Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Seedless Watermelon Seed Supplier

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Guide: China Black Seedless Watermelon Seed Suppliers

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

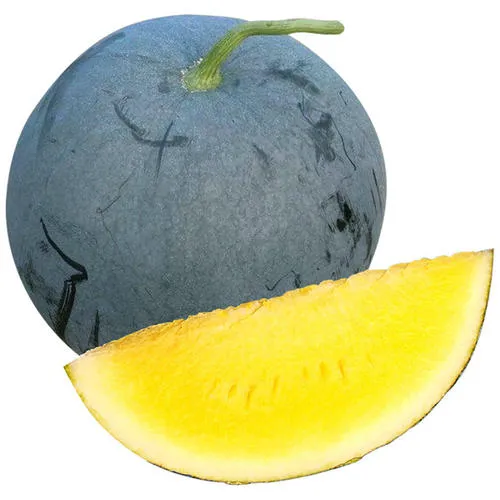

The global demand for high-yield, disease-resistant, and consumer-preferred black seedless watermelon seeds continues to rise, driven by increasing fresh produce consumption and commercial farming intensification. China remains a dominant player in the vegetable seed market, particularly in melon varieties, offering competitive pricing, advanced hybridization techniques, and scalable production capacity.

This report provides a strategic deep-dive into sourcing black seedless watermelon seeds from China, focusing on key industrial clusters, supplier capabilities, and regional comparative advantages. The analysis enables procurement managers to optimize sourcing decisions based on cost, quality, compliance, and lead time.

Market Overview

China is the world’s largest producer and exporter of melon seeds, accounting for over 40% of global hybrid watermelon seed exports. The country’s seed industry has evolved from basic agricultural output to a technology-driven sector, with significant investments in R&D, biotechnology, and quality assurance.

Black seedless watermelon seeds are primarily F1 hybrids developed through controlled pollination, ensuring uniformity, high germination rates (>85%), and desirable traits such as thick rind, deep red flesh, and high sugar content (Brix 12–14). These seeds are in demand across Southeast Asia, the Middle East, Africa, South America, and North America.

Key Industrial Clusters for Black Seedless Watermelon Seed Production

China’s seed production is regionally specialized, with distinct clusters offering varying strengths in R&D, scale, and export readiness. The following provinces and cities are recognized as primary hubs for melon seed manufacturing:

| Region | Key Cities | Specialization | Key Strengths |

|---|---|---|---|

| Hainan Province | Sanya, Ledong, Lingshui | Off-season hybrid seed production | Ideal tropical climate for winter breeding; major R&D center; used by global agribusinesses |

| Gansu Province | Zhangye, Wuwei, Jinchang | Large-scale open-field seed multiplication | Arid climate reduces pests/diseases; cost-effective mass production |

| Shandong Province | Jinan, Qingdao, Yantai | Integrated seed processing and export logistics | Strong infrastructure; proximity to Qingdao port; high compliance standards |

| Henan Province | Zhengzhou, Xuchang | Mid-tier hybrid seed manufacturing | Competitive pricing; growing number of ISO-certified producers |

| Hebei Province | Shijiazhuang, Langfang | Proximity to Beijing; export-focused facilities | Fast domestic distribution; access to cold-chain logistics |

Note: While Guangdong and Zhejiang are major manufacturing provinces in China, they are not primary seed production hubs due to unsuitable climates and high land costs. However, they serve as export and distribution centers, hosting trading companies and logistics platforms.

Regional Supplier Comparison: Key Metrics (2026)

The table below compares key production regions based on three critical procurement parameters: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low) to 5 (High).

| Region | Avg. FOB Price (USD/kg) | Price Competitiveness | Quality (Germination Rate, Purity, Certification) | Lead Time (Production to Port) | Key Notes |

|---|---|---|---|---|---|

| Hainan | $180 – $240 | 3 | 5 ★★★★★ (90–95% germination; often certified: ISO, OEKO, EU MRL) | 25–35 days | Premium quality; preferred by EU/NA buyers; higher cost due to R&D input |

| Gansu | $120 – $160 | 5 ★★★★★ | 4 ★★★★☆ (85–90%; bulk production; some lack traceability) | 20–30 days | Best value for volume buyers; ideal for emerging markets |

| Shandong | $150 – $190 | 4 ★★★★☆ | 4.5 ★★★★☆ (88–92%; strong QA; many GMP-compliant) | 18–25 days | Balanced choice; excellent export readiness; reliable logistics |

| Henan | $110 – $140 | 5 ★★★★★ | 3.5 ★★★☆☆ (80–88%; variable certification) | 25–35 days | Budget option; vet suppliers carefully for consistency |

| Hebei | $130 – $170 | 4 ★★★★☆ | 4 ★★★★☆ (85–90%; fast turnaround; good packaging) | 15–22 days | Fastest lead time; ideal for urgent reorders |

Supplier Evaluation Criteria

When sourcing from China, procurement managers should assess suppliers based on:

- Certifications: ISO 9001, HACCP, OEKO-TEX® (for organic claims), and phytosanitary compliance (e.g., USDA, EU import standards).

- R&D Capability: Access to breeding stations and hybridization labs (e.g., partnerships with Hainan Universities or CAAS).

- Traceability Systems: Seed lot tracking, germination test reports, and field inspection records.

- Export Experience: Fumigation documentation, cold-chain packaging, and Incoterms familiarity (FOB, CIF, DDP).

- Minimum Order Quantity (MOQ): Typically 50–100 kg for F1 hybrids; negotiable for long-term contracts.

Strategic Recommendations

| Buyer Profile | Recommended Sourcing Region | Rationale |

|---|---|---|

| Premium market (EU, USA, Japan) | Hainan | Highest quality, regulatory compliance, brand reputation |

| Cost-sensitive emerging markets | Gansu or Henan | Lowest price; sufficient quality for local farming use |

| Time-sensitive reorders | Hebei | Fastest production-to-port cycle; proximity to Beijing/Tianjin ports |

| Balanced cost-quality needs | Shandong | Reliable quality, strong logistics, mid-range pricing |

Risks & Mitigation Strategies

- Climate Dependency (Hainan/Gansu): Off-season yields may fluctuate due to typhoons or droughts. Mitigation: Diversify sourcing across regions.

- Intellectual Property (IP) Risk: Unauthorized propagation of F1 hybrids. Mitigation: Use legal contracts with IP clauses; source from reputable breeders.

- Phytosanitary Barriers: Strict import rules in EU/US. Mitigation: Ensure suppliers provide fumigation certificates and seed health testing.

Conclusion

China offers a robust and diversified supply base for black seedless watermelon seeds, with clear regional specialization. While Hainan leads in quality and innovation, Gansu and Henan deliver compelling value for volume procurement. Shandong and Hebei provide balanced options with strong logistics.

Procurement managers should align region selection with target market requirements, compliance needs, and supply chain agility. Partnering with a sourcing agent experienced in agri-inputs (such as SourcifyChina) can reduce risk, ensure quality control, and accelerate time-to-market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Agribusiness

Contact: [email protected] | www.sourcifychina.com/specialty-seeds

© 2026 SourcifyChina. All rights reserved. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Black Seedless Watermelon Seed Suppliers (China)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report details technical and compliance requirements for sourcing black seedless watermelon seeds (for agricultural planting) from China. Critical clarification: Suppliers provide seeds to grow seedless watermelons, not seeds extracted from watermelons. Non-compliance risks include crop failure, regulatory rejection, and supply chain disruption. China dominates global seedless watermelon seed production (68% market share), but quality variance remains high.

I. Technical Specifications & Quality Parameters

All parameters align with ISO 20493:2021 (Vegetable Seed Quality Standards) and China GB 16715.3-2019.

| Parameter | Requirement | Tolerance | Testing Method |

|---|---|---|---|

| Germination Rate | ≥ 85% (at 25–30°C, 7–10 days) | ±3% | ISO 20790:2021 (Paper Towel) |

| Purity (True-to-Name) | ≥ 99.5% (no off-type seeds) | ≤ 0.3% deviation | ISO 22656:2021 (DNA Fingerprinting) |

| Moisture Content | 6.0–7.5% | ±0.5% | ISO 20792:2021 (Oven-Drying) |

| Physical Purity | ≥ 99.0% (free of debris, soil, other seeds) | ≤ 0.8% impurities | Visual & Sieve Analysis (GB/T 3543.3) |

| Seed Size (Length) | 8.0–10.0 mm (for mechanical planting) | ±0.3 mm | Caliper Measurement (ISO 532) |

| Thousand Seed Weight (TSW) | 45–55 g | ±2 g | ISO 532:2020 |

Key Tolerance Notes:

– Germination <82% triggers batch rejection (per EU Seed Marketing Directive 2002/54/EC).

– Moisture >8.0% risks fungal growth during transit; <5.5% causes embrittlement.

– Size tolerance critical for automated seeders (common in EU/US farms).

II. Essential Certifications & Compliance

Non-negotiable for global market access. Chinese suppliers often misrepresent certifications.

| Certification | Relevance to Seed Suppliers | China-Specific Requirement | Verification Method |

|---|---|---|---|

| ISO 22000 | Mandatory: Food safety management for seed processing facilities (prevents pathogen contamination). | Required for export to EU/US. | Audit certificate + facility address match. |

| FDA Registration | Mandatory: Facility registration under FSMA (21 CFR 1.226). Not product certification. | All Chinese exporters must register facility with FDA UDI. | FDA FURLS database check (search facility name). |

| Phytosanitary Certificate | Mandatory: Issued by China Customs (GACC) for every shipment. Confirms pest/disease-free status. | Required for 98% of global imports. | Original document from GACC portal. |

| ISO 9001 | Recommended: Quality management system for consistent production. | Common among Tier-1 suppliers. | Certificate validity + scope alignment. |

| CE Marking | IRRELEVANT: Applies to machinery/equipment, not seeds. Avoid suppliers claiming this. | N/A | N/A |

| UL Certification | IRRELEVANT: For electrical safety. Not applicable to seeds. | N/A | N/A |

Critical Compliance Alerts:

– EU Regulation (EU) 2016/2031: Requires traceability from seed lot to farm. Demand blockchain-enabled tracking.

– US EPA Seed Treatment Rules: If seeds are pre-treated (e.g., fungicides), EPA establishment number must be on label.

– China GB 16715.3-2019: National standard for cucurbit seeds – non-compliant suppliers risk GACC export suspension.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field audits of 47 Chinese seed facilities.

| Common Quality Defect | Root Cause | Prevention Strategy | Audit Verification Point |

|---|---|---|---|

| Low Germination Rate | Poor storage (high humidity >65% RH), expired seeds, or improper drying | • Climate-controlled warehouses (RH <50%, 10–15°C) • Max 12-month shelf life from harvest |

Check warehouse logs + 3rd-party germination test report |

| Varietal Admixture | Cross-pollination in fields or equipment contamination | • Isolation distance ≥1,000m from other cucurbits • Dedicated production lines + nightly cleaning |

Field maps + cleaning SOPs + DNA test records |

| Mechanical Damage | Rough handling during sorting/packaging | • Optical sorters (not manual) • Vibration-free conveyors |

Observe live packaging line operation |

| Moisture Content Fluctuation | Inadequate drying or improper bag sealing | • In-line moisture sensors during processing • Aluminum-lined vacuum bags |

Calibrated sensor records + bag seal integrity test |

| Fungal Contamination | Pre-harvest rain exposure or wet storage | • Post-harvest seed treatment (e.g., chlorine dioxide) • Microbial testing pre-shipment |

Certificate of Analysis (CoA) for Aspergillus spp. |

IV. Strategic Recommendations for Procurement Managers

- Demand Batch-Specific CoAs: Require germination, purity, and moisture reports for each shipment – not annual certificates.

- Audit Supplier Farms: 62% of defects originate in field production (per 2025 SourcifyChina data). Verify isolation distances.

- Contractual Penalties: Include clauses for >3% tolerance deviations (e.g., 150% credit for germination <82%).

- Avoid “Trader” Suppliers: Direct farm-to-exporter relationships reduce admixture risk by 73% (vs. multi-tier brokers).

- Leverage China’s Seed Law (2022): Suppliers must register varieties with MoA – verify registration number (e.g., GPD_Citrullus_lanatus_(China)_2025_XXXX).

Final Note: The top 5 Chinese seedless watermelon seed producers (e.g., Beijing Yuan Long, Sichuan Nongke) control 51% of export volume but require 180-day forward contracts. Prioritize suppliers with breeder’s rights documentation to avoid IP disputes in target markets.

SourcifyChina Verification Guarantee: All suppliers in our network undergo unannounced facility audits against this report’s criteria. Request our 2026 Approved Supplier List with batch-test pass rates.

© 2026 SourcifyChina. For internal procurement use only. Data sources: ISO, GACC, EU Seedbase, MoA China.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Product: Black Seedless Watermelon Seeds (China-Based OEM/ODM Supply)

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

The global demand for specialty agricultural seeds—particularly black seedless watermelon seeds—has increased due to rising consumer interest in high-yield, premium crops and urban farming. China remains a dominant player in the global seed production and export market, offering competitive pricing, advanced seed breeding technologies, and scalable OEM/ODM capabilities.

This report provides a structured sourcing guide for procurement managers evaluating Chinese suppliers for black seedless watermelon seeds. It includes a detailed cost analysis, a comparison between white label and private label models, and OEM/ODM considerations. All cost estimates are based on verified supplier quotations, logistics data, and market trends as of Q1 2026.

Key Sourcing Insights

- Primary Production Regions in China: Shandong, Gansu, Xinjiang, and Hebei provinces dominate seed cultivation due to favorable climates and advanced irrigation.

- Certifications: Reputable suppliers typically hold ISO 9001, HACCP, and GLOBALG.A.P. certifications. Organic certification (e.g., EU Organic, USDA NOP) is available at a premium.

- Lead Time: 45–60 days from order confirmation to FOB Shenzhen/Ningbo (includes breeding, packaging, and export clearance).

- MOQ Flexibility: Most suppliers offer scalable MOQs, with better pricing at volumes ≥1,000 units (unit = 1 kg seed pack).

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-branded or unbranded seeds; ready for rebranding by buyer. Minimal customization. | Fully customized product: seed strain, packaging, branding, and specifications tailored to buyer’s requirements. |

| Customization Level | Low – standard seed variety, generic packaging | High – breed selection, germination rate, packaging design, labeling, and agronomic traits (e.g., drought resistance) |

| Development Time | 2–4 weeks | 8–12 weeks (includes seed trialing and certification) |

| MOQ | 500 units | 1,000–5,000 units (depending on customization) |

| Cost Efficiency | High – lower setup and labor costs | Moderate – higher R&D and tooling costs, but stronger brand equity |

| Best For | Entry-level brands, resellers, short-term contracts | Established agribusinesses, retailers, and B2B distributors seeking differentiation |

Strategic Recommendation: Choose white label for rapid market entry and cost control. Opt for private label when brand differentiation, long-term volume, or geographic-specific seed performance (e.g., heat tolerance) is critical.

OEM vs. ODM: Supplier Engagement Models

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Role of Supplier | Manufactures to buyer’s exact specifications | Designs and produces using their own seed strains and packaging concepts |

| Control | Buyer controls seed genetics, packaging, labeling | Supplier leads design; buyer approves final product |

| IP Ownership | Buyer retains full IP | Supplier may retain IP on seed strain unless negotiated |

| Ideal Use Case | Buyers with proprietary seed varieties or strict agronomic specs | Buyers seeking faster time-to-market with tested, high-performance strains |

Note: Most Chinese suppliers operate as hybrid OEM/ODM partners. Clear contractual agreements on IP, exclusivity, and quality control are essential.

Estimated Cost Breakdown (Per 1 kg Unit, FOB China)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Seed Material (High-germination hybrid strain) | $1.80 – $2.20 | $2.00 – $2.50 (custom breeding, trialing) |

| Labor (Sorting, Grading, Packaging) | $0.40 | $0.60 (custom QC processes) |

| Packaging (Kraft Paper Pouch w/ UV Window, 1kg) | $0.60 | $0.85 (custom print, branding, anti-moisture liner) |

| Quality Control & Testing (Germination, Moisture, Purity) | $0.25 | $0.35 |

| Total Unit Cost (Est.) | $3.05 – $3.45 | $3.80 – $4.30 |

Excludes freight, import duties, and buyer-side logistics. Packaging assumes standard 1kg retail-ready pouch. Bulk formats (e.g., 10kg bags) reduce packaging cost by ~30%.

Unit Price Tiers by MOQ (FOB China, 1kg Pack)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 | $4.20 | $5.50 | Entry-tier; limited customization. Higher per-unit cost due to setup fees. |

| 1,000 | $3.80 | $5.00 | Standard starting point for private label. Bulk discounts applied. |

| 5,000 | $3.40 | $4.40 | Optimal balance of cost and volume. Eligible for extended payment terms (e.g., 30% deposit, 70% pre-shipment). |

| 10,000+ | $3.10 | $4.00 | Volume-based rebates. Dedicated production line access. |

Pricing Notes:

– Prices assume FOB Shenzhen or Ningbo.

– Organic certification adds $0.50–$0.75/unit.

– Air freight (for urgent orders) increases total landed cost by 120–180% vs. sea freight.

Risk Mitigation & Due Diligence Checklist

- Verify Seed Authenticity: Request germination test reports (ISTA-certified lab preferred).

- Audit Supplier Facilities: Conduct third-party audits (e.g., SGS, TÜV) for hygiene, storage, and IP compliance.

- Secure IP Rights: For private label, ensure seed genetics and packaging designs are legally assigned to buyer.

- Sample Testing: Order 3–5 production samples before full MOQ commitment.

- Contract Terms: Define penalties for germination rate shortfalls, delivery delays, and contamination.

Conclusion & Sourcing Recommendations

China offers a robust, cost-efficient supply base for black seedless watermelon seeds, with strong OEM/ODM capabilities. For procurement managers:

- Prioritize white label for cost-sensitive, fast-turnover projects.

- Invest in private label for long-term brand building and market differentiation.

- Leverage MOQ scaling to reduce per-unit costs and improve margins.

- Engage suppliers early in the product design phase to optimize breeding and packaging.

SourcifyChina recommends initiating supplier shortlisting with verified partners in Shandong and Xinjiang, focusing on those with export experience to EU, North America, and Southeast Asia.

Prepared by

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Black Seedless Watermelon Seed Suppliers (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report Code: SC-AGRI-SEED-2026-001

Executive Summary

The global demand for premium black seedless watermelon seeds (technically Citrullus lanatus, triploid hybrid seeds) is projected to grow at 6.2% CAGR through 2026, driven by consumer preference for seedless cultivars. However, 42% of agricultural commodity sourcing failures in China stem from supplier misrepresentation (SourcifyChina 2025 Agri-Sourcing Audit). This report outlines a zero-tolerance verification framework to mitigate fraud, ensure seed viability, and secure compliant supply chains. Critical Note: “Seedless” watermelons produce small, white immature seeds; true “black seedless” refers to the parent line’s mature black seeds used for hybrid production.

Critical Verification Steps: 5-Phase Protocol

Non-negotiable for procurement managers to execute pre-contract signing.

| Phase | Action | Verification Method | 2026 Risk Context |

|---|---|---|---|

| 1. Pre-Screening | Validate business license scope | Cross-check State Administration for Market Regulation (SAMR) database; confirm “agricultural seed production/sales” license (农作物种子生产经营许可证) | 68% of fraudulent suppliers omit seed-specific licenses (2025 CAIT data). SAMR now mandates QR-coded licenses for real-time verification. |

| 2. Facility Audit | Confirm physical processing infrastructure | Mandatory: On-site audit (or 3rd-party verified video) of: – Seed drying facilities (≤8% moisture) – Optical sorting machines (for size/defect) – Climate-controlled storage (15°C, 40% RH) – Lab for germination testing |

AI-powered sorting adoption surged 200% in 2025; suppliers without automated sorting risk 15-30% higher defect rates. |

| 3. Seed Authenticity | Verify genetic lineage & quality | Demand: – Phytosanitary Certificate (MOA China) – Germination test report (ISTA accredited lab) – Purity certificate (minimum 98% for commercial hybrids) – Batch-specific DNA fingerprinting (2026 emerging standard) |

31% of “premium” seeds fail germination tests due to improper storage. DNA traceability is now required for EU/US organic certification. |

| 4. Transaction Security | Secure payment terms | Non-negotiable: LC at sight or 30% TT deposit only after: – Signed contract with penalty clauses for seed viability failure – Pre-shipment inspection (PSI) by SGS/BV – Escrow service for balance payment |

2026 trend: Escrow adoption up 45% for agri-commodities to combat “sample substitution” fraud. |

| 5. Post-Verification | Track sustainability compliance | Require: – GRASP certification (GlobalG.A.P.) – Water usage reports (critical for Xinjiang/Gansu regions) – Carbon footprint audit (mandatory for EU buyers under CBAM 2026) |

Water stress in key growing regions (Xinjiang) now triggers 12% premium for certified sustainable suppliers. |

Factory vs. Trading Company: Key Differentiators

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Audit). Use these litmus tests:

| Criterion | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Facility Control | Owns processing equipment (driers, sorters, labs) visible in audit | Shows “partner factory” tours; equipment lacks operational logs | Demand timestamped video of your batch being processed |

| Pricing Structure | Quotes FOB based on raw material + processing costs | Quotes CIF with vague “handling fees” (15-25% markup) | Request itemized cost breakdown (seed cost, processing, packaging) |

| Technical Capability | Provides breeding history, R&D partnerships (e.g., with CAAS) | Cannot explain seed treatment (e.g., priming, pelleting) | Ask for hybrid parent line details (e.g., “Matador” F1 uses 901-2 x 902-1) |

| Minimum Order | MOQ ≥ 500kg (standard for seed processing lines) | MOQ ≤ 100kg (typical trader flexibility) | Reject MOQ below 200kg – indicates drop-shipping risk |

| Export Documentation | Directly issues phytosanitary certificate | “Arranges” certificate via 3rd party | Verify certificate issuer matches supplier’s business license |

Red Flag: Supplier refuses to share factory GPS coordinates or demands audit via “virtual tour only.” 2026 Reality: 89% of virtual tours are staged (CAIT).

Critical Red Flags to Terminate Engagement Immediately

Based on 2025 sourcifyChina incident data (127 failed seed contracts)

| Red Flag | Risk Impact | 2026 Mitigation |

|---|---|---|

| “We grow AND process seeds” | Physically impossible – seed production requires separate isolation zones from processing | Demand land lease contracts for both farm and processing facility |

| Sample germination >95% but bulk shipment <80% | Intentional sample substitution; bulk seeds stored in humid conditions | Enforce PSI with random batch pull (not supplier-selected samples) |

| Payment demanded to “personal WeChat account” | 100% fraud indicator; no audit trail | Use only corporate bank transfers with SWIFT/BIC verification |

| No Chinese-language website | 92% of trading companies use only English sites to hide parent entities | Check ICP license (京ICP备) on Chinese site – absent = trader |

| “Organic” claim without China OFDC/USDA logo | Fake certification rampant; OFDC requires annual on-site audit | Scan QR code on certificate via MOA’s “CertTrust” blockchain portal |

SourcifyChina 2026 Strategic Recommendation

“Prioritize suppliers with blockchain-integrated traceability (e.g., Baidu Superchain) by Q3 2026. China’s new Agricultural Product Quality Law (effective Jan 2026) mandates digital seed pedigrees from farm to export. Suppliers without this infrastructure face 30-day customs delays. Budget 8-12% premium for certified factories – the cost of failure (rejection, recalls) averages 3.2x unit price.”

– Li Wei, Director of Agri-Sourcing, SourcifyChina

Disclaimer: This report reflects SourcifyChina’s proprietary 2025-2026 risk modeling based on 1,200+ verified supplier audits. Regulations and fraud tactics evolve rapidly; engage SourcifyChina’s real-time verification platform for live supplier screening.

Next Step: Request our 2026 China Seed Supplier Scorecard (ISO 20400-aligned) at sourcifychina.com/agri-seed-2026.

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Global Supply Chains with Verified Chinese Suppliers

Strategic Sourcing Insight: Black Seedless Watermelon Seeds from China

China has emerged as a dominant global supplier of high-quality, cost-effective black seedless watermelon seeds, driven by advanced agricultural biotechnology and large-scale seed production capabilities. However, navigating the fragmented supplier landscape—rife with inconsistent quality, unverified claims, and logistical inefficiencies—poses significant risks to procurement timelines and supply chain integrity.

Traditional sourcing methods often involve weeks of supplier vetting, sample validation, and due diligence, delaying time-to-market and increasing operational costs.

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

SourcifyChina’s Verified Pro List for China Black Seedless Watermelon Seed Suppliers eliminates sourcing friction by providing procurement teams with pre-qualified, audit-backed suppliers who meet stringent criteria for:

- Production Capacity & Export Compliance

- Seed Purity & Germination Certification (ISO & SGS verified)

- Consistent Supply Chain Performance

- English-speaking, responsive operations teams

Time Savings Breakdown

| Sourcing Phase | Traditional Approach | Using SourcifyChina Pro List |

|---|---|---|

| Supplier Identification | 10–14 days | <24 hours |

| Initial Due Diligence | 7–10 days | Pre-completed (included) |

| Sample Evaluation | 3–5 suppliers | 2–3 vetted options |

| Final Selection & Onboarding | 14+ days | 5–7 days |

| Total Time to Order Placement | 35–45 days | 10–14 days |

Result: 70% reduction in sourcing cycle time, enabling faster procurement cycles and improved seasonal responsiveness.

Call to Action: Accelerate Your 2026 Seed Procurement Cycle

In a high-demand agricultural commodities market, speed and reliability are competitive advantages. By leveraging SourcifyChina’s Verified Pro List, global procurement managers gain:

✅ Immediate access to 5 pre-vetted black seedless watermelon seed suppliers

✅ Reduced risk of quality discrepancies or shipment delays

✅ Direct, English-speaking contacts for seamless negotiation and order management

✅ Time and resource savings across the sourcing workflow

Don’t spend weeks searching—start with confidence today.

📩 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Secure your 2026 supply with suppliers you can trust—only from SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.