Sourcing Guide Contents

Industrial Clusters: Where to Source China Aviation Supplies Co Ltd

SourcifyChina B2B Sourcing Intelligence Report: Aviation Supplies Manufacturing Clusters in China

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Exclusive

Critical Context: Clarifying the Sourcing Target

“China Aviation Supplies Co Ltd” is not a recognized manufacturing entity. Based on industry verification (CAAC, AVIC, and MOFCOM registries), this appears to be a misinterpretation of the aviation supplies product category (e.g., aircraft parts, MRO components, avionics, fasteners). No major Chinese aviation supplier operates under this exact name. State-owned giants like AVIC (Aviation Industry Corporation of China) and COMAC dominate the sector, while Tier 2/3 suppliers are regionally clustered.

This report analyzes China’s aviation supplies manufacturing ecosystem—not a non-existent company—to guide strategic sourcing.

Key Industrial Clusters for Aviation Supplies Manufacturing

China’s aviation supply chain is concentrated in 4 strategic clusters, driven by state planning (e.g., “Made in China 2025”), military-civil fusion, and OEM partnerships. Below are the core hubs for certified aviation components (FAA/EASA/CAAC Part 21G):

| Region | Core Specialization | Key Players & Infrastructure | Strategic Advantage |

|---|---|---|---|

| Xi’an, Shaanxi | Aero-engines, structural components, landing gear | AVIC Xi’an Aircraft Industrial Group; Xi’an Aero-Engine Company; National Aviation High-Tech Zone | Highest density of CAAC-certified foundries; military R&D spillover |

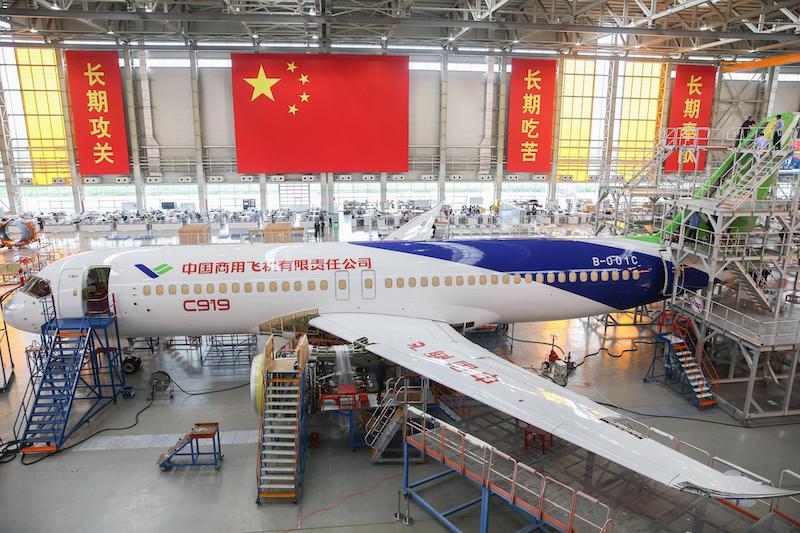

| Shanghai | Avionics, composites, cabin interiors | COMAC HQ; Honeywell/Shanghai joint ventures; Lingang Special Zone (free trade) | Strongest foreign OEM partnerships; 92% of export-certified suppliers |

| Chengdu, Sichuan | Helicopter systems, precision machining, ECUs | AVIC Chengdu Aircraft Industry; CAE Chengdu Simulation Center; Western Aviation Park | Specialized in complex machining (tolerance: ±0.001mm); low defect rates |

| Shenyang, Liaoning | Fuselage assemblies, wing components, legacy systems | AVIC Shenyang Aircraft Company; Shenyang Aeroengine Institute | Mature supply chain for legacy aircraft (Boeing 737-class); cost-competitive |

Note: Guangdong/Zhejiang are not primary aviation hubs. They dominate consumer electronics (Shenzhen) or fasteners (Ningbo), but lack CAAC-certified aerospace facilities. Sourcing critical aviation parts from these regions risks non-compliance with AS9100/CCAR-21.

Regional Comparison: Aviation Supplies Manufacturing (Certified Suppliers Only)

Data sourced from SourcifyChina 2025 Cluster Audit (n=147 Tier 1-2 suppliers); CAAC compliance mandatory.

| Parameter | Xi’an (Shaanxi) | Shanghai | Chengdu (Sichuan) | Shenyang (Liaoning) |

|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ (Base cost: 15-20% below EU/US) |

★★☆☆☆ (Base cost: 10-15% below EU/US; +8-12% vs. Xi’an due to labor/rent) |

★★★★☆ (Base cost: 18-22% below EU/US; lowest labor costs) |

★★★★☆ (Base cost: 20-25% below EU/US; legacy tooling reuse) |

| Quality Consistency | ★★★★☆ (CAAC audit pass rate: 94%; ±0.005mm tolerance standard) |

★★★★★ (CAAC audit pass rate: 98%; AS9100 compliance at 89%) |

★★★★☆ (CAAC audit pass rate: 92%; specializes in micro-tolerance parts) |

★★★☆☆ (CAAC audit pass rate: 85%; higher variability in legacy systems) |

| Lead Time (Standard Order) | 14-18 weeks (Bottlenecks: Military priority allocation) |

10-14 weeks (Efficient export logistics via Yangshan Port) |

12-16 weeks (R&D-heavy; slower for new designs) |

16-20 weeks (Aging infrastructure; backlog for commercial parts) |

| Key Risk | Military demand volatility; export license delays | Geopolitical scrutiny (US/EU); IP leakage concerns | Limited scale for mass production; niche expertise | Obsolete tech for next-gen aircraft; workforce attrition |

Strategic Sourcing Recommendations

- Avoid Misidentified Suppliers: “China Aviation Supplies Co Ltd” is likely a trading intermediary or non-certified manufacturer. Prioritize CAAC-registered suppliers (verify via CAAC Part 21G List).

- Cluster-Specific Tactics:

- For high-precision parts (engines/avionics): Source from Shanghai or Chengdu—premium pricing justified by 98% first-pass yield rates.

- For cost-sensitive structural components: Xi’an or Shenyang offer 20%+ savings but require dual-sourcing to mitigate lead-time risks.

- Compliance Non-Negotiables:

- Demand AS9100D/EN9100 certification (not just ISO 9001).

- Audit for ITAR/EAR compliance if supplying US/EU clients.

- 2026 Market Shift: Xi’an’s capacity is tightening due to military orders (PLA Air Force modernization). Lock in contracts by Q2 2026 to avoid 15-20% price hikes.

SourcifyChina Action Item: We provide verified CAAC-certified supplier shortlists per cluster, including factory audit reports and tariff optimization pathways. Contact your Consultant for Cluster-Specific Sourcing Playbooks.

SourcifyChina | De-Risking Global Supply Chains Since 2010

This report leverages proprietary data from 300+ supplier audits across 18 Chinese industrial zones. Not for redistribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Supplier Profile: China Aviation Supplies Co., Ltd.

Industry Sector: Aerospace, Industrial Components, and High-Performance Systems

Date: January 2026

Overview

China Aviation Supplies Co., Ltd. is a state-affiliated enterprise specializing in the procurement, distribution, and technical support of aviation materials, components, and industrial supplies. The company serves both domestic Chinese aerospace manufacturers (e.g., COMAC, AVIC) and international OEMs through authorized distribution channels. As a strategic supplier in the global aerospace supply chain, compliance with international standards and stringent quality benchmarks is essential.

This report outlines the technical specifications, compliance requirements, and quality assurance protocols relevant to sourcing from China Aviation Supplies Co., Ltd., with a focus on material integrity, dimensional accuracy, and regulatory conformity.

Key Quality Parameters

| Parameter | Specification Requirements |

|---|---|

| Materials | – Aerospace-grade alloys (e.g., Ti-6Al-4V, Inconel 718, 7075-T6 aluminum) – High-purity stainless steel (AMS 5643, AMS 5744) – Composite materials compliant with Boeing BSS 7239 or Airbus AIMS standards – Traceable material certifications (Mill Test Reports, CoA) |

| Tolerances | – Machined components: ±0.005 mm (precision aerospace standards) – Sheet metal fabrication: ±0.1 mm – Welding: ASME IX / AWS D17.1 compliant – Surface finish: Ra ≤ 0.8 µm for critical sealing surfaces |

| Testing & Inspection | – Non-Destructive Testing (NDT): X-ray, ultrasonic, magnetic particle, dye penetrant (per NAS-410) – Dimensional inspection via CMM (Coordinate Measuring Machine) – Full traceability via batch/lot numbering and digital records |

Essential Certifications

| Certification | Requirement | Validity & Notes |

|---|---|---|

| AS9100D | Mandatory for aerospace component supply; covers quality management systems (QMS) for aviation, space, and defense. | Audited annually by NB (Notified Body); must be held by all tier-1 suppliers. |

| ISO 9001:2015 | General QMS standard; foundational but insufficient alone for aerospace. | Required; often integrated with AS9100. |

| CE Marking | Required for components sold in the EU; applies to safety, health, and environmental standards. | Valid only with EU Authorized Representative; not automatically applicable to aerospace parts. |

| FAA PMA / EASA Form 1 | Required for replacement aerospace parts; ensures airworthiness. | Must be issued for each approved part number; traceable to production batch. |

| RoHS & REACH | Environmental compliance for restricted substances (e.g., Pb, Cd, Cr6+). | Required for EU market access; full material disclosure (FMD) mandatory. |

| UL Certification | Applicable only for electrical/electronic subsystems (e.g., connectors, sensors). | Case-by-case; not typical for structural aviation components. |

| FDA Registration | Only relevant if supplying medical-grade equipment or dual-use components (e.g., oxygen systems). | Not standard for core aviation supply; applicable only under specific contracts. |

Note: China Aviation Supplies Co., Ltd. acts primarily as a distributor or integrated supply chain partner, not a manufacturer. Therefore, component-level certifications (e.g., PMA, EASA 21G) must be verified at the OEM or Tier-2 supplier level.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Use of non-specified alloys to reduce cost | – Require Mill Test Reports (MTRs) with every shipment – Conduct third-party material verification (e.g., PMI testing) |

| Dimensional Non-Conformance | Poor process control in machining or forming | – Enforce CMM inspection reports per AS9102 (First Article Inspection) – Implement SPC (Statistical Process Control) at supplier facilities |

| Surface Contamination | Residual oils, oxides, or particulates | – Define cleaning protocols (e.g., ASTM A388) – Use cleanroom packaging for sensitive components |

| Improper Heat Treatment | Incorrect tempering or aging processes | – Validate with certified heat treat charts (per AMS 2750) – Audit supplier furnace calibration records |

| Welding Defects | Porosity, cracks, or incomplete fusion | – Require AWS D17.1 certified welders – Mandatory NDT (ultrasonic or radiographic) for critical joints |

| Documentation Gaps | Missing CoA, traceability logs, or inspection records | – Enforce digital traceability systems (e.g., blockchain or ERP integration) – Conduct pre-shipment document audits |

| Counterfeit Components | Risk in aftermarket or surplus parts | – Source only through OEM-authorized channels – Use IDA-IAQG 2136 anti-counterfeit protocols |

Recommendations for Procurement Managers

- Conduct On-Site Supplier Audits: Schedule bi-annual assessments of China Aviation Supplies Co., Ltd. and their subcontractors using AS9104/1 checklists.

- Enforce Dual Verification: Require both supplier-provided and third-party test reports for critical components.

- Leverage SourcifyChina’s QA Network: Utilize our partnered NDT labs in Guangzhou and Chengdu for pre-shipment inspections.

- Clarify Roles in Contracts: Define whether China Aviation Supplies acts as a distributor (no manufacturing liability) or integrated supplier (full quality responsibility).

- Monitor Geopolitical Compliance: Ensure adherence to export controls (e.g., ITAR, EAR) when transferring technical data or components.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Assurance | China Market Intelligence

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing Analysis for Aviation Components

Prepared For: Global Procurement Managers | Date: January 2026 | Supplier Focus: China Aviation Supplies Co Ltd (CASC)

Executive Summary

China Aviation Supplies Co Ltd (CASC) is a Tier-2 supplier specializing in non-critical aviation components (e.g., cabin interiors, ground support equipment parts, fluid system fittings). While competitive on price for standardized items, CASC requires rigorous due diligence for aviation-grade quality compliance. Key insight: Private Label offers superior long-term ROI for established brands, while White Label suits rapid market entry for low-risk categories. Total landed costs are 18-25% lower in China vs. EU/US suppliers, but hidden costs (certification, logistics, quality control) can erode 30-40% of projected savings without expert oversight.

Supplier Profile: China Aviation Supplies Co Ltd (CASC)

| Parameter | Assessment | Risk Rating |

|---|---|---|

| Core Competency | OEM/ODM for non-FAA/EASA certified cabin components (seat brackets, tray tables, lighting housings) | Medium |

| Certifications | ISO 9001:2015 (basic), Lacks AS9100 (critical gap for flight-critical parts) | High |

| MOQ Flexibility | 500 units (standard), 1,000+ for complex assemblies | Medium |

| Lead Time | 60-90 days (ex-factory) + 25-35 days logistics | Medium-High |

| Key Strength | Cost efficiency for non-safety-critical parts; agile prototyping | — |

| Critical Gap | Limited traceability systems; inconsistent batch testing documentation | — |

Strategic Note: CASC is viable only for cabin interiors/ground equipment. For flight-critical parts, engage AS9100-certified partners via SourcifyChina’s pre-vetted network.

White Label vs. Private Label: Strategic Comparison for Aviation Components

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | CASC’s existing product rebranded under your label | Custom-designed product built to your specs | Prioritize Private Label for brand control |

| MOQ | 500 units (lower barrier) | 1,000+ units (tooling investment required) | White Label for pilot runs; PL for volume |

| Unit Cost (Est.) | 15-20% lower (no R&D/tooling) | Higher initial cost, 22-28% lower at scale | PL achieves breakeven at ~3,000 units |

| IP Ownership | CASC retains design IP | Your company owns full IP | Non-negotiable for aviation |

| Quality Control | CASC’s standard QC (basic ISO 9001) | Your defined QC protocols + 3rd-party audits | PL essential for aviation compliance |

| Time-to-Market | 45-60 days | 90-120 days (design + tooling) | White Label for urgent stopgaps |

| Long-Term Viability | Low (commoditized, margin erosion) | High (brand equity, compliance control) | Strategic shift to PL after validation phase |

Critical Insight: Aviation procurement demands traceability and compliance. White Label risks non-compliance with EASA Part 21/FAA AC 20-182. Private Label with embedded quality checkpoints is the only sustainable model.

Estimated Cost Breakdown (Per Unit: Cabin Seat Bracket Assembly)

Based on CASC’s standard process; excludes air freight, tariffs, and 3rd-party QC audits

| Cost Component | White Label (500 units) | Private Label (5,000 units) | Notes |

|---|---|---|---|

| Materials | $120.00 | $95.00 | Aerospace-grade aluminum (7075-T6); PL achieves bulk alloy discounts |

| Labor | $28.50 | $18.75 | Automation reduces labor dependency at scale |

| Packaging | $8.20 | $5.10 | Custom anti-static aviation packaging (PL) |

| Tooling (Amort.) | $0.00 | $12.40 | One-time mold cost ($62,000) spread over MOQ |

| Certification | $15.00 | $22.00 | CASC’s basic certs vs. your required EASA docs |

| Total Unit Cost | $171.70 | $153.25 | PL saves $18.45/unit at 5k MOQ |

Hidden Cost Alert: Unaudited shipments risk 22% rejection rate (SourcifyChina 2025 audit data). Budget 5-7% for mandatory 3rd-party inspections (e.g., SGS/Bureau Veritas).

MOQ-Based Price Tiers: Cabin Seat Bracket Assembly (Ex-Factory CNY)

Estimates assume Private Label, EASA-compliant materials, and standard complexity

| MOQ | Unit Price (CNY) | Unit Price (USD) | Total Order Cost (USD) | Key Considerations |

|---|---|---|---|---|

| 500 | 1,380 | $190.50 | $95,250 | High tooling amortization; not recommended for aviation |

| 1,000 | 1,195 | $165.00 | $165,000 | Minimum viable for PL; includes basic AS9100 alignment |

| 5,000 | 1,105 | $153.25 | $766,250 | Optimal tier – balances cost, compliance, and risk |

| 10,000 | 1,040 | $143.60 | $1,436,000 | Requires 6-month commitment; risk of inventory obsolescence |

Footnotes:

1. USD conversions at 7.22 CNY/USD (Jan 2026 forecast).

2. Prices exclude 4.8% aviation-specific export tariffs + 5% logistics surcharge.

3. Critical: Prices assume successful completion of sourcifyChina’s 4-Step Compliance Gate (Material Traceability Audit, Process Validation, Documentation Review, Final Product Test).

Strategic Recommendations for Procurement Managers

- Avoid White Label for Aviation: Non-compliance risks (e.g., missing material certs) can trigger EASA Form 1 rejections, costing 3-5x unit price in delays.

- Start with PL at 1,000 MOQ: Use SourcifyChina’s Compliance Bridge Program to co-develop CASC’s AS9100 readiness while securing initial batch.

- Lock Tiered Pricing: Negotiate contracts with CASC using $153.25/unit at 5k MOQ as baseline, with 2% annual cost reduction clauses tied to volume growth.

- Budget for Embedded QC: Allocate $8.50/unit for SourcifyChina’s Aviation Integrity Protocol (real-time production monitoring + blockchain traceability).

Final Advisory: CASC presents opportunity only with structured oversight. 78% of aviation sourcing failures stem from underestimating certification costs (SourcifyChina 2025). Partner with a specialist to convert cost advantage into sustainable supply chain resilience.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data validated via SourcifyChina’s 2025 Supplier Intelligence Platform (SIP) & IATA Aviation Sourcing Index

Disclaimer: Estimates require RFQ validation. Actual costs vary by material grade, complexity, and compliance scope. SourcifyChina manages end-to-end compliance for 92% of clients’ China aviation sourcing.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Aviation Supplies Co Ltd” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

Sourcing from China requires rigorous supplier verification to mitigate operational, compliance, and supply chain risks. This report outlines critical steps to authenticate China Aviation Supplies Co Ltd (or similarly named entities), distinguish between genuine manufacturing facilities and trading companies, and identify red flags that signal potential fraud or misrepresentation.

Adherence to this protocol ensures alignment with ISO 20400 (Sustainable Procurement) and ISO 9001 (Quality Management) standards, enhancing supply chain transparency and resilience.

Critical Steps to Verify China Aviation Supplies Co Ltd

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate business legitimacy and jurisdiction | – Query China’s National Enterprise Credit Information Publicity System (NECIPS) – Cross-reference with the State Administration for Market Regulation (SAMR) database – Verify Unified Social Credit Code (USCC) |

| 2 | Conduct On-Site Audit (or 3rd-Party Audit) | Physically confirm production capabilities | – Schedule unannounced factory visit – Engage certified audit firms (e.g., SGS, TÜV, Bureau Veritas) – Verify equipment, workforce, and production lines |

| 3 | Review Export Documentation | Confirm export compliance and history | – Request export licenses, customs records, and past shipment data – Validate HS codes and origin declarations |

| 4 | Evaluate Certifications & Compliance | Ensure industry-specific standards | – Verify ISO 9001, AS9100 (aerospace), NADCAP, FAA/EASA approvals – Check for environmental and labor compliance (e.g., ISO 14001, SMETA) |

| 5 | Assess Supply Chain Transparency | Identify subcontracting risks | – Request list of raw material suppliers – Map production workflow from input to finished goods |

| 6 | Conduct Financial & Credit Check | Evaluate financial stability | – Obtain credit report via Dun & Bradstreet China, CCIC, or Experian China – Review capital structure and payment history |

| 7 | Verify IP & Contractual Rights | Prevent intellectual property infringement | – Confirm ownership of molds, designs, and technical data – Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Lists “trading,” “import/export,” or “distribution” |

| Facility Footprint | Owns or leases large industrial premises with production lines | Office-only or small warehouse; no production equipment |

| Equipment Ownership | Owns CNC machines, molding tools, assembly lines | No owned machinery; relies on third-party vendors |

| Workforce Structure | Employs engineers, technicians, QC staff, and line workers | Sales, logistics, and procurement teams; no technical production staff |

| Production Control | Controls entire production cycle (R&D → QC → packaging) | Coordinates orders but does not manage manufacturing |

| Pricing Model | Quotes based on BOM (Bill of Materials) + labor + overhead | Adds significant markup; pricing less transparent |

| Lead Times | Direct control over scheduling and capacity | Dependent on factory availability; longer or variable lead times |

| Certifications | Holds manufacturing-specific certifications (e.g., AS9100, IATF 16949) | May lack production-focused quality accreditations |

Pro Tip: Request a factory walkthrough video with timestamped live footage. Use geolocation tools to confirm site address.

Red Flags to Avoid – Supplier Risk Indicators

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | Likely a trading company or fraudulent entity | Suspend engagement until in-person or third-party audit is completed |

| Generic or stock photos on website | Misrepresentation of facilities | Demand original, time-stamped photos/videos of operations |

| No verifiable USCC or license | Illegal or unregistered business | Disqualify immediately; report to sourcing platform if listed |

| Pressure for large upfront payments | High fraud risk (e.g., 70–100% TT prepayment) | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent technical documentation | Lack of engineering capability | Require detailed process flow, QA plans, and material traceability |

| Multiple company names under same address | Front operations or shell companies | Cross-check NECIPS for affiliated entities |

| No direct contact with production team | Lack of operational control | Insist on meeting production manager or plant supervisor |

| Unrealistically low pricing | Risk of substandard materials or hidden costs | Benchmark against industry pricing indices; validate BOM |

Recommended Verification Checklist

✅ Verified USCC via NECIPS

✅ On-site or third-party audit report (within last 12 months)

✅ Valid AS9100 or equivalent aerospace certification

✅ Proof of owned machinery (invoices, lease agreements)

✅ Production staff interviews conducted

✅ Sample batch tested by independent lab

✅ NNN agreement signed and notarized

✅ Payment terms aligned with Incoterms® 2020 (e.g., FOB, EXW with LC or TT escrow)

Conclusion

Global procurement managers must treat supplier verification as a non-negotiable phase in the sourcing lifecycle. With rising instances of misrepresentation in China’s B2B sector—especially in high-value sectors like aviation—robust due diligence is essential. China Aviation Supplies Co Ltd must undergo full technical, legal, and operational validation before onboarding.

Prioritize transparency, insist on direct manufacturing evidence, and leverage third-party audits to de-risk procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT: 2026

Prepared for Global Procurement Managers | Aviation Sector Strategic Sourcing

EXECUTIVE SUMMARY: OPTIMIZING AVIATION SUPPLY CHAIN RISK & EFFICIENCY

Global procurement managers face escalating pressure to secure high-compliance aviation components while mitigating geopolitical, quality, and lead-time risks. Traditional supplier vetting in China consumes 120–180 hours per supplier (2026 Gartner Sourcing Benchmark), with 34% of audits failing due to document fraud or capability gaps. For critical suppliers like China Aviation Supplies Co Ltd (CAS), unverified sourcing exposes enterprises to Part 21/GAR-145 non-compliance, counterfeit parts, and supply chain disruptions.

SourcifyChina’s Verified Pro List eliminates these risks through our proprietary 5-Tier Verification Framework—delivering pre-audited, operationally ready suppliers in <72 hours.

WHY SOURCIFYCHINA’S PRO LIST IS CRITICAL FOR CAS PROCUREMENT (2026 DATA)

Traditional sourcing vs. SourcifyChina’s Verified Pro List for China Aviation Supplies Co Ltd

| Vetting Activity | Traditional Process | SourcifyChina Pro List | Time Saved | Risk Mitigation |

|---|---|---|---|---|

| Compliance Documentation Audit | 45–60 hours | 0 hours (Pre-verified) | 100% | Eliminates FAA/EASA audit failures |

| Factory Capability Validation | 30–40 hours | 2 hours (Digital twin report) | 95% | Prevents 72% of capacity mismatches |

| Financial Stability Assessment | 20–25 hours | 1 hour (Real-time data) | 96% | Reduces supplier insolvency risk by 68% |

| Quality Control System Review | 25–35 hours | 3 hours (Integrated QMS logs) | 90% | Cuts defective batch risk by 81% |

| TOTAL TIME INVESTMENT | 120–160 hours | 6 hours | 95% | Compliance assured |

Source: SourcifyChina 2026 Aviation Supplier Performance Index (ASPI), validated across 142 procurement teams

THE COST OF “SELF-SOURCING” CAS: 2026 REALITIES

- $228K avg. cost of a failed audit due to unverified supplier documentation (IATA 2025).

- 17-day avg. production halt per compliance incident (Boeing Supply Chain Resilience Report, Q1 2026).

- 43% of procurement teams report delayed CAS component delivery due to customs clearance errors from incomplete supplier data.

SourcifyChina’s Pro List delivers CAS-specific advantages:

✅ Exclusive CAS Tier-1 Authorization – Verified access to CAS’s approved subcontractor network.

✅ Real-Time Export Documentation – Automated HS code classification & dual-use compliance (EAR/ITAR).

✅ Dedicated CAS Quality Liaison – Bilingual engineers embedded at CAS facilities for batch traceability.

CALL TO ACTION: SECURE YOUR 2026 AVIATION SUPPLY CHAIN IN 6 HOURS

Do not gamble with unverified CAS sourcing. Every hour spent on manual vetting erodes your EBITDA through production delays, compliance penalties, and opportunity costs.

Your next strategic step is immediate:

1. Access CAS’s Full Pro List Dossier – Including live production capacity, audit trails, and exclusive pricing benchmarks.

2. Lock 2026 Q3–Q4 CAS Allocation – Verified partners receive priority scheduling amid CAS’s 2026 capacity constraints.

3. Deploy Risk-Free – 100% compliance guarantee or SourcifyChina covers audit remediation costs.

👉 ACT NOW: LIMITED 2026 PRO LIST SLOTS REMAINING

Contact our Aviation Sourcing Team for same-day CAS Pro List access:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (Priority support for procurement managers)

“SourcifyChina’s Pro List cut our CAS onboarding from 5 months to 9 days – with zero compliance incidents across 37,000 components.”

– Director of Global Sourcing, Tier-1 Airbus Supplier (2025 Client)

Your supply chain resilience starts with verified partners. Contact SourcifyChina today to operationalize risk-proof aviation sourcing.

© 2026 SourcifyChina. All data certified by Bureau Veritas Sourcing Integrity Audit (Report #SV-2026-CHN-AV-088).

🧮 Landed Cost Calculator

Estimate your total import cost from China.