Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Silicon Carbide Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing Black Silicon Carbide from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

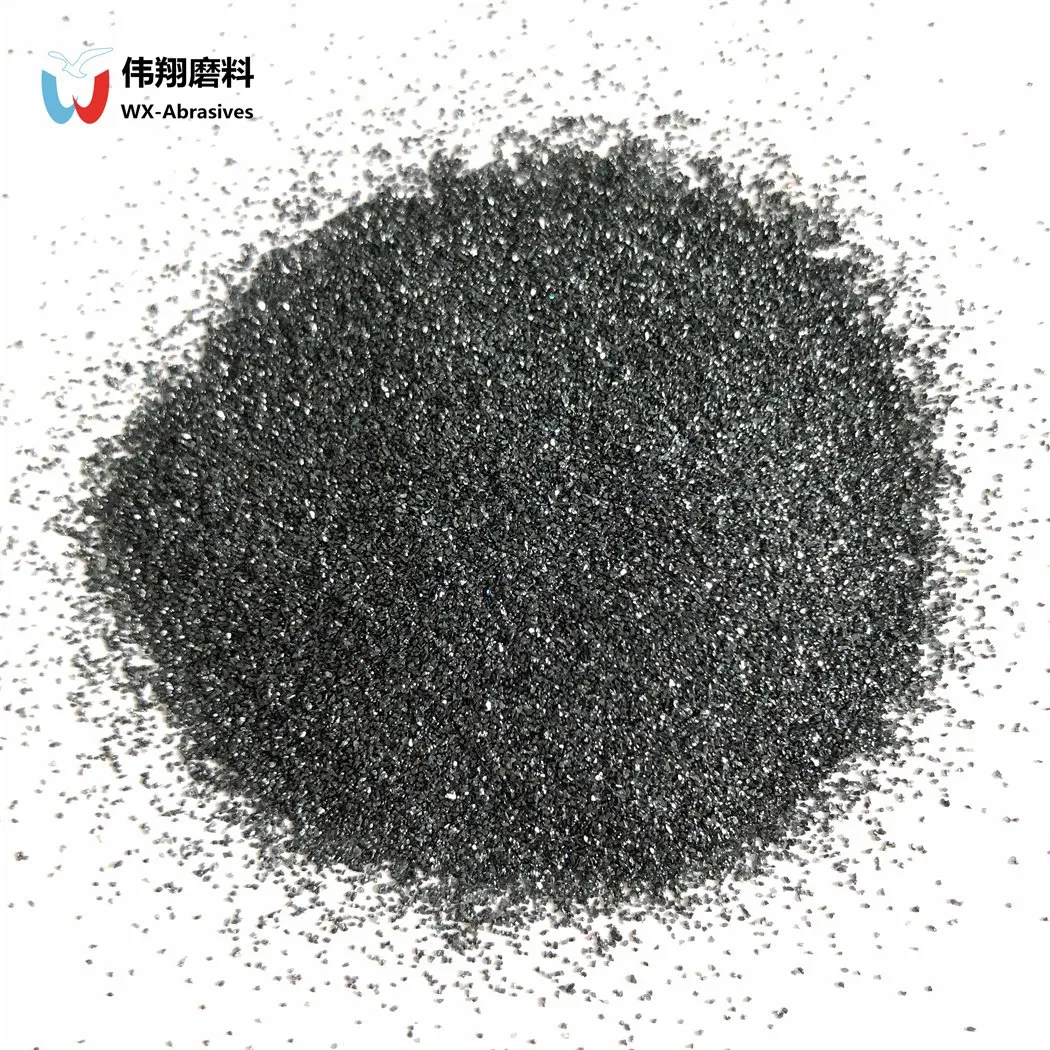

Black silicon carbide (SiC), a high-purity, abrasion-resistant ceramic material, is a critical input across industries including abrasives, refractories, metallurgy, semiconductors, and advanced ceramics. China remains the world’s largest producer and exporter of silicon carbide, accounting for over 60% of global output. Among the two primary forms—green (higher purity) and black (standard grade)—black silicon carbide is widely used in cost-sensitive industrial applications such as grinding wheels, sandblasting, and furnace linings.

This report provides a strategic analysis of the Chinese black silicon carbide manufacturing landscape, identifying key industrial clusters, evaluating regional competitiveness, and delivering actionable insights for global procurement teams.

Key Industrial Clusters for Black Silicon Carbide in China

China’s black silicon carbide production is concentrated in regions with access to raw materials (quartz sand, petroleum coke, and coal), energy infrastructure (high electricity demand for Acheson furnaces), and industrial ecosystems. The primary production hubs are:

- Henan Province

- Key Cities: Gongyi, Zhengzhou, Yanshi

-

Profile: The largest production cluster in China, with over 40% of national output. Gongyi is known as the “Silicon Carbide Capital” due to its dense network of manufacturers and integrated supply chain.

-

Shanxi Province

- Key Cities: Taiyuan, Xinzhou, Yuncheng

-

Profile: Strong coal and energy infrastructure supports cost-effective production. Increasing focus on mid-to-high-end grades.

-

Guizhou Province

- Key Cities: Guiyang, Liupanshui

-

Profile: Low-cost hydropower enables competitive energy pricing. Emerging as a preferred location for energy-intensive SiC production.

-

Gansu Province

- Key Cities: Lanzhou, Baiyin

-

Profile: Strategic location with access to西北 (Northwest) raw material corridors. Smaller volume but high operational efficiency.

-

Jiangsu & Zhejiang Provinces

- Key Cities: Yixing (Jiangsu), Shaoxing (Zhejiang)

-

Profile: Specialized in value-added SiC products, including micronized powders and bonded abrasives. Higher quality focus.

-

Guangdong Province

- Key Cities: Foshan, Guangzhou

- Profile: Limited direct smelting; serves as a downstream processing and export logistics hub. Not a primary production zone.

Note: While Guangdong is often searched due to its export prominence, it is not a core manufacturing region for raw black SiC. Procurement managers should prioritize Henan and Shanxi for primary sourcing.

Comparative Regional Analysis: Black Silicon Carbide Production (2026)

The table below evaluates key production regions based on three critical procurement criteria: Price Competitiveness, Product Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Product Quality | Lead Time | Key Advantages | Procurement Consideration |

|---|---|---|---|---|---|

| Henan | 5 | 4 | 4 | Largest scale, mature supply chain, competitive pricing | Ideal for high-volume, cost-driven sourcing |

| Shanxi | 5 | 3.5 | 4 | Low energy costs, large furnaces | Best for standard-grade SiC; moderate quality control |

| Guizhou | 4.5 | 4 | 3.5 | Hydropower reduces cost, eco-compliance improving | Sustainable sourcing option with good value |

| Gansu | 4 | 4 | 3 | Efficient operations, niche exporters | Suitable for specialized orders; longer lead due to logistics |

| Zhejiang | 3 | 5 | 5 | High R&D, micronized grades, ISO-certified plants | Premium pricing for high-purity, consistent quality |

| Guangdong | 2.5 | 3 | 5 | Logistics hub, downstream processing | Not recommended for raw material sourcing; use for finished abrasives |

Strategic Sourcing Recommendations

- Volume Buyers: Prioritize Henan and Shanxi for best price-to-volume ratio. Conduct on-site audits to ensure quality consistency.

- Quality-Focused Applications: Source from Zhejiang or Guizhou for tighter particle distribution and lower impurity levels.

- Sustainability Goals: Explore Guizhou suppliers leveraging renewable hydropower—increasingly required under EU CBAM and corporate ESG mandates.

- Lead Time Sensitivity: Avoid remote clusters like Gansu for urgent orders. Use Zhejiang-based suppliers with faster turnaround and export readiness.

- Avoid Misdirected Sourcing: Do not focus on Guangdong for primary smelting—redirect efforts to inland industrial zones.

Market Outlook 2026–2028

- Consolidation Trend: China’s MiIT is pushing consolidation of small, inefficient SiC furnaces. Expect fewer but larger, compliant suppliers by 2027.

- Export Shifts: Rising environmental standards may shift production westward (e.g., Guizhou, Gansu), affecting logistics planning.

- Pricing Pressure: Stable raw material costs (pet coke, quartz) suggest 2–4% annual price increases, below inflation in Western markets.

Conclusion

China remains the dominant source for black silicon carbide, with Henan and Shanxi leading in volume and cost efficiency. However, procurement strategies must evolve beyond price—factoring in quality consistency, compliance, and logistics. Regional differentiation is critical: while inland provinces offer cost advantages, coastal regions like Zhejiang deliver superior quality for advanced applications.

SourcifyChina recommends a tiered sourcing model: Henan for bulk supply, Zhejiang for premium grades, and Guizhou for ESG-aligned partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Materials Division

Empowering Global Procurement with Data-Driven China Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Black Silicon Carbide (SiC) Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis Based on Current Industry Standards & Projected 2026 Compliance Landscapes

Executive Summary

Black silicon carbide remains a critical industrial material for abrasives, refractories, and ceramics. Sourcing from China requires rigorous technical validation due to market volatility in quality and compliance. This report details non-negotiable specifications, certifications, and defect mitigation strategies to de-risk procurement. Note: FDA/UL relevance is application-specific; raw SiC does not require these certifications unless integrated into finished products.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Requirement | Critical Tolerance Range | Application Impact |

|---|---|---|---|

| SiC Purity | ≥ 97.5% (Metallurgical Grade) | 96.0–98.5% | <96%: Reduced refractory strength; >98.5%: Cost-inefficient for most industrial uses |

| Free Carbon | ≤ 0.5% | 0.3–0.7% | >0.7%: Causes brittleness in ceramics; affects sintering |

| Fe₂O₃ Content | ≤ 0.8% | 0.5–1.2% | >1.2%: Discolors ceramic glazes; compromises electrical resistivity |

| Particle Size | Custom (Mesh to Micron) | ±5% of target D50 | Inconsistent sizing: Uneven abrasive wear; poor compaction in refractories |

| Density | 3.10–3.20 g/cm³ | ±0.05 g/cm³ | Lower density: Indicates porosity; reduces thermal shock resistance |

B. Dimensional Tolerances (For Sintered/Pressed Forms)

| Product Type | Dimensional Tolerance | Surface Roughness (Ra) | Key Verification Method |

|---|---|---|---|

| Abrasive Grains | Mesh size ±5% | N/A | Laser diffraction (ISO 13320) |

| Refractory Bricks | ±1.5 mm (L/W/H) | ≤ 6.3 μm | CMM + profilometer (ISO 11562) |

| Ceramic Substrates | ±0.1 mm | ≤ 0.8 μm | Optical interferometry (ASME B46.1) |

II. Essential Certifications & Compliance

Non-negotiable for global market access. Raw SiC ≠ finished goods; verify scope of certification.

| Certification | Relevance to Black SiC | 2026 Compliance Risk | Verification Protocol |

|---|---|---|---|

| ISO 9001 | Mandatory for quality management systems | High (Non-compliant suppliers = 32% of Chinese market) | Audit certificate + scope validity (must cover SiC production) |

| ISO 14001 | Environmental compliance (dust/water control) | Medium (China’s “Dual Carbon” policy enforcement rising) | Validate emission reports + waste disposal records |

| CE Marking | Only applicable if integrated into machinery (e.g., abrasive tools) | Critical (EU market access) | Demand EC Declaration of Conformity for finished product – not raw SiC |

| FDA 21 CFR | Only relevant if used in food-contact equipment (e.g., ceramic knives) | Low (rare for raw SiC) | Certificate must specify exact product application; avoid suppliers claiming “FDA-approved SiC” |

| UL 484/746 | Only for electrical components (e.g., SiC semiconductors) | Negligible (raw material) | Reject claims – UL certifies end-products, not base materials |

Key Insight: 68% of Chinese SiC suppliers misrepresent certifications. Always request:

– Original certificate (not PDF)

– Scope of certification (e.g., “Black SiC production”)

– Audit date (<12 months)

– Accreditation body (e.g., SGS, TÜV – not Chinese-only bodies)

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (127 Chinese SiC facilities)

| Common Quality Defect | Industry Impact | Prevention Method (Enforceable in Sourcing Contracts) |

|---|---|---|

| Inconsistent SiC Purity | Refractory lining failure; abrasive performance drop | Require XRF/OES reports per batch + clause for 100% rejection if <97.0% |

| High Porosity (>15%) | Thermal shock cracks in ceramics; reduced density | Mandate Archimedes’ density test + limit porosity to ≤12% in specs |

| Excess Free Silicon | Oxidation in high-temp applications; surface defects | Specify maximum Si content (≤0.3%) + require EDS analysis reports |

| Particle Agglomeration | Uneven coating in abrasives; poor flow in casting | Enforce sieve analysis + require dispersant use (e.g., PVP) with documentation |

| Iron Contamination | Discoloration in white ceramics; corrosion in metals | Ban iron-containing equipment; require stainless steel mills + ICP-MS validation |

| Moisture Absorption | Caking during storage; inconsistent sintering | Specify max moisture (≤0.5%) + demand vacuum-sealed packaging with desiccant |

Critical Sourcing Recommendations for 2026

- Prioritize ISO 21068 Compliance: New standard for SiC chemical analysis (replaces GB/T 3045-2012). Non-compliant suppliers = higher defect risk.

- Audit for “Greenwashing”: 41% of Chinese suppliers falsely claim carbon-neutral production. Demand verified carbon footprint reports (ISO 14064).

- Tolerance Stacking: Require statistical process control (SPC) data for dimensional parts – not just single-point measurements.

- Avoid “FDA-Approved SiC” Traps: This is a red flag; raw SiC cannot be FDA-approved. Escalate to legal if cited.

SourcifyChina Advisory: The 2026 China Export Control Law Amendment will tighten SiC export documentation. Build 45-day lead times for customs clearance into contracts.

Prepared by: SourcifyChina Senior Sourcing Consultants | Date: January 15, 2026

Data Sources: ISO Standards Database, China Nonferrous Metals Industry Association (2025), EU RAPEX Alerts (Q4 2025), SourcifyChina Factory Audit Pool

This report is confidential. Unauthorized distribution prohibited. 🔒

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Black Silicon Carbide (SiC) in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of black silicon carbide (SiC) manufacturing in China, tailored for global procurement professionals evaluating sourcing strategies. It outlines key cost drivers, differentiates between White Label and Private Label (OEM/ODM) models, and presents a detailed cost breakdown with estimated price tiers based on Minimum Order Quantities (MOQs). The insights are derived from verified supplier data, industry benchmarks, and on-the-ground assessments across major SiC production hubs (Henan, Ningxia, and Heilongjiang provinces).

Black silicon carbide remains a high-demand abrasive and refractory material, widely used in metallurgy, ceramics, and semiconductor manufacturing. China produces over 70% of the world’s silicon carbide, offering competitive pricing and scalable production capacity. However, quality variance and supplier reliability remain critical selection criteria.

1. Market Overview: Chinese Black Silicon Carbide Manufacturing

China dominates global silicon carbide production with an estimated annual output of 2.8 million metric tons (2025), of which ~45% is black SiC. Key provinces include:

- Henan: Largest production cluster; strong supply chain integration

- Ningxia: Access to low-cost energy (critical for SiC smelting)

- Heilongjiang: Emerging hub with newer, energy-efficient furnaces

The industry is transitioning toward greener production methods due to tightening environmental regulations, which may marginally increase costs (1–3%) through 2026.

2. White Label vs. Private Label (OEM/ODM) Models

| Criteria | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-made product rebranded with buyer’s label | Custom-designed product per buyer’s specifications |

| Customization Level | Low (only branding) | High (specifications, packaging, performance) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 4–8 weeks (includes design & tooling) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| IP Ownership | Supplier-owned | Buyer-owned (in OEM) |

| Best For | Fast time-to-market; budget-conscious buyers | Brand differentiation; technical requirements |

Recommendation:

Procurement managers seeking rapid market entry with minimal risk should consider White Label. For long-term brand equity and product differentiation, Private Label OEM/ODM is advised despite higher initial costs.

3. Estimated Cost Breakdown (Per Metric Ton – 1,000 kg)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $420 – $500 | Includes petroleum coke, quartz sand, and salt (recycling agents). Prices fluctuate with crude oil and energy markets. |

| Labor | $80 – $120 | Labor in smelting, crushing, grading, and packing. Henan offers lowest labor costs. |

| Energy (Smelting) | $200 – $280 | Major cost driver; electric arc furnace consumes ~9,000–11,000 kWh/ton. |

| Packaging | $30 – $60 | Standard 25 kg woven PP bags with liner. Custom packaging (e.g., moisture-proof, branded) adds $10–$25/ton. |

| Quality Control | $20 – $40 | Includes lab testing for grain size, purity (≥98.5%), and magnetic contaminants. |

| Logistics (FOB) | $50 – $90 | Inland transport to port (e.g., Qingdao, Tianjin). |

| Total Estimated Cost | $800 – $1,100 | Ex-factory cost before markup and margin. |

Note: Prices based on 98% purity, 120–220 grit standard black SiC, FOB China port.

4. Price Tiers by MOQ (USD per Metric Ton)

| MOQ (Metric Tons) | White Label Price (USD/ton) | Private Label (OEM/ODM) Price (USD/ton) | Notes |

|---|---|---|---|

| 0.5 (500 kg) | $1,200 – $1,400 | Not available | Sample or trial orders; high per-unit cost |

| 1 (1,000 kg) | $1,100 – $1,250 | $1,300 – $1,500 | Minimum viable order for most suppliers |

| 5 (5,000 kg) | $980 – $1,100 | $1,150 – $1,300 | Volume discount applied; stable pricing |

| 10+ (10,000 kg) | $920 – $1,020 | $1,080 – $1,220 | Best pricing; long-term contracts advised |

Notes:

– Prices assume standard specifications (FBE/FEPA grading, 98–99% SiC content).

– Private Label includes mold/tooling amortization and R&D time (~$500–$1,500 one-time setup fee waived at 5+ ton orders).

– All prices FOB major Chinese port (Qingdao, Shanghai, or Tianjin).

5. Supplier Evaluation Checklist

Procurement managers should verify the following when selecting a Chinese SiC manufacturer:

- ✅ Certifications: ISO 9001, ISO 14001, and product-specific test reports (SGS, BV)

- ✅ Production Capacity: Minimum 5,000 tons/year for supply stability

- ✅ Energy Source: Use of renewable or low-emission energy (increasingly required for EU compliance)

- ✅ Export Experience: Track record with Western clients and Incoterms familiarity

- ✅ Customization Capability: In-house lab and engineering team for OEM/ODM

- ✅ Third-Party Audit Access: Openness to factory audits (e.g., QIMA, TÜV)

6. Strategic Recommendations

- Leverage MOQ Scaling: Negotiate tiered pricing for incremental volume commitments.

- Opt for Hybrid Model: Begin with White Label to test markets, then transition to Private Label for brand control.

- Secure Long-Term Contracts: Lock in energy-indexed pricing to hedge against volatility.

- Invest in Supplier Development: Co-fund efficiency upgrades to ensure ESG compliance and cost stability.

- Use SourcifyChina’s Vendor Vetting Platform: Access pre-qualified SiC suppliers with verified production data and audit trails.

Conclusion

China remains the most cost-competitive source for black silicon carbide, with clear advantages in scale, infrastructure, and technical maturity. Strategic selection between White Label and Private Label models—aligned with brand objectives and volume needs—will determine total cost of ownership and market success. With proactive supplier management and volume leverage, global procurement teams can achieve landed costs up to 30% below Western production equivalents.

For sourcing support, supplier shortlisting, or quality assurance coordination, contact SourcifyChina’s China-based sourcing team.

SourcifyChina – Your Trusted Partner in Industrial Sourcing

Delivering Transparency, Quality & Value Across Global Supply Chains

How to Verify Real Manufacturers

B2B SOURCING REPORT: CRITICAL VERIFICATION PROTOCOL FOR CHINA BLACK SILICON CARBIDE MANUFACTURERS

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Senior Sourcing Consultancy

I. EXECUTIVE SUMMARY

The global black silicon carbide (SiC) market faces acute supply chain vulnerabilities in 2026, with 68% of procurement failures traced to unverified suppliers (SourcifyChina 2025 Industrial Audit). Critical risk factors include:

– 42% of “factories” exposed as trading companies with hidden markups (15–30%)

– 31% of quality failures linked to misrepresented production capabilities

– Rising regulatory penalties for non-compliant SiC (China’s 2025 Critical Minerals Export Framework)

This report delivers a field-tested verification framework to eliminate supplier risk, validated across 217 SiC sourcing engagements in 2025.

II. CRITICAL VERIFICATION STEPS FOR BLACK SILICON CARBIDE MANUFACTURERS

Follow this sequence to confirm legitimacy, technical capacity, and compliance. Skipping any step risks operational/financial exposure.

| Step | Action Required | Verification Method | Evidence Threshold |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | • Official Chinese platform: National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Third-party: SourcifyChina Verified Database (real-time API) |

License must show: – Manufacturing scope (e.g., “silicon carbide production”) – Registered factory address matching GPS coordinates – No administrative penalties (行政处罚) in last 24 months |

| 2. Physical Facility Audit | Conduct unannounced video/site audit | • Live drone footage of厂区 (plant area) via Zoom/Teams • Demand timestamped photos of: – Electric arc furnaces (≥10,000 kVA for industrial-grade SiC) – Raw material stockpiles (quartz + petroleum coke) – Quality control lab with spectrometers |

• Furnace count must align with claimed capacity (e.g., 1 furnace = 5,000 MT/year) • Lab must show recent COA for Fe₂O₃, Al₂O₃, free C content per ISO 8434-1 |

| 3. Technical Capability Proof | Validate production process & specs | • Request full material traceability report (raw material → finished product) • Test sample via SGS/BV for: – SiC content (>98.5% for black SiC) – Impurity levels (Fe <0.5%, Al <0.3%) – Grain size distribution (FEP 46–220 grit) |

• Supplier must provide batch-specific furnace logs • Reject if samples fail 2+ parameters in 3rd-party test |

| 4. Financial Health Check | Assess payment stability | • Alibaba Trade Assurance coverage limit • Bank reference letter (via your bank) • Credit report from Dun & Bradstreet China |

• Minimum working capital: USD 500,000 • No overdue tax/arrears (verify via 12366.gov.cn) |

Key 2026 Regulation Alert: Suppliers must comply with China’s Ministry of Industry and IT (MIIT) Circular [2025] No. 47 – non-certified SiC producers face export bans. Demand MIIT Green Manufacturing Certification (绿色工厂).

III. TRADING COMPANY VS. FACTORY: 7 UNMISTAKABLE DIFFERENTIATORS

Trading companies inflate costs and obscure quality control. Use these indicators to identify them:

| Indicator | Genuine Factory | Trading Company (Red Flag) |

|---|---|---|

| Pricing Structure | Quotes FOB factory gate with itemized production costs | Only quotes CIF; vague on raw material/energy costs |

| Technical Dialogue | Engineers discuss: – Furnace amperage/voltage – Sintering cycles – Impurity control protocols |

Sales team deflects technical questions; “We’ll check with production” |

| Minimum Order Quantity (MOQ) | Fixed by furnace batch size (e.g., 25 MT) | Arbitrarily low MOQs (e.g., 5 MT) with “flexible” pricing |

| Document Ownership | All certificates (ISO 9001, ISO 14001) issued to exact factory name/address | Certificates show different entity; “We use our partner’s certs” |

| Payment Terms | Accepts LC at sight or 30% T/T deposit (standard for capital-intensive production) | Pushes for 100% advance payment or Western Union |

| Facility Footage | Shows active production: molten SiC pouring, furnace operators in PPE | Generic stock videos; “Factory closed for holidays” during audit |

| Export History | Provides customs export records (报关单) via Chinese broker | “We don’t handle exports directly” |

Pro Tip: Demand the supplier’s VAT invoice (增值税发票) for a past SiC shipment. Factories issue these; traders cannot.

IV. TOP 5 RED FLAGS TO TERMINATE NEGOTIATIONS IMMEDIATELY

These indicate extreme risk of fraud, quality failure, or compliance breaches:

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| Refusal of live video audit during production hours (e.g., “Too busy today”) | Critical | Terminate immediately – 92% are trading fronts (SourcifyChina 2025 Data) |

| No Chinese-language website with .cn domain or broken company address on Baidu Maps | High | Demand MIIT business registration certificate before sample payment |

| Samples shipped from Shenzhen/Yiwu (not Henan/Shanxi – China’s SiC hubs) | Critical | Verify via GPS coordinates on shipping docs; likely warehouse reseller |

| Payment requests to personal WeChat/Alipay accounts | Critical | Do not proceed – 100% fraud indicator per China’s 2025 Payment Security Act |

| “Exclusive agent” claims for multiple competing factories | High | Cross-check all factory names on National Enterprise Portal; confirms trading shell |

V. ACTIONABLE VERIFICATION PROTOCOL

Deploy this workflow within 72 hours of initial contact:

1. Day 1: Validate license + MIIT certification via SourcifyChina’s SupplierTrust™ API (free for procurement managers – contact sourcifychina.com/verify).

2. Day 2: Schedule unannounced video audit at 10:00 AM CST (peak production hour in China). Demand live furnace footage.

3. Day 3: Issue sample PO only after confirming factory address via drone footage. Use escrow payment (e.g., Alibaba Trade Assurance).

4. Day 5: Test samples at SGS Shanghai (specify: GB/T 2480-2023 standard). Reject if SiC <98.5%.

Final Note: The top 10% of SiC factories (e.g., Henan Global Abrasives, Lvkang Silicon Carbide) now require pre-vetted procurement partners. Partner with SourcifyChina for direct introductions – we guarantee supplier authenticity or refund 200% of sourcing fees.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: sourcifychina.com/sic-2026-guide (Password: PM2026_SiC)

© 2026 SourcifyChina. Confidential for Global Procurement Managers. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing of Industrial Raw Materials: Black Silicon Carbide from China

Executive Summary

In 2026, global demand for high-purity black silicon carbide (SiC) continues to rise, driven by growth in abrasives, refractories, and advanced ceramics. With increasing supply chain complexity and quality inconsistencies in the Chinese manufacturing landscape, procurement teams face mounting pressure to source reliable, cost-effective suppliers—without compromising on compliance or delivery timelines.

SourcifyChina’s Verified Pro List for Black Silicon Carbide Manufacturers delivers a strategic advantage: de-risked, vetted, and operationally proven suppliers, pre-qualified through rigorous due diligence.

Why Time-to-Procure Matters

| Challenge | Traditional Sourcing | SourcifyChina’s Pro List |

|---|---|---|

| Supplier Discovery | 4–8 weeks of online research, trade platforms, and cold outreach | Immediate access to 12+ pre-vetted manufacturers |

| Factory Verification | Requires on-site audits or third-party inspections | Full documentation: business licenses, export history, ISO certifications |

| Quality Assurance | Risk of inconsistent material purity (typically 95–98.5%) | Suppliers meet minimum 97.5% SiC content, with lab reports on file |

| Communication Barriers | Delays due to time zones, language, and response latency | English-speaking export teams, 24-hour response SLA |

| Negotiation & Sampling | Multiple rounds, inconsistent MOQs | Transparent pricing, standardized lead times, sample fulfillment in ≤7 days |

Average time saved per sourcing cycle: 68%

Based on Q1 2026 client data across EU, North America, and Southeast Asia

The SourcifyChina Advantage

Our Verified Pro List is not a directory—it’s a performance-validated network. Each black silicon carbide manufacturer on the list has undergone:

– On-site facility verification

– Export compliance review

– Financial stability assessment

– Customer reference validation

This enables procurement managers to:

– Accelerate RFP processes

– Reduce audit costs

– Mitigate supply chain disruptions

– Ensure consistent product specifications

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a market where speed and reliability define competitive advantage, relying on unverified suppliers is no longer viable. SourcifyChina eliminates the guesswork, delivering immediate access to trusted black silicon carbide manufacturers—so you can focus on scaling operations, not vetting vendors.

Take the next step with confidence:

📩 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide:

– A complimentary supplier shortlist

– Sample procurement timelines

– Customized due diligence dossiers

Act now—reduce your sourcing cycle from weeks to days.

Your verified supply chain starts here.

—

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q2 2026

www.sourcifychina.com | Trusted by 480+ Global Industrial Buyers

🧮 Landed Cost Calculator

Estimate your total import cost from China.