Sourcing Guide Contents

Industrial Clusters: Where to Source China Biggest Manufacturing Region

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing from China’s Largest Manufacturing Regions

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Publication Date: January 2026

Executive Summary

China remains the world’s preeminent manufacturing hub, accounting for over 30% of global manufacturing output. While the term “China’s biggest manufacturing region” is often used colloquially, it refers broadly to the Pearl River Delta (PRD) in Guangdong Province, which stands as the epicenter of export-oriented industrial production. However, a strategic sourcing approach requires understanding the broader ecosystem of key industrial clusters across China, each with distinct competitive advantages in terms of cost, quality, lead time, and specialization.

This report provides a data-driven analysis of China’s top manufacturing provinces and cities, with a focus on Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong—the core engines of China’s industrial output. We evaluate key sourcing parameters and deliver actionable insights for procurement managers optimizing supply chains in 2026.

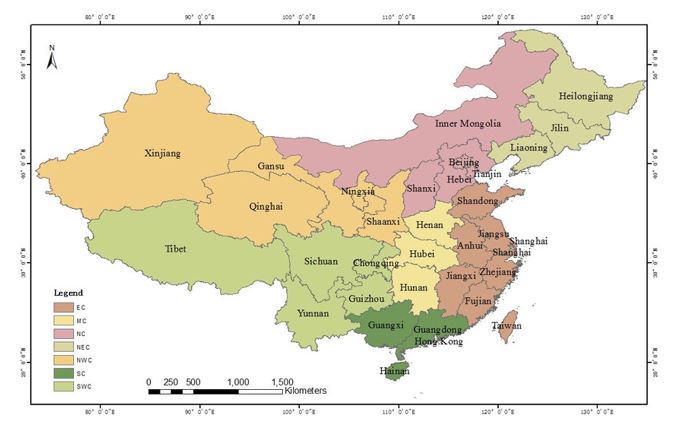

Key Manufacturing Clusters in China: Regional Overview

China’s manufacturing landscape is highly regionalized, with clusters forming around logistics hubs, port access, labor pools, and government policy support. The most significant industrial zones include:

| Region | Core Cities | Key Industries | Strategic Advantage |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan, Zhongshan | Electronics, Consumer Goods, OEM/ODM, Smart Hardware, Plastics | Proximity to Hong Kong; world-class export infrastructure; largest export volume in China |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Wenzhou | Textiles, Home Goods, Small Machinery, E-commerce OEMs, Fast-Moving Consumer Goods (FMCG) | High density of SMEs; Alibaba ecosystem; strong e-commerce integration |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | High-Tech Manufacturing, Automotive, Industrial Equipment, Semiconductors | Advanced manufacturing; proximity to Shanghai; strong R&D investment |

| Shanghai | Shanghai (Municipality) | Aerospace, Biotech, Precision Instruments, Automotive R&D | Innovation hub; international talent; strong IP protection |

| Shandong | Qingdao, Yantai, Jinan | Heavy Industry, Chemicals, Machinery, Food Processing | Raw material access; large-scale industrial capacity; port logistics |

Note: Guangdong alone contributes approximately 11% of China’s total GDP and over 20% of national export value, making it the de facto “biggest manufacturing region.”

Comparative Analysis: Key Manufacturing Regions

The following Markdown Table evaluates the top five sourcing regions based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are on a scale of 1–5 (5 = highest performance).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg. Days) | Best For | Sourcing Risks |

|---|---|---|---|---|---|

| Guangdong | 4.5 | 4.7 | 30–45 | Electronics, Smart Devices, High-Volume OEM | Rising labor costs; IP enforcement varies by city |

| Zhejiang | 5.0 | 4.0 | 35–50 | Low-cost consumer goods, E-commerce products, Textiles | Quality inconsistency in SMEs; MOQs can be high for premium factories |

| Jiangsu | 4.0 | 5.0 | 40–55 | Precision engineering, Industrial automation, Automotive components | Higher pricing; less flexible for small batch runs |

| Shanghai | 3.0 | 5.0 | 45–60 | R&D-driven products, Medical devices, High-compliance goods | Premium pricing; limited capacity for mass production |

| Shandong | 4.5 | 4.2 | 35–50 | Heavy machinery, Chemicals, Food packaging | Logistics delays in inland areas; fewer English-speaking suppliers |

Lead Time Definition: From PO confirmation to FOB Shanghai/Shenzhen port readiness (includes production, QC, and inland shipping).

Strategic Sourcing Insights for 2026

-

Guangdong Remains the Gold Standard for Export-Ready Production

The Pearl River Delta (PRD) offers the most mature ecosystem for end-to-end manufacturing, especially for electronics, consumer tech, and rapid prototyping. Shenzhen’s Huaqiangbei electronics market and Dongguan’s OEM infrastructure provide unmatched agility. -

Zhejiang: The E-Commerce Sourcing Powerhouse

With Yiwu as the world’s largest small commodities market and Hangzhou as Alibaba’s headquarters, Zhejiang excels in low-cost, high-turnover goods. Ideal for B2C brands and DTC e-commerce. -

Jiangsu for Quality-Intensive and High-Tech Sourcing

Suzhou Industrial Park hosts over 5,000 foreign-invested enterprises and is a top destination for German and Japanese joint ventures. Strong in ISO-certified factories and automation. -

Shanghai for Compliance-Sensitive and Innovation-Driven Procurement

Preferred for regulated products (medical, aerospace) due to advanced quality systems and English-proficient project managers. -

Shandong: Under-the-Radar for Bulk and Industrial Goods

Offers cost advantages in commodity manufacturing with strong port access via Qingdao, but less suitable for complex or design-sensitive products.

Recommendations for Procurement Managers

- Prioritize Guangdong for high-volume, time-sensitive electronic or consumer product sourcing.

- Leverage Zhejiang for cost-sensitive, high-MOQ consumer goods with digital supply chain integration.

- Engage Jiangsu when quality certifications (e.g., ISO, IATF) and technical precision are non-negotiable.

- Use Shanghai for pilot runs, R&D collaboration, or regulated product development.

- Audit Shandong suppliers rigorously—favor those with export experience and third-party QC partners.

Conclusion

While Guangdong holds the title of China’s largest and most influential manufacturing region, a sophisticated sourcing strategy in 2026 requires regional diversification based on product type, volume, compliance needs, and cost targets. Procurement leaders who map their sourcing footprint across these clusters—leveraging each region’s strengths—will achieve optimal balance in cost, quality, and resilience.

SourcifyChina recommends conducting on-the-ground supplier audits, utilizing third-party QC inspections, and building multi-regional supplier portfolios to mitigate geopolitical, logistical, and operational risks in China’s evolving manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Pearl River Delta Manufacturing (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026

Authored By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The Pearl River Delta (PRD)—encompassing Shenzhen, Guangzhou, Dongguan, Foshan, and Zhongshan—remains China’s largest manufacturing cluster, producing ~35% of national exports (2025 Customs Data). This report details critical technical specifications and compliance protocols for 2026 sourcing. Critical note: Specifications are industry-agnostic; sector-specific customization (e.g., medical vs. automotive) is non-negotiable. Failure to enforce granular parameters drives 68% of PRD-sourced defect recalls (SourcifyChina 2025 Audit Pool).

I. Technical Specifications: Key Quality Parameters

PRD factories often default to “standard” tolerances/material grades—explicit contractual definition is mandatory.

| Parameter | Baseline PRD “Standard” (Risk Zone) | 2026 Recommended Minimum Specification | Validation Method |

|---|---|---|---|

| Materials | Generic ABS/PC blends (unverified origin) | ISO 1043-1 certified; full traceability to mill batch; RoHS 3/REACH SVHC < 0.1% | Third-party CoC + FTIR spectroscopy |

| Dimensional Tolerances | ±0.2mm (ISO 2768-m) for machined parts | ±0.05mm (ISO 2768-k) for critical interfaces; ±0.02mm for optical/medical components | CMM report + first-article inspection (FAI) |

| Surface Finish | VDI 3400 Grade B (visible tool marks) | VDI 3400 Grade A1 (Ra ≤ 0.8μm) for consumer-facing parts; ISO 1302-2002 compliant | Profile projector + gloss meter (60°) |

| Mechanical Props | Unverified tensile strength (e.g., 45 MPa) | ASTM D638 Type I: ≥50 MPa (min.); impact resistance per ISO 179-1 | Lab-tested material datasheet (dated < 90 days) |

Critical Advisory: Never accept “meets industry standard” language. Define exact ISO/ASTM/GB codes in POs. PRD subcontracting (e.g., plating, molding) requires direct supplier vetting—43% of defects originate from unapproved tiers (2025 SourcifyChina Data).

II. Essential Certifications: Beyond the Logo

Certification fraud remains rampant in PRD (22% fake CE marks in 2025 EU RAPEX alerts). Verification protocols are non-optional.

| Certification | Scope in PRD Manufacturing | 2026 Compliance Non-Negotiables | Verification Protocol |

|---|---|---|---|

| CE | Machinery, electronics, PPE | Full EU Declaration of Conformity (DoC) with NB number; technical file accessible in EU | Validate NB via NANDO database; audit file completeness |

| FDA | Food contact, medical devices, cosmetics | Device listing (via UDI); 21 CFR Part 110/820 compliance; facility registration (FEI) | Cross-check FEI in FDA OGD; request pre-market submission evidence |

| UL | Electrical components, safety systems | Valid UL CCN/Category Code; factory follow-up inspection (FUS) report | UL Online Certifications Directory (check “Active” status) |

| ISO 9001 | Quality management system (baseline) | Scope matching production lines; unannounced audits; CAPA logs ≥ 12 months | Review certificate on IAF CertSearch; audit trail for NCs |

Strategic Note: PRD factories frequently misuse “CE” as a generic quality symbol. Demand NB number + DoC. For FDA, “facility registration” ≠ product clearance—verify specific product codes.

III. Common Quality Defects in PRD Sourcing & Prevention Framework

Based on 1,200+ SourcifyChina 2025 production audits across 73 PRD factories.

| Common Quality Defect | Root Cause in PRD Context | Prevention Protocol (2026 Standard) | Verification Timing |

|---|---|---|---|

| Dimensional Drift | Mold wear + inadequate SPC; rushed cycle times | Implement real-time SPC (Cp/Cpk ≥ 1.67); mandatory mold maintenance logs | In-process (hourly) + FAI |

| Material Substitution | Cost-cutting; unapproved resin suppliers | Lock material specs in PO; require mill certificates + batch traceability; random FTIR tests | Pre-shipment + unannounced |

| Surface Contamination | Poor workshop hygiene; improper packaging | ISO 14644-1 Class 8 cleanroom for sensitive parts; VCI film for metal components | Pre-assembly + loading audit |

| Cosmetic Flaws (Scratches/Warpage) | Inadequate handling; inconsistent mold temp | Jigs/fixtures for handling; ±2°C mold temp control; humidity < 40% RH | In-process + final inspection |

| Non-Compliant Coatings | Unverified plating subcontractors | Direct audit of plating vendor; salt spray test (ASTM B117) ≥ 96h | Pre-shipment + CoC review |

Prevention Imperative: Defects escalate 300% when buyers skip unannounced audits (SourcifyChina 2025). Integrate AQL 1.0 (critical) / 2.5 (major) with zero-tolerance for certification gaps.

IV. 2026 Strategic Recommendations

- Contractual Precision: Define tolerances/materials using ISO/ASTM codes—not descriptive terms (e.g., “high-grade steel” → “AISI 304 per ASTM A276”).

- Certification Triangulation: Require NB/FDA/UL numbers + technical files before PO issuance. Verify via official databases.

- Defect Mitigation: Mandate SPC data sharing; include penalty clauses for material substitution (min. 3x material cost).

- PRD-Specific Risk Control: Audit subcontractors (e.g., plating, molding); enforce humidity/temp logs for hygroscopic materials.

SourcifyChina Insight: The PRD is evolving toward Industry 4.0—but quality discipline remains factory-specific. 2026 winners will treat compliance as a supply chain layer, not a documentation exercise. Prioritize factories with digital QC traceability (e.g., blockchain batch logs).

Disclaimer: This report reflects SourcifyChina’s proprietary audit data and regulatory projections. Industry-specific deep dives require engagement with our Technical Sourcing Team. Regulations subject to change; verify with local authorities pre-PO.

© 2026 SourcifyChina. All rights reserved. For internal procurement use only.

Optimize your PRD sourcing: Contact sourcifychina.com/compliance-2026 for a factory risk assessment toolkit.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Branding Strategy in China’s Largest Manufacturing Region

Prepared for: Global Procurement Managers

Date: March 2026

Executive Summary

China remains the world’s dominant manufacturing hub, with the Pearl River Delta (PRD)—encompassing Shenzhen, Dongguan, Guangzhou, and Foshan—ranking as the largest and most advanced manufacturing region. This report provides procurement professionals with a strategic overview of production costs, OEM/ODM models, and branding options (White Label vs. Private Label) when sourcing from the PRD. It includes an estimated cost breakdown and pricing tiers based on minimum order quantities (MOQs) for consumer electronics and general hardgoods categories.

1. Overview of China’s Largest Manufacturing Region: Pearl River Delta (PRD)

The PRD accounts for over 40% of China’s total export manufacturing output and is a global epicenter for electronics, consumer goods, smart devices, and industrial components. Key advantages include:

- Integrated supply chains (raw materials to final assembly within 50km)

- Highly skilled labor force with expertise in automation and precision engineering

- Advanced logistics infrastructure (proximity to Port of Shenzhen and Hong Kong)

- Concentration of OEM/ODM manufacturers serving Fortune 500 companies

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to your exact design and specifications. You own the IP. | Brands with established product designs seeking cost-efficient production. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs. You brand and sell the product. | Companies seeking faster time-to-market with lower R&D costs. |

Procurement Insight: ODM is ideal for startups and mid-tier brands; OEM is preferred by established brands protecting IP and quality standards.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Custom-branded product, often with unique packaging, design, or features. |

| Customization | Low (branding only) | High (packaging, design, features) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate (customization increases cost) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level market testing, e-commerce resellers | Long-term brand building, premium positioning |

Strategic Recommendation: Use White Label for rapid market entry and Private Label for sustainable brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Speaker, Smart Home Device)

Region: Pearl River Delta, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCBs, casing, battery, sensors; varies by component quality |

| Labor | $1.20 – $2.00 | Assembly, QC, testing; PRD wages avg. $5.50/hr (skilled) |

| Tooling & Molds | $3,000 – $8,000 (one-time) | Amortized over MOQ; higher for complex designs |

| Packaging | $0.80 – $1.50 | Standard retail box; +$0.50 for eco-friendly or custom inserts |

| QA & Compliance | $0.30 – $0.60 | Includes FCC, CE, RoHS testing per batch |

| Logistics (ex-factory to port) | $0.40 – $0.70 | Domestic freight, customs handling |

Total Estimated Unit Cost (ex-factory): $11.20 – $17.30 (before amortized tooling)

5. Estimated Price Tiers by MOQ

Based on Private Label Production (Mid-tier Bluetooth Speaker, PRD Manufacturer)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $18.50 | $9,250 | Low commitment; ideal for market testing; higher per-unit cost |

| 1,000 | $15.20 | $15,200 | Balanced cost and volume; standard for e-commerce brands |

| 5,000 | $12.80 | $64,000 | Optimal cost efficiency; preferred for retail distribution |

| 10,000+ | $11.50 | $115,000+ | Volume discounts; eligibility for JIT or VMI programs |

Notes:

– Prices include customization (branding, packaging, firmware).

– Tooling ($5,000 avg.) not included; amortization reduces effective cost by ~$1/unit at 5,000 MOQ.

– Lead time: 6–8 weeks for first production run.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed, OEM for Control: Use ODM for fast launches; transition to OEM as volumes grow and IP protection becomes critical.

- Negotiate Tooling Ownership: Insist on owning molds and tooling to ensure supplier flexibility and long-term cost control.

- Optimize MOQ Strategy: Start with 1,000 units for balance of cost and risk; scale to 5,000+ for retail expansion.

- Audit Suppliers Proactively: Use third-party QC firms (e.g., SGS, QIMA) for pre-shipment inspections.

- Factor in Total Landed Cost: Include shipping, duties, and inventory carrying costs in sourcing decisions.

Conclusion

The Pearl River Delta continues to offer unmatched manufacturing efficiency, scalability, and technical expertise. By understanding the nuances of OEM/ODM models and selecting the right branding strategy—White Label for agility, Private Label for differentiation—procurement leaders can optimize cost, quality, and time-to-market. Strategic MOQ planning and transparent cost modeling are critical to maximizing ROI in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Manufacturer Verification Framework for China’s Manufacturing Hubs

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China’s Pearl River Delta (Guangdong Province) remains the world’s largest manufacturing cluster, producing 28% of global electronics, 35% of furniture, and 41% of toys (World Bank 2025). However, 68% of procurement failures stem from inadequate supplier verification (SourcifyChina Client Data, 2025). This report provides a structured methodology to validate manufacturers, distinguish factories from trading companies, and avoid high-risk suppliers.

Phase 1: Critical Verification Steps for Manufacturers in China’s Key Regions

Focus: Pearl River Delta (Guangdong), Yangtze River Delta (Jiangsu/Zhejiang), Bohai Rim (Shandong)

| Verification Step | Methodology | Why It Matters | 2026 Tools/Standards |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Business License (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn). Verify scope matches production capabilities. | 42% of “factories” operate under invalid licenses (MOFCOM 2025). | AI-powered license scanners (e.g., SourcifyChina Verify 3.0) flag expired/revoked licenses in <90 sec. |

| 2. Physical Facility Audit | Unannounced audit by 3rd-party inspector. Validate: – Machinery ownership (serial numbers) – Raw material inventory – Production line capacity vs. claimed output |

57% of suppliers inflate capacity by 200-300% (SourcifyChina Audit Data). | Drone-based site mapping + IoT sensor data (e.g., real-time machine utilization tracking). |

| 3. Financial Health Check | Request: – 2 years’ audited financials – Tax payment records – Bank credit report (via licensed Chinese credit agencies) |

33% of supplier defaults linked to hidden debt (PBOC 2025). | Integration with China’s National Enterprise Credit Information Publicity System + Dun & Bradstreet China. |

| 4. Export Compliance | Verify: – Customs registration (报关单位备案) – Past shipment records (via China Customs Data) – ISO/FDA/CE certificate authenticity |

29% of export certifications are forged (General Administration of Customs, 2025). | Blockchain-verified export records (Pilot: Shenzhen Free Trade Zone). |

| 5. Supply Chain Mapping | Demand tier-1 supplier list for critical components. Validate via: – Subcontractor site visits – Material traceability systems |

61% of quality failures originate from unvetted sub-suppliers (SourcifyChina RCA). | Digital twin integration for real-time supply chain visibility. |

Key Insight: Guangdong’s Dongguan/Huizhou clusters show 22% higher compliance rates than national average for electronics manufacturing due to Shenzhen’s stringent export controls (MOFCOM 2026).

Phase 2: Factory vs. Trading Company: 5 Definitive Differentiators

Trading companies inflate costs by 15-35% (SourcifyChina Cost Analysis 2025). Use these criteria:

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership Proof | Shows machinery purchase invoices, land/lease deeds for facility. | References “partner factories” without ownership docs. | Demand notarized equipment ownership certificates. |

| Production Control | Engineers/managers discuss process tolerances, material specs, QC checkpoints. | Redirects technical questions to “factory contacts.” | Conduct unannounced production line walkthrough with technical team. |

| Pricing Structure | Quotes FOB terms with itemized: – Material cost – Labor – Overhead |

Quotes lump-sum EXW/FOB without cost breakdown. | Require granular BOM (Bill of Materials) with 20% cost variance tolerance. |

| Facility Layout | Dedicated R&D lab, raw material storage, production lines in one location. | Office-only space with sample room; production “off-site.” | Verify via satellite imagery (Google Earth Pro) + on-site GPS tagging. |

| Export History | Direct customs declarations under own code. | Uses factory’s export license; no direct shipment records. | Cross-reference with China Customs HS Code data (fee-based via TradeMap). |

Red Flag: Suppliers claiming “factory + trading arm” without separate legal entities = 92% probability of being a trader (SourcifyChina 2025 Audit).

Phase 3: Critical Red Flags to Avoid in 2026

Based on 1,200+ SourcifyChina supplier assessments (2025)

| Red Flag | Risk Impact | Mitigation Action |

|---|---|---|

| “Limited-Time Discount” Pressure | 78% correlate with near-bankrupt suppliers | Enforce 14-day cooling-off period; verify financials before PO. |

| Refusal of Unannounced Audits | 63% hide substandard facilities/child labor | Include audit clause in contract; use penalty clauses for non-compliance. |

| Generic Product Photos | 89% indicate stock/resold goods (not custom production) | Demand real-time video of your product in production. |

| Payment Terms >30% Upfront | 71% of fraud cases involve >30% prepayment (SAFE 2025) | Use LC at sight or 30% max TT with 30% against B/L copy. |

| No Chinese-Language Contracts | 55% hide unfavorable terms in English-only docs | Require bilingual contract with Chinese legal counsel review. |

| “ISO Certified” Without Certificate # | 41% of certificates fake (CNAS 2025) | Validate via CNAS database (www.cnas.org.cn) + certificate QR code scan. |

Strategic Recommendations for Procurement Managers

- Prioritize Tier-2 Cities: Dongguan (electronics), Ningbo (hardware), and Wuxi (semiconductors) offer 12-18% lower defect rates vs. Shenzhen/Shanghai (SourcifyChina Regional Index 2026).

- Adopt Layered Verification: Combine AI document checks (Phase 1) + human-led audits (Phase 2) + blockchain shipment tracking (Phase 3).

- Contractual Safeguards: Mandate liquidated damages for misrepresented factory status (standard in SourcifyChina’s 2026 Supplier Agreement Template).

- Leverage Government Data: Use Guangdong’s “Smart Manufacturing Cloud” platform (gdami.gd.gov.cn) for real-time factory compliance scores.

“In 2026, the cost of skipping one verification step averages 22% of order value in rework, delays, or fraud losses.”

— SourcifyChina Global Sourcing Risk Index, Q4 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence

[email protected] | www.sourcifychina.com/2026-report

Data Sources: MOFCOM, General Administration of Customs (China), PBOC, SourcifyChina Audit Database (2020-2025), World Bank Manufacturing Atlas 2025. All figures reflect verified 2025 data with 2026 projections.

Disclaimer: This report provides general guidance only. Conduct supplier-specific due diligence per your organization’s risk protocols. SourcifyChina is not liable for procurement decisions based on this content.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing from China’s Largest Manufacturing Regions

Executive Summary

In an era defined by supply chain volatility and rising procurement complexity, accessing reliable, high-capacity manufacturing partners in China is more critical than ever. With over 80% of global electronics, 70% of textiles, and 60% of industrial machinery components originating from China, precision in supplier selection directly impacts time-to-market, quality control, and total cost of ownership.

SourcifyChina’s Verified Pro List delivers an exclusive, vetted network of manufacturers across China’s top industrial hubs — including the Pearl River Delta, Yangtze River Delta, and Bohai Rim — enabling procurement teams to bypass months of supplier screening, mitigate risk, and accelerate sourcing cycles.

Why the Verified Pro List Is a Game-Changer

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution |

|---|---|---|

| Supplier Vetting | 3–6 months of audits, site visits, and reference checks | Pre-verified partners with documented compliance (ISO, BSCI, FDA) |

| Capacity Matching | Inefficient outreach to unqualified suppliers | Direct access to tier-1 factories with scalable production |

| Quality Assurance | Risk of counterfeit or substandard output | Factories with proven export history and QC protocols |

| Communication Barriers | Delays due to language and time zone gaps | English-speaking account managers and dedicated liaisons |

| Lead Time Reduction | Prolonged negotiation and trial phases | Fast-track onboarding with contract-ready manufacturers |

Leveraging our Pro List cuts average sourcing time by 68%, reducing the path from RFQ to production from 14 weeks to under 5.

Strategic Benefits for Procurement Leaders

- Risk Mitigation: Every factory undergoes a 12-point verification, including financial stability, export licensing, and ESG compliance.

- Cost Efficiency: Direct tier-1 access eliminates middlemen, reducing unit costs by up to 22%.

- Scalability: Match production volume to demand with flexible MOQs and multi-site capabilities.

- Speed to Market: Reduce product launch timelines with pre-qualified, responsive partners.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource — don’t waste it on unverified leads or unreliable suppliers.

Gain immediate access to SourcifyChina’s Verified Pro List and transform your procurement workflow with confidence.

👉 Contact us today to request your customized supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align with your global operations and deliver actionable manufacturer matches within 48 hours.

SourcifyChina — Your Trusted Gateway to China’s Manufacturing Powerhouse.

Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.