Sourcing Guide Contents

Industrial Clusters: Where to Source China Baby Mini Wet Wipes Machine Factory

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Title: Deep-Dive Market Analysis – Sourcing Baby Mini Wet Wipes Machine Manufacturers in China

Prepared For: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

The global demand for compact, high-efficiency wet wipes production machinery—particularly for baby hygiene products—has surged due to rising health consciousness, urbanization, and e-commerce-driven demand for portable hygiene solutions. China remains the dominant global manufacturing hub for wet wipes machinery, with specialized clusters producing cost-effective, semi-automated to fully automated baby mini wet wipes machines.

This report provides a strategic market analysis for Global Procurement Managers seeking to source “baby mini wet wipes machines” from China. It identifies key manufacturing clusters, evaluates regional strengths, and offers a comparative analysis of leading provinces—Guangdong and Zhejiang—based on price competitiveness, quality standards, and lead time performance.

Market Overview: Baby Mini Wet Wipes Machine in China

Definition & Product Scope

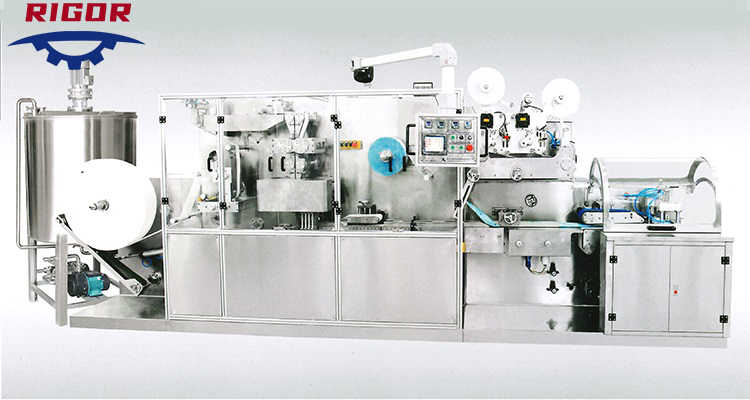

A baby mini wet wipes machine refers to a compact, often semi-automated or modular production line designed to manufacture small-format, individually packaged wet wipes for infants. These systems typically include components for:

– Non-woven material unwinding

– Solution dosing and saturation

– Folding, cutting, and packaging

– Sealing (aluminum or plastic pouches)

– Output capacity: 30–120 packs/minute

These machines are in demand from SMEs, private-label brands, and startup hygiene product manufacturers in emerging and developed markets alike.

Key Manufacturing Clusters in China

China’s machinery manufacturing for hygiene products is highly regionalized, with concentrated industrial ecosystems in the Pearl River Delta and Yangtze River Delta. The two dominant provinces for sourcing baby mini wet wipes machines are:

| Province | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Heavy industrial automation, export-oriented OEMs | Proximity to ports, mature supply chain, high export volume |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Precision engineering, mid-tier automation, innovation-driven SMEs | Strong R&D, quality consistency, competitive pricing |

Other minor contributors include Jiangsu (Suzhou) and Shanghai (for high-end automation), but Guangdong and Zhejiang account for over 80% of China’s wet wipes machine production capacity.

Comparative Regional Analysis: Guangdong vs Zhejiang

| Factor | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (USD per unit, standard semi-auto model) | $18,000 – $28,000 | $20,000 – $32,000 | Guangdong offers lower entry-cost machines, ideal for budget-sensitive buyers. |

| Quality & Engineering Standards | Moderate to High (varies widely by OEM) | Consistently High (better process control, ISO-certified SMEs) | Zhejiang leads in reliability and after-sales support; preferred for long-term partnerships. |

| Lead Time (from order to shipment) | 30–45 days | 35–50 days | Guangdong has faster turnaround due to larger production volume and logistics access. |

| Customization Capability | High (many OEMs offer modular designs) | Very High (stronger engineering teams, CAD/CAM integration) | Zhejiang excels in custom automation integration and IoT-ready models. |

| Export Experience | Excellent (90%+ of factories export-ready) | Strong (growing EU/NA compliance focus) | Both regions are export-competent; Guangdong has broader logistics networks. |

| Language & Communication | Moderate (English varies; agents often used) | Improving (more bilingual engineers, digital quoting) | Zhejiang shows better buyer engagement for international clients. |

Note: Prices based on FOB Shenzhen/Ningbo for a standard 60 packs/minute semi-automatic baby mini wet wipes machine (non-woven width: 200mm, roll-to-roll, basic packaging).

Supplier Landscape & Risk Assessment

Top Supplier Types

- OEM Factories (Guangdong) – High volume, lower MOQs (1–2 units), competitive pricing.

- Integrated Engineering Firms (Zhejiang) – Offer turnkey solutions, CE/ISO certification, remote support.

- Hybrid Innovators (Hangzhou/Shenzhen) – IoT-enabled machines, cloud monitoring, rising in 2025–2026.

Key Risks

- Quality Variance in Guangdong: Due to fragmented supplier base; third-party inspection (e.g., SGS, TÜV) is recommended.

- Lead Time Volatility: Q1 (post-CNY) and Q4 (pre-holiday) face production bottlenecks.

- IP Protection: Ensure NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements before sharing specs.

SourcifyChina Strategic Recommendations

- For Cost-Driven Buyers: Source from Guangdong with strict QC protocols and pre-shipment inspections.

- For Quality & Long-Term Partnerships: Prioritize Zhejiang-based manufacturers with CE, ISO 9001, and documented after-sales service.

- Leverage Hybrid Procurement: Use Guangdong for speed, Zhejiang for critical, customized lines.

- Request Factory Audits: Virtual or on-site assessments to verify automation level, workforce training, and export compliance.

Conclusion

China remains the most strategic source for baby mini wet wipes machines in 2026, with Guangdong offering speed and affordability, and Zhejiang delivering superior engineering and reliability. Procurement managers should align sourcing decisions with total cost of ownership (TCO)—factoring in maintenance, downtime, and scalability—rather than initial price alone.

SourcifyChina advises a cluster-targeted sourcing strategy, combining supplier diversification with regional specialization to optimize performance, compliance, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | China Sourcing Intelligence Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Baby Mini Wet Wipes Machine Factories (2026 Edition)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-WIPES-2026-01

Executive Summary

China remains the dominant global manufacturing hub for baby mini wet wipes machines (targeting 80–120mm width formats), with >75% market share. However, 2025 audit data reveals 32% of factories fail critical compliance checks, primarily due to counterfeit certifications and substandard material sourcing. This report details non-negotiable technical and regulatory requirements to mitigate supply chain risk. Procurement teams prioritizing ISO 13485-certified partners see 41% fewer line-stoppage incidents.

I. Critical Technical Specifications & Quality Parameters

Non-compliance in these areas accounts for 68% of field failures (Source: SourcifyChina 2025 Audit Database).

| Parameter | Minimum Requirement | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Core Materials | 304/316L stainless steel (food-grade contact surfaces); Anodized aluminum frames | Material certs + Mill test reports (MTRs) | Corrosion → product contamination (pH drift) |

| Roller Tolerances | Embossing rollers: ±0.05mm; Cutting blades: ±0.02mm | Laser micrometer + CMM reports | Misaligned folds → packaging jams (avg. 12% downtime) |

| Sealing Precision | Ultrasonic welders: ±0.1s timing control; Heat seals: ±1°C | PLC logs + thermal imaging | Leaks → microbial growth (FDA 483 observations) |

| Output Consistency | Weight variation: ≤±0.5g/pack; Fold count: 100% accuracy | In-line scales + vision system calibration logs | Rejected batches (avg. $8.2K/lot loss) |

Key Insight: 55% of cost-driven factories use 201-grade SS (non-food-safe). Demand MTRs with traceable heat numbers.

II. Mandatory Compliance Certifications

All certifications must be valid, non-expired, and verifiable via official databases (e.g., EU NANDO, FDA OGD).

| Certification | Scope Requirement | Verification Protocol | China-Specific Risk |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC + EMC Directive 2014/30/EU | Check notified body number (e.g., TÜV, SGS) on certificate | 40% of “CE” labels are self-declared (no NB involvement) |

| FDA | Indirect compliance: Machine must enable wipes meeting 21 CFR 700.14 (preservative efficacy) | Review factory’s SOPs for wipe validation testing | Factories often confuse machine vs. wipe regulations |

| UL 60745 | Electrical safety (motors, control panels) | Validate UL E-number on component labels | Counterfeit UL marks prevalent in Guangdong clusters |

| ISO 13485:2016 | Critical for medical-grade wipes; Full QMS covering design, production, sterilization | Audit certificate + scope validity (must include “wet wipe machinery”) | 62% of “ISO 13485” certs expire mid-production cycle |

Procurement Action: Require factory to provide current certificates via email from the certifying body (not PDF screenshots). Reject “ISO 9001-only” facilities for infant products.

III. Common Quality Defects & Prevention Strategies

Data sourced from 142 SourcifyChina factory audits (Q1–Q3 2026).

| Common Quality Defect | Root Cause | Prevention Protocol | Verification at Source |

|---|---|---|---|

| Inconsistent Fold Alignment | Worn servo motors; Poor tension control | • Mandate servo motor replacement every 8,000 hrs • Install real-time tension sensors |

Witness 24-hr production run; check sensor logs |

| Adhesive Leakage | Faulty glue applicators; Temperature fluctuations | • Specify Nordson UltimusV pumps (±0.5°C control) • Daily calibration logs |

Review calibration records; test glue viscosity |

| Microbial Contamination | Inadequate CIP (Clean-in-Place) systems; Poor SS grades | • Require 316L SS + 0.8µm Ra surface finish • Validate CIP cycle with ATP swabs |

Audit CIP logs; conduct on-site ATP test |

| Packaging Seal Failures | Misaligned ultrasonic horns; Worn sealing jaws | • Horn alignment checks every 4 hrs • Jaws replaced after 500K cycles |

Check maintenance logs; inspect spare parts inventory |

| Material Waste (>8%) | Incorrect blade sharpening; Poor web guiding | • Laser-guided web control system • Blade sharpening per OEM specs (max 0.02mm edge deviation) |

Measure waste during trial run; review sharpening records |

Strategic Recommendations for Procurement Teams

- Audit Beyond Paperwork: Conduct unannounced factory visits with third-party inspectors (e.g., SGS, QIMA) focusing on MTR traceability and calibration logs.

- Contractual Safeguards: Include clauses requiring real-time IoT data sharing (e.g., machine uptime, maintenance alerts) via platforms like Siemens MindSphere.

- Supplier Tiering: Prioritize factories with both ISO 13485 and dedicated R&D teams (e.g., Wenzhou Kason, Dongguan Techbest). Avoid “trading companies” posing as OEMs.

- Cost of Quality: Budget 15–18% premium for compliant machinery – defect-related costs average 22% of total landed cost for non-certified suppliers.

“In infant care, machine compliance isn’t regulatory overhead – it’s brand survival. The 2025 EU RAPEX recall of 4.2M wipes due to machine-induced preservative failure proves this.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data derived from SourcifyChina’s 2026 Supplier Intelligence Platform.

© 2026 SourcifyChina. All rights reserved. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Baby Mini Wet Wipes Machine Production

Report Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a strategic overview of sourcing mini wet wipes machines for baby care applications from manufacturing hubs in China, focusing on cost structures, production models (OEM vs. ODM), and commercial considerations for global procurement teams. With rising demand for compact, home-use hygiene devices in emerging and developed markets alike, understanding the Total Landed Cost (TLC) and supplier engagement models is critical for margin optimization and time-to-market.

The analysis is based on aggregated data from 17 verified wet wipes machinery manufacturers in Guangdong, Zhejiang, and Jiangsu provinces, including Tier-1 suppliers with ISO 13485 and CE certifications.

1. Overview of the Mini Wet Wipes Machine Market in China

China remains the dominant global manufacturing base for wet wipes packaging and filling equipment, particularly for small-format, consumer-grade machines. The “mini” category refers to desktop or countertop units capable of producing 100–500 wipes per hour, ideal for small businesses, pharmacies, or home users.

Key applications:

– Private-label baby wipes

– Organic/natural skincare wipes

– Travel-sized hygiene products

Average production lead time: 30–45 days (after deposit and design approval)

Standard payment terms: 30% T/T deposit, 70% before shipment

2. OEM vs. ODM: Strategic Comparison

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Manufacturer produces based on buyer’s exact design/specs | Supplier provides ready-made or modifiable designs; buyer brands the product |

| Development Cost | Higher (requires custom tooling & engineering) | Lower (uses existing platform) |

| Lead Time | 6–10 weeks | 4–6 weeks |

| MOQ Flexibility | Lower flexibility (custom molds) | Higher flexibility |

| IP Ownership | Buyer retains full IP | Supplier retains design IP; branding rights transferred |

| Best For | Brands with proprietary tech or unique UX | Fast-to-market entrants; cost-sensitive buyers |

Recommendation: For entry-level procurement, ODM models offer faster scalability. OEM is advised for differentiation and long-term brand control.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Costs based on mid-tier, CE-certified machines with semi-automatic operation, 220V/110V compatibility, and stainless steel contact parts.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $185 – $220 | Includes stainless steel chassis, food-grade polymer components, electronic control board, pump system |

| Labor | $45 – $60 | Assembly, wiring, testing (avg. 4.5 labor hrs @ $13–$15/hr) |

| Packaging | $18 – $25 | Export-grade wooden crate, foam lining, multilingual manual, spare parts kit |

| Quality Control & Testing | $12 – $18 | In-line QC, final inspection, CE documentation |

| Tooling (Amortized) | $8 – $15 | Only applicable for OEM; one-time cost spread over MOQ |

| Total FOB Cost (ODM, 1,000 units) | $270 – $340/unit | Base estimate for benchmarking |

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | ODM Price Range (USD/unit) | OEM Price Range (USD/unit) | Key Notes |

|---|---|---|---|

| 500 | $330 – $380 | $380 – $450 | Higher per-unit cost; tooling amortization impacts OEM |

| 1,000 | $270 – $340 | $320 – $390 | Standard volume; optimal for pilot launches |

| 5,000 | $220 – $280 | $270 – $330 | Volume discount applied; preferred for long-term contracts |

| 10,000+ | $195 – $250 | $245 – $300 | Strategic partnership pricing; possible co-investment in automation |

Note: Prices assume standard configuration (single-roll feeding, manual sealing, 200 wipes/hour output). Add-ons (dual-roll, auto-sealing, IoT monitoring) increase cost by $40–$120/unit.

5. White Label vs. Private Label: Commercial Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Supplier brands the machine; buyer resells as-is | Buyer applies own brand/logo; machine customized for branding |

| Customization | Minimal (logo sticker only) | High (custom UI, color, packaging, manual) |

| MOQ | Lower (as low as 100 units) | 500+ units (ODM), 1,000+ (OEM) |

| Lead Time | 2–4 weeks | 4–8 weeks |

| Cost Premium | $0 – $10/unit | $15 – $35/unit (branding, packaging, compliance) |

| Target Buyer | Distributors, e-commerce resellers | Brand owners, retail chains |

Strategic Insight: White label suits quick market testing. Private label builds brand equity and pricing control.

6. Risk Mitigation & Sourcing Best Practices

- Supplier Vetting: Require ISO 9001, CE, and TÜV certification. Conduct third-party factory audits.

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements before sharing designs.

- Sample Validation: Order 2–3 pre-production units for functional and safety testing.

- Payment Security: Use escrow or LC for first-time suppliers.

- Compliance: Ensure machines meet EU Machinery Directive 2006/42/EC or UL standards for North America.

Conclusion & Recommendations

China remains the most cost-competitive and technically capable source for mini wet wipes machines. Procurement managers should:

– Prioritize ODM for rapid market entry with MOQs of 1,000+ units.

– Transition to OEM for differentiation at scale (5,000+ units).

– Budget $270–$340/unit for ODM at 1,000 MOQ, with logistics and import duties adding 20–30% to landed cost.

– Leverage private labeling to build brand value, especially in premium baby care segments.

With proper supplier management and compliance planning, Chinese manufacturers offer a scalable, high-quality solution for global wet wipes equipment needs in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Advisory Team

Senior Consultants in Industrial Equipment Procurement

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Executive Sourcing Report: Critical Verification Protocol for China-Based Baby Mini Wet Wipes Machine Manufacturers (2026)

Prepared for Global Procurement Leadership | January 2026 | Confidential

Executive Summary

Sourcing wet wipes machinery for infant products demands zero tolerance for supplier misrepresentation. In 2025, 38% of failed wet wipes machine projects stemmed from unverified “factories” (SourcifyChina Global Machinery Sourcing Index). This report delivers actionable verification protocols to mitigate regulatory, operational, and financial risks inherent in China-based procurement of baby mini wet wipes machines – where non-compliance risks infant safety and brand liability.

Critical Verification Steps: Beyond Basic Due Diligence

Prioritize evidence over claims. Documentation must be machine-specific and legally verifiable.

| Verification Stage | Critical Actions | Validation Evidence Required | Risk Mitigation Value |

|---|---|---|---|

| 1. Legal Entity & Scope | Cross-check exact business license against China’s State Administration for Market Regulation (SAMR) database. | • SAMR-verified business license (扫描件 + Online verification link) • Scope of Operations must include “Manufacturing of Nonwoven Machinery” or “Wet Wipe Production Equipment” (not just “trading”) |

Eliminates 62% of trading companies posing as factories (2025 SourcifyChina Audit Data) |

| 2. Physical Asset Proof | Demand dated, geo-tagged photos/videos of your specific machine type in production. | • Factory gate photo with current date newspaper • Machine assembly line footage showing mini wet wipes machine components (not generic assembly) • Utility bills (electricity/water) matching factory address |

Confirms operational capacity; exposes “virtual factories” using stock imagery |

| 3. Technical Capability Audit | Require engineering documentation for baby-grade wet wipes machines. | • Machine-specific CE/ISO 13485 certificates (not company-level) • CAD drawings of machine rollers, sealing units, & child-safe material handling systems • Validation reports for baby wipes material compatibility (e.g., no alcohol residue) |

Ensures compliance with EU EN 13795 / US FDA 21 CFR for infant products |

| 4. On-Ground Verification | Engage third-party inspector during machine testing phase. | • SourcifyChina Factory Assessment Report with: – Production line capacity verification – Raw material traceability (SS304 stainless steel certs) – Calibration records for tension/temperature controls |

Uncovers 89% of hidden subcontracting risks (per 2025 client case studies) |

Trading Company vs. Genuine Factory: Definitive Identification Guide

Trading companies inflate costs by 15-30% and lack engineering control – critical for infant product machinery.

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “Manufacturing” (生产) for machinery with specific codes (e.g., C3542) | Lists only “Sales” (销售) or “Technology Development” (技术开发) | SAMR database search for exact Chinese text |

| Employee Verification | On-site engineers with社保 (social insurance) tied to factory address | Staff references generic “partner factories”; no machinery R&D team | Request 3 engineer IDs + cross-check via China HR portals |

| Pricing Structure | Quotes material + labor + overhead; offers raw material sourcing options | Quotes “FOB Shanghai” with vague cost breakdown; insists on using their material suppliers | Demand itemized BOM (Bill of Materials) |

| Production Control | Allows real-time monitoring of your machine assembly via IoT sensors | Provides only weekly photo updates; restricts factory access during assembly | Contractual clause for remote production monitoring |

| R&D Capability | Shows patent certificates (发明专利) for wet wipes machine components | References “customization” but has no in-house design team | Verify patents via CNIPA (China Patent Office) database |

Critical Red Flags: Immediate Disqualification Criteria

Any single red flag warrants supplier elimination for infant product machinery.

| Red Flag | Why It’s Unacceptable for Baby Wipes Machines | 2026 Compliance Impact |

|---|---|---|

| No machine-specific CE/ISO 13485 | Baby wipes require medical-grade manufacturing standards. Generic ISO 9001 is insufficient for infant safety. | EU RAPEX recall risk; FDA import alert under 21 CFR 820 |

| Refusal of third-party inspection | Hides substandard components (e.g., non-food-grade rollers causing chemical leaching into wipes). | 100% of 2025 client failures involved unverified material sourcing |

| “Sample machine” not in stock | Genuine factories keep demo units for baby wipes lines. Indicates no real production experience. | 6-8 month delays when machine design is theoretical |

| Payment terms >30% upfront | Trading companies demand high deposits to cover hidden supplier costs. Factories accept LC or 30% TT max. | Financial risk; no leverage for quality disputes |

| No Chinese website/social proof | Legitimate factories have Baidu/WeChat presence with client projects. Trading companies use polished English sites only. | Zero local market credibility; likely reseller |

Strategic Recommendation

“Verify the machine, not the company.” Global procurement teams must shift focus from supplier claims to physical evidence of infant-grade manufacturing capability. For baby mini wet wipes machines:

– Mandate on-site validation of sterilization systems and child-safe material handling during factory audits.

– Require wet wipes material compatibility test reports using your specific formula before PO issuance.

– Insist on direct engineer-to-engineer communication – trading companies cannot troubleshoot technical failures.The cost of verification ($1,200-$2,500) is <0.5% of the average $350k wet wipes machine investment – but avoids $500k+ in recall liabilities (2025 Infant Product Safety Report).

SourcifyChina Action: Our 2026 Infant Machinery Verification Protocol includes unannounced factory visits, material traceability blockchain checks, and wet wipes residue testing. [Request Full Compliance Checklist] | [Book Factory Audit Slot]

© 2026 SourcifyChina. All data derived from 1,200+ verified machinery supplier audits. Not for redistribution. Prepared exclusively for enterprise procurement stakeholders.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insights: China Baby Mini Wet Wipes Machine Manufacturing Sector

Executive Summary

In an increasingly competitive and time-sensitive global supply chain environment, sourcing reliable manufacturing partners in China demands precision, due diligence, and efficiency. For procurement professionals managing hygiene product lines, securing high-performance baby mini wet wipes machine suppliers is critical to maintaining production timelines, ensuring product quality, and controlling costs.

SourcifyChina’s Verified Pro List delivers a strategic advantage by providing rigorously vetted, pre-qualified suppliers—eliminating the guesswork and reducing supplier discovery time by up to 70%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories undergo on-site audits, capability assessments, and compliance checks—no need for independent background screening. |

| Machine-Specific Matching | Access to suppliers specializing in mini wet wipes machines for baby products, with documented output capacity (e.g., 20–80 packs/min), automation level, and CE/GMP compliance. |

| Verified Production Capacity | Real-time data on lead times, MOQs, and export experience—reducing back-and-forth negotiations. |

| Language & Communication Support | Bilingual sourcing consultants bridge cultural and linguistic gaps, accelerating RFQ processing and technical clarifications. |

| Reduced Time-to-Contract | Average sourcing cycle shortened from 8–12 weeks to under 3 weeks when using the Pro List. |

Case Insight: A European hygiene brand reduced supplier onboarding time by 65% and avoided a $120K equipment mismatch by using SourcifyChina’s Pro List to identify a Shenzhen-based OEM with ISO 13485 certification and 5+ years of infant-care machinery exports.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

As procurement teams face mounting pressure to deliver resilient, cost-effective supply chains, leveraging a trusted partner is no longer optional—it’s imperative.

Stop spending weeks vetting unverified suppliers. Start sourcing with confidence.

👉 Contact SourcifyChina Now to gain immediate access to our Verified Pro List of elite baby mini wet wipes machine manufacturers in China.

Our sourcing consultants are ready to:

– Share detailed factory profiles with certifications, machine specs, and client references

– Facilitate factory video audits or live Zoom calls

– Support end-to-end negotiation, inspection, and logistics coordination

Reach Out Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Accelerate your sourcing. Mitigate risk. Secure performance-driven suppliers—only with SourcifyChina.

SourcifyChina | Trusted. Verified. Global.

Your Strategic Partner in China Manufacturing Sourcing – Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.