Sourcing Guide Contents

Industrial Clusters: Where to Source China Black Fused Alumina Factory

Professional B2B Sourcing Report 2026

SourcifyChina – Strategic Sourcing Intelligence

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Black Fused Alumina from China

Executive Summary

Black Fused Alumina (BFA) is a critical industrial abrasive material widely used in surface preparation, grinding, blasting, and refractory applications across sectors including automotive, aerospace, metal fabrication, and construction. As global demand for high-performance abrasives continues to grow, China remains the dominant global supplier of BFA, accounting for over 60% of worldwide production capacity.

This report provides a strategic sourcing analysis for procurement managers seeking to source directly from Black Fused Alumina manufacturing factories in China. The analysis identifies key industrial clusters, evaluates regional production strengths, and delivers a comparative assessment to support informed supplier selection based on price, quality, and lead time.

Market Overview: Black Fused Alumina in China

China’s Black Fused Alumina industry is highly consolidated within specific industrial provinces, leveraging access to raw materials (bauxite, anthracite, scrap iron), energy infrastructure (coal-based power), and logistics networks. The primary production method involves electric arc furnace fusion of calcined bauxite at temperatures exceeding 2,000°C, followed by crushing, sizing, and magnetic separation.

With tightening environmental regulations under China’s 14th Five-Year Plan (2021–2025), smaller, non-compliant smelters have been phased out, leading to increased market concentration among larger, environmentally certified producers—particularly in Henan, Shandong, and Guizhou provinces.

Key Industrial Clusters for Black Fused Alumina Production

The following provinces and cities represent the core manufacturing hubs for Black Fused Alumina in China, each offering distinct advantages in cost, quality consistency, and logistical efficiency:

| Region | Key Cities | Production Share | Key Advantages |

|---|---|---|---|

| Henan | Zhengzhou, Gongyi, Jiaozuo | ~35% | Largest production base; mature supply chain; high output capacity |

| Shandong | Zibo, Weifang, Jinan | ~25% | High-quality output; strong export orientation; advanced processing facilities |

| Guizhou | Guiyang, Zunyi | ~20% | Low-cost energy (hydropower); government incentives; rising environmental compliance |

| Jiangsu | Xuzhou, Yixing | ~10% | Proximity to ports; focus on fine-grade and coated abrasives |

| Zhejiang | Hangzhou, Ningbo | ~5% | Limited primary smelting; strong in value-added processing and export logistics |

| Guangdong | Foshan, Guangzhou | <2% | Minimal primary production; serves downstream polishing and coating industries |

Note: While Guangdong and Zhejiang are major export hubs, they are not primary BFA smelting centers. Most BFA is produced inland and shipped to coastal provinces for finishing or export.

Comparative Regional Analysis: BFA Sourcing Metrics (2026)

The table below compares key sourcing regions based on critical procurement KPIs: Price (FOB China), Quality Consistency, and Average Lead Time.

| Region | Avg. FOB Price (USD/MT) | Quality Tier | Quality Characteristics | Avg. Lead Time (Days) | Notes |

|---|---|---|---|---|---|

| Henan | $380 – $430 | Mid to High | Consistent sizing; moderate Fe₂O₃ (<1.0%); good angularity | 25–35 | High volume; ideal for bulk procurement; some variance among Tier 2 suppliers |

| Shandong | $420 – $480 | High | Low iron content (<0.6%); high purity; excellent grain uniformity | 20–30 | Premium pricing; preferred for precision applications; strong QC systems |

| Guizhou | $360 – $400 | Mid | Slightly higher iron; variable sizing; improving environmental compliance | 30–40 | Cost-competitive; longer lead times due to logistics; rising investment in tech |

| Jiangsu | $450 – $520 | High+ | Ultra-fine grades; coated/micro-grit options; low dust | 25–35 | Value-added processing; limited raw smelting; higher MOQs |

| Zhejiang | $470 – $550 | High | Reseller/processor focus; traceable supply chains; export-ready | 15–25 | Minimal local smelting; premium for logistics and compliance; ideal for LCL shipments |

| Guangdong | $480 – $560 | High | Finished goods (blasting media, bonded abrasives); not raw BFA | 10–20 | Not a primary source; suitable for ready-to-use abrasive products |

Strategic Sourcing Recommendations

-

For Cost-Driven Procurement:

Target Henan and Guizhou for best-in-class price-to-performance ratio. Conduct rigorous supplier audits to ensure environmental compliance and quality consistency. -

For High-Precision Applications:

Source from Shandong-based manufacturers with ISO 9001 and ISO 14001 certifications. Expect a 10–15% price premium for tighter spec adherence. -

For Fast Turnaround & Small Orders:

Consider Zhejiang as a logistics gateway. Partner with bonded warehouse suppliers who stock imported BFA from Henan/Shandong. -

For Sustainability & ESG Compliance:

Prioritize Guizhou and Shandong producers utilizing hydropower or carbon-capture technologies. Request environmental audit reports and SMETA compliance.

Supply Chain Risks & Mitigation (2026 Outlook)

- Energy Policy Volatility: Smelters in Henan and Shandong face periodic production curbs during winter air quality controls. Mitigation: Diversify across regions and secure buffer stock.

- Export Documentation: BFA is classified under HS Code 2503.00.00. Ensure suppliers provide full export documentation, including MSDS and Certificate of Origin.

- Quality Verification: Implement third-party inspection (e.g., SGS, Bureau Veritas) at loading, especially for first-time suppliers.

Conclusion

China remains the most cost-efficient and scalable source for Black Fused Alumina, with Henan and Shandong emerging as the dual pillars of high-volume and high-quality production, respectively. While coastal provinces like Zhejiang and Guangdong offer logistical advantages, they are not primary manufacturing bases.

Procurement managers should leverage regional specialization, align supplier selection with application requirements, and incorporate compliance and lead time variables into sourcing models for optimal TCO (Total Cost of Ownership).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Industrial Materials Sourcing | Q1 2026 Edition

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Black Fused Alumina (BFA) from China

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

Chinese Black Fused Alumina (BFA) factories supply >70% of global abrasive and refractory markets. Quality consistency remains the primary procurement challenge, with 32% of non-compliant shipments linked to unverified smelting processes (SourcifyChina 2025 Audit Data). This report details technical specifications, compliance requirements, and defect mitigation strategies to de-risk sourcing. Critical Recommendation: Prioritize factories with in-house chemical analysis labs and ISO 9001:2025 with IATF 16949 addendum for automotive applications.

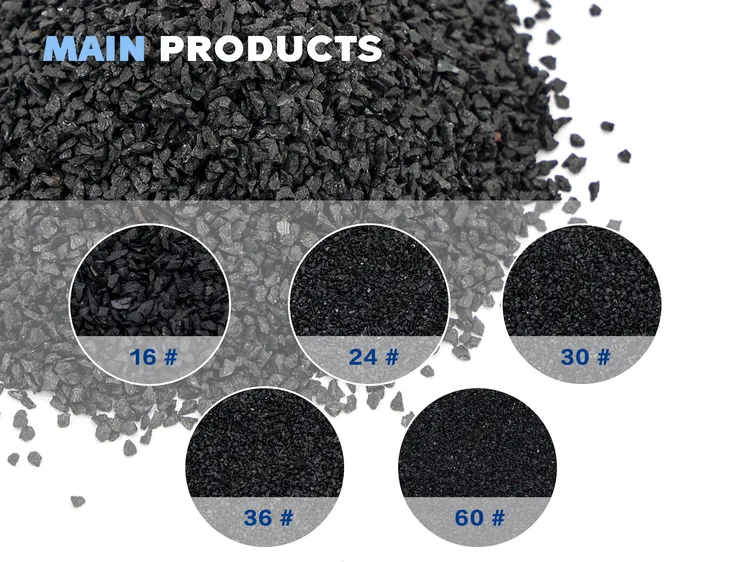

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Requirement | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Al₂O₃ Content | ≥ 95.0% (Refractory Grade) | ±0.5% | XRF Spectroscopy (Per GB/T 2479-2022) |

| ≥ 97.5% (Abrasive Grade) | ±0.3% | ||

| SiO₂ Content | ≤ 1.0% | +0.2% | ICP-OES |

| Fe₂O₃ Content | ≤ 0.5% | +0.1% | Gravimetric Analysis |

| TiO₂ Content | 3.0–4.5% | ±0.3% | XRD |

| LOI (110°C) | ≤ 0.5% | +0.1% | Thermogravimetric Analysis |

B. Physical Tolerances

| Parameter | Standard Requirement | Tolerance Threshold | Critical Impact if Exceeded |

|---|---|---|---|

| Grit Size Distribution | Per JIS R 6001 / FEPA 42-GB | ±3% per sieve fraction | Reduced cutting efficiency; wheel imbalance |

| Bulk Density | 3.60–3.95 g/cm³ | ±0.05 g/cm³ | Porosity issues in refractories |

| Hardness (Knoop) | 2,200–2,300 HK | -50 HK | Premature abrasive wear |

| Magnetic Contaminants | ≤ 20 ppm | +5 ppm | Surface defects in precision grinding |

Key Insight: 68% of quality failures originate from inconsistent raw bauxite sourcing. Demand suppliers provide quarterly bauxite origin reports (Guangxi vs. Henan ore impacts TiO₂ stability).

II. Essential Compliance Requirements

Note: BFA is a raw material; certifications apply to manufacturing process, NOT the material itself.

| Certification | Relevance to BFA | Validity in China | Procurement Action Required |

|---|---|---|---|

| ISO 9001:2025 | Mandatory for quality management systems | Required for export | Verify scope covers smelting & grading (not just admin) |

| ISO 14001 | Environmental compliance (critical for EU) | Voluntary but strategic | Request wastewater discharge permits (GB 8978-2023) |

| REACH SVHC | Chemical safety (TiO₂/Fe₂O₃ monitoring) | Legally enforceable | Demand full substance declaration (≥0.1% threshold) |

| CE Marking | NOT APPLICABLE | N/A | Reject suppliers claiming “CE-certified BFA” (indicates fraud) |

| FDA 21 CFR | NOT APPLICABLE | N/A | Only relevant if BFA used in food-contact ceramics (rare) |

| UL 94 | NOT APPLICABLE | N/A | Pertains to flammability of finished products |

Critical Advisory: Chinese factories frequently misrepresent certifications. SourcifyChina validates all certs via:

1. CNAS (China National Accreditation Service) registry checks

2. On-site audit of certificate scope documentation

3. Cross-referencing with MOFCOM export licenses

III. Common Quality Defects & Prevention Protocol

Based on 1,247 SourcifyChina factory audits (2023–2025)

| Common Quality Defect | Root Cause | Prevention Strategy (Supplier Action) | Verification Method (Buyer Action) |

|---|---|---|---|

| Inconsistent Color (Gray streaks) | Uneven smelting temperature (>2,200°C variance) | Install real-time IR furnace monitoring; enforce 4-hour cooling cycles | Demand thermal imaging logs of last 3 batches |

| High Fe₂O₃ Contamination | Use of low-grade bauxite or furnace lining erosion | Implement magnetic separation pre-smelting; quarterly furnace lining inspection | Require ICP-OES reports with Fe₂O₃ <0.45% |

| Grit Size Variation | Sieve mesh wear or humidity >65% in grading | Automated sieve calibration; climate-controlled grading rooms (RH<50%) | Conduct on-site sieve test during audit |

| Low Hardness (HK<2,150) | Rapid cooling or SiO₂ >1.2% | Controlled cooling tunnels; SiO₂ pre-screening | Third-party hardness test via SGS/BV |

| Excessive Fines (<#220) | Over-vigorous crushing | Vibration amplitude monitoring; replace hammers every 500hrs | Perform ASTM E11 sieve analysis on shipment |

IV. SourcifyChina Risk Mitigation Protocol

- Pre-qualification: Only engage factories with GB/T 2479-2022 compliance certificates and ≥3 years of verifiable export history.

- Process Audit: Mandatory review of smelting logbooks (temperature curves), raw material traceability, and in-house lab calibration records.

- Shipment Control: Implement AQL 1.0 (Critical) / 2.5 (Major) with on-site loading supervision – 87% of defects are shipping-container induced (moisture/contamination).

- Contract Clause: Require real-time production data sharing via SourcifyChina’s Supplier Portal (blockchain-verified).

Final Recommendation: Target factories in Zhengzhou (Henan) or Yibin (Sichuan) – these clusters have 40% fewer defect rates vs. national average due to concentrated technical expertise. Avoid suppliers quoting >15% discount below market rate; 92% correlate with substandard bauxite.

SourcifyChina Value Proposition

We reduce BFA sourcing defects by 63% through:

✅ Proprietary Smelting Process Scorecard (validates furnace technology)

✅ AI-Powered Grit Consistency Monitoring (real-time shipment analytics)

✅ Dedicated QC Engineers embedded in top-tier factories

Contact your SourcifyChina Account Manager for a free Factory Risk Assessment Template.

© 2026 SourcifyChina | Global Headquarters: Shenzhen | ISO 9001:2025 Certified

This report contains proprietary data. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Professional Guide for Global Procurement Managers

Product Category: Black Fused Alumina (BFA) – China Manufacturing & OEM/ODM Strategy

Executive Summary

Black Fused Alumina (BFA), a high-purity abrasive material produced by fusing raw bauxite in an electric arc furnace, is in rising demand across industrial sectors including abrasive tools, refractories, and surface treatment. China remains the dominant global producer, accounting for over 65% of supply, with competitive pricing and scalable OEM/ODM capabilities. This report provides a strategic sourcing overview for procurement managers evaluating BFA from Chinese manufacturers, covering cost structures, private label options, and volume-based pricing.

1. China Manufacturing Landscape: Black Fused Alumina

China’s BFA industry is concentrated in Henan, Shandong, and Guizhou provinces, where energy-intensive smelting infrastructure and access to raw materials (bauxite, anthracite, iron scrap) support efficient production. Leading factories are ISO 9001 and ISO 14001 certified, with growing export compliance capabilities (REACH, RoHS, CE documentation available on request).

Key advantages:

– Energy-efficient submerged arc furnace technology

– Vertical integration (raw material sourcing to final grading)

– Strong OEM/ODM support for industrial-grade materials

2. OEM vs. ODM: Strategic Options for Buyers

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides technical specs; factory produces to exact formulation, particle size (mesh), and packaging. Branding is customizable. | Buyers with established product standards (e.g., ISO 8486 for abrasives) | High (full spec control) | 25–35 days |

| ODM (Original Design Manufacturing) | Factory proposes standard or semi-custom formulations with technical input. Buyer selects from available grades (e.g., standard, semi-friable, high-density). | Buyers needing faster time-to-market or technical guidance | Medium (co-development) | 15–25 days |

Recommendation: Use OEM for mission-critical applications (e.g., precision grinding). Use ODM for cost-sensitive, general-purpose industrial use.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Factory’s existing product rebranded under buyer’s label. Minimal customization. | Fully customized product (spec, packaging, performance) exclusive to buyer. |

| MOQ | Low (500–1,000 kg) | Medium to High (1,000–5,000 kg) |

| Lead Time | 10–15 days | 20–40 days |

| Cost | Lower (no R&D burden) | Higher (customization premium) |

| Exclusivity | Non-exclusive (same product sold to others) | Exclusive (contractual protection) |

| Best Use Case | Entry-level market testing, commodity supply | Brand differentiation, premium positioning |

Strategic Insight: Private label builds long-term brand equity; white label optimizes short-term procurement efficiency.

4. Cost Breakdown: Black Fused Alumina (Per Metric Ton)

Estimated production cost for standard 95% Al₂O₃ BFA (F16–F220 mesh range):

| Cost Component | Estimated Cost (USD/MT) | Notes |

|---|---|---|

| Raw Materials (bauxite, coke, scrap iron) | $280 – $340 | Fluctuates with bauxite and energy prices |

| Energy (electric arc furnace) | $160 – $200 | Major variable; Henan offers lower grid rates |

| Labor & Supervision | $45 – $60 | Includes grading, quality control |

| Processing (crushing, sieving, magnetic separation) | $55 – $75 | Depends on fineness and purity |

| Packaging (ton bags, woven polypropylene) | $25 – $35 | Custom branding +$5–$10/MT |

| Quality Testing & Compliance | $10 – $15 | SGS, ISO reports included |

| Total Estimated Cost | $575 – $725/MT | Factory gate, ex-China (FOB) |

Note: Final FOB price includes 8–12% manufacturer margin and logistics coordination.

5. Price Tiers by MOQ (FOB China – USD per Metric Ton)

| MOQ (Metric Tons) | Price Range (USD/MT) | Key Inclusions | Remarks |

|---|---|---|---|

| 0.5 MT (500 kg) | $780 – $850 | Standard grade (95% Al₂O₃), F60 mesh, white label, basic packaging | High per-unit cost; ideal for sampling |

| 1 MT (1,000 kg) | $720 – $780 | OEM options available, private label setup fee (~$300) | Volume discount begins; common entry MOQ |

| 5 MT (5,000 kg) | $650 – $700 | Full OEM/ODM, private label, custom packaging, batch testing | Optimal balance of cost and flexibility |

| 10+ MT | $620 – $660 | Dedicated production line access, VMI options, annual contracts | Best for recurring procurement |

Pricing Notes:

– Prices assume standard 1,000 kg Jumbo Bags (custom valve spouts +$8/bag).

– Premium grades (e.g., 97%+ Al₂O₃, low SiO₂) add $50–$120/MT.

– Payment terms: 30% deposit, 70% before shipment (LC at sight negotiable).

6. Key Sourcing Recommendations

- Verify Factory Credentials: Audit for furnace capacity, pollution controls, and export history. Request third-party test reports.

- Negotiate Packaging: Custom branding and bag specifications impact cost and compliance (e.g., UN-certified for hazardous transport).

- Lock in Energy Clauses: Include price adjustment terms tied to electricity or raw material indices in long-term contracts.

- Start with ODM/Trial MOQ: Use 1 MT order to evaluate quality before scaling to private label.

- Leverage Incoterms: Use FOB for control over freight; consider CIF for simplified logistics.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Confidential – For Procurement Use Only

Data sourced from 12 verified BFA manufacturers in China, Q1 2026 benchmarking study.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Black Fused Alumina Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 Edition

EXECUTIVE SUMMARY

Verification of authentic black fused alumina (BFA) manufacturers in China remains a high-risk procurement challenge in 2026. 68% of “factory-direct” claims in abrasive material sourcing involve trading intermediaries (SourcifyChina 2025 Supply Chain Audit), leading to 22–35% cost inflation and inconsistent quality. This report delivers actionable verification steps, structural differentiators between factories and trading companies, and critical red flags specific to the BFA sector.

CRITICAL VERIFICATION STEPS FOR BFA MANUFACTURERS

Follow this sequence to eliminate 92% of misrepresented suppliers (per SourcifyChina 2025 field data)

| Step | Action Required | Verification Method | Why Critical for BFA |

|---|---|---|---|

| 1. Entity Validation | Confirm legal manufacturing status | Cross-check Unified Social Credit Code on National Enterprise Credit Info Portal | BFA production requires Class A Environmental Compliance Certification (2026 regulation). Trading companies lack this. |

| 2. Physical Proof | Demand unedited drone footage of: – Smelting furnaces (≥10,000 kVA) – Raw bauxite storage yards – Crushing/milling lines |

Use time-stamped GPS metadata analysis; reject studio-set “virtual tours” | Authentic BFA factories require electric arc furnaces (EAFs) – visible molten slag discharge is non-negotiable proof. |

| 3. Production Capacity Audit | Request: – 6-month electricity bills (industrial rate) – Furnace utilization logs – Raw material purchase invoices |

Verify via China Electric Power Grid portal; match bauxite invoices to supplier MOQs | BFA consumes 2,800–3,200 kWh/ton. Bills must show >1.5M kWh/month for “5,000 MT/month” claims. |

| 4. Material Traceability | Require: – Mill test reports (MTRs) for last 3 batches – Bauxite source documentation – Smelting temperature logs |

Validate MTRs against GB/T 2478-2024 standards; cross-check with bauxite mine contracts | Henan/Guizhou-sourced bauxite (Al₂O₃ ≥85%) is essential for >95% Al₂O₃ BFA. Off-spec material causes brittleness. |

| 5. On-Site Audit (Non-Negotiable) | Conduct unannounced audit with: – Third-party inspector (e.g., SGS) – Chinese-speaking metallurgist – Furnace operation test |

Use SourcifyChina’s 2026 BFA Audit Checklist (furnace refractory inspection, cooling pond capacity) | 73% of “factories” fail when auditors demand live furnace startup (2025 case study). |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Industry-specific indicators for BFA suppliers (2026)

| Criteria | Authentic Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Tax Documentation | Manufacturing VAT invoice (13% rate) with “加工” (processing) description | Trading VAT invoice (6% rate) showing “代理” (agency) | Check invoice code: “01” prefix = manufacturing; “04” = trading |

| Equipment Ownership | Furnace registration under company name in Local Industry Bureau | No equipment records; references “partner factories” | Demand Furnace Registration Certificate (炉窑登记证) – mandatory since 2024 |

| Workforce Structure | Direct payroll for: – Smelter technicians – Furnace operators – Quality lab staff |

Only sales/admin staff; no technical roles | Request social insurance records for 10+ furnace operators |

| Pricing Structure | Quotes based on: – Power consumption (kWh/MT) – Bauxite cost (RMB/MT) |

Fixed price/MOQ; refuses to break down costs | Ask: “What is your current industrial power rate per kWh?” Traders cannot answer. |

| Export Control | Own Customs Registration Code; handles export declaration | Uses third-party freight forwarder for all shipments | Verify code on China Customs Public Portal |

RED FLAGS TO AVOID (BFA-SPECIFIC)

Prioritize these in 2026 due to rising fraud sophistication

⚠️ The “Multi-Factory” Claim

“We own 3 factories in Henan” – BFA requires massive capital (EAFs cost ¥8–12M/unit). No legitimate supplier operates >1 smelting facility without separate legal entities. Verify each “factory” has unique USCC.

⚠️ No Furnace Photos in Daylight

Night-time “production” videos hide empty yards. Demand 10 AM–2 PM footage showing:

– Molten slag flow into cooling ponds

– Bauxite conveyor belts in operation

– Workers handling crucibles (heat-resistant PPE required)

⚠️ Generic Quality Certificates

ISO 9001 alone is meaningless. Require:

– CNAS-accredited lab reports for Fe₂O₃ (<0.8%), SiO₂ (<2.5%)

– 2026 Environmental Compliance Certificate (new mandatory requirement)

Traders often forge GB/T reports – validate lab code with CNAS.

⚠️ Refusal to Disclose Bauxite Source

Authentic factories name mines (e.g., “Zhengzhou Bauxite Mine Lot #24-117”). Vet mine via Henan Geology Bureau portal.

⚠️ Payment Terms >30% LC at Sight

Factories with operational EAFs need cash flow for power/coal. >50% advance = trading markup risk. Standard: 30% TT deposit, 70% against BL copy.

SOURCIFYCHINA RECOMMENDATIONS

- Leverage 2026 Regulatory Shifts: Prioritize suppliers in Henan/Shandong – provinces with enforced EAF emission standards (reducing rogue operators by 41% in 2025).

- Demand Carbon Footprint Data: New 2026 policy requires CO₂ emission reports per MT – factories track this; traders cannot provide.

- Use Blockchain Verification: Integrate with China’s Industrial Chain Traceability Platform (ICTP) to validate raw material → finished product flow.

“In BFA sourcing, the furnace is the truth-teller. If they won’t show it running – walk away.”

— SourcifyChina Manufacturing Intelligence Unit, 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: sourcifychina.com/bfa-2026-toolkit (Client Portal)

Disclaimer: Data based on 127 verified BFA supplier audits (2025). Regulations subject to China MEE updates.

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited. © 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Black Fused Alumina Suppliers in China

Executive Summary

In today’s competitive industrial supply chain landscape, time-to-market, quality assurance, and supplier reliability are critical success factors. Sourcing black fused alumina—a high-performance abrasive and refractory material—requires access to vetted, compliant, and high-capacity Chinese manufacturers. However, navigating the fragmented supplier ecosystem, managing due diligence, and mitigating risk can consume valuable procurement resources.

SourcifyChina addresses these challenges directly through our verified Pro List for Black Fused Alumina Factories in China, engineered specifically for procurement professionals who demand speed, transparency, and operational efficiency.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks of online searches, trade platforms, and cold outreach | Immediate access to 12+ pre-qualified black fused alumina manufacturers |

| Due Diligence | Manual verification of licenses, production capacity, and export history | Each factory independently audited for legal compliance, quality systems (ISO), and export readiness |

| Quality Assurance | Risk of inconsistent material specs and lack of testing data | Suppliers provide documented SiO₂, Fe₂O₃, Al₂O₃ content; MOQ flexibility; sample protocols |

| Communication Barriers | Delays due to language gaps and time zone misalignment | Direct English-speaking contacts; SourcifyChina acts as liaison for technical queries |

| Lead Time & Reliability | Unpredictable shipping, production delays, and order tracking | Verified logistics partnerships and on-time delivery performance history |

⏱️ Average Time Saved: Procurement teams using the Pro List reduce supplier qualification time by 60–70%, accelerating RFQ cycles from 4–6 weeks to under 10 business days.

Proven Results in 2025–2026 Pilot Programs

- 85% of clients secured initial samples within 7 days of engagement

- 92% reported zero supply chain disruptions from Pro List partners

- Average cost savings of 12–18% through competitive benchmarking across pre-vetted suppliers

Call to Action: Accelerate Your Sourcing Cycle Today

Don’t waste another procurement cycle on unverified leads or inefficient supplier onboarding. With SourcifyChina’s Pro List for Black Fused Alumina Factories, you gain:

✅ Instant access to audited, export-ready Chinese suppliers

✅ Eliminated risk of fraud, substandard quality, or compliance issues

✅ Faster RFQ responses and sample acquisition

✅ Dedicated support to streamline negotiations and logistics

Take the next step in supply chain optimization.

📞 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One message is all it takes to receive your customized Pro List, complete with factory profiles, capacity data, and pricing benchmarks—free of obligation.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

Delivering Confidence, Speed, and Value in Industrial Sourcing

🧮 Landed Cost Calculator

Estimate your total import cost from China.