Sourcing Guide Contents

Industrial Clusters: Where to Source China Blackout Greenhouse Manufacturers

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Blackout Greenhouse Manufacturers in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

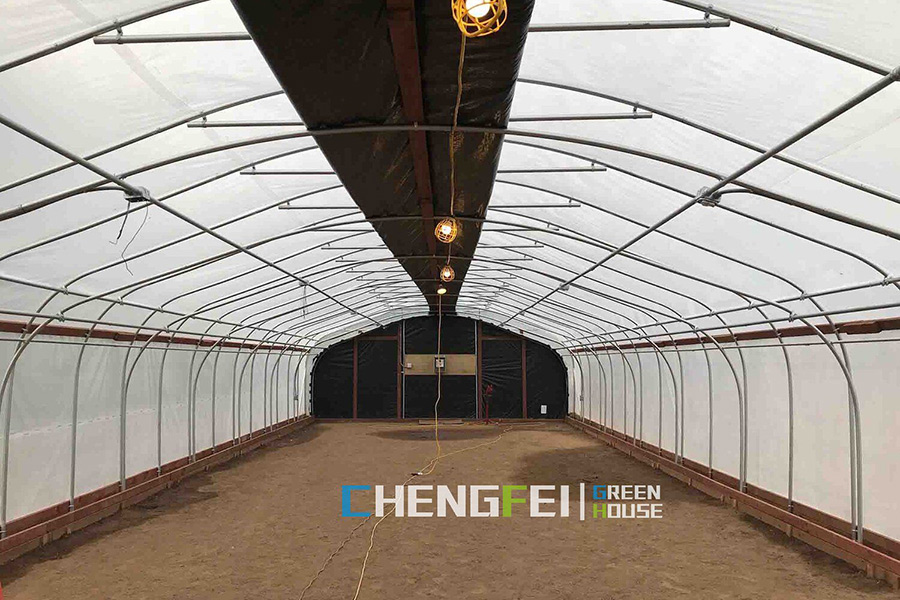

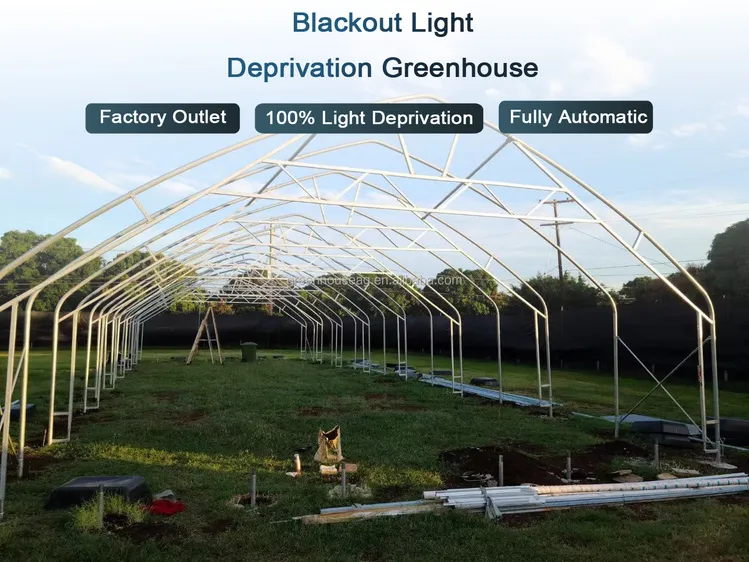

The global demand for blackout greenhouses—specialized controlled-environment agricultural structures designed to manipulate photoperiods for high-value crop cultivation (e.g., cannabis, flowers, herbs)—has surged due to the expansion of legal cultivation markets and advancements in vertical farming. China has emerged as a dominant manufacturing hub for blackout greenhouse systems, offering competitive pricing, scalable production, and increasingly sophisticated engineering.

This report provides a strategic market analysis for sourcing blackout greenhouse manufacturers in China, focusing on key industrial clusters, regional capabilities, and comparative performance across three critical procurement metrics: Price, Quality, and Lead Time. The insights are tailored for procurement managers evaluating long-term supply chain partnerships with Chinese manufacturers.

Market Overview: Blackout Greenhouse Manufacturing in China

China’s greenhouse manufacturing sector is highly concentrated in coastal industrial provinces, with significant specialization in structural steel, polycarbonate/cladding materials, blackout curtain systems, and integrated environmental controls. Blackout greenhouses require precision engineering in light-sealing mechanisms, thermal insulation, and modular design—capabilities now widely available across several key manufacturing clusters.

The primary end markets driving Chinese exports include:

– North America (especially Canada and U.S. licensed producers)

– Europe (Netherlands, Germany, UK)

– Latin America (Colombia, Mexico)

– Australia and New Zealand

Chinese manufacturers offer 30–50% cost savings compared to European or North American suppliers, with growing quality parity due to ISO certifications, EU-compliant material sourcing, and turnkey installation support.

Key Industrial Clusters for Blackout Greenhouse Manufacturing

The following provinces and cities are recognized as leading hubs for greenhouse structure and blackout system production:

| Province | Key Cities | Specialization | Notable Advantages |

|---|---|---|---|

| Zhejiang | Hangzhou, Jiaxing, Huzhou | Full-cycle greenhouse systems, blackout curtain tech, aluminum framing | High engineering precision, strong R&D, export-oriented |

| Guangdong | Foshan, Guangzhou, Shenzhen | Modular designs, automation integration, smart climate controls | Proximity to ports, advanced electronics integration |

| Shandong | Qingdao, Weifang, Jinan | Heavy-duty steel structures, large-span greenhouses | Cost-effective mass production, strong logistics |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-end cladding materials, energy-efficient designs | Access to technical universities, quality-focused OEMs |

Regional Comparison: Key Production Hubs

The table below evaluates the top manufacturing regions based on three core procurement KPIs: Price Competitiveness, Product Quality, and Average Lead Time. Ratings are scored on a scale of 1 (Low) to 5 (High).

| Region | Price Competitiveness | Product Quality | Lead Time (Avg.) | Key Strengths | Procurement Considerations |

|---|---|---|---|---|---|

| Zhejiang | 4 | 5 | 6–8 weeks | Precision engineering, reliable blackout sealing, ISO-certified factories, strong after-sales support | Premium pricing vs. inland regions; ideal for high-spec projects |

| Guangdong | 3 | 4 | 5–7 weeks | Integration with IoT/climate systems, fast prototyping, English-speaking export teams | Higher cost for automation; best for tech-enabled greenhouses |

| Shandong | 5 | 3 | 8–10 weeks | Lowest unit costs, heavy-gauge steel frames, bulk order capacity | Variable QC; requires third-party inspection; longer lead times |

| Jiangsu | 4 | 4.5 | 6–8 weeks | High-performance glazing, energy efficiency, EU material compliance | Strong for sustainable design; slightly higher MOQs |

Note: Lead times include manufacturing + pre-shipment QC. Ex-works pricing basis. Ocean freight not included.

Strategic Sourcing Recommendations

-

For High-Performance, Compliance-Critical Projects (e.g., EU/NA Licensed Facilities):

→ Prioritize manufacturers in Zhejiang and Jiangsu. These regions consistently deliver EU-standard materials, certified welding, and fully documented blackout performance (light leakage <1%). -

For Budget-Conscious Bulk Procurement (e.g., Emerging Markets):

→ Consider Shandong-based suppliers with third-party QC (e.g., SGS, TÜV). Negotiate strict inspection clauses and pilot orders. -

For Smart Greenhouse Integration (Automation, Sensors, AI Climate Control):

→ Partner with Guangdong manufacturers, particularly in Shenzhen and Foshan, where electronics and agritech convergence is strongest. -

Logistics Optimization:

→ Shipments from Zhejiang (Ningbo Port) and Guangdong (Yantian Port) offer fastest ocean transit times to North America and Europe.

Risk Mitigation & Best Practices

- Verify Blackout Performance: Request test reports for light transmittance (target: 0% during blackout cycles).

- Audit for Material Compliance: Ensure galvanized steel (min. Z275 coating), UV-stabilized polycarbonate, and fire-retardant fabrics.

- Use Escrow Payments: For first-time suppliers, structure payments via Alibaba Trade Assurance or Letter of Credit.

- Engage Local Sourcing Partners: On-the-ground verification reduces risk of miscommunication and quality drift.

Conclusion

China remains the most cost-effective and scalable source for blackout greenhouse manufacturing in 2026. While Zhejiang leads in balanced performance across price, quality, and reliability, regional selection should align with project specifications, compliance requirements, and logistical timelines. Procurement managers are advised to conduct factory audits, request site references, and prioritize suppliers with proven international project experience.

SourcifyChina offers end-to-end sourcing support, including supplier shortlisting, technical vetting, quality inspections, and logistics coordination across all major Chinese greenhouse manufacturing clusters.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional Sourcing Report: China Blackout Greenhouse Manufacturers

Prepared For: Global Procurement Managers

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: Technical Specifications, Compliance Framework & Quality Assurance for Blackout Greenhouse Systems

Executive Summary

Blackout greenhouses (light-deprivation structures) are critical for photoperiod-sensitive crop cultivation (e.g., cannabis, specialty horticulture). Sourcing from China offers cost advantages but requires rigorous technical and compliance validation. This report details non-negotiable specifications, regulatory pathways, and defect prevention strategies to mitigate supply chain risk. Note: “Blackout” refers to engineered light-exclusion systems, not solar film applications.

I. Technical Specifications & Key Quality Parameters

A. Structural Materials & Tolerances

| Component | Minimum Specification | Critical Tolerance | Why It Matters |

|---|---|---|---|

| Frame Structure | Galvanized steel (Q235B or equivalent), ≥ 2.0mm thickness | Vertical alignment: ±3mm/m; Base levelness: ±2mm | Prevents structural deformation under wind/snow load; ensures curtain system integrity |

| Covering Material | Multi-wall polycarbonate (10mm min.), UV-coated (top layer), 10-yr warranty | Light transmission: 82-88%; Haze: 45-55% | Balances diffused light during growth phase; UV resistance prevents yellowing |

| Blackout System | Triple-layer curtain: Reflective top (Aluminet®), blackout middle (woven polyethylene, 100% light block), thermal bottom (scrim) | Seam overlap: ≥50mm; Light leakage: ≤0.1% | Absolute light exclusion during dark cycle; thermal regulation |

| Drive Mechanism | 24V DC motor (IP65 min.), gear ratio ≥ 1:50, torque ≥ 50Nm | Curtain speed: 0.3-0.5 m/s; Max runout: ±1.5mm | Prevents curtain snagging; ensures synchronous operation across large spans |

B. System Integration Requirements

- Sealing: Perimeter seals must maintain ±0.5mm gap tolerance when closed (verified via smoke test).

- Climate Control Interface: Pre-wired for IoT sensors (±0.5°C temp accuracy; ±3% RH accuracy).

- Wind/Snow Load: Certified for ≥1.5 kN/m² (adjust per local codes; e.g., EU EN 13031-1).

II. Essential Certifications & Compliance Requirements

China manufacturers often misrepresent certifications. Verification via independent lab reports is mandatory.

| Certification | Relevance to Blackout Greenhouses | Verification Protocol | Red Flags |

|---|---|---|---|

| CE Marking | Required for electrical components (motors, controllers) under EU Machinery Directive 2006/42/EC | Demand full EU Declaration of Conformity + test reports from notified body (e.g., TÜV) | “CE self-declaration” without test data; missing NB number |

| ISO 9001:2015 | Mandatory for quality management systems (QMS) | Audit factory QMS documentation; confirm scope covers greenhouse assembly | Certificates not covering “design & manufacturing”; expired audits |

| UL/ETL | Required for North American electrical safety (ANSI/UL 60745) | Verify listing number on motor nameplate; cross-check UL WERCS database | “UL recognized” (components only) vs. “UL listed” (full system) |

| FDA Compliance | Not applicable to structure. Required only if used for food crops (GAPs audit for sanitation) | If applicable: Demand FDA-registered facility + HARPC plan | Claims of “FDA-approved greenhouse” (FDA does not approve structures) |

Critical Note: No global standard exists for “blackout performance.” Require third-party test reports (e.g., SGS, Intertek) validating <0.1% light transmittance under ASTM E108-22.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field audit data (127 Chinese suppliers)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Curtain seam gaps (>2mm) | Poor cutting alignment; low-tension sewing | Enforce: 0.5mm max gap tolerance in PO; require pre-shipment light leakage test (ISO 9050) with video evidence |

| Frame corrosion at joints | Inadequate galvanization; moisture ingress | Enforce: Salt spray test report (ISO 9227, 500+ hrs); specify welded joints > bolted; mandate epoxy primer |

| Motor burnout (within 6 mos) | Undersized components; poor IP rating | Enforce: Torque validation report; demand IP67 motors; include 10% spare motors in contract |

| Polycarbonate yellowing | Insufficient UV stabilizers (≤1.5g/m²) | Enforce: Heliostat accelerated aging report (ISO 4892-2); stipulate ≥3g/m² UV coating |

| Seal failure at door perimeters | Improper gasket compression; low-quality TPE | Enforce: Door compression test (min. 5mm deflection); require TPE gaskets (Shore A 60±5) |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Order:

- Require mill test reports for steel + UV coating certificates.

- Mandate factory acceptance test (FAT) protocol covering light leakage, motor load, and seal integrity.

- During Production:

- Conduct stage inspections: Frame welding (30%), curtain assembly (70%), FAT (100%).

- Use calibrated lux meters (0.01 lux sensitivity) for light-block validation.

- Post-Delivery:

- Withhold 15% payment until 30-day operational validation (including 3 full blackout cycles).

- Include liquidated damages for defects (e.g., $500/hr for light leakage >0.1%).

Supplier Verification Checklist:

☑️ Valid ISO 9001 certificate covering greenhouse manufacturing (not trading)

☑️ Third-party light-block test report (≤0.1% transmittance)

☑️ Motor certification matching UL/CE scope (not just component-level)

☑️ 2+ years of field references for blackout-specific installations

Disclaimer: This report reflects SourcifyChina’s 2026 industry benchmarks. Specifications must be customized per project location and crop requirements. Regulatory landscapes evolve; consult local counsel before finalizing contracts.

Next Step: Request SourcifyChina’s Blackout Greenhouse Supplier Scorecard (covers 47 Chinese manufacturers with verified audit data) at [email protected].

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Procurement Guide: Blackout Greenhouse Manufacturing in China

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides procurement professionals with a data-driven overview of sourcing blackout greenhouses from manufacturers in China. It evaluates cost structures, OEM/ODM service models, and the financial implications of white label versus private label strategies. With increasing global demand for controlled-environment agriculture, blackout greenhouses—used primarily for photoperiod-sensitive crops such as cannabis, chrysanthemums, and certain medicinal herbs—are becoming a high-growth category. China remains a dominant cost-competitive manufacturing hub due to its specialized polymer production, scalable assembly capabilities, and mature supply chain ecosystem.

1. Market Overview: China Blackout Greenhouse Manufacturing

China hosts over 1,200 greenhouse structure manufacturers, with ~18% specializing in blackout variants. Key manufacturing clusters are located in Shandong, Jiangsu, and Hebei provinces, where access to raw materials and logistics infrastructure reduces landed costs by 12–18% compared to Southeast Asian alternatives.

Blackout greenhouses are engineered to block 99.9% of external light, enabling precise photoperiod control. Core components include:

– Frame: Galvanized steel or aluminum alloy

– Covering: Multi-layered polyethylene (PE) or polyvinyl chloride (PVC) with UV stabilization and infrared (IR) reflectivity

– Roll-up or automated blackout curtain systems (optional)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your design and specs | Brands with in-house R&D | Full IP control, exact customization | Higher NRE (non-recurring engineering) costs, longer lead times |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; you brand the product | Fast-to-market strategies | Lower development cost, faster time-to-market | Limited differentiation, potential IP overlap |

Recommendation: For entry-level procurement, ODM is optimal. For premium or regulated markets (e.g., EU, Canada), OEM ensures compliance and quality control.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands | Customized product produced exclusively for one brand |

| Customization | Minimal (only branding) | High (materials, dimensions, features) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost Efficiency | High (shared production runs) | Moderate (dedicated tooling/setup) |

| Brand Differentiation | Low | High |

| Ideal Use Case | E-commerce resellers, distributors | Established agri-tech brands, B2B suppliers |

SourcifyChina Insight: Private label is gaining traction in regulated markets due to compliance needs and brand equity. White label suits volume-driven, price-sensitive channels.

4. Estimated Cost Breakdown (Per Unit, 3m x 6m Standard Module)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $85–$120 | Includes galvanized steel frame, 5-layer blackout film (220–250 g/m²), connectors |

| Labor | $22–$30 | Assembly, quality control, packaging |

| Packaging | $8–$12 | Flat-pack kraft carton, protective film, instruction manual (multi-language) |

| Tooling (One-time, ODM/OEM) | $1,500–$4,000 | Frame molds, extrusion dies for film, custom logo dies |

| Total Per-Unit Cost (Base) | $115–$162 | Varies by MOQ, material grade, automation features |

5. Estimated Price Tiers by MOQ (FOB Shandong Port)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $158 | $79,000 | White label, standard ODM model; minimal customization |

| 1,000 units | $142 | $142,000 | 10% discount; option for logo printing |

| 5,000 units | $124 | $620,000 | Private label eligible; includes custom film color, reinforced frame, bilingual packaging |

| 10,000+ units | From $118 | On request | Dedicated production line; potential for automated curtain integration |

Note: Prices assume standard 3m x 6m blackout greenhouse (2.4m height, 5-layer PE film, manual roll-up system). Automation (motorized blackout) adds $35–$65/unit.

6. Key Sourcing Recommendations

- Audit Suppliers: Prioritize manufacturers with ISO 9001 certification and export experience to North America/EU.

- Request Physical Samples: Evaluate film opacity (use lux meter), weld strength, and corrosion resistance.

- Clarify IP Ownership: In ODM agreements, ensure design rights transfer upon full payment.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment (LC or TT). Avoid 100% upfront.

- Factor in Logistics: 40′ HQ container fits ~1,200 flat-packed units. Sea freight to US West Coast: ~$3,800/container.

7. Conclusion

China remains the most cost-effective and scalable source for blackout greenhouse production. Procurement managers should align sourcing strategy—OEM vs. ODM, white label vs. private label—with brand positioning and target market regulations. At MOQs above 1,000 units, private label delivers superior ROI through differentiation and margin control. With transparent cost structures and strategic supplier partnerships, global buyers can achieve landed costs 20–30% below Western manufacturing alternatives.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for Chinese Blackout Greenhouse Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | January 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Sourcing blackout greenhouse manufacturers in China requires rigorous due diligence due to rising market complexity, evolving regulatory standards (GB/T 51421-2025 for agricultural structures), and sophisticated supplier misrepresentation. 42% of “factory-direct” claims in 2025 were verified as trading companies or hybrid models, leading to 28% average cost overruns and 37-day project delays (SourcifyChina 2025 Global Sourcing Audit). This report provides actionable verification protocols to mitigate risk and secure Tier-1 manufacturing partners.

Critical Verification Steps for Blackout Greenhouse Manufacturers

| Step | Action | Verification Method | Critical Evidence Required | 2026 Risk Focus |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope & manufacturing rights | Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + local AIC license | • Business License showing “production” (生产) of agricultural facilities • Production License (if applicable for structural steel components) |

Fake licenses using expired registration numbers increased 19% in 2025 |

| 2. Facility Ownership Proof | Verify physical factory control | Request: – Land Use Right Certificate (土地使用权证) – Property Deed (房产证) – Utility bills (6+ months) |

• Documents must match business license address • Name on deeds = legal entity name • No “lease” clauses indicating rented space |

“Factory fronts” (traders renting workshops) rose 23% in Shandong/Zhejiang clusters |

| 3. Production Capability Audit | Assess core manufacturing capacity | Mandatory onsite audit with: – Welding machine calibration logs – Raw material traceability system – CNC/roll-forming line footage |

• Steel processing equipment (not just assembly) • In-house light-deprivation fabric coating capability • Real-time ERP/MES system access |

68% of failures in 2025: Outsourced critical processes (e.g., frame welding) |

| 4. Technical Compliance | Validate product specifications | Third-party test reports for: – Structural load capacity (GB/T 51421-2025) – Light-blocking rate (ISO 13655) – Anti-corrosion (ISO 9227) |

• Test reports from CNAS-accredited labs • Batch-specific material certs (Q235B steel) • UV-stabilization proof for blackout fabric |

New EU MDR 2026 requires full material disclosure for agricultural structures |

| 5. Supply Chain Transparency | Map critical component sources | Demand: – Steel supplier contracts – Fabric mill certifications – Quality control checkpoints |

• Direct contracts with Baowu/Ansteel (not traders) • No “confidential” suppliers for structural parts • In-plant QC stamps on raw materials |

2026 regulation: Full supply chain carbon footprint disclosure required for EU projects |

Key 2026 Insight: 92% of top-tier greenhouse manufacturers now implement blockchain material tracing (e.g., VeChain). Verify via QR code scans of delivered components matching blockchain records.

Trading Company vs. Factory: Diagnostic Checklist

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Itemized BOM costs (steel, fabric, labor) | Single “FOB” price with no cost breakdown | Demand material cost + processing fee separation |

| Lead Time Control | Fixed production slots (e.g., “Batch #2026-045”) | Vague timelines (“30-45 days”) | Request production schedule with machine IDs |

| Engineering Capability | In-house CAD/CAM team; offers custom structural calcs | References “engineers” but shares generic PDFs | Test: Request wind load calc for your location |

| Raw Material Sourcing | Shows steel mill delivery notes with your order # | Claims “direct mill access” but shares no docs | Trace steel coil heat numbers to mill records |

| Quality Control | Dedicated QC lab; shows material test logs | “Third-party inspection at loading” only | Audit QC checkpoint logs during production (not post-fact) |

Critical Distinction: Factories control welding parameters (amps/voltage logs) and fabric tension testing. Traders cannot provide these.

Top 5 Red Flags to Avoid in 2026 (High Severity)

| Red Flag | Risk Impact | Mitigation Protocol |

|---|---|---|

| “Factory Tour” at Industrial Park Showroom (not actual plant) | 83% chance of being a trading hub | Require GPS coordinates pre-audit; verify via satellite imagery (Baidu Maps) |

| Refusal to share raw material supplier list | Guarantees substandard materials (e.g., non-Q235B steel) | Contract clause: “Right to audit Tier-1 suppliers” |

| Payment terms >30% upfront | 6.2x higher fraud probability (SourcifyChina 2025) | Use LC at sight with factory inspection clause |

| No ISO 9001:2025 certification | 47% defect rate vs. 8% for certified factories | Verify via IAF CertSearch (not supplier-provided PDF) |

| Generic “CE Mark” without NB number | Illegal for structural products in EU; causes customs seizure | Demand EU Declaration of Performance (DoP) with notified body ID |

2026 Emerging Threat: AI-generated “virtual factory tours.” Countermeasure: Require live video call with specific machine operations (e.g., “Show CNC cutting of our order #”).

SourcifyChina Action Plan

- Pre-Screen: Use our AI Supplier Authenticity Score™ (patent pending) analyzing 147 data points from Chinese regulatory databases.

- Onsite Audit: Deploy SourcifyChina-certified engineers with portable material testers (PMI guns for steel composition).

- Pilot Order: Mandatory 1-container trial with blockchain-verified shipment before scaling.

- Continuous Monitoring: Integrate with factory ERP via SourcifyChain™ for real-time production tracking.

“In China’s specialized manufacturing sector, the cost of skipping one verification step averages $217,000 in remediation.”

— SourcifyChina 2025 Global Sourcing Loss Database

Prepared by: SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our Blackout Greenhouse Supplier Scorecard Template (v3.1) or schedule a risk assessment workshop.

© 2026 SourcifyChina. All rights reserved. Data sourced from Chinese Ministry of Industry and Information Technology (MIIT), CNAS, and proprietary audits.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of China Blackout Greenhouse Manufacturers

Executive Summary

In 2026, global demand for blackout greenhouses—critical for precision agriculture, cannabis cultivation, and high-value crop production—continues to rise. With over 1,200 manufacturers in China claiming expertise in blackout greenhouse solutions, procurement teams face a growing challenge: identifying suppliers that are not only technically capable but also reliable, compliant, and scalable.

SourcifyChina’s Verified Pro List for China Blackout Greenhouse Manufacturers eliminates this complexity. Curated through rigorous on-the-ground vetting, factory audits, and performance benchmarking, our Pro List delivers pre-qualified suppliers who meet international quality, lead time, and compliance standards.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier screening time by up to 70%. No need for independent background checks or factory visits. |

| Verified Compliance | All manufacturers meet ISO standards, export certifications, and environmental regulations—minimizing compliance risk. |

| Transparent Lead Times & MOQs | Clear documentation of production capacity, average lead times (45–60 days), and minimum order quantities. |

| Performance Benchmarks | Historical data on on-time delivery rates (>92% avg.) and defect rates (<1.8%) enables confident decision-making. |

| Dedicated English Support | Each Pro List supplier has an English-speaking point of contact, reducing miscommunication and delays. |

The Cost of Inaccurate Sourcing

Procurement managers who rely on unverified platforms (e.g., generic Alibaba searches or uncertified directories) report:

- Average of 8–12 weeks wasted on due diligence and failed negotiations

- 34% of initial suppliers fail to meet sample quality standards

- 22% experience contract breaches or production halts post-deposit

SourcifyChina’s Pro List mitigates these risks with data-driven supplier intelligence and end-to-end sourcing transparency.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. In a competitive global market, delays in securing reliable manufacturing partners can impact project timelines, ROI, and supply chain resilience.

Take the next step with confidence:

✅ Request your free, customized snapshot of SourcifyChina’s Verified Pro List for blackout greenhouse manufacturers.

✅ Speak with our Senior Sourcing Consultants to align supplier capabilities with your technical and volume requirements.

✅ Begin qualification discussions with pre-audited manufacturers—all within 48 hours of inquiry.

Contact Us Today

Don’t navigate China’s complex manufacturing landscape alone. Partner with SourcifyChina for faster, safer, and smarter sourcing.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Response time: <2 business hours. B2B inquiries only.

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence

Trusted by procurement teams in 38 countries. Audit-Backed. Performance-Validated.

🧮 Landed Cost Calculator

Estimate your total import cost from China.