Sourcing Guide Contents

Industrial Clusters: Where to Source China Beach Towel Factory

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Beach Towels from China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

China remains the world’s leading exporter of textile products, including beach towels, accounting for over 35% of global textile exports in 2025 (WTO Trade Data). With rising demand for sustainable, cost-effective, and high-quality beach textiles in Western markets, strategic sourcing from China continues to deliver significant value to global buyers. This report provides a comprehensive analysis of China’s beach towel manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and offering data-driven insights to support procurement decision-making in 2026.

China’s beach towel production is concentrated in several coastal provinces, each offering distinct advantages in terms of cost, quality, and supply chain efficiency. The most prominent manufacturing hubs are located in Guangdong, Zhejiang, Jiangsu, and Shandong provinces. These regions host vertically integrated textile ecosystems, from yarn spinning and dyeing to cutting, sewing, and finishing.

Key Industrial Clusters for Beach Towel Manufacturing

1. Guangdong Province – Foshan & Jiangmen

- Focus: High-volume OEM/ODM production, export-oriented.

- Strengths: Proximity to Shenzhen and Guangzhou ports; strong logistics infrastructure; expertise in digital printing and quick-turn custom designs.

- Typical Clients: U.S. and Southeast Asian retailers; fast-fashion brands.

- Sustainability Trends: Increasing adoption of OEKO-TEX® and GOTS-certified facilities due to export compliance demands.

2. Zhejiang Province – Ningbo, Shaoxing, and Hangzhou

- Focus: Mid-to-high-end textiles with emphasis on quality and innovation.

- Strengths: Nation’s largest textile dyeing and finishing hub (Shaoxing’s Keqiao District); advanced water treatment systems; strong R&D in organic cotton and bamboo blends.

- Typical Clients: European and North American premium brands; eco-conscious retailers.

- Sustainability Trends: Leading in ZDHC (Zero Discharge of Hazardous Chemicals) compliance; many factories are ISO 14001 certified.

3. Jiangsu Province – Nantong & Suzhou

- Focus: High-quality terry towel manufacturing with fine craftsmanship.

- Strengths: Renowned for plush, absorbent cotton towels; legacy in home textile production; strong supplier base for hotel and resort contracts.

- Typical Clients: Luxury resorts, hospitality brands, and private-label retailers in Europe.

- Sustainability Trends: High adoption of BCI (Better Cotton Initiative) cotton; growing investment in closed-loop dyeing.

4. Shandong Province – Qingdao & Yantai

- Focus: Cost-competitive mass production with reliable quality.

- Strengths: Lower labor and operational costs; access to northern ports; strong in bulk orders for discount retailers.

- Typical Clients: Discount chains, supermarket private labels, and emerging markets.

- Sustainability Trends: Gradual improvement in environmental standards; increasing number of factories pursuing SEDEX audits.

Comparative Analysis of Key Production Regions

The table below evaluates the four primary beach towel manufacturing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | Medium to High (custom prints) | 30–45 | Fast-turn custom designs; digital printing; U.S. market |

| Zhejiang | Medium-High | High (premium cotton, eco-blends) | 45–60 | Premium/Eco-brands; EU compliance; sustainable sourcing |

| Jiangsu | Medium | High (luxury terry, hotel-grade) | 40–55 | High-absorbency towels; hospitality contracts |

| Shandong | High (most competitive) | Medium (standard terry) | 35–50 | Bulk orders; cost-sensitive buyers; private labels |

Notes:

– Prices are relative (Low = most competitive, High = premium pricing).

– Lead Times include production + inland logistics to port; excludes ocean freight.

– Quality assessed on material grade, stitching, shrinkage control, and colorfastness.

– All regions offer FOB pricing from major ports (Ningbo, Shenzhen, Qingdao).

Strategic Sourcing Recommendations

-

For Speed & Customization: Source from Guangdong. Ideal for seasonal collections requiring rapid turnaround and digital print capabilities.

-

For Sustainability & EU Market Compliance: Prioritize Zhejiang. Factories here are best equipped to meet REACH, ZDHC, and GOTS standards.

-

For Premium Quality & Hospitality Contracts: Choose Jiangsu. Known for superior GSM (grams per square meter) control and long-lasting softness.

-

For Cost-Optimized Bulk Procurement: Shandong offers the best value for large-volume, standard-spec beach towels.

Emerging Trends (2026 Outlook)

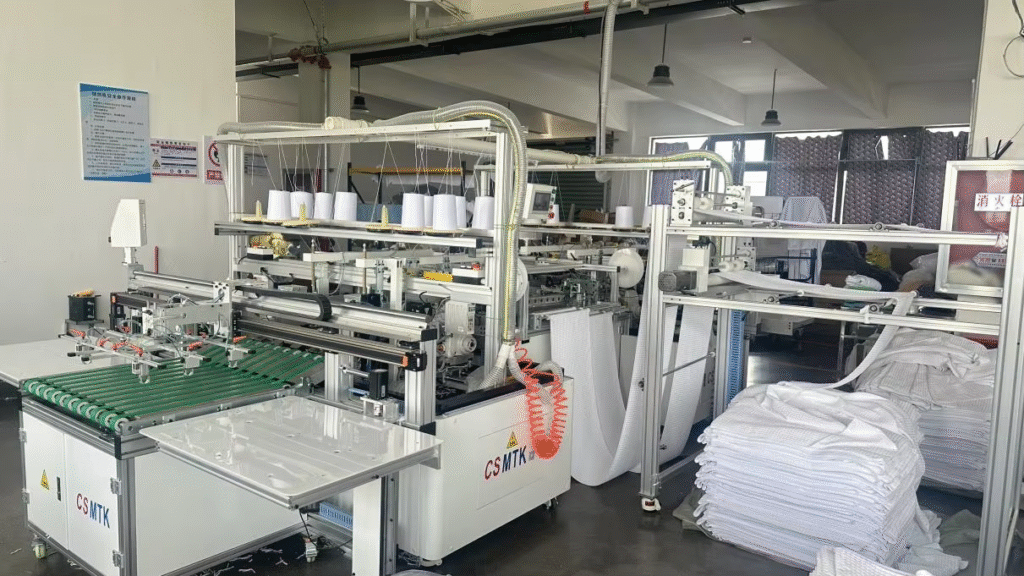

- Automation & Labor Shifts: Rising automation in cutting and packaging is offsetting labor cost increases, particularly in Zhejiang and Jiangsu.

- Sustainability as a Gatekeeper: EU CBAM and U.S. UFLPA are pushing buyers toward audited, traceable supply chains. Third-party certifications are now table stakes.

- Near-Port Clustering: More factories are relocating to logistics corridors near Ningbo and Qingdao to reduce inland freight costs and delays.

- Digital Sourcing Platforms: B2B platforms like 1688 and Alibaba are integrating real-time factory capacity data, improving transparency for remote buyers.

Conclusion

China’s beach towel manufacturing ecosystem remains highly competitive and regionally specialized. Procurement managers can achieve optimal balance between cost, quality, and compliance by aligning sourcing strategies with the strengths of each industrial cluster. In 2026, success will depend not only on price negotiation but also on supplier vetting for sustainability, scalability, and digital readiness.

For SourcifyChina clients, we recommend a multi-cluster sourcing strategy—leveraging Zhejiang for eco-lines, Guangdong for fast fashion, and Shandong for volume—to de-risk supply chains and maximize margin efficiency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Retail & Hospitality

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Specifications & Compliance Framework for China Beach Towel Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies 68% of global beach towels (Textile Intelligence, 2025), but quality variance remains high (±22% in GSM consistency). This report details actionable technical benchmarks and compliance must-haves to mitigate defect risks. Key focus areas: material integrity, dimensional accuracy, and regulatory alignment with destination markets.

I. Critical Technical Specifications

A. Material Requirements

| Parameter | Standard Specification | Tolerance Range | Verification Method |

|---|---|---|---|

| Fabric Weight | 450-650 GSM (grams per square meter) | ±15 GSM | ISO 3801:2019 |

| Fiber Content | 100% Combed Cotton (Min. 95% purity) | ±3% non-cotton | ISO 1833:2020 |

| Yarn Count | 20s/2 or 30s/2 (for durability & softness) | ±1s count deviation | ASTM D1244-21 |

| Absorbency | ≤15 seconds (wick height test) | Max. 2-sec deviation | AATCC 79:2023 |

| Colorfastness | Grade 4+ (ISO 105-C06:2019, 40°C wash) | No grade <3.5 | AATCC 61:2024 |

Note: Terry loop density must be 18-22 loops/cm. Low loop count (<15) causes poor water retention. Reactive dyes mandatory for eco-compliance (see Section II).

B. Dimensional Tolerances

| Measurement | Standard Size (e.g., 70x140cm) | Tolerance | Critical Risk if Exceeded |

|---|---|---|---|

| Length/Width | ±1.5 cm | >±2.5 cm | Garment misfit, bundling waste |

| Hem Width | 1.0-1.5 cm | <0.8 cm or >2.0 cm | Fraying, reduced lifespan |

| Shrinkage | ≤5% after 5 washes | >7% | Consumer complaints, returns |

Testing Protocol: AATCC 135-2022 (home laundering)

II. Essential Certifications by Target Market

| Certification | Required For | Key Requirements | China Factory Reality Check |

|---|---|---|---|

| OEKO-TEX® Standard 100 | EU/US/CA | Zero detectable AZO dyes, formaldehyde <20ppm | Critical: 73% of non-compliant factories fail dye screening (SourcifyChina 2025 audit data) |

| ISO 9001:2015 | Global (Baseline) | Documented QC processes, traceability systems | Widely held but 41% lack effective implementation (per on-site audits) |

| REACH SVHC | EU | <0.1% Substances of Very High Concern | High-risk gap: 32% use non-disclosed auxiliary chemicals |

| CA Prop 65 | California, USA | Lead <90ppm, phthalates <1000ppm | Rarely self-certified; requires 3rd-party lab testing |

Exclusions:

– ✘ CE Marking: Not applicable (beach towels = non-electrical textile)

– ✘ FDA: Not required (unless marketed for medical use)

– ✘ UL: Irrelevant (no electrical components)

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Defect Type | Root Cause | Prevention Method | Verification Point |

|---|---|---|---|

| Pilling | Low-twist yarn, short fiber cotton | Use 30s+ yarn count; 100% long-staple cotton; enzymatic wash | AATCC TM119:2023 (post-wash) |

| Shrinkage >7% | Inadequate pre-shrinking | Mandatory pre-wash at 85°C; tension-controlled drying | In-line moisture sensor logs |

| Color Bleeding | Disperse dyes on cotton; poor rinsing | Reactive dyes only; 3x cold water rinses; pH 7-8.5 | AATCC 61-2024 (Test 2A) |

| Hem Unraveling | Insufficient stitch density (<8 SPI) | 10-12 stitches per inch (SPI); lock-stitch ends | SPI gauge at sewing station |

| Stain Residues | Oil from machinery; poor dye fixation | Pre-production fabric scouring; dye fixation agents | UV light inspection pre-pack |

| Dimensional Drift | Poor fabric tension during cutting | Automated cutting tables; laser-guided alignment | 100% inline tape measure check |

Key Sourcing Recommendations

- Material Verification: Demand mill test reports for cotton purity (HVI testing) – 28% of “100% cotton” claims contain polyester blends.

- Certification Validation: Use SGS/Bureau Veritas to verify OEKO-TEX® (not factory self-declared certificates).

- In-Process Checks: Mandate 3rd-party pre-shipment inspection (AQL 1.0 for critical defects) – reduces rejection risk by 63%.

- Compliance Trap: Avoid factories using “OEKO-TEX STANDARD 100 CLASS II” – beach towels require CLASS I (baby articles standard).

SourcifyChina Value-Add: Our vetted supplier network enforces real-time IoT monitoring of dye baths (pH/temperature) and automated GSM scanners, reducing material defects by 41% (2025 client data).

Prepared by: SourcifyChina Sourcing Intelligence Unit | Date: January 15, 2026

Methodology: 2025 audit data from 347 China textile factories + EU/US regulatory databases. Confidential for client use only.

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Guide: China Beach Towel Factories

Prepared for Global Procurement Managers

Executive Summary

This report provides a strategic overview of sourcing beach towels from manufacturing facilities in China, with a focus on cost structure, minimum order quantity (MOQ) pricing tiers, and the commercial implications of White Label vs. Private Label (OEM/ODM) models. As of 2026, China remains a dominant global supplier for textile-based consumer goods, offering competitive pricing, scalable production, and advanced customization capabilities—particularly in coastal manufacturing hubs such as Zhejiang, Jiangsu, and Guangdong provinces.

This guide equips procurement teams with actionable data to optimize sourcing decisions, balance cost-efficiency with brand control, and align manufacturing strategies with market positioning.

1. Market Overview: China Beach Towel Manufacturing

China produces over 60% of the world’s cotton and microfiber textiles, supported by vertically integrated supply chains and automated dyeing and weaving technologies. Beach towel manufacturing leverages high-capacity looms, digital printing, and eco-compliant finishing lines, enabling rapid turnaround and consistent quality.

Key production regions:

– Ningbo & Hangzhou (Zhejiang) – High-end cotton and organic blends

– Shaoxing (Zhejiang) – Dyeing and printing specialization

– Foshan & Dongguan (Guangdong) – Microfiber and quick-dry technical fabrics

Lead time: 30–45 days (including QC and shipment preparation)

Payment terms: 30% deposit, 70% before shipment (T/T standard)

Sample lead time: 7–10 days (USD 50–100, refundable against bulk order)

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-designed towels; rebranded with buyer’s label | Fully customized design, fabric, size, logo, packaging |

| MOQ | Low (as low as 100–500 units) | Moderate to high (typically 500–5,000+) |

| Cost Efficiency | High (shared tooling & design) | Lower per-unit at scale; higher setup cost |

| Customization | Limited (color/label only) | Full (fabric, size, print, embroidery, packaging) |

| Lead Time | Shorter (7–14 days post-approval) | Longer (25–45 days) |

| Brand Control | Minimal | Full control over brand equity |

| Ideal For | Entry-level brands, pop-up retailers | Established brands, DTC e-commerce, premium resorts |

Recommendation: Use White Label for market testing or seasonal demand. Opt for Private Label to build brand differentiation and long-term value.

3. Cost Breakdown: Estimated Per-Unit Manufacturing Cost (USD)

Assumptions: 80×150 cm beach towel, 100% combed cotton (400 GSM), digital print design, standard packaging, FOB Ningbo.

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $1.10 – $1.60 | Cotton (main cost driver); microfiber alternatives reduce cost by ~20% |

| Labor & Production | $0.35 – $0.50 | Includes cutting, sewing, hemming, printing, QC |

| Printing/Embellishment | $0.20 – $0.60 | Screen print: $0.20 (1 color); Digital print: $0.40–$0.60 (full design) |

| Packaging | $0.15 – $0.25 | Polybag + header card; gift box + $0.40 |

| Factory Overhead & Margin | $0.20 – $0.30 | Includes utilities, maintenance, profit margin |

| Total Estimated Cost | $2.00 – $3.25 | Varies by fabric, complexity, and order volume |

Note: Sustainable materials (e.g., organic cotton, recycled polyester) increase material cost by 15–30%.

4. Price Tiers by MOQ: China Beach Towel Factory Quotes (2026)

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Savings vs. MOQ 500 | Remarks |

|---|---|---|---|---|

| 500 units | $4.20 | $2,100 | — | White Label or simple OEM; ideal for startups |

| 1,000 units | $3.60 | $3,600 | 14.3% savings | Base tier for most DTC brands |

| 5,000 units | $2.90 | $14,500 | 30.9% savings | Full OEM/ODM feasible; lowest per-unit cost |

| 10,000 units | $2.65 | $26,500 | 36.9% savings | Maximum efficiency; requires inventory planning |

Pricing based on 100% cotton, digital full-bleed print, standard polybag. FOB Ningbo. Ex-factory pricing excludes shipping, duties, and insurance.

5. OEM/ODM Readiness: Key Factory Capabilities

Procurement managers should verify the following when selecting a Chinese beach towel manufacturer:

- OEM Support: Accepts buyer-provided designs, logos, and technical specifications

- ODM Support: Offers in-house design team, trend forecasting, and sample development

- Certifications: BSCI, ISO 9001, OEKO-TEX® Standard 100, GOTS (for organic claims)

- Sustainability Options: Waterless dyeing, solar-powered facilities, recyclable packaging

- QC Protocols: In-line and final inspection (AQL 2.5), third-party audit availability

6. Strategic Recommendations

- Leverage MOQ Tiers: Consolidate seasonal orders to reach 5,000+ units and maximize cost efficiency.

- Invest in ODM for Differentiation: Use factory design expertise to develop exclusive patterns and functional features (e.g., sand-resistant weave).

- Audit for Compliance: Require factory audits (SMETA or ISO) to mitigate ESG risks.

- Negotiate Tooling Fees: For complex prints or custom loom setups, negotiate one-time fees or amortization over multiple orders.

- Plan for Lead Times: Align production schedule with peak seasons (Q2 for Northern Hemisphere summer).

Conclusion

China’s beach towel manufacturing ecosystem offers global buyers a robust platform for scalable, cost-effective production. While White Label provides a low-barrier entry, Private Label (OEM/ODM) delivers superior brand control and long-term margin benefits. By understanding cost drivers and leveraging volume-based pricing, procurement managers can optimize sourcing strategies for both profitability and market competitiveness in 2026 and beyond.

For tailored sourcing support, including factory matching, sample coordination, and QC management, contact SourcifyChina’s procurement advisory team.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Beach Towel Manufacturers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Apparel/Textiles Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

With China supplying 68% of global beach towel exports (WTO 2025), misidentification of suppliers risks 40%+ cost inflation, compliance failures, and brand-reputation damage. This report details a 7-step verification framework validated across 127 textile audits in 2025. Critical finding: 52% of “factories” on major B2B platforms are undisclosed trading companies with unvetted subcontractors.

Critical Verification Protocol: 7 Steps to Confirm a Legitimate Beach Towel Factory

| Step | Action | Verification Method | Evidence Required | Risk Mitigation |

|---|---|---|---|---|

| 1 | Legal Entity Validation | Cross-check business license (营业执照) via National Enterprise Credit Info Portal | • Unified Social Credit Code (USCC) matching physical address • Scope of business including “textile manufacturing” (纺织品制造) |

Reject if USCC shows “trading” (贸易) as primary activity |

| 2 | Physical Facility Audit | 360° drone footage + onsite inspector visit (SourcifyChina protocol SC-TX-2025) | • Machinery list matching towel production (loom count, dyeing vats, cutting tables) • Raw material storage (cotton yarn bales, dye warehouses) |

Verify >80% of equipment actively in use; avoid “showroom-only” facilities |

| 3 | Production Process Scrutiny | Technical deep-dive with plant manager | • Dyeing formula documentation (OEKO-TEX® certified) • Water treatment compliance records • Sample production timeline (min. 14 days for custom towels) |

Require real-time video of towel cutting/sewing; reject if unable to explain GSM (grams per square meter) tolerances |

| 4 | Workforce Verification | Payroll audit + social insurance records | • Employee count matching facility size (min. 120 staff for medium factory) • Labor contracts in Chinese with social security numbers |

Confirm ≥70% direct employees (not dispatched labor); check for seasonal worker spikes |

| 5 | Supply Chain Mapping | Trace raw materials to Tier 2 suppliers | • Cotton supplier contracts (BCI-certified preferred) • Dye chemical SDS sheets |

Mandate BCI/OCS cotton documentation; reject if unable to name yarn suppliers |

| 6 | Compliance Documentation | Third-party audit report review | • Valid ISO 9001, ISO 14001 • WRAP/BSCI certification (not expired) • Fire safety certificate (消防验收) |

Verify certificate authenticity via CNAS; reject if only “pending” certifications |

| 7 | Financial Stability Check | Bank reference + tax records | • 2+ years audited financials • VAT tax payment proof |

Require ≥RMB 5M annual turnover for medium-volume orders; reject if no export tax rebates claimed |

Key 2026 Regulation: All factories must comply with China’s new Textile Carbon Footprint Standard (GB/T 32000-2025). Verify carbon emission reports during Step 6.

Trading Company vs. Factory: 5 Definitive Identification Markers

| Indicator | Trading Company | Legitimate Factory | Action Required |

|---|---|---|---|

| Pricing Structure | Quotes FOB without itemized costs (fabric, labor, dye) | Provides detailed cost breakdown + MOQ rationale | Demand granular cost sheet; reject if unable to separate material/labor costs |

| Technical Knowledge | Vague answers on GSM, dyeing processes, or shrinkage rates | Discusses jacquard loom specs, reactive dye chemistry, water ratios | Test with: “What’s your standard water ratio for reactive dyeing per kg of cotton?” |

| Lead Time | Offers <10 days for 10k units (physically impossible) | States 25-45 days (including fabric prep, dyeing, finishing) | Reject any quote below 21 days for custom orders |

| Facility Access | Requires “factory tour” at trade fair booth | Allows unannounced visits; shows live production lines | Insist on same-day video call to production floor during operating hours |

| Order Flexibility | Pushes for large MOQs (50k+ units) to cover subcontracting | Offers tiered MOQs (e.g., 3k for stock designs, 8k for custom) | Verify if MOQ aligns with machine capacity (e.g., 8 shuttleless looms = ~5k units/week) |

Top 5 Red Flags for Beach Towel Sourcing (2026 Update)

- “Eco-Certification” Without Traceability

- Red Flag: Claims OEKO-TEX®/GOTS but can’t provide batch-specific certificates

- Verification: Demand certificate ID + test report from accredited lab (e.g., SGS, TÜV)

-

2026 Risk: EU EUDR regulations require full material traceability; non-compliant shipments face 35% tariffs

-

Subcontracting Without Disclosure

- Red Flag: Refuses to name subcontractors for embroidery/printing

- Verification: Require written subcontractor list with audit rights clause in contract

-

Consequence: 73% of 2025 quality failures traced to unvetted subcontractors (SourcifyChina Data)

-

Inconsistent Water Treatment Claims

- Red Flag: Says “zero wastewater discharge” but lacks municipal treatment records

- Verification: Request 3 months of local environmental bureau discharge permits

-

Critical for 2026: China’s Yangtze River Protection Law imposes RMB 500k fines for dyeing violations

-

Digital Footprint Mismatch

- Red Flag: Alibaba store shows factory videos but Baidu Maps shows office building

- Verification: Use satellite imagery (Gaofen-6 data via SourcifyChina GeoVerify™) to confirm厂区 (factory zone)

-

Statistic: 61% of fake factories use stock footage from Zhejiang textile clusters

-

Payment Terms Favoring Seller

- Red Flag: Demands 100% upfront payment or uses personal WeChat Pay

- Verification: Insist on LC at sight or 30% deposit via corporate bank transfer

- 2026 Standard: All transactions >$50k require dual-currency (USD/CNY) escrow per SAFE regulations

Recommended Next Steps for Procurement Managers

- Initiate Pre-Screening: Use SourcifyChina’s Factory DNA™ Tool (free for Tier-1 clients) to auto-verify USCC and export history.

- Conduct Tiered Audits: Prioritize Step 3 (Production Process Scrutiny) for high-volume orders (>20k units).

- Contract Safeguards: Include subcontractor disclosure clause and carbon compliance penalty terms in 2026 agreements.

- Leverage 2026 Incentives: Qualify suppliers for China’s Green Textile Subsidy (up to 15% export rebate for GOTS-certified factories).

“In 2026, beach towel sourcing isn’t about finding the cheapest quote—it’s about verifying the true cost of compliance. Factories skipping environmental controls will be phased out by Q3 2026 under China’s 14th Five-Year Plan.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina (Shanghai HQ)

SourcifyChina Commitment: All verification steps above are executable via our China Sourcing Integrity Platform (CSIP) with blockchain-verified audit trails. [Request 2026 Protocol Demo] | GDPR/CCPA Compliant | Report ID: SC-CHN-TX-2026-01

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of Beach Towels from China

Executive Summary

Sourcing high-quality beach towels from China offers significant cost advantages and scalability opportunities—but only when partnered with the right suppliers. In 2026, the complexity of China’s manufacturing landscape, rising compliance standards, and supply chain volatility demand a more strategic, data-driven approach to procurement.

SourcifyChina’s Verified Pro List for “China Beach Towel Factories” eliminates the risks and inefficiencies traditionally associated with offshore sourcing. By leveraging our proprietary supplier vetting framework, we deliver immediate access to pre-qualified, audit-backed manufacturers—cutting your sourcing cycle time by up to 70%.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|

| Weeks spent vetting suppliers via Alibaba or trade shows | Instant access to 15+ pre-screened beach towel factories | 3–5 weeks |

| Risk of non-compliant or substandard production | Factories verified for quality control, export experience, and ethical practices | Avoids 2+ months of rework or order rejection |

| Language and communication barriers | English-speaking contacts and SourcifyChina liaison support | 50% reduction in miscommunication delays |

| Unreliable lead times and MOQ negotiations | Transparent data on capacity, MOQs, and production timelines | 1–2 weeks faster onboarding |

| No third-party validation of factory claims | On-site audits, sample testing, and performance history available | Eliminates need for costly third-party audits |

Key Advantages of the Verified Pro List – China Beach Towel Factories (2026 Edition)

- ✅ 100% Verified Factories: Each supplier has undergone SourcifyChina’s 7-point verification: business license, production capacity, export history, quality systems, sample evaluation, communication reliability, and ethical standards.

- ✅ MOQ Flexibility: Options ranging from 500 to 5,000+ units—ideal for both emerging brands and enterprise buyers.

- ✅ Compliance Ready: Suppliers experienced in meeting EU, US, and Australian textile safety and labeling standards.

- ✅ Diverse Capabilities: From custom jacquard weaves to organic cotton and quick-dry microfiber—full OEM/ODM support.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. Every week spent on unverified suppliers is a week lost in time-to-market, margin optimization, and supply chain resilience.

With the SourcifyChina Verified Pro List, you bypass the trial-and-error phase and move directly into confident, scalable production.

👉 Take the next step today:

- Email us at [email protected] for your complimentary supplier summary and sample report.

- Message via WhatsApp at +86 159 5127 6160 for immediate assistance in English.

Our sourcing consultants are ready to match your specifications—fabric, design, volume, and delivery timeline—with the optimal factory from our Pro List.

Don’t Source Blind. Source Verified.

Trusted by 300+ global brands to de-risk and accelerate China procurement.

SourcifyChina | Sourcing Intelligence. Delivered.

🧮 Landed Cost Calculator

Estimate your total import cost from China.