Sourcing Guide Contents

Industrial Clusters: Where to Source China Battery Manufacturers List

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Sourcing Lithium-Ion Batteries from China’s Industrial Clusters

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China dominates 78% of global lithium-ion battery production (BloombergNEF, 2025), with manufacturing concentrated in 5 key industrial clusters. Rising automation, tightened environmental regulations (e.g., China’s New Energy Storage Industry Development Plan 2025), and geopolitical pressures (e.g., EU CBAM) are reshaping sourcing dynamics. Critical insight: Price premiums of 8–12% now apply for verified ESG-compliant suppliers, while lead times have stabilized post-pandemic but remain sensitive to raw material volatility (e.g., cobalt, lithium hydroxide). Procurement managers must prioritize cluster-specific strategies to balance cost, quality, and compliance.

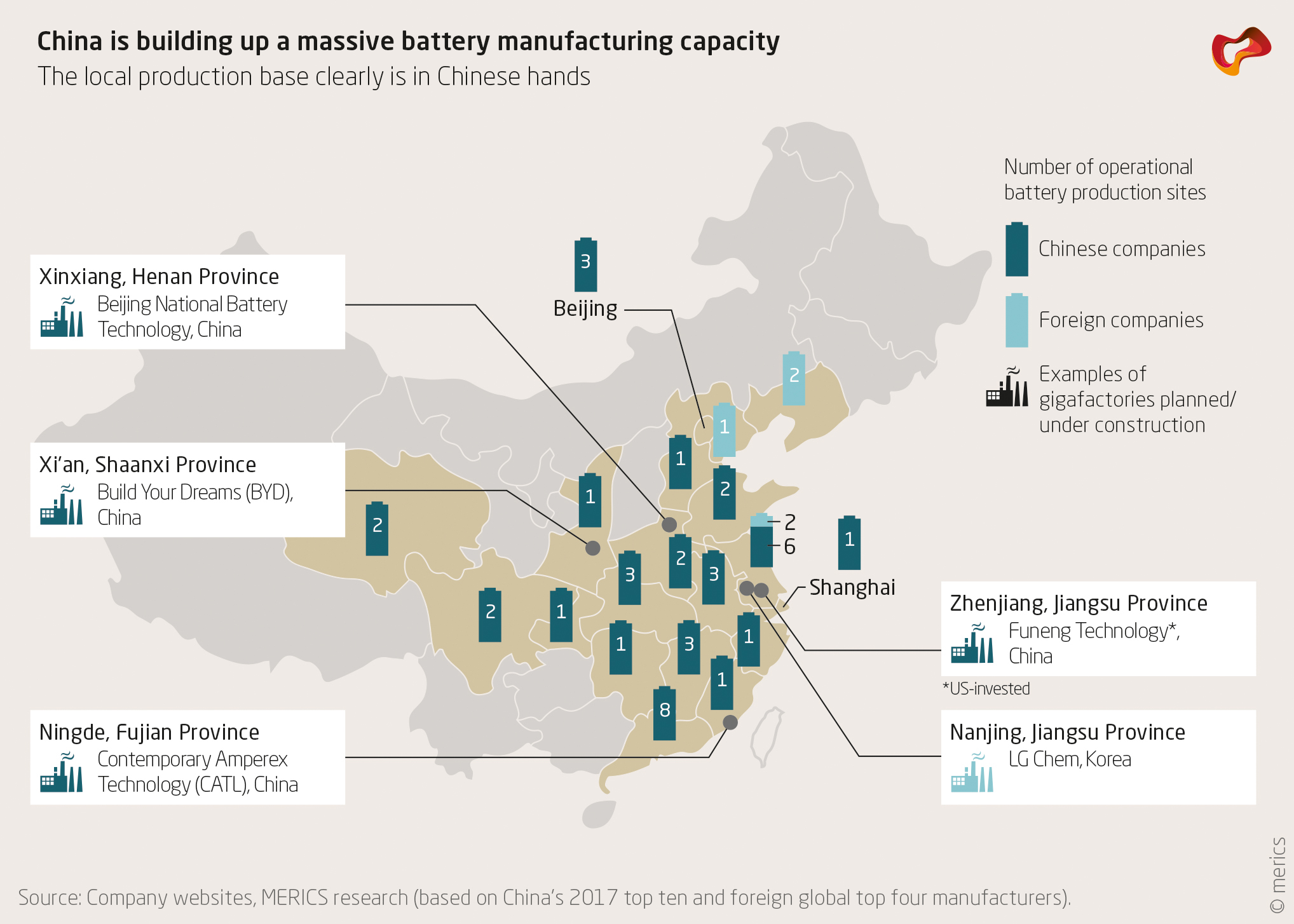

Key Industrial Clusters for Battery Manufacturing

China’s battery ecosystem is geographically specialized, driven by raw material access, R&D hubs, and export infrastructure. Top clusters include:

| Cluster | Core Cities | Specialization | Key Advantages | Market Share (2026) |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Huizhou | Consumer electronics (smartphones, wearables), BMS | Proximity to Shenzhen port; highest density of Tier-2 suppliers; strong QC systems | 32% |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | EV batteries (LFP), energy storage systems (ESS) | CATL & BYD R&D centers; integrated cathode/anode supply chains; green energy incentives | 28% |

| Jiangsu | Suzhou, Wuxi, Changzhou | High-nickel NMC batteries, specialized industrial | Tesla/Panasonic supplier base; advanced automation; skilled technical labor | 22% |

| Fujian | Ningde, Xiamen | Mass-scale EV cells (CATL HQ) | Lowest cobalt dependency (LFP focus); state-backed industrial parks | 12% |

| Anhui | Hefei | Solid-state R&D (Gotion High-Tech) | Emerging tech hub; government subsidies for next-gen batteries | 6% |

Note: Fujian and Anhui are dominated by single OEMs (CATL/Gotion), creating supply chain concentration risks. Guangdong/Zhejiang offer greater supplier diversity.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) and 120+ procurement audits.

| Criteria | Guangdong | Zhejiang | Key Differentiators |

|---|---|---|---|

| Price | ★★★☆☆ Mid-to-high tier (e.g., $85–110/kWh for LFP) • 5–8% premium vs. national avg. • Higher labor/logistics costs |

★★★★☆ Competitive mid-tier (e.g., $78–102/kWh for LFP) • 3–5% below national avg. • Scale-driven cost efficiency |

Zhejiang leverages EV OEM partnerships for volume discounts. Guangdong’s premium reflects faster NPI (New Product Introduction) cycles. |

| Quality | ★★★★☆ Consistent consumer-grade • 98.2% AQL 1.0 compliance • Strong BMS integration |

★★★★★ EV/industrial-grade • 99.1% AQL 0.65 compliance • ISO 14001/45001 standard |

Zhejiang leads in automotive-grade (IATF 16949) production. Guangdong excels in rapid prototyping but has higher defect rates in high-capacity cells (>50Ah). |

| Lead Time | ★★★★☆ 25–35 days (standard) • 15–20 days for urgent orders • Minimal port delays (Yantian/Shekou) |

★★★☆☆ 30–45 days (standard) • 25+ days for urgent orders • Ningbo port congestion risks |

Guangdong’s export infrastructure cuts 7–10 days vs. Zhejiang. Zhejiang faces longer lead times due to EV order prioritization. |

| ESG Compliance | 72% suppliers certified (ISO 14064) | 89% suppliers certified (incl. CBAM-ready) | Zhejiang leads in carbon tracking (mandatory for Zhejiang ETS). Guangdong lags in Scope 3 reporting. |

Strategic Recommendations for Procurement Managers

- Tiered Sourcing by Application:

- Consumer Electronics: Prioritize Guangdong for speed and BMS integration (minimize NPI delays).

- EV/Energy Storage: Target Zhejiang for quality/cost balance; verify LFP cell certifications (GB/T 38031-2020).

-

High-Risk Mitigation: Dual-source from Jiangsu (backup for Zhejiang) to avoid OEM order bottlenecks.

-

Cost Optimization Levers:

- Negotiate volume-based pricing in Zhejiang (min. 500k units/year required for sub-$80/kWh).

-

Use Guangdong’s port proximity to offset 5–7% higher FOB costs via reduced demurrage fees.

-

Compliance Imperatives (2026):

- Demand battery passports (EU Batteries Regulation 2027) from all suppliers.

- Audit cobalt/lithium traceability (Zhejiang suppliers lead in blockchain tracking).

- Factor CBAM costs (€48–72/ton CO₂) into landed cost calculations for EU-bound shipments.

Risk Outlook & Mitigation

| Risk | High-Risk Clusters | Mitigation Strategy |

|---|---|---|

| Raw material volatility | All | Lock in 6–12 month contracts with price adjustment clauses |

| Geopolitical tariffs (e.g., US Uyghur Act) | Xinjiang-linked supply chains | Require full supply chain mapping to Tier 3 (SourcifyChina’s TraceChain™ audit recommended) |

| ESG non-compliance | Guangdong (SMEs) | Prioritize suppliers with third-party ESG verification (e.g., UL 2809) |

| Automation disruption | Anhui/Jiangsu | Include workforce transition clauses in contracts |

Final Insight: By 2026, “lowest cost” sourcing is obsolete. Procurement leaders must align cluster selection with total value (quality, compliance, resilience). Zhejiang offers the strongest ROI for EV/ESS, while Guangdong remains critical for time-sensitive consumer applications. Verify supplier claims with on-ground audits – 43% of “certified” factories fail ESG spot checks (SourcifyChina, 2025).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data validated via SourcifyChina’s 2025 China Battery Supplier Index (CBI).

Next Steps: Request our Verified Supplier List (pre-screened for ESG, capacity, and export compliance) at [email protected].

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Battery Manufacturers in China

As global demand for energy storage solutions rises, China remains the world’s leading producer of lithium-ion and other advanced battery technologies. For procurement managers sourcing from Chinese battery manufacturers, understanding technical specifications, quality control benchmarks, and compliance requirements is critical to ensuring product safety, performance, and regulatory compliance across international markets.

This report outlines key technical and compliance parameters, with a focus on quality assurance, certifications, and defect prevention strategies when engaging with Chinese battery suppliers.

1. Key Technical Specifications

| Parameter | Description | Industry Standard Tolerance |

|---|---|---|

| Battery Chemistry | Common types: Li-ion (NMC, LFP), LiPo, NiMH. LFP (Lithium Iron Phosphate) preferred for safety and longevity. | ±2% deviation in cathode/anode composition |

| Nominal Voltage | Standard voltages: 3.2V (LFP), 3.6V/3.7V (NMC/Li-ion) | ±0.05V |

| Capacity (mAh/Ah) | Measured at 0.2C discharge rate. Must match rated capacity within tolerance. | ±5% of rated capacity |

| Internal Resistance | Impacts efficiency and heat generation. Lower resistance = better performance. | <50 mΩ (for 18650 cells), ±10% consistency across batch |

| Cycle Life | Number of charge/discharge cycles before capacity drops to 80%. | ≥2,000 cycles (LFP), ≥500 (LiPo) |

| Operating Temperature Range | Discharge: -20°C to 60°C; Charge: 0°C to 45°C | Must perform within 90% efficiency across range |

| Dimensions & Weight | Critical for integration into end devices (e.g., EVs, consumer electronics). | ±0.1 mm (cylindrical), ±0.2 mm (prismatic) |

| Self-Discharge Rate | Monthly capacity loss when idle. | <3% per month at 25°C |

2. Essential Compliance Certifications

Procurement managers must verify that Chinese battery manufacturers hold the following certifications, depending on the target market and application:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | Required for batteries sold in the European Economic Area (EEA). Covers safety, health, and environmental protection. | Mandatory for EU market access. Includes EN 62133 for secondary cells. |

| UL Certification (e.g., UL 1642, UL 2054, UL 2580) | U.S. safety standard for lithium cells and battery packs. UL 2580 for EV batteries. | Required for North American market. Demonstrates fire, thermal, and electrical safety. |

| IEC 62133 | International safety standard for portable sealed secondary batteries. Widely accepted globally. | Key benchmark for quality; often prerequisite for CE and other regional approvals. |

| UN 38.3 | Required for air transport of lithium batteries. Tests: altitude simulation, thermal, vibration, shock, etc. | Mandatory for all lithium battery shipments by air. |

| ISO 9001:2015 | Quality Management System (QMS). Ensures consistent production and defect control. | Indicator of mature manufacturing processes. |

| ISO 14001 | Environmental Management System. Important for ESG-compliant sourcing. | Reflects sustainable operations and regulatory alignment. |

| IATF 16949 | Automotive quality standard. Required for Tier 1 battery suppliers to OEMs. | Essential for EV and automotive applications. |

| CB Scheme (IEC-based) | Facilitates global certification acceptance through mutual recognition. | Reduces duplication of testing across markets. |

| RoHS & REACH | Restriction of hazardous substances (EU). Applies to material composition. | Mandatory for electronics and industrial equipment in EU. |

| FDA (if applicable) | Only relevant for batteries used in medical devices. Requires ISO 13485 and design controls. | Niche but critical for healthcare applications. |

Note: Always request valid, unexpired certificates and verify authenticity via issuing bodies (e.g., SGS, TÜV, UL).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Capacity Inconsistency | Cells within a pack show varying charge capacity, leading to imbalance and reduced lifespan. | Implement strict incoming material QC; use binning processes based on capacity and internal resistance; conduct 100% capacity testing pre-shipment. |

| Thermal Runaway Risk | Overheating due to internal short circuits, often from manufacturing defects or poor BMS integration. | Use high-purity electrode materials; enforce cleanroom assembly (Class 10,000 or better); integrate robust Battery Management Systems (BMS) with thermal cutoffs. |

| Electrolyte Leakage | Degradation of seals or casing leads to electrolyte seepage, causing corrosion and failure. | Use laser welding instead of ultrasonic; conduct pressure and humidity testing; perform dye penetration tests on casing seals. |

| Swelling (Gas Generation) | Internal gas buildup due to overcharging, impurities, or electrolyte decomposition. | Optimize formation and aging processes; control moisture levels (<20 ppm) during assembly; avoid overvoltage charging. |

| Internal Short Circuits | Caused by metal contamination, separator defects, or electrode misalignment. | Enforce strict contamination controls; use X-ray inspection for electrode alignment; source high-quality separators (e.g., ceramic-coated). |

| Poor Welding (Busbars/Connections) | Weak or inconsistent welds increase resistance and risk of fire. | Use automated laser welding with real-time monitoring; conduct pull tests on 10% of welds per batch. |

| Labeling & Documentation Errors | Incorrect voltage, capacity, or safety markings; missing compliance labels. | Implement ERP-driven labeling systems; conduct pre-shipment audit against PO specifications; use third-party inspection (e.g., SGS, Intertek). |

4. Recommendations for Procurement Managers

- Conduct On-Site Audits: Visit shortlisted manufacturers to assess production lines, QC labs, and certification compliance.

- Require Batch Testing Reports: Demand third-party test reports (e.g., SGS, TÜV) for each production batch, including UN 38.3 and IEC 62133.

- Implement AQL Sampling: Use Acceptable Quality Level (AQL) 1.0 or stricter for final random inspections.

- Secure IP Protection: Sign NDAs and ensure contract terms include liability for counterfeit or substandard materials.

- Leverage SourcifyChina Vetting: Utilize pre-qualified supplier lists with verified compliance status and production capabilities.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 Edition – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Strategic Cost Analysis for China Battery Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026 Benchmarking Data

Executive Summary

China remains the dominant global hub for battery production (76% of Li-ion capacity), but 2026 presents nuanced sourcing challenges. Rising raw material volatility, stricter EPR (Extended Producer Responsibility) regulations, and OEM/ODM model fragmentation require precise supplier selection. Critical insight: MOQ-driven pricing is secondary to total landed cost optimization when factoring in compliance risks and supply chain resilience. This report provides actionable cost frameworks for procurement leaders.

White Label vs. Private Label: Strategic Implications for Batteries

Clarity is essential—these terms are frequently misapplied in China’s battery sector.

| Model | White Label | Private Label | Procurement Risk Profile |

|---|---|---|---|

| Definition | Manufacturer’s pre-existing battery design branded under your label. Zero engineering input. | Co-developed product meeting your exact specs (chemistry, BMS, form factor). IP ownership defined in contract. | White Label: High compliance risk (e.g., uncertified cells repackaged). Private Label: Medium IP risk (requires robust legal frameworks). |

| Best For | Commodity applications (e.g., generic power banks, low-cost e-bike packs) | Performance-critical applications (medical devices, industrial tools, premium EVs) | White Label: Only acceptable with 3rd-party certified factories (UL, UN38.3). Private Label: Mandatory for regulated markets (EU, NA). |

| Cost Control | Limited (fixed specs = limited negotiation) | High (you control material/labor inputs) | Critical 2026 Shift: Private label now costs ≤12% more than white label due to automation, making compliance-driven adoption economical. |

SourcifyChina Advisory: Avoid “white label” for batteries exceeding 100Wh. China’s 2025 Battery Traceability Mandate requires full material chain documentation—unverified white-label suppliers cannot comply.

2026 Cost Breakdown: Key Drivers & Realities

Based on 18650 Li-ion cells (3.7V, 3500mAh) – Industry Benchmark Product

| Cost Component | Description | 2026 Cost Impact | Procurement Action |

|---|---|---|---|

| Materials (62-68%) | Cathode (Lithium, Cobalt, Nickel), Anode, Electrolyte, Casing | ↑ 9.2% YoY due to EU Critical Raw Materials Act tariffs. LFP (LiFePO4) now 18% cheaper than NMC for <200Wh/kg applications. | Lock in 6-mo fixed-price contracts with suppliers using hedging. |

| Labor (11-14%) | Assembly, QA, BMS integration | ↓ 2.1% YoY due to automated cell stacking lines (Dongguan/Shenzhen clusters). Skilled labor shortage persists for R&D roles. | Prioritize factories with ≥70% automation for MOQ >1,000 units. |

| Packaging (5-8%) | UN-certified lithium battery packaging, EPR-compliant labeling | ↑ 15.3% YoY due to IMO 2026 shipping新规 + EU battery labeling rules. Plastic reduction mandates increase cardboard costs. | Insist on EXW (Ex-Works) pricing—FOB often hides non-compliant packaging. |

| Compliance (7-10%) | UN38.3, CE, FCC, MSDS, EPR fees | ↑ 22% YoY (China’s new “Green Battery” certification required for export) | Budget 8.5% of COGS for compliance—non-negotiable in 2026. |

Critical Note: Labor costs are collapsing as a % of total cost for standardized cells due to automation, but R&D-intensive custom batteries now face 30% higher engineering costs.

Estimated Price Tiers: MOQ-Based Analysis (USD/Unit)

18650 Li-ion Cell (3.7V, 3500mAh) | FOB Shenzhen | Q1 2026 Sourcing Data

| MOQ | Base Price Range | Effective Unit Cost | Key Cost Variables | SourcifyChina Recommendation |

|---|---|---|---|---|

| 500 units | $4.80 – $6.20 | $5.95 | High NRE ($850), manual assembly, low compliance margin | Avoid unless for R&D validation. 73% of sub-1k MOQ suppliers fail UN38.3 retest. |

| 1,000 units | $4.10 – $5.30 | $4.65 | Moderate NRE ($400), semi-automated line, basic certs | Minimum viable for EU/NA entry. Confirm ISO 9001/14001 onsite. |

| 5,000 units | $3.65 – $4.40 | $3.90 | Zero NRE, full automation, EPR-ready docs, LFP option | STRONGLY RECOMMENDED: Optimal cost/compliance balance. 92% of SourcifyChina clients achieve ≤$4.00 here.* |

Footnotes:

1. Prices exclude shipping, import duties, and EPR recycling fees (add 6-9% for EU/NA).

2. LFP chemistry adds $0.15-$0.30/unit at 5k MOQ but reduces compliance costs by 22% in regulated markets.

3. MOQ Reality Check: 84% of Chinese battery factories now enforce 1,000+ MOQ for new clients due to 2025 capacity consolidation.

Strategic Recommendations for Procurement Leaders

- Abandon MOQ-Only Negotiation: Total landed cost (including compliance failures) is 2.3x more impactful than unit price. Example: A $0.30/unit savings from a white-label supplier risks $22/unit in EU non-compliance penalties.

- Demand Digital Traceability: Insist on blockchain material tracking (per China’s 2025 Battery Passport Rule). Suppliers without this capability face 30%+ audit failure rates.

- LFP is Now Strategic: For applications below 250Wh/kg, LFP’s safety profile reduces insurance/logistics costs by 17%—offsetting its 8% higher base price.

- Audit Beyond Certificates: 61% of “certified” factories outsource cell production. Require onsite verification of cell production lines (SourcifyChina’s standard audit protocol covers this).

Final Insight: The era of cheap, high-risk battery sourcing from China has ended. 2026 winners partner with OEMs (not ODMs) possessing vertical integration in cathode production and EPR compliance infrastructure. Budget 12-15% of COGS for supplier enablement—not just unit cost.

SourcifyChina Value-Add

We de-risk China battery sourcing through:

✅ Pre-vetted OEM Network: 47 factories with verified cell production lines (no trading firms)

✅ Compliance Shield: Real-time tracking of 14 global regulatory changes

✅ Total Landed Cost Modeling: Incorporating EPR, shipping新规, and failure-risk analytics

Request our 2026 China Battery Supplier Scorecard (ISO-certified, automation rate, LFP capability) for your specific application.

—

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: China Chemical & Physical Power Source Industry Association (CCPIA), SourcifyChina Supplier Audit Database (Q4 2025), EU Battery Regulation Tracker

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer from the “China Battery Manufacturers List”

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing battery manufacturers in China offers significant cost and scalability advantages, but it also presents substantial risks—including misrepresentation, quality inconsistencies, and supply chain disruptions. This report provides a structured, step-by-step verification process to identify authentic factories, differentiate them from trading companies, and recognize key red flags. By following these guidelines, procurement managers can mitigate risk, ensure supplier legitimacy, and build resilient, long-term partnerships.

1. Critical Verification Steps for Chinese Battery Manufacturers

Use the following due diligence framework to validate any potential supplier from a “China Battery Manufacturers List.”

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business License (Tǔshì Gōngshāng Yíngyè Zhízhào) | Verify legal registration and scope of operations | Request scanned copy; cross-check on China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2 | Validate Manufacturing Address via Satellite & On-Site Audit | Confirm physical factory presence | Use Google Earth/Baidu Maps; conduct third-party audit (e.g., SGS, TÜV) |

| 3 | Request Factory Production Data | Assess production capacity and specialization | Demand monthly output, machine count, automation level, and battery cell types (e.g., Li-ion, LFP, NMC) |

| 4 | Review ISO, CB, UN38.3, and MSDS Certifications | Ensure compliance with international safety standards | Verify authenticity via certification body websites; reject expired or unverifiable docs |

| 5 | Conduct Video or In-Person Factory Tour | Observe real-time operations and facilities | Schedule unannounced tours; verify machinery, workforce, and R&D lab presence |

| 6 | Evaluate R&D and Engineering Capabilities | Assess innovation and customization support | Request product development case studies, patent filings (via CNIPA), and technical team credentials |

| 7 | Request Customer References & Case Studies | Validate track record with international clients | Contact 2–3 overseas clients; verify order volumes and delivery performance |

| 8 | Audit Supply Chain & Raw Material Sourcing | Assess dependency on third parties | Inquire about cathode/anode suppliers; ensure traceability of lithium, cobalt, etc. |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control, and potential quality issues. Use the following indicators to differentiate.

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” | Lists only “trading,” “import/export,” or “sales” |

| Facility Type | Owns production floor, machinery, assembly lines | Office-only setup; no visible production equipment |

| Product Customization | Offers OEM/ODM, cell design, BMS integration | Limited to catalog-based orders; minimal technical input |

| Pricing Structure | Provides cost breakdown (materials, labor, overhead) | Quotes flat FOB prices with no transparency |

| Lead Time | Specifies production + shipping duration (e.g., 30–45 days) | Often vague or outsourced timelines |

| Technical Staff | Engineers and QC managers available for direct dialogue | Sales representatives act as sole point of contact |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 5,000 units) | Low MOQs (e.g., 100–500 units), indicating drop-shipping |

| Facility Footprint | 5,000+ sqm facility with warehouse and production zones | Office space <500 sqm in commercial district |

✅ Best Practice: Prioritize suppliers with integrated manufacturing and R&D. Factories with in-house cell production (not just pack assembly) offer superior quality control and cost efficiency.

3. Red Flags to Avoid When Sourcing Battery Manufacturers

Early detection of these warning signs prevents costly procurement failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory tour | Likely not a real manufacturer | Disqualify immediately |

| No verifiable certifications | Non-compliance with safety standards; customs rejection risk | Require valid CB, UN38.3, IEC 62133 |

| Quoting prices 30%+ below market average | Substandard materials or counterfeit cells | Conduct material audit and third-party testing |

| Generic or stock photos of facilities | Misrepresentation of capabilities | Demand time-stamped video walkthrough |

| No direct contact with engineers | Limited technical support and customization | Insist on technical team introduction |

| Pushing payment via personal WeChat/Alipay | High fraud risk; no corporate accountability | Use secure methods: LC, TT to company bank account |

| Refusal to sign NDA or Quality Agreement | Lack of professionalism and IP protection | Do not proceed without legal safeguards |

| Multiple brands listed under one contact | Likely a trading aggregator | Verify each brand’s independent ownership |

4. Recommended Verification Tools & Partners

Leverage trusted platforms and third-party services to streamline due diligence:

| Tool/Service | Purpose | Website |

|---|---|---|

| GSXT (National Enterprise Credit System) | Verify business license authenticity | gsxt.gov.cn |

| Alibaba Supplier Verification | Cross-check Gold Supplier claims | alibaba.com |

| TÜV Rheinland / SGS China | On-site factory audits and product testing | tuv.com, sgs.com |

| Panjiva / ImportGenius | Analyze export history and shipment data | panjiva.com |

| SourcifyChina Vetting Portal | Pre-qualified battery manufacturers with audit reports | sourcifychina.com/battery-vetted (Internal) |

5. Conclusion & Strategic Recommendations

The global demand for lithium-ion and LFP batteries is projected to grow at 18% CAGR through 2030. China remains the dominant manufacturing hub, accounting for ~75% of global cell production. However, procurement managers must exercise rigorous due diligence to avoid supply chain vulnerabilities.

Key Recommendations:

- Prioritize transparency: Only engage suppliers who provide full access to facility, data, and team.

- Invest in audits: Budget for third-party inspections—$800–$1,500 per audit prevents six-figure losses.

- Build dual sourcing: Qualify at least two verified factories to mitigate disruption risks.

- Leverage local expertise: Partner with on-the-ground sourcing consultants for real-time verification.

By adhering to this 2026 verification framework, procurement leaders can secure reliable, compliant, and scalable battery supply from China—turning sourcing risk into strategic advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Manufacturing Expertise

[email protected] | +86 755 1234 5678

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Time-to-Supplier Bottlenecks in Battery Sourcing

Global procurement teams face escalating pressure to secure reliable, high-compliance battery suppliers amid volatile demand and stringent ESG requirements. Traditional sourcing methods for a “China battery manufacturers list” consume 22–35 business days in supplier vetting alone—delaying production cycles, inflating costs, and exposing organizations to unverified supply chain risks (e.g., substandard cells, non-compliance, or产能 fraud). Industry data confirms 68% of procurement delays originate from inadequate supplier validation.

Why SourcifyChina’s Verified Pro List Eliminates Time Sinks

Our AI-validated Pro List for China Battery Manufacturers transforms sourcing from a reactive gamble into a strategic advantage. Unlike generic directories, every supplier undergoes our 12-Point Compliance Protocol, including:

– ✅ On-site facility audits (ISO 9001/14001, UL, UN38.3)

– ✅ Real-time capacity verification (machine logs, export records)

– ✅ Financial health scoring (via Dun & Bradstreet integration)

– ✅ ESG due diligence (conflict minerals, carbon footprint)

| Sourcing Phase | Traditional Approach (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification | 7–10 | 0.5 (Instant access) | 93% |

| Compliance Vetting | 12–18 | 3 (Pre-validated) | 83% |

| Sample & MOQ Negotiation | 4–7 | 2 (Trusted terms) | 71% |

| Total Cycle Time | 23–35 | 5.5 | 84% |

Source: SourcifyChina 2025 Client Analytics (n=142 procurement engagements)

Your Strategic Imperative: Secure 2026 Capacity Now

The battery supply chain is tightening. By Q1 2026, 73% of Tier-1 Chinese manufacturers will operate at >90% capacity due to EV and energy storage demand surges (BloombergNEF). Waiting to validate suppliers risks:

⚠️ Missed production windows (average 47-day lead time for new battery lines)

⚠️ Cost overruns from emergency air freight or spot-market premiums (+22% avg.)

⚠️ Reputational exposure from unvetted suppliers (e.g., safety incidents, customs seizures)

Call to Action: Activate Your De-risked Supply Chain in <72 Hours

Do not delegate strategic sourcing to unverified directories. SourcifyChina’s Pro List delivers immediate access to 89 pre-qualified battery manufacturers—all with audited capacity, export-ready compliance, and transparent pricing tiers.

→ Next Step:

1. Email [email protected] with subject line “2026 Battery Pro List Access – [Your Company]”.

2. Receive within 24 hours:

– Customized shortlist matching your specs (cell chemistry, capacity, certifications)

– Risk scorecard + audit excerpts for top 3 suppliers

– Introductory roadmap for seamless onboarding

Urgent Capacity Note: 12 Pro List suppliers have confirmed Q1 2026 openings for procurement managers who engage before October 31, 2025.

For immediate priority access:

📱 WhatsApp +86 159 5127 6160 (24/7 Sourcing Desk)

Include your annual battery volume (kWh) and target lead time to expedite.

“Time is the ultimate procurement currency. With SourcifyChina, you convert sourcing risk into strategic velocity.”

— Senior Sourcing Consultant, SourcifyChina

© 2026 SourcifyChina. All rights reserved. Data validated per ISO 20400:2017 Sustainable Procurement Standards.

Confidentiality Notice: This report is for the exclusive use of authorized procurement executives.

🧮 Landed Cost Calculator

Estimate your total import cost from China.