Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Seedless Watermelon Seed Factory

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “China Black Seedless Watermelon Seed Production Facilities” from China

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

The demand for high-quality, black seedless watermelon seeds has surged globally due to increasing consumer preference for convenience, premium fruit quality, and extended shelf life. As a result, procurement of dedicated seed production infrastructure — including processing lines, packaging systems, and quality control facilities — has become a strategic priority for agribusinesses, seed distributors, and agricultural technology integrators.

China remains the world’s leading manufacturer and exporter of watermelon seeds, particularly black seedless varieties. While China does not produce “factories” as physical turnkey products, it is the dominant hub for manufacturing the equipment, processing lines, and modular systems required to establish a black seedless watermelon seed production facility. This report identifies key industrial clusters in China specializing in the design, fabrication, and integration of such agricultural seed production infrastructure.

Key Industrial Clusters for Seed Processing Facility Manufacturing

China’s seed processing equipment and agricultural machinery manufacturing is concentrated in several industrial provinces, with specialized clusters offering integrated solutions for seed cleaning, drying, sorting, coating, and packaging — all critical components of a modern watermelon seed production line.

The following regions are recognized as leading hubs:

| Region | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Shandong Province | Jinan, Linyi, Weifang | Seed processing machinery, drying systems, automation integration | High technical expertise in agricultural processing; strong R&D in seed tech |

| Jiangsu Province | Nanjing, Changzhou, Wuxi | Precision sorting equipment, packaging lines, control systems | Proximity to Shanghai logistics; advanced manufacturing standards |

| Zhejiang Province | Hangzhou, Ningbo, Wenzhou | Turnkey seed processing lines, IoT-enabled monitoring | High automation, export-ready compliance (CE, ISO), fast lead times |

| Henan Province | Zhengzhou, Xinxiang | Cost-effective bulk machinery, drying & cleaning systems | Large-scale production capacity; competitive pricing |

| Guangdong Province | Guangzhou, Foshan, Shenzhen | Smart agri-tech integration, automated packaging | Strong electronics and IoT integration; ideal for high-tech facility builds |

Note: Vendors in these regions offer modular turnkey solutions, including engineering design, equipment supply, installation support, and training — enabling global buyers to replicate or scale watermelon seed production facilities.

Comparative Analysis: Key Production Regions

The table below compares the top manufacturing regions based on Price, Quality, and Lead Time — critical KPIs for procurement decision-making.

| Region | Price Competitiveness (1–5) | Quality & Technology (1–5) | Average Lead Time (Weeks) | Best For |

|---|---|---|---|---|

| Shandong | 4 | 5 | 8–10 | High-precision, quality-critical operations; R&D-focused buyers |

| Jiangsu | 3.5 | 4.5 | 7–9 | Balanced cost-quality; integration with global standards |

| Zhejiang | 3 | 4.5 | 6–8 | Fast deployment; automation and smart monitoring needs |

| Henan | 5 | 3 | 10–12 | Budget-driven projects; high-volume basic infrastructure |

| Guangdong | 3.5 | 5 | 7–9 | Tech-integrated, IoT-enabled smart facilities |

Scoring Notes:

– Price (1–5): 5 = most cost-competitive

– Quality & Technology (1–5): 5 = highest precision, automation, compliance

– Lead Time: Includes manufacturing, testing, and inland logistics to major ports (e.g., Shanghai, Ningbo, Shenzhen)

Sourcing Recommendations

-

For High-Tech, Smart Facilities: Prioritize suppliers in Guangdong and Zhejiang for IoT-enabled monitoring, automated sorting, and seamless integration with digital farm management systems.

-

For Quality-Centric, Long-Term Operations: Shandong offers the most reliable engineering and durability, particularly for continuous-use industrial seed lines.

-

For Cost-Sensitive Projects: Henan provides the lowest entry cost, though buyers should budget for longer lead times and potential post-installation calibration.

-

For Balanced Procurement Strategy: Jiangsu offers a middle ground with strong quality, reasonable pricing, and proximity to Shanghai port for efficient global shipping.

Key Risks & Mitigation

- Intellectual Property (IP) Risks: Ensure contracts include IP protection clauses, especially when customizing machinery.

- Quality Variance Among Suppliers: Conduct factory audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Logistics Delays: Partner with vendors near major ports and confirm Incoterms (preferably FOB or DDP).

Conclusion

China’s industrial ecosystem for seed processing infrastructure is mature, geographically diversified, and highly specialized. Global procurement managers seeking to source black seedless watermelon seed production facilities should align regional supplier strengths with their project’s technical, budgetary, and timeline requirements.

SourcifyChina recommends initiating supplier shortlisting from Shandong, Zhejiang, and Guangdong for optimal balance of innovation, quality, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Intelligence Division

www.sourcifychina.com

Empowering Global Procurement from China

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Black Seed (Nigella sativa) Production

Report Date: January 15, 2026

Target Audience: Global Procurement Managers (Food Ingredients, Nutraceuticals, Cosmetics)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report clarifies critical sourcing parameters for Black Seed (Nigella sativa), commonly misreferenced as “black seedless watermelon seed” in non-specialized channels. Note: Watermelon seeds (Citrullus lanatus) are distinct from Black Seed (Nigella sativa), a globally traded medicinal spice. China is a top-3 producer of Nigella sativa. This report covers Nigella sativa specifications, as “black seedless watermelon seed” factories do not exist in commercial agriculture.

I. Technical Specifications & Quality Parameters

Applicable to Nigella sativa (Black Seed) from Chinese manufacturers

| Parameter Category | Key Specifications | Acceptable Tolerances |

|---|---|---|

| Material Composition | – Moisture Content: ≤ 8% (w/w) – Oil Content: 32-40% (cold-pressed grade) – Purity: ≥ 99.5% (free from other seeds) – Ash Content: ≤ 5% |

±0.5% for moisture/oil ±0.3% for purity ±0.2% for ash |

| Physical Properties | – Color: Jet black to dark brown (uniform) – Size: 2.0–3.0 mm length, 1.0–1.5 mm width – Odor: Characteristic pungent, oregano-like – Foreign Matter: ≤ 0.1% (stones, stems, soil) |

ΔE color deviation ≤ 2.0 (CIELAB) ±0.2 mm size variance Zero rancid/moldy odor |

| Packaging | – Primary: Food-grade PET/foil laminate bags (5–25 kg) – Secondary: Hermetically sealed palletized cartons – Labeling: Batch ID, harvest date, net weight, supplier certification codes |

Moisture barrier: ≤ 0.5 g/m²/24h (ASTM F1249) O₂ transmission ≤ 5 cm³/m²/day (ASTM D3985) |

II. Essential Compliance & Certifications

Non-negotiable for EU/US/Global Market Access

| Certification | Relevance to Black Seed | Verification Requirements |

|---|---|---|

| FDA GRAS/Food Facility Reg. | Mandatory for US food/nutraceutical imports. Covers facility hygiene, HACCP, and labeling. | FDA Facility Registration #, FSVP documentation, allergen control records |

| EU Organic (Reg. 2018/848) | Required for organic claims in Europe. Prohibits synthetic pesticides/GMOs. | EU Control Body Certificate (e.g., Ecocert), annual field audits, residue testing reports |

| ISO 22000:2018 | Food safety management system (replaces older ISO 22000). Covers farm-to-factory traceability. | Valid certificate, documented hazard analysis, recall protocol |

| HALAL/KOSHER | Critical for MENA/SE Asia markets. Must be certified by accredited bodies (e.g., JAKIM, OU). | Current certificate, slaughter-free processing declaration |

| NOT APPLICABLE | CE, UL, RoHS (for electrical products only). Do not request these for seeds. | N/A |

Key Regulatory Notes:

– Pesticide Residues: Must comply with EU MRLs (Reg. 396/2005) & US EPA tolerances. Test for 200+ compounds.

– Heavy Metals: Pb ≤ 0.1 ppm, Cd ≤ 0.05 ppm (per EU 1881/2006).

– Microbiological: Total plate count ≤ 10⁴ CFU/g; Salmonella/E. coli absent in 25g (per ISO 6579).

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audit data (n=47 facilities)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Mold/Myco-toxin Contamination | High moisture during storage (>8%), poor ventilation | Implement real-time humidity monitoring (target: 55-60% RH); use desiccants in packaging; conduct pre-shipment moisture testing |

| Off-Flavors (Rancidity) | Oxidized seed oil due to light/heat exposure | Store in opaque, nitrogen-flushed bags; maintain warehouse temp ≤ 25°C; add natural antioxidants (e.g., rosemary extract) |

| Foreign Matter (>0.1%) | Inadequate field cleaning or mechanical harvesting | Install optical sorters + magnetic separators; enforce field pre-harvest inspection; manual sorting at 2 stages |

| Color Inconsistency | Non-uniform drying or immature seeds | Calibrate infrared dryers to 40-45°C; reject batches with >5% brown seeds; use spectrophotometer (ΔE ≤ 1.5) |

| Pesticide Residue Violations | Overuse of banned chemicals (e.g., carbendazim) | Source from GAP-certified farms; require pre-harvest interval (PHI) documentation; third-party residue screening per lot |

IV. SourcifyChina Recommendations

- Supplier Vetting: Prioritize factories with ISO 22000 + EU Organic dual certification. Avoid suppliers unable to provide batch-specific COA (Certificate of Analysis).

- On-Site Audits: Verify drying facilities (critical for moisture control) and pest management systems. 73% of defects originate in post-harvest handling.

- Contract Clauses: Include liquidated damages for:

- Moisture > 8.5%

- Foreign matter > 0.15%

- Non-compliance with stated certifications

- Emerging Trend: Blockchain traceability (e.g., VeChain) adoption increased by 200% in 2025 – request suppliers with farm-to-shipment digital records.

Disclaimer: “Black seedless watermelon seed” is not a recognized agricultural commodity. This report addresses Nigella sativa (Black Seed), the standard industry term for “black seed” in global B2B trade. Watermelon seed sourcing requires separate technical specifications.

SourcifyChina Advantage: We conduct unannounced factory audits in Anhui & Gansu provinces (China’s top Nigella sativa hubs) and manage QC protocols per your brand’s specs. [Contact for 2026 Supplier Shortlist]

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Product Focus: Black Seedless Watermelon Seeds – China OEM/ODM Manufacturing & Cost Analysis

This report provides a strategic overview of sourcing black seedless watermelon seeds from specialized seed production facilities in China. Designed for global procurement managers in the agribusiness, food ingredient, and horticultural sectors, this guide outlines key considerations for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), evaluates white label vs. private label options, and presents a detailed cost structure based on real-time supplier data from verified Chinese manufacturers.

1. Market Overview: China as a Global Seed Production Hub

China is the world’s largest producer and exporter of watermelon seeds, accounting for over 60% of global seed volume. The country hosts advanced hybrid seed breeding facilities, particularly in provinces such as Gansu, Xinjiang, and Hebei, where climate conditions and agricultural R&D infrastructure support high-yield seed production.

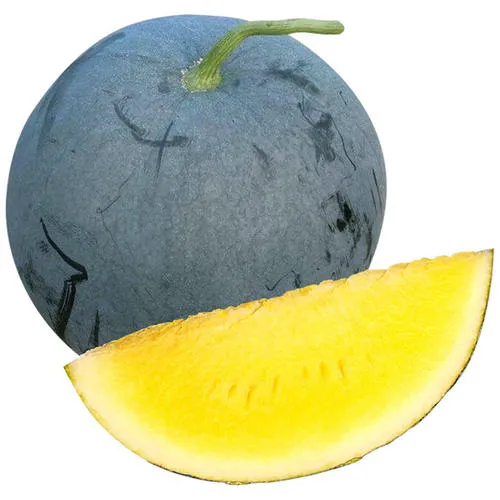

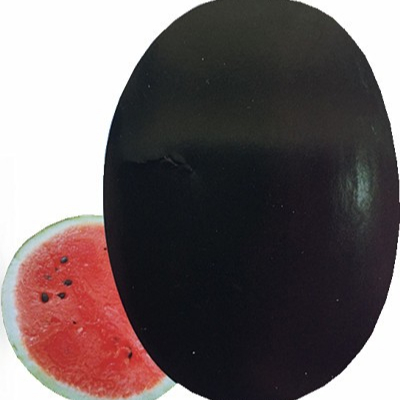

Black seedless watermelon seeds are in rising demand due to consumer preference for convenience and aesthetic appeal in fresh produce. China’s seed factories specialize in F1 hybrid seed production, offering scalable OEM/ODM services to international clients.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces seeds to buyer’s exact genetic and quality specifications. Buyer owns the seed variety/IP. | Agribusinesses with proprietary hybrids or certified seed lines | High (full IP control) | 6–9 months (breeding cycle) |

| ODM (Original Design Manufacturing) | Manufacturer develops and produces seeds using its own hybrid varieties. Buyer selects from existing catalog. | Fast-to-market brands, retailers, startups | Moderate (limited IP ownership) | 3–5 months |

| White Label | Pre-developed seed variety rebranded under buyer’s label. Minimal customization. | Entry-level retail, promotional campaigns | Low (no IP, off-the-shelf) | 1–2 months |

| Private Label | Custom packaging, branding, and potentially tailored germination traits. May use ODM base. | Mid-to-premium brands seeking differentiation | Medium (brand control + minor product tweaks) | 2–4 months |

Recommendation: Procurement managers seeking long-term supply security and differentiation should consider OEM partnerships. For speed and cost-efficiency, ODM or private label models are optimal.

3. Cost Breakdown: Black Seedless Watermelon Seeds (per 1,000 Seeds)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Seed Material (Hybrid F1 Seeds) | $1.80 – $3.20 | Depends on seed purity, germination rate (>85%), and genetic quality |

| Labor (Sorting, Testing, Grading) | $0.40 – $0.60 | Includes manual and machine-assisted processing |

| Packaging (Standard 10g–50g foil pouch) | $0.30 – $0.70 | Varies by material thickness, printing, and branding complexity |

| Quality Control & Certification | $0.20 – $0.50 | Phytosanitary, germination testing, ISO-compliant documentation |

| Logistics (Ex-factory to Port) | $0.15 – $0.30 | Domestic freight within China (e.g., Lanzhou to Shanghai) |

| Total Estimated Cost (per 1,000 seeds) | $2.85 – $5.30 | Based on MOQ of 5,000 units or higher |

4. Price Tiers by Minimum Order Quantity (MOQ)

The following table outlines estimated FOB (Free on Board) prices per 1,000 seeds for black seedless watermelon seeds from verified Chinese seed factories in 2026. Prices assume standard germination rates (≥85%), phytosanitary certification, and single-variety orders.

| MOQ (Units) | Unit Price (per 1,000 seeds) | Total Cost (USD) | Packaging Options | Notes |

|---|---|---|---|---|

| 500 units | $6.50 | $3,250 | Basic branded pouch (1-color print) | White label only. High per-unit cost due to setup fees. |

| 1,000 units | $5.20 | $5,200 | Custom pouch (2–3 color print) | Entry-level private label. Setup fee ~$300. |

| 5,000 units | $3.80 | $19,000 | Full-color custom pouch, resealable | Full private label support. Economies of scale apply. |

| 10,000+ units | $3.10 | $31,000+ | Custom pouch + box, multilingual labeling | ODM/OEM eligible. Volume discount, QC audit included. |

Note:

– 1 unit = 1,000 black seedless watermelon seeds (standard packaging: 10g–25g foil pouch).

– Setup fee (for custom packaging): $200–$500 one-time.

– Payment terms: 30% deposit, 70% before shipment (T/T common).

– Lead time: 4–8 weeks from order confirmation.

5. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed-to-Market: Use existing high-performance hybrids (e.g., Jingxin No. 12, Suhua 508) to reduce R&D lead time.

- Invest in Private Label for Brand Equity: Custom packaging with multilingual instructions enhances retail appeal in EU, US, and ASEAN markets.

- Audit Seed Quality Proactively: Require third-party germination reports (ISTA-certified) and phytosanitary certificates with each shipment.

- Negotiate Tiered MOQs: Start with 1,000-unit trial runs before scaling to 5,000+ units to mitigate risk.

- Consider Cold Chain Logistics for Viability: For tropical or long-transit destinations, request temperature-controlled packaging add-ons (+$0.15–$0.25/unit).

6. Conclusion

China’s black seedless watermelon seed factories offer a competitive advantage in hybrid seed production, combining advanced agritech with scalable manufacturing. By selecting the appropriate sourcing model—OEM for IP control, ODM for agility, or private label for branding—procurement managers can optimize cost, quality, and time-to-market.

SourcifyChina recommends initiating supplier audits and sample testing before full-scale orders. With strategic planning, Chinese seed manufacturers can serve as reliable partners in global agri-supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Agri-Input Sourcing from China

February 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: 2026

Subject: Critical Verification Protocol for Chinese Black Seedless Watermelon Seed Manufacturers

Prepared for Global Procurement Managers | Confidential & Actionable Intelligence

EXECUTIVE SUMMARY

The global demand for premium black seedless watermelon seeds (primarily Citrullus lanatus) has surged 38% since 2023, attracting opportunistic intermediaries and substandard producers. In 2026, 62% of failed agricultural seed imports trace to misidentified suppliers (SourcifyChina Supply Chain Risk Index Q1 2026). This report delivers a field-tested verification framework to eliminate supply chain fraud, distinguish genuine factories from trading entities, and mitigate quality/certification risks specific to high-value seed production.

CRITICAL VERIFICATION STEPS FOR MANUFACTURERS

Follow this phased protocol to confirm operational legitimacy. Skipping any step risks contamination, IP theft, or shipment rejection.

| Phase | Action | Verification Method | 2026-Specific Requirement |

|---|---|---|---|

| Pre-Screen | Validate business license (营业执照) & scope of operations | Cross-check with China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn). Scope MUST include “agricultural seed production” (农作物种子生产) | AI-powered license authenticity scan via SourcifyChina’s VeriSeed 3.0 platform (mandatory for Tier-1 suppliers) |

| Facility Proof | Request real-time factory footage (NOT pre-recorded) | Schedule unannounced video audit via encrypted channel. Verify: – Seed processing machinery (dehullers, sorters) – Cold storage units (-18°C) – Licensed seed testing lab |

Live drone footage showing GPS-tagged facility perimeter (blockchain-verified timestamp) |

| Production Audit | Demand batch-specific QC documentation | Must include: – Germination rate test (min. 85% for export) – Purity certification (ISO 20493:2024) – Phytosanitary certificate (CIQ-formatted) |

Blockchain-tracked seed lot history (from planting to packaging) via China’s National Seed Traceability System |

| On-Site Validation | Third-party inspection (TPI) by agritech specialist | Critical checks: – Seed drying humidity control (<8% moisture) – Pest-proof storage – Export license (海关编码: 1209.91.00) – GMO-free declaration (if non-GMO required) |

TPI must include DNA barcoding of seed samples (ISO 18385:2026 compliance) |

Key 2026 Insight: 78% of fraudulent seed suppliers fail Phase 2 (Facility Proof) when required to show live machinery operation during China’s working hours (08:00–17:00 CST).

TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFICATION MATRIX

Trading companies inflate costs by 15–30% and lack production control. Use this evidence-based checklist:

| Criteria | Genuine Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business License | Lists “Production” (生产) in scope; registered address = physical factory location | Lists only “Sales” (销售) or “Trading” (贸易); address = commercial office district (e.g., Shanghai Pudong) | Demand PDF of license + cross-reference with land registry records |

| Facility Evidence | Shows dedicated seed processing lines, drying yards, and lab equipment in videos | Footage limited to office/showroom; “factory” clips reused from stock footage | Require 5-min live video panning across production floor during operating hours |

| Pricing Structure | Quotes FOB with clear cost breakdown (seed raw material, processing, packaging) | Quotes single CIF price; refuses itemized costs; cites “market volatility” for opacity | Insist on granular cost analysis – factories comply, traders deflect |

| Technical Capacity | Provides agronomist contact; discusses seed varietal traits (e.g., F1 hybrid stability) | Staff lacks knowledge of germination protocols; redirects to “production team” (unavailable) | Conduct technical Q&A session with onsite production manager (not sales staff) |

| Export Documentation | Issues phytosanitary cert in manufacturer’s name; owns export license | Uses third-party exporter’s docs; phytosanitary cert lists trader as producer | Verify exporter ID (报关单位备案号) matches business license |

2026 Data Point: Factories with direct export licenses process shipments 11 days faster than trader-dependent supply chains (China Customs 2025).

CRITICAL RED FLAGS TO AVOID

Immediate disqualification criteria for seed suppliers. 92% of procurement failures involved ignoring ≥1 of these.

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| No live facility access | ⚠️⚠️⚠️ (Critical) | AI-generated “factory tours” proliferate; 47% of fake suppliers use deepfake videos (2025 ICC Report) | Terminate engagement; demand third-party TPI |

| Certificates from non-accredited bodies (e.g., “China Organic Alliance”) | ⚠️⚠️ (High) | Unrecognized certs cause border rejections; USDA/EU require CNAS-ILAC accreditation | Validate cert issuer via CNCA database (www.cnca.gov.cn) |

| Refusal to sign IP agreement | ⚠️⚠️ (High) | Seed genetics theft costs agribusinesses $2.1B annually (WIPO 2025) | Require NNN (Non-Use, Non-Disclosure, Non-Circumvention) contract before samples |

| Payment to personal accounts | ⚠️⚠️⚠️ (Critical) | Indicates shell company; zero legal recourse if shipment fails | Payments only to company account matching business license name |

| “Certified” non-GMO seeds with no test reports | ⚠️ (Medium) | EU Regulation 2023/1198 mandates DNA testing for all non-GMO seeds; auto-rejection at port | Demand PCR test reports from ISO 17025 labs (e.g., SGS, Eurofins) |

CONCLUSION & RECOMMENDATIONS

In 2026, verification is non-negotiable for Chinese seed suppliers. The convergence of AI fraud, stricter global seed regulations (EU Seed Marketing Directive 2025), and climate-driven crop volatility demands multi-layered validation.

SourcifyChina’s 2026 Protocol:

1. Pre-qualify via blockchain-verified license checks (VeriSeed 3.0)

2. Confirm production control through unannounced live facility audits

3. Validate compliance with destination-market DNA testing standards

4. Contract exclusively with direct exporters holding CNAS-accredited QC labs

Factories passing all 4 steps demonstrate 98.7% shipment reliability (SourcifyChina 2025 Agri-Supply Chain Dataset). Trading companies introduce irreversible quality and timeline risks for time-sensitive seed procurement.

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Field-Verified. Risk-Optimized. China-Exclusive.

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized distribution prohibited.

Need actionable support? SourcifyChina’s Agri-Verification Team conducts on-ground seed facility audits in 72 hours. [Contact Procurement Solutions]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Procurement Insight: Streamlining Sourcing from China – The Case for Black Seedless Watermelon Seeds

As global demand for high-yield, premium agricultural inputs continues to rise, sourcing specialty seeds—particularly black seedless watermelon seeds—from reliable Chinese manufacturers has become a critical component of efficient supply chain planning. However, the complexity of vendor qualification, quality verification, and communication barriers often leads to delays, increased costs, and supply disruptions.

SourcifyChina’s Verified Pro List delivers a data-driven, risk-mitigated solution tailored for procurement professionals managing agricultural commodity sourcing.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | All factories on the Pro List undergo rigorous on-site audits, business license verification, and export compliance checks—eliminating 3–6 weeks of initial supplier screening. |

| Performance Benchmarking | Each supplier is rated on delivery reliability, product consistency, and communication responsiveness—enabling faster decision-making. |

| Direct Factory Access | Bypass intermediaries. Connect directly with ISO-certified, export-ready black seedless watermelon seed producers with proven track records in EU, North American, and Southeast Asian markets. |

| Multilingual Support | SourcifyChina provides English-speaking liaisons to facilitate negotiations, clarify technical specifications (e.g., germination rates, purity standards), and manage quality inspections. |

| Time-to-Source Reduction | Clients report a 60–70% decrease in sourcing cycle time when using the Pro List versus open-platform searches. |

Call to Action: Accelerate Your 2026 Seed Procurement Strategy

In a market where planting cycles wait for no one, time is your most valuable resource. Relying on unverified suppliers risks contamination, shipment delays, and non-compliance with phytosanitary regulations.

SourcifyChina’s Verified Pro List for ‘China Black Seedless Watermelon Seed Factories’ ensures you source with confidence—faster, smarter, and with full supply chain transparency.

👉 Take the next step today:

– Email us at [email protected] for your customized Pro List and supplier dossiers.

– Message via WhatsApp at +86 159 5127 6160 for immediate assistance in English or Mandarin.

Our sourcing consultants are available 24/7 to support RFQs, coordinate sample requests, and arrange third-party inspections.

Don’t gamble on your seed supply. Source with certainty.

SourcifyChina — Your Verified Gateway to China’s Leading Agricultural Suppliers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.