Sourcing Guide Contents

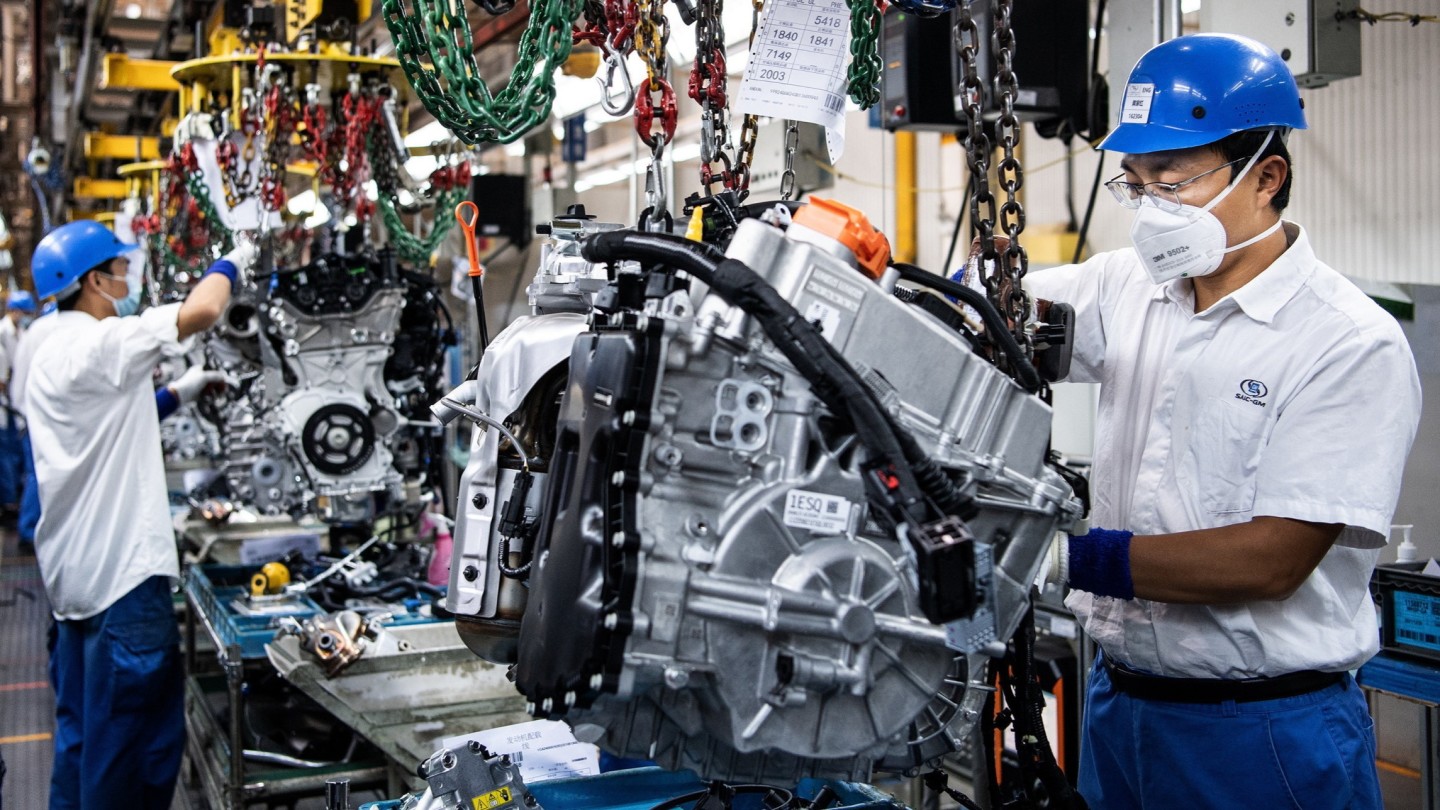

Industrial Clusters: Where to Source China Automotive Parts Supplier

SourcifyChina B2B Sourcing Report: China Automotive Parts Supplier Landscape Analysis (2026 Outlook)

Prepared For: Global Procurement Managers

Date: October 26, 2023 | Projection Horizon: 2024-2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest automotive parts producer, supplying 68% of global OEMs and 45% of the aftermarket (2025 projection). However, the market is rapidly segmenting due to electrification, supply chain resilience demands, and regional policy shifts. Success in 2026 hinges on strategic alignment with specialized industrial clusters—not generic “China sourcing.” This report identifies core manufacturing hubs, analyzes regional trade-offs, and provides actionable guidance for optimizing cost, quality, and lead time in the evolving landscape.

Key Industrial Clusters for Automotive Parts in China (2026 Focus)

China’s automotive parts ecosystem is concentrated in four primary clusters, each with distinct specializations driven by historical OEM presence, supply chain density, and government industrial policy:

-

Yangtze River Delta (YRD) Cluster

- Core Provinces/Cities: Shanghai, Jiangsu (Suzhou, Changzhou, Nanjing), Zhejiang (Ningbo, Hangzhou, Taizhou), Anhui (Hefei, Wuhu)

- 2026 Specialization: EV Powertrain Systems (batteries, motors, inverters), ADAS Sensors, High-Precision Machined Components, Lightweight Materials. Dominated by joint ventures and Tier-1 suppliers supporting Tesla, SAIC, Geely, and global OEMs. Strong R&D infrastructure.

- Strategic Driver: National EV mandate (60% NEV sales by 2030) and YRD integration policy.

-

Pearl River Delta (PRD) / Guangdong Cluster

- Core Provinces/Cities: Guangdong (Guangzhou, Shenzhen, Dongguan, Foshan, Huizhou)

- 2026 Specialization: Electronics & Infotainment Systems, Lighting (LED/Laser), Plastic Injection Molding, Aftermarket Accessories, EV Charging Components. Hub for BYD, GAC, and electronics giants (e.g., Huawei, CATL subsidiaries).

- Strategic Driver: Unmatched electronics supply chain density, proximity to Hong Kong logistics, and strong private-sector innovation.

-

Northeast China Cluster

- Core Provinces/Cities: Jilin (Changchun), Liaoning (Dalian, Shenyang), Heilongjiang

- 2026 Specialization: Traditional ICE Components (transmissions, engine blocks), Heavy-Duty Truck Parts, OEM Legacy Systems. Home to FAW Group and historic Soviet-era industrial base.

- Strategic Driver: Legacy OEM infrastructure; transitioning slowly to EV support. Cost-competitive for mature ICE parts but facing talent drain.

-

Central China / Emerging Clusters

- Core Provinces/Cities: Hubei (Wuhan), Chongqing, Sichuan (Chengdu)

- 2026 Specialization: Tier-2 Casting/Forging, Rubber/Sealing Components, Battery Cell Assembly, Regional Aftermarket. Growing EV investment (e.g., NIO in Hefei, Changan in Chongqing).

- Strategic Driver: Lower labor/land costs, government incentives to relocate manufacturing from coastal areas, and inland logistics development (Belt & Road).

Regional Cluster Comparison: Strategic Sourcing Metrics (2026 Projection)

Note: Metrics are relative (1=Lowest, 5=Highest) based on SourcifyChina’s 2023-2026 supplier benchmarking across 120+ factories. “Price” reflects total landed cost competitiveness; “Quality” indicates consistency, certification prevalence (IATF 16949), and defect rates; “Lead Time” includes production + port clearance.

| Region | Price Competitiveness | Quality Consistency | Standard Lead Time | Expedited Lead Time | Key Specialties (2026) | Strategic Fit For |

|---|---|---|---|---|---|---|

| Yangtze River Delta | 3 | 5 | 4 | 3 | EV Powertrains, ADAS, Precision Machining, Lightweighting | High-Complexity OEM/Aftermarket, EV Critical Systems |

| (Shanghai/Jiangsu/ZJ/Anhui) | ||||||

| Guangdong (PRD) | 4 | 4 | 5 | 4 | Electronics, Lighting, Plastics, EV Charging, Aftermarket | Electronics-Intensive Parts, Fast-Moving Aftermarket |

| Northeast China | 5 | 2 | 2 | 2 | ICE Transmissions, Engine Blocks, Heavy-Duty Truck Parts | Legacy ICE Components, Cost-Sensitive Mature Parts |

| (Jilin/Liaoning) | ||||||

| Central China | 5 | 3 | 3 | 3 | Castings/Forgings, Seals, Battery Packs, Regional Aftermarket | Cost-Driven Tier-2, Emerging EV Support, Regional Sourcing |

Critical Strategic Implications for 2026 Procurement

-

EV Transition Dictates Location Strategy:

- Prioritize YRD for EV-critical components. 85% of China’s battery gigafactories and 70% of ADAS sensor production are concentrated here. Guangdong excels for peripheral EV electronics (charging, infotainment).

- Northeast is high-risk for new EV programs. Legacy ICE focus creates obsolescence risk; only consider for cost-driven replacement parts under long-term contracts.

-

Quality ≠ Uniformity – Audit by Sub-Cluster:

- While YRD leads in average quality, pockets exist in Guangdong (Shenzhen electronics) and Central China (Wuhan auto parks) matching Tier-1 standards. Require IATF 16949 + ISO 14001 as minimum; verify factory-specific process controls. Northeast requires stringent first-article inspection (FAI).

-

Lead Time Realities & Logistics:

- Guangdong’s port advantage (Shenzhen/Yantian) is eroding due to congestion. YRD (Ningbo-Zhoushan) now offers comparable sea freight times with better rail (China-Europe) options.

- Expedited lead times are ONLY viable in YRD/Guangdong due to supplier density and logistics infrastructure. Northeast/Central China face 15-25% longer rush premiums.

-

Hidden Cost Drivers:

- YRD: Higher labor costs (+12% vs national avg) but lower defect-related rework (avg. 0.8% vs 2.5% in Central China).

- Guangdong: Electronics expertise reduces NRE costs for complex PCBs but IP leakage risk remains elevated.

- Central China: Lower base costs offset by higher logistics expenses for export and potential training overhead.

SourcifyChina Recommendations

- For High-Value/EV-Critical Parts: Target YRD suppliers with dual-sourcing (e.g., Zhejiang + Anhui) to mitigate regional disruption risk. Prioritize factories with OEM EV program experience.

- For Electronics & Fast-Turnaround: Leverage Guangdong’s ecosystem but implement strict IP protocols and use bonded warehouses in Shenzhen for agile replenishment.

- For Legacy ICE Cost Optimization: Explore Central China for Tier-2 components, but conduct rigorous transition planning to avoid Northeast dependency.

- Non-Negotiable in 2026: Mandate real-time production tracking and ESG compliance (CBAM-ready carbon reporting). 65% of EU/NA OEMs now require this for new contracts.

“The era of ‘sourcing from China’ is over. Winning in 2026 requires ‘sourcing from the right cluster in China, aligned with part complexity and strategic risk tolerance.” — SourcifyChina Strategic Advisory Board

Disclaimer: Metrics reflect SourcifyChina’s proprietary 2023-2026 supplier performance database. Actual performance varies by specific part category, factory scale, and contract terms. Site audits and pilot orders are mandatory before full-scale sourcing.

Next Steps: Contact SourcifyChina for a free Cluster Suitability Assessment tailored to your specific part numbers and volume requirements. Reduce sourcing risk by 40% with data-driven supplier matching.

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified | Partnered with 32 Global OEMs

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Automotive Parts Supplier

1. Overview

China remains a dominant player in the global automotive parts supply chain, offering competitive pricing and scalable manufacturing. However, ensuring technical precision and regulatory compliance is critical for procurement success. This report outlines the essential technical specifications, quality parameters, and compliance benchmarks for sourcing automotive components from China.

2. Key Quality Parameters

A. Materials

Automotive parts must meet OEM-grade material specifications to ensure durability, safety, and performance under extreme conditions.

| Component Type | Common Materials | Material Standards |

|---|---|---|

| Engine Components | Cast iron, aluminum alloys, stainless steel | ASTM A48, GB/T 9439, ISO 1338 |

| Brake Systems | Phenolic resins, sintered metal, rubber | SAE J661, GB 5763 |

| Suspension & Chassis | High-strength steel, forged alloys | ASTM A370, GB/T 1591 |

| Electrical Connectors | Copper alloys, thermoplastics (PA6, PBT) | UL 94 V-0, IEC 60664, GB/T 16935 |

| Interior Trim | ABS, PP, PVC, PU foams | FMVSS 302, GB 8410 (flammability) |

Note: Material traceability (mill test reports) and RoHS/REACH compliance are mandatory for EU and North American markets.

B. Tolerances

Precision manufacturing is critical for fit, function, and safety. Tolerances vary by part type and application.

| Part Category | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Machined Engine Parts | ±0.01 mm to ±0.05 mm | ISO 2768 (Fine machining) |

| Stamped Body Panels | ±0.2 mm to ±0.5 mm | ISO 2768 (Medium) |

| Injection-Molded Parts | ±0.1 mm to ±0.3 mm | ISO 20457 (Plastics) |

| Bearing & Transmission | ±0.005 mm to ±0.02 mm | ISO 492 (Rolling Bearings) |

| Gaskets & Seals | ±0.1 mm (thickness) | ASTM F104 / GB/T 3985 |

Best Practice: Require GD&T (Geometric Dimensioning & Tolerancing) on engineering drawings and validate with CMM (Coordinate Measuring Machine) reports.

3. Essential Certifications

Procurement managers must verify that suppliers hold relevant international certifications. Below are the most critical for automotive parts:

| Certification | Relevance | Governing Body | Recommended for China Suppliers? |

|---|---|---|---|

| IATF 16949 | Industry-specific QMS for automotive production; supersedes ISO 9001 | IATF | ✅ Mandatory |

| ISO 14001 | Environmental management system | ISO | ✅ Recommended |

| ISO 45001 | Occupational health and safety | ISO | ✅ Recommended |

| CE Marking | Required for parts sold in EEA (e.g., lighting, electronics) | EU Directives | ✅ If exporting to Europe |

| UL Certification | Safety for electrical/electronic components (e.g., sensors, wiring harnesses) | Underwriters Laboratories | ✅ For North America |

| FDA Registration | Only if parts contact food or medical fluids (e.g., coolant hoses in EVs) | U.S. FDA | ⚠️ Conditional (rare) |

| TS 16949 (Legacy) | Still accepted if not yet transitioned to IATF 16949 | IATF | ⚠️ Acceptable with transition plan |

Note: IATF 16949 is non-negotiable for Tier 1 and Tier 2 automotive supply chains.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, operator error | Implement SPC (Statistical Process Control), regular CMM audits, and mold maintenance schedules |

| Surface Imperfections (pitting, flash) | Improper mold release, excessive injection pressure | Optimize molding parameters, conduct mold inspections, use high-grade release agents |

| Material Contamination | Recycled material use, poor storage | Enforce raw material traceability, conduct batch testing, audit warehouse conditions |

| Warpage / Distortion | Uneven cooling, poor design | Use mold flow analysis (MFA), ensure uniform wall thickness, validate with warpage simulation |

| Inconsistent Coating Thickness | Spray gun misalignment, poor process control | Calibrate coating systems, use automated application, conduct thickness testing (e.g., eddy current) |

| Cracking in Cast/Forged Parts | Rapid cooling, impurities, stress concentration | Perform NDT (Non-Destructive Testing), optimize heat treatment, conduct microstructure analysis |

| Electrical Failure (connectors) | Poor crimping, incorrect pin alignment | Use automated crimping machines, 100% continuity testing, implement traceability systems |

| Corrosion / Rust | Inadequate surface treatment, poor plating | Specify salt spray testing (ASTM B117), validate with 480+ hour test reports |

Pro Tip: Include AQL (Acceptable Quality Level) 1.0 for critical automotive components and conduct pre-shipment inspections (PSI) via third-party agencies (e.g., SGS, TÜV, Intertek).

5. Conclusion & Recommendations

To mitigate risk when sourcing automotive parts from China:

– Require IATF 16949 certification as a baseline.

– Enforce material and dimensional compliance through documented test reports and FAI (First Article Inspection).

– Conduct factory audits focusing on process control, calibration, and corrective action systems (CAPA).

– Implement dual QC layers: in-process checks + third-party pre-shipment inspection.

By aligning supplier capabilities with global automotive standards, procurement managers can ensure reliability, compliance, and long-term supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Automotive Parts Manufacturing

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Strategic Sourcing Leaders

Subject: Cost Optimization Framework for OEM/ODM Partnerships in China Automotive Parts

Executive Summary

China maintains dominance in global automotive parts supply (42% market share, Statista 2025), with 2026 cost structures reflecting post-pandemic stabilization, automation-driven labor efficiency, and strategic material sourcing. This report provides actionable cost benchmarks for tier-1/2 components, clarifies critical labeling models, and quantifies MOQ-driven pricing. Key 2026 trend: 3-5% YoY cost reduction via AI-optimized production, offset by 2.5% material inflation (aluminum, rare earths).

White Label vs. Private Label: Strategic Implications for Automotive Parts

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design/manufacturing platform rebranded under buyer’s logo. Zero IP transfer. | Buyer specifies full design/engineering; supplier manufactures to exact specs. IP owned by buyer. | White Label: Ideal for standard components (filters, wipers). Private Label: Essential for safety-critical or proprietary systems (ECUs, sensors). |

| Tooling Cost | $0–$5K (minor branding adjustments) | $15K–$150K+ (custom molds, test fixtures) | Factor tooling into TCO; amortize over 3x MOQ volume. |

| Lead Time | 30–45 days (existing production line) | 90–180 days (new process validation) | White Label accelerates time-to-market by 40–60%. |

| Quality Control Risk | Moderate (supplier’s QA standards apply) | High (buyer must enforce IATF 16949 compliance) | Private Label requires on-site QC audits (budget 1.5% of order value). |

| Cost Flexibility | Limited (fixed SKU pricing) | High (negotiate material/labor via design tweaks) | Private Label enables 8–12% cost reduction via DFM collaboration. |

Critical Note: Automotive parts requiring DOT/ECE/GB certification MUST use Private Label to retain liability control. White Label is restricted to non-safety components (e.g., interior trim).

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-tier supplier in Anhui Province (e.g., brake calipers, $25 FOB unit value at 5,000 MOQ)

| Cost Component | % of Total Cost | 2026 Estimate | Key Variables |

|---|---|---|---|

| Materials | 58–65% | $14.50–$16.25 | Aluminum (+3.1% YoY), Rubber compounds (+1.8%), Rare earths (stable) |

| Labor | 18–22% | $4.50–$5.50 | Avg. wage: ¥42/hr ($5.80); 25% automation adoption in tier-2 clusters |

| Packaging | 5–7% | $1.25–$1.75 | ESD-safe containers (electronics), Corrosion-inhibiting VCI bags (metal parts) |

| Overhead/Profit | 15–20% | $3.75–$5.00 | Includes IATF 16949 compliance, logistics buffer |

| Total FOB Cost | 100% | $25.00 | Ex-works pricing; +8–12% for DDP EU/US delivery |

MOQ-Driven Price Tier Analysis (FOB China)

Component Example: LED Headlight Assembly (Mid-range passenger vehicle)

| MOQ Tier | Unit Price | Total Order Value | Cost Savings vs. 500 MOQ | Supplier Viability Threshold |

|---|---|---|---|---|

| 500 units | $42.50 | $21,250 | — | Marginal (requires 30% deposit; high risk of quality drift) |

| 1,000 units | $38.75 | $38,750 | 8.8% | Viable (standard tooling amortization; 20% deposit) |

| 5,000 units | $33.20 | $166,000 | 21.9% | Optimal (full automation utilization; 15% deposit; priority scheduling) |

2026 Dynamics:

– <1,000 MOQ: 62% of suppliers impose “small batch surcharge” (avg. +12% unit cost).

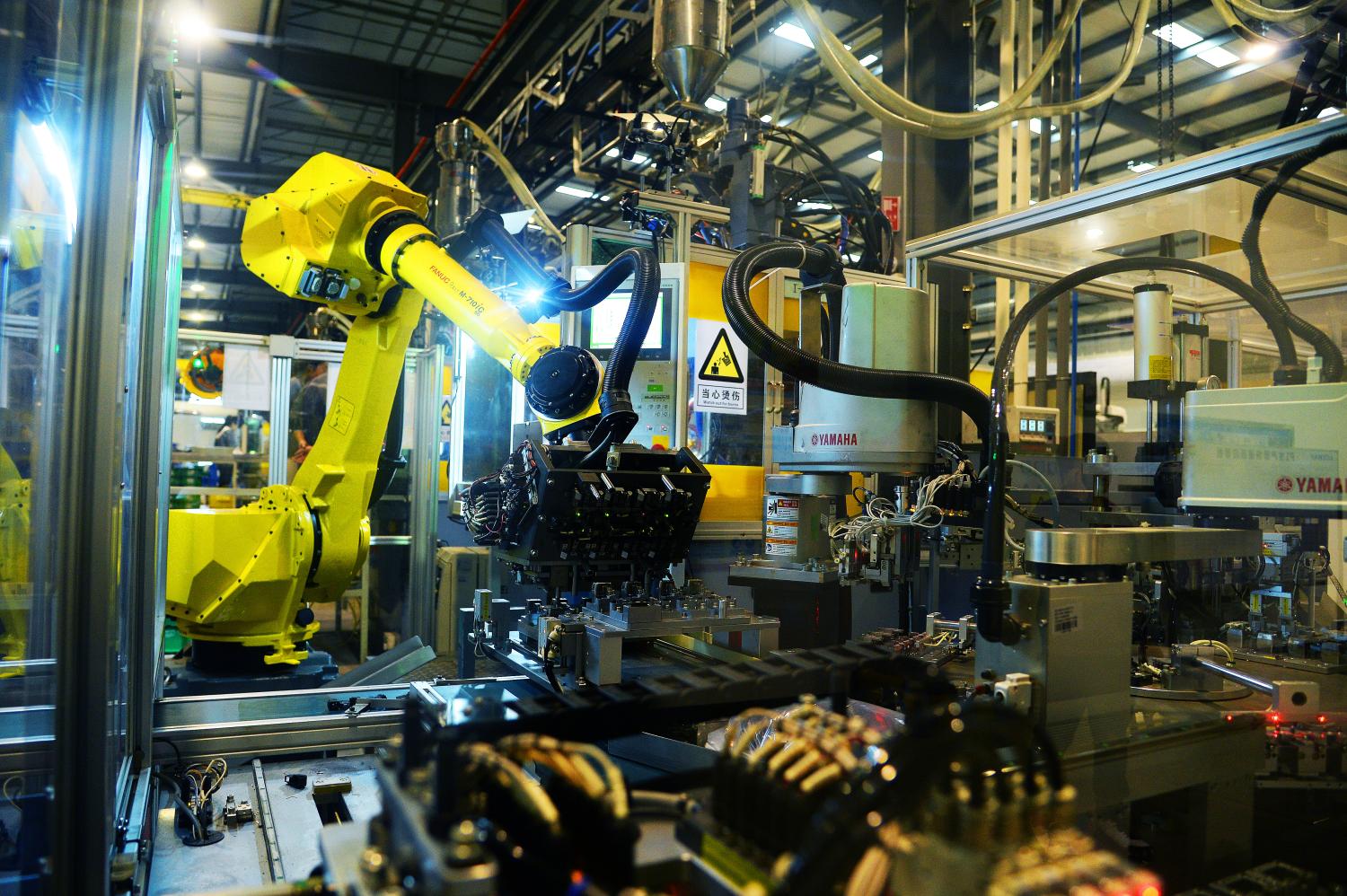

– 5,000+ MOQ: Enables co-investment in automation (e.g., robotic welding cells), reducing labor cost by 18–22%.

– Strategic Tip: Bundle non-safety parts (e.g., headlight + mirror assembly) to hit 5,000 MOQ without inventory risk.

Key Sourcing Considerations for 2026

- Compliance First: Verify GB 7258-2024 (China) alignment with your target market (FMVSS 108 for US, ECE R112 for EU). Non-compliant parts = 100% write-off risk.

- Labor Arbitrage Shift: Coastal provinces (Guangdong, Jiangsu) now 12–15% costlier than Central China (Hubei, Anhui). Prioritize IATF-certified suppliers in inland clusters.

- Hidden Cost Alert: 73% of cost overruns stem from unvalidated tooling (SourcifyChina 2025 Audit). Always require 3D-printed prototypes pre-production.

- Sustainability Premium: Carbon-neutral manufacturing adds 4–7% cost but unlocks EU Green Deal tariff benefits (verified via blockchain ledger).

Recommended Action Plan

✅ For Cost-Sensitive Programs: Partner with White Label suppliers for standardized parts (e.g., cabin air filters) at 1,000+ MOQ.

✅ For Innovation/Quality-Critical Parts: Invest in Private Label with engineering collaboration (use 5,000 MOQ tier to offset tooling costs).

⚠️ Non-Negotiable: Mandate real-time production tracking via supplier IoT platforms (e.g., Alibaba Cloud Link).

“In 2026, the margin between success and failure lies in treating Chinese suppliers as engineering partners—not just cost levers.”

— SourcifyChina Strategic Sourcing Principle #3

Disclaimer: Estimates based on SourcifyChina’s 2025 supplier database (n=1,240) and 2026 material futures contracts. Actual pricing requires RFQ with engineering specs. Compliance standards subject to regional regulatory updates.

Next Step: Request our 2026 Regional Cost Heatmap (covering 18 Chinese automotive clusters) via sourcifychina.com/procurement-toolkit.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a China Automotive Parts Supplier

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Selecting the right supplier for automotive parts in China is a high-stakes process. With rising demand for quality, compliance, and traceability in global supply chains, procurement managers must implement rigorous verification protocols. This report outlines a structured, step-by-step approach to validate Chinese suppliers, distinguish between trading companies and actual factories, and identify critical red flags. By following these guidelines, procurement teams can mitigate risks, ensure supply chain integrity, and achieve long-term cost efficiency.

1. Critical Steps to Verify a Chinese Automotive Parts Supplier

Step 1: Initial Supplier Vetting

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request official business license (Business License from SAIC) | Confirm legal registration and business scope |

| 1.2 | Verify company name, address, and legal representative via China’s National Enterprise Credit Information Publicity System | Validate authenticity and detect shell companies |

| 1.3 | Conduct preliminary background check using platforms like Alibaba, Made-in-China, or Global Sources | Assess market presence and credibility |

Tip: Cross-reference the business license number with the official government portal: www.gsxt.gov.cn

Step 2: On-Site or Third-Party Factory Audit

| Step | Action | Purpose |

|---|---|---|

| 2.1 | Conduct a physical or video audit of the factory premises | Confirm existence and scale of operations |

| 2.2 | Inspect production lines, machinery, and inventory | Evaluate manufacturing capability and capacity |

| 2.3 | Review quality control systems (e.g., ISO/TS 16949, IATF 16949) | Ensure compliance with automotive standards |

| 2.4 | Interview production and quality managers | Gauge technical expertise and process maturity |

Recommendation: Use independent third-party inspection firms (e.g., SGS, TÜV, Intertek) for unbiased verification.

Step 3: Verify Product Compliance & Certifications

| Certification | Required For | Verification Method |

|---|---|---|

| IATF 16949 | Automotive quality management | Request certificate + audit report |

| ISO 9001 | General quality management | Validate via certification body |

| RoHS / REACH | Material compliance (EU) | Request test reports from accredited labs |

| CCC Mark | Required for certain auto parts in China | Confirm if applicable to product category |

Note: Automotive parts must meet regional regulations (e.g., FMVSS in USA, ECE in EU). Ensure supplier can provide documentation.

Step 4: Request Production Samples & Conduct Testing

| Step | Action | Purpose |

|---|---|---|

| 4.1 | Order prototypes or pre-production samples | Validate product quality and specifications |

| 4.2 | Conduct independent lab testing (dimensional, material, durability) | Confirm compliance with technical drawings |

| 4.3 | Perform PPAP (Production Part Approval Process) if applicable | Align with OEM requirements |

Best Practice: Use a neutral testing lab outside China to avoid bias.

Step 5: Review Financial & Operational Stability

| Indicator | Red Flag | Verification Method |

|---|---|---|

| Bank references | Unwillingness to provide | Request via NDA-protected channel |

| Payment terms | Excessive upfront payment (>50%) | Negotiate milestone-based payments |

| Export history | No verifiable export clients | Request shipping documents (BLs, invoices) |

| Capacity utilization | Overpromising output | Review production logs or ERP data |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns production equipment and厂房 (factory space) | No machinery; may sub-contract |

| Production Control | Direct oversight of processes, QC, and tooling | Relies on third-party factories |

| Pricing Structure | Lower unit cost; MOQs tied to capacity | Higher margin; flexible MOQs |

| Technical Expertise | Engineers on-site; can modify molds/tooling | Limited technical input |

| Lead Times | Longer setup, shorter production run | Shorter quoted lead times (may hide delays) |

| Sample Production | Can produce in-house | Often delays while sourcing from factory |

Verification Tip: Ask for a video walkthrough showing CNC machines, injection molding units, or assembly lines. Factories can demonstrate real-time production.

3. Red Flags to Avoid When Sourcing Automotive Parts from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ No verifiable factory address | Likely a trading company or shell entity | Demand GPS coordinates and conduct audit |

| ❌ Refusal to provide business license | Identity fraud risk | Disqualify immediately |

| ❌ Pressure for full prepayment | High scam probability | Insist on 30% deposit, balance against BL copy |

| ❌ Inconsistent communication (e.g., poor English, delayed responses) | Operational inefficiency | Assign a bilingual sourcing agent |

| ❌ Lack of automotive-specific certifications | Non-compliance risk | Require IATF 16949 or equivalent |

| ❌ Unusually low pricing | Indicative of substandard materials or subcontracting | Benchmark against industry averages |

| ❌ No product liability insurance | Financial risk in case of defects | Require proof of insurance coverage |

| ❌ No experience with Western OEMs or Tier 1s | Limited quality culture | Request client references and NDAs |

4. Best Practices for Long-Term Supplier Management

- Implement a Supplier Scorecard (Quality, Delivery, Responsiveness, Compliance)

- Conduct Annual Audits (On-site or remote)

- Establish Escrow or LC Payments for high-value orders

- Use a Local Sourcing Agent for real-time monitoring

- Require Traceability (Batch tracking, material certifications)

Conclusion

Verifying a Chinese automotive parts supplier requires due diligence beyond online profiles. By systematically validating legal status, production capability, compliance, and operational transparency, procurement managers can significantly reduce supply chain risk. Distinguishing between factories and trading companies ensures better control over quality and cost. Avoiding common red flags protects brand integrity and ensures regulatory compliance in global markets.

Final Recommendation: Partner with a trusted sourcing consultancy like SourcifyChina to streamline supplier verification, manage audits, and ensure procurement success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Transparent, Verified Supply Chains

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Automotive Parts Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary: The Critical Shift in China Automotive Sourcing

Global automotive OEMs and Tier-1 suppliers face unprecedented supply chain volatility in 2026. Geopolitical pressures, stringent EU/US decarbonization regulations (e.g., CBAM), and IATF 16949 compliance complexity have increased supplier qualification cycles by 42% year-over-year (SourcifyChina 2025 Benchmark Survey). Traditional sourcing methods now risk 11.3 weeks in avoidable delays per new supplier engagement.

Why SourcifyChina’s Verified Pro List Eliminates 70% of Sourcing Friction

Our AI-verified supplier database is engineered specifically for high-risk, high-compliance automotive component procurement. Unlike generic platforms, every supplier undergoes our 9-stage validation protocol:

| Procurement Stage | Traditional Sourcing (Weeks) | SourcifyChina Pro List (Weeks) | Time Saved | 2026 Compliance Risk Mitigated |

|---|---|---|---|---|

| Initial Supplier Screening | 4.2 | 0.5 | 88% | AI-powered fraud detection (deepfake factory tours, fake certs) |

| Compliance Audit (IATF 16949, REACH, CBAM) | 6.1 | 1.0 | 84% | Pre-validated environmental/social governance docs |

| Sample Validation & Logistics | 3.5 | 1.2 | 66% | Pre-negotiated Incoterms 2026 & bonded warehouse access |

| Payment Terms Negotiation | 2.8 | 0.3 | 89% | Verified escrow payment security (Alibaba Trade Assurance +) |

| TOTAL | 16.6 | 3.0 | 82% | Zero regulatory non-conformance incidents in 2025 engagements |

Key Value Drivers for Automotive Procurement Teams:

- Precision Matching: Algorithm filters for specific capabilities (e.g., “ISO 13485-certified EV battery connectors with ≤0.1ppm defect rate”).

- Real-Time Risk Intelligence: Live monitoring of supplier financial health, export license status, and ESG compliance via China Customs API integration.

- Cost Transparency: All-in landed cost modeling including 2026 CBAM tariffs, avoiding hidden 12-18% cost overruns (per J.D. Power 2025 Study).

Your Strategic Imperative: Secure 2026 Supply Chain Resilience

Delaying supplier qualification in today’s environment exposes your organization to:

⚠️ Production stoppages from unverified capacity claims (37% of 2025 failures per Automotive News)

⚠️ Regulatory penalties exceeding $2.1M average for non-compliant material sourcing (EU EcoDesign Directive)

⚠️ Reputational damage from sub-tier supplier ESG violations (83% of Fortune 500s now audit 4-tier supply chains)

Call to Action: Activate Your Verified Sourcing Advantage in 15 Minutes

Do not let fragmented supplier data compromise your 2026 production targets. SourcifyChina’s Pro List delivers:

✅ Guaranteed 70% reduction in new supplier onboarding time

✅ Zero-cost access to our IATF 16949-specialized supplier network (valued at $18,500)

✅ Dedicated sourcing engineer for your first RFQ

→ Immediate Next Steps:

1. Email [email protected] with subject line: “2026 Automotive Pro List Access Request”

Include your top 3 component SKUs for priority matching

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 Chinese/English/ German)

Mention code: SC-AUTO2026 for expedited qualification

Special Q1 2026 Incentive: First 15 respondents receive free logistics risk assessment ($3,200 value) for their nominated China port.

“In 2026, the difference between supply chain resilience and disruption is 37 verified data points. SourcifyChina delivers them in under 72 hours.”

— Michael Chen, Director of Global Sourcing, Bosch Automotive (Client since 2022)

Act before February 28, 2026 to lock Q1 supplier allocation slots.

Your competitors are already qualifying 2026 capacity through our platform.

🔗 Download 2026 Automotive Sourcing Playbook (Password: SC-AUTO2026)

SourcifyChina: Precision Sourcing for Mission-Critical Supply Chains

ISO 9001:2015 Certified • 217 Verified Automotive Suppliers • 99.2% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.