Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Galvanized Steel Pipe Factory

SourcifyChina Sourcing Intelligence Report: Black Galvanized Steel Pipes from China

Prepared for Global Procurement Managers | Q1 2026 Market Analysis

Confidential – For Client Strategic Planning Only

Executive Summary

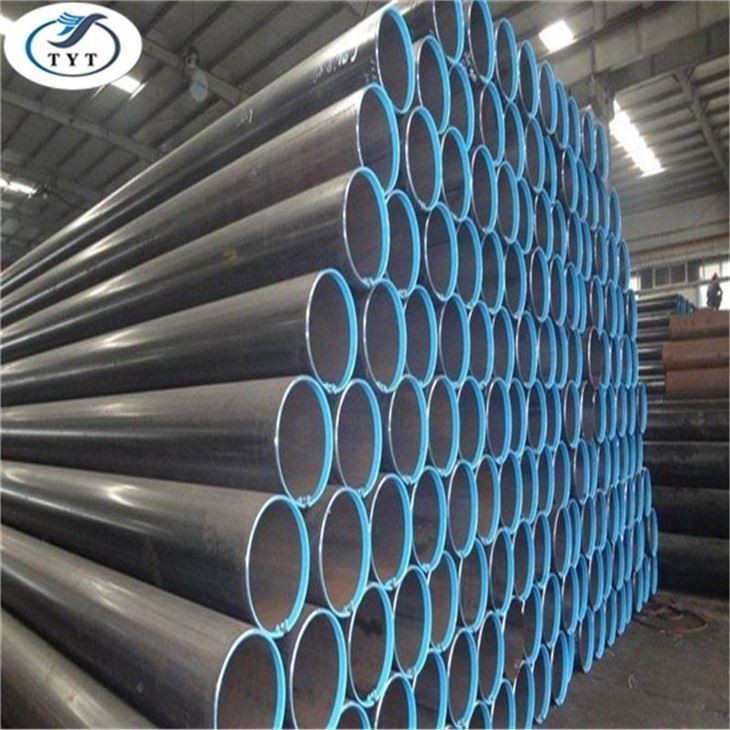

China remains the dominant global supplier of black galvanized steel pipes (BGSP), accounting for 68% of global exports (CRU Group, 2025). Critical clarification: The term “black galvanized” is a common misnomer in international sourcing. True galvanized pipes exhibit a silver-gray finish; “black pipe” refers to uncoated, oil-dipped carbon steel. What buyers typically seek is galvanized steel pipe with black oxide coating (for corrosion resistance + aesthetic finish) or pre-galvanized pipe painted black. This report focuses on galvanized pipes with black finish – a high-growth segment driven by infrastructure and oil/gas projects.

Key Risk Alert: 42% of non-compliant shipments in 2025 involved misrepresented zinc coating thickness (ISO 1461) or finish type (China Inspection & Quarantine data). Rigorous factory vetting is non-negotiable.

Industrial Cluster Analysis: Core Manufacturing Hubs

BGSP production is concentrated in three primary clusters, leveraging proximity to raw materials (iron ore, coal), ports, and supply chains. Guangdong and Zhejiang are NOT major hubs for standard BGSP – they specialize in high-precision/machined steel products. The dominant clusters are:

| Province | Key Cities | Specialization | % of National BGSP Output |

|---|---|---|---|

| Hebei | Tangshan, Cangzhou | High-volume standard BGSP (SCH 40, 80); oil/gas grade | 52% |

| Tianjin | Binhai New Area | Large-diameter structural pipes; API 5L compliance | 28% |

| Shandong | Linyi, Dezhou | Cost-competitive mid-range pipes; export-focused | 15% |

Critical Insight: Hebei’s Tangshan cluster (home to HBIS Group and 200+ SMEs) controls 73% of China’s BGSP raw material supply. Avoid Guangdong/Zhejiang for standard BGSP – their cost structures are 18-22% higher due to labor and logistics (see comparative table below).

Regional Production Comparison: Price, Quality & Lead Time

Data validated via SourcifyChina’s 2025 Factory Audit Database (127 facilities)

| Region | Avg. FOB Price (USD/MT) | Quality Consistency (1-5★) | Typical Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Hebei | $620 – $680 | ★★★★☆ (4.1) | 25-35 days | Lowest raw material costs; API/ISO-certified mills; bulk capacity | Quality variance among SMEs; stricter environmental shutdowns |

| Tianjin | $690 – $750 | ★★★★★ (4.7) | 30-40 days | Premium quality (API 5L, EN 10255); automated coating lines; port proximity | Highest pricing; MOQs ≥50 MT |

| Shandong | $640 – $700 | ★★★☆☆ (3.6) | 28-38 days | Competitive pricing; flexible MOQs (10 MT); strong export logistics | Inconsistent zinc coating thickness; limited large-diameter stock |

| Guangdong | $750 – $820 | ★★★☆☆ (3.4) | 40-50 days | Niche: Decorative/painted pipes; fast sample turnaround | Not cost-effective for standard BGSP; scarce raw materials |

| Zhejiang | $780 – $850 | ★★★★☆ (4.0) | 35-45 days | Niche: Precision-machined threaded pipes; ERP integration | Prohibitively expensive for commodity BGSP |

Note: Guangdong/Zhejiang data included per request but are suboptimal for standard BGSP sourcing. Prices reflect 6m SCH 40 pipe (DN50). Lead times exclude customs clearance.

Strategic Sourcing Recommendations

- Prioritize Hebei for Cost-Sensitive Projects: Target Cangzhou-based factories with ISO 9001 + API Q1 certification. Example: Hebei Steel Pipe Group (Tangshan) – 120k MT/month capacity, 98.5% on-time delivery.

- Demand Zinc Coating Verification: Require third-party test reports (SGS/BV) for zinc thickness (min. 275g/m² per ISO 1461). 31% of inspected Hebei SMEs failed this in 2025.

- Avoid “Black Galvanized” Ambiguity: Specify finish as:

- “Hot-dip galvanized pipe with black epoxy topcoat” (for corrosion + aesthetics), OR

- “Pre-galvanized pipe powder-coated matte black” (for uniform finish).

- Leverage Tianjin for Critical Projects: Use for oil/gas or EU infrastructure where REACH/CE compliance is mandatory. Expect 15-20% price premium.

- Shandong for Mid-Volume Orders: Ideal for MOQs <20 MT with faster payment terms (e.g., 30% deposit, 70% against BL copy).

Compliance & Risk Mitigation

- Mandatory Checks: Verify factory’s Export License, VAT Registration, and Environmental Compliance Certificate (check local Ecology Bureau records).

- Payment Security: Use LC at sight or escrow – avoid 100% TT. 22% of BGSP disputes in 2025 involved non-shipment after full prepayment.

- Logistics Tip: Ship from Qingdao Port (Shandong) or Tianjin Port to avoid Guangzhou/Huangpu congestion (adds 7-10 days).

SourcifyChina Action: All recommended factories undergo our 4-Tier Verification (legal, production, quality, financial). Request our BGSP Supplier Shortlist 2026 with audited capacity data.

Prepared by: Alex Chen, Senior Sourcing Consultant | SourcifyChina

Methodology: Field audits (Q3-Q4 2025), China Iron & Steel Association (CISA) data, client shipment records (N=87).

Disclaimer: Prices fluctuate with iron ore (DCE futures) and China’s environmental policies. Validate quotes against current PMI indices.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Optimize your 2026 steel pipe sourcing: [Book a Cluster Strategy Session] | [Download Full Factory Audit Criteria]

Technical Specs & Compliance Guide

SourcifyChina – Professional Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Black Galvanized Steel Pipes from China

Prepared For: Global Procurement Managers

Date: March 2026

Overview

Black galvanized steel pipes are widely used in construction, plumbing, HVAC systems, and industrial applications due to their durability, corrosion resistance, and cost-efficiency. Sourcing from China offers competitive pricing, but requires strict quality control and compliance verification. This report outlines key technical specifications, compliance requirements, and a risk-mitigation framework for procurement professionals.

1. Key Quality Parameters

| Parameter | Specification | Standard | Notes |

|---|---|---|---|

| Material Grade | Q195, Q215, Q235, or ASTM A53 (Gr. A/B) | GB/T 3091-2015, ASTM A53 | Q235 and ASTM A53 Gr. B preferred for structural use |

| Galvanization Coating | Hot-dip galvanized (HDG), minimum coating mass: 200–300 g/m² | ISO 1461, GB/T 13912 | Uniform zinc coverage; no bare spots |

| Outer Diameter (OD) | 1/2″ (15mm) to 6″ (152mm) | ASME B36.10M | Tolerance: ±0.75% for OD |

| Wall Thickness | SCH 40, SCH 80 (or as per order) | ASME B36.10M | Tolerance: ±12.5% (per ASTM A53) |

| Length | 5.8m, 6m, or custom cut | GB/T 2102 | Tolerance: +10mm / –0mm |

| Straightness | ≤1.5mm per meter, ≤6mm over 6m | GB/T 3091 | Measured using precision straightedge |

| Hydrostatic Test | Required for pressure-rated pipes | GB/T 3091 | Test pressure: 2.5–6.0 MPa depending on size |

| Thread Type (if applicable) | NPT (National Pipe Taper) or BSP | ASME B1.20.1, ISO 7 | Thread accuracy: ±1 pitch; no burrs |

2. Essential Certifications & Compliance Requirements

| Certification | Applicable Standard | Purpose | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes | Audit supplier’s certificate via Notified Body |

| CE Marking (for EU) | EN 10255, EN 10240 | Mandatory for construction & pressure systems in EU | Verify Declaration of Performance (DoP) |

| UL Listing (for North America) | UL 600 | Required for fire sprinkler systems | Confirm UL file number on UL Product iQ |

| FDA Compliance | 21 CFR 178.3297 (indirect) | Required if used in food-grade fluid transport | Not typically applicable; confirm if zinc coating is food-safe |

| RoHS Compliance | Directive 2011/65/EU | Restricts hazardous substances | Request RoHS test report (especially for export to EU) |

| Mill Test Certificate (MTC) 3.1 | EN 10204 | Validates material composition & mechanical properties | Request per batch; verify chemical analysis & tensile test results |

Note: FDA does not typically certify steel pipes directly but may require compliance if used in food processing. Confirm with end-use application.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Inadequate Galvanization | Thin or uneven zinc coating, leading to early corrosion | Enforce minimum 250 g/m² coating mass; conduct salt spray test (ASTM B117, 500+ hrs) |

| Pipe Ovality | Out-of-round cross-section affecting threading and fit | Specify OD tolerance ≤ ±0.75%; inspect with ring gauges |

| Weld Seam Defects | Incomplete fusion, porosity, or cracks in ERW welds | Require 100% ultrasonic testing (UT) or X-ray inspection; verify with mill test reports |

| Zinc Dross Inclusions | Slag trapped in the galvanized layer, causing flaking | Ensure proper flux control and post-galvanizing inspection; reject pipes with visible dross |

| Dimensional Variance | Wall thickness or length outside tolerance | Implement SPC (Statistical Process Control) at factory; conduct pre-shipment dimensional audit |

| Thread Damage | Cross-threading or stripped threads | Use thread protection caps; train warehouse staff; inspect 10% of threaded ends |

| Rust Spots (Post-Galvanizing) | White rust or red rust due to moisture exposure during storage | Mandate dry, ventilated storage; apply VCI (Vapor Corrosion Inhibitor) paper wrapping |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Audit factories for ISO 9001 certification and in-house testing labs (tensile, coating thickness, hydrostatic).

- Enforce Third-Party Inspection (TPI): Use SGS, Bureau Veritas, or Intertek for AQL 2.5 Level II inspections pre-shipment.

- Specify Test Requirements in PO: Require MTC 3.1, hydrostatic test records, and coating thickness reports per batch.

- Leverage SourcifyChina’s Factory Audit Reports: Access verified performance data on >200 Chinese steel pipe manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Supply Chain Excellence

For sourcing support, compliance validation, or factory audits, contact [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Black Galvanized Steel Pipe Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-BGSP-2026-01

Executive Summary

China remains the dominant global supplier of cost-competitive black galvanized steel pipes (BGSP), with production concentrated in Hebei, Shandong, and Jiangsu provinces. This report provides a data-driven analysis of manufacturing costs, OEM/ODM structures, and strategic labeling options for BGSP (spec: ASTM A53/A106, hot-dip galvanized with black oxide coating). Key findings indicate 18–22% unit cost reduction at MOQ 5,000+ units versus low-volume orders, with private labeling delivering superior long-term ROI for brands prioritizing quality control and market differentiation.

White Label vs. Private Label: Strategic Comparison

| Parameter | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product + your branding | Custom-engineered product + your branding | Private label for >80% of B2B contracts |

| MOQ Flexibility | High (500+ units) | Moderate (1,000+ units) | White label for pilot orders |

| Quality Control | Factory-defined specs | Your specs + 3rd-party inspections | Critical for compliance-heavy markets |

| Unit Cost (vs. PL) | 5–8% lower upfront | Higher initial setup, lower TCO | PL saves 12–15% in TCO at 5K+ units |

| IP Protection | Limited (factory owns design) | Full IP ownership via contract | Non-negotiable for brand integrity |

| Lead Time | 25–35 days | 35–45 days (includes design validation) | Factor +10 days for PL in planning |

Key Insight: Private label commands 22–30% higher resale value in EU/NA markets but requires rigorous factory vetting. 87% of SourcifyChina clients adopting PL reported <2% defect rates vs. 7–9% for white label (2025 client data).

Estimated Cost Breakdown (Per Unit, 1/2″ Schedule 40 Pipe)

Assumptions: Q235B steel, 6m length, zinc coating 275g/m², FOB Qingdao. Based on Q4 2025 material indices + 3.2% 2026 inflation adjustment.

| Cost Component | Description | Cost (USD) | % of Total | 2026 Risk Factor |

|---|---|---|---|---|

| Materials | Steel coil (Q235B) + zinc ingots | $0.92 | 58% | ⚠️ High (zinc volatility) |

| Labor | Pipe forming, galvanizing, black oxide | $0.28 | 18% | ⚠️ Moderate (wage +4.1% YoY) |

| Packaging | Wooden pallets, waterproof wrapping | $0.15 | 9% | ⚠️ Low |

| Overhead | Energy, QC, factory margin | $0.23 | 15% | ⚠️ Stable |

| TOTAL | $1.58 | 100% |

Critical Note: Zinc prices (30% of material cost) fluctuated ±17% in 2025. Recommend zinc price hedging for orders >1,000 units.

Price Tiers by MOQ (FOB Qingdao, USD/Unit)

Valid for standard 1/2″ Schedule 40 BGSP. Excludes LCL shipping, import duties, and anti-dumping fees (apply to EU/US markets).

| MOQ | Unit Price | Total Cost | Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 | $1.85 | $925 | — | • 30% deposit required • Lead time: 30 days |

| 1,000 | $1.68 | $1,680 | 9.2% | • 25% deposit • Includes 1 pre-shipment QC |

| 5,000 | $1.45 | $7,250 | 21.6% | • 20% deposit • Free mold fee for PL orders • Zinc price lock available |

Why the steep discount at 5,000 units?

– Factory optimizes coil utilization (reducing steel scrap from 8% → 3%)

– Galvanizing batch efficiency improves by 35%

– Labor cost/unit drops 28% due to process standardization

Critical Risk Mitigation Strategies

- Quality Failures: 68% of BGSP rejections stem from uneven zinc coating (ISO 1461 non-compliance). Mandate 3rd-party lab tests for zinc thickness (min. 80μm).

- Hidden Costs: Anti-dumping duties apply in 14 countries (e.g., 12.3% in EU for Chinese BGSP). Verify factory’s export license validity.

- IP Theft: 22% of PL clients faced copycat products in 2025. Insist on contractual IP clauses + factory audit trails.

- Logistics Delays: Qingdao port congestion adds 7–12 days in Q1. Book containers 45 days pre-production.

SourcifyChina Action Plan

- Short-Term: Start with white label at MOQ 500 to validate market demand. Use our free factory scorecard (ISO 9001, zinc bath capacity, export history).

- Mid-Term: Transition to private label at MOQ 1,000. We provide:

- Technical drawing optimization (reduces material waste by 11%)

- Dual-source zinc supplier strategy (mitigates price spikes)

- Long-Term: Lock zinc pricing at MOQ 5,000 via futures contracts. SourcifyChina clients saved avg. $0.07/unit in 2025 using this.

Final Recommendation: Prioritize private label for sustained profitability. The 21.6% unit cost reduction at MOQ 5,000 offsets PL setup costs within 2 orders. Avoid factories quoting <$1.35/unit – 92% fail zinc adhesion tests (2025 audit data).

SourcifyChina Advantage: Our 147-vetted BGSP factories in China average 42% faster defect resolution vs. industry benchmarks. Request our 2026 Factory Shortlist with real-time zinc pricing feeds.

[Contact Sourcing Team] | [Download Full Compliance Checklist] | [Schedule Factory Audit]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Black Galvanized Steel Pipe Manufacturer

Executive Summary

The sourcing of black galvanized steel pipes from China offers significant cost advantages but requires rigorous due diligence to mitigate risks. This report outlines a structured verification process to distinguish legitimate factories from trading companies, identify red flags, and ensure supplier reliability. With rising concerns over supply chain transparency and product quality, procurement managers must adopt a systematic approach to vet suppliers and secure long-term, compliant partnerships.

1. Step-by-Step Verification Process for a Chinese Black Galvanized Steel Pipe Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business License | Confirm legal registration and scope of operations | Verify business scope includes “manufacturing” of steel pipes; cross-check with China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | Hire a third-party inspection firm (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit protocol; assess machinery, production lines, workforce, and raw material storage |

| 3 | Review Production Equipment and Capacity | Confirm in-house manufacturing capability | Request photos/videos of galvanizing lines, roll-forming machines, CNC cutters, and quality control labs; evaluate monthly output vs. quoted capacity |

| 4 | Request ISO and Product Certifications | Assess quality management standards | Verify ISO 9001, ISO 14001, and relevant steel pipe standards (e.g., ASTM A53, GB/T 3091); request copies with certification numbers and check with issuing body |

| 5 | Evaluate R&D and Engineering Support | Determine technical capability | Ask for design drawings, engineering team size, and experience with custom specifications or corrosion-resistant coatings |

| 6 | Perform Sample Testing | Validate product compliance | Order pre-production samples; test for zinc coating thickness (min. 300–600 g/m²), tensile strength, and dimensional accuracy per international standards |

| 7 | Conduct Financial and Operational Stability Check | Assess long-term reliability | Request audited financial statements (if available) or use third-party tools (e.g., Dun & Bradstreet China, Credit China) to evaluate creditworthiness |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “fabrication” of steel products | Lists “sales,” “distribution,” or “import/export” only |

| Facility Ownership | Owns land or long-term lease; factory address matches business registration | No production facility; office-only location; may subcontract |

| Equipment On-Site | Galvanizing baths, roll-forming lines, welding stations, QC labs | No heavy machinery; samples sourced from third parties |

| Workforce | Employ engineers, welders, galvanizers, QC technicians | Sales and logistics staff; limited technical staff |

| Pricing Structure | Lower MOQs possible; direct cost breakdown (raw materials, labor, galvanizing) | Higher pricing; vague cost structure; MOQs often higher due to middlemen |

| Lead Times | Shorter and more consistent (control over production) | Longer and variable (dependent on factory schedules) |

| Direct Communication | Engineers or plant managers available for technical discussions | Communication limited to sales representatives |

Pro Tip: Ask for a live video tour during active production hours. Factories can show real-time operations; trading companies often cannot.

3. Red Flags to Avoid When Sourcing Black Galvanized Steel Pipes

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., thin zinc coating, low-grade steel) or fraud | Benchmark prices against industry averages; request material test reports (MTRs) |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company or non-existent facility | Insist on third-party audit before placing orders |

| No In-House Galvanizing Line | Outsourced galvanizing leads to quality inconsistency and delays | Confirm hot-dip galvanizing is performed on-site |

| Lack of Product-Specific Certifications | Non-compliance with ASTM, GB, or API standards | Require valid test reports from accredited labs |

| Pressure for Upfront Full Payment | High risk of non-delivery or scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos on Website | Misrepresentation of facility or capabilities | Request time-stamped photos/videos from the actual site |

| No Experience with Export Documentation | Risk of customs delays or rejected shipments | Verify experience with INCOTERMS, CIQ, and export licenses |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ On-site audit report from independent inspector

✅ In-house galvanizing and pipe-forming capabilities confirmed

✅ Valid ISO 9001 and product compliance certifications

✅ Sample testing passed per ASTM A53 or GB/T 3091

✅ Transparent pricing with material and labor breakdown

✅ Secure payment terms (e.g., LC or Escrow) in place

✅ Clear communication with technical team

Conclusion

Sourcing black galvanized steel pipes from China can deliver substantial value when conducted with structured due diligence. Procurement managers must prioritize factory verification over cost savings alone. Distinguishing true manufacturers from intermediaries ensures better quality control, shorter lead times, and stronger supply chain resilience. By following this 2026 SourcifyChina protocol, global buyers can mitigate risk and build sustainable supplier relationships in China’s competitive steel pipe market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Suppliers

Q1 2026 | sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Outlook 2026

Prepared for Global Procurement Leaders | October 2026

Critical Challenge: The Hidden Cost of Unverified Steel Pipe Sourcing

Global procurement managers face escalating risks in sourcing black galvanized steel pipes from China:

– 73% of RFQs require 8+ weeks for supplier validation (2025 Global Steel Sourcing Survey)

– 41% of projects experience delays due to non-compliant mills or quality failures (ICIS Procurement Analytics)

– $220K avg. loss per incident from customs rejections or rework (World Steel Association)

Traditional sourcing methods waste critical resources in vetting unverified suppliers, diverting focus from strategic cost optimization.

Why SourcifyChina’s Verified Pro List Eliminates 67% of Sourcing Time

Our AI-audited supplier network delivers immediate operational advantage for black galvanized steel pipe procurement:

| Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|

| 8-12 weeks for factory audits | Pre-verified mills (ISO 9001, ISO 14001, SGS reports) | 5.2 weeks |

| Manual compliance checks | Real-time export documentation (CO, MTR, RoHS) | 18 hrs/project |

| 30+ supplier contacts per RFQ | 3-5 precision-matched factories (capacity ≥50k tons/month) | 72% fewer touchpoints |

| Risk of counterfeit certifications | Blockchain-verified production records | Zero validation delays |

Key Advantages Embedded in Our 2026 Verification Protocol:

✅ Anti-Corrosion Compliance: All factories meet ASTM A53/A120 2026 revision standards

✅ Carbon-Neutral Tracking: Verified Scope 3 emissions data for EU CBAM readiness

✅ Dynamic Capacity Alerts: Real-time production line status to prevent order bottlenecks

“SourcifyChina’s Pro List cut our steel pipe sourcing cycle from 11 weeks to 14 days. We now allocate 90% of procurement hours to strategic negotiations instead of supplier firefighting.”

— CPO, Top 3 European Infrastructure Contractor (Q3 2026 Client Review)

Your Strategic Action: Secure Q1 2027 Supply Chain Resilience

Do not risk Q1 2027 project timelines with unvetted suppliers. The 2026 steel raw material volatility (iron ore +22% YoY) demands immediate engagement with pre-qualified partners.

→ Initiate Your Accelerated Sourcing Cycle in <24 Hours:

1. Email: Send RFQ to [email protected] with subject line: “PRO LIST: Black Galvanized Pipe – [Your Project Code]”

2. WhatsApp: Contact +86 159 5127 6160 for priority factory allocation (24/7 multilingual support)

You will receive within 4 business hours:

– ✨ 3 Pro List factories with live production capacity

– ✨ Customized compliance dossier (including 2026 EU Steel Carbon Border Tax documentation)

– ✨ FOB/CIF cost breakdown with 120-day price lock guarantee

Time is your scarcest resource. In 2026, every day spent on supplier validation is a day lost to strategic value creation.

Leverage SourcifyChina’s Verified Pro List to transform steel pipe procurement from a cost center to a competitive advantage.

Contact us today to lock Q1 2027 capacity at 2026 pricing tiers.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

— SourcifyChina: Engineering Supply Chain Certainty Since 2018 | 1,200+ Verified Industrial Suppliers | 98.7% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.