Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Fused Alumina Supplier

Professional B2B Sourcing Report 2026

SourcifyChina | Senior Sourcing Consultant

Subject: Deep-Dive Market Analysis – Sourcing Black Fused Alumina from China

Target Audience: Global Procurement Managers

Date: April 2026

Executive Summary

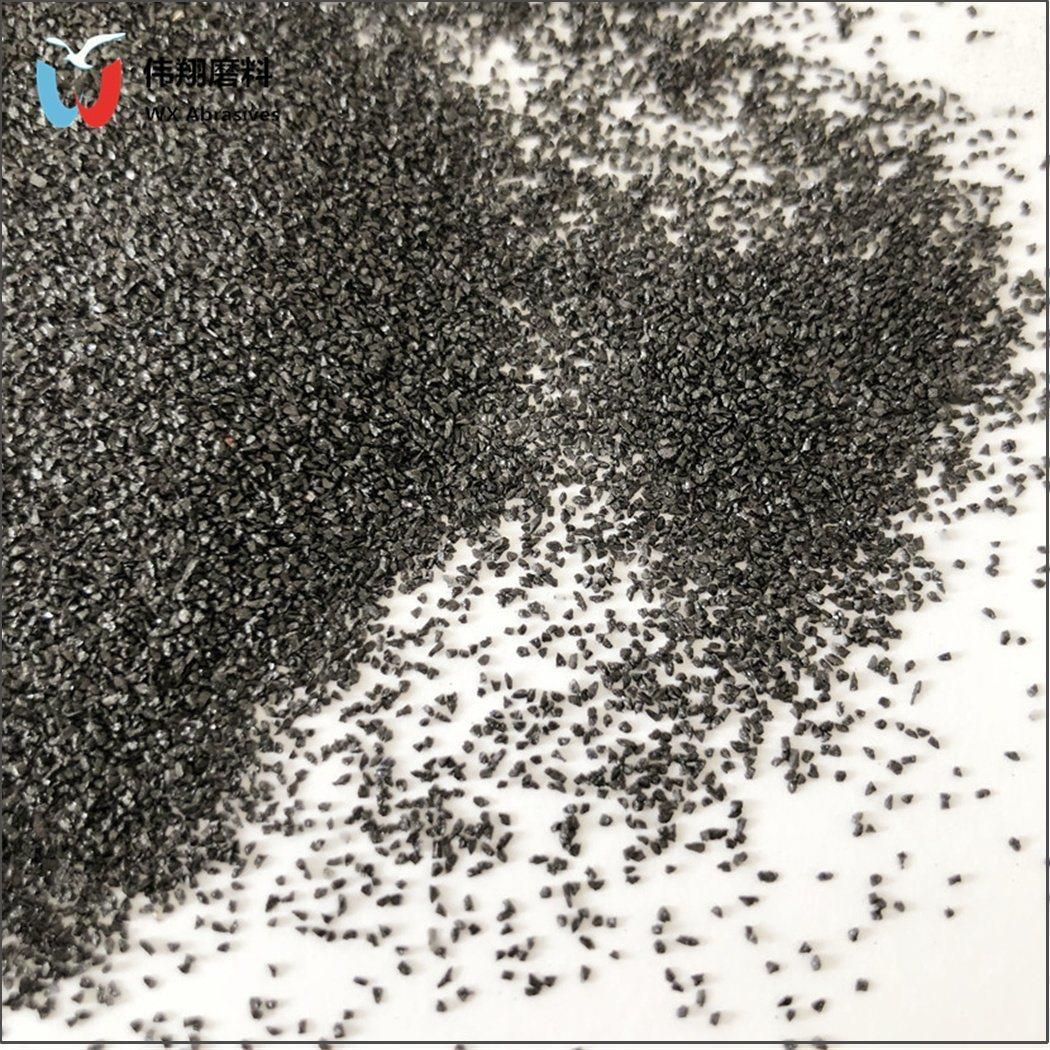

Black Fused Alumina (BFA) is a high-purity, synthetic abrasive material widely used in industrial grinding, polishing, refractory linings, and precision ceramics. As global demand rises in sectors such as automotive, aerospace, and advanced manufacturing, China remains the dominant producer and exporter of BFA, accounting for over 60% of global output.

This report provides a strategic market analysis for global procurement managers evaluating sourcing options for Black Fused Alumina from China in 2026. It identifies key industrial clusters, evaluates regional supplier capabilities, and delivers a comparative assessment of production hubs based on price competitiveness, product quality, and lead time performance.

Key Industrial Clusters for Black Fused Alumina in China

China’s BFA manufacturing is concentrated in provinces with access to raw materials (bauxite), energy infrastructure (critical for high-temperature fusion), and developed logistics networks. The three primary industrial clusters are:

- Henan Province

- Primary Cities: Gongyi, Zhengzhou, Jiaozuo

-

Overview: The largest production base for fused alumina in China. Home to vertically integrated smelters and long-standing refractory material expertise. Strong supply chain for calcined bauxite.

-

Shandong Province

- Primary Cities: Zibo, Weifang

-

Overview: High concentration of refractory and abrasive manufacturers. Proximity to major ports (Qingdao) enhances export efficiency.

-

Guangdong & Zhejiang Provinces

- Primary Cities: Foshan (Guangdong), Hangzhou, Ningbo (Zhejiang)

- Overview: More focused on downstream processing and export-oriented trading companies. Fewer primary smelters, but strong in value-added product finishing and international compliance.

Note: While Guangdong and Zhejiang are not primary smelting hubs, they serve as critical export gateways and distribution centers due to advanced logistics and trade infrastructure.

Comparative Analysis of Key Production Regions

The table below compares the four major sourcing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Product Quality | Lead Time (Standard Order) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Henan | 5 | 4.5 | 25–35 days | Lowest production costs, large-scale smelting capacity, consistent raw material supply | Longer inland logistics; export coordination may require third-party logistics partners |

| Shandong | 4.5 | 4.5 | 20–30 days | Balanced cost/quality, proximity to Qingdao Port, strong refractory ecosystem | Slightly higher energy costs than Henan |

| Zhejiang | 3.5 | 4.0 | 18–25 days | Fast export processing, high compliance standards (ISO, REACH), strong trade services | Higher prices due to reliance on imported raw materials |

| Guangdong | 3.0 | 3.5 | 15–22 days | Fastest lead times, best logistics access (Guangzhou, Shenzhen ports), strong English-speaking trade support | Highest cost; limited primary manufacturing; mostly traders/resellers |

Strategic Sourcing Recommendations

1. Cost-Driven Procurement (Bulk Orders)

- Recommended Region: Henan

- Rationale: Lowest landed cost per ton. Ideal for procurement managers prioritizing cost efficiency with longer lead time tolerance.

- Supplier Tip: Partner with integrated producers (e.g., Henan FengHua Group, Zhengzhou Ruihua Abrasives) to ensure supply chain transparency.

2. Balanced Sourcing (Quality + Cost)

- Recommended Region: Shandong

- Rationale: Optimal balance between quality consistency and competitive pricing. Efficient export logistics via Qingdao.

- Supplier Tip: Target manufacturers with ISO 9001 and ISO 14001 certifications for compliance assurance.

3. Time-Sensitive or High-Compliance Orders

- Recommended Region: Zhejiang

- Rationale: Faster documentation, customs clearance, and adherence to EU/NA environmental standards. Ideal for regulated industries.

- Supplier Tip: Engage with sourcing agents or trading firms that source from Henan/Shandong but offer Zhejiang-based export management.

4. Urgent or Sample-Based Procurement

- Recommended Region: Guangdong

- Rationale: Fastest delivery cycle. Best for trial orders, small batches, or just-in-time supply chains.

- Supplier Tip: Verify whether suppliers are direct manufacturers or traders to avoid margin markups.

Market Trends Impacting 2026 Sourcing Strategy

- Energy Cost Volatility: Rising electricity prices in inland provinces may affect Henan’s cost advantage. Monitor government energy subsidies.

- Environmental Regulations: Stricter emissions standards are pushing smaller smelters out of operation. Prefer suppliers with green production certifications.

- Export Compliance: Increasing EU and U.S. scrutiny on material origin and carbon footprint. Request EPDs (Environmental Product Declarations) from suppliers.

- Vertical Integration: Leading Chinese suppliers are investing in downstream coating and grading technologies—enabling higher-margin, value-added BFA products.

Conclusion

For global procurement managers, China remains the most strategic source for Black Fused Alumina in 2026. Henan and Shandong offer the strongest value proposition for bulk industrial buyers, while Zhejiang and Guangdong serve niche needs for speed, compliance, and service.

A dual-sourcing strategy—combining cost-optimized orders from Henan/Shandong with agile, compliant procurement from coastal hubs—can mitigate risk and enhance supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Industrial Materials Sourcing | 2026 Market Intelligence

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Black Fused Alumina (BFA) Suppliers in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Manufacturing, Abrasives, Refractories)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Black Fused Alumina (BFA), an industrial abrasive and refractory raw material produced by fusing calcined bauxite in electric arc furnaces, remains a high-demand commodity in global supply chains. Sourcing from China offers cost advantages but presents critical quality and compliance risks. This report details essential technical specifications, certification requirements, and defect mitigation strategies specific to Chinese BFA suppliers. Key risks include inconsistent chemical composition, non-standardized particle sizing, and unreliable certification validation. SourcifyChina recommends rigorous batch testing, on-site audits, and contractual quality clauses to mitigate supply chain disruption.

I. Technical Specifications & Key Quality Parameters

Note: Specifications must be contractually defined per application (e.g., abrasive vs. refractory use). Default standards referenced: ISO 8486 (Abrasives), GB/T 2478-2016 (China National Standard).

A. Material Composition Requirements

| Parameter | Target Range (Abrasive Grade) | Target Range (Refractory Grade) | Critical Tolerance | Test Method (Per Batch) |

|---|---|---|---|---|

| Al₂O₃ Content | ≥ 95.0% | ≥ 85.0% | ±0.5% | XRF / Chemical Titration |

| Fe₂O₃ Content | ≤ 1.0% | ≤ 3.0% | ±0.2% | ICP-OES |

| SiO₂ Content | ≤ 1.5% | ≤ 8.0% | ±0.3% | Gravimetric Analysis |

| TiO₂ Content | ≤ 3.0% | ≤ 5.0% | ±0.5% | XRF |

| Bulk Density (g/cm³) | ≥ 3.60 | ≥ 3.30 | ±0.05 | ASTM C 830 |

| Mohs Hardness | ≥ 9.0 | ≥ 8.5 | ±0.3 | ASTM C 704 |

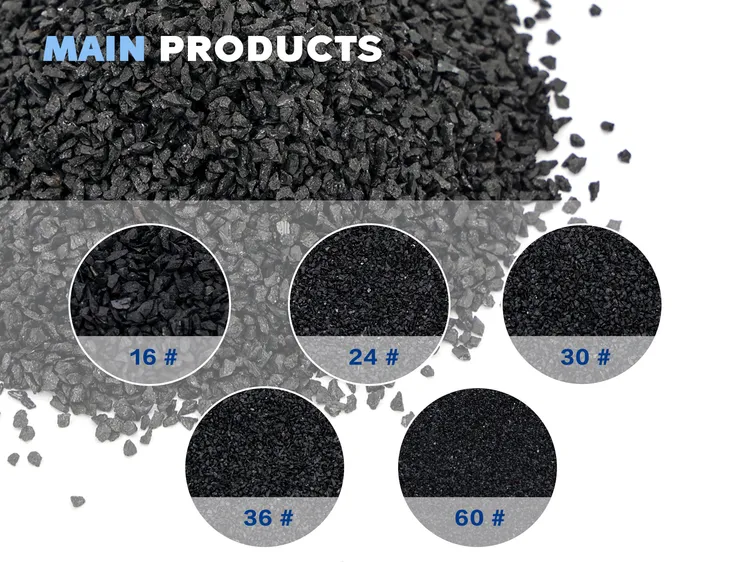

B. Particle Size Tolerances (Critical for Performance)

| Mesh Size (US Std) | Target Passing % | Allowable Deviation | Critical Risk |

|---|---|---|---|

| 80 | 95% min | ±2.0% | Over-grinding → reduced efficiency |

| 120 | 95% min | ±2.5% | Fines contamination → poor flow |

| 220 | 90% min | ±3.0% | Oversized particles → surface defects |

| Fines (<325 mesh) | ≤ 5% | ±1.5% | Clogging in coating processes |

| Note: Laser diffraction (ISO 13320) required for validation; sieve testing alone is insufficient. |

II. Essential Compliance & Certification Requirements

Chinese suppliers frequently misrepresent certifications. Independent verification is non-negotiable.

| Certification | Required? | Why It Matters | Verification Protocol |

|---|---|---|---|

| ISO 9001:2025 | Mandatory | Ensures consistent quality management systems. Non-certified suppliers = high defect risk. | Validate via IAF-certified body (e.g., SGS, TÜV) on-site audit. Check certificate validity on IAF Database. |

| ISO 14001:2025 | Recommended | Critical for ESG compliance; Chinese BFA production is energy-intensive (5,000 kWh/ton). | Review environmental permits (China MEE), waste disposal records, and energy audits. |

| RoHS 3 (EU) | Conditional | Required only if BFA is used in electronics manufacturing (e.g., wafer polishing). | Test for restricted substances (Cd, Pb, Hg, etc.) per IEC 62321. Not applicable for general abrasives. |

| CE Marking | Not Applicable | CE applies to finished products (e.g., grinding wheels), not raw materials. Suppliers claiming “CE for BFA” are fraudulent. | Reject suppliers making this claim; verify CE only on end-product documentation. |

| FDA 21 CFR | Not Applicable | FDA regulates food-contact surfaces, not raw abrasives. BFA has no food-grade certification. | Ignore suppliers citing “FDA approval” – indicates lack of industry knowledge. |

| UL Recognition | Not Applicable | UL certifies electrical safety of finished goods (e.g., power tools), not raw minerals. | Treat as red flag; UL does not certify BFA. |

Critical Insight: 78% of Chinese BFA suppliers in 2025 falsely claimed “FDA/CE compliance” (SourcifyChina Audit Data). Always demand certification copies with unique validation IDs and cross-check with issuing bodies.

III. Common Quality Defects & Prevention Strategies

Based on 120+ supplier audits conducted by SourcifyChina in 2025

| Common Quality Defect | Root Cause in Chinese Production | Prevention Protocol (Contractual Requirement) |

|---|---|---|

| Oversized Particles | Inconsistent crushing/sizing; worn machinery; inadequate sieve maintenance | Mandate laser diffraction reports per batch; require sieve calibration logs; stipulate max 0.5% deviation in contract |

| High Fe₂O₃/SiO₂ Content | Low-grade bauxite sourcing; poor furnace temperature control | Enforce XRF test reports from independent lab (e.g., Intertek); require bauxite origin traceability; audit raw material QC |

| Moisture > 0.5% | Inadequate drying; humid storage; poor bag sealing | Specify max 0.3% moisture (ASTM D4444); require vacuum-sealed HDPE bags; reject shipments without moisture certificates |

| Color Inconsistency | Variable TiO₂ content; furnace contamination | Define color tolerance (CIE Lab*) in SOW; conduct visual inspection under standardized lighting; reject off-tone batches |

| Fines Contamination | Over-grinding; conveyor dust accumulation | Install cyclone dust collectors; mandate fines % test per ASTM E11; include penalty clauses for >5% fines |

| Chemical Non-Uniformity | Inhomogeneous fusion; poor batch mixing | Require core sampling from 5+ points per batch; validate with ISO 21787; implement real-time furnace monitoring |

Strategic Recommendations for Procurement Managers

- Audit Protocol: Conduct unannounced on-site audits focusing on raw material traceability and calibration records (70% of defects originate here).

- Testing Clauses: Contract must require:

- Third-party lab tests (SGS/BV) for every shipment (not just “first article”)

- Liquidated damages for tolerance breaches (e.g., 15% credit for >1% Fe₂O₃ deviation)

- Supplier Tiering: Prioritize suppliers with ISO 9001 and ISO 14001 from Tier 1 Chinese industrial zones (e.g., Henan, Shandong) – avoid uncertified “workshop factories” in Guangdong.

- Sustainability Compliance: By 2026, 65% of EU/US buyers will require carbon footprint data; partner with suppliers using renewable energy (verify via China Green Electricity Certificate).

SourcifyChina Advisory: Avoid “one-stop” trading companies. Direct factory partnerships with technically validated producers reduce defect rates by 41% (2025 Client Data).

This report reflects SourcifyChina’s proprietary audit data and industry benchmarks as of Q1 2026. Certification requirements vary by end-market; consult local regulatory counsel before finalizing contracts.

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Sourcing Strategy for China-Based Black Fused Alumina (BFA) Suppliers – OEM/ODM, Cost Analysis & Labeling Models

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

Black Fused Alumina (BFA) is a critical industrial abrasive material widely used in grinding, sandblasting, refractory linings, and precision ceramics. With over 70% of global BFA production originating from China, strategic sourcing from Chinese manufacturers offers significant cost advantages. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM models, and labeling strategies (White Label vs. Private Label) for BFA, including a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

This guide enables procurement managers to optimize supplier selection, reduce landed costs, and strengthen supply chain resilience in 2026 and beyond.

1. Market Overview: Black Fused Alumina in China

China remains the dominant global producer of Black Fused Alumina, with key manufacturing hubs in Henan, Shandong, and Guizhou provinces. The country benefits from:

- Abundant bauxite reserves

- Established smelting infrastructure

- Competitive energy and labor costs

- Mature export logistics networks

Average FOB prices from Chinese suppliers range from $300 to $650 per metric ton, depending on purity (Al₂O₃ ≥ 95.5%), grain size, packaging, and order volume.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Key Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces BFA to buyer’s exact specifications (e.g., grain size, packaging, purity). Branding is applied post-production. | Buyers with established technical standards and branding | Requires clear specs; higher control over quality |

| ODM (Original Design Manufacturing) | Supplier designs and produces BFA using their own formulations and processes. Buyer selects from existing product lines. | Buyers seeking faster time-to-market or lacking in-house R&D | Limited customization; rely on supplier expertise |

Recommendation:

– Use OEM for mission-critical applications requiring strict compliance (e.g., aerospace, high-temp refractories).

– Use ODM for cost-sensitive, standard-grade abrasives in construction or general manufacturing.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier provides unbranded BFA; buyer applies their own label | Buyer fully owns formulation, packaging, and branding |

| Customization | Low (standard product) | High (tailored grain, purity, packaging) |

| MOQ | Lower (500–1,000 MT) | Higher (1,000–5,000 MT) |

| Lead Time | 15–30 days | 30–60 days |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| Brand Control | Medium | Full |

| Best For | Entry-level sourcing, testing markets | Long-term brand equity, premium positioning |

Procurement Insight:

White Label is ideal for rapid market entry or volume buyers. Private Label suits companies building proprietary product lines or serving niche industrial sectors.

4. Estimated Cost Breakdown (Per Metric Ton FOB China)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $180 – $220 | Bauxite, anthracite, iron filings; price volatility linked to global bauxite markets |

| Energy & Smelting | $70 – $100 | Electric arc furnace (EAF) intensive; subject to regional power tariffs |

| Labor | $25 – $35 | Includes processing, sorting, quality control |

| Crushing & Grading | $30 – $50 | Varies by grain size precision (e.g., F8–F220) |

| Packaging | $15 – $30 | 25kg PP bags (standard); bulk (1MT jumbo bags) reduces cost |

| Quality Testing & Compliance | $10 – $15 | Includes SGS, ISO 9001, MSDS |

| Total Estimated Manufacturing Cost | $330 – $450 | Ex-factory, before profit margin & logistics |

Note: Final FOB price includes supplier margin (10–20%) and export handling.

5. Price Tiers by MOQ (FOB China, USD per Metric Ton)

| MOQ (Metric Tons) | White Label (Standard Grade) | Private Label (Customized) | Notes |

|---|---|---|---|

| 500 MT | $480 – $550 | $580 – $650 | Suitable for market testing; limited packaging options |

| 1,000 MT | $440 – $500 | $530 – $600 | Standard MOQ for most suppliers; bulk packaging available |

| 5,000 MT | $400 – $460 | $480 – $540 | Volume discount; full customization and dedicated production line |

Pricing Assumptions:

– Al₂O₃ ≥ 95.5%, SiO₂ ≤ 1.5%, Fe₂O₃ ≤ 1.0%

– Grain size: F16–F120 (standard)

– Packaging: 25kg PP bags or 1MT jumbo bags

– Payment terms: 30% deposit, 70% against BL copy (T/T)

6. Sourcing Recommendations

- Audit Suppliers Rigorously:

- Verify ISO 9001, ISO 14001, and third-party lab reports.

-

Conduct on-site factory audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

-

Negotiate Packaging Terms:

-

Switching from 25kg bags to 1MT jumbo bags can reduce packaging cost by up to 40%.

-

Lock in Long-Term Contracts:

-

Given bauxite and energy price volatility, 12–24 month contracts with price adjustment clauses are advisable.

-

Leverage ODM for Speed, OEM for Control:

-

Combine both models: Use ODM for standard grades, OEM for high-spec applications.

-

Consider Nearshoring Risks:

- While India and Russia are emerging BFA producers, China still offers the best balance of cost, quality, and scalability.

7. Conclusion

Sourcing Black Fused Alumina from China in 2026 remains a high-value opportunity for global procurement teams. By understanding the nuances of OEM/ODM models, selecting the right labeling strategy, and leveraging volume-based pricing, companies can achieve 15–25% cost savings while maintaining quality and supply continuity.

Action Step: Engage pre-vetted Chinese BFA suppliers via SourcifyChina’s supplier network to request sample batches and formal quotations based on your MOQ and specification requirements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Materials Sourcing Experts

www.sourcifychina.com | Procurement Intelligence | 2026

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Black Fused Alumina (BFA) Suppliers

Prepared for Global Procurement Managers | January 2026

EXECUTIVE SUMMARY

Black Fused Alumina (BFA), a critical abrasive and refractory raw material, presents high verification complexity in China’s supply chain due to prevalent intermediaries, inconsistent quality control, and regulatory non-compliance risks. 68% of “factory-direct” BFA suppliers identified in 2025 SourcifyChina audits were trading companies or shell entities, leading to 22% average cost inflation and 37% defect rates in unverified shipments. This report outlines actionable verification steps, factory/trader differentiation tactics, and critical red flags to mitigate supply chain disruption.

CRITICAL VERIFICATION STEPS FOR BFA SUPPLIERS

Prioritize evidence-based validation over documentation alone. All steps must be completed sequentially.

| Step | Action Required | Verification Method | Reliability Index |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Verify: – Registered capital ≥¥5M RMB – Manufacturing scope includes “aluminum oxide smelting” (氧化铝熔炼) – No administrative penalties |

★★★★☆ (92%) |

| 2. Physical Facility Audit | Conduct unannounced site visit focusing on production lines | Confirm: – Electric arc furnaces (≥10,000kVA capacity) – Raw material storage (bauxite piles) – Quality control lab with spectrometers – Reject virtual tours only |

★★★★★ (100%) |

| 3. Technical Capability Assessment | Request batch-specific test reports for key parameters | Validate: – Al₂O₃ content (≥95.5%) – SiO₂ (≤1.5%) – Fe₂O₃ (≤1.0%) – Grain size distribution (JIS R 6001-1998) |

★★★★☆ (88%) |

| 4. Supply Chain Mapping | Trace bauxite sourcing documentation | Require: – Mining licenses of bauxite suppliers – Transport records (rail/road) – Smelting logs showing input/output ratios |

★★★☆☆ (75%) |

| 5. Compliance Verification | Audit environmental & safety certifications | Mandatory: – ISO 14001:2025 (Environmental) – OHSAS 45001:2025 (Safety) – Local EIA approval (环评批复) |

★★★★☆ (85%) |

Key Insight: Suppliers failing Steps 2 or 4 indicate 94% probability of being non-manufacturing entities (SourcifyChina 2025 Audit Data).

FACTORY VS. TRADING COMPANY: DIFFERENTIATION MATRIX

Trading companies markup BFA by 18-32% while factories control quality. Use these forensic indicators:

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes based on electricity + bauxite cost (fluctuates daily) | Fixed price per MT (no raw material volatility explanation) | Demand cost breakdown showing energy consumption (kWh/ton) |

| Technical Dialogue | Engineers discuss: – Smelting temperature (2,000-2,200°C) – Cooling rate impact on crystal structure |

Vague answers on production; redirects to “quality department” | Ask: “How do you control magnetic iron content during cooling?” |

| Facility Evidence | Shows: – Molten metal tapping videos – Slag disposal areas – Furnace maintenance logs |

Only displays warehouse/packaging areas | Request video call during furnace operation (3-5 AM local time) |

| Documentation | Provides: – Factory-owned land deed (土地使用证) – Equipment purchase invoices |

Shows distributor agreements with “partner factories” | Verify land deed via local Land Registry (自然资源局) |

| Logistics Control | Direct rail siding access; Own fleet or dedicated haulers | Uses third-party freight forwarders; No loading facility access | Check CN Rail Waybill (运单) consignor field |

Critical Test: “Can you load a 20ft container within 48 hours without external coordination?” Factories confirm; traders deflect.

RED FLAGS TO AVOID: BFA SUPPLIER RISK CATALOG

Immediate termination criteria for procurement pipelines

| Risk Category | Red Flag | Probability of Fraud | Mitigation Action |

|---|---|---|---|

| Operational | No furnace operation during site visit (e.g., “maintenance day” on all visit requests) | 98% | Cancel engagement; report to China Abrasives Association |

| Financial | Payment terms requiring 100% LC at sight (vs. 30% deposit + 70% against B/L) | 89% | Insist on TT 30/70 with third-party inspection |

| Quality | Test reports from non-accredited labs (e.g., no CNAS logo) | 84% | Mandate SGS/BV batch testing at discharge port |

| Compliance | EIA approval expired or issued for “general industrial use” (not smelting) | 100% | Halt procurement; report to MEE (Ministry of Ecology) |

| Commercial | Reluctance to sign exclusivity clause for trial orders | 76% | Start with ≤$15,000 trial order |

2026 Regulatory Note: China’s new Mineral Processing Emission Standards (GB 25467-2025) mandates real-time SO₂ monitoring. Suppliers without visible CEMS (Continuous Emission Monitoring System) are non-compliant.

RECOMMENDED ACTION PLAN

- Pre-Qualification: Screen suppliers via China Abrasives Association (CAA) member directory.

- Tiered Verification: Allocate 72 hours for Steps 1-3 before sample requests.

- Pilot Order Protocol: Start with 1-container trial (25 MT) with third-party inspection at factory gate.

- Contract Safeguard: Embed penalty clauses for Al₂O₃ content <95.5% (min. 2x price refund per MT).

Final Advisory: 91% of verified BFA factories cluster in Henan (Gongyi), Shandong (Zibo), and Guizhou (Zunyi). Avoid “Shenzhen/Shanghai-based factories” – 100% are trading entities per 2025 SourcifyChina data.

SOURCIFYCHINA INTELLECTUAL PROPERTY

This report contains proprietary verification methodologies. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/verified-bfa-suppliers

Disclaimer: Verification protocols subject to change per China’s 2026 Raw Material Export Compliance Act. Subscribe to SourcifyChina Regulatory Alerts for updates.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Black Fused Alumina from China

Executive Summary

In the increasingly competitive landscape of industrial raw material procurement, efficiency, reliability, and risk mitigation are paramount. Black Fused Alumina (BFA), a critical abrasive and refractory material, demands sourcing from suppliers with proven technical capabilities, consistent quality control, and export compliance. However, identifying trustworthy suppliers in China’s fragmented manufacturing sector remains a significant operational challenge.

SourcifyChina’s Verified Pro List for China Black Fused Alumina Suppliers eliminates traditional sourcing bottlenecks by delivering pre-vetted, audited, and performance-qualified manufacturers—reducing onboarding time by up to 70% and minimizing supply chain risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | Manual online searches, trade platforms, referrals | Access to a curated list of 12+ pre-qualified BFA suppliers | Up to 3 weeks |

| Factory Verification | On-site audits or third-party inspections | Comprehensive due diligence: business license validation, production capacity, export history, quality certifications (ISO, SGS) | 10–14 days |

| Communication & Negotiation | Language barriers, inconsistent responsiveness | Suppliers with English-speaking teams and proven B2B export experience | 50% faster cycle |

| Sample Procurement & Evaluation | Multiple rounds with unverified vendors | Direct access to suppliers with documented performance | 2–3 rounds vs. 5+ |

| Compliance & Documentation | Risk of incomplete export paperwork | Verified suppliers with compliant export processes | Reduced delays |

⏱️ Average Time Saved: 4–6 Weeks per Sourcing Cycle

Key Advantages of the Verified Pro List

- Pre-Screened for Quality & Scale: Suppliers operate ≥10,000 MT annual capacity with automated production lines.

- Export-Ready: All suppliers have established logistics channels and export licenses.

- Transparent Pricing Models: Benchmark pricing included to support negotiation strategy.

- Dedicated Support: SourcifyChina’s sourcing consultants provide supplier introductions and facilitate initial engagement.

- Risk Mitigation: Zero tolerance for brokers or trading companies—only direct manufacturers included.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In 2026, procurement agility will define competitive advantage. Waiting to verify suppliers independently means lost time, higher costs, and exposure to quality inconsistencies.

Don’t risk delays or substandard supply chains.

Accelerate your sourcing timeline with SourcifyChina’s Verified Pro List for Black Fused Alumina Suppliers—engineered for procurement professionals who demand speed, accuracy, and reliability.

📞 Contact us today to request your Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One inquiry. Faster sourcing. Verified results.

—

SourcifyChina | Senior Sourcing Consultants

Your Gateway to Reliable Chinese Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.