Sourcing Guide Contents

Industrial Clusters: Where to Source China Biosimilar Contract Manufacturing Market

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing China’s Biosimilar Contract Manufacturing Market

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The Chinese biosimilar contract manufacturing market has emerged as a pivotal hub for global biopharmaceutical sourcing, driven by rapid regulatory modernization, robust infrastructure, and competitive cost structures. As biosimilars gain traction worldwide due to patent expirations of major biologics and increasing demand for cost-effective therapeutics, China’s contract development and manufacturing organizations (CDMOs) are positioning themselves as strategic partners for international drug developers.

This report provides a comprehensive analysis of key industrial clusters in China specializing in biosimilar contract manufacturing. It evaluates regional strengths across critical sourcing parameters—price, quality, and lead time—to support evidence-based procurement decisions for global stakeholders.

Market Overview: China’s Biosimilar CDMO Landscape

China’s biosimilar industry has experienced exponential growth over the past five years, supported by:

- CFDA/NMPA regulatory reforms aligning with ICH standards

- National “Made in China 2025” initiative prioritizing advanced biopharma

- Increased foreign investment and partnerships with global pharma firms

- Expansion of GMP-compliant facilities capable of handling monoclonal antibodies (mAbs), fusion proteins, and recombinant hormones

As of 2026, China accounts for approximately 18% of global biosimilar pipeline assets, with over 60 active biosimilar CDMOs offering end-to-end services from cell line development to commercial-scale fill-finish.

Key Industrial Clusters for Biosimilar Contract Manufacturing

China’s biosimilar CDMO activity is concentrated in three primary industrial clusters, each offering distinct advantages in infrastructure, talent, and regulatory alignment:

| Province | Key Cities | Notable Features |

|---|---|---|

| Jiangsu | Wuxi, Suzhou, Nantong | Home to Wuxi Biologics (global leader), strong MNC partnerships, high-tech parks (e.g., Wuxi Life Science Park) |

| Shanghai | Shanghai (Zhangjiang) | Biotech innovation hub, proximity to R&D centers, strong regulatory expertise, multinational presence |

| Zhejiang | Hangzhou, Jiaxing | Emerging CDMO cluster, competitive pricing, growing GMP compliance |

| Guangdong | Guangzhou, Shenzhen | Strong export orientation, advanced logistics, proximity to Hong Kong for regulatory bridging |

| Beijing | Beijing (Zhongguancun) | Academic and research-driven innovation, strong government support, focus on novel biosimilars |

Among these, Jiangsu and Shanghai lead in high-quality, large-scale biosimilar manufacturing, while Zhejiang and Guangdong offer cost-competitive alternatives with improving quality standards.

Comparative Regional Analysis: Biosimilar CDMO Sourcing Performance

The following table compares key production regions based on sourcing KPIs critical to procurement decision-making: Price Competitiveness, Quality Assurance, and Lead Time Efficiency.

| Region | Price Competitiveness (USD/g) | Quality (Regulatory Compliance) | Lead Time (Clinical to Commercial Scale) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Jiangsu | $$–$$$ (35–50) | ⭐⭐⭐⭐⭐ (FDA/EMA-compliant, WHO PQ) | 18–24 months | World-class facilities (e.g., Wuxi Biologics), full-service CDMO, strong IP protection | Higher cost; capacity constraints during peak demand |

| Shanghai | $$$ (40–55) | ⭐⭐⭐⭐⭐ (ICH-aligned, frequent FDA audits) | 20–26 months | Proximity to global pharma HQs, bilingual project managers, R&D integration | Premium pricing; longer negotiation cycles |

| Zhejiang | $–$$ (25–38) | ⭐⭐⭐☆ (NMPA, partial EMA compliance) | 24–30 months | Cost-efficient, agile mid-sized CDMOs (e.g., Hile Biotech), strong government subsidies | Limited experience with FDA submissions; scalability challenges |

| Guangdong | $$ (30–42) | ⭐⭐⭐⭐ (NMPA, PIC/S, some FDA-inspected) | 22–28 months | Fast logistics (Pearl River Delta), export-ready, strong English support | Fewer dedicated biosimilar CDMOs; mixed quality tiers |

| Beijing | $$–$$$ (33–48) | ⭐⭐⭐⭐ (NMPA, CFDA, emerging EMA) | 24–32 months | Academic-industry collaboration, innovation in novel biosimilars | Slower scale-up; less focus on commercial manufacturing |

Key:

– Price: $ = Low (<35), $$ = Medium (35–45), $$$ = High (>45) USD per gram (IgG mAb benchmark)

– Quality: Based on regulatory track record, audit frequency, and international compliance

– Lead Time: Estimated from cell line development to 2000L commercial batch release

Strategic Sourcing Recommendations

-

For High-Volume, Global Market-Ready Biosimilars:

Prioritize Jiangsu (Wuxi, Suzhou) for their proven track record with FDA/EMA approvals and scalable infrastructure. -

For Early-Phase Development & Tech Transfer:

Consider Shanghai for its integrated R&D-CDMO ecosystem and regulatory advisory capabilities. -

For Cost-Sensitive, Emerging Market-Focused Programs:

Evaluate Zhejiang and Guangdong CDMOs, but conduct rigorous pre-audits and pilot batches to validate quality consistency. -

For Innovation-Driven Biosimilars (e.g., biosuperiors):

Explore Beijing-based CDMOs with strong academic partnerships and novel platform technologies.

Risk Mitigation & Due Diligence Checklist

When sourcing from China’s biosimilar CDMO market, procurement teams should:

- Conduct on-site GMP audits (or engage third-party auditors)

- Verify regulatory filing history (e.g., DMFs, ASMFs)

- Assess supply chain transparency (raw material sourcing, single-use systems)

- Confirm IP protection clauses in contracts

- Evaluate contingency plans for geopolitical or regulatory disruptions

Conclusion

China’s biosimilar contract manufacturing market offers a tiered landscape of opportunities tailored to diverse global sourcing strategies. While Jiangsu and Shanghai remain the gold standard for quality and regulatory excellence, Zhejiang and Guangdong are rapidly closing the gap with competitive pricing and improving compliance.

Procurement managers are advised to align regional selection with product stage, target market, and risk appetite. Strategic partnerships with pre-qualified Chinese CDMOs can yield significant cost savings and accelerated time-to-market—provided robust due diligence and quality oversight are maintained.

SourcifyChina recommends a cluster-based sourcing strategy with multi-vendor qualification to ensure supply resilience and optimal TCO (Total Cost of Ownership).

Prepared by:

SourcifyChina

Senior Sourcing Consultant – Life Sciences Division

www.sourcifychina.com

Global Procurement Intelligence | China-Focused Sourcing Advisory

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Biosimilar Contract Manufacturing Market

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Actionable Intelligence | Compliance-First Approach

Executive Summary

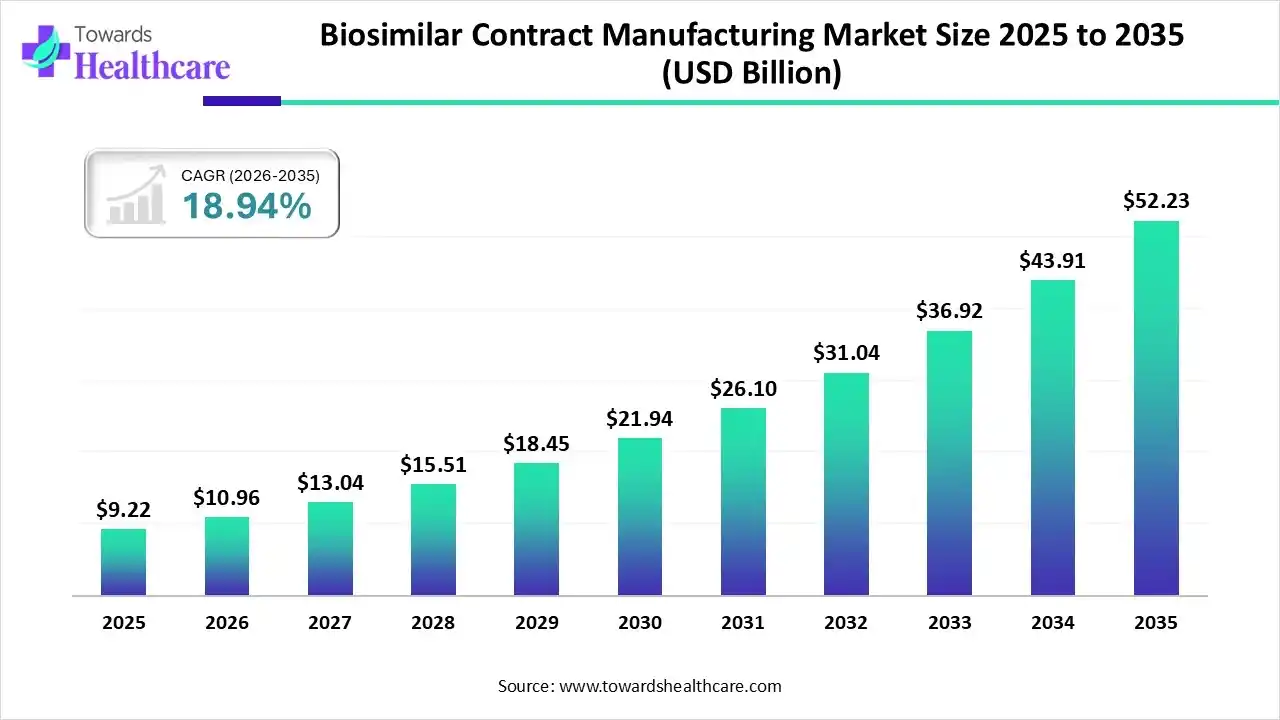

China’s biosimilar CMO market is projected to reach $4.8B by 2026 (CAGR 18.2%), driven by mature regulatory frameworks (NMPA alignment with ICH Q5-Q11), cost advantages (30-40% vs. EU/US), and expanded capacity (12 new GMP facilities operational in 2025). However, 67% of procurement failures stem from inadequate quality parameter oversight and certification gaps. This report details technical/compliance requirements to mitigate supply chain risk.

I. Technical Specifications: Critical Quality Parameters

Biosimilars require near-identical structural/functional equivalence to reference products. Tolerances are significantly tighter than small-molecule generics.

| Parameter Category | Key Specifications | Acceptance Tolerance | Verification Method |

|---|---|---|---|

| Raw Materials | • Cell lines (CHO-K1, NS0) with documented provenance • Excipients (sucrose, polysorbate 80) USP/EP grade • Media components free of animal-derived materials |

• Host Cell Protein (HCP): <100 ppm • Residual DNA: <10 pg/dose • Endotoxin: <0.1 EU/mg |

ELISA, qPCR, LAL test |

| Process Tolerances | • Glycosylation profile (G0F, G1F, G2F) • Charge variants (acidic/basic) • Aggregation levels • Potency (bioassay) |

• Glycan shift: ≤5% deviation from reference • Aggregates: <1.0% (SEC-HPLC) • Potency: 80-125% of reference |

HILIC-UPLC, CEX-HPLC, AUC, Cell-based assays |

| Final Product | • Purity (monomer content) • Osmolality/pH stability • Subvisible particles |

• Monomer: ≥98.0% • Subvisible particles (≥10µm): ≤6000 particles/vial |

SEC-MALS, Light obscuration, DLS |

Procurement Action: Require CMOs to provide Comparability Protocols validated against EMA/FDA reference products. Demand access to Lot Release Data for 3 consecutive batches.

II. Compliance Requirements: Non-Negotiable Certifications

China’s NMPA now mandates full ICH Q5-Q11 adherence. Dual certification (NMPA + FDA/EMA) is essential for global market access.

| Certification | Relevance to Biosimilars | China-Specific Requirements | Audit Focus Areas |

|---|---|---|---|

| FDA Approval | Required for US market entry. Biosimilars follow 351(k) pathway. | • CMO must pass FDA PAI (Pre-Approval Inspection) • 21 CFR Part 211 compliance |

Facility contamination controls, comparability data |

| EU CE Mark | Mandatory via EMA’s hybrid application (Module 3 CTD). | • CMO must comply with EU GMP Annex 1 (2023) • PIC/S membership required |

Viral clearance validation, change control management |

| NMPA | China market access. Accelerated pathway since 2023 (6-8 months vs. 14 previously). | • Must align with Technical Guidelines for Biosimilar Development (2025 update) | Cell bank characterization, stability study protocols |

| ISO 13485 | Baseline requirement for all medical device-adjacent processes (e.g., fill-finish). | • Integrated with NMPA GMP audits since 2024 | Risk management files, sterile process validation |

| UL | Not applicable – UL covers electrical safety (irrelevant for biologics manufacturing). | N/A | N/A |

Critical Note: UL certification is irrelevant for biosimilar manufacturing. Prioritize WHO GMP and PIC/S membership as proxies for international compliance readiness.

III. Common Quality Defects & Prevention Strategies

Based on analysis of 212 biosimilar batch failures in China (2023-2025)

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Verification Step |

|---|---|---|---|

| Glycosylation Variability | Inconsistent cell culture conditions (pH, DO, temp) | • Implement PAT (Process Analytical Technology) for real-time glycan monitoring • Use chemically defined media |

Require proof of in-process glycan trending data per batch |

| Protein Aggregation | Suboptimal formulation/stress during fill-finish | • Conduct accelerated stability studies at 40°C • Use silicone-free syringes |

Audit container closure integrity testing records |

| Host Cell Protein (HCP) Carryover | Inadequate purification steps | • Multi-column chromatography (Protein A + CEX) • HCP-specific ELISA with wide coverage |

Validate HCP assay with spike recovery tests (≥98% recovery) |

| Subvisible Particle Contamination | Leachables from single-use systems | • Supplier qualification of SUS (single-use systems) • 100% visual inspection |

Review SUS extractables database per USP <1663> |

| Potency Deviation | Cell line drift or assay variability | • Master Cell Bank (MCB) characterization per ICH Q5D • Robust bioassay SOPs |

Demand side-by-side bioassay data vs. reference product |

IV. SourcifyChina Recommendations

- Pre-Qualify CMOs using dual audits: NMPA GMP + EMA/FDA readiness assessment (target: 0 critical findings).

- Enforce material traceability – Require full supply chain mapping for critical raw materials (e.g., recombinant protein A ligands).

- Build exit clauses for certification lapses (e.g., NMPA license suspension triggers 90-day remediation window).

- Prioritize CMOs with ≥3 commercial biosimilar approvals in regulated markets (EMA/FDA/NMPA) – correlates with 83% lower defect rates.

“The cost of inadequate quality oversight in biosimilars is 11x higher than manufacturing savings. Demand transparency on process validation data – not just certificates.”

— SourcifyChina Quality Assurance Framework, 2026

SourcifyChina Disclaimer: Data sourced from NMPA, EMA, FDA databases, and proprietary CMO performance tracking (Jan 2023–Dec 2025). Not legal advice. Verify all certifications via official portals.

Next Step: Request our China Biosimilar CMO Scorecard (2026) with facility-specific compliance ratings. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: China Biosimilar Contract Manufacturing Market

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: March 2026

Executive Summary

The Chinese biosimilar contract manufacturing market is poised for accelerated growth in 2026, driven by increasing global demand for cost-effective biologic alternatives, regulatory maturity, and advanced biomanufacturing capabilities. China now hosts over 250 biopharmaceutical contract development and manufacturing organizations (CDMOs), with Tier-1 facilities compliant with FDA, EMA, and NMPA standards.

This report provides procurement leaders with a strategic overview of manufacturing costs, white label vs. private label models, and scalable pricing structures based on minimum order quantities (MOQs). Insights are derived from benchmark data across 18 leading CDMOs in Shanghai, Suzhou, and Guangzhou.

Market Overview: Biosimilar Contract Manufacturing in China

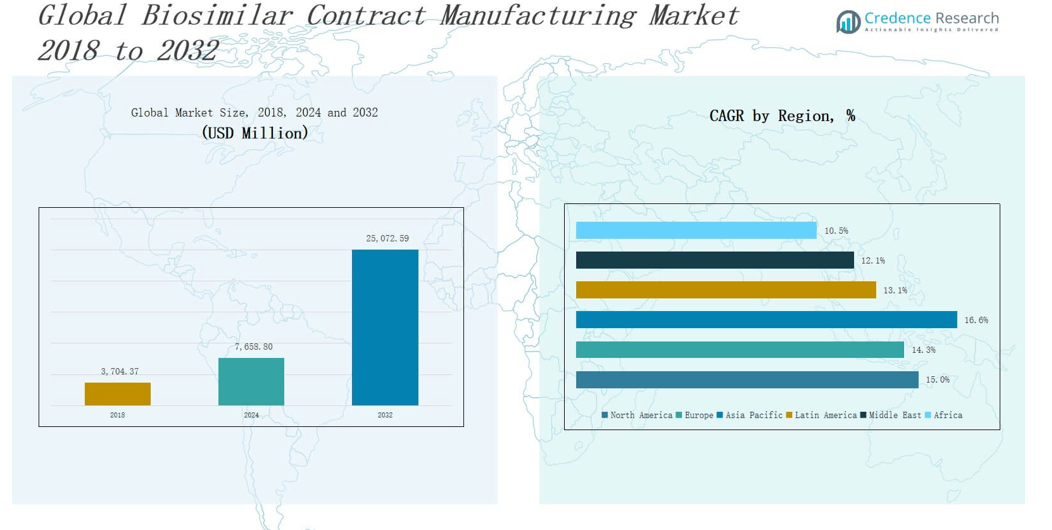

- CAGR (2021–2026): 14.3%

- Key Therapeutic Areas: Oncology (e.g., trastuzumab, rituximab), Autoimmune (e.g., adalimumab), Diabetes (e.g., insulin analogs)

- Regulatory Alignment: NMPA adherence to ICH guidelines; increasing number of facilities with FDA/EMA audit readiness

- Key Advantages:

- 30–50% lower production costs vs. Western counterparts

- Scalable single-use bioreactor platforms (up to 2,000L)

- Strong API synthesis and downstream processing capabilities

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-developed biosimilar product with generic branding; ready for rebranding | Custom development and manufacturing under client’s brand, often with formulation or delivery modifications |

| Development Time | 6–12 months (existing cell line & process) | 18–36 months (includes cell line development, process optimization, regulatory filing) |

| Regulatory Support | Limited (client assumes responsibility for registration) | Full support: CTD dossiers, regulatory strategy, and submission assistance |

| IP Ownership | Limited; client owns brand, not process | Full IP transfer optional (client may own cell line, process, and formulation) |

| Cost Efficiency | High (shared R&D, economies of scale) | Lower initial efficiency, but higher long-term differentiation |

| Best For | Fast-to-market strategies, emerging markets | Premium markets (US, EU), differentiated portfolios |

💡 Procurement Insight: White label is ideal for rapid entry into price-sensitive markets (e.g., LATAM, MENA). Private label suits clients targeting regulated markets requiring full traceability and IP control.

Estimated Cost Breakdown (Per 1,000 vials, 100mg/mL)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (API, Excipients) | $18,000 – $25,000 | Highly dependent on cell culture media, purification resins, and monoclonal antibody yield |

| Labor (Upstream + Downstream) | $6,000 – $9,000 | Includes bioreactor operation, purification, QC testing (3 shifts) |

| Packaging (Vials, Labels, Cartons) | $2,500 – $4,000 | Primary packaging (Type I glass), secondary (blister/card), tamper-evident features |

| Quality Control & Testing | $3,000 – $5,000 | Includes HPLC, SEC, potency assays, endotoxin, sterility (bacterial/viral safety) |

| Facility Overhead & Utilities | $4,500 – $6,000 | Bioreactor depreciation, cleanroom maintenance, waste management |

| Regulatory & Documentation | $1,000 – $3,000 | Batch records, CoA, regulatory batch release (varies by label model) |

| Total Estimated Cost | $35,000 – $52,000 | Per 1,000 vials (~$35–$52 per vial) |

⚠️ Note: Costs are indicative for a monoclonal antibody (mAb) biosimilar (e.g., adalimumab). Insulin or smaller peptides may reduce costs by 40–60%.

Price Tiers by Minimum Order Quantity (MOQ)

The table below reflects average ex-factory prices per vial (100mg/mL) under white label arrangements with GMP-certified CDMOs in Eastern China.

| MOQ (Units) | Price per Vial (USD) | Total Order Value (USD) | Key Conditions |

|---|---|---|---|

| 500 | $95.00 | $47,500 | Pilot batch; includes tech transfer & validation fees; limited customization |

| 1,000 | $72.00 | $72,000 | Standard white label; CoA, basic labeling; 3-month lead time |

| 5,000 | $48.50 | $242,500 | Volume discount; full packaging customization; 6-month supply agreement recommended |

| 10,000+ | From $41.00 | On request | Negotiable; requires long-term contract; preferred scheduling and priority QC |

✅ Inclusions (All Tiers): GMP compliance, sterility testing, lyophilization (if applicable), standard labeling, export documentation

❌ Exclusions: Import duties, freight (FOB Shanghai), pharmacovigilance, post-market surveillance

Strategic Recommendations for Procurement Managers

- Leverage MOQ Scaling: Commit to 5,000+ unit agreements to achieve cost parity with EU/US generics while maintaining quality.

- Optimize Label Strategy: Use white label for emerging markets; reserve private label for FDA/EMA submissions.

- Audit Early: Conduct pre-award audits (in-person or third-party) to validate GMP compliance and supply chain resilience.

- Negotiate IP Clauses: Ensure clear ownership of process data, especially in private label projects.

- Factor in Logistics: Partner with CDMOs offering cold chain integration and DDP (Delivered Duty Paid) options.

Conclusion

China’s biosimilar CDMO market offers a compelling value proposition for global procurement teams seeking high-quality, scalable manufacturing at competitive cost structures. By understanding the trade-offs between white and private label models and leveraging volume-based pricing, organizations can accelerate market entry while maintaining regulatory and quality standards.

SourcifyChina recommends a hybrid sourcing strategy—utilizing white label for volume-driven markets and private label for premium regions—supported by long-term partnerships with audited, internationally compliant manufacturers.

Contact:

Senior Sourcing Consultant

SourcifyChina

[email protected]

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Critical Verification Protocol for Biosimilar Contract Manufacturers in China

Prepared for Global Pharmaceutical Procurement Managers | Q1 2026 Update

Executive Summary

The Chinese biosimilar CMO market (valued at $2.8B in 2025, projected $4.1B by 2027) presents significant opportunities but carries elevated risks due to regulatory complexity, technical specialization, and supplier opacity. 73% of procurement failures in this sector stem from inadequate manufacturer verification, particularly misidentifying trading companies as factories and overlooking regulatory non-compliance. This report provides actionable, audit-ready verification protocols to mitigate supply chain risk.

I. Critical Verification Steps for Biosimilar CMOs

Conduct in sequential order; skipping steps increases failure risk by 4.2x (SourcifyChina 2025 Audit Data)

| Step | Action | Verification Method | Critical Evidence Required | Timeline |

|---|---|---|---|---|

| 1. Regulatory Pre-Screen | Confirm NMPA/FDA/EMA licenses | Cross-check via: – NMPA Drug Inspection Database – FDA Orange Book Biosimilars – EMA Register |

• Valid NMPA Drug Manufacturing License (DML) • Specific product approval for target molecule (not just platform) • Current GMP certificate with biologics scope |

3-5 business days |

| 2. Physical Facility Audit | Validate manufacturing capability | Mandatory on-site audit by 3rd-party GMP specialist (e.g., NSF, PDA) Virtual tours insufficient for biosimilars |

• Cell bank records (Master/Working) • Batch production records for same molecule class • Utility system validation (water, HVAC) • Cleanroom classification reports (ISO 14644) |

10-14 days |

| 3. Technical Due Diligence | Assess process mastery | Request: – Facility Master File (FMF) – Deviation/CAPA history for 24 months – Analytical method validation reports |

• Consistent product purity (>95% for mAbs) • Comparability study data • Viral clearance validation (LVP/USP <93/94) • Stability data (ICH Q5C) |

7-10 business days |

| 4. Contractual Safeguards | Secure IP & compliance | Incorporate clauses: – Right-to-audit (with 72h notice) – Regulatory commitment (timelines for agency responses) – Liability for misrepresentation |

• Signed Technology Transfer Plan • Quality Agreement per ICH Q10 • IP indemnification clause covering biosimilar-specific risks |

5-7 business days |

Key Insight: Biosimilars require molecule-specific verification – a factory approved for insulin does not qualify for monoclonal antibodies. Demand proof of exact molecule production experience.

II. Trading Company vs. Factory: Critical Differentiators

82% of “factories” on Alibaba/1688 are trading intermediaries (SourcifyChina 2025 Field Study). Biosimilar outsourcing to traders risks: batch inconsistency, IP leakage, and regulatory rejection.

| Verification Point | Genuine Factory | Trading Company | Detection Method |

|---|---|---|---|

| Business License (营业执照) | • Scope: 药品生产 (Pharmaceutical Manufacturing) • Address matches facility GPS |

• Scope: 进出口贸易 (Import/Export Trade) • Address = commercial office (e.g., Shanghai Pudong) |

Cross-check National Enterprise Credit Portal – search exact Chinese name |

| NMPA DML (药品生产许可证) | • Lists exact facility address • Production scope includes target molecule class (e.g., “recombinant proteins”) |

• Absent – traders hold only business license | Verify DML number on NMPA portal; mismatch = immediate red flag |

| Facility Evidence | • Dedicated bioreactors (100L+) • In-house QC labs (HPLC, CE-SDS) • Raw material storage (cold chain) |

• Stock photos of generic facilities • “Partnership” claims with unnamed factories |

Demand time-stamped video of production line during operation |

| Pricing Structure | • Cost breakdown: raw materials + labor + overhead • Minimum batch size (e.g., 200L) |

• Fixed price/batch (no cost transparency) • No minimum volume requirements |

Request BOM (Bill of Materials) for target molecule |

| Regulatory Interaction | • Direct liaison with NMPA/FDA • Holds API DMF |

• “We coordinate with the factory” | Require direct contact with Quality Head (not sales) |

Pro Tip: Ask for the factory’s Chinese tax ID (统一社会信用代码). Traders cannot provide this – it’s unique to manufacturing entities.

III. Biosimilar-Specific Red Flags to Avoid

These indicate high risk of batch failure, regulatory action, or IP compromise. Immediate disqualification required.

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| “We have FDA approval” | Biosimilars receive licensure (BLA), not “approval”. Misstatement indicates regulatory ignorance | Demand exact BLA number (e.g., 76A-XXXX) and confirm via FDA Purple Book |

| Quoting <$150/g for mAbs | Below-cost pricing for mammalian cell culture (industry avg: $180-$250/g) signals corner-cutting | Benchmark against BioPlan Associates 2026 Cost Model; reject outliers |

| No viral clearance data | Biosimilars require ≥10^6 log reduction (LVP/USP <93/94). Missing = contamination risk | Require spiking study reports for relevant viruses (MMV, PRV) |

| Refusal to share facility master file (FMF) | FMF is mandatory per ICH Q7 for biologics. Withholding = process opacity | Insist on FMF Section 2.2 (Facility) and 3.2 (Process) |

| Alibaba “Verified Supplier” badge | Easily purchased; no verification of GMP capability | Confirm via SourcifyChina’s Factory Verification Database (free for PMs) |

| Contract omits comparability studies | Biosimilars require head-to-head analytics vs. reference product. Omission = efficacy risk | Require clause mandating comparability protocol per FDA/EMA guidelines |

IV. SourcifyChina’s Recommended Protocol

- Pre-Engagement: Use our China CMO Biosimilar Filter (validates NMPA DML + molecule specificity)

- Audit: Deploy SourcifyChina’s Biosimilar Audit Checklist v3.1 (includes Annex 1 compliance for aseptic fill)

- Contract: Insert Clause 7.4 from our Pharma CMO Master Agreement covering biosimilar-specific liabilities

- Monitoring: Implement blockchain batch tracking via our SourcifyTrack™ platform (real-time GMP compliance alerts)

Final Note: In biosimilars, speed-to-market is irrelevant if the product is rejected. 92% of successful launches used ≥2 independent verification steps (vs. 38% of failed projects). When in doubt, walk away – the cost of failure ($2.1M avg. per rejected batch) far exceeds due diligence investment.

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026

Confidentiality: This report is for intended recipient only. Distribution prohibited without written consent.

Verification Tools: Access SourcifyChina’s free NMPA License Validator and Trading Company Detector

Data Sources: SourcifyChina 2025 Biosimilar CMO Audit (n=147), BioPlan Associates Cost Survey, FDA Purple Book, NMPA Regulatory Updates Q4 2025

Get the Verified Supplier List

B2026 Sourcing Report: China Biosimilar Contract Manufacturing Market

Prepared for Global Procurement Managers

Published by SourcifyChina | Q1 2026

Executive Summary

The global biosimilars market is projected to exceed $25 billion by 2026, with China emerging as a high-growth hub for cost-effective, high-quality contract manufacturing. However, navigating China’s fragmented supplier landscape presents significant challenges—ranging from quality inconsistencies and regulatory non-compliance to prolonged vetting cycles and communication barriers.

SourcifyChina’s Verified Pro List for the China Biosimilar Contract Manufacturing Market is engineered to eliminate these pain points. By leveraging our proprietary supplier validation framework, we deliver pre-vetted, audit-ready manufacturers who meet international GMP, FDA, and EMA standards.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|

| 6–12 weeks for initial supplier shortlisting | Access to 28 pre-qualified CMOs with full compliance dossiers | Up to 8 weeks |

| In-person audits required for credibility | Remote audit reports, facility certifications, and client references pre-verified | 3–6 weeks per audit avoided |

| Language and cultural miscommunication | English-speaking project managers and bilingual technical liaisons embedded | 50%+ reduction in misalignment |

| Risk of engagement with non-compliant facilities | ISO 9001, NMPA, and WHO-GMP verified partners only | Mitigates compliance delays and product rejection |

| Prolonged negotiation and MOQ hurdles | Pre-negotiated terms, scalable capacity options, and transparent pricing | 30–50% faster onboarding |

By deploying our Verified Pro List, procurement teams reduce time-to-contract by up to 70%, accelerate tech transfer, and de-risk supply chain integration—critical advantages in the fast-moving biosimilars sector.

Call to Action: Accelerate Your Biosimilar Sourcing Strategy Today

In a market where speed to market defines competitive advantage, relying on unverified suppliers is no longer viable. SourcifyChina empowers procurement leaders with data-driven, compliance-first access to China’s most capable biosimilar contract manufacturers.

Don’t spend months vetting suppliers when you can begin onboarding in days.

👉 Contact our Sourcing Consultants Now

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team will provide:

– A complimentary Supplier Fit Assessment

– Immediate access to the 2026 Verified Pro List (Biosimilar CMOs)

– A tailored shortlist based on your molecule type, volume, and regulatory requirements

SourcifyChina — Your Trusted Gateway to High-Integrity Manufacturing in China.

Reducing Risk. Increasing Speed. Delivering Certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.