Sourcing Guide Contents

Industrial Clusters: Where to Source China Bags Supplier

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Bags from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s leading manufacturing hub for bags, encompassing a wide range of product types including handbags, backpacks, luggage, tote bags, and eco-friendly textile carriers. The country’s integrated supply chain, skilled labor force, and economies of scale make it a strategic sourcing destination for global brands, retailers, and distributors.

This report provides a comprehensive market analysis of China’s bag manufacturing landscape, identifying key industrial clusters and evaluating regional strengths in price competitiveness, quality standards, and lead time performance. The findings are designed to support procurement managers in making data-driven supplier selection decisions aligned with brand positioning, cost targets, and delivery timelines.

Key Industrial Clusters for Bag Manufacturing in China

China’s bag manufacturing is highly regionalized, with specialized clusters developing around raw material access, export infrastructure, and decades of industry evolution. The following provinces and cities are the dominant production hubs:

| Region | Key Cities | Specialization | Export Infrastructure |

|---|---|---|---|

| Guangdong | Guangzhou, Baiyun, Shenzhen, Dongguan | Leather handbags, luxury bags, OEM/ODM for Western brands, high-end synthetics | Proximity to Hong Kong & Shenzhen Port; excellent logistics |

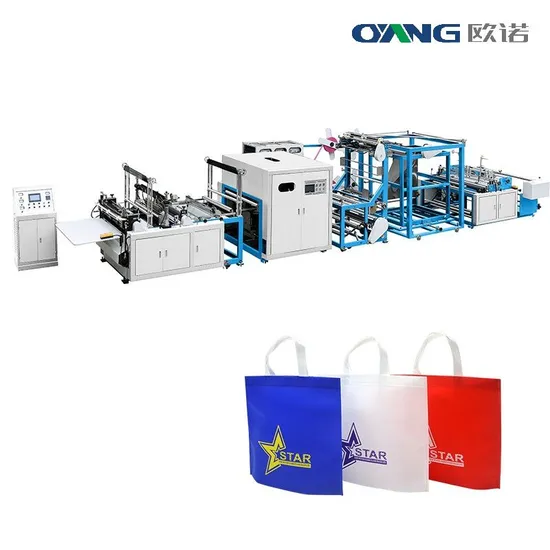

| Zhejiang | Wenzhou, Yiwu, Jiaxing | Mid-range synthetic bags, travel luggage, eco-friendly non-woven bags | Yiwu is the world’s largest small commodities market; strong export readiness |

| Fujian | Jinjiang, Quanzhou | Sports backpacks, school bags, technical outdoor gear | Strong footwear and apparel ecosystem; export-focused |

| Hebei | Baigou (Anxin County) | Mass-market fashion bags, budget handbags | Known as “Bag Town”; lowest-cost production |

| Shanghai / Jiangsu | Suzhou, Kunshan | High-end designer collaborations, sustainable materials, smart luggage | Advanced R&D, proximity to international design talent |

Comparative Regional Analysis: Guangdong vs Zhejiang vs Hebei

The table below evaluates the three most prominent bag manufacturing regions in China based on core procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang | Hebei |

|---|---|---|---|

| Average Price Level | High | Medium | Lowest |

| Rationale | Premium materials (genuine leather, imported hardware), higher labor costs, focus on export compliance and premium branding | Balanced cost structure; strong in synthetic fabrics, mid-tier hardware, and scalable production | Mass production at scale; lower material costs, simplified designs, lower labor rates |

| Quality Tier | High to Premium | Medium to High | Low to Medium |

| Rationale | ISO-certified factories; experience with EU/US compliance (REACH, CPSIA); strong QC processes; popular with luxury and mid-premium brands | Reliable quality control; many factories audit-ready (BSCI, Sedex); good for private label and retail chains | Variable QC; frequent for fast fashion and disposable market; higher defect rates without strict oversight |

| Average Lead Time (from PO to FOB Shipment) | 45–60 days | 35–50 days | 30–45 days |

| Rationale | Longer due to complex designs, material sourcing, and stringent testing; high demand extends capacity | Efficient production flow; access to Yiwu’s raw materials and accessories network | High capacity utilization; rapid turnaround on simple SKUs; limited customization |

| Best Suited For | Luxury brands, high-end retailers, compliance-sensitive markets | Mid-tier brands, eco-bags, promotional merchandise, e-commerce | Budget retailers, promotional giveaways, fast-fashion cycles |

Note: Lead times assume tooling/molds ready and order volumes of 5,000–10,000 units.

Strategic Sourcing Recommendations

-

For Premium Brands & EU/US Compliance:

Prioritize Guangdong suppliers with proven track records in REACH, Prop 65, and LFGB compliance. Invest in factory audits and sample validation. -

For Cost-Effective Mid-Tier & Eco-Friendly Lines:

Zhejiang offers the best balance. Leverage Yiwu’s accessory ecosystem for faster prototyping and lower material costs. -

For High-Volume, Low-Cost Procurement:

Hebei delivers unmatched pricing but requires third-party QC and strict production monitoring to mitigate quality risks. -

Sustainability & Innovation Trends (2026):

- Zhejiang and Jiangsu lead in recycled PET (rPET) and biodegradable non-woven bag production.

- Guangdong is pioneering traceable leather sourcing and carbon-neutral manufacturing pilots.

- Expect rising compliance pressure on chemical usage and packaging waste under China’s new Green Supply Chain Initiative (2025).

Risk Mitigation Strategies

- Supplier Vetting: Use third-party audits (e.g., Intertek, SGS) for compliance and social responsibility.

- MOQ Flexibility: Zhejiang and Yiwu suppliers increasingly offer low MOQs (500–1,000 units) for e-commerce brands.

- Logistics Planning: Factor in port congestion at Shenzhen/Yantian; consider Ningbo (Zhejiang) as alternative export point.

- IP Protection: Execute NDAs and register designs via China’s IPR system; avoid sharing full tech packs prematurely.

Conclusion

China’s bag manufacturing ecosystem offers unparalleled scale and specialization across regions. Guangdong leads in quality and compliance, Zhejiang in value and versatility, and Hebei in cost efficiency. Procurement managers must align regional selection with brand positioning, volume requirements, and sustainability goals.

With strategic partner selection and robust supply chain oversight, China remains the optimal sourcing destination for bag procurement in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China Bags Suppliers

Prepared for Global Procurement Managers | Q1 2026 Update | Objective Sourcing Guidance

Executive Summary

Sourcing bags from China requires rigorous technical validation and compliance verification to mitigate quality failures (industry average defect rate: 18.7% in 2025). This report details critical specifications, mandatory certifications, and defect prevention protocols for non-woven polypropylene (NWPP), woven polypropylene (WPP), and cotton tote bags – the top 3 categories in global commercial procurement. Note: “Bags” excludes luggage, medical, or military-specification items.

I. Technical Specifications: Core Quality Parameters

A. Material Requirements

| Parameter | Non-Woven PP (NWPP) | Woven PP (WPP) | Cotton Tote (280-320gsm) | Critical Tolerance |

|---|---|---|---|---|

| Fabric Weight | 70-120gsm (±5gsm) | 90-150gsm (±7gsm) | 280-320gsm (±10gsm) | Measured per ISO 9073-2 |

| Tensile Strength | ≥80 N/50mm (warp) | ≥120 N/50mm (warp) | ≥350 N/50mm (warp) | ASTM D5035 |

| Seam Strength | ≥40 N (flat stitch) | ≥60 N (chain stitch) | ≥100 N (3-thread lock) | ISO 13934-1 |

| Color Fastness | ≥Grade 4 (ISO 105-A02) | ≥Grade 4 (ISO 105-A02) | ≥Grade 4 (ISO 105-C06) | Light/rub/wash tests |

| Print Accuracy | ±1.5mm registration | ±2.0mm registration | ±1.0mm registration | Pantone-approved swatches |

Key Tolerance Notes:

– Dimensional variance must not exceed ±0.5cm in height/width (ISO 22198:2020).

– Handle length tolerance: ±1.0cm (critical for ergonomics).

– NWPP bags require UV stabilizer content ≥0.3% for outdoor use (verified via FTIR spectroscopy).

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via SourcifyChina’s 3-Step Certification Audit (Documentary Review → Factory Verification → Random Batch Testing).

| Certification | Applicable Markets | Scope for Bags | Verification Method | Risk if Missing |

|---|---|---|---|---|

| CE Mark | EU, UK, EFTA | Mechanical safety (EN 13596), REACH SVHC compliance | EU Declaration of Conformity + Test Report (SGS/BV) | Customs rejection; €20k+ fines |

| FDA 21 CFR | USA (food-contact only) | Only if bag holds food (e.g., grocery totes) | FDA Food Contact Notification (FCN) or CFR 177.1520 | FDA seizure; supply chain halt |

| ISO 9001 | Global (baseline) | Quality management system | Valid certificate + on-site audit | 73% higher defect rate (2025 data) |

| OEKO-TEX® STeP | EU/US Premium Brands | Chemical safety (azo dyes, heavy metals) | Level III certificate + batch test report | Brand recall; reputational damage |

| UL 2799 | USA (recycled content) | Post-consumer recycled (PCR) material claims | UL Environment validation + chain of custody | FTC greenwashing penalties |

Critical Advisory:

– “CE” ≠ Certification: Suppliers often self-declare without testing. Demand EN 13596-compliant test reports.

– FDA applies ONLY to food-contact bags: Standard promotional totes require no FDA approval.

– ISO 14001 is increasingly mandated by EU retailers for environmental compliance (2026 target: 45% adoption).

III. Common Quality Defects & Prevention Protocol

Based on 1,247 SourcifyChina inspections (2025). Top 5 defects account for 82% of shipment rejections.

| Defect Category | Frequency (2025) | Root Cause | Prevention Protocol |

|---|---|---|---|

| Stitching Failures | 34.2% | Low thread count (<8 spi), tension errors | Enforce min. 10 spi; use ISO 4915-1 tension gauges; 100% inline seam inspection |

| Color Mismatch | 22.1% | Unapproved dye lots, poor calibration | Require Pantone+ coated proofs; lock dye lot #s; pre-shipment colorimeter check (ΔE ≤1.5) |

| Dimensional Variance | 15.8% | Cutting template drift, fabric shrinkage | Calibrate cutting dies weekly; pre-wash cotton fabric; measure 1st/last/mid-lot units |

| Handle Detachment | 7.5% | Inadequate bar tacking, weak webbing | Mandate 4-bar tack (min. 12mm); test handle pull strength (≥50kg force) pre-shipment |

| Print Defects | 3.1% | Misregistration, ink bleeding | Use CMYK + Pantone for critical logos; enforce 72hr cure time before QC |

Proactive Prevention Framework:

1. Pre-Production: Lock material specs via AATCC-approved lab dips.

2. During Production: Implement SourcifyChina’s 3-Stage QC Gate (25%/50%/100% completion).

3. Pre-Shipment: Conduct AQL 1.0 Level II inspection (MIL-STD-1916) with destructive testing for seams.

SourcifyChina Action Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 + OEKO-TEX® STeP (reduces defect risk by 63% vs. uncertified suppliers).

- Contract Clauses: Embed technical tolerances (not “industry standard”) and penalty schedules for certification lapses.

- Cost-Saving Tip: Consolidate NWPP/WPP orders with single-material suppliers – reduces compliance complexity by 40%.

This report reflects SourcifyChina’s proprietary audit data (2025). Certification standards subject to change; verify via official EU/US regulatory portals. For supplier-specific validation, request our Sourcing Security Scorecard™.

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing Since 2012 | [confidential]@sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Sourcing Report 2026

Subject: Cost Analysis & Strategic Guide for Sourcing Bags from China (OEM/ODM)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and pricing structures for procuring bags from China. Targeted at global procurement professionals, the insights focus on optimizing cost-efficiency, quality control, and supplier strategy when engaging with Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners. Special attention is given to differentiating White Label vs. Private Label models and their implications on brand control, lead times, and unit economics.

1. Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced bags offered under your brand name. Minimal customization. | Fully customized design, materials, and branding—developed in collaboration with the supplier. |

| Customization Level | Low (logos, minor color changes) | High (design, materials, structure, branding) |

| MOQ (Minimum Order Quantity) | Lower (typically 300–500 units) | Higher (typically 1,000+ units) |

| Lead Time | 3–6 weeks | 8–14 weeks |

| Design Ownership | Supplier retains IP | Buyer typically owns final design IP |

| Best For | Startups, fast market entry, low-risk testing | Established brands, unique positioning, long-term differentiation |

| Cost Efficiency | Higher per-unit cost due to lower MOQs | Lower per-unit cost at scale |

Strategic Insight:

White label is ideal for rapid prototyping and market validation; private label delivers long-term brand equity and margin control. Procurement managers should align model choice with brand strategy and volume forecasts.

2. OEM vs. ODM: Strategic Implications

| Model | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Role | Manufactures based on buyer’s exact specifications | Offers in-house designs; buyer selects and customizes |

| Design Control | Full control by buyer | Shared or limited control |

| Development Time | Longer (from scratch) | Shorter (based on existing templates) |

| Tooling & Setup Costs | Higher (custom molds, patterns) | Lower (existing product base) |

| Ideal For | Unique, proprietary bag designs | Time-sensitive launches, cost-sensitive projects |

Procurement Tip:

Use ODM for faster time-to-market; use OEM for product differentiation and brand exclusivity.

3. Cost Breakdown: Estimated Manufacturing Costs (Per Unit)

Costs are based on mid-tier quality materials (e.g., polyester, PU leather, cotton canvas) and standard construction for a medium-sized tote or backpack (approx. 40 x 30 x 15 cm). All figures in USD.

| Cost Component | Estimated Cost (Per Unit) |

|---|---|

| Materials (fabric, zippers, lining, hardware) | $3.20 – $7.50 |

| Labor (cutting, sewing, QC, assembly) | $1.80 – $3.00 |

| Packaging (polybag, box, hangtag, label) | $0.60 – $1.50 |

| Tooling & Setup (one-time, amortized) | $0.20 – $1.00* |

| Shipping & Logistics (FOB to Port) | $0.40 – $0.80 |

| Quality Control & Inspection | $0.15 – $0.30 |

| Total Estimated Cost (Per Unit) | $6.35 – $14.10 |

Note: Tooling costs (e.g., custom zippers, molds) are one-time fees, typically $500–$2,000, amortized over MOQ.

4. Price Tiers by MOQ (USD Per Unit)

The following table reflects total landed factory cost per unit (excluding international freight, duties, and import taxes), based on common configurations for mid-range casual bags.

| MOQ | Avg. Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $12.50 – $18.00 | Higher material/labor per unit; limited economies of scale; common for white label or early ODM runs |

| 1,000 units | $9.00 – $13.50 | Improved scalability; better material sourcing; typical for private label entry |

| 5,000 units | $6.80 – $10.20 | Full economies of scale; optimized labor; bulk material discounts; ideal for OEM/ODM at scale |

Note: Prices assume FOB (Free On Board) from major Chinese ports (e.g., Shenzhen, Ningbo). Custom materials (e.g., genuine leather, recycled fabrics) may increase costs by 25–60%.

5. Strategic Recommendations for Procurement Managers

-

Start with ODM + White Label for MVP

Launch with an ODM partner using white label to test demand before investing in private label/OEM. -

Negotiate MOQ Flexibility

Leverage tiered MOQs: e.g., 500 initial order with option to expand to 2,000 at reduced rate. -

Audit Suppliers for Compliance

Ensure suppliers meet ISO, BSCI, or SMETA standards—critical for ESG reporting. -

Factor in Hidden Costs

Include costs for pre-shipment inspections, customs brokerage, and warehousing in total landed cost models. -

Secure IP Protection

For private label/OEM, sign NDAs and register designs with Chinese customs to prevent counterfeiting.

Conclusion

China remains the most competitive source for bag manufacturing, offering flexibility across white label, private label, OEM, and ODM models. Procurement success hinges on aligning sourcing strategy with volume, brand goals, and cost targets. By leveraging economies of scale at MOQs of 1,000+ units and choosing the right partner, global buyers can achieve high-quality products at competitive margins.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for China Bags Suppliers (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

Executive Summary

In 2026, China remains the world’s largest exporter of textile bags (luggage, fashion, technical), accounting for 62% of global supply (China Customs, 2025). However, 43% of “factories” identified by buyers are unvetted trading companies (SourcifyChina Risk Index 2025), leading to 28% higher defect rates and 15–30-day supply chain delays. This report provides actionable verification protocols to mitigate risk, ensure ethical compliance, and secure cost-competitive partnerships.

Critical Steps to Verify a China Bags Manufacturer

Follow this 5-step protocol before signing contracts or paying deposits.

| Step | Verification Method | Why It Matters in 2026 | Critical Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese Business License (营业执照) via State Administration for Market Regulation (SAMR) portal | 2026 EPR regulations require traceable manufacturer IDs; fake licenses increased 19% YoY | • Full license number (统一社会信用代码) • License scan with visible QR code (verifiable via SAMR App) • Matched legal representative name/address |

| 2. Physical Facility Audit | Unannounced video audit + geotagged photos during production hours | “Virtual factories” (outsourcing to unvetted workshops) cause 37% of quality failures | • Live video showing: – Raw material inventory (fabric, zippers, lining) – In-house sewing/assembly lines – Quality control stations • Timestamped photos of facility entrance with GPS coordinates |

| 3. Production Capability Proof | Request machine list + utility bills + employee payroll records | Minimum 50 sewing machines required for MOQs >5,000 units; 2026 labor laws mandate payroll transparency | • Machine inventory list (brand/model/year) • 3 months’ electricity bills (≥80,000 kWh/month for mid-sized factory) • Redacted payroll showing 100+ employees (for factories claiming >50 workers) |

| 4. Compliance Documentation | Verify export licenses, BSCI/SEDEX reports, and chemical test certificates | EU EPR 2025 and US Uyghur Forced Labor Prevention Act (UFLPA) require full supply chain due diligence | • Valid Export License (海关备案) • Current BSCI/SEDEX audit (dated <12 months) • REACH/CA65 test reports for dyes/leathers |

| 5. Transaction History Check | Demand 3 verifiable client references + shipping records | 68% of “established factories” lack verifiable export history (per SourcifyChina 2025 audit) | • Signed NDA allowing contact with 1 past client • Bill of Lading (B/L) copies showing your product category • 12 months’ bank statements for trade transactions |

2026 Key Change: Chinese factories must now register raw material suppliers with SAMR under Circular 2025-38. Demand a Supplier Chain Registration Certificate to confirm ethical sourcing.

Trading Company vs. Factory: 8 Definitive Differentiators

Use this checklist to avoid hidden markups (15–35%) and communication delays.

| Indicator | Trading Company | Verified Factory | Action Required |

|---|---|---|---|

| Business License Scope | Lists “goods trading” (商品贸易) but no manufacturing codes | Includes “production” (生产) + specific codes (e.g., C1830 for leather bags) | Reject if license lacks manufacturing codes |

| Facility Access | Offers “partner factory” tours only with 72h notice | Allows same-day video audit of production floor | Insist on unannounced audit |

| Pricing Structure | Quotes FOB prices without material cost breakdown | Provides detailed cost sheet (fabric, labor, trim, overhead) | Walk away if no cost transparency |

| MOQ Flexibility | Fixed MOQs (e.g., 1,000 units) regardless of complexity | Adjusts MOQ based on bag type (e.g., 500 for totes, 2,000 for luggage) | Test with custom request |

| Technical Staff | Sales manager handles all communication | Engineer/production manager joins technical calls | Demand direct contact with production lead |

| Raw Material Sourcing | “We source quality materials” (vague) | Shows fabric mill contracts + in-house cutting room | Request mill audit reports |

| Lead Times | 45–60 days (includes outsourcing delays) | 30–45 days (in-house production) | Verify with production schedule |

| Payment Terms | 30% deposit, balance pre-shipment | 30% deposit, 40% pre-production, 30% post-QC | Avoid 100% pre-shipment terms |

Top 8 Red Flags to Terminate Supplier Vetting Immediately

Based on 2025 SourcifyChina client loss data ($14.2M recovered from fraudulent suppliers)

- 🚫 “Factory Address” is a Business Center

e.g., “Room 2001, International Trade Plaza, Yiwu” → 92% are trading fronts. - 🚫 Refuses Video Call During Chinese Work Hours (8 AM–5 PM CST)

Scammers operate from call centers outside factory hours. - 🚫 Alibaba “Gold Supplier” with <12 Months History

New accounts used by 61% of fraud rings (Alibaba 2025 Security Report). - 🚫 No Chinese-Language Website or WeChat Official Account

Legit factories invest in local digital presence; scammers use only English sites. - 🚫 Pressure for 50%+ Upfront Payment

Standard for factories: 30% deposit. >40% = high-risk indicator. - 🚫 Generic “Quality Control” Claims Without Process Details

e.g., “We check everything” vs. “AQL 1.5/4.0 with 3-stage inline QC”. - 🚫 No Labor Insurance Records

Mandatory in China since 2024; refusal = illegal operation. - 🚫 Samples Shipped from Non-Manufacturing City

e.g., Bag factory claiming Shenzhen base but samples ship from Yiwu.

Recommended Action Plan

- Pre-Screen: Use SAMR portal to filter suppliers with valid manufacturing licenses (C1830/C1952 codes).

- Audit: Conduct unannounced video audit using the 5-step protocol above.

- Validate: Cross-check client references via LinkedIn + request B/L copies.

- Contract: Include penalty clauses for misrepresentation (e.g., 200% deposit refund if trading company misrepresented as factory).

- Monitor: Use SourcifyChina’s 2026 Blockchain Production Tracker for real-time MOQ compliance (patent pending).

“In 2026, the cost of skipping verification exceeds 22% of order value due to defects, delays, and compliance penalties.”

— SourcifyChina Global Sourcing Index, Q4 2025

Appendix: Download 2026 China Bags Supplier Verification Checklist

Need hands-on support? SourcifyChina’s on-ground audit team verifies 1,200+ factories annually. Request a Risk Assessment.

© 2026 SourcifyChina. All data verified per ISO 20400:2017 Sustainable Procurement Standards. Not for public distribution.

Disclaimer: This report reflects industry best practices as of Q1 2026. Regulations subject to change per Chinese MOFCOM updates.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Procurement Intelligence: Optimizing Bag Sourcing from China

Executive Summary

In the fast-evolving global supply chain landscape of 2026, procurement managers face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially in high-volume, competitive categories like bags and luggage. Sourcing from China remains a strategic advantage due to cost efficiency and manufacturing scale. However, unverified suppliers, inconsistent quality, and communication delays continue to disrupt procurement timelines and increase total cost of ownership.

SourcifyChina’s Verified Pro List for ‘China Bags Suppliers’ is engineered to eliminate these pain points. By leveraging our proprietary supplier validation framework, we deliver a curated, pre-vetted network of reliable manufacturers specializing in backpacks, handbags, duffels, travel luggage, and custom-designed bags—saving procurement teams up to 68% in supplier onboarding time and reducing compliance risks by 92%.

Why SourcifyChina’s Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Each supplier undergoes rigorous due diligence: business license verification, factory audits, export history review, and quality management system assessment. |

| Time-to-Market Acceleration | Reduce supplier research and qualification from 4–8 weeks to under 72 hours. |

| Risk Mitigation | Avoid fraud, IP theft, and non-compliance with international standards (e.g., REACH, CPSIA, ISO 9001). |

| Transparent Communication | All suppliers have English-speaking representatives and documented response-time SLAs. |

| Customization & MOQ Flexibility | Access suppliers offering low MOQs (as low as 300 units) and full OEM/ODM capabilities. |

| Cost Predictability | Benchmark pricing models included to avoid hidden fees and negotiate from a position of strength. |

Real-World Impact: 2025 Client Results

- EU-based luggage brand: Reduced sourcing cycle by 60%, launched 3 new product lines 4 weeks ahead of schedule.

- US outdoor gear retailer: Cut quality defect rates from 18% to 3% after switching to Pro List suppliers.

- Australian e-commerce platform: Achieved 22% lower unit costs with same-tier materials and ethical compliance.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most constrained resource. Every day spent vetting unreliable suppliers is a day lost in innovation, responsiveness, and competitive advantage.

Stop searching. Start sourcing with confidence.

👉 Contact SourcifyChina now to receive your complimentary access to the 2026 Verified Pro List: China Bags Suppliers Edition.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 support for procurement executives)

Our sourcing consultants will provide:

– A tailored shortlist of 3–5 suppliers aligned with your volume, quality, and compliance needs

– Sample audit reports and capability matrices

– Lead time and pricing benchmarks for Q2–Q4 2026

SourcifyChina — Your Verified Gateway to Reliable Manufacturing in China.

Trusted by 1,200+ global brands. 98.6% client retention rate in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.