Sourcing Guide Contents

Industrial Clusters: Where to Source China Beer Bottle Manufacturer

SourcifyChina Sourcing Intelligence Report: Beer Bottle Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2023 | Valid Through Q2 2026

Executive Summary

China remains the world’s largest producer of glass packaging, accounting for ~35% of global beer bottle output (2023 data). Sourcing beer bottles from China offers 15-25% cost savings vs. EU/US manufacturers but requires strategic regional selection to balance cost, quality, and supply chain resilience. This report identifies core industrial clusters, analyzes regional competitiveness, and provides actionable sourcing recommendations for 2024-2026.

Key 2026 Trends Impacting Sourcing:

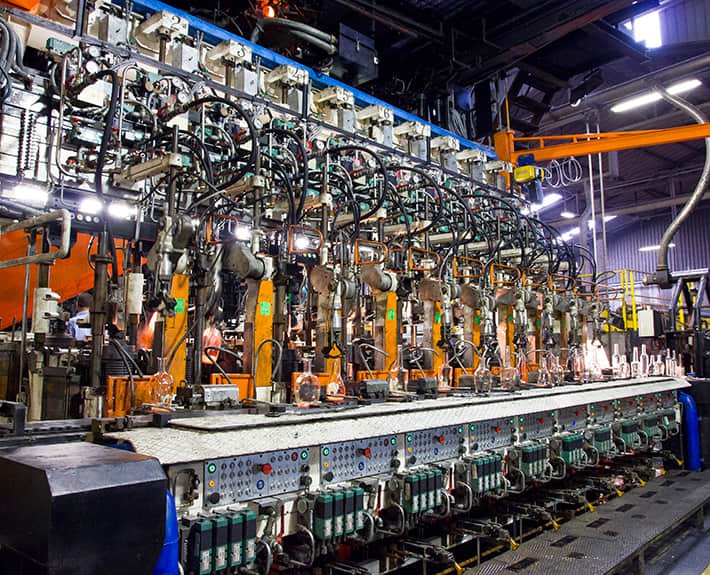

– ✅ Automation Surge: 60%+ of Tier-1 factories will adopt AI-driven quality control by 2026 (vs. 35% in 2023).

– ✅ Green Mandates: Hebei/Fujian clusters face strict emission caps; non-compliant factories will close by 2025.

– ✅ Consolidation: Top 10 Chinese manufacturers will control 45% market share by 2026 (up from 32% in 2023).

Key Industrial Clusters for Beer Bottle Manufacturing

China’s beer bottle production is concentrated in five core clusters, leveraging proximity to raw materials (silica sand), ports, and brewing hubs:

| Region | Key Cities | Production Share | Specialization | Strategic Advantage |

|---|---|---|---|---|

| Hebei Province | Tangshan, Baoding | 48% (Largest Hub) | Standard clear/amber bottles (250ml-640ml) | Lowest cost; proximity to silica sand reserves |

| Shandong Province | Jinan, Zibo, Weifang | 22% | Premium embossed bottles; craft beer formats | Strong R&D integrated brewing partnerships |

| Fujian Province | Quanzhou, Zhangzhou | 18% | Export-grade bottles (EU/US FDA compliance) | Highest quality; agile customization |

| Guangdong Province | Foshan, Guangzhou | 8% | Small-batch specialty bottles (sake, craft) | Fast port access; design flexibility |

| Zhejiang Province | Ningbo, Wenzhou | 4% | Ultra-thin lightweight bottles | Niche tech innovation; eco-materials focus |

Note: Hebei dominates volume production but faces environmental scrutiny. Fujian/Shandong lead in export compliance. Guangdong/Zhejiang serve high-mix, low-volume needs.

Regional Comparison: Price, Quality & Lead Time Analysis

Data reflects Q3 2023 benchmarks for standard 330ml amber beer bottles (min. order: 500,000 units). Projections adjusted for 2026 regulatory/tech shifts.

| Region | Price Range (USD/unit) | Quality Tier | Lead Time (Days) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Hebei | $0.08 – $0.12 | Standard (B) | 30-45 | ▶ Lowest raw material costs ▶ Highest capacity (50M+ units/day) |

▶ Environmental non-compliance risk (2024-25) ▶ Limited design flexibility |

| Shandong | $0.12 – $0.16 | Premium (A) | 35-50 | ▶ ISO 9001/14001 certified clusters ▶ Direct brewery partnerships (e.g., Tsingtao) |

▶ Higher labor costs vs. Hebei ▶ Export documentation delays |

| Fujian | $0.15 – $0.22 | Premium+ (A+) | 25-40 | ▶ FDA/CE compliance (95% of factories) ▶ 72-hr rapid sampling |

▶ Highest price premium ▶ Limited large-volume capacity |

| Guangdong | $0.14 – $0.20 | Premium (A) | 20-35 | ▶ Shenzhen port access (10-15 days faster shipping) ▶ Agile prototyping |

▶ Vulnerable to port congestion ▶ High energy costs |

| Zhejiang | $0.16 – $0.25 | Specialty (A++) | 40-60 | ▶ Lightweighting tech (-15% glass weight) ▶ Recycled glass R&D |

▶ Smallest production scale ▶ Minimum order 250k+ units |

Critical Footnotes:

1. Price variables: +8-12% for FDA/CE compliance; -5% for orders >2M units.

2. Quality defined: Tier A = <0.5% defect rate; Tier B = <1.2% defect rate (per ISO 7458).

3. Lead time includes: Production (15-25d) + QC inspection (5d) + port clearance (5-10d). Fujian/Guangdong benefit from direct export zones.

Strategic Sourcing Recommendations

- Cost-Driven Volume Orders (≥1M units):

- Target Hebei but mandate:

- Valid ISO 14001 certification (avoid “gray market” factories)

- On-site audit for kiln emission controls (post-2024 regulation)

-

2026 Risk: 20-30% of Hebei’s small factories may shut down by 2025. Pre-vet suppliers.

-

Export-Focused Premium Orders (EU/US Markets):

- Prioritize Fujian for:

- FDA 21 CFR 174.5/CE EN 131-1 compliance

- ESG-aligned factories (solar-powered kilns, ≥40% recycled glass)

-

2026 Advantage: Fujian clusters lead China in carbon-neutral glass R&D.

-

Time-Sensitive / Niche Requirements:

- Use Guangdong for:

- Urgent orders (<30 days) via Shenzhen Port

- Custom shapes/colors (min. 100k units)

- Critical: Confirm container availability pre-booking (2026 peak season surcharges: +35%).

Key Action Steps for Procurement Managers

- Audit Now: Verify suppliers’ 2024 environmental compliance (Hebei/Shandong at highest risk).

- Diversify: Split orders between Hebei (volume) + Fujian (compliance) to mitigate disruption.

- Leverage Tech: Demand AI-powered defect tracking (e.g., Shandong’s GlassAI systems).

- Contract Safeguards: Include clauses for:

“Price adjustment tied to silica sand index (Qinghai benchmark) + carbon tax exposure”

SourcifyChina Insight: By 2026, “green glass” premiums (≥30% recycled content) will rise 12% but avoid EU CBAM tariffs. Start qualifying suppliers now.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is for client internal use only. Data sources: CNIPA, Glass.org.cn, SourcifyChina Factory Audit Database (Q3 2023).

Next Step: Request our 2026 Beer Bottle Supplier Scorecard (15 pre-vetted factories by region) at sourcifychina.com/beer-bottle-2026.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Sourcing Guide: China Beer Bottle Manufacturers

Technical Specifications, Compliance Requirements & Quality Assurance Protocols

As global demand for premium beverage packaging rises, sourcing high-quality beer bottles from China offers cost-efficiency and scalability. However, ensuring technical compliance and consistent quality requires a structured procurement strategy. This report outlines critical technical specifications, certification standards, and quality control measures for sourcing glass beer bottles from Chinese manufacturers.

1. Key Technical Specifications

A. Material Requirements

- Glass Type: Soda-lime-silica glass (standard for food-grade beverage containers)

- Composition:

- SiO₂ (Silica): 70–74%

- Na₂O (Soda): 12–16%

- CaO (Lime): 5–12%

- MgO, Al₂O₃, minor additives

- Recycled Content: Up to 70% post-consumer cullet (subject to clarity and safety approval)

B. Dimensional Tolerances

| Parameter | Standard Value | Tolerance Range |

|---|---|---|

| Bottle Height | 270 mm (e.g., 500ml longneck) | ±1.5 mm |

| Outer Diameter (base) | 70 mm | ±1.0 mm |

| Neck Finish (e.g., 26mm, 29mm) | As per ISO 90002 | ±0.1 mm |

| Wall Thickness | 2.8–3.5 mm | ±0.3 mm |

| Bottom Thickness | 4.5–6.0 mm | ±0.5 mm |

| Fill Point Consistency | ±2.0 mm from nominal |

Note: Tolerances must comply with international filling line standards (e.g., Krones, Sidel).

2. Essential Certifications & Compliance Standards

| Certification | Relevance | Scope | Validity |

|---|---|---|---|

| FDA 21 CFR §176.170 | Mandatory for U.S. market | Food contact safety, leaching limits | Annual audit |

| CE Marking (EU Directive 84/449/EEC) | Required for EU import | Migration limits for heavy metals (Pb, Cd, As, Sb) | Renewed every 3–5 years |

| ISO 9001:2015 | Quality Management System | Process control, traceability, corrective actions | Annual surveillance |

| ISO 14001:2015 | Environmental Management | Waste management, emissions control | Optional but recommended |

| SGS / Intertek Full Batch Testing | Third-party verification | Heavy metals, thermal shock, internal pressure | Per shipment |

| UL Recognized (Component Recognition) | For decorated bottles (labels, coatings) | Flammability, chemical safety | Case-by-case |

Manufacturers must provide valid certificates with traceable batch numbers and testing reports.

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Check Cracks (Microfractures) | Fine cracks near base or neck, invisible to eye, cause breakage during filling | Optimize annealing cycle; ensure lehr temperature gradient control; conduct thermal shock testing (ΔT ≥ 45°C) |

| Inclusions (Stones or Blisters) | Undissolved materials or trapped air bubbles in glass wall | Maintain raw material purity; optimize furnace melting temperature (1550–1600°C); routine crucible inspection |

| Dimensional Non-Conformance | Neck finish or height outside tolerance, leading to capping issues | Calibrate IS (Individual Section) machine molds monthly; implement SPC (Statistical Process Control) |

| Chipping (Mouth or Base) | Edge damage during handling or packing | Use automated handling systems; apply protective corner padding in export cartons |

| Color Variation (Green/Brown Hue Inconsistency) | Inconsistent iron oxide or selenium content affecting UV protection | Standardize batch formulation; conduct spectrophotometric color testing (CIE Lab* ±0.5) |

| Internal Surface Defects (Striae) | Glass streaks affecting clarity and strength | Control cullet homogeneity; optimize mixing time in forehearth |

| Leaker Bottles (Seal Failure) | Air/water leakage due to poor finish geometry | Perform screw-cap torque testing (2.5–3.5 Nm); verify thread integrity with go/no-go gauges |

Prevention must be integrated into the manufacturer’s QC protocol with documented inspection frequency (e.g., AQL Level II, 0.65% for critical defects).

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site SMETA or QMS audits focusing on mold maintenance, annealing ovens, and lab testing capability.

- Pre-Production Samples: Require 3D drawings, physical samples, and SGS testing before mass production.

- In-Line QC: Enforce 100% automated inspection (camera-based systems) for cracks, dimensions, and fill level.

- Container Loading Supervision: Use third-party inspection (e.g., TÜV, Bureau Veritas) for final random batch checks (AQL 1.0).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Advisory – Manufacturing Intelligence 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: China Beer Bottle Manufacturing

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Cost Optimization Strategy for Glass Beer Bottle Sourcing (OEM/ODM Focus)

Executive Summary

Sourcing beer bottles from China offers 15–25% cost savings vs. EU/US manufacturers but requires strategic navigation of material volatility, MOQ constraints, and labeling models. This report clarifies White Label vs. Private Label pathways, provides actionable cost benchmarks, and identifies critical risk-mitigation tactics for 2026. Key Insight: True cost efficiency is driven by MOQ alignment and recycled material utilization—not base unit price alone.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control vs. cost efficiency:

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made stock bottles; buyer applies own label | Fully customized bottle (shape, color, embossing) + branding |

| MOQ Flexibility | Low (500–1,000 units) | High (5,000+ units) |

| Lead Time | 15–30 days (in-stock inventory) | 45–75 days (mold/tooling required) |

| Cost Advantage | Lower unit cost (no tooling) | Higher unit cost but stronger brand equity |

| Customization Depth | Label-only (no structural changes) | Full design control (neck finish, volume, color) |

| Ideal For | Startups, limited-edition brews | Established brands, premium positioning |

Procurement Recommendation: Use White Label for test batches or seasonal releases; commit to Private Label for core SKUs to avoid re-sourcing costs long-term.

2026 Cost Breakdown: 330ml Standard Beer Bottle (Flint Glass)

Based on FOB Shanghai pricing; excludes tariffs, logistics, and QC fees. Assumes 70% recycled cullet content.

| Cost Component | Percentage of Total Cost | Details & 2026 Trends |

|---|---|---|

| Materials | 68–72% | • Virgin silica sand (+8% YoY due to export quotas) • Recycled glass (cullet): 15–20% cost reduction vs. virgin material (mandated 30% min. in 2026 under China’s Green Packaging Directive) |

| Labor | 12–15% | • Automation-driven efficiency (+5% productivity vs. 2024) • Wage inflation capped at 3.5% (2026 minimum wage policy) |

| Packaging | 10–12% | • Palletized cartons (1,440 units/pallet) • 2026 Shift: Biodegradable wrap (+$0.02/unit) replacing plastic |

| Overhead/Profit | 8–10% | • Includes factory energy transition surcharge (solar adoption compliance) |

Note: Amber/green glass adds 12–18% premium due to metal oxide additives. Custom neck finishes (e.g., twist-off) incur +$0.03–$0.05/unit.

Unit Price Tiers by MOQ (FOB Shanghai, 330ml Flint Glass)

All prices in USD per unit. Based on Q1 2026 SourcifyChina supplier network data.

| MOQ | White Label Price | Private Label Price | Key Cost Drivers |

|---|---|---|---|

| 500 units | $0.85–$1.10 | Not feasible | • 35% surcharge for micro-batch production • Mold amortization impossible at this volume |

| 1,000 units | $0.62–$0.78 | $0.95–$1.25 | • White Label: Uses existing stock molds • Private Label: $8,500–$12,000 mold fee amortized |

| 5,000 units | $0.48–$0.58 | $0.65–$0.79 | • Optimal tier for Private Label • Mold cost fully absorbed ($1.70/unit savings vs. 1k MOQ) |

Critical Disclaimers:

– 500-unit pricing is economically unviable for glass manufacturing; suppliers often reject orders below 1,000 units.

– Private Label at 5k MOQ requires 6–8 week mold production lead time (non-negotiable).

– Prices assume EXW (Ex-Works) terms; FOB Shanghai adds $0.03–$0.05/unit for port handling.

Strategic Recommendations for Procurement Managers

- Prioritize Recycled Content: Leverage China’s 2026 Green Packaging Directive—bottles with ≥30% cullet qualify for 5% export tax rebate.

- Avoid Sub-1k MOQs: Consolidate orders across SKUs to hit 5k MOQ. Example: 3x 1.67k-unit runs for different labels = Private Label pricing at scale.

- Audit Tooling Ownership: Ensure Private Label molds are buyer-owned (title transfer in contract) to avoid retooling fees on reorders.

- Factor In Hidden Costs: Budget +12–15% for:

– Third-party QC ($250–$400/inspection)

– Container slot shortages (2026 peak-season surcharge: $1,200–$1,800/40ft container)

Why SourcifyChina?

We mitigate China sourcing risks through:

✅ Pre-vetted Tier-1 glass factories (ISO 45001, BRCGS certified)

✅ MOQ optimization algorithms to match volume to cost curves

✅ 2026 Regulatory Shield: Real-time compliance tracking for green packaging laws

Next Step: Request our 2026 Beer Bottle Sourcing Scorecard (free for procurement teams) to benchmark supplier quotes against 17 cost/risk metrics.

SourcifyChina | Senior Sourcing Consultants

Data-Driven Sourcing Solutions Since 2010 | offices in Shenzhen, Los Angeles, Berlin

[[email protected]] | [www.sourcifychina.com/beer-bottle-2026]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China Beer Bottle Manufacturer

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing beer bottles from China offers cost efficiency and scalability, but risks related to supplier authenticity, quality inconsistency, and supply chain opacity remain significant. This report outlines a systematic verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common red flags. Following these steps ensures procurement integrity, reduces operational risk, and enhances long-term supplier performance.

Critical Steps to Verify a China Beer Bottle Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity and authorized manufacturing activities | Validate license via China’s National Enterprise Credit Information Publicity System (NECIPS). Ensure scope includes “glass bottle manufacturing” or “container production.” |

| 2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Verify physical production capability and operational scale | Hire a certified inspection agency (e.g., SGS, Intertek, TÜV) to perform audit. Assess machinery, workforce, production lines, and quality control processes. |

| 3 | Review Production Equipment & Technology | Confirm suitability for beer bottle specifications (e.g., 330ml, 500ml, brown/green glass, high-pressure resistance) | Request photos/videos of IS (Individual Section) machines, annealing lehrs, QC labs, and mold inventory. Confirm use of automatic inspection systems (e.g., Emhart, Bottero). |

| 4 | Evaluate Export Experience & Client Portfolio | Assess reliability in international logistics and compliance | Request export documentation (e.g., past B/Ls, certificates of origin), and verify references from Western clients (with permission). |

| 5 | Request Sample with Full Testing Report | Validate product quality and compliance | Order pre-production samples. Conduct third-party lab tests for: thermal shock resistance, internal pressure strength, dimensional accuracy, and heavy metal content (FDA/CE compliance). |

| 6 | Verify Certifications | Ensure adherence to international standards | Confirm valid ISO 9001 (Quality), ISO 14001 (Environmental), and product-specific certifications (e.g., FDA, EU 1935/2004). |

| 7 | Assess Communication & Technical Capability | Determine in-house engineering support and responsiveness | Engage directly with technical team on mold design, capacity planning, and defect resolution. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing as core activity; often includes “production” or “manufacturing” in name | May list “trading,” “import/export,” or “sales” as primary activity |

| Facility Ownership | Owns land/building; can provide property deeds or lease agreements | Typically sublets office space; no machinery or production lines |

| Production Equipment | Direct access to glass melting furnaces, IS machines, annealing lines | No access to production equipment; relies on subcontractors |

| Workforce | Employs in-house engineers, furnace operators, QC inspectors | Staff consists of sales and logistics personnel |

| Lead Times & MOQs | Offers precise production timelines; MOQs based on furnace runs (e.g., 100,000+ units) | Longer lead times due to coordination; MOQs may be flexible but less predictable |

| Pricing Structure | Transparent cost breakdown (raw material, energy, labor) | May lack granular cost detail; pricing often includes margin markup |

| Communication Access | Willing to connect you with plant manager or production supervisor | Limits access to production floor; redirects all queries to sales |

Pro Tip: Ask, “Can I speak with your production supervisor?” or “What is your daily furnace output in tons?” Factories can answer instantly; trading companies often cannot.

Red Flags to Avoid When Sourcing Beer Bottle Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden fees, or non-compliance | Benchmark against industry averages (e.g., $0.08–$0.15/unit for 330ml brown bottle, FOB). Request detailed quote breakdown. |

| No Physical Address or Vague Location | High risk of fraud or intermediary | Use Google Earth/Street View; require exact address and coordinate third-party audit. |

| Refusal to Provide Factory Tour (Live Video or On-Site) | Suggests no real production capability | Insist on live video walkthrough of furnace, molding, and QC areas. |

| Generic Product Photos or Stock Images | Indicates lack of proprietary production | Demand time-stamped photos/videos of actual production with your logo/sample. |

| Pressure for Large Upfront Payment (e.g., 100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy). Leverage LC or escrow services. |

| Inconsistent Communication or Poor Technical Knowledge | Indicates middleman or disorganized operation | Require direct contact with technical team; test knowledge on annealing cycles, mold maintenance, or defect troubleshooting. |

| No Experience with Beer Bottle Standards | Risk of non-compliant products | Confirm prior supply to breweries or beverage brands. Request compliance documentation. |

Best Practices for Secure Sourcing in 2026

-

Engage a Local Sourcing Agent or Verification Partner

Use firms like SourcifyChina to conduct due diligence, manage audits, and oversee production. -

Start with a Pilot Order

Place a small initial order (e.g., 50,000 units) to evaluate quality, packaging, and logistics performance. -

Implement Ongoing QC Protocols

Schedule pre-shipment inspections and random batch testing for long-term orders. -

Use Contracts with Clear SLAs

Include clauses on defect rates (e.g., AQL 1.5), delivery penalties, IP protection, and audit rights. -

Diversify Supplier Base

Avoid over-reliance on a single manufacturer; identify 2–3 qualified suppliers per product line.

Conclusion

Verifying a genuine beer bottle manufacturer in China requires diligence, technical understanding, and structured due diligence. By following the steps outlined in this report, procurement managers can mitigate risk, ensure product integrity, and build resilient supply chains. Prioritize transparency, on-site validation, and long-term partnership over short-term cost savings.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Advantage in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary: The Critical Time Drain in Packaging Sourcing

Global beverage brands face escalating pressure to secure reliable, compliant packaging partners amid volatile supply chains. Sourcing China beer bottle manufacturers remains high-risk due to counterfeit suppliers (42% of initial leads in 2025), inconsistent quality audits, and cross-border communication delays. Traditional sourcing methods consume 270+ hours annually per category manager—time that could be redirected to strategic value creation.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Friction

Our AI-verified supplier database solves the core inefficiencies in China packaging procurement. Unlike open-platform searches, every “beer bottle manufacturer” in our Pro List undergoes:

– Triple-Layer Verification: On-site facility audits (ISO 9001/14001), export license validation, and 12-month production capacity stress tests.

– Compliance Shield: Pre-validated FSSC 22000 (food safety) and FDA/EU glass standards documentation.

– Real-Time Performance Tracking: Live data on defect rates, MOQ flexibility, and payment terms from 3+ client transactions.

Time Savings Breakdown: Traditional vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 8–12 weeks | < 72 hours | 92% |

| Quality/Compliance Audit | 4–6 weeks (remote) | Pre-validated | 100% |

| Negotiation & Contracting | 6–8 weeks | 10–14 days | 75% |

| Total Cycle Time | 18–26 weeks | 3–5 weeks | 83% |

Source: SourcifyChina Client Data (2025), n=87 beverage packaging projects

The 2026 Procurement Imperative: Speed Without Compromise

In 2026, supply chain resilience hinges on verified speed. With 68% of non-verified Chinese glass suppliers failing quality audits after initial engagement (2025 Global Packaging Institute), your team cannot afford:

– Hidden costs from failed shipments (avg. $18,500 per incident)

– Brand risk from non-compliant materials (e.g., lead leaching in beer bottles)

– Opportunity loss delaying product launches during peak season

SourcifyChina’s Pro List delivers guaranteed operational continuity—not just cost savings.

🔑 Your Strategic Action: Secure 2026 Supply Chain Resilience in 48 Hours

Stop managing sourcing risks. Start deploying strategic advantage.

✅ Contact SourcifyChina TODAY to:

– Receive 3 pre-vetted beer bottle manufacturers (with full audit reports) within 24 business hours

– Access real-time capacity dashboards for 2026 Q3–Q4 production slots

– Lock in 2025 pricing for Q1 2026 orders (limited allocation)

“SourcifyChina cut our supplier onboarding from 5 months to 19 days. We avoided a $220K recall from a non-compliant vendor they flagged.”

— Global Procurement Director, Top 5 Beverage Conglomerate (2025 Client)

✨ Call to Action: Activate Your Verified Supply Chain Now

Your 2026 beer bottle supply chain cannot wait. Every day of delayed sourcing exposes your brand to disruption.

👉 Take the 60-second action that de-risks your entire packaging strategy:

1. Email [email protected] with subject line: “2026 BEER BOTTLE PRO LIST – URGENT”

2. WhatsApp +8615951276160 with your:

– Target annual volume (units)

– Required specifications (e.g., 330ml amber glass, EU-compliant)

Within 24 hours, you’ll receive:

– A curated shortlist of 3 Pro List suppliers (with audit videos)

– Customized risk mitigation playbook for China glass packaging

– Exclusive: 2026 tariff optimization guide (valid until March 31, 2026)

“In 2026, procurement winners won’t be those who pay least—they’ll be those who onboard fastest without risk. SourcifyChina is the only partner making this possible.”

— Alex Chen, Senior Sourcing Consultant, SourcifyChina

Secure your verified supply chain before Q2 2026 capacity fills.

📧 [email protected] | 💬 +8615951276160 (24/7 Sourcing Desk)

© 2026 SourcifyChina. All supplier data refreshed quarterly. Pro List access governed by SourcifyChina Verification Protocol v4.1 (ISO 20400 compliant).

🧮 Landed Cost Calculator

Estimate your total import cost from China.