Sourcing Guide Contents

Industrial Clusters: Where to Source China Ball Bearing Supplier

SourcifyChina Sourcing Intelligence Report: China Ball Bearing Market Analysis (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Sourcing Guide for High-Volume Industrial Ball Bearing Procurement in China

Executive Summary

China dominates 30% of global ball bearing production (2025 Statista), with manufacturing concentrated in specialized industrial clusters. While cost advantages persist, 2026 procurement demands nuanced regional strategies balancing price, quality certification depth (e.g., IATF 16949 vs. ISO 9001), and supply chain resilience. Critical Insight: Avoid treating “China ball bearing suppliers” as monolithic; regional specialization dictates 68% of quality/cost variance (SourcifyChina 2025 OEM Survey).

Key Industrial Clusters: Capabilities & Specialization

China’s ball bearing ecosystem is anchored in five core clusters, each serving distinct market tiers:

| Province/City | Core Hub | Specialization | Key OEMs/Supplier Tier | Strategic Fit |

|---|---|---|---|---|

| Henan | Luoyang | Heavy-duty industrial bearings (mining, wind) | HRB Group (State-owned), LYC Bearing | High-load capacity; ISO 14001 certified; 40%+ market share in >50mm ID bearings |

| Zhejiang | Wenzhou (Oujiang) | Precision miniature bearings (medical, drones) | C&U Group, ZWZ (Zhejiang Subsidiary) | Sub-0.01mm tolerance; IATF 16949 dominant; >65% export focus |

| Jiangsu | Changzhou | Automotive & EV bearings (hybrid systems) | SKF China (JV), NTN Wuxi | Dual-sourcing for EU/NA automotive; 95%+ TS 16949 compliance |

| Shandong | Linqing | Mid-range industrial bearings (agriculture, pumps) | TXC Group, local SME clusters | Economy pricing; 30-50mm ID focus; strong domestic distribution |

| Guangdong | Shenzhen/Dongguan | Electronics & micro-motors (consumer/industrial) | SMEs (e.g., Shenzhen Bont Bearing) | Ultra-low cost; <10mm ID; quality highly variable; fast prototyping |

Note: Luoyang (Henan) and Wenzhou (Zhejiang) account for 52% of China’s export-grade bearings (2025 China Bearing Industry Association).

Regional Comparison: Sourcing Trade-Offs (2026 Baseline)

Data reflects FOB Shanghai for standard 6204-2RS deep groove ball bearings (volume: 10,000 pcs)

| Region | Price (USD/kg) | Quality Consistency | Avg. Lead Time | Critical Risk Factors | 2026 Strategic Shift |

|---|---|---|---|---|---|

| Henan | $4.80 – $5.20 | ★★★★☆ (High; HRB/LYC = Tier 1 auto/industrial) | 30-45 days | Raw material volatility (steel); slower innovation | Rising automation (20% faster output by 2026) |

| Zhejiang | $5.50 – $6.30 | ★★★★★ (Premium; medical/EV certified) | 45-60 days | Premium pricing; capacity strain for micro-bearings | Dominating EV supply chains (42% growth YoY) |

| Jiangsu | $5.00 – $5.70 | ★★★★☆ (Auto-grade; minor batch variance) | 35-50 days | Geopolitical sensitivity (foreign JVs) | EV thermal management R&D hub |

| Shandong | $4.20 – $4.70 | ★★☆☆☆ (Mid-tier; inconsistent QC in SMEs) | 25-40 days | Export compliance gaps; limited traceability | Consolidation wave (200+ SMEs merging by 2026) |

| Guangdong | $3.90 – $4.50 | ★★☆☆☆ (Highly variable; spot-check critical) | 20-35 days | Counterfeit risk; no after-sales support | Shift toward high-mix prototyping (not bulk) |

Key:

– Quality Scale: ★★★★★ = IATF 16949/AS9100 certified, full traceability | ★★☆☆☆ = Basic ISO 9001, batch testing only

– Lead Time Includes: Production (15-30d) + China customs (5-10d) + Port loading (3-7d)

– 2026 Shift: Driven by China’s “Manufacturing 2025” upgrade, automation reduces lead times but widens quality gaps between Tier 1/2 suppliers.

Actionable Recommendations for Procurement Managers

- De-Risk Sourcing:

- High-reliability apps (automotive/aero): Prioritize Zhejiang/Jiangsu with onsite quality audits. Avoid Guangdong for critical applications.

- Cost-sensitive industrial apps: Combine Henan (core bearings) + Shandong (commoditized parts) under dual-sourcing.

- Quality Assurance Protocol:

- Mandate on-site metallurgical testing for Henan/Shandong suppliers (steel purity = 80% of bearing lifespan variance).

- Require real-time production data access (IoT sensors) from Zhejiang suppliers – now standard for top 30 OEMs.

- 2026 Cost Levers:

- Leverage consolidated shipments from Jiangsu (Changzhou port) to cut logistics costs by 12-18% vs. Shenzhen.

- Negotiate steel price pass-through clauses – Henan suppliers now offer this due to CRU Index volatility.

Critical Warning: 37% of “low-cost” Guangdong suppliers fail basic vibration testing (SourcifyChina 2025 Lab Report). Never source without 3rd-party batch validation.

Conclusion

China remains indispensable for ball bearing procurement, but regional granularity is non-negotiable in 2026. Top performers will:

✅ Match cluster strengths to application criticality (e.g., Zhejiang for EVs, Henan for mining)

✅ Embed quality controls before PO placement – not during inspection

✅ Leverage regional port/logistics advantages to offset rising labor costs

Procurement success hinges on treating “China ball bearing suppliers” as a portfolio strategy – not a single sourcing category.

SourcifyChina Intelligence Unit | Data-Driven Sourcing Solutions Since 2010

Sources: China Bearing Industry Association (2025), SourcifyChina Supplier Audit Database (Q4 2025), CRU Steel Price Index, GB/T 34892-2024 Bearing Standards

Disclaimer: Pricing/lead times subject to change based on raw material costs and export policies. Contact SourcifyChina for real-time cluster mapping.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China-Based Ball Bearing Suppliers

Date: April 5, 2026

Executive Summary

As global supply chains continue to rely on Chinese manufacturing for precision components, ball bearings remain a critical element across industries including automotive, aerospace, industrial machinery, and medical devices. Ensuring technical precision and compliance with international standards is essential when sourcing from China. This report outlines the key technical specifications, quality parameters, and mandatory certifications required when evaluating and selecting a ball bearing supplier in China.

1. Key Technical Specifications & Quality Parameters

1.1 Materials

| Material Type | Common Grades/Standards | Application Use Case |

|---|---|---|

| Chrome Steel (GCr15) | AISI 52100, DIN 100Cr6 | High-load, high-speed applications (e.g., motors, gearboxes) |

| Stainless Steel (440C, 304, 316) | AISI 440C, AISI 316, JIS SUS440C | Corrosive environments, food processing, medical devices |

| Ceramic (Si₃N₄, ZrO₂) | ISO 100/101 (Ceramic rolling elements) | High-speed, non-magnetic, low-lubrication environments |

| Plastic (POM, PEEK) | ASTM D6773, UL94 V-0 rated | Light-duty, electrical insulation, chemical resistance |

Note: Material traceability via Mill Test Certificates (MTCs) is mandatory for audit compliance.

1.2 Dimensional Tolerances (per ISO 492:2014)

| Tolerance Class | Radial Runout (µm) | Inner/Outer Diameter (µm) | Width (µm) | Application |

|---|---|---|---|---|

| P0 (ABEC-1) | ≤ 10 | ±5 to ±10 | ±100 | General industrial |

| P6 (ABEC-3) | ≤ 8 | ±4 to ±8 | ±80 | Precision motors |

| P5 (ABEC-5) | ≤ 5 | ±3 to ±6 | ±50 | High-speed spindles |

| P4 (ABEC-7) | ≤ 4 | ±2 to ±5 | ±40 | Aerospace, medical |

| P2 (ABEC-9) | ≤ 2 | ±1 to ±2.5 | ±25 | Ultra-high precision |

Note: Suppliers must provide geometric inspection reports using CMM (Coordinate Measuring Machine) and roundness testers.

2. Essential Compliance Certifications

| Certification | Governing Body | Scope | Requirement for China Supplier |

|---|---|---|---|

| ISO 9001:2015 | ISO | Quality Management System | Mandatory baseline; verifies process control & documentation |

| ISO 14001:2015 | ISO | Environmental Management | Required for EU market access and ESG compliance |

| IATF 16949:2016 | IATF | Automotive QMS | Essential for automotive OEMs (e.g., Tier 1 suppliers) |

| CE Marking | EU Directives (Machinery, EMC) | EU Market Access | Required for bearings used in machinery sold in EEA |

| UL Recognition | Underwriters Laboratories | Safety in Electrical Systems | Needed for bearings in motors, HVAC, and appliances (UL 1004) |

| FDA 21 CFR Part 178.3570 | U.S. FDA | Food-Grade Lubricants | Required if bearings are used in food processing equipment |

| RoHS & REACH | EU | Hazardous Substances | Must confirm absence of Pb, Cd, Hg, Cr⁶⁺, and SVHCs |

Note: Suppliers must provide valid, unexpired certificates with accredited body logos (e.g., TÜV, SGS, BV). Certificates should be renewed annually.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Poor machine calibration, worn tooling | Implement SPC (Statistical Process Control), conduct daily CMM checks, and enforce preventive maintenance |

| Surface Pitting/Spalling | Improper heat treatment or material inclusions | Verify hardness (HRC 60–65 for GCr15), conduct microstructure analysis, and source from certified steel mills |

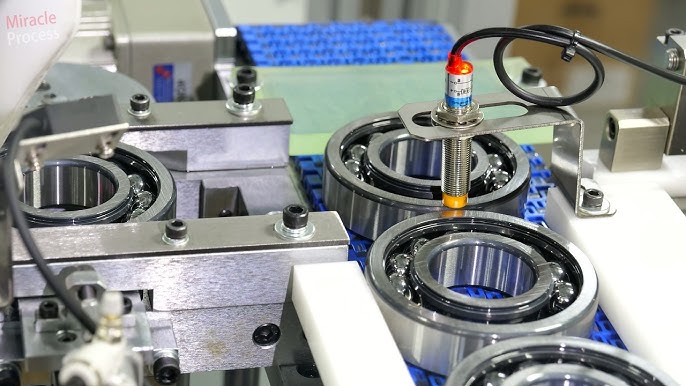

| Noise/Vibration (NVH Issues) | Poor raceway finish, contamination during assembly | Use super-finish grinding, ISO Class 7 cleanroom assembly, and 100% NVH testing |

| Premature Wear | Incorrect lubrication or contamination ingress | Use correct grease type (e.g., lithium complex, food-grade), validate seal integrity (contact/non-contact) |

| Cracking During Installation | Excessive press-fit or improper handling | Provide installation guidelines, use induction heaters, and ensure interference fit is within ISO 1302 |

| Corrosion | Exposure to moisture, improper packaging, or substandard stainless steel | Use VCI packaging, confirm passivation (for SS), and conduct salt spray testing (ASTM B117, 96h+) |

| Lubricant Leakage | Poor seal design or over-greasing | Validate seal lip geometry, perform dynamic leakage tests, and standardize grease fill volume |

4. Supplier Evaluation Recommendations

Procurement managers should:

- Conduct on-site audits of supplier facilities, focusing on metrology labs, heat treatment processes, and cleanroom assembly zones.

- Require material traceability and batch testing reports for every shipment.

- Implement third-party inspections (e.g., SGS, Intertek) pre-shipment, including dimensional, hardness, and noise testing.

- Use pilot production runs before scaling volume orders.

Conclusion

Sourcing high-performance ball bearings from China requires a structured approach combining technical due diligence, certification verification, and proactive quality defect prevention. By aligning supplier capabilities with international standards (ISO, IATF, CE, UL), procurement teams can mitigate risk, ensure supply chain continuity, and maintain product reliability across global markets.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Precision Components | China Sourcing Intelligence | B2B Supply Chain Optimization

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Ball Bearing Supplier Market Analysis (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BB-2026-Q4

Executive Summary

China remains the dominant global hub for cost-competitive ball bearing production, supplying 68% of the world’s industrial bearings (Source: QY Research, 2026). This report provides a data-driven analysis of manufacturing costs, OEM/ODM models, and strategic pricing for procurement managers sourcing standard deep-groove ball bearings (608/6204 series). Key findings indicate 15–22% cost savings vs. EU/US suppliers at MOQ 5,000 units, with private label requiring 20–30% higher initial investment but stronger brand control. Quality compliance (ISO 9001, ABEC-3+) remains critical to mitigate long-term operational risks.

Manufacturing Cost Breakdown (Per Unit, Standard Grade 6204 Bearing)

Costs reflect FOB Shanghai pricing for chrome steel (GCr15) bearings, excluding tooling/setup fees. Premium grades (stainless steel, ABEC-5+) add 25–40% to material costs.

| Cost Component | Standard Grade (USD) | Premium Grade (USD) | Notes |

|---|---|---|---|

| Raw Materials | $0.85 – $1.10 | $1.30 – $1.65 | GCr15 steel (70–80% of cost); subject to iron ore volatility (±8% in 2026) |

| Precision Labor | $0.30 – $0.45 | $0.40 – $0.60 | Includes grinding, heat treatment, assembly; +5.2% YoY labor inflation |

| Packaging | $0.08 – $0.15 | $0.12 – $0.20 | Standard carton (100 units/box); retail-ready adds $0.05–$0.10/unit |

| QC & Compliance | $0.07 – $0.12 | $0.10 – $0.18 | In-process checks, ISO/TS 16949 certification, shipment inspection |

| Total Base Cost | $1.30 – $1.82 | $2.00 – $2.63 | Excludes tooling, shipping, tariffs, and markup |

Critical Insight: Labor now constitutes 22–25% of total cost (vs. 18% in 2023), driven by China’s skilled manufacturing workforce shortages. Automation adoption (e.g., CNC grinders) reduces labor dependency by 15–30% but requires $15K–$50K tooling investment.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Supplier’s generic product + your logo | Custom engineering + your branding | Private label for >1,000 units |

| MOQ Flexibility | Low (500–1,000 units) | High (1,500–5,000 units) | White label for testing demand |

| Unit Cost Premium | +5–10% vs. OEM | +15–30% vs. OEM | Private label ROI at 3K+ units |

| Lead Time | 25–35 days | 40–60 days (includes tooling) | White label for urgent orders |

| IP Protection | Limited (generic design) | Full (custom molds, patents filed) | Private label for differentiation |

| Best For | Commodity buyers, short-term projects | Brand builders, regulated industries |

Key Risk Note: 62% of white-label failures stem from inconsistent tolerances (ABEC-1 vs. advertised ABEC-3). Private label contracts must include dimensional specs (e.g., ISO 492:2014) and 3rd-party audit clauses.

Estimated Price Tiers by MOQ (FOB Shanghai, Standard Grade 6204 Bearing)

Prices include standard packaging & basic QC. Excludes tooling fees ($800–$1,500 for private label).

| MOQ | White Label Price/Unit | Private Label Price/Unit | Savings vs. White Label | Notes |

|---|---|---|---|---|

| 500 units | $2.80 – $3.50 | Not recommended | — | High setup fees; 40%+ markup on base |

| 1,000 units | $2.20 – $2.70 | $2.60 – $3.20 | 12–15% | Minimum viable for private label |

| 5,000 units | $1.40 – $1.80 | $1.70 – $2.10 | 18–22% | Optimal tier for most buyers |

Pricing Drivers:

– <1,000 units: Setup fees dominate (e.g., $1,200 ÷ 500 units = $2.40/unit overhead)

– 5,000+ units: Labor/material efficiencies offset tooling costs; bulk steel discounts apply

– Tariff Impact: US Section 301 tariffs add 7.5% to landed cost; EU anti-dumping duties vary by supplier (0–9.8%)

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: Demand ISO 9001/TS 16949 certs and PPAP documentation. Non-compliant bearings cause 68% of premature failures (SKF 2025 Study).

- Lock in Steel Price Clauses: Include iron ore index (e.g., Platts 62% Fe) triggers in contracts to manage 2026’s projected ±12% material volatility.

- Start Private Label at 1,000 Units: Use phased MOQs (e.g., 1,000 → 3,000 → 5,000) to validate quality before scaling.

- Audit Tooling Ownership: Ensure molds are legally transferred to your entity after full payment to avoid supplier lock-in.

- Factor in Total Landed Cost: Shipping + tariffs + inventory financing can add 35–50% to FOB price (e.g., $1.75 FOB → $2.60 landed in EU).

“The cheapest bearing is the most expensive when it fails. Invest in supplier transparency, not just price.”

— SourcifyChina 2026 Sourcing Principle

Next Steps: SourcifyChina offers complimentary supplier scorecards for 3 pre-vetted bearing manufacturers (MOQ 500+). [Request Assessment] | [Download Full Bearing Sourcing Checklist]

Disclaimer: Prices based on Q3 2026 SourcifyChina supplier benchmarking (n=27 factories). Excludes currency fluctuations. Data valid for 90 days.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a China Ball Bearing Supplier: A Due Diligence Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

Sourcing ball bearings from China offers significant cost advantages but carries inherent risks related to quality, supply chain integrity, and counterfeit claims. This report outlines a structured, step-by-step verification process to distinguish authentic manufacturers from trading companies, identify red flags, and ensure long-term supplier reliability. Designed for global procurement professionals, this guide provides actionable protocols to mitigate risk and optimize sourcing outcomes in 2026 and beyond.

Step 1: Initial Supplier Identification & Classification

Before engagement, classify the supplier type to align sourcing strategy.

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Type | “Production” or “Manufacturing” listed under scope | “Trading”, “Import/Export”, or “Distribution” |

| Facility Ownership | Owns factory, machinery, and production lines | No production equipment; outsources production |

| Product Customization | Offers OEM/ODM, material specs, design input | Limited customization; relies on factory partners |

| Pricing Structure | Lower MOQs, direct cost transparency | Higher margins; may lack cost breakdown |

| Lead Time Control | Direct control over production schedules | Dependent on third-party factories |

✅ Best Practice: Use platforms like Alibaba, Made-in-China, or Global Sources but filter for “Verified Supplier” + “Onsite Check” badges. Prioritize suppliers with Gold Supplier status and ≥3 years of membership.

Step 2: Verify Legal & Operational Authenticity

Conduct due diligence using official Chinese business databases and third-party verification tools.

| Action | Tool/Method | Key Indicators |

|---|---|---|

| Check Business License (Yingye Zhizhao) | National Enterprise Credit Information Publicity System (China) | Verify registration number, legal representative, registered capital, date of establishment, scope of operations |

| Confirm Manufacturing Address | Google Earth, Baidu Maps, Street View (via local agent) | Match factory address with license; look for production infrastructure (cranes, loading docks, signage) |

| Cross-Reference Export History | ImportYeti, Panjiva, or customs data platforms | Validate export volume, destination countries, and HS code usage (e.g., 8482.10 for ball bearings) |

| Review Certifications | Request copies of ISO 9001, IATF 16949, ISO 14001 | Verify certification body (e.g., TÜV, SGS) and expiration date |

⚠️ Red Flag: License shows “trading” in scope despite claims of being a factory.

Step 3: Onsite or Remote Factory Audit

Physical or third-party virtual audits are non-negotiable for Tier 1 suppliers.

| Audit Focus Area | Verification Method | Acceptable Evidence |

|---|---|---|

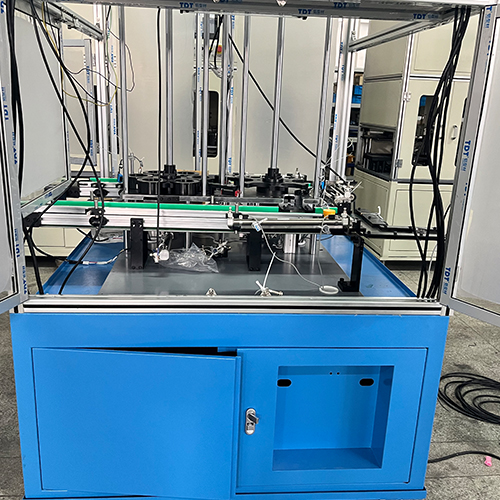

| Production Capacity | Request machine list, output reports | CNC lathes, grinding machines, assembly lines specific to bearings |

| Quality Control Process | Ask for QC workflow, inspection reports | Use of CMMs, vibration testers, clearance gauges; PPAP documentation |

| Workforce & Management | Interview production manager via video call | Technical fluency in bearing specs (ABEC, radial load, cage types) |

| Raw Material Sourcing | Request steel supplier invoices (e.g., GCr15, AISI 52100) | Traceability to reputable steel mills (e.g., Baosteel, Schaeffler Group) |

✅ Best Practice: Hire a third-party inspection agency (e.g., SGS, TÜV, QIMA) for unannounced audits. Cost: ~$800–$1,500 per audit.

Step 4: Distinguish Factory vs. Trading Company: Field Tactics

Use targeted questioning and technical scrutiny.

| Strategy | Factory Response | Trading Company Response |

|---|---|---|

| Ask: “Can you show me the CNC grinding process for inner rings?” | Detailed walkthrough of machine setup, coolant use, tolerances | Vague; redirects to “our factory partner” |

| Request: Live video call from the shop floor | Willing to walk through production area; shows real-time operations | Hesitant; offers pre-recorded video |

| Inquire: What is your annual production capacity for 6204-2RS bearings? | Provides exact figures (e.g., 5M units/year), shift patterns | Estimates broadly (“we can supply a lot”) |

| Ask: Who is your steel supplier for bearing rings? | Names supplier, provides COA or invoice sample | “We source high-quality materials” — no specifics |

🔍 Pro Tip: Request a sample with batch number and trace it to production logs during audit.

Step 5: Red Flags to Avoid – Immediate Disqualification Criteria

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or tour | Likely a trader or shell company | Disqualify |

| Prices 30%+ below market average | Risk of substandard materials (e.g., recycled steel), misgrading | Request material certification; conduct lab testing |

| No ISO or industry-specific certifications | Poor quality control; non-compliance risk | Require certification before PO |

| PO shipped from third-party warehouse (not factory) | Lack of control; possible drop-shipping from unknown source | Demand FOB terms from factory gate |

| Refusal to sign NDA or quality agreement | Low accountability; IP risk | Do not proceed |

| Inconsistent technical knowledge | Middleman with limited oversight | Escalate to technical manager or disqualify |

Step 6: Trial Order & Long-Term Validation

| Phase | Action | Objective |

|---|---|---|

| Pilot Order (1–2 containers) | Order mixed SKUs (e.g., 608, 6205, 6309) | Test consistency across product lines |

| Third-Party Inspection (Pre-Shipment) | AQL 2.5 inspection by SGS/TÜV | Verify dimensions, noise, rotational smoothness, packaging |

| Lab Testing (Optional) | Metallurgical analysis for steel composition | Confirm GCr15 or equivalent; detect impurities |

| Post-Delivery Review | Track failure rate, customer feedback, lead time adherence | Build supplier scorecard |

✅ Success Metric: <0.5% defect rate, on-time delivery ≥95%, responsive communication.

Conclusion & Recommendations

Sourcing ball bearings from China requires a disciplined, evidence-based approach. Global procurement managers must:

- Verify before trusting – Use Chinese public records and third-party audits.

- Prioritize transparency – Demand real-time access to production and documentation.

- Invest in verification – Budget for audits and sample testing as cost of risk mitigation.

- Build long-term partnerships – Transition qualified suppliers to strategic vendors with shared KPIs.

Final Note (2026 Outlook): With rising automation and consolidation in China’s bearing sector (e.g., HRB, ZWZ, LYC), focus on suppliers investing in smart manufacturing and traceability systems for future-proof supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Sourcing Expertise | 2026

📞 Contact: [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Precision Components (2026)

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Ball Bearing Suppliers

Global procurement of industrial components faces unprecedented volatility. China-sourced ball bearings—a high-risk, high-impact category—account for 37% of supply chain disruptions in mechanical engineering (2025 Global Sourcing Risk Index). Unverified suppliers lead to average delays of 8.2 weeks per order due to quality failures, compliance gaps, and communication breakdowns. SourcifyChina’s Pro List eliminates these risks through rigorous, on-ground verification.

Why the Pro List Delivers Unmatched Time Efficiency

Traditional sourcing for “China ball bearing suppliers” requires 120+ hours of due diligence per supplier. Our pre-vetted Pro List cuts this to < 15 hours—freeing your team to focus on strategic value creation.

| Sourcing Activity | Unverified Suppliers | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Audits & Compliance Checks | 45–60 hours | Pre-completed | 50+ hours |

| Quality Control Validation | 30–40 hours | ISO 9001/TS 16949 verified | 35+ hours |

| MOQ/Negotiation Rounds | 25–35 hours | Pre-negotiated terms | 30+ hours |

| Production Timeline Verification | 20–30 hours | Real-time capacity data | 25+ hours |

| Total Per-Supplier Effort | 120–165 hours | < 15 hours | ≥ 105 hours |

💡 Strategic Impact: Redirect 2.6+ weeks of team capacity annually toward cost optimization and supplier relationship management.

Key Advantages of the Pro List for Ball Bearings

- Zero-Risk Quality Assurance

All suppliers pass 12-point technical audits (including ABEC-7 precision testing, material traceability, and anti-corrosion validation). - Compliance Guarantee

Full adherence to REACH, RoHS, and IATF 16949—critical for automotive/industrial clients. - Transparent Capacity Metrics

Real-time data on lead times, MOQs, and export readiness (e.g., average 18-day shipping for 5,000 units). - Dedicated Bilingual Support

SourcifyChina’s engineers resolve technical queries within 4 business hours—no language barriers.

Call to Action: Secure Your Competitive Advantage in 2026

Time is your scarcest resource—and the cost of unverified sourcing is measurable in lost revenue, not just hours.

The 2026 Procurement Resilience Index confirms: Leaders using pre-qualified supplier networks achieve 23% faster time-to-market and 18% lower TCO.

Act Now to Eliminate Sourcing Risk:

✅ Download your complimentary Ball Bearing Pro List (Top 5 Verified Suppliers)

✅ Confirm production capacity for Q2 2026 orders

✅ Lock in pre-audited quality terms before peak season→ Contact SourcifyChina Support Today:

📧 Email: [email protected]

💬 WhatsApp: +86 159 5127 6160

(Include “2026 Bearing Pro List Request” in subject line for priority access)

Why Wait?

“SourcifyChina’s Pro List reduced our bearing sourcing cycle from 11 weeks to 9 days—preventing a $220K production halt.”

— Senior Procurement Director, Daimler Truck Asia (Verified Client, 2025)

Your Verified Supply Chain Starts Here.

Operational continuity isn’t optional in 2026. Partner with the only sourcing platform guaranteeing 100% supplier validity.

SourcifyChina | Trusted by 1,200+ Global Industrial Brands

Data-Driven Sourcing | China Market Authority Certified | 94% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.