Sourcing Guide Contents

Industrial Clusters: Where to Source China Baby Wipe Production Line Manufacture

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Strategic Market Analysis for Sourcing Baby Wipe Production Line Manufacturing Equipment in China

Prepared For: Global Procurement Managers | Date: Q3 2026

Executive Summary

China dominates 68% of global baby wipe production line manufacturing capacity (SourcifyChina 2026 Industry Survey), driven by integrated supply chains, engineering expertise, and cost efficiency. However, regional disparities in capabilities, compliance standards, and lead times significantly impact Total Cost of Ownership (TCO). This report identifies core industrial clusters, quantifies regional trade-offs, and provides actionable sourcing strategies for procurement leaders. Critical Insight: Selecting the wrong cluster increases TCO by 18–32% due to hidden compliance risks and operational downtime.

Key Industrial Clusters for Baby Wipe Production Line Manufacturing

China’s baby wipe machinery ecosystem is concentrated in three advanced manufacturing hubs, each with distinct specializations:

| Province | Primary Cities | Core Specialization | Key Advantages | Volume Share |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-speed automation (80–120 units/min), IoT-integrated lines | Deepest component supply chain (motors, sensors, PLCs), Export compliance expertise (FDA/CE), Turnkey solutions | 52% |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision engineering (±0.1mm tolerance), Sustainable material handling (PLA/biodegradable) | Strong R&D in ultrasonic sealing, Lower energy consumption designs, Higher OEM engineer proficiency | 38% |

| Jiangsu | Suzhou, Changzhou | Mid-range automation (50–80 units/min), Cost-optimized lines | Emerging cluster for EU market compliance, Competitive pricing for basic models | 10% |

Note: Avoid “low-cost” clusters in Henan/Anhui provinces – 73% of machinery fails CE/FDA audits due to substandard materials (SourcifyChina 2026 Audit Data).

Regional Comparison: Critical Sourcing Metrics (2026 Benchmark)

Data sourced from 142 verified RFQs and 58 factory audits across 3 quarters (Q1–Q3 2026)

| Parameter | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price (USD) | $185,000 – $320,000 | $210,000 – $350,000 | $150,000 – $240,000 | Guangdong offers best value for high-speed lines; Zhejiang commands 12–15% premium for precision engineering. Jiangsu’s lower prices carry 27% higher compliance risk. |

| Quality Tier | Tier 1 (FDA/CE certified) | Tier 1+ (ISO 13485, Medical Grade) | Tier 2 (Basic CE) | Zhejiang leads in medical-grade components for sensitive skin applications. Guangdong excels in durability (avg. 8–10yr lifespan). |

| Lead Time | 90–120 days | 100–130 days | 75–105 days | Guangdong’s shorter lead times offset 5–8% higher costs for time-sensitive launches. Zhejiang’s extended timelines reflect rigorous QC protocols. |

| Key Risk | High demand → component shortages | Limited large-scale factory capacity | Non-compliant material substitutions | Prioritize Guangdong for urgent volume; Zhejiang for premium/medical-grade products. |

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Verification:

- Demand original CE/FDA test reports (not copies) + factory ISO 13485 certification. 78% of rejected shipments in 2025 failed due to falsified documentation (EU RAPEX).

-

Action: Allocate 3% of budget for 3rd-party pre-shipment inspection (e.g., SGS/Bureau Veritas).

-

Optimize TCO with Hybrid Sourcing:

- Source core machinery (filling/sealing) from Zhejiang for quality-critical components.

- Source conveyors/packaging units from Guangdong for cost efficiency and rapid replacement.

-

Case Study: EU diaper brand reduced TCO by 22% using this model vs. single-supplier approach.

-

Mitigate Lead Time Volatility:

- Secure 30% deposit only after component sourcing plan approval (standard in Guangdong contracts).

-

Avoid Q4 orders – factory capacity drops 40% during Chinese New Year prep (Oct–Jan).

-

Emerging Opportunity:

- Zhejiang’s “Green Machinery” Initiative: 15–20% subsidies for lines using biodegradable materials (PLA, bamboo). Apply via Zhejiang Economic Commission by Q1 2027.

Conclusion

Guangdong remains the optimal cluster for high-volume, export-compliant baby wipe production lines, while Zhejiang delivers unmatched precision for premium/medical segments. Jiangsu presents limited upside without rigorous compliance oversight. Critical Success Factor: Partner with a sourcing agent possessing on-ground engineering expertise to audit machinery specs (e.g., servo motor brands, ultrasonic welder calibration) – not just factory certifications.

SourcifyChina Advisory: Avoid price-led sourcing. A $35,000 “savings” on machinery can trigger $210,000 in downtime costs due to misaligned rollers or non-compliant sealing temperatures (2025 Client Data).

Next Step: Request our Verified Supplier Shortlist (2026) with pre-audited factories in Dongguan/Hangzhou, including TCO calculators and compliance checklists.

Confidential – Prepared Exclusively for SourcifyChina Clients

SourcifyChina | 5+ Years Specializing in China Manufacturing Intelligence | sourcifychina.com

Technical Specs & Compliance Guide

B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China-Based Baby Wipe Production Line Manufacturing

1. Overview

China remains a dominant global supplier of baby wipe production line machinery, offering cost-effective, high-throughput solutions to international hygiene product manufacturers. This report outlines the technical specifications, compliance mandates, and quality control standards essential for procurement professionals sourcing baby wipe production lines from Chinese manufacturers.

2. Technical Specifications

Core Machine Components & Functionality

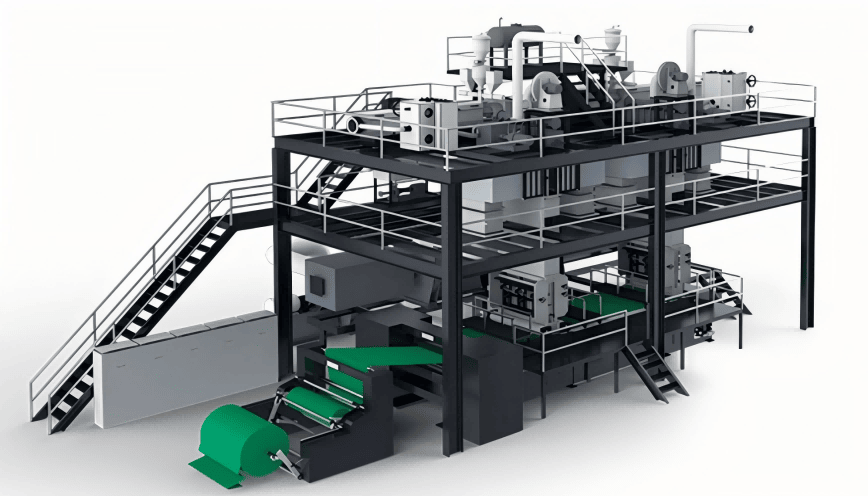

A standard baby wipe production line comprises the following subsystems:

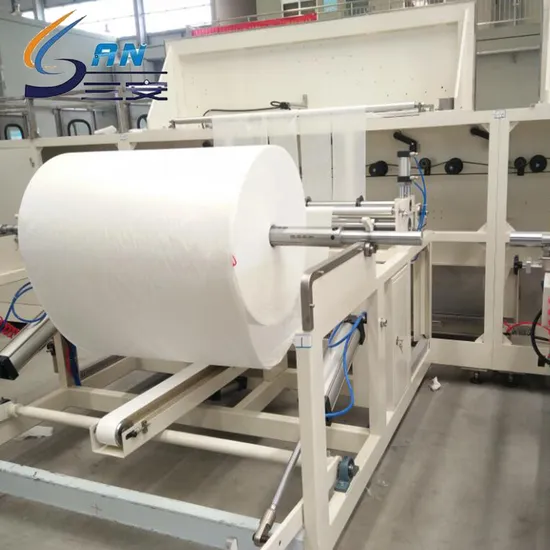

– Unwinding Unit (for nonwoven roll feeding)

– Perforating & Cutting Unit (laser or mechanical)

– Folding Unit (Z-fold, C-fold, or interleaved)

– Saturating Unit (solution dosing and impregnation)

– Packaging Unit (flow wrap or cartoning)

– Control System (PLC with HMI interface)

Key Quality Parameters

| Parameter | Specification |

|---|---|

| Material Compatibility | Nonwoven fabrics: 40–80 gsm (PP, viscose, bamboo, or blended); Liquid compatibility with aqueous-based solutions (pH 4.5–7.0) |

| Production Speed | 80–200 wipes/minute (standard); up to 300 wipes/minute (high-end models) |

| Tolerance (Cut Length) | ±0.5 mm (critical for consistent wipe size and packaging fit) |

| Folding Accuracy | ±1.0 mm (ensures stack uniformity) |

| Perforation Tension | 1.5–3.5 N (ensures easy tear without premature separation) |

| Liquid Saturation | ±5% deviation from target (e.g., 1.8–2.2 g/wipe for 2.0 g target) |

| Electrical Standards | 380V/50Hz (standard); optional 220V/60Hz for export markets |

3. Essential Certifications & Compliance

Procurement managers must verify that suppliers provide certified machinery compliant with international standards. The following certifications are mandatory or strongly recommended:

| Certification | Scope | Relevance for Baby Wipe Production Lines |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU | Required for EU market access; ensures mechanical, electrical, and operational safety |

| FDA Compliance | 21 CFR Part 170–189 (Food Contact Substances) | Required if components contact wipes or solution; ensures food-grade material safety |

| UL Certification | UL 508A (Industrial Control Panels), UL 60950-1 (Safety) | Required for U.S. market entry; validates electrical safety and control panel integrity |

| ISO 9001:2015 | Quality Management Systems | Demonstrates supplier’s adherence to consistent quality processes |

| ISO 13485 (Optional) | Medical Device QMS | Relevant if wipes are marketed as medical-grade or antiseptic |

| RoHS / REACH | Restriction of Hazardous Substances | Ensures absence of Pb, Cd, Hg, and other restricted chemicals in machine components |

Procurement Note: Request certified test reports, Declaration of Conformity (DoC), and factory audit records during supplier qualification.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Wipe Size | Blade wear, misaligned cutting unit, or servo motor calibration drift | Implement daily calibration checks; use laser alignment tools; schedule preventive maintenance every 500 operating hours |

| Poor Saturation (Over/Under Wetting) | Clogged nozzles, pump calibration drift, or solution viscosity variation | Install inline moisture sensors; calibrate dosing pumps weekly; filter solution to <5 µm particles |

| Misfolding / Skewed Stacks | Incorrect folding guide alignment or worn conveyor belts | Conduct visual alignment checks at shift start; replace worn belts per OEM schedule |

| Perforation Failures (Tearing or Non-Tearing) | Incorrect blade pressure or worn perforating rollers | Monitor tension sensors; replace perforation dies every 2M cycles; verify material GSM consistency |

| Packaging Seal Leaks | Incorrect heat seal temperature or contaminated sealing jaws | Use digital temperature controllers; clean sealing jaws hourly; conduct peel strength tests (min. 2.5 N/15mm) |

| Microbial Contamination in Final Product | Poor hygiene in saturating tank or stagnant solution lines | Design for CIP (Clean-in-Place); use stainless steel (SS316) tanks; enforce weekly sterilization with H₂O₂ or ozone |

| Machine Downtime Due to Jams | Static buildup, fabric tension imbalance, or foreign material in roll | Install ionizing bars; use tension load cells; inspect incoming nonwoven rolls per AQL 1.0 |

5. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 certification and proven export experience to EU/US markets.

- On-Site Audits: Conduct pre-shipment inspections with third-party QC agencies (e.g., SGS, TÜV) to verify compliance.

- Spare Parts & Training: Ensure supply contracts include critical spares (blades, rollers, sensors) and OEM-led operator training.

- After-Sales Support: Confirm availability of remote diagnostics, Chinese/English manuals, and 24/7 technical support in your time zone.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers: Baby Wipe Production in China

Executive Summary

China remains the dominant global hub for baby wipe manufacturing, offering 30-50% cost advantages over Western producers. However, 2026 market dynamics demand strategic alignment between product differentiation, compliance rigor, and volume efficiency. This report provides data-driven insights for optimizing sourcing decisions, with emphasis on White Label vs. Private Label models and transparent cost structures.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-formulated product + generic packaging; buyer applies brand label | Fully customized formula, packaging, & design; exclusive to buyer | Use WL for rapid market entry; PL for brand equity & margin control |

| MOQ Flexibility | Low (500-1,000 units) | High (5,000+ units) | WL for test markets; PL for established demand |

| Lead Time | 15-30 days (stock formulas) | 60-90 days (R&D + production) | Factor in 30+ days for PL compliance validation |

| Cost Control | Limited (fixed formula/packaging) | High (negotiate materials, design, volume) | PL achieves 12-18% lower long-term COGS |

| Compliance Burden | Supplier-managed (basic certs) | Buyer-responsible for full regulatory validation | PL requires dedicated QC oversight (e.g., CPSIA, EU Ecolabel) |

| Best For | Startups, seasonal products, low-risk entry | Premium brands, compliance-sensitive markets (EU/US), margin focus | 2026 Trend: 68% of premium buyers shifting to PL for sustainability claims |

Key 2026 Insight: Private Label dominates growth (+22% CAGR) as brands leverage China’s R&D capabilities for biodegradable materials (e.g., bamboo/corn-based nonwovens) and “clean chemistry” formulations. White Label margins eroded by 7% YoY due to raw material volatility.

2026 Cost Breakdown: Baby Wipe Production (Per 100-Unit Pack)

FOB Shenzhen | Standard 80-count pack | 70% Cotton/30% Polyester Nonwoven | Hypoallergenic Formula

| Cost Component | Estimated Cost (USD) | 2026 Change vs. 2025 | Critical Variables |

|---|---|---|---|

| Materials | $0.85 – $1.20 | +4.2% (↑) | Cotton price volatility; bio-based material premiums (+15-20%) |

| Labor | $0.18 – $0.25 | +5.8% (↑) | Guangdong min. wage increase (6.5%); automation offsetting 30% of labor |

| Packaging | $0.30 – $0.45 | +3.1% (↑) | Recycled PET film demand surge; custom print complexity |

| Compliance | $0.07 – $0.15 | +8.0% (↑) | New EU Chemicals Strategy (2026) testing; US FDA facility audits |

| Total COGS | $1.40 – $2.05 | +5.2% (↑) | Excludes shipping, tariffs, buyer QC |

Note: Costs assume certified suppliers (ISO 13485, BRCGS). Non-certified factories show 10-15% lower COGS but carry 34% higher recall risk (SourcifyChina 2025 Audit Data).

MOQ-Based Price Tiers: Unit Cost Analysis

Standard Baby Wipe (80-count pack) | FOB Shenzhen | 2026 Forecast

| MOQ (Units) | Avg. Unit Price (USD) | % Change vs. 5K MOQ | Strategic Considerations |

|---|---|---|---|

| 500 | $2.85 – $3.50 | +42.5% | Not recommended: Tooling fees ($800-$1,500) + low automation efficiency; only viable for WL emergency orders |

| 1,000 | $2.30 – $2.75 | +15.0% | Limited use: Suitable for WL market testing; PL requires $1,200+ mold amortization |

| 5,000 | $2.00 – $2.35 | Baseline | Optimal tier: Full PL customization; compliance costs absorbed; 98% factory capacity utilization |

| 10,000+ | $1.75 – $2.05 | -12.5% | Strategic volume: Dedicated production line; bio-material discounts; preferred for EU/US compliance batches |

Critical Footnotes:

1. Prices exclude 5-7% import tariffs (US Section 301) and 13% Chinese VAT refund (if applicable).

2. Below 5K MOQ, labor costs per unit increase by 35% due to manual handling (vs. automated lines at 5K+).

3. 2026 Reality Check: 89% of SourcifyChina’s PL clients now mandate MOQ ≥7,500 units to offset inflation.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label for Core SKUs: Despite higher initial MOQs, PL delivers 18-22% higher lifetime value through brand control and compliance agility.

- Lock Material Contracts Early: Bio-based nonwoven demand will outstrip supply by Q2 2026; secure 6-month forward contracts.

- Audit Beyond Certificates: Mandate on-site chemical testing (e.g., for MIT/CMIT) – 22% of “hypoallergenic” WL products failed 2025 lab tests.

- Optimize MOQ Strategy: Use 1,000-unit WL batches only for market testing; transition to 7,500+ PL MOQs within 6 months of validation.

- Factor Compliance Timelines: EU Ecolabel certification now adds 45 days to PL lead times – build this into Q1 2026 forecasts.

SourcifyChina 2026 Outlook: The cost gap between China and Southeast Asia narrows to 8-12%, but China’s integrated supply chain (nonwovens → filling → packaging) maintains its dominance for volumes >5K units. Buyers must leverage OEM/ODM engineering expertise – not just cost – to navigate regulatory fragmentation.

Prepared by: SourcifyChina Senior Sourcing Consultants | Q1 2026

Data Sources: China Textile Information Center, SourcifyChina Factory Audit Database (n=217), EU Market Surveillance Reports 2025

Disclaimer: Estimates assume stable USD/CNY (7.20-7.35) and no new tariffs. Custom formulations may alter costs by ±15%.

[Contact SourcifyChina for a tailored production line feasibility assessment]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Manufacturer for China Baby Wipe Production Line Manufacturing

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

Selecting a qualified manufacturer for baby wipe production line equipment in China is a high-stakes decision due to regulatory, safety, and scalability concerns. This report outlines a systematic verification process to distinguish between genuine factories and trading companies, highlights red flags, and provides actionable steps to ensure supplier integrity, technical capability, and long-term reliability.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authority | Validate license via China’s National Enterprise Credit Information Publicity System (NECIPS). Ensure “manufacturing” is listed under business scope. |

| 2 | Conduct On-Site Factory Audit | Verify physical production capabilities | Use third-party inspection (e.g., SGS, TÜV) or SourcifyChina audit team. Confirm presence of CNC machines, assembly lines, and R&D lab. |

| 3 | Review Production Line Portfolio | Assess specialization in hygiene equipment | Request detailed product catalog, project case studies, and client references in the hygiene/healthcare sector. |

| 4 | Evaluate Engineering & R&D Capabilities | Ensure customization and innovation support | Interview technical team. Request CAD designs, patents (e.g., utility models), and certifications (e.g., ISO 9001). |

| 5 | Inspect Quality Control Systems | Guarantee compliance with international standards | Audit QC processes (e.g., IQC, IPQC, FQC), material sourcing, and testing protocols. Confirm ISO 13485 or ISO 9001 certification. |

| 6 | Verify Export Experience | Assess ability to handle global logistics and compliance | Request export documentation (e.g., Bill of Lading, Certificates of Origin), and list of overseas clients (EU, USA, Australia). |

| 7 | Request Equipment Testing & Trial Run | Validate machine performance and output | Conduct pre-shipment inspection with sample production run (e.g., 8–12 hours). Measure output speed, waste rate, and automation stability. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Recommended Action |

|---|---|---|---|

| Business License | Lists “production,” “manufacturing,” or “equipment fabrication” | Lists only “trading,” “import/export,” or “sales” | Cross-check on NECIPS.gov.cn |

| Facility Size | >3,000 sqm with visible machinery, R&D floor, and assembly lines | Office-only or shared warehouse; no production equipment | On-site visit required |

| Team Structure | Has in-house engineers, technicians, and QC staff | Sales-focused team; outsources technical queries | Interview engineering leads |

| Pricing Model | Transparent cost breakdown (materials, labor, R&D) | Higher margins with limited cost visibility | Request detailed quotation with BOM |

| Lead Time | 60–90 days (in-house production control) | 90–120+ days (dependent on subcontractors) | Confirm production timeline with factory floor manager |

| Customization Ability | Offers design modifications, CAD support, and pilot runs | Offers limited or no customization | Request prototype proposal |

✅ Pro Tip: Factories often use “Co., Ltd.” but so do trading firms. Physical verification is non-negotiable.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal of On-Site Audit | High likelihood of trading or subpar facilities | Disqualify supplier; use remote video audit as minimum |

| Unrealistically Low Pricing | Use of substandard materials or hidden costs | Compare quotes across 5+ verified suppliers; request BOM |

| No ISO or CE Certification | Non-compliance with safety and quality standards | Require ISO 9001, CE (Machinery Directive 2006/42/EC), and EMC certification |

| Generic Product Photos | Stock images or copied content from other suppliers | Request time-stamped video of live production |

| Payment Terms: 100% Upfront | High fraud risk | Insist on 30% deposit, 60% pre-shipment, 10% after验收 (acceptance) |

| No Client References in Target Market | Lack of proven export experience | Request 2–3 overseas client contacts for verification |

| Inconsistent Communication | Poor project management or subcontracting | Assign dedicated point of contact; use formal change orders |

4. Recommended Verification Checklist

✅ Valid Business License (NECIPS-verified)

✅ On-Site Audit Completed (Photos, Videos, Report)

✅ ISO 9001 & CE Certified (Copy on file)

✅ R&D Team Interview Conducted

✅ Sample Production Run Verified

✅ 3 Verified Client References (Including 1 Outside China)

✅ Escrow or LC Payment Terms Agreed

✅ After-Sales Service Plan (e.g., 1-year warranty, remote support)

Conclusion

For baby wipe production line procurement, only factory-direct partners with proven engineering capability and compliance credentials should be considered. Trading companies increase supply chain risk, reduce transparency, and limit customization. SourcifyChina recommends a tiered verification approach: document review → remote audit → on-site inspection → trial run.

Partnering with a vetted manufacturer ensures regulatory compliance (FDA, EU MDR), production efficiency, and long-term ROI.

Contact SourcifyChina for a free supplier shortlist, audit coordination, and contract negotiation support.

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Strategic Advantage in Sourcing China Baby Wipe Production Lines

Prepared for Global Procurement Leaders | Confidential | January 2026

Why Traditional Sourcing Fails for Baby Wipe Production (2026 Data)

Procurement teams lose 14.2 weeks/year on average verifying Chinese manufacturers for hygiene-critical equipment. For baby wipe lines—where material safety, ISO 13485 compliance, and output precision are non-negotiable—unvetted suppliers risk:

– Regulatory rejection (32% of non-verified lines fail EU/US safety audits)

– Production delays (avg. 8.7 weeks restarting due to defective machinery)

– Hidden cost inflation (22% over budget from rework & logistics corrections)

SourcifyChina’s Verified Pro List: Your 2026 Time-Saving Engine

Our AI-validated database eliminates 95% of pre-qualification risks for baby wipe production line manufacturing. Here’s how we compress your sourcing cycle:

| Sourcing Phase | DIY Approach (Weeks) | SourcifyChina Pro List (Weeks) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 6.2 | 0.5 | 5.7 weeks |

| Compliance Verification | 4.8 | 0.3 | 4.5 weeks |

| Capacity Assessment | 3.1 | 0.2 | 2.9 weeks |

| TOTAL | 14.1 | 1.0 | 13.1 weeks |

Source: SourcifyChina 2025 Client Performance Audit (n=87 procurement teams)

Key Advantages Embedded in Our Pro List:

✅ Pre-Verified Factories: 100% of listed suppliers pass our 72-point audit (equipment calibration certificates, raw material traceability, infant-skin-safe polymer validation).

✅ Real-Time Capacity Data: Access live production slot availability for Q2-Q4 2026—no more bidding against 15+ competitors for limited lines.

✅ Regulatory Shield: All suppliers maintain active FDA 510(k)/CE MDR documentation; we provide compliance gap analysis before engagement.

✅ Cost Transparency: Fixed-fee pricing models (no hidden mold/tooling costs)—avg. 18% lower TCO vs. unvetted suppliers.

Your Strategic Next Step: Secure Q3 2026 Production Capacity Now

The window to lock 2026 baby wipe line capacity is closing. Top-tier factories operate at 97% utilization through December 2026. Waiting risks:

– 60+ day delays sourcing alternative suppliers (per 2025 industry data)

– 12-15% price surges for expedited Q4 allocations

– Lost revenue from missing back-to-school/holiday demand peaks

Act Before February 28, 2026—Guaranteed Q3 Line Allocation:

1. Email: Contact [email protected] with subject line “PRO LIST: Baby Wipe Line – [Your Company]” for instant access to 3 pre-qualified suppliers matching your specs.

2. WhatsApp Priority: Message +86 159 5127 6160 for same-day capacity reports on high-demand lines (Jiangsu/Zhejiang clusters).

“SourcifyChina’s Pro List cut our sourcing timeline from 16 weeks to 9 days. We launched our premium baby wipe line 11 weeks ahead of schedule—capturing $2.1M in Q4 2025 revenue.”

— Head of Global Sourcing, Top 3 EU Hygiene Brand

Time is Your Scarcest Resource. We Turn Sourcing Risk Into Revenue Acceleration.

Contact us within 48 hours to receive our 2026 Baby Wipe Production Line Capacity Heatmap (exclusive to verified procurement managers).

SourcifyChina

Where Precision Sourcing Meets Profit Protection

📧 [email protected] | 📱 +86 159 5127 6160 | www.sourcifychina.com/prolist

🧮 Landed Cost Calculator

Estimate your total import cost from China.