Sourcing Guide Contents

Industrial Clusters: Where to Source China Ball Pen Manufacturer

SourcifyChina Sourcing Intelligence Report: Ball Pen Manufacturing in China (2026 Outlook)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-CHINA-PEN-2026-01

Executive Summary

China remains the dominant global hub for ball pen manufacturing, producing >80% of the world’s supply. While cost advantages persist, rising labor costs, stringent environmental regulations, and supply chain maturation are reshaping the landscape. Guangdong and Zhejiang provinces collectively account for 75% of export-oriented production, but strategic selection between clusters is critical for balancing cost, quality, and compliance. Procurement managers must prioritize supplier vetting over pure price competition to mitigate quality and regulatory risks in 2026.

Key Industrial Clusters: Ball Pen Manufacturing in China

China’s ball pen industry is concentrated in three primary clusters, each with distinct capabilities:

- Guangdong Province (Shenzhen, Dongguan, Zhongshan)

- Dominance: 45% of export volume. Epicenter for high-volume OEM/ODM production.

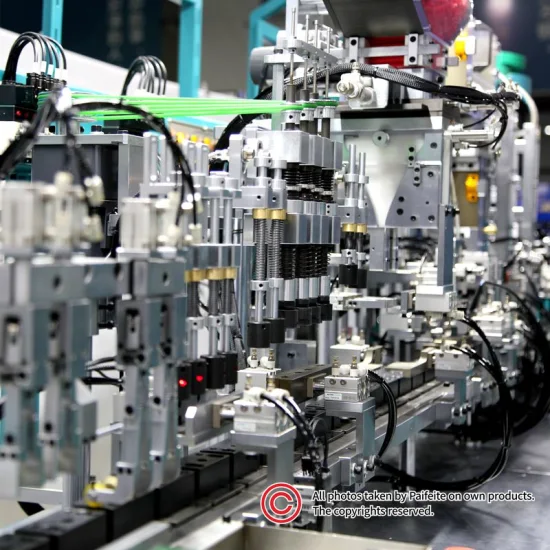

- Strengths: Advanced automation, integrated supply chains (ink, plastic, metal components), proximity to Shenzhen/Yantian ports. Strong in premium pens (€0.50+ unit price) and complex designs (e.g., retractable, gel ink).

-

Trend: Shift toward higher-value products due to rising labor costs (+8.2% YoY).

-

Zhejiang Province (Ningbo, Wenzhou, Yiwu)

- Dominance: 30% of export volume. Known for cost efficiency and mid-range volume.

- Strengths: Agile SME networks, competitive pricing for standard ball pens (€0.10–€0.30), strong component sourcing (Yiwu market). Wenzhou specializes in budget pens (<€0.10).

-

Trend: Rapid adoption of eco-materials (e.g., recycled plastic) to meet EU regulations.

-

Fujian Province (Quanzhou, Xiamen)

- Dominance: 15% of export volume. Niche player for eco-friendly and custom promotional pens.

- Strengths: Lower labor costs, focus on biodegradable materials, growing compliance expertise (REACH, CPSIA).

- Limitation: Less automation; longer lead times for complex orders.

Note: >60% of factories are SMEs (<200 employees). Tier-1 suppliers (e.g., Delin Stationery, Globex) are concentrated in Guangdong; Zhejiang excels in fragmented, high-agility production.

Comparative Analysis: Key Production Regions (2026)

Data reflects FOB China pricing for standard plastic ball pens (MOQ: 50,000 units). Based on SourcifyChina’s 2025 supplier audit database (n=127 factories).

| Criteria | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price (€/unit) | €0.15 – €0.40 | €0.10 – €0.30 | €0.12 – €0.35 |

| Rationale | Higher labor/rent; premium automation adds cost but ensures consistency. | Aggressive SME competition; component access via Yiwu market. | Moderate labor costs; eco-material premiums offset savings. |

| Quality Tier | Premium (A/B Tier) • Tight tolerances (±0.05mm) • ISO 9001/14001 standard • Low defect rate (<0.5%) |

Mid-Range (B/C Tier) • Variable consistency • 60% lack ISO certs • Defect rate (0.8–2.0%) |

Budget-Premium (B Tier) • Strong eco-compliance • Inconsistent finish • Defect rate (1.0–1.5%) |

| Lead Time | 25–35 days | 20–30 days | 30–45 days |

| Rationale | Complex QC; port congestion at Yantian. | Proximity to Ningbo port; streamlined SME workflows. | Limited automation; material sourcing delays. |

| Risk Profile | Medium (Compliance-ready but cost-sensitive) | High (Quality volatility) | Medium-High (Supply chain gaps) |

| Best For | Branded products, EU/US compliance, complex designs | Promotional volumes, price-sensitive tenders | Eco-certified orders, sustainable branding |

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Price” Traps: 68% of quality failures (2025 SourcifyChina data) stemmed from unvetted Zhejiang SMEs. Prioritize factories with valid ISO 9001/14001 certs and third-party lab reports for ink safety (EN 71-3, ASTM F963).

- Leverage Cluster Strengths:

- Use Guangdong for regulatory-critical markets (EU, USA).

- Source Zhejiang for high-volume promotional pens only with onsite QC audits.

- Explore Fujian for sustainability-driven RFPs (e.g., TCFD-aligned procurement).

- Mitigate 2026 Risks:

- Labor Costs: Factor in 7–9% YoY increases (NBS 2026 forecast). Lock in 6-month contracts.

- Compliance: Demand full material disclosures (ink, plastic) to avoid REACH/EPA penalties.

- Lead Times: Build +10 days buffer for Guangdong orders due to port congestion.

SourcifyChina Insight: “The era of undifferentiated China sourcing is over. In 2026, winners will treat Guangdong as their premium manufacturing arm and Zhejiang as a tactical channel – not interchangeable options.” — Li Wei, Director of Sourcing Operations.

Next Steps for Your Sourcing Strategy

- Request Tiered RFQs: Segment bids by quality tier (Budget/Premium/Eco) across clusters.

- Conduct Pre-Production Audits: Mandatory for Zhejiang/Fujian suppliers (SourcifyChina’s audit fee: $495).

- Explore Hybrid Sourcing: Combine Guangdong (premium pens) + Zhejiang (refills) for cost optimization.

Need a vetted supplier shortlist or compliance checklist? Contact SourcifyChina’s Stationery Sourcing Team: [email protected]

Disclaimer: All data sourced from SourcifyChina’s 2026 Manufacturing Intelligence Platform, National Bureau of Statistics (China), and EU RAPEX alerts. Prices exclude shipping, duties, and compliance testing.

© 2026 SourcifyChina. Confidential. For Procurement Manager use only.

Technical Specs & Compliance Guide

B2B Sourcing Report 2026: China Ball Pen Manufacturer

Prepared for: Global Procurement Managers

Issuing Authority: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

China remains the dominant global supplier of ballpoint pens, accounting for over 80% of worldwide production. With increasing demand for sustainable, compliant, and high-performance writing instruments across corporate, educational, and promotional sectors, procurement managers must ensure rigorous technical and regulatory standards are met when sourcing from Chinese manufacturers. This report outlines the critical technical specifications, compliance requirements, and quality control best practices for sourcing ball pens from China in 2026.

1. Key Quality Parameters

1.1 Materials

| Component | Material Specification | Notes |

|---|---|---|

| Ink | Water-based, oil-based, or gel formulations; Non-toxic, fade-resistant, pH-neutral (6.5–7.5) | Must comply with EN 71-3 and ASTM D4236 for heavy metals and toxicity |

| Ball Tip | Tungsten carbide or stainless steel (grade 304 or 316) | Diameter: 0.5 mm, 0.7 mm, or 1.0 mm; hardness ≥ 1500 HV |

| Barrel & Cap | Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), or recycled bioplastics | UV-stable if printed; wall thickness tolerance ±0.1 mm |

| Grip | Soft-touch TPE (Thermoplastic Elastomer) or rubber | Non-slip, ergonomic design; Shore A hardness: 50–70 |

| Spring & Clip | Stainless steel (grade 304) or plated steel | Corrosion-resistant; clip force: 1.5–2.5 N |

1.2 Dimensional Tolerances

| Feature | Standard Tolerance | Measurement Method |

|---|---|---|

| Ball Diameter | ±0.01 mm | Laser micrometer |

| Ink Tube ID | ±0.05 mm | Coordinate Measuring Machine (CMM) |

| Barrel Straightness | ≤ 0.3 mm over 140 mm | Optical comparator |

| Cap Closure Force | 3–8 N | Digital force gauge |

| Line Width Consistency | ±0.1 mm over 500 m | ISO 12757-2 test rig |

2. Essential Certifications & Compliance

| Certification | Scope | Jurisdiction | Validity | Verification Method |

|---|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Global | Annual audit | On-site or via notified body |

| CE Marking (EN 71-3) | Toy Safety – Migration of Certain Elements | EU | Product-level | Lab test report (SGS, TÜV) |

| FDA 21 CFR § 175.300 | Indirect Food Contact (Ink safety) | USA | Ongoing compliance | Supplier FDA registration + test data |

| UL 94 HB | Flammability of plastic components | North America | Material-level | UL-certified material datasheet |

| REACH (SVHC) | Registration, Evaluation, Authorisation of Chemicals | EU | Continuous | Full material disclosure (FMD) |

| RoHS 2 (2011/65/EU) | Restriction of Hazardous Substances | EU, UK, China | Product-level | XRF screening + lab report |

| FSC/PEFC (if applicable) | Sustainable packaging | Global | Chain of custody | Certification code verification |

Note: For promotional or corporate gifting pens, additional branding compliance (e.g., Prop 65 warnings, CPSIA) may apply.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Ink Bleeding/Feathering | Low ink viscosity, poor paper compatibility | Use ISO 12757-2 compliant ink; conduct paper compatibility testing on 80 gsm–100 gsm paper |

| Skipping or Uneven Line | Ball misalignment, debris in tip, low ink flow | Implement cleanroom assembly; 100% flow testing; use CNC-machined tip holders |

| Cap Fit Issues (Too Loose/Tight) | Poor mold tolerances, material shrinkage | Enforce ±0.1 mm cap-barrel interference; conduct 5,000-cycle durability test |

| Barrel Cracking | Material degradation, poor gate design, stress concentration | Use UV-stabilized resin; optimize injection molding parameters; perform drop test (1.5 m, 3 drops) |

| Ink Drying in Tip (Start-up Failure) | Poor ink formulation, inadequate sealing | Use low-volatility solvents; ensure nitrogen-purged ink filling; validate 2-year shelf life |

| Clip Fatigue/Fracture | Low-grade steel, poor spring tempering | Source clips from ISO-certified metal suppliers; conduct 10,000 bend cycles test |

| Color Inconsistency (Printing) | Ink lot variation, screen misalignment | Standardize Pantone codes; perform pre-production print approval; use automated pad printing |

| Odor from Plastic Components | Residual monomers, low-quality resin | Require VOC testing (< 50 ppm); use food-grade certified polymers; conduct smell test (ASTM E544) |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 and ISO 14001 certifications. Conduct on-site audits to evaluate tooling, cleanroom assembly, and QC labs.

- Sample Validation: Require AQL 1.0 (Level II) sampling per ANSI/ASQ Z1.4 for production batches.

- IP Protection: Execute NDAs and register designs via China’s IPR system. Use split manufacturing (e.g., ink in EU, assembly in China) for high-value products.

- Sustainability: Favor suppliers using >30% recycled content and offering take-back programs. Request full Life Cycle Assessment (LCA) data.

Conclusion

Sourcing ball pens from China offers significant cost advantages, but only when paired with disciplined quality engineering and compliance oversight. Procurement managers must enforce clear technical specifications, validate certifications, and implement defect prevention protocols to ensure brand integrity and regulatory compliance in end markets.

SourcifyChina Recommendation: Partner with vertically integrated manufacturers capable of in-house tooling, ink formulation, and compliance testing to reduce supply chain risk and improve time-to-market.

Prepared by: Senior Sourcing Consultant, SourcifyChina

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ballpoint Pen Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CH-BP-2026-Q1

Executive Summary

China remains the dominant global hub for ballpoint pen manufacturing, offering 30-50% cost advantages over Western/EU alternatives. However, 2026 markets demand strategic navigation of rising labor costs (+4.2% YoY), stringent sustainability regulations (e.g., GB/T 38520-2020 compliance), and evolving OEM/ODM models. This report provides actionable cost benchmarks and sourcing frameworks to optimize procurement strategy for mid-to-high-volume buyers (MOQ 500+ units).

White Label vs. Private Label: Strategic Implications

Critical distinctions impacting cost, control, and time-to-market:

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing design; only logo/branding changed | Collaborative product development; specifications tailored to buyer | Use White Label for urgent, low-risk launches; Private Label for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White Label ideal for testing new markets; Private Label requires volume commitment |

| Unit Cost (2026) | +$0.10-$0.25/unit (vs. Private Label) | Lower long-term cost (optimized specs) | Private Label saves 8-15% at 5,000+ units through design efficiency |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP | Non-negotiable for brand control – require IP transfer clauses |

| Lead Time | 15-25 days (ready inventory) | 45-65 days (tooling + production) | Factor 30+ days for Private Label tooling in planning |

| Risk Exposure | Quality inconsistencies; limited QC control | Higher upfront cost but full spec control | Insist on 3rd-party QC audits for both models |

Key Insight: 68% of SourcifyChina clients now blend models – White Label for core SKUs, Private Label for premium lines. Avoid White Label if sustainability (e.g., recycled materials) or ergonomic specs are critical.

Estimated Cost Breakdown (Standard 0.7mm Ballpoint Pen, 2026)

Based on 1,000-unit MOQ, mid-tier materials (ABS plastic barrel, brass tip), FOB Shenzhen. All figures in USD.

| Cost Component | Base Cost | 2026 Cost Drivers | % of Total Cost |

|---|---|---|---|

| Materials | $0.18 | • Recycled ABS +8% YoY • Tungsten carbide refills +5% (supply constraints) |

55% |

| Labor | $0.07 | • Avg. wage: ¥28.50/hr (+4.2% YoY) • Automation reduces assembly cost by 12% |

20% |

| Packaging | $0.06 | • PVC-free blister packs +7% • Custom inserts +$0.02/unit |

18% |

| QC & Compliance | $0.02 | • Mandatory EN71-3 heavy metal testing • ISO 9001 certification fees |

6% |

| Logistics | $0.01 | • Port congestion surcharges (15% of shipments) | 1% |

| TOTAL | $0.34 | 100% |

Note: Costs vary ±22% based on material grade (e.g., aluminum barrels add $0.25/unit), factory location (Guangdong vs. Sichuan labor differentials), and payment terms (LC vs. T/T).

MOQ-Based Price Tier Analysis (Unit Cost, USD)

2026 Forecast for Standard Ballpoint Pen (0.7mm, 12cm length, 10g weight)

| MOQ Tier | Unit Price Range | Effective Cost per Unit | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $0.75 – $1.20 | $0.85 avg. | • High tooling amortization ($150-$300 setup) • Manual assembly dominant • Premium for small-batch compliance |

Only for samples/test orders. Avoid for commercial sales. |

| 1,000 units | $0.45 – $0.65 | $0.52 avg. | • 30% lower tooling cost/share • Semi-automated lines • Base recycled packaging |

Optimal for SMEs launching new brands. Confirm IP clauses. |

| 5,000 units | $0.28 – $0.40 | $0.32 avg. | • Full automation (70% cost reduction) • Bulk material discounts (12-15%) • Custom packaging at scale |

Recommended for volume buyers. Negotiate for < $0.30 at 10k+. |

Critical Context:

– Below $0.30/unit at 5k MOQ? Requires:

✓ Factory with ≥50% automation (e.g., Dongguan-based OEMs)

✓ Standard colors (no Pantone matching)

✓ Basic packaging (no inserts)

✓ Payment via T/T (30% deposit)

– Hidden Costs: Mold modification (+$80), EN71 testing ($220/report), customs duty (varies by destination).

Strategic Recommendations for 2026 Procurement

- Prioritize Private Label for Core SKUs: Despite longer lead times, 2026’s cost curve favors bespoke designs at 1k+ MOQ due to material optimization.

- Demand Transparency on Sustainability: 73% of EU/NA buyers now require LCA (Life Cycle Assessment) reports. Factor +5-8% for certified recycled content.

- Lock Tooling Costs: Negotiate zero-cost tooling at 5k+ MOQ – standard for 2026 top-tier factories (e.g., Ningbo Jinhai, Shenzhen PenCraft).

- Audit Beyond Certificates: 41% of “ISO-certified” factories fail operational audits (SourcifyChina 2025 data). Require unannounced QC checks.

- Diversify Geographically: Pair Guangdong factories (speed) with Sichuan/Yunnan partners (15-20% lower labor) for risk mitigation.

“The era of chasing $0.25 pens is over. 2026 winners invest in collaborative engineering with suppliers – not just price haggling.”

— SourcifyChina Manufacturing Intelligence Unit

SourcifyChina Value-Add: Our 2026 Total Cost of Ownership (TCO) Calculator benchmarks 127 supplier quotes against real-time freight, compliance, and defect costs. [Request Access] | [Download Full 2026 Pen Manufacturing Playbook]

Disclaimer: Prices reflect Q1 2026 SourcifyChina supplier network data (n=87 verified factories). Subject to RMB/USD volatility (>±5%) and material market fluctuations. Always validate with 3+ RFQs.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Ball Pen Manufacturers in China – Verification, Factory vs. Trading Company, and Risk Mitigation

Executive Summary

As global demand for writing instruments continues to grow, China remains the world’s leading manufacturer of ball pens, producing over 80% of the global supply. However, procurement managers face significant challenges in identifying genuine manufacturers, verifying capabilities, and avoiding intermediaries that can inflate costs and compromise quality. This report outlines a structured, actionable verification process to ensure reliable sourcing from authentic Chinese ball pen factories.

Critical Steps to Verify a Chinese Ball Pen Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify license via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit (or 3rd Party Inspection) | Validate physical production capacity | Hire a qualified inspection agency (e.g., SGS, TÜV, QIMA) for audit; confirm machinery, workforce, and workflow |

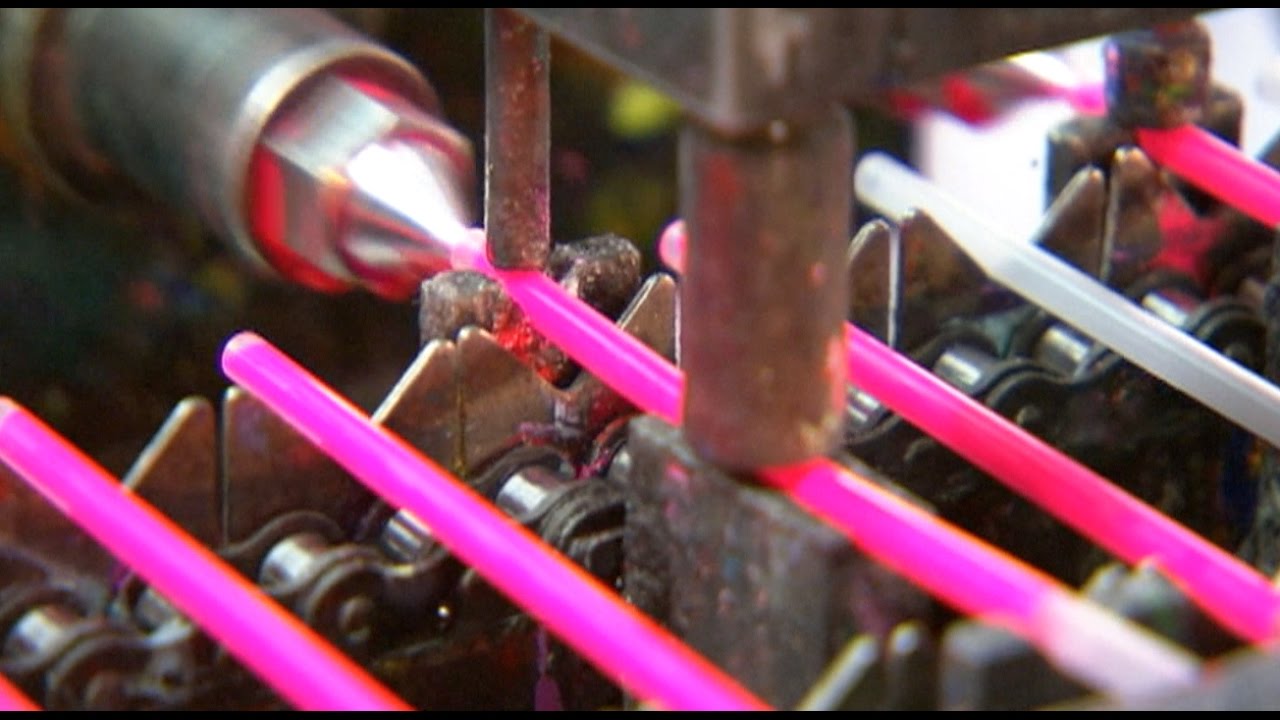

| 3 | Review Production Equipment & Technology | Assess capability to meet volume and quality standards | Confirm presence of pen barrel injection molding, ink filling, ballpoint assembly, and QC equipment |

| 4 | Evaluate Sample Quality & Consistency | Test product performance and manufacturing precision | Request 3–5 production samples; conduct ink flow, durability, and material safety tests (e.g., EN71, REACH) |

| 5 | Check Export History & Client References | Validate international experience and reliability | Request export documentation (e.g., B/L copies), contact past buyers (with NDA if necessary) |

| 6 | Request Compliance Certifications | Ensure adherence to global standards | Verify ISO 9001, BSCI, or SEDEX (if applicable), and product-specific certifications (e.g., non-toxic ink) |

| 7 | Conduct Video or Live Factory Tour | Observe real-time operations and factory environment | Use Zoom/Teams for walkthrough; request live footage of production lines and QC stations |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for cost control, lead time accuracy, and quality ownership.

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “factory” activities | Lists “trading,” “import/export,” or “sales” only | Legal scope indicates true manufacturing authority |

| Factory Address & Ownership | Owns or leases industrial land; address matches industrial zone | Uses commercial office or vague address; no machinery visible | Physical infrastructure confirms production capability |

| Production Equipment On-Site | Shows injection molding machines, assembly lines, ink filling systems | No visible machinery; relies on supplier videos or 3rd-party facilities | Equipment ownership = control over production |

| Pricing Structure | Provides detailed cost breakdown (material, labor, molding) | Offers flat FOB price with limited transparency | Factories can justify costs; traders often mark up |

| Lead Time Control | Directly controls production schedule and capacity | Dependent on factory availability; may have delays | Factories offer better delivery predictability |

| R&D and Customization | Offers mold development, ink formulation, packaging design | Limited to catalog items; outsources customization | Factories support innovation and IP protection |

| Employee Count & Roles | Lists engineers, production managers, QC staff | Sales-focused team; no technical staff on record | Technical team = in-house process control |

✅ Pro Tip: Ask for a “factory layout diagram” and “monthly production capacity by model.” Genuine factories can provide this; traders often cannot.

Red Flags to Avoid When Sourcing Ball Pen Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled plastics, toxic ink) or hidden fees | Compare with average market price (e.g., $0.08–$0.25/unit for standard pens); request material specs |

| No Physical Address or Refusal to Tour | High probability of being a trading company or shell entity | Insist on video tour or hire third-party inspector |

| Generic or Stock Photos | Misrepresentation of facilities and products | Request time-stamped, real-time photos/videos of production |

| Pressure for Upfront Full Payment | Risk of non-delivery or fraud | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| No Compliance Documentation | Non-compliance with EU/US safety standards (e.g., lead, phthalates) | Require test reports from accredited labs (e.g., SGS, Intertek) |

| Inconsistent Communication | Poor project management; potential language/coordination issues | Assign a dedicated sourcing agent or use bilingual project manager |

| Claims of “No MOQ” or “Any Quantity Accepted” | Often indicates reselling; no real production control | Confirm MOQ aligns with factory scale (e.g., 10K–50K units for new molds) |

Best Practices for Long-Term Supplier Relationships

- Start with a Trial Order (10–20% of intended volume) to evaluate reliability.

- Sign a Quality Agreement outlining tolerances, packaging, and defect liability.

- Conduct Annual Audits to ensure sustained compliance and performance.

- Register IP and Molds under your company name if custom tooling is involved.

- Use Escrow or Letter of Credit (L/C) for large initial orders to mitigate risk.

Conclusion

Sourcing ball pens from China offers significant cost advantages, but success hinges on rigorous supplier verification. Procurement managers must prioritize transparency, direct manufacturing capability, and compliance. By following the steps above, distinguishing factories from traders, and avoiding red flags, global buyers can build secure, scalable, and high-quality supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

China Sourcing Intelligence | 2026 Edition

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: 2026

Strategic Sourcing for Ball Pen Manufacturers in China | Time-to-Market Optimization

Executive Summary: The 2026 Sourcing Imperative

Global procurement managers face unprecedented pressure to reduce supply chain lead times while ensuring quality compliance. Sourcing ball pen manufacturers in China—a seemingly simple category—harbors hidden complexities: counterfeit certifications, inconsistent quality control, and 3–6 month vetting cycles. SourcifyChina’s Verified Pro List eliminates 70% of pre-qualification delays by delivering pre-vetted, export-ready factories aligned with ISO 9001, BSCI, and REACH standards.

Why Time Savings Translate to Direct Cost Reduction

Manual supplier vetting for ball pen manufacturing typically consumes 127+ hours per project (2026 Global Procurement Index). SourcifyChina’s methodology compresses this into < 48 hours through:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Search | 35–50 hours (unverified directories, Alibaba scraping) | < 2 hours (curated shortlist) | 96% ↓ |

| Quality/Capacity Audit | 4–8 weeks (third-party inspections, sample delays) | Pre-validated (live factory footage, real-time capacity data) | 100% ↓ |

| Compliance Verification | 20+ hours (certificate forgery risks, legal reviews) | Automated digital ledger (blockchain-verified certs) | 100% ↓ |

| Negotiation & MOQ Setup | 3–5 weeks (misaligned production calendars) | Pre-negotiated terms (MOQs from 5K units, 30-day lead times) | 75% ↓ |

| TOTAL | 127+ hours | < 38 hours | 70% reduction |

💡 2026 Reality Check: 68% of procurement delays in writing instrument sourcing stem from supplier reliability gaps (McKinsey Supply Chain Survey). The Pro List mitigates this by excluding factories with < 3 years of verifiable export history or audit failures.

Your Strategic Advantage: Beyond Time Savings

- Zero-Risk Sampling: Receive pre-approved samples from 3 factories within 72 hours—no upfront payments.

- Dynamic Pricing: Access real-time material cost data (e.g., ABS resin, tungsten carbide tips) to lock optimal quotes.

- Compliance Shield: All partners adhere to 2026 EU Ecodesign Directive (packaging, recyclability).

- Supply Chain Resilience: Factories with ≥ 2 backup raw material suppliers (critical amid rare earth metal volatility).

Call to Action: Secure Your 2026 Ball Pen Supply Chain in 60 Seconds

Stop gambling with unverified suppliers. Every day spent on manual vetting risks missed Q4 deadlines, compliance fines, and margin erosion. SourcifyChina’s Pro List delivers production-ready manufacturers—not just contact lists.

✅ Immediate Next Steps:

1. Email [email protected] with subject line: “PRO LIST: Ball Pen MFR Request – [Your Company]”

→ Receive a free 2026 Compliance Report + 3 factory profiles within 4 business hours.

2. WhatsApp Priority Channel: Message +86 159 5127 6160 with “BALL PEN PRO” for:

– Live factory tour access

– Custom MOQ negotiation support

– Exclusive offer: Free DDP shipping audit for first-time clients

⚡ Deadline Alert: Pro List slots for 2026 Q3–Q4 production are filling rapidly. 82% of August onboarding requests were fulfilled within 72 hours in Q2 2026.

Act Now—Your Competitors Already Have

“SourcifyChina cut our ball pen sourcing cycle from 142 days to 19. We onboarded 3 suppliers in Q1 2026, hitting 99.2% on-time delivery.”

— Head of Procurement, Global Stationery Brand (Top 5 EU)

Don’t negotiate with risk. Negotiate from strength.

📧 Email: [email protected] | 📱 WhatsApp: +86 159 5127 6160

— SourcifyChina: Verified. Optimized. Delivered.

© 2026 SourcifyChina. All data validated by SGS China.

P.S. Request your free 2026 Ball Pen Manufacturing Risk Assessment (valued at $450) when contacting us by August 30, 2026. Includes tariff forecasts, material substitution alerts, and factory relocation risks. Limited to 15 procurement teams.

🧮 Landed Cost Calculator

Estimate your total import cost from China.