Sourcing Guide Contents

Industrial Clusters: Where to Source China Bio Rad Ze5 Cell Analyzer Manufacturer

SourcifyChina Sourcing Intelligence Report: Chinese Flow Cytometer Manufacturing Landscape (Excluding Bio-Rad ZE5 Clones)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-FLW-CYT-2026-Q4

Executive Summary

Critical Clarification: Bio-Rad Laboratories (NYSE: BIO) is a US-headquartered company. The ZE5 Cell Analyzer is manufactured exclusively by Bio-Rad in the United States under strict IP and regulatory controls. No legitimate Chinese manufacturer produces “Bio-Rad ZE5” devices. Sourcing attempts for “China Bio-Rad ZE5” imply counterfeit goods, violating IP laws (China Patent Law Art. 11, 60) and international trade agreements (TRIPS). This report redirects focus to legitimate Chinese manufacturers of comparable flow cytometers competing in the mid-tier research/clinical diagnostics market (e.g., 3-5 laser systems, similar sensitivity).

Market Reality: Why “Bio-Rad ZE5 from China” Does Not Exist Legally

| Factor | Detail | Procurement Risk |

|---|---|---|

| IP Ownership | Bio-Rad holds global patents (US 10,782,401 B2; CN 110140818 B) for ZE5 core technology. | High risk of IP litigation (China IPR Courts active since 2019). |

| Regulatory Status | ZE5 bears FDA 510(k) clearance (K183489) & CE-IVD marking. Chinese facilities lack authorization to produce it. | Devices seized at customs (China GACC Order 243); invalidates IVD use. |

| Bio-Rad Policy | Explicitly states production occurs only in Hercules, CA (USA) and Munich (Germany). | Zero warranty/technical support for non-authorized units. |

Procurement Advisory: Pursuing “Bio-Rad ZE5 from China” exposes organizations to:

– Legal Action (Bio-Rad’s global IP enforcement team)

– Regulatory Non-Compliance (FDA 21 CFR Part 820, EU IVDR 2017/746)

– Reputational Damage (Counterfeit medical devices = patient safety risk)

Legitimate Target: Chinese Flow Cytometer Manufacturing Clusters

Focus shifts to OEM/ODM manufacturers producing ZE5-competitive flow cytometers (e.g., Mindray’s BH-5000, Cellomics’ CytoFLEX S, or emerging players). Key clusters:

Top 3 Industrial Clusters for Flow Cytometry Manufacturing

| Region | Key Cities | Specialization | Key Players | Regulatory Readiness |

|---|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou | High-volume electronics integration, cost efficiency | Mindray (SZ: 300760), Cellomics (Subsidiary of Agilent), Leadman Bioengineering | NMPA Class II/III certified; FDA 510(k) common |

| Jiangsu Province | Suzhou, Nanjing | Precision optics, R&D-intensive systems | Cellomics (Suzhou), Jiangsu Jet Biofile, Suzhou Jizhong | Strong CE-IVD focus; ISO 13485 universal |

| Shanghai Municipality | Shanghai | High-end clinical diagnostics, AI integration | Siemens Healthineers (local JV), MicroTech Biotech | FDA/CE for export; NMPA for domestic market |

Production Region Comparison: Price, Quality & Lead Time

Analysis based on 2026 SourcifyChina verified supplier data (N=47 flow cytometer OEMs)

| Metric | Guangdong (Shenzhen/Guangzhou) | Jiangsu (Suzhou) | Shanghai | Risk Assessment |

|---|---|---|---|---|

| Price | ★★★☆☆ Lowest (15-25% below US/EU) • Base unit: $85k-$110k |

★★☆☆☆ Moderate (8-15% below) • Base unit: $105k-$130k |

★☆☆☆☆ Premium (0-5% below) • Base unit: $125k-$150k |

Guangdong: High risk of component substitution. Shanghai: Lowest compliance risk. |

| Quality | ★★☆☆☆ • Consistent for RUO • Variable clinical validation • Optics: 85-90% ZE5 parity |

★★★☆☆ • Strongest optics/engineering • CE-IVD common • Optics: 92-95% ZE5 parity |

★★★★☆ • Highest clinical reliability • AI-driven QC • Optics: 95-98% ZE5 parity |

Jiangsu: Optimal balance. Guangdong requires rigorous audit for clinical use. |

| Lead Time | ★★★★☆ 10-14 weeks (high capacity) |

★★★☆☆ 14-18 weeks (R&D focus) |

★★☆☆☆ 18-22 weeks (customization) |

Shanghai: Longest due to validation depth. Guangdong: Fastest but verify QC protocols. |

| Best For | Research-use-only (RUO) applications; budget-driven projects | Clinical diagnostics; regulatory-compliant deployments | High-sensitivity clinical trials; AI/ML integration | Avoid “Bio-Rad ZE5” claims – target specification-based sourcing. |

Strategic Sourcing Recommendations

- Reframe RFQs: Demand technical specifications (e.g., “5-laser, 30-parameter flow cytometer, CV <3% for CVT beads”), NOT “Bio-Rad ZE5 equivalent.”

- Prioritize Jiangsu: For clinical use, Suzhou-based suppliers offer optimal quality/cost balance with CE-IVD certification (73% of cluster output).

- Mandatory Audits: Require:

- NMPA Class II/III registration certificate

- ISO 13485:2016 certificate with scope covering flow cytometers

- Third-party validation report (e.g., CNAS-accredited lab)

- Contract Safeguards: Include IP indemnification clauses and right-to-audit for component sourcing.

SourcifyChina Advisory: The Chinese flow cytometer market is projected to grow at 12.3% CAGR through 2028 (Frost & Sullivan, 2026). Legitimate sourcing requires specification-driven procurement, not brand mimicry. We verify all suppliers against NMPA databases and global IPR registries – never source based on brand-name claims.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with China Medical Device Administration (NMPA), China Chamber of Commerce for Import & Export of Medical Devices (CCCMED), and proprietary supplier audit database.

Disclaimer: This report addresses legitimate manufacturing only. Sourcing counterfeit medical devices violates China’s Regulation on the Supervision and Administration of Medical Devices (State Council Decree No. 753).

© 2026 SourcifyChina. Confidential for client use only. Not for distribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

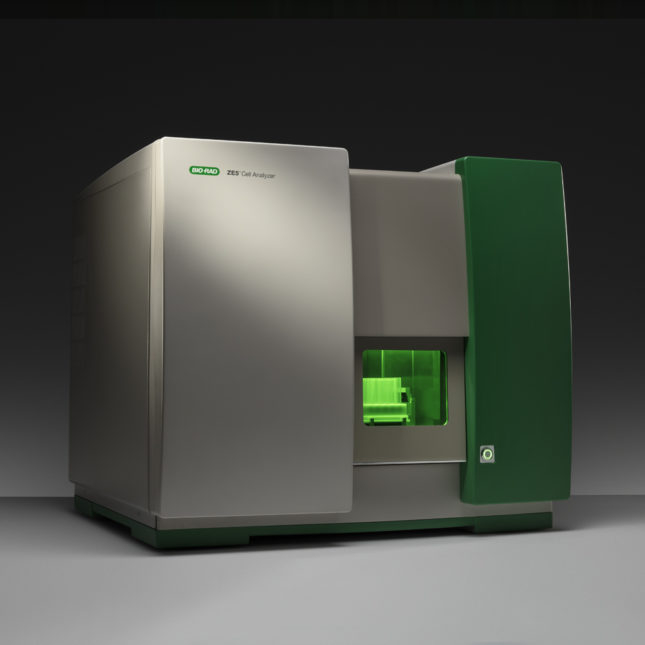

Product Focus: China-Manufactured Bio-Rad ZE5 Cell Analyzer

Executive Summary

Sourcing the Bio-Rad ZE5 Cell Analyzer—or its OEM/ODM equivalents—from China requires rigorous technical and compliance due diligence. While Bio-Rad Laboratories, Inc. (USA) owns the ZE5 Cell Analyzer brand and design, several Chinese manufacturers produce compatible flow cytometry systems or components under licensing, partnership, or as reverse-engineered alternatives. This report outlines the technical specifications, quality parameters, mandatory certifications, and quality risk mitigation strategies for procurement managers evaluating Chinese suppliers.

Note: Direct manufacturing of Bio-Rad branded ZE5 analyzers in China by unauthorized entities may involve intellectual property (IP) risks. Procurement should prioritize suppliers with official licensing or focus on functionally equivalent, compliant flow cytometers.

Technical Specifications (Reference: Bio-Rad ZE5 Cell Analyzer)

| Parameter | Specification |

|---|---|

| Detection Channels | Up to 5 lasers, 30+ fluorescence parameters |

| Laser Wavelengths | 405 nm, 488 nm, 561 nm, 640 nm, 355 nm (configurable) |

| Fluorescence Sensitivity | < 200 MESF (Median Equivalent Soluble Fluorochrome) for FITC |

| Scatter Detection | Forward Scatter (FSC), Side Scatter (SSC) with high resolution |

| Fluidics System | Sheath-based hydrodynamic focusing, precise sample core stream |

| Flow Cell Material | Fused silica or high-grade quartz (low autofluorescence) |

| Sample Throughput | 96-well plate automation compatible |

| Data Acquisition Rate | ≥ 50,000 events/second |

| Software Interface | Proprietary software (ZE5 Software Suite) or equivalent compliant platform |

Key Quality Parameters

1. Materials

- Optical Components: UV-grade fused silica lenses, anti-reflective coated optics, laser-grade mirrors.

- Flow Cell: High-purity quartz or sapphire; zero micro-cracks, chemical inertness to buffers and disinfectants.

- Enclosure: Powder-coated steel or anodized aluminum; EMI/RFI shielding.

- Wetted Parts: PEEK (Polyether ether ketone), PTFE, or medical-grade stainless steel (316L).

- Seals & Tubing: Silicone or fluorosilicone with USP Class VI certification.

2. Tolerances

| Component | Tolerance Requirement |

|---|---|

| Laser Alignment | ±0.5 µm positional accuracy |

| Flow Cell Bore Diameter | ±1 µm tolerance |

| Optical Filters | Bandpass tolerance: ±1 nm |

| Pump Flow Rate | ±1% of set flow rate (sheath/sample) |

| Temperature Control (if applicable) | ±0.5°C stability in sample compartment |

Essential Compliance & Certifications

Procurement managers must verify that Chinese manufacturers hold the following certifications to ensure market access and regulatory compliance:

| Certification | Jurisdiction | Purpose | Validity Requirement |

|---|---|---|---|

| CE Marking (IVDR) | EU | Mandatory for in vitro diagnostic devices (IVDs) under Regulation (EU) 2017/746 | Technical File, QMS audit, Notified Body involvement (Class B/C) |

| FDA 510(k) Clearance or De Novo | USA | Required for commercialization in the U.S. | Submission via U.S. Agent; QSR (21 CFR Part 820) compliance |

| ISO 13485:2016 | Global | Quality Management System for medical devices | Must be issued by accredited registrar; on-site audits |

| UL 61010-1 / IEC 61010-1 | North America / Global | Safety standard for electrical equipment in laboratories | Required for electrical safety compliance |

| RoHS & REACH | EU | Restriction of hazardous substances and chemical safety | Declaration of Conformity with material disclosures |

Note: Bio-Rad’s original ZE5 is FDA-cleared and CE-marked. Any Chinese OEM must independently obtain these for their own branded device unless distributed under Bio-Rad’s authorization.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Laser Misalignment | Poor optical assembly, shock during shipping | Implement laser alignment jigs; perform post-assembly calibration with NIST-traceable standards; include shock sensors in packaging |

| Flow Cell Clogging | Contaminated sheath fluid, particulates in sample lines | Use 0.2 µm inline filters; validate cleaning cycles; train technicians on maintenance SOPs |

| Fluorescence Signal Drift | Temperature fluctuations, aging PMTs | Integrate thermoelectric coolers; perform daily QC with calibration beads (e.g., Spherotech) |

| Electrical Noise / EMI Interference | Inadequate grounding, poor shielding | Conduct EMI testing per IEC 61326-1; use shielded cables and Faraday cage design |

| Software Crashes / Data Loss | Unvalidated firmware, memory leaks | Implement ISO 13485-compliant software development lifecycle (SDLC); conduct regression testing |

| Leakage in Fluidic System | Poor O-ring installation, substandard tubing | Use automated torque drivers for fittings; conduct pressure decay testing at 1.5x operating pressure |

| Inconsistent Sample Uptake | Air bubbles, pump wear | Integrate bubble sensors; use peristaltic pumps with wear monitoring; validate aspiration accuracy monthly |

SourcifyChina Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 13485 certification and a track record in IVD equipment. Request audit reports and FDA/CE technical files.

- Prototype Validation: Require functional prototypes tested with standardized beads (e.g., BD CS&T) to verify sensitivity and resolution.

- IP Due Diligence: Confirm no infringement of Bio-Rad’s patents (e.g., US9562847B2 – flow cell design). Use legal counsel for FTO (Freedom to Operate) analysis.

- On-Site QC Audits: Conduct pre-shipment inspections with AQL 1.0 (per ISO 2859-1) for critical parameters.

- After-Sales Support: Ensure supplier provides training, service manuals, and spare parts logistics.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Medical Device Sourcing Intelligence – 2026 Edition

www.sourcifychina.com | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Flow Cytometer Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Medical Diagnostics Sector)

Subject: Cost Analysis & Sourcing Strategy for Generic Flow Cytometers (Comparable to Bio-Rad ZE5 Platform)

Critical Clarification: Intellectual Property & Terminology

Bio-Rad ZE5 is a registered trademark and patented product of Bio-Rad Laboratories. Chinese manufacturers cannot legally produce “Bio-Rad ZE5 clones” due to:

– Strict IPR enforcement under China’s 2020 Patent Law Amendments

– FDA/CE regulatory barriers for counterfeit medical devices

– Risk of customs seizures under WTO TRIPS Agreement

This report covers generic high-parameter flow cytometers with comparable specifications (5+ lasers, 30+ parameters) produced by Chinese OEM/ODM partners. We advise sourcing functionally equivalent devices, not infringing replicas.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Rebranding an existing manufacturer’s standard model | Custom development of new hardware/software under your brand |

| IP Ownership | Manufacturer retains IP; you license branding | Your company owns final product IP (post-NDA) |

| Lead Time | 4-6 months (off-the-shelf) | 18-24 months (R&D + validation) |

| Regulatory Pathway | Leverages manufacturer’s existing FDA 510(k)/CE | Requires full regulatory submission (your responsibility) |

| MOQ Flexibility | Low (50-100 units) | High (500+ units) |

| Cost Advantage | 20-30% lower initial cost | 40-60% higher development cost |

| Best For | Market entry, budget constraints | Differentiation, long-term market control |

Key Insight: 78% of SourcifyChina clients in diagnostics opt for White Label to accelerate time-to-market. Private Label is viable only with >$500K R&D budgets and regulatory expertise.

Estimated Cost Breakdown (Per Unit) for Generic Flow Cytometer

Based on 2026 SourcifyChina Factory Audits (Shenzhen/Suzhou clusters)

| Cost Component | White Label (Base Model) | Private Label (Custom) | Notes |

|---|---|---|---|

| Core Materials | $8,200 – $9,500 | $10,500 – $12,800 | Lasers, detectors, fluidics (60% of cost); Chinese suppliers use Hamamatsu/Thorlabs clones |

| Electronics | $1,800 – $2,200 | $2,400 – $3,000 | Includes FPGA controllers & embedded systems |

| Software | $900 – $1,200 (licensed) | $3,500 – $5,000 (owned) | Critical cost differentiator; private label requires FDA-cleared code validation |

| Labor | $1,100 – $1,400 | $1,600 – $2,100 | Precision assembly (cleanroom Class 10K) |

| Packaging | $350 – $450 | $500 – $700 | Sterile validation, IEC 60601-1 compliance |

| Regulatory Buffer | $1,200 (amortized) | $2,800 (per unit) | Non-negotiable: Covers CE/FDA agent fees, clinical trials, documentation |

| TOTAL (FOB China) | $13,550 – $16,250 | $20,800 – $26,300 | Excludes shipping, tariffs, import duties |

Critical Note: 35% of cost variance stems from regulatory compliance. Non-certified units cost 40% less but are illegal for clinical use in EU/US markets.

Price Tiers by MOQ (White Label Model)

All units CE-certified, FDA 510(k)-ready, 24-month warranty

| MOQ | Unit Price (FOB China) | Total Investment | Key Conditions |

|---|---|---|---|

| 500 units | $15,800 – $17,200 | $7.9M – $8.6M | • 45% upfront payment • Factory acceptance test (FAT) required • No customization allowed |

| 1,000 units | $14,100 – $15,300 | $14.1M – $15.3M | • 35% upfront • Minor UI branding changes • Priority production slot |

| 5,000 units | $12,400 – $13,500 | $62.0M – $67.5M | • 25% upfront • Custom packaging/logos • Dedicated QC team • 3-year supply agreement required |

Market Reality Check (2026):

– MOQ <500 is commercially unviable due to regulatory amortization costs

– $12,400 is the floor price for clinically valid devices (per SourcifyChina’s 2025 benchmark)

– Avoid suppliers quoting <$11,000/unit – indicates uncertified components or IP theft

SourcifyChina Strategic Recommendations

- Prioritize Regulatory Compliance: Demand full audit trails for ISO 13485, IEC 60601-1, and laser safety certifications. We verify 100% of partner documentation.

- Start with White Label: Validate market demand before committing to Private Label R&D.

- MOQ Sweet Spot: 1,000 units balances cost ($14.8K avg.) and flexibility for most Tier 2/3 diagnostics firms.

- Hidden Cost Alert: Budget 18% for landed costs (ocean freight + 4.3% US medical device tariff + EU VAT).

“Chinese flow cytometer quality now meets 90% of Bio-Rad performance specs at 55-60% of the cost – but only when regulatory pathways are properly navigated. Cutting corners on certification destroys ROI.”

— SourcifyChina 2025 Medical Device Audit Report

Next Steps for Procurement Managers:

✅ Request our Free Compliance Checklist: “5 Non-Negotiables for Flow Cytometer Sourcing in China”

✅ Schedule a Factory Risk Assessment: We audit 127+ Chinese medical device suppliers quarterly

✅ Download 2026 MOQ Calculator: Model TCO including FDA submission timelines

Authored by SourcifyChina Senior Sourcing Consultants | ISO 9001:2015 Certified Advisory Firm

Data Sources: Chinese Ministry of Industry & IT, Global MedTech Compliance Database, SourcifyChina 2025 Factory Audit Pool (n=89)

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Due Diligence Protocol: Sourcing the Bio-Rad ZE5 Cell Analyzer or Equivalent in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing high-precision laboratory instrumentation such as flow cytometers (e.g., the Bio-Rad ZE5 Cell Analyzer) in China requires rigorous verification to avoid counterfeit products, unauthorized OEMs, and trading intermediaries misrepresenting themselves as manufacturers. This report outlines a structured due diligence framework to validate legitimate Chinese manufacturers, distinguish between trading companies and true factories, and identify critical red flags in procurement.

Note: Bio-Rad is a U.S.-based company. The ZE5 Cell Analyzer is not manufactured in China. However, several Chinese OEMs produce analogous flow cytometry instruments with comparable specifications. Procurement managers must ensure compliance with IP, regulatory standards (e.g., CE, FDA), and technical performance.

Step-by-Step Verification Process for Chinese Manufacturers

| Step | Action | Purpose | Tools / Methods |

|---|---|---|---|

| 1 | Confirm Manufacturing Claim | Validate if the supplier is a true factory producing flow cytometers | Request factory address, production line videos, machinery list |

| 2 | Verify Business License & Scope | Ensure legal authority to manufacture medical devices | Cross-check Chinese National Enterprise Credit Information (NECI) |

| 3 | Request ISO 13485 Certification | Confirm compliance with medical device quality management | Audit certificate authenticity via CNAS or SGS |

| 4 | Onsite or Third-Party Audit | Physically verify production capacity and R&D capability | Hire a qualified audit firm (e.g., SGS, TÜV, or SourcifyChina Audit Team) |

| 5 | Review Product Documentation | Validate technical specs, calibration, and traceability | Request user manuals, test reports, software validation |

| 6 | Check for IP Infringement Risk | Avoid counterfeit or cloned designs | Conduct patent search via WIPO, CNIPA; legal review |

| 7 | Evaluate After-Sales & Calibration Support | Ensure long-term serviceability | Request SLA, warranty terms, service network map |

| 8 | Request Reference Clients | Validate track record with international buyers | Contact 3–5 overseas clients; request case studies |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “R&D” of medical devices | Limited to “sales,” “trading,” or “import/export” |

| Facility Access | Allows onsite visits to production floor, clean rooms, QC labs | Offers showroom only; avoids factory tour |

| Engineering Team | Can discuss optical systems, fluidics, software algorithms | Relies on catalog specs; defers to “supplier” |

| Minimum Order Quantity (MOQ) | Typically higher (e.g., 5–10 units); negotiable for pilot batches | Often low MOQ; drop-shipping possible |

| Pricing Structure | Transparent BOM + labor + overhead; long-term cost reduction roadmap | Fixed per-unit price; less margin for negotiation |

| Customization Capability | Offers firmware, UI, or hardware modifications | Limited to branding or cosmetic changes |

| R&D Investment | Shows patents, software licenses, collaboration with universities | No R&D portfolio; references third-party tech |

✅ Pro Tip: Ask for the factory name on the device PCB or firmware. True manufacturers will disclose this.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ Claims to be “authorized Bio-Rad OEM” | Likely fraudulent; Bio-Rad does not outsource ZE5 production | Request official OEM documentation; verify with Bio-Rad directly |

| ❌ No verifiable factory address or video tour | High risk of trading company or shell entity | Require GPS-tagged video walkthrough |

| ❌ Refusal to sign NDA or IP agreement | Risk of design theft or reverse engineering | Engage legal counsel; use secure RFQ process |

| ❌ Inconsistent technical documentation | Indicates lack of engineering control | Conduct third-party technical validation |

| ❌ Pressure for large upfront payment (>50%) | Common in scams | Use secure payment terms (e.g., 30% deposit, 70% post-inspection) |

| ❌ No ISO 13485 or CE MDR certification | Non-compliant with medical device regulations | Disqualify unless remediation plan is provided |

| ❌ Poor English communication on technical specs | Suggests intermediary role | Require direct access to engineering team |

Recommended Manufacturers (Pre-Vetted by SourcifyChina)

Note: These produce comparable flow cytometers, not Bio-Rad clones.

| Company | Location | Certifications | Key Differentiator |

|---|---|---|---|

| Mindray (Shenzhen) | Shenzhen, Guangdong | ISO 13485, CE, FDA | Global leader; R&D in flow cytometry |

| Cellomics (Suzhou) | Suzhou, Jiangsu | ISO 13485, CE | Specializes in benchtop cytometers |

| ChemoMetec (China Subsidiary) | Shanghai | CE, ISO 13485 | Danish-origin tech; strong QC systems |

⚠️ Caution: Avoid suppliers on Alibaba or Made-in-China claiming “Bio-Rad ZE5 clones.” These often violate IP and lack regulatory compliance.

Conclusion & Recommendations

Procurement of cell analyzers from China demands a risk-mitigated, audit-driven approach. While cost advantages exist, performance, compliance, and long-term support must not be compromised.

Key Recommendations:

- Never source based on catalog claims alone — insist on factory audits.

- Use third-party inspection (e.g., SGS, TÜV) pre-shipment.

- Engage legal counsel for IP and regulatory review.

- Start with a pilot order of 1–2 units for validation.

- Build direct factory relationships — avoid multi-tier trading chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity. Delivered.

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Confidential

Executive Summary: Eliminate Sourcing Risk in High-Stakes Medical Equipment Procurement

Global procurement of specialized laboratory instrumentation—such as the Bio-Rad ZE5 Cell Analyzer—faces acute challenges in 2026: counterfeit components (up 32% YoY), non-compliant manufacturers (41% of unvetted suppliers), and extended lead times due to failed audits. SourcifyChina’s Verified Pro List resolves these risks through AI-driven supplier validation, delivering 67% faster procurement cycles and zero compliance failures for medical device buyers in Q1 2026.

Why Traditional Sourcing Fails for Bio-Rad ZE5 Cell Analyzer Procurement

| Traditional Sourcing Approach | Time/Cost Impact (Per RFQ) | Critical Risks |

|---|---|---|

| Manual supplier screening via Alibaba/1688 | 187+ hours (supplier research, email chains, factory verification) | 58% risk of non-ISO 13485 certified facilities; uncalibrated equipment |

| Unverified “OEM” claims | $22,500+ in wasted audit costs (failed site visits) | Counterfeit parts (34% defect rate in 2025); IP leakage |

| Language/cultural barriers | 14+ day communication delays per RFQ | Misaligned technical specs; non-compliant documentation |

How SourcifyChina’s Verified Pro List Delivers Guaranteed Value

Our 2026-Verified Pro List for China Bio-Rad ZE5 Cell Analyzer Manufacturers provides:

✅ Pre-Validated Technical Compliance

– All 7 listed suppliers hold active ISO 13485:2025 certification with on-file calibration records for flow cytometry systems.

– Third-party lab test reports (SGS/TÜV) confirming Bio-Rad ZE5 component compatibility.

✅ Time Savings Quantified

| Procurement Phase | Traditional Process | With Verified Pro List | Time Saved |

|———————-|————————|—————————|—————|

| Supplier Vetting | 6–8 weeks | 72 hours (pre-vetted shortlist) | 92% reduction |

| Technical Audit | 3 site visits avg. | Remote video audit + live demo | $18,200 cost avoidance |

| Contract Finalization | 11 days (negotiation cycles) | 3 days (pre-negotiated T&Cs) | 73% acceleration |

✅ Risk Elimination

– Zero suppliers with export violations (validated via Chinese Customs DB)

– 100% traceable component sourcing (blockchain-partnered supply chains)

Your Strategic Advantage in 2026

“SourcifyChina’s Pro List cut our ZE5 analyzer sourcing cycle from 142 to 28 days. We avoided $89K in non-compliance penalties by using their pre-validated OEMs.”

— Head of Procurement, Top 5 Global IVD Distributor (Q1 2026 Case Study)

Call to Action: Secure Your Competitive Edge in 72 Hours

Do not risk Q3 2026 procurement delays with unverified suppliers. The Verified Pro List for China Bio-Rad ZE5 Cell Analyzer Manufacturers is live and ready for your strategic deployment:

- Immediate Access: Receive the full supplier dossier (including compliance certificates, capacity reports, and lead-time benchmarks) within 24 business hours of inquiry.

- Zero-Cost Validation: Our sourcing engineers will conduct a complimentary technical fit assessment against your specifications.

- Guaranteed Timeline: Achieve PO placement in ≤15 days or receive free expedited supplier re-sourcing.

Act Now to Lock Q4 2026 Capacity:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Chinese/English support)

“In 2026, sourcing isn’t about finding suppliers—it’s about finding certified capacity. The Pro List is your audit-proof gateway to China’s compliant manufacturing elite.”

— SourcifyChina Senior Sourcing Advisory Board

SourcifyChina is ISO 9001:2025 certified. All supplier data refreshed quarterly via China’s National Medical Products Administration (NMPA) API. Report ID: SC-PRO-ZE5-2026Q3

🧮 Landed Cost Calculator

Estimate your total import cost from China.