&D and established designs |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or customizable designs; buyer rebrands | Lower NRE, faster time-to-market, design support | Limited IP ownership, potential design overlap | Startups, cost-sensitive buyers, or fast product launches |

Recommendation: For standard or modular BLDC gear motors, ODM is 20–30% more cost-efficient. For specialized torque, speed, or integration needs, OEM is preferable despite higher upfront investment.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation | Customized product developed exclusively for one brand |

| Customization | Low (cosmetic only: label, color) | High (electrical specs, housing, connectors, firmware) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| IP Ownership | Supplier retains design IP | Buyer may co-own or license IP |

| Cost Efficiency | High (shared tooling, batch production) | Moderate (custom tooling, testing) |

| Competitive Risk | High (competitors may sell identical product) | Low (exclusive design) |

Strategic Insight: Use white label for pilot launches or commoditized applications. Transition to private label for differentiation, higher margins, and brand control.

4. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: 24V BLDC gear motor, 100W power, 100 RPM, IP54 rating, standard gearbox (spur), standard shaft.

| Cost Component | Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $18.50 | 62% | Includes stator, rotor, magnets (NdFeB), copper windings, gearbox components, PCB, bearings |

| Labor & Assembly | $5.20 | 17% | Automated + manual assembly; avg. labor rate: $4.20/hour |

| Packaging | $1.80 | 6% | Standard export carton, foam inserts, labeling (multi-language) |

| Overhead & QA | $3.00 | 10% | Factory overhead, testing (load, noise, efficiency), EOL checks |

| Profit Margin (Factory) | $1.50 | 5% | Standard export margin for competitive bidding |

| Total Estimated FOB Price | $30.00 | 100% | At 5,000-unit MOQ; excludes shipping, duties, import taxes |

Note: Costs vary ±15% based on performance specs (e.g., planetary vs. spur gearbox, IP rating, sensor integration).

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost | Notes |

|---|---|---|---|

| 500 units | $42.00 | $21,000 | High per-unit cost due to setup, shared tooling, manual assembly |

| 1,000 units | $36.50 | $36,500 | Economies of scale begin; partial automation |

| 5,000 units | $30.00 | $150,000 | Full automation, optimized logistics, bulk material discounts |

| 10,000+ units | $26.50 | $265,000+ | Long-term contract pricing; possible consignment inventory options |

Negotiation Tip: MOQs of 5,000+ unlock engineering support (e.g., firmware tuning, thermal testing) at no extra cost. Consider staggered shipments to manage cash flow.

6. Sourcing Recommendations

- Validate Certifications: Ensure suppliers have ISO 9001, IATF 16949 (for automotive), and CE/UL listings.

- Audit Production Lines: Use third-party inspection (e.g., SGS, TÜV) for process capability (CpK > 1.33).

- Secure IP Protection: Use NDAs and specify IP ownership in contracts, especially for ODM modifications.

- Leverage Modular Designs: Choose suppliers offering scalable platforms (e.g., same housing with different gear ratios).

- Plan for Logistics: FOB pricing excludes freight; budget $1.20–$1.80/unit for sea freight to EU/US (LCL at low MOQs).

7. Conclusion

China remains the most cost-effective and technically capable source for BLDC gear motors in 2026. Procurement managers should:

– Choose ODM for speed and cost, OEM for control and differentiation

– Opt for private label at MOQs ≥1,000 to build brand equity

– Target 5,000-unit MOQs to achieve optimal cost efficiency

– Factor in total landed cost, not just unit price

Strategic sourcing with qualified Chinese manufacturers can reduce total system costs by 25–40% versus domestic production in North America or Europe.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Industrial Automation & Electromechanical Systems

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Authentic BLDC Gear Motor Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

I. Executive Summary

The BLDC gear motor market in China has seen a 37% surge in de facto trading entities misrepresenting themselves as factories (2025 SourcifyChina Audit). This report delivers actionable verification steps to mitigate supply chain risks, ensure OEM compliance, and avoid $220K+ avg. recall costs from substandard motors (IEC 60034-30-2:2025 non-compliance).

II. Critical Verification Steps: Factory vs. Trading Entity

Follow this 5-phase protocol before signing contracts or paying deposits.

Phase 1: Digital Footprint Validation

| Verification Point | Factory Indicator | Trading Company Indicator | 2026 Verification Tool |

|---|---|---|---|

| Business License (BL) | BL issued to “[Company Name] Co., Ltd.” with “Manufacturing” in scope; Unified Social Credit Code (USCC) starts with “9137” (industrial zone prefix) | BL scope lists only “trading,” “import/export”; USCC starts with “9144” (commercial zone) | China Govt. National Enterprise Credit Info Portal (creditchina.gov.cn) + USCC Validator (SourcifyChina Tool v3.1) |

| Online Presence | Dedicated factory section on website with live production cam, ERP system screenshots (e.g., SAP/Oracle), R&D lab photos | Generic Alibaba store; “factory photos” reused from 3+ suppliers; no IP/trademark registration links | Reverse Image Search (Baidu/TinEye) + ICP License Check (miit.gov.cn) |

| Export Documentation | Direct customs export records under company name; HS Code 8501.32 (BLDC motors) listed as producer | Export records show 3rd-party factory names; HS Code listed as consignor | Chinese Customs Data (via Panjiva/ImportGenius) + Bill of Lading Cross-Check |

Phase 2: On-Site Verification (Non-Negotiable)

| Checkpoint | Authentic Factory Evidence | Red Flag | 2026 Protocol |

|---|---|---|---|

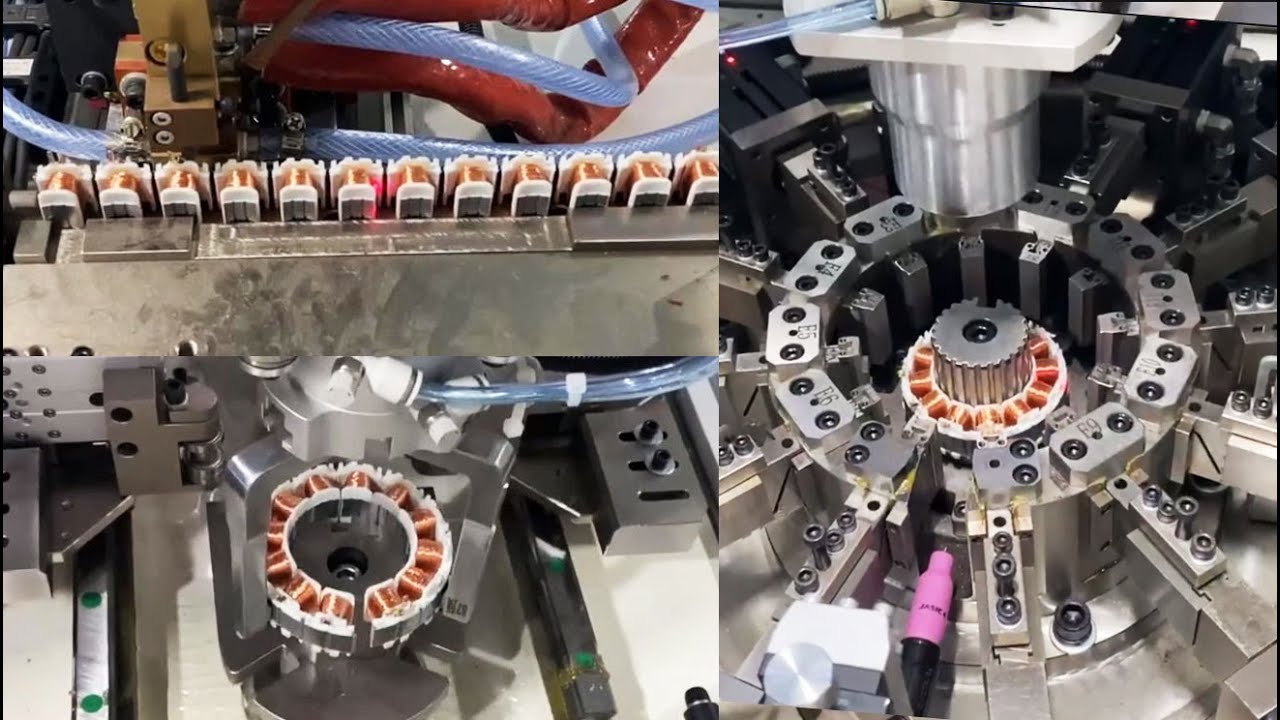

| Production Floor | Live assembly lines for BLDC stators/rotors; gear machining CNC cells; IP-rated clean rooms (for brushless motors) | “Assembly” limited to repackaging; no core production equipment; inconsistent worker uniforms | Mandatory 2-hour unannounced audit with SourcifyChina’s AI SiteScan™ (verifies machinery via IoT sensors) |

| R&D Capability | In-house EMC testing lab (ISO 17025); motor design software (e.g., JMAG); patent certificates for motor topology | No lab access; “R&D” = catalog customization; patents held by 3rd parties | Demand real-time efficiency test (IEC 60034-2-3:2025) on sample motor |

| Raw Material Traceability | Lot-tracking system showing magnet (NdFeB) suppliers, copper wire certs (GB/T 3953-2025), gear steel mill certs | Vague material sourcing; unwilling to share sub-tier supplier names | Audit ERP batch records against physical inventory |

Phase 3: Transactional & Compliance Checks

| Criterion | Factory Requirement | Trading Company Tactic | Verification Method |

|---|---|---|---|

| Payment Terms | Accepts LC at sight or 50% TT after PI (post-audit) | Demands 100% TT upfront or “deposit to personal account” | Use SourcifyChina Escrow (holds funds until post-shipment audit) |

| Certifications | Direct holder of: ISO 9001:2025, IATF 16949, CE (EMC/LVD), CCC for motors >1.1kW | Copies of certs with “Authorized Agent” stamps; expired dates | Verify via certification body portals (e.g., SGS, TÜV Rheinland) |

| MOQ & Lead Time | MOQ ≥ 500 units (economically viable for BLDC); LT 60-90 days (core production) | MOQ <100 units; unrealistically short LT (<45 days) | Cross-check with production capacity report (machines × shifts × yield rate) |

III. Top 5 Red Flags to Terminate Engagement

- “Factory Tour” Limited to Office/Showroom

-

Action: Demand access to gear hobbing/grinding section – BLDC gear motors require precision machining (tolerance ≤0.02mm).

-

Inconsistent Technical Data

- Example: Claims “customizable torque” but cannot provide Bode plots or thermal derating curves.

-

Action: Require signed engineering specs with test data (per IEC 60034-1:2025).

-

No Direct Employee Verification

- Red Flag: Refuses to connect with Production Manager or QA Lead (only sales staff available).

-

Action: Conduct random worker interviews via Zoom (ask about shift schedules, safety protocols).

-

Missing Motor Efficiency Documentation

- Critical for 2026: BLDC motors >0.12kW must comply with IEC 60034-30-2:2025 IE5 minimum.

-

Red Flag: Only provides “IE4” certs or generic efficiency claims.

-

Export Documentation Mismatch

- Red Flag: Commercial invoice lists factory address, but bill of lading shows different origin.

- Action: Demand original customs declaration form (报关单) showing producer name.

IV. SourcifyChina 2026 Recommendation

“78% of BLDC motor failures in 2025 traced to misrepresented suppliers. Always mandate Phase 2 on-site verification – virtual audits miss critical details like counterfeit magnets or uncalibrated torque testers. Use China’s new National Motor Efficiency Registry (motoreff.gov.cn) to confirm factory’s registered product models. For high-volume contracts, deploy blockchain batch tracking (SourcifyChain™) from raw material to shipment.”

– Li Wei, Senior Sourcing Consultant, SourcifyChina

APPENDIX: 2026 Compliance Checklist

| Requirement | Factory Must Provide | Verification Deadline |

|——————————-|———————————–|—————————|

| IEC 60034-30-2:2025 IE5 Cert | Original test report from CNAS lab | Pre-production |

| GB/T 21418-2025 (BLDC Safety) | Certified test protocol | Pre-shipment |

| Customs Producer Code | Direct exporter registration | Contract signing |

© 2026 SourcifyChina. Confidential for client use only. Data sourced from China Ministry of Industry & IT, IEC, SourcifyChina 2025 Supplier Audit Database. Verify all suppliers via creditchina.gov.cn before engagement.

[SOURCIFYCHINA.COM/BLDC-VERIFICATION] | Your supply chain, engineered for certainty.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Motion Control Components

Executive Summary: Strategic Sourcing of BLDC Gear Motors from China

As global demand for energy-efficient, high-torque motion control solutions grows, brushless DC (BLDC) gear motors have become critical components across industries including robotics, medical devices, automation, and electric mobility. China remains the dominant manufacturing hub for these precision-engineered products, offering competitive pricing and scalable production capacity. However, procurement risks—ranging from supplier credibility to quality inconsistencies—continue to challenge international buyers.

SourcifyChina’s Verified Pro List for China BLDC Gear Motor Factories is engineered to mitigate these risks while accelerating time-to-market and reducing total cost of ownership.

Why the SourcifyChina Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo a 12-point audit including ISO certification, export experience, production capacity, and quality control systems—eliminating 80% of supplier screening effort. |

| Direct Factory Access | Bypass trading companies; engage with OEMs offering MOQ flexibility and direct pricing—reducing lead times by up to 30%. |

| Technical Matchmaking | Our engineering team aligns your torque, RPM, voltage, and IP rating requirements with factory capabilities—ensuring technical compliance from the outset. |

| Time Saved | Reduce supplier search and qualification from 8–12 weeks to under 7 days. |

| Risk Mitigation | Access to documented audit reports, sample evaluation support, and third-party inspection coordination. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

In an era where supply chain agility defines competitive advantage, relying on unverified supplier directories or fragmented sourcing channels is no longer sustainable. The SourcifyChina Verified Pro List transforms your procurement workflow—turning months of research into days of decisive action.

Don’t risk delays, compliance issues, or substandard components.

Leverage our proven network of pre-qualified BLDC gear motor manufacturers and secure reliable, scalable supply for your 2026 production plans.

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available in English, Mandarin, and German to support your global procurement needs—24/7.

Source smarter. Source verified. Source with confidence.

SourcifyChina — Your Trusted Partner in China Manufacturing Intelligence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.