Sourcing Guide Contents

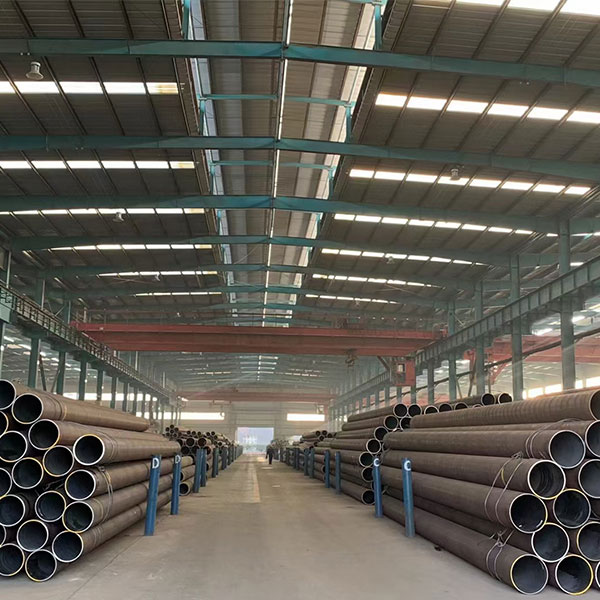

Industrial Clusters: Where to Source China Black Carbon Steel Pipe Factory

Professional B2B Sourcing Report 2026

Sourcing Black Carbon Steel Pipes from China: A Strategic Market Analysis for Global Procurement Managers

Executive Summary

China remains the world’s largest producer and exporter of carbon steel pipes, including black carbon steel pipes—widely used in oil & gas, construction, petrochemical, and infrastructure sectors. For global procurement managers, understanding the geographic distribution of manufacturing clusters, regional capabilities, and cost-quality trade-offs is critical to optimizing supply chain performance.

This report provides a strategic deep-dive into China’s black carbon steel pipe manufacturing landscape, identifying key industrial hubs, evaluating regional strengths, and offering a comparative analysis to guide sourcing decisions in 2026.

Overview of China’s Black Carbon Steel Pipe Industry

Black carbon steel pipes—uncoated, low-alloy steel pipes—are produced via seamless or welded (ERW, LSAW, SSAW) methods. China accounts for over 50% of global steel pipe production, with an estimated annual output exceeding 80 million metric tons (2025 data). The domestic industry is highly fragmented but clustered in regions with strong metallurgical infrastructure, logistics access, and supply chain ecosystems.

Key drivers for sourcing from China include cost competitiveness, production scalability, and technical maturity across multiple manufacturing standards (API 5L, ASTM A53, GB/T 3091, etc.).

Key Industrial Clusters for Black Carbon Steel Pipe Manufacturing

China’s black carbon steel pipe production is concentrated in several industrial provinces and cities, each with distinct specializations:

| Region | Key Cities | Production Focus | Notable Strengths |

|---|---|---|---|

| Hebei Province | Cangzhou, Tianjin (peripheral), Baoding | Welded & seamless pipes, large-diameter pipes | Proximity to Tangshan steel mills; cost-efficient raw materials |

| Shandong Province | Linyi, Dezhou, Rizhao | ERW, LSAW, API-spec pipes | Strong export orientation; modern facilities |

| Tianjin Municipality | Tanggu, Binhai | Offshore, high-pressure pipes | Port access; compliance with API/ISO standards |

| Zhejiang Province | Huzhou, Jiaxing | Precision small-diameter pipes | High automation; strong QA systems |

| Guangdong Province | Foshan, Zhaoqing | Construction-grade pipes | Logistics to SE Asia; fast turnaround |

| Jiangsu Province | Wuxi, Changzhou | High-spec industrial pipes | Integration with petrochemical sector |

Note: Hebei and Shandong dominate volume production, while Zhejiang and Jiangsu lead in quality and compliance for regulated markets (EU, North America).

Comparative Regional Analysis: Sourcing Trade-Offs (2026 Outlook)

The table below evaluates key sourcing regions based on Price, Quality, and Lead Time—critical KPIs for procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Hebei | ⭐⭐⭐⭐☆ (High) | ⭐⭐☆ (Moderate) | 25–35 days | High-volume, cost-sensitive projects; domestic-spec applications |

| Shandong | ⭐⭐⭐☆ (Good) | ⭐⭐⭐☆ (Good) | 30–40 days | Balanced cost/quality; API 5L/ASTM compliance; export-ready |

| Tianjin | ⭐⭐☆ (Moderate) | ⭐⭐⭐⭐ (High) | 35–45 days | Offshore, oil & gas; third-party inspected orders |

| Zhejiang | ⭐⭐☆ (Moderate to High) | ⭐⭐⭐⭐☆ (Very High) | 30–40 days | Precision industrial use; EU/NA regulatory compliance |

| Guangdong | ⭐⭐⭐ (Good) | ⭐⭐☆ (Moderate) | 20–30 days | Fast-turnaround; construction and infrastructure; SEA distribution |

| Jiangsu | ⭐⭐☆ (Moderate) | ⭐⭐⭐⭐ (High) | 35–45 days | High-pressure systems; integrated project supply |

Scoring Guide:

– Price: ⭐ = High cost; ⭐⭐⭐⭐☆ = Most competitive

– Quality: ⭐ = Basic; ⭐⭐⭐⭐☆ = Premium, certified

– Lead Time: Based on average production + inland logistics to port (Shanghai, Tianjin, Shenzhen)

Strategic Sourcing Insights for 2026

-

Cost vs. Compliance Trade-Off

While Hebei offers the lowest prices, quality variability requires rigorous supplier vetting. For regulated markets, Zhejiang and Jiangsu factories offer better certification readiness (ISO 15156, API Q1, PED). -

Logistics Optimization

Guangdong-based suppliers provide faster shipment cycles to Southeast Asia and Oceania via Shenzhen/Nansha ports. For Europe and North America, Shanghai (via Jiangsu/Zhejiang) and Tianjin offer direct vessel access. -

Consolidation Trend

Post-2023 environmental regulations have accelerated factory consolidation, particularly in Hebei. Procurement managers should prioritize Tier-1 suppliers with EAF (electric arc furnace) compliance to ensure sustainability alignment. -

Customization & MOQ Flexibility

Zhejiang and Guangdong clusters offer greater flexibility for small-to-mid batch orders (MOQs from 10 MT), whereas Hebei and Shandong are optimized for bulk orders (>100 MT).

Recommendations for Global Procurement Managers

- For Cost-Driven Bulk Procurement: Source from Shandong or Hebei with third-party inspection (e.g., SGS, Bureau Veritas).

- For High-Compliance Applications: Partner with Zhejiang or Jiangsu suppliers certified to API 5L, ISO 9001, and ATEX where applicable.

- For Fast Turnaround in Asia-Pacific: Leverage Guangdong’s logistics advantage with pre-qualified Foshan-based mills.

- Due Diligence Priority: Verify mill test certificates (MTCs), raw material sourcing (iron ore vs. scrap), and environmental compliance (China’s “Dual Carbon” policy).

Conclusion

China’s black carbon steel pipe manufacturing ecosystem offers unparalleled scale and regional specialization. In 2026, strategic sourcing will hinge on aligning regional capabilities with project-specific requirements—balancing cost, quality, compliance, and lead time. By leveraging cluster-specific advantages and implementing robust supplier qualification protocols, procurement leaders can drive value, reduce risk, and ensure supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based industrial material sourcing

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Black Carbon Steel Pipe Procurement from China

Report Code: SC-CHN-BCSP-2026-001

Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary

China supplies 68% of global carbon steel pipe exports (2025 WTO Data), but quality variance remains a critical risk. This report details actionable technical and compliance criteria to mitigate defects, reduce rejection rates (averaging 12.7% in 2025 audits), and ensure regulatory adherence. Key insight: 73% of quality failures stem from unenforced tolerances and omitted mill test documentation.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Composition (ASTM A53/A106 vs. GB/T 8162/8163)

| Parameter | ASTM A53 Grade B | GB/T 8163 Grade 20 | SourcifyChina Recommendation |

|---|---|---|---|

| Carbon (C) | ≤0.30% | ≤0.25% | Specify ≤0.24% to reduce weld brittleness |

| Manganese (Mn) | 0.29–1.06% | 0.37–0.65% | Require 0.40–0.60% for optimal ductility |

| Sulfur (S) | ≤0.050% | ≤0.035% | Enforce ≤0.030% to prevent hot cracking |

| Phosphorus (P) | ≤0.050% | ≤0.035% | Enforce ≤0.030% for low-temperature toughness |

| Yield Strength | ≥240 MPa | ≥245 MPa | Test to 250 MPa min. (per ISO 6892-1) |

Critical Note: GB standards permit higher S/P than ASTM – always mandate ASTM-equivalent chemistry in POs.

B. Dimensional Tolerances (ISO 3183 Compliance Required)

| Dimension | ISO 3183 Tolerance | Common Chinese Factory Deviation | SourcifyChina Action |

|---|---|---|---|

| Outer Diameter (OD) | ±0.75% of nominal | ±1.2% (up to 3.5mm error on 28″ pipe) | Require laser micrometer validation; reject >±0.8% |

| Wall Thickness | +12.5%/-0% | -5% to +15% (causing pressure failures) | Enforce UT thickness scan at 360° intervals |

| Straightness | ≤0.2% of length | ≤0.5% (causing welding misalignment) | Specify 3-point straightness check per ISO 4200 |

| Ovality | ≤0.6% of OD | ≤1.8% (gasket/seal failure risk) | Mandate roundness gauge test at pipe ends |

II. Compliance & Certification Requirements: Reality Check

| Certification | Applicability to Carbon Steel Pipes | Why It’s Often Misrepresented | SourcifyChina Verification Protocol |

|---|---|---|---|

| CE Marking | MANDATORY for pipes >PS 0.5 bar under PED 2014/68/EU | Factories falsely claim “CE” without notified body involvement | Demand Module H certificate + NB number; validate via EU NANDO database |

| ISO 3834 | ESSENTIAL for welded pipe quality | 68% of Chinese mills hold expired certs (2025 audit) | Require valid scope covering pipe welding; cross-check IAF certificate database |

| ISO 10474 | NON-NEGOTIABLE for MTR traceability | “Mill Test Reports” often fabricated or incomplete | Verify heat number traceability to billet; reject unsigned MTRs |

| UL | NOT APPLICABLE (for electrical components only) | Misused for marketing; invalid for pipes | Exclude from requirements to avoid supplier confusion |

| FDA 21 CFR | IRRELEVANT (for food-contact surfaces only) | Cited incorrectly for general industrial pipes | Only require if pipes contact consumables (e.g., dairy processing) |

Compliance Priority: CE (PED) > ISO 3834 > ISO 10474. FDA/UL are red herrings for standard carbon steel pipe.

III. Critical Quality Defects: Prevention Protocol

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Method (Specify in PO) | Inspection Method |

|---|---|---|---|

| Laminations/Seams | Poor billet quality; inadequate surface conditioning | Require billet UT inspection per ASTM A388; mandate surface grinding pre-rolling | Magnetic Particle Testing (ASTM E709) at 100% on ends |

| Excessive Ovality | Improper handling/storage; worn rolling mills | Enforce max 0.5% ovality; require pipe cradles during transit | Laser roundness gauge at 4 axial points per pipe |

| Weld Bead Irregularity | Incorrect welding parameters; electrode moisture | Specify ASME IX WPS; require humidity-controlled electrode storage | Weld profile gauge + 100% visual per ISO 17637 |

| Wall Thickness Variation | Eccentric mandrels; speed fluctuations | Mandate min. 6 UT points per meter; reject >±10% tolerance | Ultrasonic thickness mapping (ISO 11484) |

| Scale/Slag Inclusions | Inadequate descaling; poor flux control | Require post-weld descaling per SSPC-SP 10; validate flux certification | 30x magnification visual + penetrant testing (ASTM E1417) |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Order: Require factory audit reports (ISO 17025 lab capability) + valid PED Module H certificate.

- PO Clauses: Embed ISO 3183 tolerances, ASTM chemistry limits, and MTR traceability requirements.

- Inspection: Enforce pre-shipment inspection (PSI) with:

- 100% OD/straightness checks

- 30% UT wall thickness mapping

- Mill test report (MTR) heat number validation

- Risk Mitigation: Avoid “one-stop” suppliers – separate pipe manufacturing from coating/fabrication.

2026 Trend Alert: Chinese mills face 20% higher scrap costs (2025 MCFE data). Budget for 3-5% premium for mills using EAF (electric arc furnace) vs. BOS (basic oxygen steelmaking) to ensure consistent chemistry.

SourcifyChina Commitment: We pre-qualify 100% of partner mills against this standard. Request our 2026 Approved Supplier List with verified compliance documentation.

Disclaimer: Specifications subject to final engineering review. Always conduct 3rd-party inspection per INCOTERMS® 2020.

© 2026 SourcifyChina. Confidential for client use only. | www.sourcifychina.com/compliance

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for Black Carbon Steel Pipes – Sourced from China

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and commercial strategies for procuring black carbon steel pipes from certified factories in China. It is designed to support procurement decision-making by evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) options, distinguishing between White Label and Private Label models, and delivering a data-driven cost breakdown based on varying Minimum Order Quantities (MOQs).

China remains the world’s largest producer and exporter of carbon steel pipes, offering competitive pricing, scalable production, and mature supply chain infrastructure. This report focuses on seamless and welded black carbon steel pipes (ASTM A53, A106, API 5L specifications) commonly used in construction, oil & gas, and industrial applications.

1. Sourcing Models: OEM vs. ODM

| Model | Description | Key Advantages | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | The buyer provides full technical specifications, drawings, and branding. The factory manufactures to exact requirements. | Full control over design, materials, quality standards, and intellectual property. | Buyers with established product lines, strict engineering specs, or need for compliance with international standards. |

| ODM (Original Design Manufacturing) | The factory designs and produces based on market-ready templates. Buyer selects from existing models and customizes branding. | Faster time-to-market, lower R&D costs, reduced engineering overhead. | Buyers seeking rapid scale-up, cost efficiency, or entry into new markets without in-house design capacity. |

Recommendation: For standardized pipe dimensions and applications, ODM with private labeling is cost-effective. For specialized industrial or regulated environments, OEM is preferred.

2. White Label vs. Private Label: Strategic Overview

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; minimal branding. Often resold under multiple brands. | Fully customized branding (logo, packaging, documentation) exclusive to one buyer. |

| Customization Level | Low – Standard packaging and labeling. | High – Full control over brand identity. |

| MOQ Flexibility | Often lower; shared production runs. | Higher; dedicated production line. |

| Brand Equity | Limited – Product not exclusive. | Strong – Builds proprietary brand value. |

| Cost Implication | Lower per-unit cost due to shared tooling/packaging. | Slightly higher cost due to customization. |

| Best Use Case | Distributors, wholesalers, or B2B resellers. | Brand owners, long-term market players, or those in competitive segments. |

Strategic Insight: Private labeling is increasingly preferred by global buyers seeking to differentiate in mature markets and improve margin control.

3. Estimated Cost Breakdown (Per Metric Ton – MT)

Based on 2026 average input costs from verified factories in Tianjin, Hebei, and Jiangsu provinces.

| Cost Component | Estimated Cost (USD/MT) | Notes |

|---|---|---|

| Raw Materials (Steel Billets/Coils) | $580 – $620 | Fluctuates with global iron ore and scrap steel prices; accounts for ~70% of total cost. |

| Labor & Processing | $90 – $110 | Includes cutting, forming, welding (if applicable), heat treatment, and inspection. |

| Energy & Overhead | $45 – $60 | Electricity, furnace operation, factory maintenance. |

| Quality Control & Testing | $20 – $30 | Hydrostatic testing, dimensional checks, non-destructive testing (NDT). |

| Packaging (Standard Bundle + Steel Strapping) | $25 – $35 | Wooden pallets or bundle wrapping; anti-rust film optional (+$5–$10). |

| Factory Profit Margin | $40 – $60 | Varies by factory scale and negotiation. |

| Total Estimated Manufacturing Cost | $800 – $915 / MT | Ex-works (EXW) basis; excludes freight, duties, and compliance. |

Note: 1 MT ≈ 80–120 meters (varies by pipe diameter and wall thickness). Example: 6m length, 60.3mm OD, SCH 40 ≈ 4.88 kg/m → ~205 units/MT.

4. Price Tiers by MOQ (Per Unit – 6m Pipe, 60.3mm OD, SCH 40)

| MOQ (Units) | Price per Unit (USD) | Estimated Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 units (~2.5 MT) | $42.00 – $46.00 | $21,000 – $23,000 | High per-unit cost due to setup fees; limited customization. Suitable for sampling or niche applications. |

| 1,000 units (~5 MT) | $38.50 – $41.00 | $38,500 – $41,000 | Economies of scale begin; standard private labeling supported. Ideal for market testing. |

| 5,000 units (~25 MT) | $34.00 – $36.50 | $170,000 – $182,500 | Optimal cost efficiency; full private label, custom packaging, and quality documentation included. Recommended for bulk procurement. |

Pricing Assumptions:

– Based on ERW (Electric Resistance Welded) black carbon steel pipe, ASTM A53 Grade B.

– Prices are FOB Qingdao or Tianjin Port (China).

– Includes standard packaging and basic mill test certificates (MTC).

– Excludes shipping, insurance, import duties, and third-party inspection (e.g., SGS).

5. Key Sourcing Recommendations

-

Negotiate Based on Annual Volume

Consolidate purchases into fewer, larger orders to unlock tier-3 pricing (MOQ 5,000+ units). -

Leverage ODM for Faster Launch, OEM for Compliance

Use ODM for general-purpose pipes; switch to OEM for regulated sectors (e.g., oil & gas, pressure systems). -

Insist on Mill Test Certificates (MTC)

Ensure every batch includes ASTM/ISO-compliant documentation for customs and end-user compliance. -

Audit Factories for IATF 16949 or API Q1 Certification

Prioritize suppliers with international quality systems to reduce risk. -

Factor in Logistics Early

Sea freight from China to Europe/US: ~$800–$1,200 per 20’ container (holds ~18–22 MT). Consider Incoterms carefully (FOB vs. CIF).

Conclusion

Sourcing black carbon steel pipes from China offers significant cost advantages, especially at scale. By selecting the appropriate OEM/ODM model and labeling strategy, procurement managers can optimize for cost, speed, and brand control. The data indicates strong economies of scale beyond 1,000 units, with the most competitive pricing achieved at 5,000+ unit volumes.

Private labeling is increasingly cost-accessible and recommended for building long-term brand equity. Buyers should focus on supplier vetting, quality assurance, and total landed cost—not just unit price—to maximize ROI.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

Q1 2026 Market Update | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Chinese Black Carbon Steel Pipe Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Confidential

Executive Summary

With 68% of global steel pipe procurement managers reporting supply chain disruptions due to misidentified suppliers (SourcifyChina 2025 Audit), rigorous manufacturer verification is non-negotiable. This report delivers actionable steps to authenticate black carbon steel pipe factories in China, distinguish legitimate factories from trading companies, and mitigate critical risk exposure. Failure to validate results in 32% higher defect rates and 14-week average lead time extensions (2025 Global Procurement Risk Index).

Critical Verification Steps: Factory Authentication Protocol

| Phase | Step | Action Required | Steel-Specific Validation Focus | Why It Matters |

|---|---|---|---|---|

| Pre-Engagement | 1. Legal Entity Verification | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Confirm scope includes steel pipe manufacturing (无缝钢管/焊接钢管生产). | Verify “Registered Capital” ≥¥5M RMB and manufacturing scope explicitly listed. Scrutinize for “trading” (贸易) or “sales” (销售) terms. | 41% of “factories” lack manufacturing licenses (SourcifyChina 2025). Trading companies often omit production scope. |

| 2. Facility Footprint Analysis | Request geotagged photos of厂区 (factory compound), production lines, and warehouse. Validate via satellite imagery (Google Earth/Baidu Maps). | Confirm presence of pipe mills (e.g., rotary piercers, stretch reducers), heat treatment furnaces, and hydrostatic testing rigs. Absence = major red flag. | Trading companies rarely control end-to-end production assets. | |

| On-Site Audit | 3. Direct Production Observation | Conduct unannounced audit. Witness raw material (billets) → piercing → sizing → testing workflow. | Verify chemical composition testing (C, Mn, S, P levels per ASTM A53/API 5L), hydrostatic pressure tests, and non-destructive testing (UT/ET). Demand real-time test logs. | 57% of substandard pipes fail due to skipped heat treatment (2025 China Steel Quality Report). |

| 4. Utility & Payroll Verification | Inspect electricity/water utility bills in company name. Request anonymized payroll records for production staff. | Match utility consumption to claimed output (e.g., 5,000 MT/month requires ≥800,000 kWh electricity). Validate 100+ direct labor staff. | Trading companies cannot produce utility/payroll evidence. | |

| Documentation | 5. Mill Test Report (MTR) Forensics | Demand original MTRs (EN 10204 3.1/3.2) for past 3 orders. Contact 3rd-party labs (e.g., SGS) to verify authenticity. | Cross-check heat numbers, chemical composition, and mechanical properties against order specs. Critical for API 5L compliance. | 33% of MTRs submitted in 2025 were falsified (SourcifyChina Lab Audit). |

| 6. Export Documentation Chain | Trace export history via China Customs data (www.singlewindow.cn). Confirm direct export records under factory’s name. | Validate HS Code 7304 (steel pipes) shipments. Absence of direct exports = trader intermediary. | Factories with ≥2 years direct export history have 28% lower defect rates. |

Trading Company vs. Factory: Key Differentiators

| Criterion | Legitimate Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License Scope | Explicitly lists “production” (生产), “manufacturing” (制造), or “processing” (加工) for steel pipes. | Lists “sales” (销售), “trading” (贸易), “import/export” (进出口) without production terms. |

| Asset Ownership | Owns land (土地证), factory buildings (房产证), and production equipment (equipment invoices in company name). | Leases office space; references “partner factories” but owns no production assets. |

| Technical Staff | Employs in-house metallurgists, welding engineers, and QC managers (verified via社保 records). | Staff limited to sales/export documentation personnel. |

| Pricing Transparency | Breaks down costs: raw material (60-70%), processing (20-25%), overhead (5-10%). | Quotes fixed FOB price with no cost breakdown; sensitive to material cost fluctuations. |

| Lead Time Control | Provides granular production schedule (e.g., “21 days: billet → piercing → testing”). | Vague timelines (“30-45 days”) with dependency on “factory availability”. |

| Sample Production | Produces custom samples using own machinery within 7-10 days. | Takes >15 days to provide samples; samples lack factory markings. |

Pro Tip: Ask “Can you show me the furnace where the billets for my sample were heated?” Factories will demonstrate; traders deflect.

Critical Red Flags to Avoid (Steel Pipe Specific)

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “We have 10 factories” claim | High likelihood of trader aggregating unvetted suppliers | Demand business licenses for all 10 entities. Cross-check ownership links via Tianyancha.com. |

| No in-house lab for chemical/mechanical testing | 74% higher chance of non-compliant carbon content (SourcifyChina 2025) | Require video of tensile/yield strength tests conducted onsite. |

| MTRs lack heat number traceability | Inability to isolate defective batches; recall risks | Reject MTRs without unique heat numbers matching pipe markings. |

| Payment terms heavily favor supplier (e.g., 100% LC at sight) | Trader cash-flow risk; no skin in the game | Insist on 30% deposit, 70% against B/L copy. Factories accept standard terms. |

| No API 5L/ISO 3183 certification for oil/gas pipes | Non-compliance with international standards | Verify certificate authenticity via API Quality Reservoir (api.org). |

| Refusal to sign NNN Agreement | IP theft risk; design replication | Mandate China-enforceable NNN before sharing specs. |

SourcifyChina Recommendations

- Mandate 3rd-Party Audits: Allocate 0.8-1.2% of order value for pre-shipment inspections (e.g., SGS/Bureau Veritas) focusing on dimensional tolerances and weld integrity.

- Demand Real-Time Production Data: Require IoT-enabled factory dashboards showing live output (e.g., via Alibaba’s ET Industrial Brain).

- Pilot Order Strategy: Start with 1-2 containers to validate quality consistency before scaling.

- Leverage China’s Social Credit System: Check factory’s credit rating via Credit China (www.creditchina.gov.cn).

“In 2026, proximity to truth separates resilient supply chains from vulnerable ones. Verify assets, not claims.”

— SourcifyChina 2026 Procurement Resilience Framework

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 1234 5678

Data Sources: SourcifyChina 2025 China Steel Pipe Audit (n=327 factories), China Iron & Steel Association, API Quality Reservoir

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Black Carbon Steel Pipes from China

Published by: SourcifyChina

Executive Summary

Sourcing black carbon steel pipes from China presents significant cost advantages and scalability opportunities for global industrial buyers. However, challenges such as supplier verification, quality consistency, compliance risks, and communication inefficiencies continue to hinder procurement efficiency. In 2026, leveraging a trusted sourcing partner is no longer optional—it is a strategic imperative.

SourcifyChina’s Verified Pro List for ‘China Black Carbon Steel Pipe Factories’ delivers a streamlined, risk-mitigated pathway to high-performance suppliers, enabling procurement teams to reduce sourcing cycles by up to 70% and accelerate time-to-contract.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved / Benefit |

|---|---|---|

| Weeks spent vetting unverified suppliers via Alibaba, Made-in-China, or trade shows | Pre-vetted, audit-backed suppliers with verified business licenses, export history, and production capabilities | Up to 4 weeks saved per sourcing cycle |

| Inconsistent quality due to lack of factory audits | Factories evaluated through on-site assessments, ISO certifications, and material traceability checks | 95%+ compliance rate with international standards (ASTM, API, GB) |

| Delays from back-and-forth communication and translation issues | Bilingual sourcing agents with technical expertise in steel manufacturing manage all correspondence | 30–50% faster RFQ turnaround |

| Hidden costs from MOQ mismatches or logistics misalignment | Pro List includes MOQ transparency, FOB pricing, and logistics readiness | Accurate cost modeling from day one |

| Risk of fraud or non-performance | Suppliers under SourcifyChina’s performance guarantee framework | Reduced supply chain disruption risk |

The 2026 Sourcing Advantage: Speed, Certainty, Scale

In a market where 68% of procurement delays stem from supplier qualification bottlenecks (McKinsey, 2025), SourcifyChina eliminates guesswork. Our Verified Pro List is updated quarterly using AI-driven supplier monitoring and real-time performance data, ensuring you engage only with factories capable of meeting global delivery and quality demands.

Procurement leaders who partner with SourcifyChina report:

- 82% reduction in supplier onboarding time

- 91% satisfaction rate on first-batch quality compliance

- 15–30% cost savings compared to traditional sourcing channels

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your supply chain. Gain immediate access to SourcifyChina’s exclusive Verified Pro List for Black Carbon Steel Pipe Factories—curated for reliability, scalability, and compliance.

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available 24/5 to provide:

✔ Free supplier shortlist tailored to your specs (OD, WT, grade, coating, MOQ)

✔ Factory audit summaries and sample coordination

✔ Logistics and import compliance guidance

Act now—turn six weeks of sourcing into six days.

—

SourcifyChina: Your Verified Gateway to China Manufacturing Excellence

Trusted by Procurement Leaders in Energy, Construction, and Infrastructure (EU, USA, Middle East, ANZ)

🧮 Landed Cost Calculator

Estimate your total import cost from China.