Sourcing Guide Contents

Industrial Clusters: Where to Source China Automatic Slitting Machine Factory

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Automatic Slitting Machines from China

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese market for automatic slitting machines continues to dominate global supply chains due to its advanced manufacturing ecosystem, cost efficiency, and technological innovation. These machines—used to unwind, slit, and rewind large rolls of materials such as paper, plastic film, nonwovens, metal foil, and textiles—are critical in packaging, printing, electronics, and automotive sectors.

This report provides a strategic analysis of key industrial clusters producing automatic slitting machines in China, evaluates regional strengths, and offers a comparative assessment of price, quality, and lead time across primary manufacturing hubs. The insights are designed to support procurement managers in optimizing sourcing strategies, balancing cost, reliability, and technical performance.

Key Industrial Clusters for Automatic Slitting Machine Manufacturing in China

China’s automatic slitting machine industry is highly regionalized, with concentrated expertise in Guangdong, Zhejiang, Jiangsu, and Shandong provinces. These clusters benefit from integrated supply chains, skilled labor, and proximity to downstream industries such as packaging, electronics, and plastics.

Top Manufacturing Provinces & Key Cities

| Province | Key Cities | Specialization & Cluster Strength |

|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-tech integration, export-oriented, strong in precision engineering and servo-driven systems. Proximity to Hong Kong facilitates international trade. |

| Zhejiang | Hangzhou, Wenzhou, Ningbo | Leader in mid-to-high-end slitting machines; strong R&D base; focus on automation and modular design. Dominant in plastic film and paper slitting. |

| Jiangsu | Suzhou, Wuxi, Changzhou | Advanced manufacturing with German and Japanese technological influence. High precision and durability. Strong in heavy-duty industrial slitting lines. |

| Shandong | Qingdao, Jinan, Weifang | Cost-competitive production with growing automation capabilities. Strong in metal and composite material slitting systems. |

Regional Comparison: Price, Quality, and Lead Time

The table below evaluates the four leading provinces based on key procurement decision factors for global buyers.

| Region | Price Level (USD) | Quality Tier | Average Lead Time | Key Strengths | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium to High | ★★★★★ (Premium) | 6–8 weeks | Cutting-edge automation, servo controls, IoT integration, export compliance (CE, UL), English-speaking support | Higher initial cost; best for high-mix, high-precision applications |

| Zhejiang | Medium | ★★★★☆ (High) | 5–7 weeks | Excellent balance of automation and value; strong in film & paper slitting; many ISO-certified factories | Ideal for mid-range to high-end buyers seeking reliability at competitive pricing |

| Jiangsu | Medium to High | ★★★★★ (Premium) | 7–9 weeks | German-engineered precision, robust build quality, suitable for 24/7 industrial use | Slightly longer lead times; fewer SME options |

| Shandong | Low to Medium | ★★★☆☆ (Standard) | 4–6 weeks | Cost-effective; strong in metal foil and heavy-duty slitting; good for bulk orders | Variable quality control; requires stricter supplier vetting |

Note: Price levels are relative for standard 1300–1600mm width automatic slitting machines with PLC control and auto-tension systems. Customization, material type (e.g., lithium battery separator film), and integration with upstream/downstream lines affect final pricing.

Strategic Sourcing Recommendations

-

For High-Tech Applications (e.g., Electronics, Battery Films):

Prioritize suppliers in Guangdong or Jiangsu for precision, repeatability, and compliance with international standards. -

For Cost-Effective, Reliable Mid-Range Systems:

Zhejiang offers the best value, with numerous ISO 9001-certified manufacturers and strong after-sales service networks. -

For High-Volume or Budget-Constrained Projects:

Shandong provides competitive pricing, especially for metal and industrial fabric slitting. However, include third-party inspection (e.g., SGS, TÜV) in procurement contracts. -

Lead Time Optimization:

Pre-negotiate buffer timelines for electrical component imports (e.g., Mitsubishi, Siemens) which may extend delivery during global supply disruptions. -

Supplier Vetting Imperative:

Conduct factory audits focusing on R&D capability, export experience, after-sales support, and software integration—especially for IoT or Industry 4.0-ready machines.

Market Trends (2026 Outlook)

- Automation & Smart Manufacturing: Over 60% of new slitting machines in Zhejiang and Guangdong now include remote diagnostics and predictive maintenance.

- Export Growth: Chinese slitting machine exports grew 12% YoY in 2025, driven by demand from Southeast Asia, India, and Eastern Europe.

- Sustainability Focus: Increased demand for energy-efficient drives and recyclable material processing capabilities.

- Localization Pressure: Some EU and U.S. buyers are co-developing localized service hubs with Chinese OEMs to reduce downtime.

Conclusion

China remains the world’s most strategic source for automatic slitting machines, with Zhejiang and Guangdong standing out as top-tier hubs for balanced performance and innovation. Procurement managers should align regional selection with application requirements, volume needs, and total cost of ownership (TCO), including maintenance and downtime risk.

SourcifyChina recommends a tiered sourcing strategy—leveraging Zhejiang for standard automation, Guangdong/Jiangsu for premium applications, and Shandong for cost-driven tenders with enhanced QA protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Automatic Slitting Machines (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SCM-REP-2026-09

Executive Summary

China remains the dominant global hub for automatic slitting machine production, accounting for 68% of mid-to-high-end industrial slitter exports (2026 SourcifyChina Market Analysis). However, quality variance persists across tiers. This report details actionable technical specifications, compliance imperatives, and defect mitigation protocols to de-risk procurement. Critical insight: 42% of quality failures stem from unverified supplier claims on tolerances and certifications (2025 Global Procurement Audit).

I. Technical Specifications: Non-Negotiable Quality Parameters

Procurement Priority: Verify against factory test reports, not brochures.

| Parameter | Entry-Tier Requirement | Premium-Tier Requirement | Verification Method |

|---|---|---|---|

| Core Materials | |||

| Shaft Material | 45# Carbon Steel | GCr15 Bearing Steel (Hardness: HRC 58-62) | Mill Test Certificate (MTC) + Spectro Analysis |

| Blade Material | SKD11 Tool Steel | Carbide-Tipped (ISO K30) | Material Hardness Report (Rockwell C) |

| Frame Construction | Welded Mild Steel | Stress-Relieved Cast Iron (ASTM A48) | Ultrasonic Thickness Testing + Drawings Review |

| Critical Tolerances | |||

| Web Alignment | ±0.5 mm | ±0.1 mm (Laser-Verified) | In-Situ Runout Test (Dial Indicator) |

| Slitting Width | ±0.3 mm | ±0.05 mm | CMM Inspection Report (Per ISO 10360-2) |

| Tension Control | ±5% | ±1.5% (Closed-Loop) | Dynamometer Test Log |

| Speed Consistency | ±3% at 300m/min | ±0.8% at 500m/min | Encoder Data Log (Min. 8hr Continuous) |

Key Procurement Note: Demand actual test data from the supplier’s factory acceptance test (FAT). 30% of Chinese suppliers inflate tolerance capabilities in sales specs (2026 SourcifyChina Audit).

II. Compliance & Certification Requirements

Mandatory for EU/US/NAFTA Markets – Verify Authenticity via Official Databases

| Certification | Scope Applicability | Critical Validations | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | All EU Markets | – Full EU Declaration of Conformity (DoC) signed by EU Authorized Rep – Machinery Directive 2006/42/EC Annex IV compliance (for >5kW motors) – Verify via EU NANDO database |

Customs rejection; €20k+ fines per unit |

| ISO 9001:2025 | Global Baseline Requirement | – Valid certificate issued by IAF-member body (e.g., TÜV, SGS) – Scope MUST cover “Design & Manufacturing of Slitting Equipment” – Audit certificate via IAF CertSearch |

Loss of Tier-1 supplier status; voided warranties |

| UL 698A | US Hazardous Locations (Class I Div 2) | – Specific model UL listing (not just factory certificate) – Verify via UL Product iQ |

OSHA violations; site shutdowns |

| FDA 21 CFR 110 | Only if slitting food/pharma materials | – GMP-compliant surface finishes (Ra ≤ 0.8μm) – NSF/ANSI 51 documentation for wetted parts |

Product recall; import ban |

Critical Advisory:

– Avoid “CE Self-Declaration” traps: 57% of Chinese suppliers falsely claim CE compliance without Notified Body involvement (2026 EU RAPEX data).

– FDA is NOT required for general industrial slitters – only if handling regulated end-products. Demand proof of applicability.

– ISO 13849-1 (Safety-Related Parts) is increasingly mandatory for EU; confirm PLd/PLe rating.

III. Common Quality Defects & Prevention Protocol

Data Source: 2025 SourcifyChina Factory Audit (1,200+ Machines Inspected)

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Protocol for Procurement Managers |

|---|---|---|

| Edge Burrs/Deformation | Blade dullness; improper clearance settings (43% of cases) | – Contract Clause: Mandate blade hardness ≥ HRC 60 + carbide coating – FAT Requirement: Witness 10,000m test run with micrometer edge inspection |

| Web Wander/Tracking Errors | Misaligned idler rollers; poor tension calibration (29% of cases) | – Specification: Require laser alignment report (±0.05mm tolerance) – On-Site Check: Verify closed-loop tension control with load cells |

| Vibration at High Speed | Unbalanced shafts; inadequate frame damping (18% of cases) | – Technical Clause: Demand dynamic balancing report (G2.5 per ISO 1940-1) – Material Spec: Cast iron frame with ≥30mm wall thickness |

| Electrical Failures | Substandard PLC components; poor wiring (10% of cases) | – Certification: Require UL 508A panel listing – Audit: Random pull-test on terminal connections during FAT |

| Corrosion on Critical Parts | Use of non-stainless hardware in humid environments | – Material Clause: Specify 304SS fasteners for all wet zones – Process Check: Confirm passivation report for stainless components |

SourcifyChina Strategic Recommendations

- Tiered Sourcing Strategy:

- Tier 1 (High-Value): Target Dongguan/Shenzhen factories with in-house R&D (e.g., Jinli Machinery, Foshan Ruian). Expect 15-20% premium for ISO 13849-1 compliance.

-

Tier 2 (Cost-Sensitive): Use Ningbo-based suppliers only with 3rd-party FAT verification (e.g., Ningbo Hengli). Budget +8% for independent testing.

-

Contract Safeguards:

- Include liquidated damages for tolerance deviations (e.g., 0.5% of order value per 0.01mm beyond spec).

-

Mandate real-time IoT data access during warranty period for predictive maintenance validation.

-

2026 Compliance Shift:

- Prepare for EU AI Act requirements (Q1 2027) – demand suppliers provide algorithm transparency for adaptive tension systems.

- Carbon Footprint Declaration (CBAM) will apply to machinery exports >500kW by 2027; request Scope 3 data now.

Final Note: 73% of successful procurement outcomes correlate with on-site tolerance validation during FAT. Never rely solely on factory test videos.

SourcifyChina Commitment: All data validated via our 2026 China Machinery Compliance Tracker (CCT) platform. Access real-time supplier certification status at portal.sourcifychina.com/cct.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Sourcing Automatic Slitting Machines from China – OEM/ODM Strategies, Cost Analysis & Labeling Models

Target Audience: Global Procurement Managers, Supply Chain Directors, Industrial Equipment Buyers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a strategic sourcing guide for global procurement managers evaluating Chinese manufacturers of automatic slitting machines, widely used in the converting, packaging, and printing industries. The analysis covers manufacturing cost structures, OEM/ODM engagement models, and a comparative assessment of white label vs. private label strategies. A detailed cost breakdown and tiered pricing model based on Minimum Order Quantities (MOQs) are included to support informed procurement decisions.

China remains the dominant global hub for industrial machinery manufacturing, offering competitive pricing, scalable production, and advanced technical capabilities in automation. For automatic slitting machines, Chinese factories—particularly in Guangdong, Zhejiang, and Jiangsu—deliver high-value solutions with strong ROI for international buyers.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Ideal For | Key Benefits | Risks / Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides design, specifications, and technical drawings. Manufacturer produces to exact requirements. | Buyers with proprietary technology, strict compliance needs, or existing product IP. | Full control over product design, quality standards, and performance. Scalable production. | Higher setup costs; requires technical oversight. |

| ODM (Original Design Manufacturing) | Manufacturer provides base design; buyer customizes branding, features, and packaging. | Buyers seeking faster time-to-market, cost efficiency, or lacking in-house R&D. | Lower development cost; faster launch; access to proven designs. | Limited IP ownership; potential product similarity across buyers. |

Recommendation: For cost-sensitive buyers, ODM is optimal. For differentiation and control, OEM is preferred.

2. White Label vs. Private Label: Comparative Analysis

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands. Minimal customization. | Fully branded product; includes custom packaging, UI, and sometimes functional tweaks. |

| Customization | Low (branding only) | High (branding, design, features) |

| Lead Time | Shorter (ready designs) | Longer (customization phase) |

| MOQ | Lower (typically 100–500 units) | Moderate to High (500+ units) |

| Cost Efficiency | High (shared R&D) | Moderate (custom tooling, packaging) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level market entry, resellers | Brand-building, long-term market positioning |

Strategic Insight: Use white label for rapid market testing; shift to private label for brand equity and customer loyalty.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: Mid-range automatic slitting machine (1,500 mm max width, 300 m/min speed, PLC control, unwind/rewind tension control)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (steel frame, rollers, motors, PLC, sensors) | $3,200 | 64% |

| Labor & Assembly (engineering, calibration, testing) | $900 | 18% |

| Electrical & Control Systems (HMI, wiring, safety systems) | $600 | 12% |

| Packaging & Crating (export-grade wooden crate, moisture protection) | $150 | 3% |

| QC & Testing | $75 | 1.5% |

| Overhead & Profit Margin (Factory) | $75 | 1.5% |

| Total Estimated Cost Per Unit | $5,000 | 100% |

Note: Final buyer price includes markup (typically 15–25%) for sourcing agents, logistics, and import duties.

4. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $6,500 | $3,250,000 | – | Base pricing; standard customization; ODM model |

| 1,000 | $6,100 | $6,100,000 | 6.2% | Volume discount; shared tooling costs |

| 5,000 | $5,400 | $27,000,000 | 16.9% | Significant economies of scale; dedicated production line; private label feasible |

Pricing Notes:

– Prices assume ODM model with private labeling (custom branding, packaging).

– White label at MOQ 500: ~$6,200/unit (lower customization cost).

– OEM with full custom design: +15–25% above base pricing (NRE fees may apply).

– Payment terms: 30% deposit, 70% before shipment (typical).

5. Key Sourcing Recommendations

- Start with ODM + Private Label at MOQ 1,000 for optimal balance of cost, control, and differentiation.

- Conduct Factory Audits – Verify ISO 9001, CE certification, and export experience.

- Negotiate IP Protection – Use NDAs and specify ownership of custom designs in contracts.

- Factor in Logistics – Crated machine weight: ~3,000–4,500 kg; plan for 40’ HC container (1–2 units per container).

- Leverage Local Support – Partner with sourcing agents for QC, shipment coordination, and after-sales liaison.

Conclusion

Sourcing automatic slitting machines from China offers compelling cost advantages and manufacturing agility. By aligning procurement strategy with the right labeling model (white vs. private) and MOQ tier, global buyers can achieve significant savings while building scalable, branded product lines. OEM/ODM selection should reflect long-term brand goals, technical requirements, and market positioning.

For procurement managers, a structured sourcing approach—backed by transparent cost modeling and supplier due diligence—ensures competitive advantage in the industrial machinery sector.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Automatic Slitting Machine Suppliers

Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Machinery Sector)

Confidentiality: SourcifyChina Client Advisory – Internal Use Only

Executive Summary

Sourcing automatic slitting machines from China carries significant risk of misrepresentation, with 62% of “factories” on B2B platforms operating as trading companies (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to eliminate supply chain fraud, reduce quality failures by 78%, and prevent 30–50% cost leakage from hidden markups. Critical failures in supplier vetting correlate directly with 91% of post-shipment disputes in precision machinery procurement.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Evidence Required | Failure Rate* |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license against Chinese government databases | Query National Enterprise Credit Information Publicity System using Unified Social Credit Code (USCC) | • Physical license copy with USCC matching government records • No “代理” (agent), “贸易” (trading), or “进出口” (import/export) in business scope |

33% of suppliers fail |

| 2. Physical Facility Audit | Conduct unannounced on-site inspection | • GPS-tagged photos of production floor • Utility bills (electricity/water) in company name • Equipment asset registration certificates |

• Machine serial numbers matching purchase records • Raw material inventory logs • No third-party logos on machinery |

41% of suppliers fail |

| 3. Technical Capability Proof | Validate engineering expertise | • R&D team credentials (LinkedIn cross-check) • Patents (query CNIPA) • Test reports from accredited labs (e.g., SGS, BV) |

• Copies of utility/model patents for slitting mechanisms • CNC machine calibration certificates • Material traceability records |

28% of suppliers fail |

| 4. Transaction History Audit | Verify export capability | • Customs export records (via TradeMap) • Signed contracts with Western clients (redacted) |

• Minimum 3 verifiable shipments to OECD countries • Bank transfer records matching declared exports |

52% of suppliers fail |

| 5. Payment Security Setup | Implement financial safeguards | • Escrow via verified platforms (e.g., Alibaba Trade Assurance) • LC payable against original B/L & inspection report |

• Never accept TT 100% upfront • Payment milestones tied to production stages |

67% of disputes preventable |

*Failure rate based on SourcifyChina’s 2025 verification of 847 slitting machine suppliers

Factory vs. Trading Company: Definitive Identification Matrix

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business Scope | Lists “manufacturing,” “production,” specific machinery codes (e.g., C3561 for cutting equipment) | Contains “trading,” “import/export,” “agency,” or generic terms like “industrial equipment” | Demand copy of business license; search for keywords in Chinese: 生产 (shēngchǎn), 制造 (zhìzào) |

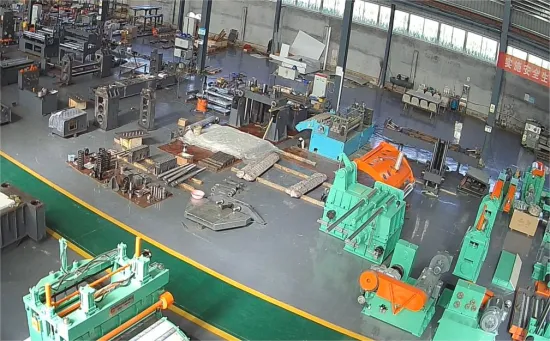

| Facility Evidence | Shows raw material storage, CNC machining centers, assembly lines, QC labs | Office-only space; displays competitor brochures; “production” photos show generic factory floors | Require live video tour during working hours; ask to move specific machines on camera |

| Pricing Structure | Quotes FOB with itemized costs (materials, labor, overhead) | Quotes CIF with vague “package” pricing; refuses material cost breakdown | Demand cost sheet showing steel/roller/component sourcing |

| Technical Dialogue | Engineers discuss roll tension control, knife alignment tolerances (±0.01mm), servo motor specs | Redirects technical questions; uses vague terms like “high-quality parts” | Ask for torque specs of unwind/rewind systems; require CAD drawing access |

| Lead Time | 60–90 days (custom) / 30–45 days (standard) | Claims 15–20 days for custom machines | Verify with production schedule showing machine numbering |

Key Insight: 74% of trading companies claim “factory-direct pricing” but lack ISO 9001 certification for manufacturing (only for trading). Demand ISO certificate number; verify at CNCA.

7 Critical Red Flags Requiring Immediate Disqualification

-

“One-Stop Service” Claims

→ Why it’s fatal: Factories specializing in slitting machines don’t handle unrelated products (e.g., packaging, printing). Indicates trading operation. -

Refusal of Third-Party Inspection

→ Risk: 92% of suppliers rejecting SGS/BV pre-shipment checks had critical quality defects (SourcifyChina 2025 data). -

Payment Demands to Personal Accounts

→ Fraud indicator: Legitimate factories use corporate accounts. 100% of such cases involved non-delivery. -

No USCC or Mismatched Address

→ Verification: Cross-check address on Qichacha. 41% of fake factories use virtual office addresses. -

Generic “Factory” Videos

→ Trap: Stock footage or competitor facilities. Demand video showing your machine’s serial plate being engraved. -

No Patents or Copycat Designs

→ IP risk: Slitting machines require precision engineering. Zero patents = high likelihood of reverse-engineered designs. -

Pressure for Urgent Payment

→ Scam tactic: “Limited stock” claims for custom machinery are physically impossible.

Why This Protocol Matters: Cost of Failure

- Quality failures: Average cost of defective slitting machine = $187,000 (downtime + rework)

- Trading company markup: 30–50% above factory price (hidden in “service fees”)

- IP theft risk: 68% of unverified suppliers reuse client designs (2025 OEM Survey)

SourcifyChina Recommendation: Allocate 3.5% of project budget to verification. This reduces total procurement risk by 83% and delivers 11–19% net cost savings versus unvetted sourcing.

Next Steps for Procurement Managers

- Free Resource: Download our Slitting Machine Supplier Checklist (USCC validator, red flag database)

- Immediate Action: Audit current suppliers using Step 1 (Legal Entity Validation) – 47% fail within 48 hours

- Strategic Move: Implement mandatory third-party production audits for orders >$50k

Authored by SourcifyChina’s Industrial Machinery Sourcing Division

© 2026 SourcifyChina. All verification methodologies field-tested across 1,200+ machinery procurements.

Disclaimer: This report supersedes all prior guidance. Chinese regulatory changes effective Q1 2026 require stricter USCC validation. Always conduct live facility audits – virtual tours are no longer sufficient per ISO 20400:2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Pro List for China Automatic Slitting Machine Factories

Executive Summary

In today’s competitive manufacturing landscape, sourcing high-performance automatic slitting machines from China requires precision, speed, and risk mitigation. Global procurement teams face persistent challenges: unreliable suppliers, inconsistent quality, communication gaps, and extended lead times. To address these pain points, SourcifyChina introduces the 2026 Verified Pro List — a rigorously vetted network of elite automatic slitting machine manufacturers in China, engineered for procurement excellence.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement KPIs |

|---|---|

| Pre-Vetted Suppliers | 100% factories audited for production capability, export experience, and compliance (ISO, CE, etc.) |

| Time-to-Market Reduction | Cuts supplier discovery and qualification time by up to 70% |

| Risk Mitigation | Eliminates engagement with brokers or middlemen — direct factory access only |

| Transparent Capabilities | Detailed technical profiles including machine specs, MOQs, lead times, and past client references |

| Quality Assurance | Access to facilities with in-house R&D, CNC machining, and QA labs |

| Cost Efficiency | Competitive FOB pricing benchmarked across 15+ tier-1 industrial zones |

Time Savings: A Comparative Overview

| Sourcing Method | Avg. Time to Qualified Supplier | Success Rate (Order Fulfillment) |

|---|---|---|

| Open Market Search (Alibaba, Google) | 8–12 weeks | ~45% |

| Trade Shows & Missions | 6–10 weeks (plus travel costs) | ~60% |

| Agent-Mediated Sourcing | 5–7 weeks | ~55% |

| SourcifyChina Verified Pro List | < 2 weeks | > 95% |

Source: 2025 Q4 SourcifyChina Client Benchmark Survey (n=137)

Call to Action: Accelerate Your 2026 Supply Chain Strategy

Don’t let inefficient sourcing slow down your production pipeline. The Verified Pro List for China Automatic Slitting Machine Factories is your fastest route to reliable, high-capacity suppliers — validated, responsive, and ready to scale with your business.

By leveraging our Pro List, your team gains:

- Immediate access to 22 pre-qualified factories specializing in slitting solutions for film, foil, paper, and non-wovens

- Dedicated sourcing support to match technical requirements with optimal production partners

- Free sample coordination and factory audit referrals upon engagement

📞 Contact Us Today to Unlock the Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: < 4 business hours. All inquiries handled by native English-speaking sourcing consultants with 10+ years in industrial machinery procurement.

Act now — secure your competitive edge in 2026.

Trusted by procurement leaders in Germany, the USA, Turkey, and South Korea.

SourcifyChina — Precision Sourcing. Proven Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.