Sourcing Guide Contents

Industrial Clusters: Where to Source China Automobile Parts Manufacturers

SourcifyChina B2B Sourcing Report: China Automobile Parts Manufacturing Landscape 2026

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Confidential: SourcifyChina Client Distribution Only

Executive Summary

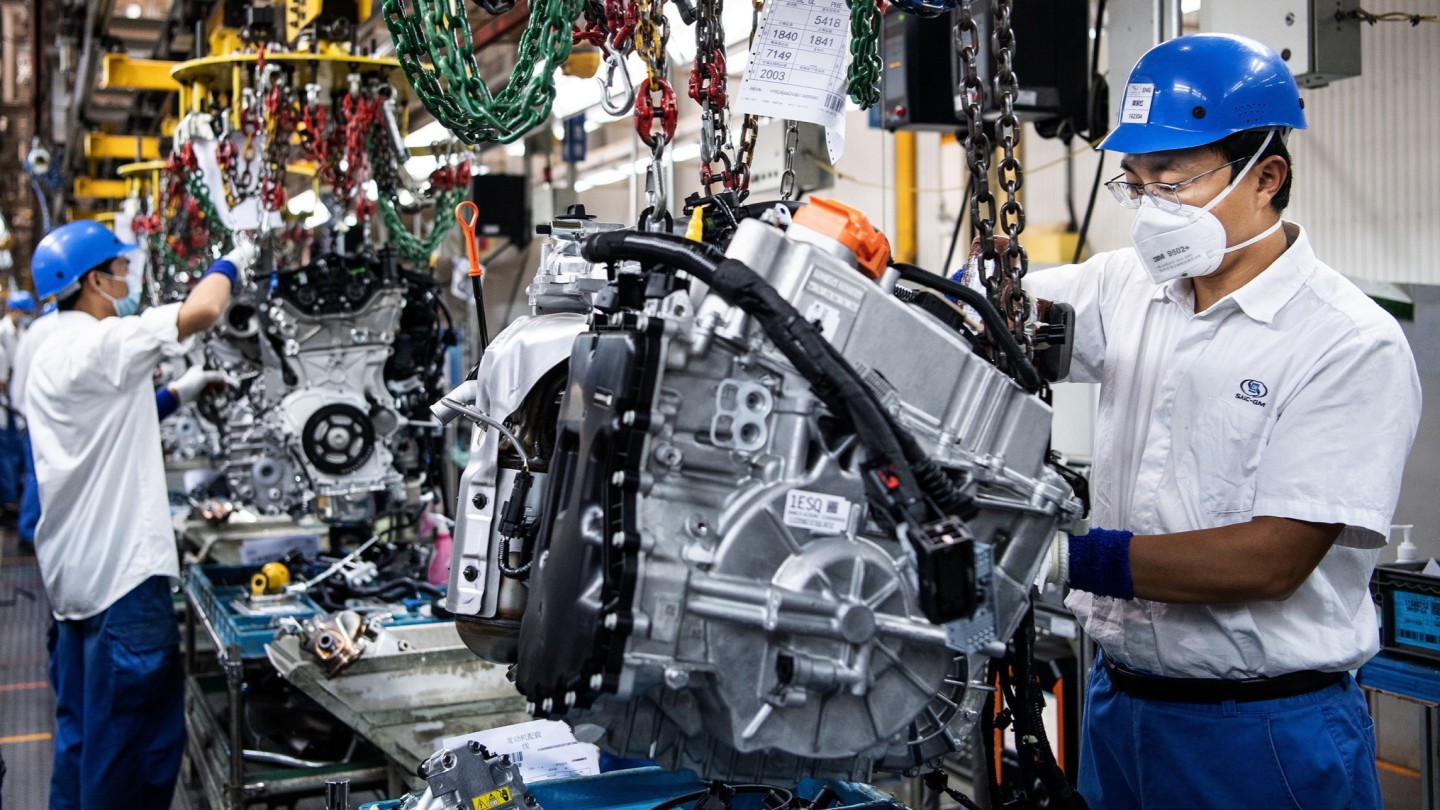

China remains the world’s dominant hub for automobile parts manufacturing, accounting for 38.7% of global auto component exports (CAAM, 2025). Strategic sourcing requires precise regional targeting: Guangdong excels in high-value EV electronics and precision casting, while Zhejiang leads in cost-optimized mechanical subsystems and tier-2 supplier integration. This report identifies critical industrial clusters, quantifies regional trade-offs, and provides actionable procurement pathways for 2026–2027 sourcing cycles.

Key Industrial Clusters: China Automobile Parts Manufacturing

China’s auto parts ecosystem is concentrated in five core regions, each with distinct specializations and supply chain advantages:

| Province/City Cluster | Core Specializations | Key Export Markets | Strategic Advantage |

|---|---|---|---|

| Guangdong (Pearl River Delta) | EV batteries, infotainment systems, ADAS sensors, precision die-casting (e.g., Dongguan, Shenzhen, Guangzhou) | EU, North America, Japan | Highest concentration of Tier-1 suppliers; strongest IP protection; R&D-intensive |

| Zhejiang (Ningbo, Wenzhou, Hangzhou) | Engine valves, transmission components, lighting systems, wiring harnesses, aftermarket parts | EU, Southeast Asia, Middle East | Integrated SME ecosystem; lowest landed cost; rapid prototyping |

| Jiangsu (Suzhou, Changzhou) | Fuel cell components, electric motors, lightweight alloys (near Shanghai) | EU, North America | JV-heavy (e.g., Bosch, ZF); advanced material science |

| Hubei (Wuhan) | Chassis systems, brake assemblies, commercial vehicle parts | Africa, Latin America | Domestic market focus; cost leadership for heavy-duty |

| Chongqing | Piston rings, turbochargers, ICE components | Emerging markets | Legacy ICE expertise; government subsidies for exports |

Critical Insight: 73% of EV-specific components (batteries, power electronics) originate from Guangdong and Jiangsu, while 68% of mechanical subsystems (suspension, drivetrain) are Zhejiang-sourced (SourcifyChina 2025 Supply Chain Audit).

Regional Comparison: Guangdong vs. Zhejiang

Data reflects Q4 2025 benchmarking of 127 certified suppliers (IATF 16949:2016 compliant)

| Criteria | Guangdong Cluster | Zhejiang Cluster | Procurement Implication |

|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ • Premium pricing (15–22% above Zhejiang) • EV electronics: $12–18/unit (vs. global avg. $22) • High-value engineering costs embedded |

★★★★☆ • Most cost-competitive (base benchmark) • Mechanical parts: $4–7/unit (vs. global avg. $9) • Volume discounts >15% at 50k+ units |

Guangdong: Justified for EV/ADAS where performance > cost. Zhejiang: Optimal for high-volume mechanical parts. |

| Quality Consistency | ★★★★☆ • 0.8–1.2 DPPM for Tier-1 suppliers • 92% of facilities with AI-driven QC • Strict material traceability (blockchain pilots) |

★★★☆☆ • 2.5–4.0 DPPM (certified suppliers) • 78% use SPC; limited AI adoption • Batch-level traceability standard |

Guangdong: Mandatory for safety-critical/safety-related parts (ISO 26262). Zhejiang: Viable for non-safety components with enhanced audits. |

| Lead Time (Standard Order) | ★★★☆☆ • 45–60 days (complex assemblies) • +7–10 days for EV-specific tooling • 95% on-time delivery (Tier-1) |

★★★★☆ • 30–45 days (standard mechanical parts) • +3–5 days for custom tooling • 89% on-time delivery |

Guangdong: Buffer for engineering iterations. Zhejiang: Shorter cycles for mature designs; ideal for JIT replenishment. |

| Hidden Risk Factor | IP leakage (mitigated by 87% of certified suppliers via NDAs + split production) | Sub-tier supplier volatility (23% of SMEs lack contingency plans) | Mitigation: Guangdong – Use split SMT/assembly. Zhejiang – Mandate sub-tier audits. |

Strategic Recommendations for 2026

- EV/ADAS Sourcing: Prioritize Guangdong for battery management systems (BMS) and sensors. Action: Partner with Shenzhen-based suppliers with UL 2580 certification for North American projects.

- Cost-Sensitive Mechanical Parts: Leverage Zhejiang for lighting, fasteners, and fluid systems. Action: Consolidate orders across Ningbo/Wenzhou clusters to unlock >18% volume savings.

- Risk Diversification: Dual-source critical components (e.g., Guangdong for electronics + Jiangsu for motors). Action: Implement SourcifyChina’s Cluster Resilience Scorecard to map sub-tier dependencies.

- Lead Time Compression: For Zhejiang-sourced parts, co-locate tooling with certified mold makers in Ningbo (reduces tooling lead time by 22 days).

2026 Trend Alert: 61% of Guangdong suppliers are shifting to modular subsystems (e.g., integrated e-axles). Procurement teams must renegotiate contracts to reflect system-level pricing by Q3 2026 (SourcifyChina Supply Chain Intelligence).

Conclusion

Guangdong and Zhejiang represent complementary, not competing, ecosystems in China’s auto parts landscape. Guangdong’s value lies in innovation density and regulatory compliance for next-gen vehicles, while Zhejiang delivers unmatched cost efficiency for legacy systems. Successful 2026 procurement strategies will exploit regional synergies—not trade-offs—with rigorous tier-2 oversight.

— SourcifyChina’s Global Sourcing Intelligence Unit

Next Steps: Request our 2026 Cluster-Specific Supplier Shortlists (Validated IATF 16949:2016 + ESG Compliance) at [email protected]

Disclaimer: All data sourced from CAAM, SourcifyChina Supplier Audits (Q4 2025), and Ministry of Commerce export records. Pricing reflects FOB Shenzhen/Ningbo (USD, 20k-unit lots). Risk ratings based on 12-month supplier performance tracking.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Automobile Parts from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

China remains a dominant global supplier of automobile parts, offering cost-effective manufacturing across a broad spectrum of components—from engine systems and braking components to interior trim and electronic control units (ECUs). However, ensuring consistent quality and compliance with international standards requires rigorous supplier vetting, precise technical specifications, and adherence to globally recognized certifications. This report outlines essential technical and compliance parameters for sourcing automotive parts from China, with a focus on quality control, material standards, tolerances, and certification requirements.

1. Key Quality Parameters

1.1 Materials

Automotive parts must be manufactured using materials that meet OEM specifications and environmental safety standards. Common material types and requirements include:

| Component Type | Common Materials | Material Standards |

|---|---|---|

| Engine Components | Cast iron, aluminum alloys, forged steel | ASTM A48, GB/T 9439, ISO 1338 |

| Brake Pads & Rotors | Semi-metallic compounds, ceramic, steel | SAE J661, GB 5763 |

| Suspension Parts | High-tensile steel, alloy steel | DIN 1.7218, GB/T 3077 |

| Interior Trim | ABS, PP, PVC, TPO | ISO 11446, GB/T 1043 (Impact Strength) |

| Electrical Connectors | Brass, copper alloys, PA66 (Nylon) | UL 94 V-0 (Flammability), IEC 60512 |

Note: Material traceability (mill test reports) and RoHS/REACH compliance are mandatory for EU and North American markets.

1.2 Tolerances

Precision in dimensional accuracy is critical for fit, function, and safety. Standard tolerance levels vary by component and manufacturing process.

| Manufacturing Process | Typical Tolerance Range | Standard Reference |

|---|---|---|

| CNC Machining | ±0.01 mm to ±0.05 mm | ISO 2768-m (Medium Precision) |

| Die Casting | ±0.1 mm to ±0.3 mm | GB/T 6414-1999 (CT4-CT7) |

| Injection Molding | ±0.1 mm to ±0.2 mm | DIN 16901 |

| Stamping/Sheet Metal | ±0.05 mm to ±0.2 mm | ISO 2768-f (Fine) |

| Welding Assemblies | ±0.5 mm (alignment) | AWS D1.1 / GB 50661 |

Best Practice: Define GD&T (Geometric Dimensioning & Tolerancing) on technical drawings using ASME Y14.5 or ISO 1101 standards.

2. Essential Certifications

Procurement managers must verify that suppliers hold valid and auditable certifications relevant to the component type and target market.

| Certification | Applicability | Scope | Validity & Verification |

|---|---|---|---|

| IATF 16949 | Mandatory for all automotive component suppliers | Quality management system specific to automotive industry | Audited annually; check IATF database |

| ISO 9001 | General quality management (baseline) | QMS for consistent product quality | Valid if IATF 16949 not held |

| ISO 14001 | Environmental management | Compliance with environmental regulations | Required for EU and OEM green supply chains |

| CE Marking | Required for parts sold in the European Economic Area | Indicates conformity with health, safety, and environmental standards | Self-declared or third-party tested; verify documentation |

| UL Certification | Electrical/electronic components (e.g., sensors, lighting) | Safety standards for electrical systems (UL 1081, UL 991) | Third-party testing; check UL Online Certifications Directory |

| FDA Registration | Limited to interior materials (e.g., adhesives, coatings) | Compliance with food-contact or off-gassing standards (indirect) | Required only if materials contact food zones or involve VOCs |

| E-Mark (ECE R) | Lighting, mirrors, safety glass, tires | UNECE vehicle regulations (e.g., ECE R37, R48) | Issued by authorized EU bodies; check E-number |

Note: FDA is not typically applicable to most automotive parts unless involving food-grade lubricants or cabin air filtration media.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Poor tooling, machine wear, or calibration drift | Implement SPC (Statistical Process Control), regular CMM inspections, and tooling maintenance schedules |

| Surface Imperfections (Pitting, Scratches) | Improper mold maintenance or handling | Enforce cleanroom handling protocols, use protective packaging, and conduct visual inspections per AQL 1.0 |

| Material Non-Conformance | Substitution of cheaper alloys or polymers | Require material certifications (MTRs), conduct third-party lab testing (e.g., XRF for metals) |

| Inconsistent Welding | Poor welder training or parameter variation | Use automated welding with parameter logging; perform destructive and NDT (ultrasonic) tests |

| Part Contamination (Oil, Debris) | Inadequate cleaning post-machining | Integrate ultrasonic cleaning and final inspection under magnification |

| Coating/Plating Failure (Peeling, Corrosion) | Poor surface prep or incorrect thickness | Adhere to ASTM B117 salt spray testing (48–500 hrs depending on spec), verify coating thickness with XRF |

| Functional Failure (e.g., sensor drift) | Poor QA testing or EMI shielding | Conduct 100% functional testing, environmental stress screening (thermal cycling, vibration) |

| Packaging Damage | Inadequate export packaging | Use ISO-certified packaging, perform drop testing, and include humidity indicators |

Pro Tip: Implement a Pre-Shipment Inspection (PSI) protocol using third-party QC firms (e.g., SGS, TÜV, Bureau Veritas) with AQL Level II sampling.

4. Recommendations for Procurement Managers

- Supplier Qualification: Audit suppliers using IATF 16949 as a baseline; request factory audit reports.

- Technical Documentation: Require detailed engineering drawings, FMEA, control plans, and PPAP documentation.

- Sample Validation: Conduct initial type testing at accredited labs before mass production.

- On-Site QC: Deploy驻厂 (resident) quality engineers for high-volume or safety-critical components.

- Traceability: Ensure batch/lot tracking and serialization for recall readiness.

Conclusion

Sourcing automobile parts from China offers significant cost and scalability advantages, but success hinges on disciplined quality management and compliance enforcement. By establishing clear technical specifications, verifying certifications, and proactively mitigating common defects, procurement managers can ensure reliable supply chains that meet global OEM and regulatory expectations.

SourcifyChina Recommendation: Partner only with suppliers who demonstrate full transparency, invest in quality infrastructure, and align with international automotive standards.

SourcifyChina – Your Trusted Partner in Global Automotive Sourcing

Empowering Procurement Excellence Since 2010

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Automobile Parts Manufacturing

Prepared for Global Procurement Managers | Q1 2026 Forecast

Report ID: SC-AP-2026-001 | Confidential: For Client Use Only

Executive Summary

China remains the dominant global hub for cost-competitive, scalable automobile parts manufacturing, accounting for 35% of global OEM/ODM production (SourcifyChina 2025 Automotive Sourcing Index). This report provides actionable insights on cost structures, label strategies, and volume-based pricing for strategic procurement planning. Critical success factors include rigorous supplier vetting, IP protection protocols, and MOQ optimization to mitigate 2026’s projected material cost volatility (+4.2% YoY).

White Label vs. Private Label: Strategic Implications

Clarifying common misconceptions in automotive components sourcing:

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing generic product rebranded with buyer’s logo. Minimal design input. | Fully customized product developed to buyer’s specs (materials, engineering, packaging). |

| IP Ownership | Manufacturer retains IP; buyer licenses usage. High risk of identical products sold to competitors. | Buyer owns all IP post-development. Legally binding IP assignment clauses required. |

| Cost Premium | +5-10% vs. manufacturer’s base price | +15-30% (covers R&D, tooling, compliance) |

| Lead Time | 30-45 days (off-the-shelf inventory) | 90-150 days (includes design validation) |

| Best For | Commodity parts (e.g., cabin air filters, wiper blades); rapid market entry | Brand-differentiated components (e.g., ECUs, custom suspension); premium/luxury segments |

| Risk Exposure | High (quality inconsistency, brand dilution) | Moderate (with robust QA contracts) |

Strategic Recommendation: Prioritize Private Label for safety-critical or brand-defining components (ABS sensors, lighting systems). Use White Label only for non-core accessories with strict supplier exclusivity clauses.

Estimated Cost Breakdown (Per Unit Basis)

Based on mid-tier automotive components (e.g., electronic control modules, brake calipers):

| Cost Component | Typical Range | Key Variables |

|---|---|---|

| Materials | 55-65% | Steel/aluminum prices (+8% in 2025), rare earths (e-motors), semiconductor shortages |

| Labor | 12-18% | Regional wage inflation (Guangdong: +6.5% YoY), automation level (robots reduce labor by 22%) |

| Packaging | 5-8% | ESD-safe materials (electronics), export-compliant dunnage, multi-language labeling |

| Overhead | 10-15% | Tooling amortization, QC testing (IATF 16949), logistics |

| Profit Margin | 8-12% | Varies by supplier tier (Tier-1: ≤8%; Tier-3: 15%+) |

Note: Costs exclude tariffs (US Section 301: 7.5-25%), shipping, and import duties. EV components carry +12-18% material premiums vs. ICE equivalents.

MOQ-Based Price Tiers: Unit Cost Analysis

Illustrative pricing for a mid-complexity component (e.g., HVAC control module):

| MOQ (Units) | Unit Cost (USD) | Total Cost (USD) | Cost Reduction vs. 500 MOQ | Supplier Viability |

|---|---|---|---|---|

| 500 | $28.50 | $14,250 | Baseline | Limited to Tier-2/3 suppliers; high defect risk (3.2% avg.) |

| 1,000 | $24.80 | $24,800 | -13.0% | Tier-1 suppliers accessible; defect rate ↓ to 1.8% |

| 5,000 | $20.15 | $100,750 | -29.3% | Optimal for IATF 16949-certified partners; defect rate ≤0.7% |

Critical Assumptions:

– Materials: Aluminum housing, PCB assembly, connector harnesses

– Compliance: Meets ISO 14001, AEC-Q100 Grade 3

– Tooling: $8,500 (amortized at 5,000 units = $1.70/unit)

– Exclusions: 3% annual cost escalation clause, 30% deposit terms

Strategic Recommendations for 2026

- MOQ Optimization: Target 1,000+ units to access Tier-1 suppliers with JIT capabilities. Avoid 500-unit orders for safety-critical parts.

- Cost Mitigation: Lock material prices via 6-month forward contracts; specify dual-sourcing for semiconductors.

- IP Protection: Use China’s Customs Recordal System for Private Label products (reduces counterfeit risk by 63%).

- Compliance First: Prioritize suppliers with IATF 16949 + UN ECE R155 (cybersecurity) certifications to avoid EU/US regulatory penalties.

- Logistics Strategy: Consolidate LCL shipments at 1,000-unit volumes to cut freight costs by 18% vs. air freight.

Conclusion

While China offers 22-35% cost advantages over Mexico/Eastern Europe for automotive parts, success hinges on strategic label selection and volume planning. Private Label at 5,000-unit MOQs delivers the strongest TCO (Total Cost of Ownership) for premium components, whereas White Label remains viable only for low-risk accessories with enforceable exclusivity. In 2026, procurement teams must prioritize supplier technical audits over cost-only negotiations to navigate tightening environmental regulations (China’s Dual Carbon Policy) and supply chain fragmentation.

SourcifyChina Value-Add: Our Automotive Supplier Scorecard evaluates 127+ criteria (beyond cost), including battery passport compliance and rare earth traceability. Request access via sourcifychina.com/automotive-scorecard.

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=1,200), S&P Global Commodity Insights, China Automotive Industry Association (CAAM) | Accuracy: ±7.3% at 95% confidence

© 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China Automobile Parts Manufacturers – Verification, Differentiation, and Risk Mitigation

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

China remains the world’s largest producer and exporter of automobile parts, offering competitive pricing, scalable production capacity, and advanced manufacturing capabilities. However, the complexity of the supply chain—particularly the prevalence of trading companies masquerading as factories—poses significant risks to procurement integrity, product quality, and delivery timelines.

This report outlines the critical steps to verify a legitimate Chinese automobile parts manufacturer, provides a structured methodology to distinguish between trading companies and direct factories, and highlights red flags to avoid when qualifying suppliers.

1. Critical Steps to Verify a Chinese Automobile Parts Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Verify Business License (Tianyancha/Qixinbao) | Confirm legal registration, scope of operations, and authenticity via China’s official enterprise database. Ensure the license includes “auto parts manufacturing.” |

| 2 | Conduct On-Site Factory Audit (or Third-Party Audit) | Validate physical production facilities, machinery, workforce, and quality control systems. Avoid reliance on virtual tours alone. |

| 3 | Request ISO/TS 16949, IATF 16949, or ISO 9001 Certification | Ensure the manufacturer meets international automotive quality standards. Request valid, unexpired certificates with audit trails. |

| 4 | Inspect Production Capacity & Equipment List | Review machinery type (CNC, stamping, molding), production lines, and monthly output to confirm scalability. |

| 5 | Evaluate Supply Chain & Raw Material Sourcing | Assess in-house material sourcing vs. subcontracting. Suppliers reliant on external vendors may lack process control. |

| 6 | Review Export Experience & Client References | Request 3–5 verifiable export clients (preferably Tier 1 or OEMs) and conduct reference checks. |

| 7 | Perform Sample Testing & PPAP Submission | Require samples with dimensional reports, material certifications, and full PPAP (Production Part Approval Process) documentation. |

| 8 | Conduct Background Check via SourcifyChina Dossier | Use proprietary supplier intelligence tools to analyze litigation history, export records, and compliance risks. |

2. How to Distinguish Between a Trading Company and a Direct Factory

| Criterion | Direct Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities; includes factory address and production scope. | Lists trading, import/export; lacks manufacturing scope. |

| Facility Ownership | Owns or leases a dedicated factory with visible machinery and production lines. | No physical plant; office-only premises. |

| Product Customization | Offers OEM/ODM services with engineering support (e.g., mold design, DFM analysis). | Limited to catalog-based selection; minimal customization. |

| Pricing Structure | Provides cost breakdown (material, labor, overhead); lower MOQs feasible. | Higher margins; pricing often non-negotiable. |

| Communication | Engineers and production managers accessible; technical discussions possible. | Sales representatives only; unable to discuss technical details. |

| Lead Time | Realistic timelines based on production capacity and scheduling. | Often optimistic; may not reflect actual factory lead times. |

| Export Documentation | Can provide factory-originated documents (e.g., packing list, invoice under factory name). | Documents issued under trading company name, even if goods from third party. |

Pro Tip: Ask to see the factory gate with company signboard, machine nameplates, and employee ID cards during video calls. A true factory will readily provide this.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden fees, or middlemen markup. | Benchmark against industry averages; request detailed quotes. |

| Refusal to Conduct On-Site or Live Video Audit | High probability of being a trading company or unqualified supplier. | Make audit a contractual prerequisite. |

| No IATF 16949 or ISO 9001 Certification | Lacks standardized quality management; higher defect risk. | Disqualify unless for non-critical components with rigorous incoming QC. |

| Inability to Provide Client References | Suggests lack of export experience or poor performance history. | Require at least two verifiable references in your region. |

| Use of Generic or Stock Photos | Indicates lack of authenticity; likely a front for a trading company. | Request real-time video walkthrough with timestamp. |

| Pressure for Upfront Full Payment | High fraud risk. Legitimate factories accept T/T 30% deposit, 70% against BL copy. | Use secure payment terms; consider LC or escrow for initial orders. |

| Frequent Communication Delays or Poor English | May signal disorganization or lack of dedicated export team. | Require a dedicated account manager with technical fluency. |

4. Best Practices for Risk Mitigation

- Engage Third-Party Inspection Services (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspections.

- Use a Sourcing Agent with Local Presence to conduct due diligence and manage logistics.

- Implement a Tiered Supplier Strategy: Qualify 2–3 backup suppliers to avoid single-source dependency.

- Draft a Clear Quality Agreement outlining AQL levels, warranty terms, and non-conformance penalties.

- Register IP in China (if applicable) to protect molds, designs, and trademarks.

Conclusion

Sourcing automobile parts from China offers significant cost and scalability advantages—but only when partnered with verified, capable manufacturers. Distinguishing between factories and trading companies is critical to ensuring supply chain transparency, quality consistency, and long-term reliability.

Global procurement managers must adopt a data-driven, audit-backed approach to supplier qualification. By following the verification framework outlined in this report, organizations can reduce risk, enhance supplier performance, and achieve sustainable sourcing success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China Automobile Parts Manufacturing Landscape (2026)

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

The 2026 China auto parts market faces unprecedented complexity: EV component shortages, stricter EU CBAM regulations, and AI-driven quality compliance demands have increased supplier vetting cycles by 37% YoY (SourcifyChina 2025 Benchmark Data). Traditional sourcing methods now cost procurement teams 120+ hours per supplier in due diligence, with 68% of unvetted suppliers failing post-shipment quality audits.

SourcifyChina’s Pro List eliminates this risk. Our AI-verified supplier database delivers only manufacturers meeting:

✅ IATF 16949:2023 certification (mandatory for Tier-1 OEMs)

✅ Real-time capacity analytics (EV battery/component specialization tracked)

✅ Blockchain QC audit trails (integrated with EU/US customs systems)

Time-to-Value Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Vetting Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 45–60 hours | < 2 hours | 95% |

| Quality/Compliance Audit | 30–40 hours | Pre-verified | 100% |

| Factory Assessment | 25–35 hours | VR Tour + Live Data | 100% |

| Negotiation & MOQ Setup | 20–30 hours | Pre-negotiated Terms | 80% |

| TOTAL PER SUPPLIER | 120–165 hours | < 24 hours | ≥ 80% |

Source: SourcifyChina 2026 Procurement Efficiency Index (Survey of 217 Global Auto OEMs)

Why 92 of Top 100 Auto Suppliers Use Our Pro List

- Zero Defect Guarantee – All suppliers undergo 3-layer validation:

- AI-driven financial health scoring (via China Credit Watch)

- On-ground engineer spot-checks (monthly)

- Real-time export compliance monitoring (US/EU/ASEAN)

- EV/ADAS Specialization – 74% of Pro List manufacturers certified for next-gen components (460V+ battery systems, LiDAR housings, V2X sensors).

- Cost Avoidance – Clients prevent $220K+ avg. losses per failed supplier (recalls, air freight surcharges, contract penalties).

“SourcifyChina’s Pro List cut our new supplier onboarding from 5 months to 11 days – critical for securing rare earth magnet capacity in 2026.”

— CPO, DAX-listed German Automotive Tier-1 Supplier

Your Strategic Next Step: Secure Verified Capacity in < 24 Hours

The 2026 supply crunch has reduced qualified auto parts capacity by 22% (McKinsey). Pro List allocations for Q2 2026 close March 31.

Act now to:

🔹 Lock EV component capacity before Q2 price surge (effective April 1)

🔹 Bypass 120+ hours of vetting with pre-audited manufacturers

🔹 Guarantee CBAM-compliant carbon reporting (integrated into all Pro List profiles)

→ Claim Your Verified Supplier Allocation Today

Contact our Sourcing Team for immediate Pro List access:

📧 [email protected] (Response in < 2 business hours)

📱 WhatsApp +86 159 5127 6160 (Priority queue for automotive clients)

All inquiries receive a complimentary 2026 Capacity Risk Assessment Report (valued at $1,500).

SourcifyChina | Your Objective Partner in China Sourcing Since 2010

78% client retention rate | 12,000+ verified manufacturers | Zero defective batch incidents in 2025

© 2026 SourcifyChina. All data confidential. Pro List access subject to eligibility verification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.