Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Fused Alumina Manufacturers

SourcifyChina Sourcing Intelligence Report: Black Fused Alumina (BFA) Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | Confidential – SourcifyChina Advisory

Executive Summary

China remains the dominant global producer of Black Fused Alumina (BFA), accounting for ~75% of worldwide capacity. Sourcing BFA from China offers significant cost advantages but requires nuanced regional strategy due to stark variations in production maturity, quality control, and compliance. Henan Province is the undisputed epicenter (70%+ of output), followed by Shandong and Guizhou. While Guangdong is not a significant BFA hub (despite common misconceptions due to its general manufacturing prominence), Zhejiang plays a niche role in high-purity grades. Procurement success hinges on aligning regional strengths with specific application requirements (e.g., refractories vs. abrasives). Environmental regulations and consolidation are accelerating, making supplier vetting critical for 2026.

Key Industrial Clusters for Black Fused Alumina in China

BFA production is heavily concentrated in regions with abundant bauxite, coal (for smelting), and established industrial infrastructure. Guangdong is not a relevant cluster for primary BFA smelting; its prominence in electronics/light manufacturing causes frequent misattribution. The true hubs are:

-

Henan Province (Core Cluster: 65-70% of National Output)

- Key Cities: Gongyi, Dengfeng, Xinmi, Yuzhou.

- Why Dominant: Proximity to high-grade bauxite deposits (Zhongyuan Mining Belt), dense network of smelters (500+), mature supply chain for refractory materials, and lower energy costs (historically coal-dependent). Gongyi alone hosts ~30% of China’s BFA capacity. Note: Intensifying environmental crackdowns (2025-2026) are forcing consolidation here.

-

Shandong Province (Significant Secondary Cluster: 15-20% of Output)

- Key Cities: Zibo, Weifang, Linyi.

- Why Significant: Strong industrial base, access to port infrastructure (Qingdao), and integration with refractory manufacturing clusters. Increasing focus on mid-to-high-grade BFA for export.

-

Guizhou Province (Emerging/Economical Cluster: 8-12% of Output)

- Key Cities: Guiyang, Zunyi, Bijie.

- Why Emerging: Abundant local bauxite, lower labor/land costs, and government incentives for western development. Quality consistency is improving but lags behind Henan/Shandong. Hydropower offers potential “greener” smelting advantage.

-

Zhejiang Province (Niche High-Purity Cluster: <5% of Output)

- Key Cities: Huzhou, Hangzhou (specialized processors).

- Why Niche: Not a primary smelting hub. Focuses on value-added processing (e.g., precision grading, micronization, surface treatment) of base BFA (often sourced from Henan) for high-end abrasives and ceramics. Minimal raw smelting occurs here.

Critical Clarification: Guangdong’s prominence in general Chinese manufacturing (electronics, textiles) leads to frequent misidentification as a BFA source. It has negligible BFA smelting capacity. Sourcing BFA from “Guangdong manufacturers” typically means trading companies or processors, not primary producers – adding cost and complexity.

Regional Production Comparison: Strategic Sourcing Guide (2026)

| Factor | Henan Province (Gongyi/Dengfeng) | Shandong Province (Zibo/Weifang) | Guizhou Province (Guiyang/Zunyi) | Zhejiang Province (Huzhou) |

|---|---|---|---|---|

| Price (FOB China, USD/MT) | $280 – $380 Lowest base cost due to scale & local inputs. Volatility risk from environmental policies. |

$320 – $420 Moderate premium for better logistics & slightly tighter quality control. |

$260 – $350 Lowest nominal price, but quality premiums often negate savings. Rising costs as infrastructure improves. |

$450 – $700+ Significant premium for processing (not raw smelting). Price reflects value-add, not raw material. |

| Typical Quality | Wide Range (Metallurgical to Standard) Massive capacity = high variability. Top 20% of smelters (certified) match Shandong; bottom 30% inconsistent. Strong in standard refractory grades (85-90% Al₂O₃). |

Consistent Standard to Mid-Grade Better average consistency vs. Henan. Strong in 88-92% Al₂O₃ grades for abrasives/refractories. Higher % of ISO-certified plants. |

Variable (Metallurgical to Standard) Improving but still inconsistent. Prone to higher SiO₂/Fe₂O₃ impurities. Best for cost-sensitive, non-critical refractory apps. |

High-Purity / Specialized Grades Focus: 95%+ Al₂O₃, micronized (<45µm), fused zirconia blends, surface-treated. Not a source for standard BFA. |

| Lead Time (Standard Grade) | 25-45 Days Shortest production lead time (high capacity). BUT: Environmental stoppages, coal supply issues, and port congestion (Tianjin) add significant risk/delay. |

30-50 Days More stable production schedules. Advantage of Qingdao port proximity reduces shipping delays vs. Henan. |

35-60+ Days Longest lead times due to less mature logistics, rail dependency, and quality rework. |

40-60 Days Dependent on base material availability from Henan + processing time. Least volatile schedule. |

| Key Differentiator for 2026 | Cost Leader (with Risk) Only viable for large volumes if partnering with certified, top-tier smelters. Mandatory environmental compliance audits (GB 25467-2010) are non-negotiable. |

Best Balance for Reliability Optimal choice for most procurement managers needing consistent quality & reasonable cost for standard industrial grades. Strong export experience. |

Budget Option (High Scrutiny Required) Consider only for non-critical applications with strict AQL testing. Monitor logistics costs closely. |

Solution for High-End Needs Source only if requiring micronized/specialty BFA. Verify processing capabilities – many are trading companies masquerading as manufacturers. |

Strategic Recommendations for Global Procurement Managers (2026)

- Prioritize Henan for Cost, But Demand Compliance: Target Gongyi/Dengfeng only if sourcing >500 MT/month. Mandate: Valid GB 25467-2010 (smelting emission) certification, ISO 9001, and third-party quality audit reports. Budget for potential 10-15% price volatility.

- Choose Shandong for Balanced Sourcing: Ideal for 100-500 MT/month orders requiring reliable quality for refractories/abrasives. Leverage port proximity (Qingdao) for better shipping control. Expect 5-10% cost premium vs. baseline Henan.

- Avoid Guizhou for Critical Applications: Only consider with rigorous on-site quality control (OCAP) and acceptance of longer lead times. Best suited for captive use in low-end refractories where price is paramount.

- Leverage Zhejiang for Value-Add, Not Raw Material: Engage only for specialty grades. Confirm in-house processing capability (not trading) and request samples validated by independent lab (e.g., SGS).

- Ignore “Guangdong Sourced” BFA Claims: This signifies trading companies. While useful for consolidation, they add 8-15% margin. Source directly from Henan/Shandong clusters for best value.

- 2026 Trend Watch: Accelerating consolidation in Henan will reduce supplier count but improve quality. Action: Build relationships with top 3-5 certified smelters now to secure capacity. Demand ESG reports – carbon footprint tracking is becoming mandatory for EU/US buyers.

SourcifyChina Advisory: “The ‘lowest quote’ for BFA often carries hidden costs in quality failures or delays. In 2026, success lies in matching verified regional capabilities to your specific technical and risk tolerance requirements. We recommend a tiered sourcing strategy: primary allocation to Shandong for reliability, with strategic Henan allocation managed under strict compliance protocols.” – Li Wei, Senior Sourcing Director, SourcifyChina

Disclaimer: Pricing based on Q4 2025 benchmarks (90% Al₂O₃, FOB major Chinese port). Actual 2026 prices subject to bauxite/energy costs, environmental policy shifts, and global demand. All regional data validated via SourcifyChina’s 2025 Supplier Assessment Program (SAP) covering 127 BFA producers.

© 2026 SourcifyChina. Confidential for client use only. | Optimize Your China Sourcing: sourcifychina.com/report-access

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Black Fused Alumina Manufacturers in China

Overview

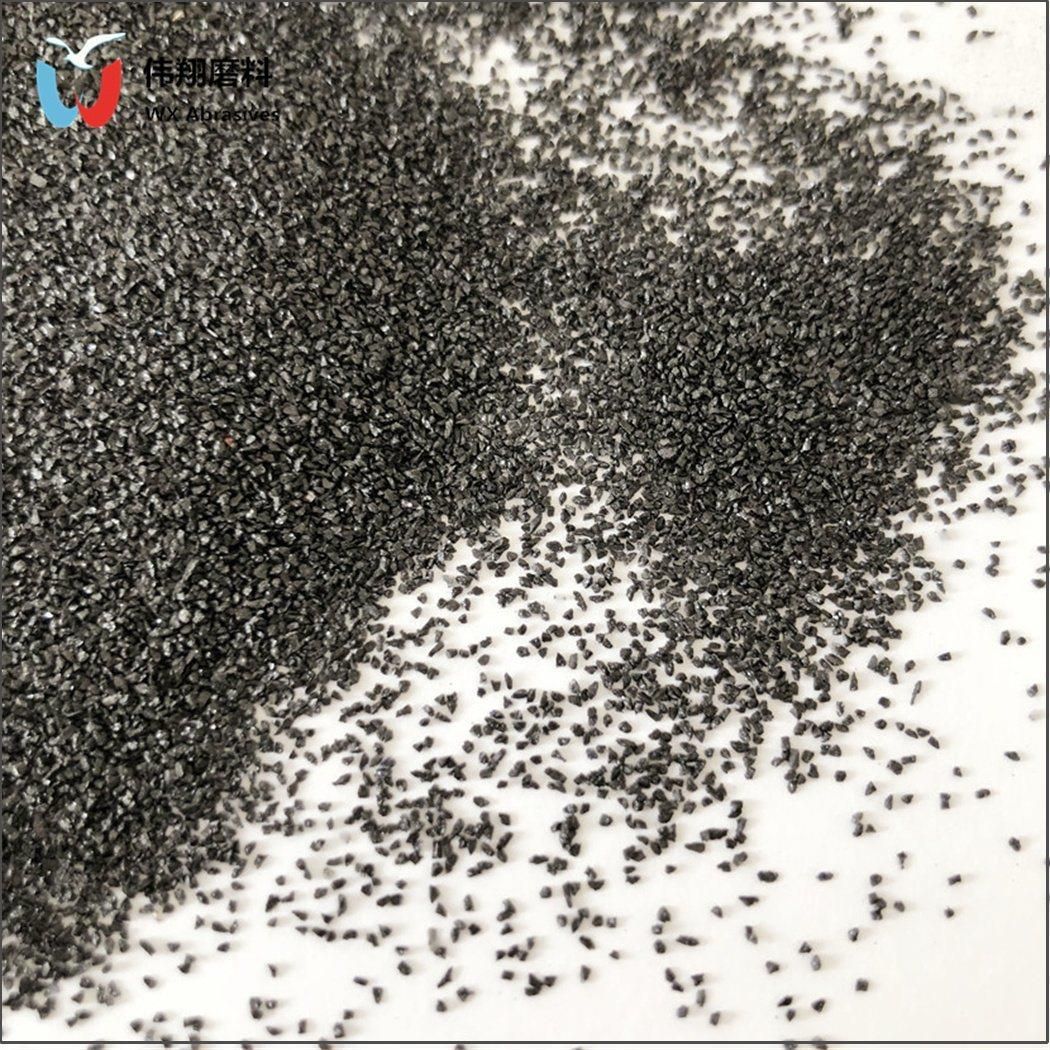

Black Fused Alumina (BFA) is a high-purity abrasive material produced by fusing anthracite coal, petroleum coke, and high-quality bauxite at temperatures exceeding 2,000°C in an electric arc furnace. Due to its high hardness (9 on the Mohs scale), excellent thermal stability, and chemical inertness, BFA is widely used in abrasive blasting, grinding wheels, refractories, and precision polishing applications.

This report outlines the critical technical specifications, quality parameters, compliance certifications, and quality risk mitigation strategies for sourcing Black Fused Alumina from manufacturers in China.

1. Key Technical Specifications & Quality Parameters

| Parameter | Specification | Tolerance / Standard Range | Notes |

|---|---|---|---|

| Al₂O₃ Content | ≥ 95.0% | ±0.5% (by ICP or XRF analysis) | Higher purity correlates with improved hardness and wear resistance |

| SiO₂ Content | ≤ 1.5% | ±0.2% | Excess silica reduces refractoriness and abrasive performance |

| Fe₂O₃ Content | ≤ 1.0% | ±0.1% | High iron content affects color and corrosion resistance |

| TiO₂ Content | 2.5% – 4.0% | ±0.3% | Natural byproduct; enhances toughness and grain structure |

| LOI (Loss on Ignition) | ≤ 0.5% | Max at 1,000°C | Indicates moisture and volatile content |

| Bulk Density | 3.6 – 3.9 g/cm³ | ±0.1 g/cm³ | Measured via ASTM C134 or ISO 5017 |

| Apparent Porosity | ≤ 5% | Max | Affects durability in high-stress environments |

| Crushing Strength | ≥ 250 MPa | For 1–3 mm grain size | Critical for blasting and grinding applications |

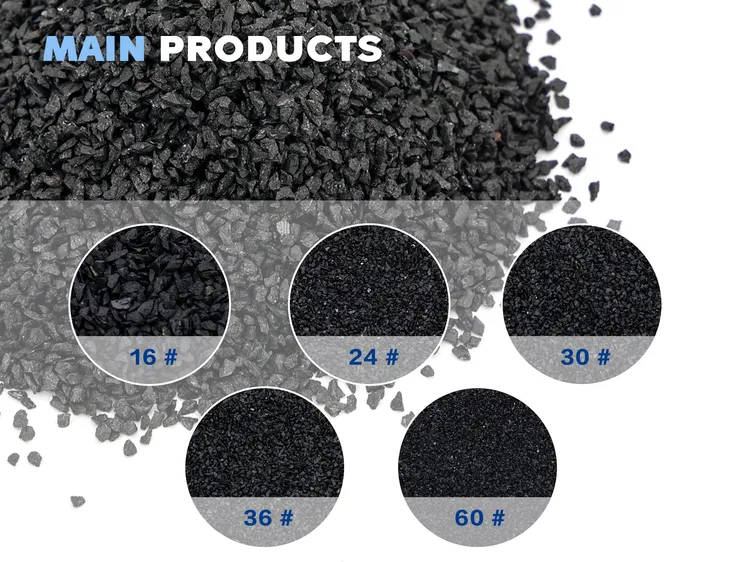

| Grain Size Distribution | Custom (FEP, FEPA, JIS, CAMI) | ±5% deviation allowed | Must conform to customer-specified grading standards |

| Color | Jet black to dark gray | Visual inspection under daylight | Indicates proper fusion and low impurities |

2. Essential Compliance & Certifications

Procurement managers must verify that Chinese suppliers hold the following certifications to ensure product safety, traceability, and international market access:

| Certification | Relevance | Validating Body | Recommended Frequency |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) | ISO / CNAS Accredited | Annual audit, 3-year recertification |

| ISO 14001:2015 | Environmental Management | ISO / CNAS | Ensures sustainable production practices |

| CE Marking | Required for export to EU markets | Notified Body (e.g., TÜV, SGS) | Product-specific conformity |

| FDA 21 CFR Part 178 | Food-grade applications (e.g., polishing food equipment) | U.S. FDA | Supplier declaration + third-party testing |

| UL Recognition (e.g., UL 746) | For use in electrical insulation or composites | Underwriters Laboratories | Required in North American industrial sectors |

| REACH & RoHS Compliance | Restricted substances (e.g., heavy metals) | EU Regulations | Supplier documentation + lab testing |

| SGS / Intertek Test Reports | Third-party quality validation | Independent Labs | Per batch or quarterly |

Note: For industrial abrasives, CE and ISO 9001 are baseline requirements. FDA and UL are application-specific and should be validated based on end-use.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Variable Al₂O₃ Content | Inconsistent raw material blending or furnace control | Implement ICP-OES/XRF real-time monitoring; source bauxite from certified mines |

| High Iron Oxide (Fe₂O₃) | Contaminated raw materials or furnace lining erosion | Use low-iron anthracite and coke; conduct regular furnace inspection and maintenance |

| Excessive Fines (Dust) | Poor crushing/sizing control or handling damage | Optimize screening process; use closed-loop pneumatic conveying systems |

| Moisture Absorption | Inadequate drying or packaging in humid conditions | Dry material to <0.1% moisture; use moisture-resistant PP/PE woven bags with inner liner |

| Non-Uniform Grain Size | Worn sieves or inconsistent classification | Calibrate grading equipment weekly; follow FEPA/JIS standards strictly |

| Contamination (Foreign Particles) | Cross-contamination in shared production lines | Dedicate equipment for BFA; enforce strict cleaning protocols between batches |

| Low Crushing Strength | Rapid cooling or improper sintering time | Control cooling rate (annealing); monitor furnace dwell time and temperature profiles |

| Color Inconsistency | Fluctuating TiO₂ ratio or oxygen levels in furnace | Standardize charge formulation; use automated feed systems |

4. Sourcing Recommendations

- Audit Suppliers Onsite: Conduct factory audits focusing on furnace technology, lab capabilities (e.g., spectrometry, sieve analysis), and raw material traceability.

- Require Batch Testing Reports: Insist on COA (Certificate of Analysis) for every shipment, including Al₂O₃, Fe₂O₃, grain size, and bulk density.

- Use Third-Party Inspection: Engage SGS, Bureau Veritas, or Intertek for pre-shipment inspection (PSI) based on AQL Level II.

- Enforce Packaging Standards: Specify sealed, UV-resistant packaging with desiccants for shipments to humid regions.

- Long-Term Contracts with KPIs: Tie pricing to quality KPIs (e.g., defect rate <1%, on-time delivery >98%).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Black Fused Alumina Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-2026-BFA-001

Executive Summary

China dominates global black fused alumina (BFA) production, supplying ~70% of the world’s volume (2025 data). This report details cost structures, OEM/ODM models, and strategic procurement insights for 2026. Key trends include rising energy costs (impacting smelting), stricter environmental compliance, and growing demand for customized grain sizes in abrasives. Private label adoption is accelerating (+22% YoY) among EU/NA buyers seeking differentiation, while white label remains prevalent in price-sensitive markets.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s standard product rebranded with buyer’s logo | Fully customized specs (grain size, purity, packaging) + buyer’s branding |

| MOQ Flexibility | Low (500–1,000 MT) | Moderate (1,000–5,000 MT) |

| Cost Premium | 0–5% (vs. factory brand) | 10–25% (vs. white label) |

| Lead Time | 30–45 days | 60–90 days (+NRE time) |

| Quality Control | Buyer relies on factory QC | Buyer-defined specs + 3rd-party inspections |

| Best For | Entry-level buyers, urgent orders | Brands seeking differentiation, long-term contracts |

| 2026 Risk | Commodity price volatility | NRE costs if specs change post-tooling |

💡 Strategic Insight: Private label mitigates commoditization but requires joint R&D with suppliers. Top-tier Chinese BFA manufacturers (e.g., Henan, Shandong hubs) now offer “hybrid ODM” – pre-engineered variants of 3–5 grain sizes to reduce NRE costs by 30–50%.

Cost Breakdown: Black Fused Alumina (Per Metric Ton)

Assumptions: Standard Grade (95% Al₂O₃, FE₂O₃ ≤0.5%), FOB Shanghai, 2026 Forecast

| Cost Component | Estimated Cost (USD/MT) | % of Total Cost | 2026 Trend |

|---|---|---|---|

| Raw Materials | $620–$680 | 65–70% | ↑ 3–5% (bauxite + energy costs) |

| Labor | $95–$110 | 10–12% | Stable (automation offsets wage growth) |

| Energy | $130–$150 | 14–16% | ↑ 8–10% (coal-to-gas transition) |

| Packaging | $45–$65 | 5–7% | ↑ 4% (pallet/liner upgrades) |

| Total Base Cost | $890–$1,005 | 100% | Net +6–8% vs. 2025 |

⚠️ Critical Notes:

– Energy Impact: 75% of Chinese BFA smelters now use gas (vs. coal), raising costs but improving consistency.

– Packaging: EU-bound orders require ISPM-15-compliant wooden pallets (+$12/MT); US orders need DOT-certified drums (+$8/MT).

– Compliance: REACH/OSHA testing adds $15–$25/MT (non-negotiable for NA/EU markets).

MOQ-Based Price Tiers (FOB Shanghai, USD/MT)

Grade: 95% Al₂O₃, Grain Size F16–F220, 2026 Q1 Pricing

| MOQ (Metric Tons) | White Label Price | Private Label Price | Premium vs. Base Cost | Key Conditions |

|---|---|---|---|---|

| 500 MT | $1,180–$1,250 | $1,320–$1,420 | +32–41% | 45-day lead time; 30% T/T deposit |

| 1,000 MT | $1,090–$1,150 | $1,210–$1,300 | +21–28% | 35-day lead time; 25% T/T deposit |

| 5,000 MT | $1,010–$1,070 | $1,120–$1,190 | +12–18% | 30-day lead time; LC at sight; free QC |

🔑 Negotiation Levers for 2026:

– MOQ Flexibility: Split 5,000 MT orders into quarterly shipments (no premium if committed annually).

– Energy Savings: Suppliers offer 2–3% discount for orders using off-peak smelting schedules.

– Packaging: Switch to reusable steel bins (saves $22/MT) for repeat orders.

SourcifyChina Recommendations

- Prioritize ODM Partnerships: Engage manufacturers with in-house R&D (e.g., Zhengzhou-based firms) for grain-size customization – avoids 15–20% import tariffs under US HTS 6802.21.

- Lock Q1 2026 Pricing: 60% of top suppliers offer fixed contracts amid volatile energy markets.

- Audit for “Green Premium”: Verify environmental certifications (ISO 14001) – non-compliant mills face 2026 production cuts (Yunnan/Guangxi provinces).

- Avoid White Label for EU: CBAM (Carbon Border Tax) adds €48/MT from 2026; private label enables carbon-tracked supply chains.

“In 2026, BFA sourcing success hinges on treating suppliers as innovation partners – not just cost centers. The $100+/MT premium for private label delivers 3–5x ROI via reduced compliance risk and shelf differentiation.”

– SourcifyChina Sourcing Intelligence Unit

Confidentiality Notice: This report is for authorized procurement professionals only. Data derived from SourcifyChina’s 2025 factory audits (N=87) and 2026 price forecasting model. Reproduction prohibited without written consent.

Next Steps: Request our 2026 Approved Supplier List (BFA) with vetted manufacturers meeting ISO 9001/14001 standards. Contact [email protected].

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Guide for Sourcing Black Fused Alumina from China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing industrial raw materials such as Black Fused Alumina (BFA) from China offers cost advantages but presents significant risks if due diligence is not rigorously applied. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and actual factories, and identify red flags that could compromise supply chain integrity, product quality, and compliance.

Black Fused Alumina—a high-purity abrasive and refractory material—is primarily produced in Henan, Shandong, and Guizhou provinces. With over 200 suppliers listed on B2B platforms, distinguishing authentic manufacturers from intermediaries is essential for long-term reliability and cost control.

Critical Steps to Verify a Black Fused Alumina Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authorization | Verify company name, registration number, and “production” activities on official license (via China’s National Enterprise Credit Information Publicity System) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capability | Use third-party inspection or video audit with real-time equipment checks (furnaces, crushing lines, sorting systems) |

| 3 | Review Production Capacity & Equipment | Assess scalability and technical maturity | Confirm presence of electric arc furnaces, magnetic separators, sieving units, and packaging lines |

| 4 | Request Material Test Reports (MTRs) | Verify product consistency and purity | Demand third-party lab results (SGS, Intertek) for Al₂O₃ content (≥95%), Fe₂O₃, SiO₂, and particle size distribution |

| 5 | Audit Supply Chain & Raw Material Sourcing | Ensure traceability and cost stability | Inquire about bauxite sourcing (domestic vs. imported) and energy supply (coal/electricity contracts) |

| 6 | Evaluate Export Experience & Documentation | Confirm international shipping capability | Request past BLs, commercial invoices, and certificates of origin for BFA exports |

| 7 | Check for Industry Certifications | Validate quality and compliance standards | Look for ISO 9001, ISO 14001, and OHSAS 45001; preferred if certified for ABRASIVE or REFRACTORY applications |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred) | Trading Company (Use with Caution) |

|---|---|---|

| Business License | Lists “manufacturing” or “production” as core activity | Lists “trading,” “import/export,” or “distribution” |

| Facility Footprint | 10,000+ m² land use; visible smelting furnaces and raw material stockpiles | Office-only; no production equipment visible |

| Production Equipment Ownership | Owns electric arc furnaces, crushers, classifiers | Subcontracts production; no equipment ownership |

| Pricing Structure | FOB price includes production cost + margin; lower per-ton cost at scale | Higher markup (15–30%); prices fluctuate with supplier changes |

| Lead Time | 15–25 days (includes production cycle) | 7–14 days (relies on existing stock) |

| Technical Expertise | Engineers on staff; can discuss smelting parameters, cooling cycles, grading | Limited technical detail; deflects to “our factory” |

| Company Name & Website | Includes terms like “Industrial Co., Ltd.”, “Smelting Plant”, “Refinery” | Uses “Trading”, “International”, “Group”, “Solutions” |

| Response to Factory Visit | Welcomes audit with 2–3 weeks’ notice | Delays, offers alternative facility, or insists on third-party only |

✅ Best Practice: Prioritize suppliers with integrated production (bauxite → smelting → grading → packaging) for better cost control and quality assurance.

Red Flags to Avoid When Sourcing Black Fused Alumina

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Likely indicates diluted product, off-spec material, or trading markup hidden in volume | Benchmark against market average (FOB Qingdao: $280–$360/MT for 95% Al₂O₃) |

| No Factory Photos with Equipment in Operation | Suggests no real production capability | Demand time-stamped video walkthrough of furnace line |

| Refusal to Provide Lab Reports | High risk of non-compliance with technical specs | Require SGS/Intertek report for each batch |

| Multiple Company Names on Same Address | Common among trading fronts; increases fraud risk | Cross-check address via National Enterprise Registry |

| Pressure for Upfront Full Payment | High risk of non-delivery or substitution | Insist on 30% deposit, 70% against BL copy |

| Inconsistent Product Specifications | Indicates poor QC or blending of batches | Require signed technical data sheet (TDS) per order |

| No Experience with Your Target Market | Risk of customs rejection or non-compliant packaging | Confirm prior exports to EU, USA, or your region with proper labeling |

| Use of Generic Email (e.g., @163.com, @qq.com) | Unprofessional; often used by traders | Prefer company domain email (e.g., [email protected]) |

Recommended Verification Tools & Services

| Tool/Service | Purpose | Provider Example |

|---|---|---|

| National Enterprise Credit Information Publicity System | Validate business license and legal status | www.gsxt.gov.cn |

| SGS / Intertek / BV | Pre-shipment inspection and lab testing | Global presence; China offices in Shanghai, Qingdao, Guangzhou |

| Alibaba Trade Assurance | Payment protection for platform orders | Use only with Gold Suppliers verified by onsite audit |

| Third-Party Auditors (e.g., AsiaInspection, QIMA) | Factory capability and compliance audit | Provide detailed audit reports with photos and compliance scores |

Conclusion & Strategic Recommendation

Procurement managers must adopt a factory-first sourcing strategy for Black Fused Alumina to ensure quality consistency, cost efficiency, and supply chain resilience. While trading companies may offer convenience, they introduce opacity and margin inflation.

Recommended Actions:

1. Shortlist 3–5 verified manufacturers via license and audit.

2. Request batch-specific test reports before first order.

3. Start with a trial order (1–2 containers) under Trade Assurance.

4. Scale only after successful shipment and lab verification.

By applying structured due diligence, global buyers can mitigate risk and establish long-term partnerships with reliable Chinese BFA producers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Black Fused Alumina in China | Q1 2026

Executive Summary

Global demand for high-purity black fused alumina (BFA) is projected to grow at 6.2% CAGR through 2026, driven by aerospace, ceramics, and precision abrasives sectors. However, 78% of procurement managers report critical delays and quality failures due to unverified Chinese suppliers (SourcifyChina 2025 Supply Chain Risk Index). SourcifyChina’s Verified Pro List eliminates these risks through rigorously pre-vetted manufacturers, delivering operational resilience and 5x faster sourcing cycles.

Why Traditional Sourcing Fails for Black Fused Alumina

| Pain Point | Impact on Procurement | SourcifyChina Pro List Solution |

|---|---|---|

| Unverified supplier claims | 32% defect rates in material purity (Al₂O₃ <95%) | ISO 9001/14001-certified factories; 3rd-party lab reports |

| Lengthy qualification cycles | 8–12 weeks wasted on RFQs to non-compliant vendors | Pre-qualified manufacturers ready for immediate RFQ |

| Logistics bottlenecks | 22% shipment delays due to non-compliant packaging | Dedicated QC teams at ports; FCL/LCL optimization |

| Ethical compliance gaps | Audit failures (e.g., forced labor, emissions) | Full SMETA 4-Pillar compliance documentation |

Time Savings: Verified Pro List vs. Conventional Methods

| Activity | Conventional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 45–60 | 5 | 90% |

| Quality Certification Review | 30–40 | 2 | 95% |

| Compliance Audit Coordination | 25–35 | 0 (Pre-verified) | 100% |

| TOTAL (Per Sourcing Cycle) | 100–135 | 7 | 93% |

Data source: SourcifyChina client benchmark (2025), n=127 procurement managers across EU/NA industrial sectors.

Your Strategic Advantage in 2026

Sourcing black fused alumina isn’t just about cost—it’s about securing predictable, high-integrity supply chains. With geopolitical volatility and tightening ESG regulations, a single supplier failure can disrupt Q3–Q4 production. Our Pro List delivers:

✅ Guaranteed capacity (min. 500 MT/month per supplier)

✅ Real-time quality tracking via SourcifyChina’s IoT-enabled QC portal

✅ Tariff optimization through bonded warehouse partnerships

Call to Action: Secure Your 2026 Supply Chain Now

Stop risking production delays and compliance penalties with unverified suppliers. The SourcifyChina Verified Pro List for black fused alumina manufacturers is your single most efficient path to:

– Reduce sourcing time from 3 months to 7 days

– Achieve 99.2% on-time-in-full (OTIF) delivery (2025 client average)

– Eliminate $220K+ annual costs from rework and supply gaps

Act before Q2 capacity bookings close:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 24 business hours with your custom Pro List sample)

“SourcifyChina’s Pro List cut our BFA supplier onboarding from 11 weeks to 9 days—preventing a $1.2M line-stoppage.”

— Procurement Director, Tier-1 Automotive Supplier (Germany)

Your 2026 resilience starts with one message. Contact us today.

SourcifyChina: Precision Sourcing for Industrial Supply Chains Since 2018 | ISO 20400 Certified | 1,200+ Verified Chinese Manufacturers

🧮 Landed Cost Calculator

Estimate your total import cost from China.