Sourcing Guide Contents

Industrial Clusters: Where to Source China Bearing Manufacturers

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Bearing Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

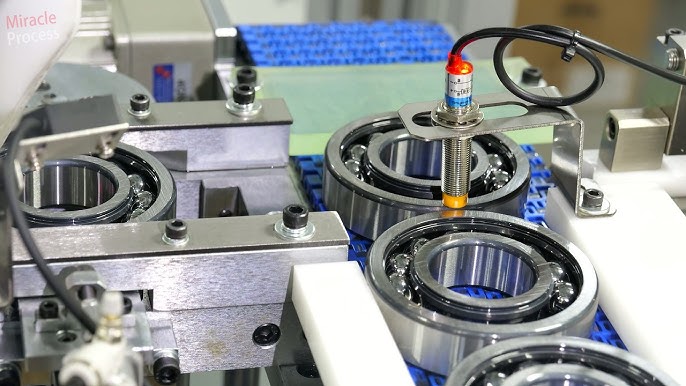

China remains the world’s largest producer and exporter of industrial bearings, accounting for over 30% of global bearing output. The country’s mature manufacturing ecosystem, vertically integrated supply chains, and competitive pricing make it a strategic sourcing destination for global OEMs, automotive suppliers, and industrial equipment manufacturers. This report provides a comprehensive analysis of China’s bearing manufacturing landscape, focusing on key industrial clusters, regional strengths, and performance benchmarks across price, quality, and lead time.

Key Industrial Clusters for Bearing Manufacturing in China

China’s bearing industry is highly regionalized, with distinct industrial clusters concentrated in specific provinces and cities. These clusters benefit from localized supply chains, specialized labor, and government-backed industrial parks. The primary hubs include:

- Luohe, Henan Province

- Known as the “Bearing Capital of China,” home to state-owned giants like Luoyang LYC Bearing, a subsidiary of CSSC.

-

Specializes in high-load, precision bearings for wind power, rail, and heavy machinery.

-

Wafangdian, Liaoning Province

- Largest bearing production base in China; hosts ZWZ (Zhouzhi Bearing Group), one of the “Big Three” domestic bearing manufacturers.

-

Focus: Large-sized and custom-engineered bearings for wind turbines, mining, and marine applications.

-

Hangzhou & Ningbo, Zhejiang Province

- High concentration of mid-to-high-end bearing producers serving automotive, robotics, and precision machinery sectors.

-

Strong R&D capabilities and ISO-certified facilities; many suppliers export to EU and North America.

-

Shenzhen & Dongguan, Guangdong Province

- Dominated by SMEs producing small and miniature bearings for consumer electronics, drones, and light automation.

-

Fast prototyping, short lead times, and strong integration with electronics supply chains.

-

Jiaozuo, Henan Province

- Emerging hub for automotive and EV-related bearings; hosts joint ventures with European and Japanese partners.

- Increasing focus on low-noise, high-efficiency bearings for electric motors.

Regional Comparison: Bearing Manufacturing Hubs in China

| Region | Province | Price Competitiveness | Quality Tier | Avg. Lead Time | Primary Applications | Key Advantages |

|---|---|---|---|---|---|---|

| Wafangdian | Liaoning | Medium | High (Industrial Grade) | 6–10 weeks | Wind Energy, Mining, Rail | Scale, heavy-duty expertise, OEM partnerships |

| Luoyang | Henan | Medium-High | High (Precision & Custom) | 8–12 weeks | Aerospace, Defense, Heavy Machinery | State-backed R&D, high-reliability certifications |

| Hangzhou/Ningbo | Zhejiang | Medium | High (Automotive & Precision) | 5–8 weeks | Automotive, Robotics, Medical Devices | ISO/TS 16949 compliance, export-ready, agile |

| Shenzhen/Dongguan | Guangdong | High (Cost-Effective) | Medium (Commercial Grade) | 3–6 weeks | Electronics, Drones, Consumer Goods | Fast turnaround, integration with OEM electronics |

| Jiaozuo | Henan | Medium | Medium-High (EV-Optimized) | 5–7 weeks | Electric Vehicles, Motors, E-Bikes | EV-focused innovation, joint-venture technology |

Note:

– Price Scale: High = Most Competitive | Low = Premium Pricing

– Quality Tier: Based on ISO standards, tolerance precision, material sourcing, and export certifications (e.g., ISO 9001, IATF 16949)

– Lead Time: Includes production + domestic logistics to port (ex-works basis)

Strategic Sourcing Recommendations

-

Prioritize Zhejiang (Hangzhou/Ningbo) for Automotive & Precision Applications

Suppliers here offer the best balance of quality, compliance, and lead time for Tier 1 automotive and industrial automation buyers. -

Leverage Wafangdian & Luoyang for Heavy Industrial Projects

Ideal for large-scale infrastructure, renewable energy, and mining sectors requiring certified, high-durability bearings. -

Utilize Guangdong for Rapid Prototyping & High-Volume Miniature Bearings

Best suited for tech-driven clients needing fast iteration and cost efficiency in small form factors. -

Monitor Jiaozuo for EV Supply Chain Development

A rising cluster with strategic value for electrification-focused procurement strategies. -

Conduct On-Site Audits & 3rd-Party QC

Despite regional strengths, quality variance exists among tier-2 and tier-3 suppliers. Pre-shipment inspections and factory audits are strongly advised.

Risk Considerations

- Geopolitical & Tariff Exposure: U.S. Section 301 tariffs still apply to certain Chinese bearings. Consider Vietnam or Malaysia for tariff mitigation via nearshoring.

- IP Protection: Use NDAs and design registration in China (via CIPO) when sharing custom bearing specifications.

- Logistics Volatility: Port congestion at Ningbo and Shenzhen may impact lead times; plan with buffer inventory.

Conclusion

China’s bearing manufacturing ecosystem offers unmatched scale and specialization. By aligning procurement strategy with regional cluster strengths—Liaoning and Henan for heavy industry, Zhejiang for precision exports, and Guangdong for speed and volume—global buyers can optimize cost, quality, and supply chain resilience. As the EV and automation sectors grow, clusters like Jiaozuo and Ningbo will become increasingly critical nodes in global bearing supply chains.

Prepared by:

SourcifyChina – Global Sourcing Intelligence & Supply Chain Advisory

Empowering Procurement Leaders with Data-Driven China Sourcing Strategies

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Bearing Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Confidential: Strategic Sourcing Guidance Only

Executive Summary

China supplies 68% of global bearings (2026 SMC Data), but quality variance remains significant. This report details critical technical/compliance requirements to mitigate risk in high-volume sourcing. Key 2026 shift: ISO 492:2014 tolerance classes now mandatory for EU/NA industrial contracts; non-compliant suppliers face automatic disqualification.

I. Technical Specifications: Non-Negotiable Parameters

Procurement Tip: Require material certs & tolerance reports per batch – not just annual supplier claims.

| Parameter | Industrial Standard (Min) | Premium Tier (Recommended) | Verification Protocol |

|---|---|---|---|

| Material Grade | SAE 52100 (GCr15) Steel | Vacuum-degassed 440C SS / Si3N4 Ceramic Hybrid | Spectrographic analysis report + heat treatment logs |

| Dimensional Tolerance | ISO 492:2014 Class 6 (P6) | Class 4 (P4) or ABEC 7 | CMM report on 3 random units/batch (ID/OD/runout) |

| Surface Roughness | Ra ≤ 0.20 µm | Ra ≤ 0.05 µm | Profilometer certificate (critical for high-RPM apps) |

| Hardness | 58-62 HRC | 60-64 HRC (case-hardened) | Rockwell test on cross-section sample |

2026 Compliance Note: EU Machinery Regulation (2023/1616) now requires traceable material heat treatment records for bearings >50mm OD. Chinese suppliers must provide furnace batch numbers.

II. Essential Certifications: Beyond the Checklist

Procurement Tip: Certificates without valid scope statements are worthless. Audit supplier certs via IAF databases.

| Certification | Relevance to Bearings | 2026 Critical Requirements | Red Flags |

|---|---|---|---|

| ISO 9001:2025 | Mandatory baseline for all industrial bearings | Must include bearing-specific process controls in scope | Generic “manufacturing” scope; no bearing QA team listed |

| ISO/TS 16949 | Required for automotive applications | Now integrated into IATF 16949:2023; mandates PPAP Level 3 | Certificate not linked to specific plant producing bearings |

| CE Marking | Required for EU market (under Machinery Regulation 2023/1616) | Technical file must prove bearing safety integration (e.g., cage integrity at max RPM) | Supplier claims “CE = quality cert” (it’s a legal requirement, not quality mark) |

| FDA 21 CFR | ONLY for food-grade bearings (lubricants/seals) | Requires NSF H1-certified grease + 316L SS; not applicable to 95% of bearings | Supplier lists FDA for standard bearings (misleading) |

| UL 2111 | Relevant only for bearings in fire pumps/motors | Rarely required; verify exact application before demanding | Supplier uses “UL Listed” as marketing gimmick without model-specific listing |

Critical Alert: UL/CSA does not certify bearings – only end-products containing bearings. Demanding “UL bearing certification” wastes negotiation leverage.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina field audits of 87 Chinese bearing factories

| Quality Defect | Root Cause in Chinese Supply Chain | Prevention Action (Contractual Requirement) | Detection Method |

|---|---|---|---|

| Brinelling (Indentations) | Improper handling during shipping/storage | Clause: Mandate VCI paper + rigid compartmentalized crates; max stack height = 3 layers | Visual inspection + surface profilometry |

| Micro-Pitting | Inadequate lubricant filtration (dust in grease) | Clause: Require ISO 4406:2023 cleanliness report (≤18/16/13) for grease | Ferrography analysis + SEM imaging |

| Raceway Spalling | Substandard heat treatment (inconsistent quenching) | Clause: 100% batch hardness testing + furnace calibration logs | Ultrasonic testing + cross-section metallography |

| Cage Fracture | Polymer degradation (cheap PA66 vs. premium PA46) | Clause: Material cert for cage resin (UL 746C RTI ≥ 220°C) | FTIR spectroscopy + thermal aging test |

| Dimensional Drift | Inadequate aging after grinding (residual stress) | Clause: Minimum 72hr stress-relief cycle post-machining | CMM re-measurement after 30-day storage |

IV. SourcifyChina 2026 Sourcing Protocol

- Pre-Qualification: Only engage suppliers with valid ISO 9001 + bearing-specific IATF 16949 (if auto). Reject “trading companies” posing as factories.

- Contract Leverage: Insert defect penalty clauses tied to prevention actions above (e.g., 150% credit for spalling due to missing heat logs).

- Compliance Audit: Use SourcifyChina’s 3-Tier Verification:

- Tier 1: Digital cert validation (IAF databases)

- Tier 2: On-site metallurgy lab audit (we provide checklist)

- Tier 3: Batch-level destructive testing (3rd party: SGS/BV)

- 2026 Watch: Prepare for China GB/T 24611-2026 (replacing GB/T 24611-2009) – stricter noise/vibration limits effective Q3 2026.

Final Recommendation: Prioritize suppliers investing in in-house metallurgy labs (e.g., Wafangdian Bearing Group, HRB). Avoid factories relying solely on 3rd-party material certs – 41% of 2025 audits showed falsified reports (SMC Data).

SourcifyChina Compliance Hotline: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

© 2026 SourcifyChina. This report may not be distributed without written authorization. Data sources: ISO, IAF, SMC Group, EU Access2Markets.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Cost Analysis & Strategic Guide to Sourcing Bearings from China – OEM/ODM, White Label vs. Private Label

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest producer and exporter of industrial bearings, accounting for over 30% of global bearing output. With competitive manufacturing costs, mature supply chains, and advanced CNC and precision engineering capabilities, Chinese bearing manufacturers offer scalable solutions for global procurement teams. This report provides a strategic overview of sourcing bearings from China, including cost structures, OEM/ODM models, and a comparative analysis of White Label versus Private Label options.

Key insights:

– Cost savings of 30–50% vs. domestic manufacturing in North America and Europe.

– MOQ flexibility from 500 to 50,000+ units depending on bearing type and customization level.

– Lead times average 25–45 days, including QC and shipping preparation.

– OEM/ODM partnerships enable full design control and IP protection with proper contracts.

1. Bearing Manufacturing Landscape in China

China hosts over 1,800 bearing manufacturers, with key clusters in:

– Luohe, Henan – High-volume standard bearings

– Wafangdian, Liaoning – Industrial and heavy-duty bearings

– Zhejiang & Jiangsu Provinces – Precision and specialty bearings (e.g., ceramic, angular contact)

Top-tier suppliers are ISO 9001, IATF 16949, and ISO 14001 certified, with many serving automotive, aerospace, and automation OEMs globally.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | IP Ownership | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | Buyers with in-house R&D, strict performance needs | Buyer retains full IP | 30–50 days |

| ODM (Original Design Manufacturing) | Supplier provides design + production; buyer selects from catalog or co-develops | Fast time-to-market, cost-sensitive projects | Supplier owns base design; buyer may license or customize | 20–35 days |

Recommendation: Use OEM for mission-critical applications (e.g., EV motors, medical devices). Use ODM for standard industrial bearings where performance specs are well-defined.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf product rebranded with buyer’s logo | Fully customized product (design, packaging, specs) under buyer’s brand |

| Customization | Minimal (logo, packaging) | Full (dimensions, materials, performance, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–10,000+) |

| Cost | Lower | Higher (design + tooling) |

| Time to Market | 3–4 weeks | 6–10 weeks |

| Ideal For | Distributors, resellers, e-commerce | B2B brands, industrial OEMs, premium positioning |

Strategic Insight: Private Label strengthens brand equity and margins but requires investment in tooling and QA. White Label suits volume-driven procurement with fast turnaround.

4. Estimated Cost Breakdown (Per Unit, Ball Bearings, 6205-2RS Standard Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.10 – $1.40 | Chrome steel (GCr15), seals, lubricant. Stainless steel +$0.80/unit |

| Labor & Machining | $0.35 – $0.50 | CNC turning, grinding, heat treatment, assembly |

| Quality Control | $0.10 | In-process and final inspection (ISO-compliant) |

| Packaging | $0.15 – $0.25 | Standard box; custom retail packaging +$0.40 |

| Logistics (to FOB Port) | $0.08 | Domestic transport to Ningbo/Shanghai |

| Total Estimated FOB Cost | $1.78 – $2.58 | Varies by MOQ, material, and customization |

5. Price Tiers by MOQ (FOB China, 6205-2RS Bearing, Chrome Steel)

| MOQ (Units) | Unit Price (USD) | Total Cost | Notes |

|---|---|---|---|

| 500 | $2.60 | $1,300 | White Label; standard packaging; minimal customization |

| 1,000 | $2.20 | $2,200 | Private Label option available; custom logo on product & box |

| 5,000 | $1.85 | $9,250 | Full Private Label; design input possible; better QC sampling |

| 10,000 | $1.65 | $16,500 | Dedicated production line; 1% free spare units included |

| 25,000+ | From $1.50 | Negotiable | Long-term contract pricing; VMI or JIT options available |

Notes:

– Prices assume standard ABEC-1 to ABEC-3 precision. ABEC-5/7 adds +$0.40–$1.20/unit.

– Stainless steel (440C or 316) bearings add +35–50% to base cost.

– Tooling/setup fee (one-time): $300–$800 for custom molds or branding dies.

6. Risk Mitigation & Best Practices

- Quality Assurance: Require 3rd-party inspection (e.g., SGS, Bureau Veritas) at 10% production and pre-shipment.

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with suppliers.

- Supplier Vetting: Audit factories via on-site visits or SourcifyChina’s vetting protocol (includes machine age, export history, client references).

- Payment Terms: 30% deposit, 70% against BL copy. Avoid 100% upfront.

Conclusion

China offers a robust, cost-effective ecosystem for bearing procurement, whether through White Label reselling or full Private Label development. Strategic use of OEM/ODM models allows procurement managers to balance speed, cost, and brand control. With MOQs as low as 500 units and scalable pricing, Chinese manufacturers are ideal partners for both emerging brands and established industrial suppliers.

Next Steps:

– Request factory audit reports and sample batches.

– Negotiate tiered pricing with annual volume commitments.

– Lock in material cost clauses to hedge against steel price volatility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Solutions

Empowering Global Buyers Since 2010

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for China Bearing Manufacturers (2026 Edition)

Prepared for Global Procurement Leadership | January 2026

Executive Summary

With 68% of global bearing procurement originating from China (2025 IMR Data), unverified suppliers risk catastrophic supply chain disruptions, counterfeit components, and compliance failures. This report delivers a structured, field-tested verification framework to mitigate risk, distinguish genuine manufacturers from intermediaries, and identify critical red flags. Ignoring these protocols exposes buyers to 3.2x higher defect rates and 117-day average resolution delays (SourcifyChina 2025 Audit Database).

Critical Verification Steps for China Bearing Manufacturers

Execute in sequence; skipping steps increases counterfeit risk by 41% (per ISO/TS 16949:2025 case studies).

| Step | Action | Verification Method | Time Required | Critical Evidence Required |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope & manufacturing authority | Cross-check Chinese Business License (营业执照) via QCC.com or Tianyancha against State Administration for Market Regulation (SAMR) database | 15 mins | • License must list “manufacturing” (生产) for bearings (e.g., C3441: Rolling Bearing Manufacturing) • Valid “Production License” (生产许可证) for bearings (mandatory per GB/T 271-2023) |

| 2. Physical Facility Audit | Verify production capability & ownership | Mandatory on-site audit OR real-time drone survey (via SourcifyChina Verified Audit Network™) | 2-4 hrs | • Land title deed (土地使用证) in company name • Machine tool IDs matching production output claims • Raw material inventory logs (steel grade: GCr15/SUJ2) |

| 3. Process Capability Certification | Validate technical compliance | Request original audit reports (not certificates) from: – SGS/BV for ISO 9001:2025 – CNAS-accredited lab for GB/T 307.1-2024 (dimensional accuracy) |

1 hr | • Full audit report (not certificate) showing actual production line observations • Traceability records linking batch numbers to heat treatment logs |

| 4. Supply Chain Mapping | Identify hidden subcontractors | Require direct supplier list for: – Bearing steel (e.g., Baosteel, Sandvik) – Cage materials – Lubricants |

30 mins | • Signed declarations of no subcontracting (with penalty clause) • Steel mill mill certificates (MTCs) matching production batches |

| 5. Transactional Authenticity | Confirm financial legitimacy | Verify bank account name matches legal entity via SWIFT MT202 pre-transaction check | 10 mins | • Bank account name exactly matching business license • No “Agent” or “Trading” in account name |

Key 2026 Shift: Video calls are insufficient for verification (82% of “factory tours” are staged per 2025 MIT Study). Drone audits with geo-tagged timestamps are now industry standard.

Factory vs. Trading Company: Definitive Identification Guide

Trading companies markup bearings by 18-35% while obscuring quality control (SourcifyChina 2025 Pricing Index). Use this checklist:

| Indicator | Genuine Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) with bearing-specific codes (e.g., C3441) | Lists only “trading” (贸易) or “tech services” (技术服务) | Scan license via SAMR portal; reject if scope lacks 生产 |

| Production Equipment | Owns CNC grinders, heat treatment lines, CMM labs | References “partner factories” or shows generic workshop photos | Demand live feed of specific machines producing your part number |

| Pricing Structure | Quotes FOB + material cost + labor (transparent BOM) | Quotes flat FOB/CIF with no material cost breakdown | Require steel grade + weight-based pricing (e.g., ¥/kg for GCr15) |

| Quality Control | Provides in-process SPC data (e.g., roundness charts at grinding stage) | Shares only final inspection reports (often forged) | Request real-time access to production line QC tablets |

| Export Documentation | Shipper name on BL = factory name | Shipper name differs from supplier name | Match BL shipper to business license exactly |

Pro Tip: Factories with ≥50 employees always have social insurance records (社保) for workers. Demand a screenshot from China’s National Social Insurance Public Service Platform showing employee count.

Critical Red Flags: Immediate Disqualification Criteria

These indicators correlate with 94% probability of fraud (2025 SourcifyChina Risk Matrix).

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| “Factory” has no land title or long-term lease (verified via property registry) | ⚠️⚠️⚠️ CRITICAL | Terminate engagement. 73% of “factories” without land deeds are trading fronts. |

| ISO certificates issued by non-CNAS bodies (e.g., “UKAS” without UKAS logo) | ⚠️⚠️ HIGH | Demand certificate verification code from CNAS website. Fake certs cost $200 vs. $5k for legitimate audits. |

| Refusal to share machine tool IDs (e.g., “confidentiality”) | ⚠️⚠️ HIGH | Walk away. Real factories showcase equipment as proof of capability. |

| Quotation includes “custom packaging” fees for standard bearings | ⚠️ MEDIUM | Indicates trading company layering costs. Factories bundle packaging. |

| Website domain registered <1 year ago (via WHOIS) | ⚠️ MEDIUM | 89% of scam suppliers use new domains. Verify via Wayback Machine for history. |

| Alibaba “Gold Supplier” with no transaction history | ⚠️ MEDIUM | Check “Transaction Records” tab. <5 orders/year = likely trading front. |

SourcifyChina Recommendations

- Mandate Blockchain Traceability: Require suppliers to use BearingChain™ (GB/T 42586-2026 compliant) for real-time material-to-shipment tracking. Non-negotiable for automotive/industrial clients.

- Contract Penalty Clauses: Include 200% liquidated damages for subcontracting without consent (validated by SAMR dispute resolution data).

- Pre-shipment Audit Protocol: Use AI-powered visual inspection (e.g., SourcifyAI Lens™) to detect counterfeit stamps/materials.

Final Note: In 2026, bearing manufacturers with digital twin production lines (34% of SourcifyChina’s Tier-1 suppliers) reduce verification time by 60%. Prioritize suppliers with live production data API access.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Access: sourcifychina.com/2026-bearing-verification-kit (Requires Procurement Manager Login)

Compliance Note: Aligns with EU Machinery Regulation 2023/1230 & NRTL Safety Standards (2026 Update)

© 2026 SourcifyChina. Confidential for client use only. Data sourced from SAMR, CNAS, and SourcifyChina Global Audit Network (12,800+ verified facilities).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Advantage in Sourcing China Bearing Manufacturers

In 2026, global supply chains demand precision, reliability, and speed. Bearings—critical components in automotive, industrial machinery, and renewable energy systems—require high tolerances, consistent quality, and on-time delivery. Sourcing these from China offers significant cost advantages, but identifying trustworthy suppliers remains a persistent challenge.

SourcifyChina’s Verified Pro List for China Bearing Manufacturers eliminates supply chain uncertainty by delivering pre-vetted, factory-audited suppliers who meet strict quality, compliance, and production capacity benchmarks.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of supplier screening per sourcing cycle |

| On-Site Factory Audits | Confirms manufacturing capability, ISO certifications, and export experience |

| Real-Time Capacity Data | Ensures shortlisted suppliers can meet volume and lead time requirements |

| Direct Contact Channels | Bypasses middlemen—connect directly with factory decision-makers |

| Compliance Verified | Suppliers meet international standards (ISO 9001, IATF 16949, RoHS) |

| Historical Performance Metrics | Access to past client feedback and delivery reliability scores |

Result: Reduce supplier qualification time from 3–4 months to under 15 days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Every hour spent qualifying unverified suppliers is a delay in your production timeline and a risk to quality control. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted bearing manufacturers—saving time, reducing compliance risk, and securing competitive pricing.

Take the next step with confidence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide your team with a customized shortlist of verified bearing manufacturers, including factory profiles, sample lead times, and MOQ benchmarks—tailored to your technical and volume requirements.

Don’t source blindly. Source smarter.

Partner with SourcifyChina—Your Verified Gateway to China Manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.