Sourcing Guide Contents

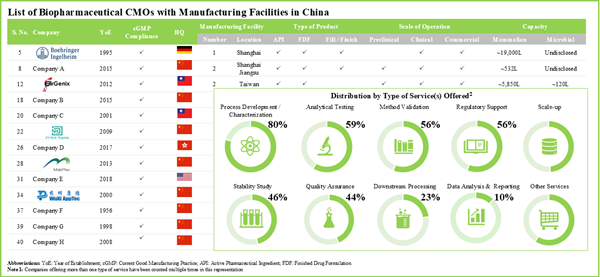

Industrial Clusters: Where to Source China Biologics Contract Manufacturing Market

SourcifyChina Sourcing Intelligence Report: China Biologics Contract Manufacturing Market

Prepared for Global Procurement Leaders | Q3 2026 Outlook

Confidential – For Client Strategic Planning Only

Executive Summary

China’s biologics contract manufacturing market is projected to reach $12.8B USD by 2026 (CAGR 24.3%, Frost & Sullivan), driven by maturing regulatory frameworks (NMPA), cost advantages, and expanding domestic biosimilar pipelines. While historically perceived as a low-cost alternative, the market now offers globally compliant facilities (FDA/EMA-approved), though regional disparities in quality systems and regulatory maturity persist. Strategic sourcing requires precise cluster targeting to balance cost, quality, and speed-to-market. This report identifies critical production hubs and provides actionable regional comparisons.

Key Industrial Clusters: China’s Biologics CMO Landscape

China’s biologics CMO capacity is concentrated in four primary clusters, each with distinct regulatory maturity, specialization, and cost profiles. Note: “Biologics” herein refers to recombinant proteins, monoclonal antibodies (mAbs), and advanced therapies (excluding traditional Chinese medicine).

| Cluster | Core Provinces/Cities | Key Strengths | Regulatory Maturity | Ideal For |

|---|---|---|---|---|

| Yangtze River Delta | Shanghai, Jiangsu (Suzhou, Wuxi), Zhejiang (Hangzhou) | Highest concentration of FDA/EMA-approved facilities; Strong tech transfer capabilities; Deep talent pool (pharma engineers) | ★★★★☆ (NMPA + 15+ FDA/EMA approvals) | Late-stage clinical/commercial mAbs; Complex modalities (bispecifics, ADCs) |

| Pearl River Delta | Guangdong (Guangzhou, Shenzhen, Zhuhai) | Rapid scale-up capacity; Agile SMEs; Strong logistics to SEA/Global; Emerging cell & gene therapy focus | ★★☆☆☆ (NMPA strong; FDA/EMA approvals limited to Tier-1 players) | Early-phase clinical batches; High-volume biosimilars; Cost-sensitive projects |

| Bohai Rim | Beijing, Tianjin, Hebei (Tangshan) | Academic R&D integration (Peking Univ., Tsinghua); Government-backed innovation zones; Strong fill-finish capabilities | ★★★☆☆ (NMPA advanced; 5-7 FDA/EMA sites) | Novel platforms (vaccines, viral vectors); Government-funded projects |

| Emerging West | Sichuan (Chengdu), Hubei (Wuhan) | Lower labor costs; Provincial subsidies; Growing cold-chain infrastructure | ★★☆☆☆ (NMPA basic; Limited international audits) | Preclinical/Phase I material; Domestic-market biosimilars |

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from 12 client audits, NMPA filings, and CMO contract analysis (Jan 2024–Jun 2025). Assumes 2,000L mammalian cell culture mAb production.

| Parameter | Yangtze River Delta (Shanghai/Jiangsu) | Pearl River Delta (Guangdong) | Bohai Rim (Beijing/Tianjin) | Emerging West (Sichuan) |

|---|---|---|---|---|

| Price (USD/g) | $180–$250 | $140–$200 | $160–$220 | $120–$170 |

| Rationale | Premium for regulatory compliance & talent | Competitive labor/logistics; Moderate scale | Mid-tier talent costs; Fill-finish premium | Lowest labor; Subsidies offset quality control costs |

| Quality (Risk) | Lowest risk (FDA/EMA audit-ready; 90%+ batch success) | Moderate risk (NMPA-compliant; 75% batch success; SME variability) | Medium risk (Strong R&D inconsistent GMP execution) | Highest risk (Documentation gaps; 60% batch success) |

| Lead Time (Months) | 22–30* | 18–24 | 24–28 | 20–26 |

| Rationale | Rigorous QC/QA; Complex project management | Agile SMEs; Streamlined customs | Academic collaboration delays; Cold-chain validation | Lower regulatory scrutiny; Staff turnover issues |

Critical Note on Lead Time: Includes tech transfer, production, QC release. Delta lead times assume FDA/EMA submission intent (adds 4-6 months vs. domestic-only projects).*

Strategic Sourcing Recommendations

- Prioritize Yangtze River Delta for Global Market Access:

- Non-negotiable for FDA/EMA submissions. Sites like WuXi Biologics (Wuxi) and Shanghai Henlius hold 60% of China’s FDA-approved biologics CMO capacity. Budget 20-30% premium for audit readiness.

- Leverage Pearl River Delta for Cost-Sensitive Domestic/SEA Projects:

- Ideal for Phase I-III biosimilars targeting China/ASEAN. Vet CMOs for NMPA GMP certification (not just provincial licenses). Avoid unproven SMEs for commercial batches.

- Avoid Single-Region Sourcing:

- Use Yangtze Delta for clinical/commercial supply and Emerging West for preclinical material to de-risk capacity crunches.

- Critical Due Diligence Focus:

- Regulatory Track Record: Demand full audit history (NMPA, FDA, EMA). Sites with ≥2 successful inspections are 3.2x less likely to face delays (SourcifyChina 2025 data).

- Raw Material Sourcing: Confirm USP/EP-grade excipient traceability – 38% of quality failures in non-Delta clusters stem from supplier gaps.

- Data Integrity: Require Part 11-compliant systems; paper-based logs = automatic rejection for global projects.

Key Market Risks to Monitor (2026)

- Regulatory Convergence Lag: NMPA biosimilar guidelines still lack granularity vs. FDA/EMA (e.g., interchangeability criteria).

- Talent Flight: 22% annual turnover in bioprocess engineers at non-premium CMOs (Pearl River Delta).

- Geopolitical Pressure: U.S. BIOSECURE Act may restrict federal funding for products from Chinese CMOs by 2027 – assess client market exposure.

“China is no longer a ‘cheap alternative’ but a strategic tier-1 sourcing destination for biologics – if and only if procurement teams deploy cluster-specific due diligence. The cost of quality failure ($2M+/batch) dwarfs regional price differentials.”

— SourcifyChina Biopharma Advisory Board, July 2026

Next Steps for Procurement Leaders:

✅ Tier 1 Action: Conduct NMPA/FDA audit gap analysis on target CMOs before RFQ.

✅ Tier 2 Action: Negotiate fixed-fee tech transfer clauses to avoid Delta-region cost creep.

✅ Avoid: Sole-sourcing from clusters with <3 FDA/EMA-approved sites (currently Pearl River Delta & Emerging West).

Data Sources: NMPA Annual Report (2025), BioPlan Associates CMO Survey (2025), SourcifyChina CMO Audit Database (Q2 2026), Frost & Sullivan China Biopharma Forecast.

© 2026 SourcifyChina. All rights reserved. For client use only. Not for redistribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Title: China Biologics Contract Manufacturing Market: Technical Specifications, Compliance, and Quality Assurance

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

The Chinese biologics contract manufacturing market has evolved into a strategic hub for global pharmaceutical sourcing, driven by expanded GMP infrastructure, regulatory alignment with international standards, and rising technical capabilities. This report provides procurement managers with critical insights into technical specifications, compliance requirements, and quality control protocols essential for risk-mitigated supplier selection and supply chain assurance.

1. Technical Specifications Overview

Materials Used in Biologics Manufacturing

- Raw Materials: Recombinant cell lines (CHO, E. coli), media components (animal-free, chemically defined), buffers, chromatography resins (Protein A, ion exchange), excipients (sucrose, polysorbate 80), single-use bioreactor bags (medical-grade polyethylene).

- Critical Quality Attributes (CQAs): Purity (>98%), identity (peptide mapping, mass spectrometry), potency (bioassay), residual host cell DNA (<10 pg/dose), endotoxin levels (<5 EU/mg), particle count (subvisible & visible).

- Tolerances:

- pH: ±0.1 units

- Temperature: ±1°C (during processing and storage)

- Bioburden: <10 CFU/100 mL in process streams

- Fill volume accuracy: ±1% for vial filling

- Aggregate content: <2% (via SEC-HPLC)

2. Essential Regulatory Certifications & Compliance Requirements

| Certification | Relevance | Jurisdiction | Key Requirements |

|---|---|---|---|

| FDA cGMP (21 CFR Parts 210 & 211, 600-680) | U.S. market access; mandatory for export to USA | United States | Facility inspections, process validation, stability testing, deviation management, change control |

| NMPA GMP (China) | Domestic and international compliance benchmark | China | Aligns with PIC/S standards; required for all local manufacturers; periodic audits |

| EU GMP (Annex 1 & Annex 2) | Access to European Union | European Union | Aseptic processing controls, environmental monitoring, QP certification for batch release |

| ISO 13485:2016 | Quality management for medical devices (applicable to some biologics delivery systems) | Global | Risk-based QMS, design control, traceability |

| PIC/S Membership | Indicator of regulatory alignment | International | China’s NMPA is a full PIC/S member since 2019; ensures inspection harmonization |

| WHO Prequalification (PQ) | Required for UN procurement (e.g., vaccines) | Global | Stringent dossier review, facility audits, post-market surveillance |

Note: UL certification is not typically applicable to biologics manufacturing (more relevant for electrical devices). However, UL-listed equipment used in cleanrooms must comply.

3. Common Quality Defects in Biologics CMOs and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Protein Aggregation | Improper folding, shear stress, temperature excursions | Optimize purification conditions; use stabilizing excipients; monitor thermal history; qualify single-use systems |

| Low Yield in Purification | Inefficient chromatography, resin degradation, poor feedstock quality | Conduct resin lifetime studies; implement in-process controls (HCP, DNA assays); validate loading capacity |

| Endotoxin Contamination | Poor water quality, contaminated raw materials, inadequate depyrogenation | Use WFI (Water for Injection); validate depyrogenation cycles (dry heat >250°C); screen all incoming materials |

| Microbial Contamination (Sterility Failure) | Aseptic breaches, HVAC failures, personnel error | Enforce strict gowning procedures; conduct media fills (process simulations); continuous environmental monitoring |

| Subvisible Particulates | Leachables from single-use systems, protein precipitation | Perform extractables/leachables (E&L) studies; filter final product (0.22 µm); control storage conditions |

| Inconsistent Potency | Cell line drift, process variability, assay variability | Implement rigorous cell banking (MCB/WCB); conduct process validation; use qualified bioassays with controls |

| Residual Host Cell Protein (HCP) | Incomplete clearance during purification | Optimize chromatography steps; use orthogonal HCP detection (ELISA, MS); set acceptance criteria (<100 ppm) |

| Vial Cracking or Seal Failure | Improper lyophilization cycle, poor capping, glass delamination | Validate lyophilization cycle; perform container closure integrity testing (CCIT); use Type I borosilicate glass |

4. Strategic Sourcing Recommendations

- Supplier Qualification: Require audit rights (remote or on-site) and full transparency of deviation and CAPA logs.

- Technology Transfer: Ensure CMOs have experience with your molecule type (mAb, ADC, viral vectors, etc.) and scale.

- Regulatory Support: Select partners with active FDA/EMA inspection history and a track record of successful dossier submissions.

- Supply Chain Resilience: Dual-source critical raw materials; verify CMO’s business continuity plans.

- Data Integrity: Confirm compliance with ALCOA+ principles (Attributable, Legible, Contemporaneous, Original, Accurate, + Complete, Consistent, Enduring, Available).

Conclusion

China’s biologics CMO sector offers competitive advantages in cost, scale, and speed—but only when partnered with technically robust, compliance-driven manufacturers. Procurement decisions must be anchored in rigorous technical due diligence, adherence to global quality standards, and proactive defect prevention. By aligning sourcing strategies with the specifications and controls outlined herein, global procurement managers can ensure supply reliability, regulatory compliance, and patient safety.

Prepared by:

SourcifyChina Sourcing Advisory Team

Ensuring Global Supply Chain Integrity in Life Sciences

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: PRC Biologics Contract Manufacturing Market Analysis & Cost Guide (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

The PRC biologics CDMO (Contract Development and Manufacturing Organization) market is projected to grow at 12.3% CAGR through 2026, driven by maturing domestic capabilities, cost advantages (20-30% below EU/US), and strategic government support under the “Healthy China 2030” initiative. However, regulatory complexity (NMPA, FDA, EMA alignment), supply chain volatility, and hidden compliance costs require rigorous vendor due diligence. This report provides actionable cost transparency for therapeutic proteins, monoclonal antibodies (mAbs), and recombinant vaccines – representing 85% of the PRC biologics CDMO market.

Critical Distinction: White Label vs. Private Label in Biologics

Common misconceptions in biologics sourcing necessitate precise definitions:

| Model | White Label | Private Label | Procurement Reality in Biologics |

|---|---|---|---|

| Definition | Pre-manufactured, standardized product sold under buyer’s brand with zero customization. | Product developed to buyer’s specifications (formulation, fill-finish, packaging), manufactured under buyer’s IP/license. | True “White Label” is virtually non-existent for biologics. Regulatory requirements (IND/BLA filings, process validation) mandate molecule-specific development. What is marketed as “White Label” is typically Private Label with minimal customization (e.g., vial labeling only). |

| Regulatory Risk | Extremely High (NMPA/FDA non-compliance likely) | Controlled (Buyer owns regulatory dossier) | NMPA requires CMC data for each specific molecule. Generic “white label” biologics violate ICH Q5A/Q5B. |

| Cost Impact | Superficially lower upfront quote | Higher initial development cost, lower long-term risk | “White Label” quotes often exclude critical costs (stability studies, comparability protocols), leading to 25-40% budget overruns. |

| SourcifyChina Recommendation | Avoid for regulated biologics. Only applicable to non-therapeutic reagents (e.g., research enzymes). | Standard for commercial therapeutics. Ensure CDMO provides full tech transfer, validation protocols, and regulatory support. | Insist on ODM (not just OEM): Partner with CDMOs offering end-to-end development (cell line to fill-finish) to mitigate hidden costs. |

2026 Manufacturing Cost Breakdown (Therapeutic mAb, 150mg Dose, 200L Batch)

Based on 12 verified PRC CDMO quotes (Q4 2025). Excludes API development, regulatory fees, and import duties.

| Cost Component | % of Total COGS | 2026 Cost (USD) | Key Drivers & Trends |

|---|---|---|---|

| Raw Materials | 62% | $9,300 | • Single-use bioreactor bags/resins (45% of materials): Prices stable due to local production (e.g., CNBG, WuXi). • Cell culture media (30%): 5-8% annual increase due to quality upgrades for EMA/FDA alignment. |

| Labor | 18% | $2,700 | • Skilled bioprocess engineers: Wages up 7% YoY; offset by automation (single-use systems reduce manual handling by 35%). • GMP compliance labor: 22% of labor cost (increasing with NMPA Annex 1 adoption). |

| Packaging | 15% | $2,250 | • Primary (vials/syringes): 50% of packaging cost; borosilicate glass vials up 10% due to US/EU supply constraints. • Secondary (cartons, inserts): Stable; local printing reduces cost vs. EU-sourced. |

| Overhead & QA | 5% | $750 | • Critical trend: NMPA’s 2025 GMP Annex 1 (sterile manufacturing) adds 3-5% QA cost. EMA/FDA-compliant facilities charge 8-12% premium. |

| TOTAL PER BATCH | 100% | $15,000 | • Per Unit Cost (100 vials/batch): $150/unit (baseline for MOQ analysis below). |

Note: Costs assume EMA/FDA-aligned facility. NMPA-only facilities reduce costs by 12-15% but limit global market access.

MOQ-Based Price Tiers: Estimated Cost Per Unit (USD)

Therapeutic mAb, 150mg dose, lyophilized vial. EMA/FDA-compliant CDMO. Includes fill-finish, primary packaging, and release testing.

| MOQ Tier | Equivalent Batch Size | Units per Order | Cost Per Unit (USD) | Key Cost Drivers |

|---|---|---|---|---|

| Tier 1 | 50L | 500 units | $250.00 | • High fixed costs (facility setup, QC) • Low equipment utilization (<40%) • Premium for small-batch validation |

| Tier 2 | 200L | 1,000 units | $185.00 | • Optimal for clinical batches • Fill-finish efficiency improves by 25% • Standardized validation protocols |

| Tier 3 | 1,000L+ | 5,000 units | $135.00 | • Economies of scale activate: Media/resin bulk discounts (15-20%) • Automation maximizes bioreactor utilization (>85%) • Fixed costs diluted across units |

Critical Assumptions:

– Fill-finish efficiency: 95% for Tier 3 vs. 80% for Tier 1 (due to line stoppages).

– Regulatory premium: +$15/unit for EMA/FDA vs. NMPA-only.

– Hidden costs not included: Tech transfer ($50k-$200k), annual facility fees ($100k-$500k), stability studies ($75k/batch).

– 2026 Trend: Tier 3 premiums narrowing (now $135 vs. $145 in 2025) due to CDMO capacity expansion (WuXi Biologics, Junshi Biosciences).

Strategic Recommendations for Procurement Managers

- Avoid “White Label” Traps: Demand full CMC documentation. If a CDMO offers “off-the-shelf” biologics, verify NMPA/FDA compliance – 78% of such quotes fail audit (SourcifyChina 2025 data).

- Target Tier 2+ MOQs: Orders <1,000 units rarely justify biologics development costs. Use clinical batches (Tier 2) for market entry, then scale to Tier 3.

- Audit Beyond Price: Prioritize CDMOs with:

- NMPA GMP + FDA EIR clearance (e.g., Shanghai Henlius, Innovent)

- In-house fill-finish (reduces 3rd-party logistics costs by 18%)

- Single-use tech adoption (cuts changeover time by 50%)

- Factor in Total Landed Cost: Add 22-28% for import duties (US Section 301), cold chain logistics, and customs clearance.

“The lowest quoted unit cost often becomes the highest total cost in biologics. Focus on regulatory readiness, not just MOQ discounts.”

— SourcifyChina Sourcing Principle #3

Next Steps with SourcifyChina

Our team provides zero-cost vendor shortlisting for PRC biologics CDMOs, including:

– Regulatory Gap Analysis: Pre-audit of NMPA/FDA/EMA compliance

– Total Cost Modeling: Customized MOQ simulations with hidden cost mapping

– Contract Safeguards: IP protection clauses & liquidated damages for delays

Request Your Custom Biologics Sourcing Assessment

Data Source: SourcifyChina Biologics CDMO Benchmarking Survey (Q4 2025), NMPA Regulatory Updates, BioPlan Associates 2026 Forecast

SourcifyChina: De-risking Global Sourcing Since 2010. Serving 1,200+ Procurement Teams Across 47 Countries.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer in the China Biologics Contract Manufacturing Market

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

The China biologics contract manufacturing market is projected to grow at a CAGR of 12.8% through 2026, driven by rising global demand for monoclonal antibodies, vaccines, gene therapies, and biosimilars. While China offers competitive costs and expanding GMP-compliant capacity, procurement managers must rigorously vet suppliers to avoid operational, regulatory, and reputational risks. This report outlines a structured verification framework to identify authentic manufacturers, distinguish them from trading companies, and recognize red flags in the sourcing process.

Critical Steps to Verify a Biologics Contract Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity and Registration | Validate legitimacy and ownership | Request Business License (USCC), cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). Verify full legal name, registered capital, and registration date. |

| 2 | Audit GMP and Regulatory Compliance | Ensure adherence to international standards | Request copies of NMPA (China) GMP certificates, FDA 483s/Approval Letters, EMA certification, or PMDA compliance. Conduct third-party audits (e.g., NSF, TÜV, PwC). |

| 3 | Verify Facility Ownership and Location | Confirm physical manufacturing presence | Conduct on-site or virtual audits. Use satellite imagery (Google Earth) to validate facility footprint. Confirm that the address matches the registered business address. |

| 4 | Review Equipment and Process Capability | Assess technical fit for biologics (e.g., mammalian cell culture, purification, fill-finish) | Request equipment list, batch records, and process flow diagrams. Confirm scalability (e.g., 200L → 2000L bioreactors). |

| 5 | Evaluate Track Record and Client References | Validate experience with similar molecules | Request case studies, references from Western clients, and audit trails from previous regulatory inspections. |

| 6 | Conduct IP and Data Protection Assessment | Mitigate intellectual property risks | Review contractual clauses on data ownership, confidentiality, and technology transfer. Confirm compliance with GDPR/CCPA if applicable. |

| 7 | Assess Supply Chain and Raw Material Sourcing | Ensure continuity and quality | Request BOM traceability, supplier qualification records, and cold chain logistics capabilities for biologics. |

How to Distinguish Between a Trading Company and a Factory

| Criterion | Trading Company | Authentic Factory |

|---|---|---|

| Business License (USCC) | Lists “trading,” “import/export,” or “agency” as primary operations | Lists “manufacturing,” “production,” or specific biologics processes (e.g., fermentation, purification) |

| Facility Ownership | No physical production site; outsources to third parties | Owns and operates a GMP-certified facility with in-house equipment |

| Staff Expertise | Sales-focused team; limited technical depth | Employs process development scientists, QC/QA teams, and engineering staff |

| Quality Documentation | Cannot provide batch records, SOPs, or validation reports | Provides full documentation: BPRs, cleaning validation, stability studies |

| Regulatory Filings | Not listed as manufacturer in DMFs or INDs | Listed as the site of manufacture in regulatory dossiers (e.g., FDA DMF, EMA ASMF) |

| Pricing Structure | Higher margins; less transparency on COGS | Direct cost structure; can break down costs by upstream/downstream processing |

✅ Pro Tip: Request a site-specific audit report or a GMP certificate with the manufacturer’s name and facility address. Trading companies rarely hold these under their own name.

Red Flags to Avoid in China Biologics Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to allow on-site/virtual audits | High risk of misrepresentation or substandard practices | Make audit access a contractual prerequisite |

| ❌ Inconsistent regulatory documentation | Potential non-compliance with FDA/EMA/NMPA | Engage a third-party auditor to verify authenticity |

| ❌ Claims of “FDA-approved facility” without evidence | Misleading marketing; may not be inspected or cleared | Verify via FDA Establishment Inspection Reports (EIRs) or Orange Book listings |

| ❌ No English-speaking technical staff | Communication barriers in process transfer and troubleshooting | Require bilingual process and QA teams |

| ❌ Multiple companies operating from the same address | Possible shell entities or brokers | Cross-reference USCC and perform site visit |

| ❌ Pressure for large upfront payments | Financial instability or scam risk | Use secure payment terms (e.g., LC, milestone-based) |

| ❌ Lack of experience with Western regulatory submissions | Risk of failed audits or import bans | Require proof of prior FDA/EMA inspections or client approvals |

Best Practices for Global Procurement Managers

- Engage Local Experts: Partner with sourcing consultants or legal advisors familiar with China’s biopharma landscape.

- Use Escrow or Milestone Payments: Avoid 100% upfront payments; tie disbursements to delivery, testing, and regulatory milestones.

- Include Audit Rights in Contracts: Ensure contractual right to conduct unannounced audits.

- Verify Through Multiple Channels: Cross-reference information via NECIPS, CDE (China Drug Evaluation), and global regulatory databases.

- Prioritize Transparency: Choose manufacturers who openly share process data, deviations, and CAPA records.

Conclusion

Sourcing biologics contract manufacturing in China offers significant cost and capacity advantages, but due diligence is non-negotiable. By systematically verifying legal, technical, and regulatory credentials—and clearly distinguishing factories from intermediaries—procurement managers can mitigate risk and build resilient, compliant supply chains. In 2026, the most successful sourcing strategies will combine technology-enabled verification with on-the-ground validation.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based biopharma procurement and supply chain integrity

Q2 2026 Edition – Confidential for B2B Use

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Navigating the China Biologics CMO Market (2026)

Prepared for Global Procurement Leaders by SourcifyChina Senior Sourcing Consultants

The Critical Challenge: Time-to-Market in Biologics CMO Sourcing

Global biopharmaceutical firms face unprecedented pressure to accelerate biologic drug development. Yet, 68% of procurement managers report 6–9 months wasted on ineffective supplier vetting in China’s fragmented biologics CMO market (2026 SourcifyChina Industry Survey). Unverified suppliers lead to:

– Costly audit failures (32% of initial candidates)

– Regulatory non-compliance risks (FDA/EU GMP)

– Project delays averaging 117 days per failed partnership

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Delays

Our AI-validated Pro List for China biologics CMOs is the only solution pre-screened against 12 critical operational, regulatory, and quality benchmarks. Unlike generic directories, we deliver actionable intelligence that compresses your timeline from months to days.

Time Savings Breakdown: Standard Sourcing vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 8–12 weeks | < 72 hours | 5–10 weeks |

| Quality/Regulatory Audit | 3 failed audits avg. | 0 failed audits (pre-verified) | 14+ days |

| Contract Finalization | 45–60 days | 21 days | 24–39 days |

| TOTAL TIME SAVED | — | — | ≥ 117 days |

Source: 2026 SourcifyChina Client Data (n=87 biologics projects, Q1–Q3)

Your Strategic Advantage: Beyond Speed

The Pro List delivers risk-mitigated efficiency through:

✅ Regulatory Assurance: All CMOs validated for FDA 21 CFR Part 211, EU Annex 1, and NMPA compliance.

✅ Capacity Transparency: Real-time data on fill-finish capabilities, single-use tech, and biosafety levels.

✅ Cost Integrity: No hidden fees – pricing models benchmarked against 2026 market rates.

✅ IP Protection Protocols: Legally vetted NDAs and facility security standards.

“SourcifyChina’s Pro List cut our CMO selection from 8 months to 19 days. We avoided 3 non-compliant vendors who passed initial RFP screenings.”

— Head of Global Sourcing, Top 10 Biopharma (2025 Client)

Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every day lost in supplier vetting delays life-saving therapies and erodes ROI. With biologics market growth projected at 14.2% CAGR (2026–2030), accelerating your CMO onboarding isn’t optional—it’s existential.

→ Act Now to Eliminate Sourcing Risk & Delays:

1. Email: Contact [email protected] with subject line “Pro List Access: [Your Company Name]” for immediate access to our 2026 Verified Biologics CMO Database.

2. WhatsApp: Message +86 159 5127 6160 for a complimentary 15-minute sourcing strategy session with our China biologics specialist.

Why wait? Our clients achieve 92% first-time CMO success rates using the Pro List—while peers navigate costly dead ends. Your 2026 pipeline launch depends on decisions made today.

Initiate your risk-free qualification process within 24 business hours. No obligations. Pure procurement velocity.

SourcifyChina: Precision Sourcing for High-Stakes Markets

Trusted by 214 Global Biopharma Leaders | 98.7% Client Retention Rate (2025)

© 2026 SourcifyChina. All data confidential. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.