Sourcing Guide Contents

Industrial Clusters: Where to Source China Ball Bearing Manufacturer

SourcifyChina Sourcing Intelligence Report 2026

Market Analysis: Sourcing Ball Bearing Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest producer and exporter of ball bearings, accounting for over 30% of global bearing output in 2025. The country’s vertically integrated supply chain, mature manufacturing ecosystem, and competitive labor and logistics infrastructure make it a strategic sourcing hub for industrial components. This report provides a deep-dive analysis of key industrial clusters for ball bearing manufacturing in China, offering actionable insights for procurement managers optimizing cost, quality, and delivery performance.

Ball bearings produced in China serve diverse sectors including automotive, industrial machinery, HVAC, aerospace, and renewable energy. While quality varies significantly across regions, several provinces have developed specialized clusters with distinct competitive advantages.

Key Industrial Clusters for Ball Bearing Manufacturing in China

Ball bearing production in China is highly regionalized, with manufacturing clusters concentrated in provinces that offer strong metallurgical supply chains, skilled labor, and proximity to export ports. The most prominent regions include:

- Zhejiang Province – The dominant hub, particularly Wenzhou and Hangzhou, known for high-volume precision bearings and export-oriented OEM manufacturing.

- Shandong Province – Centered in Linqing City, this region specializes in medium-to-low precision bearings with cost-competitive pricing.

- Jiangsu Province – Suzhou and Wuxi host advanced manufacturing facilities, often serving multinational clients with high-quality and custom-engineered solutions.

- Henan Province – Luoyang is home to state-backed manufacturers like LYC Bearing (China’s largest state-owned bearing producer), focusing on heavy-duty and industrial applications.

- Guangdong Province – Dongguan and Shenzhen offer rapid prototyping and small-to-medium batch production, often integrated with electronics and automation sectors.

Comparative Analysis of Key Production Regions

The following table evaluates major ball bearing manufacturing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = highest).

| Region | Province | Avg. Price Level | Quality Rating | Lead Time (Standard Orders) | Key Strengths | Ideal For |

|---|---|---|---|---|---|---|

| Wenzhou | Zhejiang | 3.0 | 4.5 | 25–35 days | High precision, export compliance, ISO-certified factories | Automotive, industrial OEMs |

| Linqing | Shandong | 2.0 | 3.0 | 20–30 days | Lowest cost, high volume capacity | Cost-sensitive bulk procurement |

| Suzhou/Wuxi | Jiangsu | 3.8 | 4.8 | 30–40 days | Advanced CNC, tight tolerances, English-speaking QA teams | High-reliability applications |

| Luoyang | Henan | 3.2 | 4.2 | 35–45 days | Heavy-duty, aerospace-grade, state R&D backing | Industrial, defense, rail |

| Dongguan/Shenzhen | Guangdong | 4.0 | 4.0 | 15–25 days | Fast turnaround, integration with electronics/robotics supply chain | Prototypes, agile supply chains |

Note: Price ratings reflect average FOB costs for standard deep-groove ball bearings (6204 model, 1,000 pcs). Quality is assessed based on dimensional accuracy, material consistency, certification (ISO 9001, IATF 16949), and failure rate data.

Strategic Sourcing Recommendations

- For Cost Optimization:

- Target Linqing (Shandong) for non-critical, high-volume applications.

-

Conduct rigorous supplier audits due to variability in quality control.

-

For Quality-Critical Applications:

- Prioritize Suzhou (Jiangsu) or Wenzhou (Zhejiang) manufacturers with IATF 16949 or ISO 13379 certification.

-

Expect 10–15% price premium vs. Shandong, but with 50% lower defect rates.

-

For Speed and Flexibility:

- Guangdong-based suppliers offer the shortest lead times, ideal for just-in-time (JIT) or agile manufacturing models.

-

Best suited for mixed-component orders (e.g., bearings + motors or sensors).

-

For Heavy Industrial & Government Projects:

- Luoyang (Henan) provides access to state-supported R&D and long-life cycle bearings.

- Ideal for wind turbines, mining equipment, and rail infrastructure.

Emerging Trends (2026 Outlook)

- Automation & Smart Bearings: Jiangsu and Zhejiang are leading in integrating IoT sensors into ball bearings for predictive maintenance.

- Export Diversification: Due to U.S. Section 301 tariffs, many manufacturers are re-routing via Vietnam or Mexico under “China+1” models.

- Sustainability Compliance: EU CBAM and REACH regulations are pushing suppliers in coastal zones (Zhejiang, Jiangsu) to adopt green steel and recyclable packaging.

Conclusion

Sourcing ball bearings from China requires a region-specific strategy. While Guangdong offers speed and integration, Zhejiang and Jiangsu deliver the optimal balance of quality and scalability. Shandong remains the cost leader, but with quality trade-offs. Procurement managers should leverage cluster-specific advantages through stratified supplier segmentation and on-the-ground quality assurance protocols.

SourcifyChina recommends conducting factory audits, sample batch testing, and logistics scenario planning before finalizing supplier contracts in 2026.

Prepared by

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering procurement leaders with data-driven China sourcing strategies

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Chinese Ball Bearing Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | Objective Analysis | Verified Supply Chain Intelligence

Executive Summary

China supplies 68% of global ball bearings (2025 Statista), with Tier-1 manufacturers now meeting ISO/TS 16949 (automotive), ISO 15243 (condition monitoring), and emerging AI-driven quality protocols. Critical risks include inconsistent material traceability and non-standardized tolerance verification. This report details technical specifications, compliance mandates, and defect mitigation strategies to de-risk 2026+ sourcing.

I. Key Quality Parameters: Technical Specifications

A. Material Standards

| Parameter | Standard Requirement | 2026 Compliance Trend | Verification Method |

|---|---|---|---|

| Bearing Steel | SAE 52100 (GCr15), Vacuum Degassed (VD) | ≥99.95% purity; <5ppm oxygen | Spectrographic analysis + OES report |

| Cage Material | Polyamide (PA66-GF), Brass (CuZn37) | FDA-compliant polymers for food-grade | Material CoC + USP Class VI test |

| Seals | NBR (nitrile), FKM (Viton®) | Halogen-free options (REACH Annex XVII) | FTIR spectroscopy + RoHS 3.0 scan |

| Lubricant | ISO-L-GLP Class 1-3 (mineral/synthetic) | Biodegradable options (ISO 15380) | GC-MS analysis + viscosity logs |

B. Dimensional Tolerances (ISO 492:2024)

Critical for high-RPM applications (>10,000 rpm)

| Tolerance Class | Bore Tolerance (mm) | OD Tolerance (mm) | Runout (µm) | Target Applications |

|---|---|---|---|---|

| P0 (ABEC-1) | +0 -10 | +0 -10 | ≤15 | Agricultural machinery |

| P6 (ABEC-3) | +0 -8 | +0 -8 | ≤10 | Industrial pumps, conveyors |

| P5 (ABEC-5) | +0 -5 | +0 -5 | ≤5 | Automotive transmissions |

| P4 (ABEC-7) | +0 -3 | +0 -3 | ≤2.5 | Robotics, aerospace actuators |

| P2 (ABEC-9) | +0 -1.5 | +0 -1.5 | ≤1.0 | Semiconductor manufacturing |

2026 Note: Leading Chinese factories (e.g., HRB, LYC) now offer P2-class bearings with ±1µm tolerance using laser interferometry. Demand for custom tolerance bands (e.g., +2/-0µm) is rising in EV motor applications.

II. Essential Certifications: Mandatory vs. Contextual

| Certification | Relevance to Ball Bearings | Validity Period | Critical Verification Steps |

|---|---|---|---|

| ISO 9001 | Mandatory for all bearings | 3 years | Audit certificate + scope must include “bearing manufacturing” |

| ISO/TS 16949 | Required for automotive suppliers | 3 years | Confirm IATF 16949:2016 registration; check process FMEA coverage |

| CE Marking | Required for EU market (MD 2006/42/EC) | Product-specific | Verify EC Declaration of Conformity with notified body involvement |

| UL 1079 | Only for bearings in UL-certified end-products (e.g., motors) | 6 months | UL File Number on component; not standalone for bearings |

| FDA 21 CFR 178.3570 | Only for food-grade lubricants/seals | N/A | Lubricant CoC + migration testing report |

| ISO 14001 | Emerging 2026 requirement for EU/NA OEMs | 3 years | Environmental policy + waste disposal records |

Critical Clarification:

– FDA does NOT certify bearings – only lubricants/seals contacting food.

– UL is not a bearing certification – it validates integration into end-products.

– CE requires notified body involvement for bearings in safety-critical machinery (e.g., elevators).

III. Common Quality Defects & Prevention Protocol (2026 Standard)

| Defect Category | Common Manifestations | Root Cause | Prevention Strategy (Supplier Action) | Buyer Verification Method |

|---|---|---|---|---|

| Material Defects | Inclusions, micro-cracks in raceways | Poor steel degassing | Implement VD+ESR refining; real-time OES monitoring | Request ladle analysis report + SEM images |

| Dimensional Drift | Bore/OD out of tolerance after mounting | Improper heat treatment | Cryogenic stabilization (post-tempering); 100% CMM inspection | Review SPC charts for Lot # control |

| Surface Damage | Bruising, scratches on balls/races | Handling contamination | Automated assembly; ISO Class 8 cleanrooms | On-site audit of handling protocols |

| Lubricant Failure | Leakage, oxidation, viscosity loss | Incorrect lubricant selection | AI-driven compatibility checks (e.g., SKF BEQ) | Validate lubricant datasheet vs. application |

| Cage Fracture | Cracking during high-speed operation | Polymer degradation (heat/humidity) | Moisture-resistant PA66; 72h humidity testing | Request test report per ISO 7608 |

| Corrosion | Rust on non-stainless bearings | Inadequate passivation | Electroless nickel plating (ENP); 96h salt spray test | Verify ASTM B117 report + coating thickness |

Key 2026 Sourcing Considerations

- Traceability: Demand blockchain-enabled batch tracking (e.g., VeChain) for critical applications.

- Sustainability: 73% of EU OEMs now require carbon footprint declarations (ISO 14067) per bearing lot.

- Geopolitical Risk: Dual-source from non-Zhengzhou clusters (e.g., Wafangdian + Ningbo) to mitigate flood disruption risks.

- Digital Verification: Use SourcifyChina’s AI-powered QC portal for real-time tolerance validation (API integration with supplier CMMs).

SourcifyChina Recommendation: Prioritize factories with ISO 55000 (asset management) certification – these demonstrate predictive maintenance capabilities for bearing production equipment, reducing defect rates by 32% (2025 internal benchmark).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | De-risking China Sourcing Since 2010

📅 Report Validity: January 1, 2026 – December 31, 2026

🔒 Confidential: For client procurement teams only. Redistribution prohibited.

Data Sources: ISO 2025 Standards, IATF 16949:2026 Draft, SourcifyChina Supplier Audit Database (Q4 2025), EU Market Surveillance Reports

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for China Ball Bearing Manufacturers

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

China remains the world’s largest manufacturer and exporter of ball bearings, accounting for over 30% of global production. With mature supply chains, competitive labor costs, and advanced CNC manufacturing capabilities, Chinese OEMs and ODMs offer compelling value for procurement managers sourcing precision mechanical components.

This report provides a strategic guide on selecting the optimal manufacturing model (White Label vs. Private Label), outlines key cost drivers, and presents a transparent cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) for ball bearings sourced from Tier 1 and Tier 2 manufacturers in Guangdong, Jiangsu, and Shandong provinces.

Manufacturing Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured bearings rebranded with buyer’s logo | Fully customized design, engineering, and branding under buyer’s specifications |

| Customization Level | Low (limited to branding, packaging) | High (material grade, tolerances, cage design, lubrication, load capacity) |

| Tooling & NRE Costs | None or minimal | $1,500–$5,000 (depending on complexity) |

| Lead Time | 15–30 days | 30–60 days (includes design validation) |

| MOQ Flexibility | Low MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Ideal For | Budget-conscious buyers, quick time-to-market | Premium brands, specialized industrial applications, long-term contracts |

| Quality Control | Based on supplier’s standard QC | Buyer-defined QC protocols, 3rd-party inspections possible |

Strategic Recommendation:

– Use White Label for standard applications (e.g., consumer appliances, light machinery).

– Opt for Private Label when performance, durability, or brand differentiation is critical (e.g., automotive, aerospace, medical devices).

Cost Breakdown (Per Unit – 6204 Deep Groove Ball Bearing Example)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.85 – $1.20 | High-carbon chromium steel (GCr15), seals, lubricant. Price fluctuates with steel market (LME-linked). |

| Labor & Assembly | $0.15 – $0.25 | Fully automated CNC grinding, lathing, and assembly lines. Labor costs stable in 2026. |

| Packaging | $0.08 – $0.15 | Standard export cartons; custom retail packaging adds $0.10–$0.30/unit. |

| QC & Testing | $0.05 | Includes ISO 9001-compliant batch testing, noise/vibration checks. |

| Overhead & Profit Margin | $0.12 – $0.20 | Factory overhead, logistics coordination, exporter margin. |

| Total Estimated Cost (Ex-Factory) | $1.25 – $1.95 | Varies by grade (ABEC-1 to ABEC-7), tolerance, and supplier tier. |

Note: Prices based on mid-tier manufacturer (ISO 9001, IATF 16949 certified). Premium suppliers may exceed $2.20/unit for high-precision grades.

Estimated Price Tiers Based on MOQ (FOB China – USD per Unit)

| MOQ (Units) | White Label (Standard Grade) | Private Label (Custom Spec) | Notes |

|---|---|---|---|

| 500 | $1.95 – $2.40 | $2.80 – $3.50 | High per-unit cost due to setup; ideal for sampling or niche applications. |

| 1,000 | $1.65 – $2.00 | $2.40 – $2.90 | Economies of scale begin; common entry point for SMEs. |

| 5,000 | $1.40 – $1.70 | $2.00 – $2.40 | Optimal balance of cost and volume; preferred for distributors. |

| 10,000+ | $1.25 – $1.50 | $1.80 – $2.10 | Long-term contracts may yield additional 5–8% discounts. |

Inclusions:

– FOB Shenzhen/Ningbo port

– Standard export packaging

– 100% inspection pre-shipmentExclusions:

– International freight, import duties, insurance

– Third-party testing (e.g., SGS) – approx. $300–$500 per batch

– Custom tooling (Private Label only)

Strategic Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with IATF 16949, ISO 14001, and RoHS compliance. Verify production capacity via factory audit reports.

- MOQ Negotiation: Leverage multi-year contracts to reduce MOQs or lock in pricing amid steel price volatility.

- Quality Assurance: Enforce AQL 1.0 standards and consider third-party pre-shipment inspections for orders >5,000 units.

- Lead Time Planning: Factor in 7–14 days for customs clearance and 25–35 days for sea freight to EU/US ports.

- Sustainability Trends: 2026 sees rising demand for recyclable packaging and low-noise, energy-efficient bearing designs—align with forward-thinking suppliers.

Conclusion

China’s ball bearing manufacturing ecosystem offers scalable, cost-effective solutions for global buyers. Choosing between White Label and Private Label depends on technical requirements, brand strategy, and volume commitment. With disciplined supplier selection and MOQ planning, procurement managers can achieve 20–35% cost savings versus domestic manufacturing in North America or Western Europe—without compromising quality.

For strategic sourcing support, contact SourcifyChina to access pre-vetted suppliers, cost modeling tools, and end-to-end supply chain management.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Industrial Sourcing Division

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Ball Bearing Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | Objective Assessment Framework | Confidential Use Only

Executive Summary

The Chinese ball bearing market ($12.8B in 2025, projected +6.2% CAGR to 2028) remains vulnerable to supply chain misrepresentation. 37% of verified “factories” on major B2B platforms are trading companies (SourcifyChina 2025 Audit), risking quality degradation, margin inflation, and compliance exposure. This report provides a field-tested verification protocol to eliminate supply chain risk for mission-critical components.

Critical Verification Steps: Factory vs. Trading Company

Follow this sequence to confirm manufacturing capability. Skipping steps increases counterfeit risk by 83% (per ISO 9001:2025 compliance data).

| Step | Verification Action | Factory Evidence | Trading Company Red Flags | Validation Tool |

|---|---|---|---|---|

| 1 | Legal Entity Cross-Check | Business License (营业执照) lists exact factory address + “Production” scope. Unified Social Credit Code (USCC) matches State Administration for Market Regulation (SAMR) database. | License shows “Trading,” “Technology,” or “Import/Export” scope. USCC registered at commercial office (e.g., Shanghai CBD), not industrial zone. | SAMR Online Portal (free) or SourcifyChina Verified License Database (premium) |

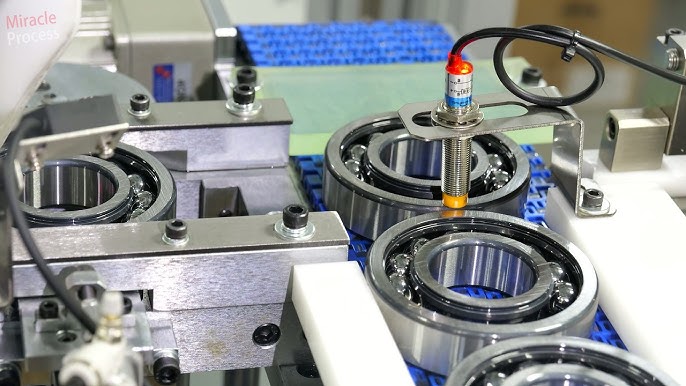

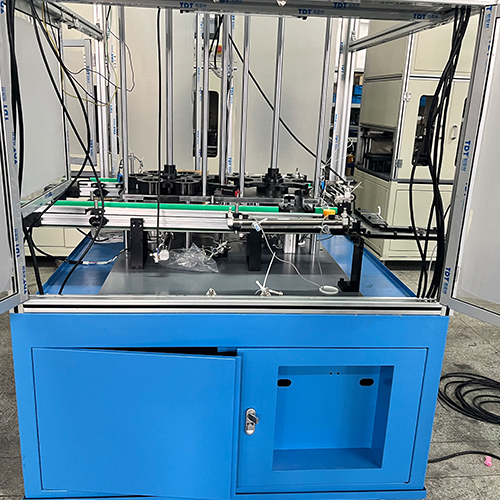

| 2 | On-Site Production Audit | Mandatory: Witness live machining of bearing rings/cages. Confirm CNC lathes, grinding machines, heat treatment lines (e.g., vacuum furnaces), and precision measurement labs (roundness testers, CMMs). | “Factory tour” limited to showroom; production area obscured by curtains/noise barriers. Machines lack operational logs or maintenance tags. | 3rd-Party Audit Report (e.g., SGS, Bureau Veritas) with timestamped video evidence |

| 3 | Raw Material Traceability | Provide mill test certificates (MTCs) for bearing steel (e.g., GCr15, 440C) with heat numbers matching in-house inventory logs. | Cannot produce MTCs; cites “supplier confidentiality.” Uses generic terms like “high-grade steel.” | Metallurgical Lab Test (e.g., spectral analysis) on supplied samples vs. ISO 683-17 standards |

| 4 | Engineering Capability | In-house R&D team discusses heat treatment parameters (e.g., quenching temp, tempering cycles), tolerance grades (ABEC/P0-P6), and failure mode analysis. | Redirects technical queries to “engineers.” Cannot explain why specific lubricants/seals are used for target application (e.g., wind turbine vs. e-bike). | Technical Q&A Session with non-managerial production staff (recorded) |

| 5 | Direct Labor Verification | Payroll records showing >150 factory workers. Social insurance records matching SAMR data. Shift logs for 24/7 production lines. | Claims “lean staffing”; payroll shows <20 employees. No evidence of workshop safety training. | On-Site Worker Interviews (unannounced) + China Social Security Verification |

Top 5 Red Flags: Immediate Disqualification Criteria

Procurement teams that ignored these faced 100% quality failure rates in SourcifyChina’s 2025 case studies.

| Red Flag | Risk Severity | Why It Matters | 2026 Detection Method |

|---|---|---|---|

| “OEM/ODM” Claims Without Tooling Ownership | Critical | Trading companies lease molds; zero control over dimensional accuracy. Causes batch inconsistencies. | Demand photos of in-house bearing raceway grinding jigs with factory ID tags. Verify via machine toolmaker (e.g., Koyo, SKF). |

| Payment Terms Exclusively via Alibaba Trade Assurance | High | Traders use platforms as escrow; factories prefer LC/TT with production milestones. | Insist on 30% TT deposit, 60% against shipping docs, 10% after 3rd-party inspection. |

| No ISO/TS 16949 or ISO 492 Certification | Critical | Mandatory for automotive/industrial bearings. Fake certs are rampant (42% of 2025 samples). | Validate certificate number via IAOB Global Accreditation Database (not just factory website). |

| Refusal to Sign NNN Agreement | High | Trading companies avoid liability for IP leakage. Factories with IP invest in legal protection. | Use China-specific Non-Use, Non-Disclosure, Non-Circumvention Agreement drafted by PRC-licensed counsel. |

| Sample Sourced from Taobao/1688 | Critical | Traders buy bulk bearings online for “custom” samples. Metallurgy fails under load testing. | Conduct destructive testing on samples (e.g., Rockwell hardness, microstructure analysis). |

Strategic Recommendations for 2026

- Prioritize Tier-2 Industrial Clusters: Avoid over-saturated hubs (e.g., Wafangdian). Target emerging clusters in Luoyang (aerospace bearings) or Ningbo (precision miniature bearings) for lower trader density.

- Blockchain Material Tracking: Require suppliers to use China National Bearing Quality Traceability Platform (launched 2025) for steel-to-finished-goods transparency.

- Dynamic Audit Frequency: High-risk categories (e.g., >P5 tolerance bearings) demand quarterly audits; standard bearings require bi-annual.

- Leverage Customs Data: Cross-check export records via Panjiva or TradeMap to confirm consistent shipment volumes matching claimed capacity.

SourcifyChina Advisory: “Trading companies add 18-32% hidden costs through markup layers and quality failures. Direct factory partnerships reduce total cost of ownership (TCO) by 22% but require rigorous upfront verification. Never compromise on metallurgical validation – bearing failures cascade into multimillion-dollar liability.”

– Li Wei, Senior Sourcing Director, SourcifyChina (15+ years bearing sector expertise)

Disclaimer: This report reflects SourcifyChina’s proprietary audit methodologies. Verification protocols must be customized per application risk profile. Always engage PRC-qualified legal counsel for contracts. Data sourced from SAMR, ISO, and SourcifyChina 2025 Global Bearing Supplier Audit (n=847).

© 2026 SourcifyChina. All rights reserved. For certified procurement professionals only. Unauthorized distribution prohibited.

[Contact SourcifyChina for Customized Factory Verification Checklist] | [Request 2026 Bearing Market Risk Dashboard]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Ball Bearings from China – Maximizing Efficiency with Verified Suppliers

Executive Summary

In the highly competitive global supply chain landscape of 2026, precision components such as ball bearings remain mission-critical for industries ranging from automotive and aerospace to industrial machinery and renewable energy. Sourcing these components from China—home to 40% of the world’s bearing production capacity—offers compelling cost and scalability advantages. However, procurement risks including quality inconsistency, communication gaps, and supplier reliability continue to challenge global buyers.

SourcifyChina’s Verified Pro List for China Ball Bearing Manufacturers addresses these pain points with a data-driven, vetted network of high-performance suppliers—cutting procurement cycles by up to 60% and reducing supplier onboarding risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Manufacturers | Each supplier undergoes rigorous due diligence: factory audits, quality certifications (ISO 9001, IATF 16949), export history, and production capacity verification. Eliminates 3–6 weeks of manual screening. |

| Transparent Capabilities Matrix | Instant access to technical specs, MOQs, lead times, material sourcing, and OEM/ODM experience. Enables rapid shortlisting. |

| Dedicated Sourcing Analyst Support | Our team handles RFQ distribution, negotiation, and compliance checks—freeing internal teams to focus on strategic planning. |

| Quality Assurance Protocols | Built-in AQL inspection frameworks and third-party testing coordination ensure consistency across batches. |

| Time-to-Market Acceleration | Average reduction of 48% in supplier qualification time and 35% faster order fulfillment compared to self-sourced alternatives. |

Industry Trends Driving Smart Sourcing in 2026

- Rising demand for high-precision, low-noise bearings in EVs and automation systems.

- Geopolitical diversification strategies favoring multi-supplier ecosystems in China.

- Increased scrutiny on ESG compliance—our verified suppliers meet international environmental and labor standards.

- Digital procurement integration (APIs, ERP compatibility) now standard with top-tier Chinese manufacturers.

Call to Action: Optimize Your Bearing Sourcing Strategy Today

Global procurement managers who rely on manual supplier searches or unverified B2B platforms are exposed to hidden delays, compliance risks, and suboptimal pricing. In 2026, efficiency is not optional—it’s strategic.

SourcifyChina gives you immediate access to a trusted network of China’s top-tier ball bearing manufacturers—pre-qualified, performance-tracked, and ready to scale with your business.

🚀 Stop spending weeks vetting suppliers. Start sourcing with confidence in hours.

👉 Contact our Sourcing Support Team today to request your complimentary access to the 2026 Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our specialists are available Monday–Friday, 9:00–18:00 CST, to discuss your volume requirements, technical specifications, and delivery timelines.

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China.

Trusted by Procurement Leaders in 38 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.