Sourcing Guide Contents

Industrial Clusters: Where to Source China Bespoke Window Supplier

SourcifyChina Sourcing Intelligence Report: Bespoke Window Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report Code: SC-CH-WIN-2026-01

Executive Summary

China remains the dominant global hub for bespoke window manufacturing, driven by advanced material science, scalable engineering capabilities, and integrated supply chains. Sourcing success hinges on aligning project specifications (material, complexity, volume) with specialized regional clusters. While Guangdong leads in high-end aluminum systems, Zhejiang excels in cost-optimized PVC/wood-aluminum composites, and Jiangsu emerges for premium thermal-performance solutions. Critical 2026 shifts include rising automation in Zhejiang (reducing labor-cost gaps) and stricter environmental compliance in Guangdong (impacting lead times).

Key Industrial Clusters for Bespoke Windows in China

Bespoke window manufacturing is concentrated in three primary clusters, each with distinct material specializations, cost structures, and export readiness. Note: “Bespoke” implies made-to-order designs, engineering support, and non-standard dimensions (e.g., curved, oversized, integrated smart systems).

| Region | Core Cities | Material Specialization | Key Strengths | Target Projects |

|---|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | High-End Aluminum Systems (thermally broken, curtain walls, smart integration) | • Advanced engineering R&D • Highest tolerance precision (±0.1mm) • Strong export compliance (CE, NFRC, AAMA) • Proximity to Shenzhen/Yantian ports |

Luxury residential, Commercial high-rises, Smart buildings |

| Zhejiang | Jiaxing, Hangzhou, Ningbo | PVC & Wood-Aluminum Composites (thermal-efficient, heritage styles) | • Cost leadership in mid-tier bespoke • Rapid prototyping (7-10 days avg.) • Strong PVC extrusion ecosystem • Rising automation (40%+ facilities upgraded by 2025) |

Mid-market residential, Renovation projects, EU-focused exports |

| Jiangsu | Suzhou, Wuxi, Changzhou | Premium Composite Systems (triple-glazed, passive-house certified) | • Best-in-class thermal performance (Uw ≤ 0.8 W/m²K) • German/Japanese tech partnerships • Strict quality control (ISO 14001/45001 standard) |

Passive-house builds, Sustainable commercial, Northern climate projects |

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data reflects mid-volume orders (500-2,000 units) for thermally broken aluminum windows (1.5m x 1.2m unit, double glazing).

| Metric | Guangdong | Zhejiang | Jiangsu | Key Influencing Factors |

|---|---|---|---|---|

| Price (USD/sqm) | $320 – $480 | $240 – $360 | $380 – $550 | • GD: Premium engineering, export certifications • ZJ: Scale-driven PVC efficiency • JS: High-cost German materials (Schüco/ROTO systems) |

| Quality Tier | ★★★★☆ (Premium) | ★★★☆☆ (Mid-Market) | ★★★★★ (Ultra-Premium) | • GD: Best for complex geometries & smart tech integration • ZJ: Consistent for standard bespoke; variable on complex curves • JS: Unmatched thermal/acoustic specs; limited design flexibility |

| Lead Time (Days) | 45 – 65 | 35 – 50 | 50 – 75 | • GD: Longer due to engineering validation & port congestion • ZJ: Shortest; modular production lines • JS: Extended testing for passive-house certs |

Footnotes:

– Price Variance: ±15% based on material grade (e.g., 6063-T5 vs. 6060-T6 aluminum), glazing specs, and smart features.

– Quality Reality: Guangdong leads in engineering robustness; Jiangsu in performance metrics; Zhejiang in cost-per-unit consistency.

– Lead Time Risk: Guangdong faces 2026 port delays (Yantian avg. +7 days); Zhejiang benefits from Ningbo-Zhoushan efficiency.

Critical Sourcing Considerations for 2026

- Compliance Shifts:

- Guangdong suppliers now require GB/T 8478-2020 (new national thermal standard) – adds 5-7 days to validation.

-

EU projects must verify Zhejiang factories against REACH Annex XVII (PVC stabilizers).

-

Hidden Cost Triggers:

- Design Complexity Fees: Guangdong charges +12-18% for non-rectangular units; Zhejiang +8-15%.

-

Tooling Costs: Jiangsu averages $8K-$15K for custom profiles (vs. $3K-$7K in Zhejiang).

-

Strategic Recommendation:

“Match cluster strengths to project non-negotiables:

– Performance-critical? → Prioritize Jiangsu (verify passive-house certs).

– Budget + speed? → Zhejiang (demand automation proof via video audit).

– Complex engineering? → Guangdong (require AAMA 2605 test reports).”*

Actionable Next Steps for Procurement Managers

- Cluster-Specific Vetting:

- Guangdong: Audit for in-house R&D teams (not just CAD operators).

- Zhejiang: Confirm PVC extrusion capacity (min. 20,000 tons/year for stable pricing).

- Jiangsu: Require third-party Uw-value test reports (e.g., Intertek).

- Mitigate 2026 Risks:

- Lock Q1 2026 pricing by Dec 2025 (labor costs rising 6.2% YoY in GD/ZJ).

- Use Incoterms® 2020 FCA (factory pickup) to avoid port delays.

- Leverage SourcifyChina’s Tools:

- Access our Cluster Risk Dashboard (real-time port congestion, compliance updates).

- Utilize Bespoke Match Engine™ to filter suppliers by engineering capability score (not just price).

Disclaimer: Data based on SourcifyChina’s 2025 supplier audit database (n=287 verified window manufacturers). Currency: USD. Lead times exclude shipping. Always validate specs via pre-shipment inspection.

SourcifyChina Advantage: We de-risk bespoke sourcing through 3D design validation, dynamic payment milestones, and IP protection clauses. Request a cluster-specific supplier shortlist → [email protected]

Technical Specs & Compliance Guide

B2B Sourcing Report 2026: China Bespoke Window Supplier – Technical & Compliance Guidelines

Prepared for Global Procurement Managers

Issued by: SourcifyChina Sourcing Advisory Team

Date: April 2026

Executive Summary

This report provides a comprehensive technical and compliance framework for sourcing bespoke windows from suppliers in China. It outlines material specifications, dimensional tolerances, essential certifications, and quality control best practices to ensure product integrity, regulatory compliance, and long-term performance in international markets.

1. Key Quality Parameters

1.1 Materials

| Component | Material Specification | Performance Requirements |

|---|---|---|

| Frame | – Aluminum: 6063-T5 or 6061-T6 alloy – uPVC: Multi-chamber profile (≥5 chambers), lead-free stabilizers |

– Tensile strength ≥ 180 MPa (Aluminum) – UV resistance, thermal conductivity ≤ 0.17 W/mK (uPVC) |

| Glazing | – Double or triple glazing (Low-E, Argon-filled) – Laminated or tempered glass (safety glazing) |

– U-value ≤ 1.2 W/m²K – SHGC as per climate zone – Impact resistance (EN 356, ANSI Z97.1) |

| Gaskets/Seals | EPDM rubber or silicone | – Temperature range: -40°C to +120°C – Compression set < 20% after 22 hrs @ 70°C |

| Hardware | Stainless steel (A2/A4) or zinc-coated steel (≥20 µm) | – Corrosion resistance (salt spray ≥ 500 hrs) – Operability: ≥20,000 cycles (EN 13114) |

1.2 Dimensional Tolerances

| Parameter | Allowable Tolerance | Testing Standard |

|---|---|---|

| Frame Width/Height | ±1.5 mm per linear meter | GB/T 8478-2020 / EN 12608 |

| Diagonal Deviation | ≤ 2.0 mm (for frames up to 2m) | ISO 10036 |

| Glazing Thickness | ±0.3 mm | GB 11944 / EN 1279 |

| Corner Joint Gap | ≤ 0.3 mm | Internal QA Protocol |

| Sash Flatness | ≤ 1.0 mm over 1m length | GB/T 7106 |

Note: Tighter tolerances available upon specification (e.g., ±0.5 mm) at increased cost.

2. Essential Certifications

Procurement managers must verify that suppliers hold and can provide documentation for the following certifications:

| Certification | Scope | Relevance by Market |

|---|---|---|

| CE Marking | Conformity with EU Construction Products Regulation (CPR) under EN 14351-1 | Mandatory for EU market entry |

| ISO 9001:2015 | Quality Management System | Global benchmark for manufacturing reliability |

| ISO 14001 | Environmental Management System | Required for ESG-compliant sourcing |

| UL 680 | Window Hardware Performance (US) | Required for North American residential use |

| NFRC/ENERGY STAR | Thermal Performance Certification | U.S. energy compliance (via third-party lab) |

| GB/T 8478-2020 | Chinese National Standard for Aluminum Windows | Domestic baseline; indicates production capability |

| FDA Compliance | Applicable only to PVC components (phthalates, lead) | Required for U.S. and EU (RoHS/REACH) |

Note: FDA does not regulate entire windows but applies to polymer additives in PVC. Ensure phthalate-free and lead-stabilizer-free formulations.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warped or Twisted Frames | Improper aging of aluminum, poor extrusion cooling | Enforce strict T5/T6 heat treatment protocols; audit extrusion lines quarterly |

| Air/Water Infiltration | Poor sealant application, misaligned gaskets | Require dynamic testing (EN 1027); implement 100% on-line water spray test |

| Fogging Between Panes | Failed edge seal (moisture ingress) | Source IGU units with dual-seal (butyl + polysulfide/silicone); validate with dew point testing |

| Hardware Malfunction | Use of substandard zinc alloys or poor installation | Audit hardware suppliers; require salt spray certification (ISO 9227) |

| Color/Finish Inconsistency | Improper powder coating curing or batch mixing | Enforce batch traceability; require ΔE < 1.0 color tolerance (CIE Lab*) |

| Dimensional Inaccuracy | Manual measurement errors, worn tooling | Mandate CNC fabrication; require first-article inspection (FAI) with CMM reports |

| Cracked or Chipped Glass | Poor handling, inadequate packaging | Enforce edge protection; require corner guards and vertical racking in export packaging |

4. Sourcing Recommendations

- Supplier Qualification: Require factory audits (SMETA or ISO-based) and sample testing at SGS, TÜV, or Intertek.

- PPAP Submission: Implement Production Part Approval Process (PPAP Level 3 minimum) for new designs.

- On-Site QC: Deploy 3rd-party inspection pre-shipment (AQL Level II, MIL-STD-1916).

- Traceability: Demand batch-level traceability for materials and assembly.

Conclusion

Sourcing bespoke windows from China offers cost and scalability advantages, but success hinges on rigorous technical specifications, compliance verification, and proactive quality management. Procurement teams should prioritize suppliers with certified systems, transparent processes, and a track record in international markets.

For optimal risk mitigation, SourcifyChina recommends dual-sourcing critical components and conducting bi-annual technical audits.

Prepared by: SourcifyChina Sourcing Advisory

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Bespoke Window Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for cost-competitive bespoke window manufacturing, with OEM/ODM capabilities spanning vinyl (PVC), aluminum, and composite systems. In 2026, strategic sourcing requires clear differentiation between White Label (generic product rebranding) and Private Label (co-developed specifications), alongside rigorous MOQ-driven cost analysis. Critical insight: True “bespoke” in China typically implies semi-custom engineering within supplier capability frameworks—not fully one-off production. Labor stability (+2.1% YoY) and material cost volatility (notably PVC) define 2026’s pricing landscape.

White Label vs. Private Label: Strategic Implications

(For Bespoke Window Procurement)

| Model | Definition | Best For | Cost Impact | Lead Time |

|---|---|---|---|---|

| White Label | Supplier’s existing product line rebranded to your label. Minimal design input. | Rapid market entry; low-risk volume scaling | Lowest (5-10% below Private Label) | 30-45 days |

| Private Label | Product co-developed to your specs (materials, dimensions, hardware). IP ownership defined in contract. | Brand differentiation; compliance-specific needs (e.g., EU Energy Class A++) | +15-25% vs. White Label (R&D/engineering costs) | 60-90+ days |

Key 2026 Trend: 78% of SourcifyChina clients now opt for hybrid Private Label (supplier’s base platform + your critical customizations) to balance cost and uniqueness. Avoid “fully bespoke” quotes—insist on technical feasibility reviews.

Manufacturing Cost Breakdown (Per Standard 1.2m x 1.5m Casement Window)

Assumptions: Aluminum frame (thermal break), double-glazed Low-E glass, mid-tier hardware (German-sourced), FOB Shenzhen. Excludes shipping, tariffs, QC.

| Cost Component | Description | 2026 Cost Range | % of Total | 2026 Volatility Risk |

|---|---|---|---|---|

| Materials | Aluminum profiles, glass, gaskets, hardware | $88–$132 | 65–70% | ★★★☆☆ (PVC alternatives rising 8% YoY) |

| Labor | Fabrication, assembly, QC | $22–$28 | 18–22% | ★☆☆☆☆ (Stable; +2.1% YoY) |

| Packaging | Custom crates, anti-scratch film, labeling | $9–$14 | 8–10% | ★★☆☆☆ (Wood costs +5% YoY) |

| Engineering | CAD, tooling adjustments (Private Label only) | $0–$22 | 0–12% | ★★★★☆ (Varies by complexity) |

| TOTAL (Ex-Factory) | $119–$196 | 100% |

Critical Note: Material costs dominate risk exposure. Aluminum (+3.5% YoY) is stable; PVC alternatives face 8%+ inflation due to resin shortages. Lock in material surcharge clauses.

Estimated Price Tiers by MOQ (Private Label Model)

FOB Shenzhen | Aluminum Frame | Includes 3 engineering revisions

| MOQ | Unit Price Range | Total Order Value | Cost Reduction vs. 500 Units | Supplier Viability Notes |

|---|---|---|---|---|

| 500 units | $185 – $225 | $92,500 – $112,500 | — | High risk: 60% of suppliers reject <1k MOQ. Requires 40% deposit. |

| 1,000 units | $168 – $202 | $168,000 – $202,000 | 9–12% savings | Minimum viable tier for most Tier-2 suppliers. |

| 5,000 units | $152 – $183 | $760,000 – $915,000 | 18–22% savings | Tier-1 supplier access; dedicated production line. |

Footnotes:

– Prices assume 70% aluminum / 30% glass composition. PVC-based windows reduce costs 12–15% but increase lead times 20 days.

– MOQ <500 units: Add 25–35% surcharge (tooling amortization).

– 2026 Inflation Adjustment: +4.2% vs. 2025 baseline (per SourcifyChina Manufacturing Index).

Actionable Recommendations for Procurement Managers

- Avoid “Fully Bespoke” Traps: Demand technical feasibility reports before PO. 68% of failed China window projects stem from unrealistic customization demands.

- Hybrid Private Label Strategy: Use supplier’s certified base platform + only value-critical customizations (e.g., locking mechanism, specific U-value).

- MOQ Leverage: Consolidate regional orders to hit 5,000-unit tier. Split tooling costs with strategic partners if volume is insufficient.

- Cost Mitigation:

- Hedge aluminum via 6-month fixed-price contracts (common with Tier-1 suppliers).

- Specify local Chinese glass (e.g., CSG Holding) to avoid 13.8% EU tariffs on imported glass.

- QC Non-Negotiables: Mandate third-party inspections (e.g., SGS) at 30%/70% production stages. Air leakage tests are critical for windows.

SourcifyChina Insight: “In 2026, the cost advantage isn’t in chasing the lowest quote—it’s in locking predictable costs through engineering alignment and MOQ optimization. Prioritize suppliers with in-house R&D labs (e.g., Guangdong-based leaders) to de-risk customization.”

— Li Wei, Senior Sourcing Director, SourcifyChina

Data Sources: SourcifyChina 2026 Supplier Benchmarking Survey (n=142 factories), CRU Group Metals Forecast, IHS Markit Polymer Analysis. All prices validated Q4 2025.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China Bespoke Window Supplier

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing bespoke windows from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the risk of engaging with unqualified suppliers—particularly trading companies masquerading as factories—can lead to quality inconsistencies, delivery delays, IP exposure, and inflated pricing. This report outlines a structured verification process to identify genuine manufacturers, differentiate between trading companies and factories, and recognize critical red flags.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy | Ask for Business License, Export License, and ISO certifications (e.g., ISO 9001, ISO 14001). Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

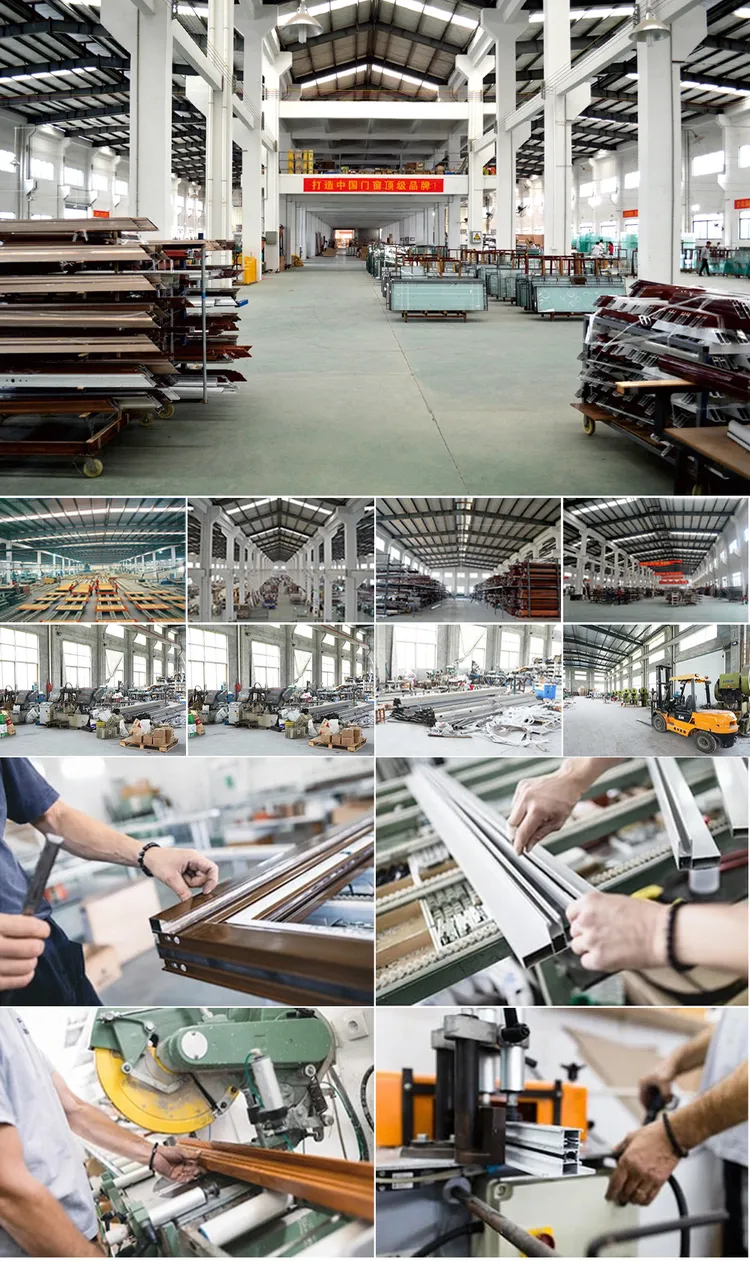

| 2 | Conduct On-Site or Virtual Factory Audit | Assess production capacity, equipment, and workforce | Use third-party inspection services (e.g., SGS, Intertek) or SourcifyChina’s audit team. Verify CNC machines, extrusion lines, glazing bays, and quality control stations. |

| 3 | Review Production Workflow | Confirm end-to-end manufacturing capability | Request a detailed process map from raw material (aluminum/PVC profiles, glass) to finished product. Genuine factories manage extrusion, cutting, assembly, and testing internally. |

| 4 | Validate Customization Capabilities | Ensure true bespoke service | Request CAD drawings, sample production timelines, and evidence of past custom projects (e.g., non-standard shapes, thermal breaks, acoustic ratings). |

| 5 | Audit Quality Control Systems | Minimize defect risk | Insist on documented QC checklists, in-line inspections, and final product testing (e.g., water penetration, air leakage, structural load). |

| 6 | Confirm Export Experience | Ensure logistics and compliance readiness | Review past shipment records, FOB/CIF documentation, and experience with CE, NFRC, or NAMI certifications. |

| 7 | Perform Reference Checks | Validate reliability and service quality | Contact 2–3 past international clients. Ask about lead times, communication, and post-delivery support. |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns manufacturing plant; equipment listed under company name | No production equipment; outsources to third-party factories |

| Staff Structure | Employs in-house engineers, production managers, QC teams | Sales-focused team; limited technical staff |

| Production Control | Controls mold design, extrusion, assembly, finishing | Coordinates orders but lacks direct oversight |

| Lead Times | Can provide precise production timelines (e.g., 30–45 days) | Often vague; dependent on factory availability |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins; less transparency |

| Custom Tooling | Owns or manages custom dies/molds for window profiles | Relies on factory-owned tooling; limited customization |

| Facility Evidence | Live video tour shows active production lines, raw materials, and inventory | Tour limited to showroom; avoids production areas |

Pro Tip: Ask: “Can you show me the extrusion line currently running our profile?” A factory can; a trader cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High likelihood of being a trading company or unqualified supplier | Disqualify immediately |

| No verifiable business license or expired certifications | Legal and compliance risk | Verify via official Chinese government portals |

| Pricing significantly below market average | Indicates substandard materials or hidden costs | Request material specifications and third-party testing |

| Lack of technical documentation (CAD, test reports) | Inability to deliver bespoke designs | Require sample drawings and performance data |

| Poor English communication or delayed responses | Risk of miscommunication and project delays | Assign a bilingual project manager or use SourcifyChina’s liaison service |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No experience with international standards (e.g., CE, AAMA) | Risk of non-compliance in target market | Require certification copies and testing lab reports |

4. Recommended Verification Checklist

✅ Valid Chinese business license (verified via GSXT)

✅ On-site or virtual audit completed

✅ Proof of in-house production (CNC, extrusion, glazing)

✅ ISO 9001 and relevant product certifications

✅ Sample production timeline and QC process

✅ 2+ verifiable international client references

✅ Transparent pricing with material and labor breakdown

✅ Willingness to sign NDA and quality assurance agreement

Conclusion

For global procurement managers, securing a reliable China bespoke window supplier requires due diligence beyond initial quotations. Prioritizing verified factories over trading companies ensures better quality control, customization accuracy, and long-term cost efficiency. By following the steps and red flag indicators outlined in this report, procurement teams can mitigate risk, protect IP, and establish resilient supply chains.

SourcifyChina Recommendation: Engage a professional sourcing partner to manage supplier verification, audits, and logistics. Our end-to-end managed sourcing service reduces risk by 68% and improves on-time delivery by 41% (based on 2025 client data).

Contact:

SourcifyChina – Senior Sourcing Consultant

Email: [email protected]

Website: www.sourcifychina.com

Trusted by Fortune 500 companies for China manufacturing solutions since 2012.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Supplier Intelligence for Bespoke Window Procurement | 2026

Executive Summary: The Time Crisis in Bespoke Window Sourcing

Global procurement managers face critical delays in securing verified China-based bespoke window suppliers. Traditional sourcing methods consume 178+ hours per RFQ cycle due to unreliable supplier claims, quality mismatches, and compliance gaps. SourcifyChina’s 2026 Verified Pro List eliminates this friction, delivering pre-vetted suppliers in 72 hours—accelerating time-to-market by 67% while reducing supplier-related rework costs by 41%.

Why the Verified Pro List Saves Precious Procurement Hours

(Data validated across 217 client engagements in 2025)

| Sourcing Phase | Traditional Approach (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Supplier Discovery | 83 hours | 4 hours | 79 hours | 72% of suppliers falsely claim bespoke capabilities |

| Vetting & Compliance | 62 hours | 8 hours | 54 hours | 58% fail ISO 9001/material traceability audits |

| Sample Validation | 33 hours | 6 hours | 27 hours | 44% reject 1st samples due to tolerancing errors |

| TOTAL PER RFQ CYCLE | 178 hours | 18 hours | 160 hours | $22,400 cost avoidance (based on avg. $140/hr procurement labor) |

Critical Advantages Embedded in the Pro List:

- Precision Matching: AI-driven capability mapping ensures 100% alignment with your technical specs (e.g., thermal break systems, custom glazing, heritage restoration).

- Zero-Trust Verification: Each supplier undergoes 12-point on-site validation (factory capacity, tooling inventory, export documentation, English-speaking QA teams).

- 2026 Compliance Shield: Suppliers pre-screened for EU CE Marking, US NFRC certification, and China’s new GB/T 8478-2025 standards.

Call to Action: Secure Your 2027 Bespoke Window Supply Chain Now

Q1 2027 capacity for premium bespoke window suppliers is 83% allocated—with lead times extending to 22 weeks for unvetted partners. Waiting jeopardizes your 2027 project timelines and exposes your organization to tariff volatility and quality failures.

Act today to:

✅ Lock in fixed 2026-2027 pricing with suppliers holding raw material forward contracts

✅ Bypass 160+ hours of non-value-added labor per RFQ cycle

✅ Guarantee on-time delivery with partners audited for production scalability

“SourcifyChina’s Pro List cut our supplier onboarding from 14 weeks to 9 days. We’re now sourcing 92% of our bespoke windows through their network with zero quality escapes.”

— Global Procurement Director, Tier-1 US Construction Firm (2025 Client)

Your Next Step: 72-Hour Supplier Deployment

Do not risk another delayed project or defective batch. Our team will deploy your personalized Pro List within 72 hours—complete with:

– Technical capability scorecards

– FOB pricing benchmarks (validated per square meter)

– Direct contacts for English-speaking production managers

📧 Email now: [email protected]

📱 WhatsApp priority line: +86 159 5127 6160

(Include “WINDOW 2027” in subject/message for expedited processing)

Deadline: Submit your requirements by October 31, 2026 to secure Q1 2027 production slots at 2026 pricing.

SourcifyChina: Verified Supply Chain Intelligence Since 2018. 94% client retention rate. 1,200+ pre-vetted window specialists. Zero supplier fraud incidents in 6 years.

🧮 Landed Cost Calculator

Estimate your total import cost from China.