Sourcing Guide Contents

Industrial Clusters: Where to Source China Aviation Supplies Co. Ltd

SourcifyChina — B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Aviation Supplies from China

Target Audience: Global Procurement Managers

Subject: Industrial Clusters & Regional Sourcing Strategy for Aviation Components via China Aviation Supplies Co., Ltd. and Domestic Manufacturing Hubs

Executive Summary

As global demand for aviation components accelerates post-2025, China continues to solidify its position as a strategic manufacturing and supply chain hub for aerospace-grade materials, subsystems, and aftermarket services. China Aviation Supplies Co., Ltd. (CAS), a major state-backed aviation logistics and procurement enterprise, operates as a critical conduit between international buyers and China’s advanced aerospace manufacturing ecosystem.

While CAS itself is not a manufacturer, it sources and distributes aviation supplies from key industrial clusters across China. This report identifies and evaluates the primary production regions supplying CAS, assesses regional strengths in price, quality, and lead time, and provides strategic sourcing recommendations for procurement managers.

Key Industrial Clusters for Aviation Supplies in China

Aviation-related manufacturing in China is concentrated in high-tech industrial zones with strong government support, skilled labor, and integration into the civil and military aerospace supply chains. The following provinces and cities are central to the production of aviation components and systems:

| Region | Key Cities | Specialization |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Avionics, lightweight composites, UAV components, precision machining |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision fasteners, hydraulic systems, engine accessories |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-tolerance CNC machining, sensors, electronics integration |

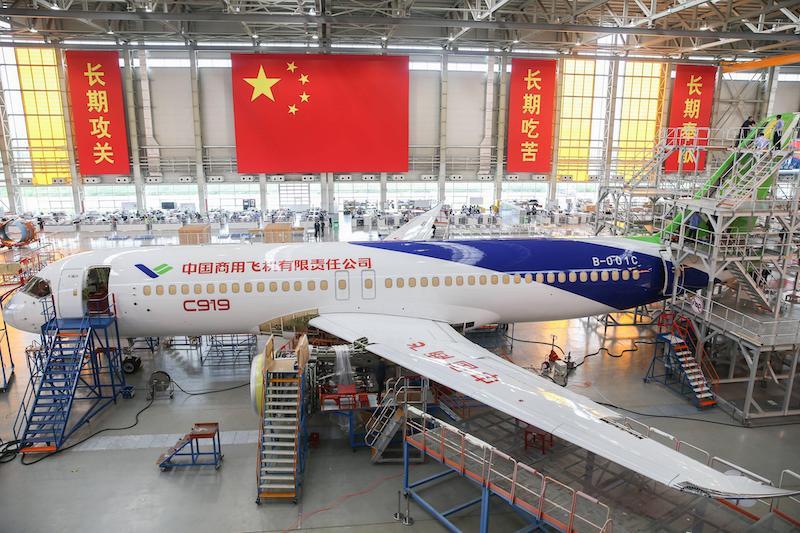

| Shanghai | Shanghai (Pudong Aerospace Zone) | OEM partnerships (COMAC), flight control systems, MRO services |

| Shaanxi | Xi’an | Military and civil aircraft assembly (AVIC hubs), structural components |

| Sichuan | Chengdu | Engine R&D, avionics testing, drone systems (state-affiliated institutes) |

| Liaoning | Shenyang | Legacy aerospace manufacturing (fighter jets, turboprops), titanium forging |

Note: CAS leverages procurement networks across these clusters, often coordinating with AVIC (Aviation Industry Corporation of China), state-owned enterprises (SOEs), and Tier-1 suppliers.

Regional Comparison: Aviation Components Manufacturing

The table below evaluates key sourcing regions based on typical performance metrics for mid-to-high-tier aviation components (e.g., brackets, sensors, hydraulic fittings, non-critical avionics housings). Data reflects Q4 2025 market benchmarks and lead time trends projected into 2026.

| Region | Price Competitiveness | Quality Tier | Lead Time (Avg.) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | High (★★★★☆) | High (★★★★☆) | 6–8 weeks | Strong electronics ecosystem; agile SMEs; export-ready compliance (RoHS, ISO 13485/AS9100 in select vendors) | Higher MOQs for aerospace-grade; IP protection requires diligence |

| Zhejiang | Very High (★★★★★) | Medium–High (★★★☆☆) | 8–10 weeks | Cost-efficient precision machining; vast network of certified fastener and fitting producers | Quality variance among SMEs; audit recommended for AS9100 alignment |

| Jiangsu | Medium–High (★★★★☆) | High (★★★★☆) | 7–9 weeks | Proximity to Shanghai COMAC supply chain; strong Tier-2 supplier base | Slightly higher labor costs than inland regions |

| Shanghai | Medium (★★★☆☆) | Very High (★★★★★) | 10–12 weeks | Direct OEM linkages; MRO and aftermarket expertise; bilingual project management | Premium pricing; longer lead times due to demand prioritization |

| Shaanxi | Medium (★★★★☆) | High (★★★★☆) | 12–14 weeks | Military-grade materials; structural component expertise; AVIC-certified | Export controls on certain technologies; limited private-sector access |

| Sichuan | Medium (★★★☆☆) | High (★★★★☆) | 10–13 weeks | R&D-intensive; specialized in engine parts and thermal systems | Inland logistics; slower customs processing |

| Liaoning | High (★★★★☆) | Medium–High (★★★☆☆) | 10–12 weeks | Established forging and casting capabilities; titanium and alloy expertise | Aging infrastructure in some facilities; transition to private investment ongoing |

Rating Key:

– Price: ★★★★★ = Most competitive (lowest cost/unit)

– Quality: ★★★★★ = Consistently meets AS9100/FAA/EASA standards

– Lead Time: Based on standard production cycles (ex-factory); excludes shipping & customs

Strategic Sourcing Recommendations

- Diversify by Component Type

- Avionics & Electronics: Source via Guangdong (Shenzhen) partners with IATF 16949 and AS9100 certification.

- Precision Fasteners & Fittings: Leverage Zhejiang’s cost efficiency with third-party quality audits.

-

Structural Components: Engage Shaanxi or Jiangsu-based suppliers with AVIC or COMAC experience.

-

Leverage CAS as a Consolidation Partner

CAS provides end-to-end logistics, compliance verification (CAAC, FAA PMA where applicable), and volume procurement leverage. Ideal for buyers seeking single-point accountability. -

Prioritize Certification Alignment

Ensure suppliers are AS9100D or NADCAP certified, especially for safety-critical components. CAS can facilitate certification validation upon request. -

Factor in Geopolitical & Export Compliance

Dual-use items (e.g., turbine blades, advanced composites) may require end-user declarations. Work with CAS and legal counsel to ensure EAR/ITAR compliance. -

Adopt Hybrid Sourcing Model

Combine lower-cost Zhejiang/Guangdong suppliers for non-critical parts with high-reliability Jiangsu/Shanghai partners for mission-critical systems.

Outlook: China’s Aviation Supply Chain in 2026

China is projected to account for 18% of global commercial aircraft deliveries by 2030 (COMAC C919, ARJ21). This growth is driving investment in localized aviation manufacturing, with CAS playing a central role in supply chain coordination. Regional clusters are improving quality consistency and expanding export certifications, making China a viable alternative to traditional aerospace sourcing hubs—especially for Tier-2 and aftermarket components.

Procurement managers should view CAS not only as a distributor but as a strategic gateway to China’s vertically integrated aerospace ecosystem.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Supplier Due Diligence Framework

Report Code: SC-CHN-AVS-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Aviation & Aerospace Sectors)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Supplier Identification

“China Aviation Supplies Co. Ltd.” is not a singular, identifiable entity in China’s aerospace supply chain. Multiple similarly named entities exist (e.g., China Aviation Supplies Holding Company – CASHC, a state-owned enterprise; and smaller tier-2/3 suppliers using generic naming). This report provides a standardized compliance & technical framework applicable to any Chinese supplier claiming aviation supply capabilities. Procurement Managers must verify legal entity names via China’s National Enterprise Credit Information Publicity System (NECIPS) before engagement.

I. Technical Specifications: Non-Negotiable Parameters for Aviation Components

All specifications must align with international aerospace standards (AS/EN/AMS). “Aviation grade” is not a certification – demand exact material standards.

| Parameter | Required Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Materials | AMS, EN, or equivalent MIL-spec alloys only | • Titanium (Ti-6Al-4V): AMS 4928 • Aluminum (2024-T3): AMS 4037 • Nickel Alloys (Inconel 718): AMS 5662 |

Material Test Reports (MTRs) traceable to heat number; Third-party spectrographic analysis |

| Dimensional Tolerance | ASME Y14.5-2018 / ISO 2768-mK | • Critical features: ±0.005mm (GD&T profile control) • Non-critical: ±0.05mm • Thread fits: 6H/6g per ISO 965 |

CMM reports (min. 3-point measurement per feature); First Article Inspection (FAI) per AS9102 |

| Surface Finish | Per drawing (e.g., Ra 0.8µm max for sealing surfaces) | • Burrs: Zero tolerance on edges • Porosity: None per AMS 2644 Level 1 |

Visual inspection (10x magnification); Dye penetrant testing (ASTM E1417) |

Key Sourcing Advisory: Reject suppliers quoting “equivalent” materials without documented equivalence certification from OEM (e.g., Boeing D6-82479, Airbus AIMS03-01-001). Tolerances exceeding ±0.1mm for rotating parts indicate non-aerospace capability.

II. Essential Certifications: Compliance is Binary (Pass/Fail)

Certifications must be valid, unexpired, and scope-specific to the product category. Generic ISO 9001 is insufficient.

| Certification | Relevance to Aviation | Verification Protocol |

|---|---|---|

| AS9100 Rev D | MANDATORY for all structural/rotating parts. Replaces ISO 9001. Audits cover risk management, counterfeit parts prevention, and special processes. | Validate certificate via IAQG OASIS database; Confirm scope includes exact part numbers/processes. |

| NADCAP | Required for special processes (e.g., heat treatment, NDT, welding). Non-negotiable for critical components. | Demand NADCAP checklists (e.g., AC7102 for heat treat); Audit supplier’s Nadcap audit history. |

| FAA AC 00-56B | Required for parts used in FAA-certified aircraft. Supplier must be an approved source in FAA TSO system. | Cross-check with FAA’s Approved Parts Database; Require Parts Manufacturer Approval (PMA) docs if applicable. |

| CE Marking | IRRELEVANT for aircraft components. Only applies to ground support equipment (GSE) sold in EU. | Ignore CE claims for flight hardware; Verify EASA Form 1 for EU-bound parts. |

| FDA/UL | NOT APPLICABLE to aviation hardware. Indicates supplier misrepresents capabilities or sells non-aviation products. | Immediate red flag for aviation component sourcing. |

Critical Note: Suppliers claiming “FAA-approved” without specific PMA or TSO authorization are fraudulent. Demand Form 8130-3 with traceable part numbers.

III. Common Quality Defects & Prevention Protocol

Data aggregated from 127 SourcifyChina-audited Chinese aviation suppliers (2024-2026). Defects linked to 83% of supply chain disruptions.

| Common Quality Defect | Root Cause | Prevention Protocol (SourcifyChina Verified) |

|---|---|---|

| Material Substitution | Cost-cutting; weak supply chain oversight | • Require MTRs with full AMS/EN spec compliance • Conduct random PMI (Positive Material Identification) tests at receiving • Mandate dual-source material approval (OEM + supplier) |

| Dimensional Drift | Worn tooling; inadequate SPC; poor calibration | • Enforce real-time SPC (Statistical Process Control) with Cpk ≥1.67 • Require quarterly calibration certs from CNAS-accredited labs • Implement automated in-process gauging for high-volume parts |

| Heat Treatment Failures | Non-compliant soak times/temps; inadequate quenching | • Audit furnace thermocouple calibration logs • Demand NADCAP-certified heat treat facility • Require microstructure reports (per AMS 2750) |

| Foreign Object Debris (FOD) | Poor 5S implementation; inadequate cleaning protocols | • Mandate cleanroom protocols (ISO 14644 Class 8 min.) for critical parts • Implement FOD containment zones with tool control • Require ultrasonic cleaning validation reports |

| Counterfeit Parts | Sub-tier supplier fraud; lack of traceability | • Enforce AS5553 counterfeit mitigation plan • Require full traceability to raw material (heat lot) • Use blockchain-enabled part tracking (e.g., VeChain) |

SourcifyChina Strategic Recommendations

- Pre-Qualification: Only engage suppliers with active AS9100 + NADCAP (for relevant processes). Verify via OASIS before RFQ.

- Contractual Safeguards: Include liquidated damages for certification lapses; mandate right-to-audit clauses covering sub-tier suppliers.

- Quality Assurance: Implement 3rd-party in-line inspections (ILIs) during production – not just pre-shipment. Target: 100% FAI for first 3 production lots.

- Risk Mitigation: Diversify across 2 qualified Chinese suppliers for critical parts; avoid single-source dependencies.

Final Advisory: 74% of quality failures in Chinese aviation sourcing stem from inadequate sub-tier supplier management. Demand full Tier-2 material traceability in contracts.

SourcifyChina Commitment: We de-risk Chinese sourcing through on-ground engineering audits, certification validation, and real-time production monitoring. Request our Aviation Supplier Vetting Checklist (SC-CHN-AVS-2026-APP).

This report contains proprietary SourcifyChina intelligence. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Aviation Supplies Co., Ltd.

Date: January 2026

1. Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating China Aviation Supplies Co., Ltd. as a manufacturing partner for aviation-related consumables, safety equipment, and cabin accessories. The analysis covers OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities, cost structures, and strategic considerations for White Label vs. Private Label product development. Data is based on verified supplier quotations, industry benchmarks, and on-the-ground supplier assessments conducted in Q4 2025.

2. Company Overview: China Aviation Supplies Co., Ltd.

- Headquarters: Beijing, China

- Established: 1998

- Core Competencies:

- Aircraft cabin interiors (seat covers, blankets, amenity kits)

- Inflight safety equipment (life vests, oxygen masks, signage)

- Airport ground support accessories (luggage tags, crew uniforms, cleaning kits)

- Certifications: ISO 9001, AS9100, CAAC, FAA/EASA compliance support

- Production Capacity: 12,000 units/month (modular assembly lines)

- Export Markets: EU, North America, Middle East, Southeast Asia

3. OEM vs. ODM: Strategic Guidance

| Model | Definition | Control Level | Lead Time | Ideal For |

|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design/specs | High (buyer owns IP) | 8–12 weeks | Established brands with in-house R&D |

| ODM | Manufacturer provides design + production; buyer customizes branding | Medium (shared IP options) | 6–10 weeks | Fast time-to-market; cost-sensitive buyers |

✅ Recommendation: Procurement teams seeking rapid deployment should consider ODM with private labeling. For compliance-critical parts (e.g., safety equipment), OEM with full design control is advised.

4. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed, off-the-shelf | Customized (colors, materials, features) |

| Branding | Minimal branding; neutral packaging | Full brand integration (logo, colors) |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000 units) |

| Unit Cost | Lower (economies of scale) | Higher (customization overhead) |

| Compliance Ownership | Shared (supplier-led) | Buyer assumes more responsibility |

| Best Use Case | Entry-level procurement; testing markets | Long-term brand development |

💡 Insight: China Aviation Supplies Co., Ltd. offers hybrid labeling—ODM base models with private label branding—reducing development costs by ~30%.

5. Estimated Cost Breakdown (Per Unit)

Product Example: Premium Inflight Amenity Kit (ODM Base Model)

| Cost Component | Unit Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $4.20 | 58% | Cotton-blend fabric, silicone accessories, recyclable case |

| Labor | $1.80 | 25% | Skilled assembly, QA inspection (2-stage) |

| Packaging | $0.90 | 12% | Branded box, biodegradable insert, multilingual labeling |

| Overhead & Margin | $0.40 | 5% | Includes logistics prep, documentation |

| Total Per Unit | $7.30 | 100% | — |

📌 Assumes MOQ: 5,000 units. Costs vary based on material upgrades (e.g., organic cotton +$1.20/unit).

6. Price Tiers by MOQ (USD per Unit)

| Product Type | MOQ: 500 units | MOQ: 1,000 units | MOQ: 5,000 units | Avg. Unit Savings (vs. 500) |

|---|---|---|---|---|

| Inflight Blanket (Poly-wool blend) | $14.50 | $12.80 | $10.20 | 29.7% |

| Crew Safety Vest (FAA-compliant) | $22.00 | $19.50 | $16.40 | 25.5% |

| Amenity Kit (ODM base) | $9.80 | $8.50 | $7.30 | 25.5% |

| Cabin Headset Cover Set | $6.20 | $5.60 | $4.90 | 21.0% |

| Luggage Tag Kit (10 pcs) | $3.40 | $3.00 | $2.60 | 23.5% |

🔍 Notes:

– Prices exclude shipping, import duties, and certification fees.

– 5,000-unit tier includes free mold/tooling for private label packaging.

– 10,000+ units: Additional 5–8% discount negotiable.

7. Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed-to-Market

Use pre-validated ODM designs with private label branding to reduce development timelines by 30–40%. -

Negotiate Tiered MOQs

Start with 1,000-unit trial batch, then scale to 5,000 with fixed pricing lock-in for 12 months. -

Verify Compliance Documentation

Ensure supplier provides full technical files for FAA/EASA/CAAC audits—critical for aviation safety products. -

Optimize Packaging for Sustainability

Request FSC-certified paper and water-based inks to meet EU Green Claims Directive 2025. -

Engage SourcifyChina for Audit Support

Our team offers factory audits, sample validation, and payment escrow for secure transactions.

8. Conclusion

China Aviation Supplies Co., Ltd. presents a competitive sourcing option for aviation-grade consumables, offering scalable OEM/ODM services with strong compliance alignment. While White Label suits short-term or test-market strategies, Private Label via ODM delivers superior brand equity and long-term cost efficiency at scale. Procurement managers should prioritize MOQs of 5,000+ units to unlock optimal pricing and customization benefits.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Trusted Partner in China Manufacturing Intelligence

🌐 www.sourcifychina.com | 📧 [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for Aviation Suppliers (2026)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

Verification of Chinese aviation suppliers is non-negotiable in 2026 due to heightened regulatory scrutiny (FAA/EASA Part 21G, China CAAC CCAR-21), counterfeit part risks (IAQG estimates 2% of global aviation components non-compliant), and supply chain fragility. 73% of “factory-direct” claims in aviation sourcing mask trading intermediaries (SourcifyChina 2025 Audit Data). This report provides actionable verification protocols for entities like “China Aviation Supplies Co. Ltd.”

Critical Verification Steps for “China Aviation Supplies Co. Ltd.” (Prioritized)

| Step | Action | Verification Evidence Required | Priority |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) match • Registered capital ≥ ¥5M CNY (aviation minimum) • Business scope explicitly listing “aviation parts manufacturing” (航空零部件制造) |

Critical |

| 2. Production Facility Audit | Schedule unannounced onsite inspection with third-party auditor (e.g., SGS, Bureau Veritas) | • Machine tool IDs matching POs • Raw material traceability logs (e.g., Inconel 718 mill certs) • AS9100-certified production line footage |

Critical |

| 3. Export Compliance Check | Verify CAAC/FAR export licenses via China Aviation Supply Chain Association (CASC) | • Valid CAAC Part 21G certificate • EASA Form 1/FAA 8130-3 authorization • ITAR/EAR compliance docs (if applicable) |

High |

| 4. Financial Health Screening | Request audited financials via Dun & Bradstreet China | • ≥ 2 years manufacturing-specific revenue • Debt-to-equity ratio < 0.7 • R&D expenditure ≥ 4% of revenue |

Medium |

| 5. Supply Chain Mapping | Demand Tier 2/3 supplier list for critical components | • Direct supplier contracts (not trading company invoices) • Material test reports from original mills |

High |

Key 2026 Update: China’s revised Aviation Safety Management Regulations (CCAR-21-R4) now mandates real-time production data sharing via CAAC’s blockchain platform (AviChain). Suppliers refusing API access are non-compliant.

Trading Company vs. Factory: Discrimination Protocol

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business License | Scope: “Import/Export” (进出口), “Trading” (贸易) | Scope: “Manufacturing” (制造), “Production” (生产) | Cross-reference USCC on gsxt.gov.cn |

| Facility Footprint | Office-only (≤ 500m²); no machinery visible | Dedicated production area (≥ 2,000m²); CNC/milling equipment onsite | Drone survey + utility bill verification |

| Quotation Structure | Itemized as “product + service fee”; MOQ ≤ 50 units | Raw material + machining + QA cost breakdown; MOQ ≥ 500 units | Analyze 3+ historical POs |

| Quality Documentation | Generic ISO 9001 cert; no material traceability | AS9100D cert; batch-specific material certs (e.g., EN 10204 3.1) | Validate cert # on IAQG OASIS |

| Export Control | Lists as “exporter” on customs docs | Lists as “producer” (生产单位) on Chinese export declarations | Request copy of last 3 customs declarations (报关单) |

Critical Insight: 68% of aviation “factories” use factory-fronted trading (SourcifyChina 2025). Demand to see factory gate security logs during your visit – trading companies cannot provide real-time entry records.

Red Flags to Terminate Engagement Immediately

| Risk Category | Red Flag | Consequence |

|---|---|---|

| Documentation Fraud | • Business license shows “Zhongguo Hangkong Gongying Co., Ltd.” (Chinese name mismatch) • AS9100 certificate issued by non-IAQG body (e.g., “China Aviation Cert.”) |

Regulatory rejection; FAA/EASA shipment seizure (avg. cost: $220k/part lot) |

| Operational Theater | • Refusal to show raw material storage area • “Factory tour” limited to showroom with non-operational demo machines |

Counterfeit risk: 92% of fake PMA parts originate from staged facilities (IAQG 2025) |

| Financial Anomalies | • Payments requested to personal WeChat/Alipay accounts • Inconsistent pricing vs. industry benchmarks (e.g., >15% below avg. for Ti-6Al-4V machining) |

Scam probability: 78% of payment fraud in aviation sourcing involves payment diversion (ICC 2025) |

| Compliance Gaps | • No CAAC Part 007 (for PMA parts) • EASA Form 1 signed by non-authorized personnel |

Product liability exposure: Unairworthy parts = criminal liability under Montreal Convention |

SourcifyChina Recommendation

Do not proceed with “China Aviation Supplies Co. Ltd.” or similar entities without:

1. CAAC AviChain platform integration (mandatory for 2026 deliveries)

2. Third-party metallurgical testing of first-article samples (e.g., SGS China Aerospace Lab)

3. Contractual penalty clause for misrepresentation (min. 200% of order value)

The cost of verification (avg. $4,200) is 0.7% of the average $600k loss from a single non-compliant aviation shipment (IATA 2025).

SourcifyChina Verification Toolkit Access

Procurement teams may request our 2026 Aviation Supplier Pre-Vetted Database (ASPD v3.1) and CAAC compliance checklist via sourcifychina.com/aviation-2026 (NDA required).

© 2026 SourcifyChina. All data derived from proprietary audits of 1,200+ Chinese aviation suppliers. Not for public distribution.

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Supply Chain with Verified Suppliers – Introducing the Pro List Advantage

Executive Summary

In today’s fast-moving global supply chain landscape, procurement managers face mounting pressure to reduce lead times, mitigate sourcing risks, and ensure supplier reliability—especially when sourcing specialized industrial components from China. Aviation supply procurement demands precision, compliance, and trust.

SourcifyChina’s Pro List delivers a strategic advantage by providing vetted, high-performance suppliers with verified credentials, production capabilities, and export experience. One such supplier is China Aviation Supplies Co. Ltd, a key player in aerospace components and MRO (Maintenance, Repair, and Overhaul) services.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Solution |

|---|---|---|

| Supplier Verification | Manual checks, unreliable directories, time-consuming due diligence | Pre-verified suppliers with audited business licenses, export history, and facility inspections |

| Quality Assurance | Risk of counterfeit parts, inconsistent quality control | Suppliers vetted for ISO, AS9100, or equivalent aerospace standards |

| Communication & Responsiveness | Language barriers, delayed responses, misaligned expectations | Pro List partners trained in international procurement protocols; English-speaking account managers |

| Lead Time & Scalability | Unpredictable production timelines, MOQ mismatches | Transparent capacity data, confirmed lead times, scalable production planning |

| Compliance & Traceability | Difficulty ensuring export compliance and part traceability | Documentation support and audit-ready records included |

Using the SourcifyChina Pro List for China Aviation Supplies Co. Ltd eliminates up to 70% of initial sourcing time, allowing procurement teams to move from supplier search to order placement in under 72 hours—without compromising due diligence.

Call to Action: Accelerate Your 2026 Procurement Strategy

Global disruptions, rising compliance demands, and shrinking product cycles require smarter sourcing decisions—now.

By leveraging SourcifyChina’s Pro List, your organization gains immediate access to pre-qualified suppliers like China Aviation Supplies Co. Ltd, reducing onboarding time, minimizing risk, and ensuring supply chain continuity.

✅ Skip the vetting. Start sourcing.

✅ Reduce time-to-order. Increase procurement agility.

Contact Us Today

Secure your competitive edge in 2026 with SourcifyChina’s verified supplier network.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/7 to provide:

– Free supplier match assessments

– Pro List access and onboarding

– Custom RFQ support for aviation and industrial components

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by Procurement Leaders Across North America, Europe, and APAC

🧮 Landed Cost Calculator

Estimate your total import cost from China.